3b. Inflation

Inflation

Inflation is defined as a sustained general rise in prices.

The opposite of inflation (deflation) is a term that can have two meanings.

When inflation falls between two measures but is still above zero it is disinflation

A general rise in prices may be quite moderate. Creeping inflation would describe a situation where prices rose a few percent on average each year.

Hyperinflation describes a situation where inflation levels are very high. There is no exact percentage to describe it but 100% would probably be considered hyper-inflation by economists

Target inflation

- Inflation is the responsibility of the Bank of England.

- They aim to control inflation by using monetary policy which includes interest rates and quantitative easing

- They are set a target of 2% by the government

- Away from the 2%, economies aim for inflation to be ‘low and stable’

The benefits of low and stable inflation are:

- Consumers will keep buying goods as they will be more expensive in the future

- Consumers won’t be worried about rapidly rising prices

- Firms will buy capital now rather than in the future

- Economic agents in general will find it easier to plan

Causes of inflation

