Macroeconomics

Types of Unemployment

Frictional

Occurs when someone new enters the labor market or is “in between jobs” but has employable skills and will likely gain employment in a short period of time

Structural

Caused by fundamental, underlying changes in the economy that can create job loss for skills that are no longer in demand (improvements in technology; globalization of industry)

Inevitable unemployment

Seasonal

Emerges as a periodic and predictable job loss that follows the character

Cyclical

Jobs that are gained and loss as the business cycle improves and worsens when the economy is expanding or contracting

Unemployment rate : Ration of unemployed to the total labor force

Unemployment Rate = (Unemployment population/Labor force) x 100

Seasonal Unemployment is unneeded

Shortcomings of Unemployment rate

Data does not include discouraged workers, a worker who has been unemployed for a period of time and has given up the search for a new job. They are NOT in labor force

UR (Unemployment rate) counts a person working part-time as employed, even if that person is seeking full-time work (underemployed)

UR counts a a person who has multiple jobs (maybe because they need additional money) the same as someone with one job

Unemployment data may understate actual unemployment. Pew research found this to be true particularly among women, Asian Americans, and immigrants

Incarcerated workers are not included in employment statistics, even though prison labor is a multi-billion dollar industry

Labor Force participation rate : Measures the percentage of the adult population in a country that is either employed or unemployed. This is the percentage of a population that are in the labor force

LFPR (( # of people employed and unemployed) / (Population)) x 100

The more LFPR declines, the more the unemployment rate understates the true levels of unemployment

Natural rate of unemployment : Level of unemployment that prevails when an economy is producing at full-employment level.

NRU includes only frictional and structural unemployment

This means that unemployment rate will never reach 0%, even at the full-employment level. There will always be some level of unemployment in an economy

True full employment (unemployment = 0%) is undesirable because it requires a completely inflexible labor market in the long run, where workers are unable to quit their current job or leave to find a better one

The NRU in the United States is thought to be between 4 and 6%

Circular Flow

National Accounts (known as national income and product accounts)

Keeps track of the spending of consumers, sales of producers, business investment spending, government purchases, and a variety of other flows of money among different sectors of the economy

Product and Factor markets

Product market: Where goods and services are bought and sold

Factor market: where resources, especially capital and labor are bought and sold

In the product market: Households demand, firms supply

In the factor market: households supply, firms demand

Simple vs. Expanded Circular Flow with two groups : households and firms

Injections and leakages add or remove money from circular flow of income in an economy

Leakages: Taxes, Imports, Spending

Business Cycle: Alteration between economic downturns and upturns in the macro economy is known as the Business cycle

ns and Troughs

The economy experiences occasional economic downturns known as recessions, periods in which output and employment are falling

The lowest point of a recession is called a trough of a business cycle

Expansions and Peaks

The trough is followed by an economic upturn- a period in which output and employment are rising- known as an expansion

The highest point of an expansion, just before the economy turns down again, is called the peak of a business cycle

Employment, Unemployment, and The Business Cycle

Although not as severe as depression, a recession is clearly an undesirable event. Like a depression, a recession leads to joblessness, reduced production, reduced incomes, and lower living standards

In general, during recessions the unemployment rate is rising, and during expansions it is falling

Actual Output vs. Potential Output

The full-employment level of output represents an economy’s potential output, the maximum level of output that could be produced using all available resources

Unlike actual GDP, potential output GDP cant be

The difference between actual and potential output is called the output gap

During expansionary periods we have a positive output gap meaning that actual output is higher than potential output

During recessionary periods we have a negative output gap, meaning that actual output is lower than potential output

The actual rate of unemployment equals the natural rate of unemployment when the economy is on the potential line

Market Economy: actors of production are privately owned and the decisions of individual producers and consumers largely determined what, how, and for whom we produce

Command Economy: the factors of production are publicly owned and a central authority makes production and consumption decisions

→ Government owns all factors of production and determine the prices of goods and services

→ Less “goal” to improve because there is no competition

Mixed Economy: Combines elements of market and command economies

→ Private Sector: Responsible for most production, and is allowed to seek profit

→ Public Sector: Regulates Businesses and may nationalize industries that provide a public good.

Production Possibilities Curve

Linear production possibilities curve (PPC) is a straight line that occurs when opportunity costs are constant. This means that the economy would have to give up the same amount of one good to produce an additional unit of another good

Synthesis:

Absolute Advantage: a country (person) has an absolute advantage in producing a good/service if the country can produce more output per worker than other countries (people)

Comparative Advantage: A country (person) has a comparative advantage in producing a good/service if its opportunity cost of producing the good/service is lower than other countries’ (people)

Specialization: A country will specialize in the task that it has a relative comparative advantage in

Terms of Trade: The rate at which one’s products exchange for those of another

Supply and Demand

Markets are where buyers and sellers are the same good or service interact. Markets vary in size and specificity.

Buyers demand, sellers supply

The supply and demand model demonstrates how supply behaves

Demand Curve: Shows relationship between quality demanded (QD) and price. It represents the sum of all the individual demand curves of all consumers in the market

The quantity demanded is the actual amount of a good or service consumers are willing to buy a given price

The law of demand says that ceteris paribus, a higher price for a good or service decreases the quantity demanded of that good or service.

Movement along the demand curve would be a change in the quantity demanded, arising from a change in the good’s price.

Shifters of Demand

Price of related goods or services (substitutes and Complements)

Income

Tastes

Future expectations

Number of consumers

Determinants of Supply:

Input prices

Technology

Expectations

Number of producers

Prices of related goods or substances

Supply and Demand Together

Equilibrium Price : price that balances supply and demand. On a graph, it is the price at which supply and demand intersect

Equilibrium Quantity: The quantity that balances supply and demand. On a graph, it is the quantity at which supply and demand intersect.

Circular Flow Model: Households provide factors of production, such as labor, capital, and resources to businesses in the factor market in exchange for income. Businesses, in turn, use these factors to produce goods and services, which they sell to households in the product market

In a simple circular flow diagram we assume an economy only contains two groups: households and firms

Injections : add

Leakage: remove

Expenditure Approach : CIGX

Consumption expenditure

Private investment

Government expenditure

Net exports

Income approach: WIRP

Wage

Interest

Rent

Profit

Nominal GDP: Measures the value of a nation’s output expressed in the value of the prices charged for that year

Nominal GDP does not adjust for inflation

Nominal GDP = Current Prices x Current Quantity of Output

Real GDP: Measures actual value of nation’s output expressed in the value of prices charged at base year

Real GDP adjusts for inflation

Real GDP = Base Year Prices x Current Quantity of output

When Price levels increase (inflation), nomain GDP overestimates the value of output compared to real output

When price levels decease (deflation), nominal GDP underestimates the value of real output compared to actual output

GDP Deflator = (Nominal GDP/Real GDP) x 100

Shortcomings of Unemployment Rate

Data does not include discouraged workers, a worker who has been unemployed for a period of time and has given up the search for a new job. They are NOT in the labor fforce

UR counts as a person working part time even if that person is seeking full time work (underemployed)

Natural Rate of Unemployment (NRU) is the level of unemployment that prevails when an economy is producing at full-employment level

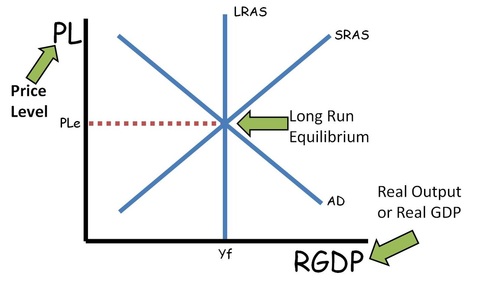

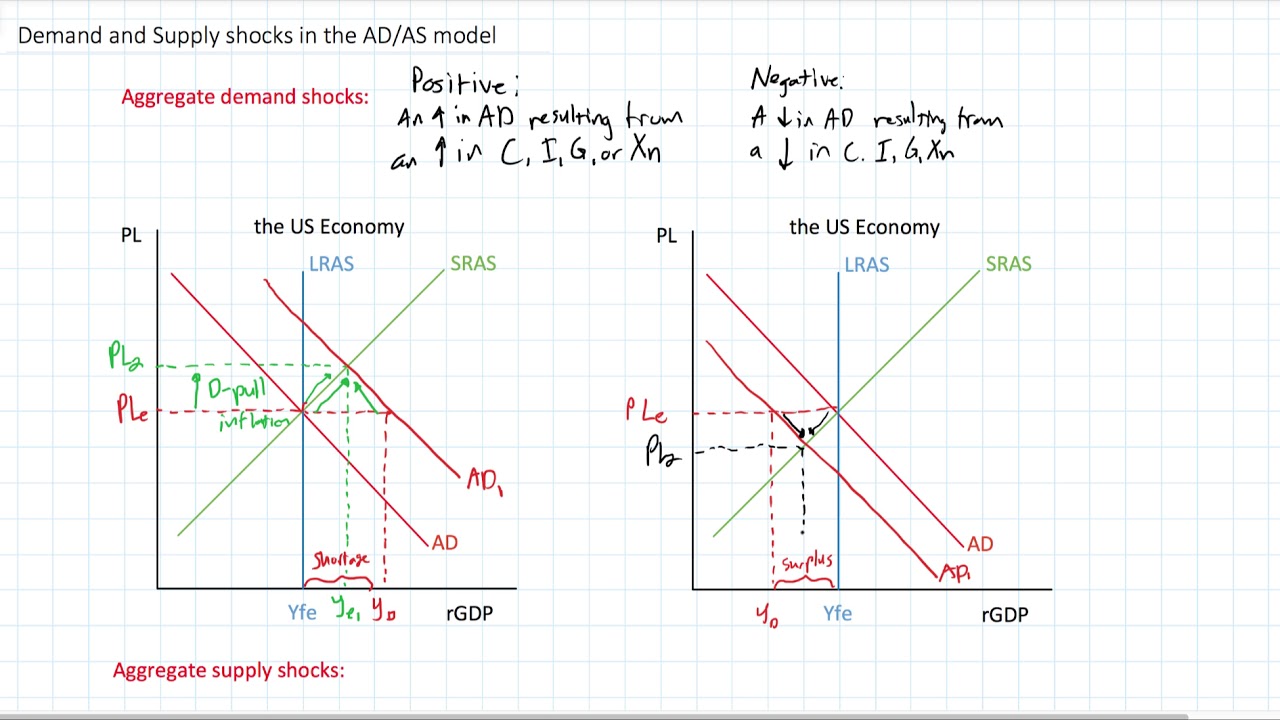

AD-AS Model: Model provides an aggregate picture of the macroeconomy and allows economists to predict how GDP, inflation, and unemployment are affected by external factors and government policies

Aggregate - “Added all together”

Aggregate Demand: All the goods and services that buyers are willing and able to purchase at different price levels

Shows the relationship between aggregate price level and the quantity of aggregate output demanded by households, businesses, the government, and the rest of the world

Aggregate Supply: All the goods and services that firms will produce in an economy at different price levels

Short-run aggregate supply shows the positive relationship between PL and the quantity of aggregate output supplied that exists in the SR, the time period when production costs are fixed

Long-Run Aggregate supply shows the relationship between PL and the quantity of aggregate output supplied that would exist if all prices, including nominal wages, are fully flexible.

Real Wealth Effect: economic phenomenon where consumers tend to spend more when the overall price level in an economy falls, marketing their existing money more valuable and essentially making them feel wealthier.

Interest Rate Effect: When price level is high (high inflation is occurring) lenders of fixed interest rate loans need to raise their interest rates in order to maximize benefit on the deal. > Consumers and businesses have less disposable income leading to lower rGDP

AD is the quanity of domestically produced final goods and services demanded during a given period by individuals, firms, government, and the world (CIGX)

Investment Spending:

Interest Rates

Expectations

Technology

Government regulation and business taxes

Fiscal policy plays a crucial role in shaping economic activity, influencing consumer spending, and investment decisions through government spending and taxation.

Net Exports (Exports-imports)

Fiscal policy: Actions by Congress to stabilize the economy: Spend and Tax

Montetary Policy: Actions by the federal reserve bank to stabilize the economy.

Expansionary Fiscal Policy increases aggregate demand

Increase in government spending

Cut in taxes

Increase in government transfers

Contradictionary Fiscal Policy reduces aggregate demand

Decrease in government spending

Increase in taxes

Reduction in government transfers

Ability to adjust spending, taxes, and transfer payments

Discretionary FIscal Policy

Congress creates new bill that is designed to change AD through government spending or taxation

Non discretionary fiscal policy

Permanent spending or taxation

Automatic Stabilizers are features fo the tax and transfer systesm that temper the economy when it overheats and stimulates the economy when it slumps, without direct intervention by policymakers

Interest on debt

Usually <10 percent all funding

Marginal Propensity to Consume (MPC) = Change in consumer spending / Change in disposable outcome

—> Increase in consumer spending when your disposable income rises

Disposable income : Money that an individual or household has to spend/save after federal, state, and local taxes and other mandatory charges are deducted.

If MPC increases, MPS decreases

If MPC decreases, MPS increases

MPC and MPS have a direct relationship ; as one rises, the other falls, indicating that changes in consumption behavior significantly impact savings rates within the economy.

Expenditure (Spending) Multiplier → Used to calculate total change to GDP due to an increase or decrease in government spending

Tax Multiplier → used to calculate total change to GDP due to an increase or decreasei in tax rates or transfer payments

Expenditure Multiplier = 1/(1-MPC)

Tax Multiplier = MPC/MPS

Government spending has a larger impact on GDP then taxes

LRAS is a vertical line bc:

In the long run, all resources are being used fully and efficiently. Unless more resources become available, aggregate demand will stay the same

Real profits remain the same, as workers demand higher wages to match higher pl.

SRAS:

P→ Productivity

E → Expectations of inflation

A → Actions by Government (taxes, subsides)

R → Resources prices

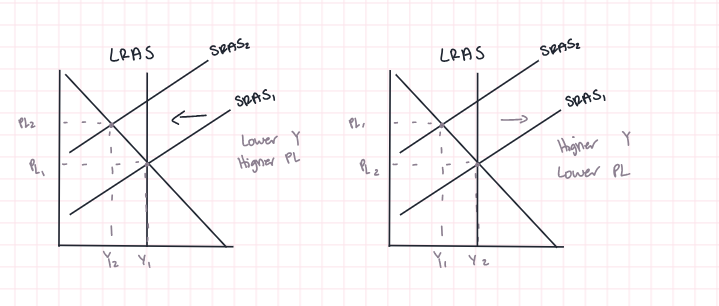

Negative Supply Shock : Lower employment, Stagflation. Lower Y and Higher PL

Positive Supply Shock : Higher Employment. Higher Y and Lower PL

Changes in the Factors of production → Shifters of the LRAS are the same as shifters of the PPC

Long-Run Adjustment: In absence of government intervention, the economy self corrects itself in a variety of ways. Always Shift in SRAS

In the long run, this self-correction can occur through changes in resource prices, wage adjustments, or shifts in consumer demand, ultimately leading to a new equilibrium.

This process highlights the economy's inherent flexibility and resilience, allowing it to adapt to shocks and return to potential output.

Shocks → Makes the entire economy less productive and the entire capacity of the economy will decrease. In this case, LRAS will shift to the left. Because production costs are now higher, SRAS will also decrease and output will be permanently lower, leading to a permanently higher level

Recessionary Gaps: Situation where economy is producing within its Production Possibilities frontier.

Inflationary Gaps: Positive output gap thus inflation. This then causes workers to ask for an increase in wages and cause supply to go down

Spending multiplier : Measures the total change in rGDP that occurs with a certain change in government spending

Tax multiplier: Measures the total change in rGDP that occurs with a certain change in taxes

The Financial System:

Money, banks, and the financial system are vital tools and institutions for an economy

Financial system as the circulatory system of the economy.

Banks deliver money throughout the economy ensuring people who can and need to borrow are able to do so

Financial Assets :

Typically represent a contractual agreement between the issuer and the buyer

Guarantee of ownership over a company (stocks) or guarantee of ownership over a company (stocks) or a guarantee of set interest payments (bonds and specialized bank accounts)

Types of Financial Assets

Stocks

Bonds

Loans

Bank deposits

A bond is an interest-bearing asset issued by a business or government

Loans are the process of borrowing money and repaying it back with interest

Suppliers of Capital → people, businesses, and governments that have extra income and choose to put that money (capital) into the financial system so that they can earn a rate of return on their capital

Demanders of Capital → people, businesses, and government that need extra money (capital):

An individual borrows money from the bank to buy a house

A firm issues a bond to expand production

A firm issues stock to expand production

Local government issues bond to improve roads

The federal government issues a bond to finance spending

Financial Markets (Stock, Bond, Currency, Exct) bring together the suppliers of capital and demanders of capital. In these markets, financial securities/assets are traded

Financial asset (securities / instruments) : An investment asset whose value is derived from a contractual claim of what they represent. These are liquid assets that can be converted into cash

Financial intermediaries (institutions) act to process transactions between suppliers of capital and demanders of capital when it is not optimal/efficient

Regulators of the financial system

Securities and exchange commission

State

Role of Banks

Money is what allows our everyday exchanges to happen- but its important to ensure that money is able to flow throughout the economy so that those who need money are able toget it - role of banks

Role of banks - people can place their money in savings or checking accounts..ensuring their money is safe

Banks also make profit - banks charge higher interest on these loans than they apply to savings accounts

Retail Banks: Retail Banks focus on consumers as customers

Commercial Banks: These banks focus on businesses as customers

Investment banks: Investment banks help businesses raise money in financial markets

Central Banks: In the US the Federal Reserve manages the monetary system and supervises banks

Federal Reserve (The Fed) is the central bank for the US of America. The AP switches between both terms relatively interchangeably

Real Interest rate = nominal interest rate - inflation (actual or expected)

Who is affected by changes in Real Interest Rate

Depositors are not the only ones who need to consider inflation rates. Lenders must also consider inflation and what they expect inflation to be, when giving out a loan.

Unexpected increases in inflation benefit borrowers and hurt lenders. Conversely, unexpected drops in inflation benefit lenders and hurt borrowers

Nominal interest rate is the interest rate actually paid for a loan.

Real interest rate is the nominal interest rate adjusted for inflation

Real interest rate = nominal interest rate - inflation

Nominal interest rate = real interest rate + inflation

Test topics:

Functions/components of money

Commodity vs. Fiat money

types of assets

Interest rates

Expected vs. actual inflation

Types of Assets:

Stocks

Stocks are a security that gives you “ownership” in a company

It represents your claim of ownership of the firm you paid for. Firms raise money with capital invesment by selling stocks for partial ownership

Bonds

An interest-bearing asset issued by a buisness or government

When a firm wants to raise money, it’ll issue a bond that promises the holder it’ll give back the same amount plus interst

Loans

Process of borrowing money and replaying it back with interst

Bank deposits

Refer to the money in your bank account

Functions of Money

Medium of Exchange

Asset used to exchange goods and services

Replaced bartering. No need for a double coincidence of wants

Needs to be readily acceptable, easily divisible, portable, and difficult to counterfeit

Store of Value

Money can be stored, retrieved, and used at a later time

Commodity money has intrinsic value, includes precious metals such as gold or silver

Unit of Account

Money is a measure of value denoted in denominations

Ex. $100 dollar bills

Standard of Deferred Payment

Can be used as credit, allows transactions to be settled in the future

Interest + Inflation

Real Interest rate = nominal interest rate - inflation (actual or expected)

Nominal interest rate is the rate the bank sets (unadjusted)

Real Interest Rate is the nominal interest rate adjusted for inflation

Unexpected increases in inflation benefit borrowers and hurt lenders

Conversely, unexpected drops in inflation benefit lenders and hurt borrowers

Demanders of Capital (borrowers) want a low interest rate (cheaper to borrow money)

The suppliers of Capital (lenders) want a high interest rate (More profit)

Expected vs. Actual inflation

Unexpected inflation increase = Borrowers ❤ , lenders 💔

Unexpected inflation decrease = Borrowers 💔, lenders ❤

M1 “Narrow Money”

Money in circulation + demand deposits (check able deposits in banks)

M2 “Money and close substitutes”

M1 + savings deposits under 100,000 money market funds

M3 “Broad Money”

M2 + Large time deposits in banks + institutional money market funds (as well as short term repurchase agreements and other large liquid assets

Fractional reserve banking system : Money that is really easy for them to take out

Money Supply

Sum total of all the currency and other liquid assets in a country’s economy

Money supply includes all cash in circulation and all bank deposits that the account holder can easily convert to cash

Fed : Policy-making body that regulates the money supply

Monetary Base: M0 = Bank reserves + Cash in circulation

Money Supply:

M1 = Cash in circulation + Check able Bank deposits (demand deposits) + Savings Accounts

M2 = M1 + Small CDs + Money Market Mutual Funds

M2 is sometimes referred to as “near-money's”

M3 = M2 + Large time deposits in banks + Institutional Money Market Funds (as well as short-term repurchase agreements and other large liquid assets)

Money supply is important because it has a powerful effect on economic activity

Increase in supply of money lowers interest rates and spurs investment, while a decrease in the supply of money increases interest rate and slows investment

Loans impact Money Supply

The MS can increase by taking the amount loaned out $90 x Money Multiplier

Demand Depoists The original

Demand Deposit $100 x Money Multiplier

Monetary Policy

Discount rate

interest on required and excess reservers

open market operations

overnight erserve repurchase agreements

reserve requirements

term depoist facility

Payment Services

Electronic payments

check collection + Cash services

Fiscal Angent for the US treasury

Bankers bank

Funds transfers

Supervision and Regulation

Regulations

Bank exams

Stress tests

Safety and soundness

The federal Reserve sets its policies to promote the following two conditions:

Maximum Employment

Price Stability : A target inflation rate of 2%

Moderate, Long term interest rates

The FED users 3 tools to control/influence the money supply:

The Reserve Requirement

How much money banks must hold after deposits are made

The Discount Rate

The interest rate charged by central banks on loans they give to commercial banks

Open market operations

The buying and selling of bonds

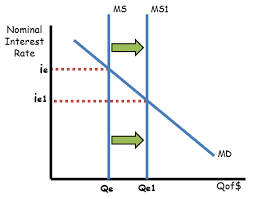

The Demand for Money:

The demand for Money refers to the desire or need to hold liquid assets (such as cash) interest in having illiquid assets (such as stocks). Various factors influence the demand for money with some examples being: interest rates, income levels

Shifters of Money Demand Curve

Price Level

RGDP

Transaction Costs

Change in laws

Expectations

Change in Credit markets

Changes in the Money supply by the federal Reserve

Ex: Federal Reserve increases money supply, money supply will shift right

To stimulate the economy, the Feds will lower its federal funds rate target

To slow the economy, the feds will raise its Federal Funds target

The federal Funds rate is a specific number

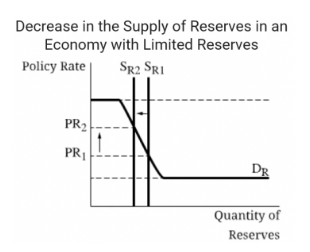

In other countries, this is called the Policy Rate

Interest rate: Cost of borrowing more money

Federal Funds rate: The interest rate that financial institutions charge each other for loans in the overnight market for resource

Open Market Operations: The purchase and sale of U.S. Treasury securities in the open market by the central bank in order to regulate the supply of money that is on reserve in U.S. Banks

Discount Rate: The interest rate of the Fed charges commercial banks to borrow funds on a short term basis. The level of the discount rate is set above the federal funds rate target, and thus serves as a backup source of funding for depository institutions.

To stimulate the economy, the Feds should lower the discount rate

To slow the economy, the Feds should raise the discount rate

This will always be above the Federal Funds rate (Policy Rate)

As the supply of reserves decreases by the Fed selling bonds, then interest rates will rise, as shown to the left. The opposite is also true – if the Fed buys bonds from the banks, the supply of reserves will increase and shift to the right, and the interest rates will decrease.

Setting Monetary Policy

Federal Funds rate : The interest rate that financial institutions charge each other for loans.

Implementing Monetary Policy: The Feds Policy Toolkit

Reserve Requirements: Sets the percentage of deposits that are required as reserves, to be held either as cash on hand or as account balances.

Open Market Operations: The purchase and sale of U.S. Treasury securities in the open market by the central bank in order to regulate the supply of money that is on reserve in U.S. banks

Discount rate: The interest rate the Fed charges commercial banks to borrow funds on a short term basis. This acts as a ceiling above the fed funds rate.

Interest on required and excess reserves: The interest rate paid on excess reserves. This acts like a floor beneath the federal funds rate.

overnight reserve repurchase agreements: The purchase of securities with the agreement to sell them at a high price at a specific future date. It is used to raise short-term capital.

Nontraditional and Crisis Tools: Ex. Purchasing a very large amount of assets such as Treasury securities, federal agency debt, and federal agency mortgage-backed securities (2008); Opened lending facilities (Covid)

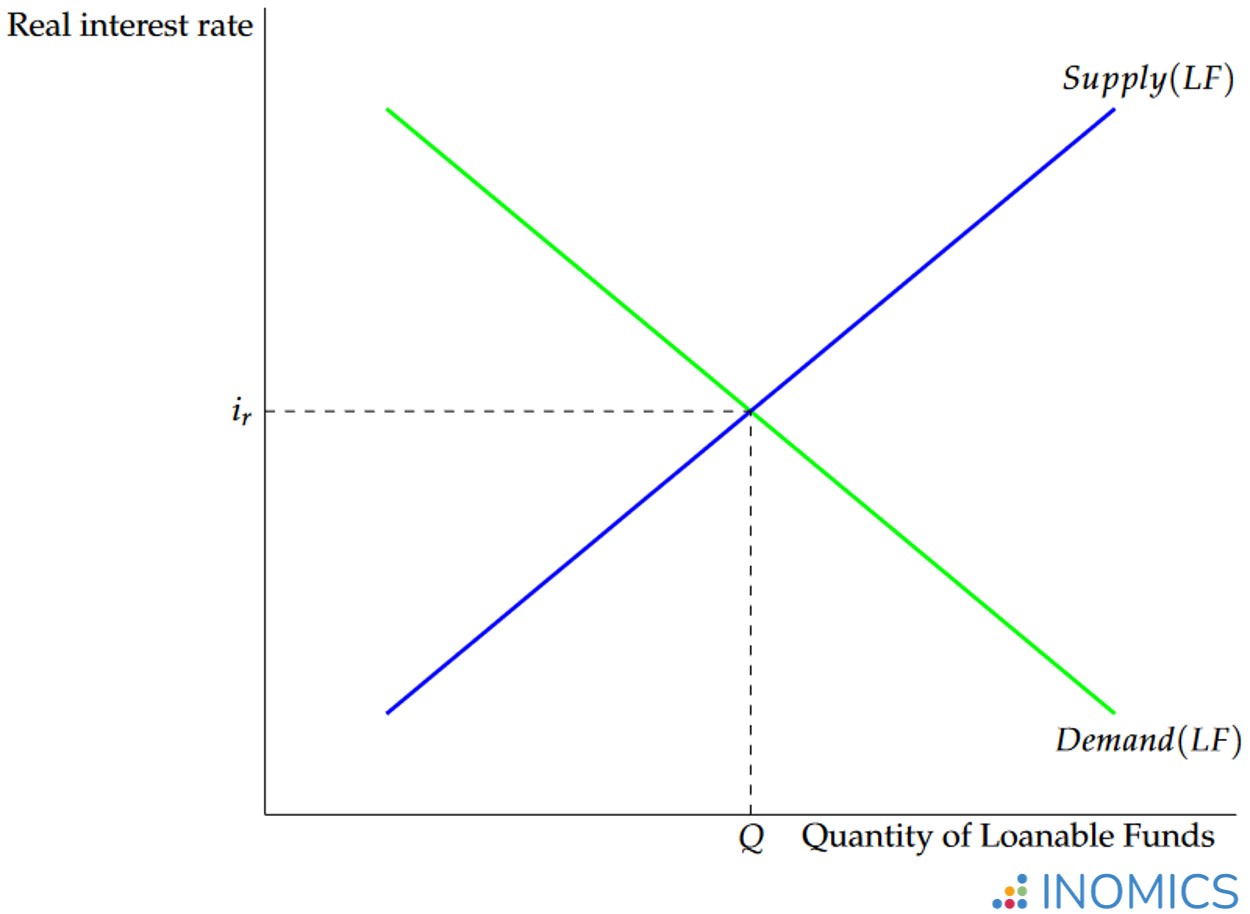

Loanable Funds

The Lonable FUnds market brings together savers and borrowers, illustrating the demand for funds generated by borrowers and the supply of funds provided by lenders.

Supply - The supply of lonable funds represents the behavior of savers. Higher interest rates shift qs to the right, as individuals are more likely to save

Demand - The demand for lonable funds represents the behavior of borrowers and the quantity of loans demanded. Lower interest rates shift qd to the right

Saving and Supply

private savings: Household savings

Public saving: Government savings

National savings: Public and Private Savings

→ A change in national savings will shift the supply of lonable funds

Foreigners and Supply

Capital Inflow: The amount of money entering the country

Capital Outflow: The amount of money leaving the country

Net capital inflow: Inflow - outflow

A change in net capital inflow will shift the supply of lonable

The Fed and Monetary Policy

Only Monetary Policy can change the MS Curve.

If a question tells you that Monetary policy is being conducted by the Fed, you know that MS is shifted.

Content: The Money Supply

When Nominal Interest decreases (Shift their wealth out of non-money interest-bearing financial assets and raise their money holdsings) investors will drive the interest rate up by IRe

When Nominal Interest rate increases (Shift their wealth into non-money interestbearing financial assets and decrease their money holdings), investors will drive the interest rate down to the IRe

Changes in Aggregate Price Level

Demand for money is proportional to the price level

If PL (Price level) rises by 20%, quantity of money demanded at a given interest rate also rises by 20%. It takes 20% more money to buy the same basket of goods and services

If prices INCREASE then money demands DECREASE

Changes in Real GDP

An increase in real GDP shifts the money demand curve rightward

The larger the quantity of goods/services there is to buy, the larger the quantity of money people will want to hold.

Changes in Credit markets + Banking tech

The invention of credit cards has drastically decreased the demand for money - people do not need to hold cash anymore!

Apple pay has and will continue to decrease MD

People can leave their funds in interest-bearing assets

Changes in institutions and Laws

Ex. In 1980, Govt’t law said banks can’t offer interest rates no checking accounts.

F- Foreign Demand for Domestic Currency

A - All borrowing, lending, and credit

D - Deficit spending

Gov’t spending more then it brings in from taxes

Borrowing from Banks

E - expectations for the future

Shifters of Supply:

S - Savings Rate

E - Expectations for the future

L - Lending at the Discount Window

F- Foreign purchases of domestic assets

Debrief: Monetary Policy Synthesis

Note: Lonable Funds Market Brings borrowers and savers together

Demand → Borrowers

Supply → Savers

Increase in MS → Decrease in Nominal Interest → Increase in (investment and consumer spending) → Decrease Savings → AD Increase → GDP Increase → PL Decrease

Decrease in MS → Increase in Nominal Interest → Decrease in (investment and consumer spending) → Increase Savings → AD Decrease → GDP Decrease → PL Increase

Negative Demand Shop → Less consumer spending thus less people are working

Positive Demand Shop → More consumer spending thus more people working

Expansionary Fiscal Policy - Increases AD — shift right

Increase in gov’t spending

Cut in taxes

Increase in gov’t transfers

Contradictory Fiscal Policy - reduces AD (shift left)

Decrease in gov’t spending

Increase in taxes

Reduction in gov’t transfers

Fiscal Policy will shift the Aggregate Demand Curve

Think:

1) Is this good or bad for buisness

2) If bad, will shift left

Demand Pull: AD shifts right

Cost-Push: SRAS shifts left

The shifters of LRAS

Entrepreneurship

Federal Reserve System

The Federal Funds Rate: The interest rate that financial institutions charge each other for loans in the overnight market for reserves

The Federal Funds Rate is a specific number.

In other countries, this is called the Policy Rate

Buy Big: To stimulate the economy, the Fed will buy securities

Buying securities increases bank reserves → Increases bank loans → Increase MS → Lowers IR → Increases Consumer / Bushiness Spending → Increases AD → Increases Inflationary Pressure

Discount Rate: This will always be above the federal Funds Rate(Policy Rate)

Note: “Administered Interest Rates” refers to the FED (central Bank) Changing Fed Funds/Discount Rate

Setting Monetary Policy:

The Federal Funds Rate: The interest rate that financial institutions charge each other for loans

Impleneting Monetary Policy: The Fed’s policy toolkit

Reserve Requirements: Sets the percentage of deposits that are required as reserves, to be held either as cash on hand or as account balances

Open Market Operations: The purchase and

Interest on Required and Excess Reserves: The Interest rate paid on excess reserves. This acts like a floor beneath the federal Funds rate

If PR increases → MS decreases

If Fed Funds Rate Increases → Ms decreases

Buy securities → MS increase

Sell Securities → MS decrease

If Discount Rate Increases → MS decreases

If Interest on reserves increase → MS decreases

If Nominal GDP increases, Money Demand increases

Real GDP Decreases, MD Decreases

Inflation Increases, MD increases

Decrease in money supply

Contractionary Money Supply

Money Demand Curve: Shifters

Changes in Aggregate Price Level

The demand for money is proportional to the price level

if price level rises by 20%, quanity of money demanded at a given interest rate also rises by 20% . it takes 20%

fiscal policy shifts aggregate demand

Changes in Real GDP

Changes in Credit market + banking tech

Changes in institutions and laws

Changes in Income

An increase in real income leads to an increase in MD

MD → refers to the desire to hold liquid currency

Loanable Funds Market

Monetary Policy → Central Bank

Fiscal Policy → Gov’t

Note: When Defecit Spending increases, Demandable Loanable Funds (DLF) increases

Note: When Savings rate increases, Savable Lonable Funds increase

C* = Consumer Spending on interest-sensitive products:

Ex: Taking out loan to buy a car

Note: Investment spending refers to business buying capital goods (machines)

Note-Note: They normally take out loans to do this

Monetary Policy Synthesis

Increase in MS → Decrease in Nominal Interest → Increase in (investment and consumer spending) → Decrease Savings → AD Increase → GDP Increase → PL Increase

Decrease in MS → Increase in Nominal Interest → Decrease in (investment and consumer spending) → Increase Savings → AD Decrease → GDP Decrease → PL Decrease

To find change in Money Supply based on sale/purchase of securities:

Total Change = initial sale or purchase * money multiplier

Long Run

Phillips Curve:

Shift in AD, Inflation and unemployment move in opposite directions (inverse)

Positive Demand Shock

Unemployment falls (Bc GDP increases)

Price level Rises

When we have a shift in SRAS, Inflation and Unemployment move in the same direction

Negative Demand Shock

Unemployment rises (GDP decreases)

Price level falls

The Short run Phillips curve is the negative relationship between the unemployment rate and the inflation. An economy is always operating somewhere along the SRPC.

Aggregate Demand Shocks correspond to movement along the SRPC

AD Shifts : Movement along SRPC

AD Right = movement on SRPC

SRAS Shifts = SRPC Shift

SRAS Right = SRPC Left

SRAS = short-run aggregate supply

SRPC = Short-Run Aggregate Supply

Inflationary Expectations shift the SRAS curve - An increase in expected inflation shifts the SRAS curve to the left and the SRPC to the right…A decrease in expected inflation shifts the SRAS curve to the right and the SRPC to the left

The long-run Phillips Curve shows the relationship between unemployment and ifnlation after expectations of inflation had time to adjust to experience

LRPC is vertical at the natural rate of unemployment because output will always return to its full-employment level once wages/prices have adjusted in the LR

Points to the left of LR equilibrium represent inflation gaps; points to the right represent recessionary gaps

Factors that cause the natural rate of unemployment(changes to characteristics of the labor force, government policies, etc.) to change will cause the LRPC to shift

Knowt

Knowt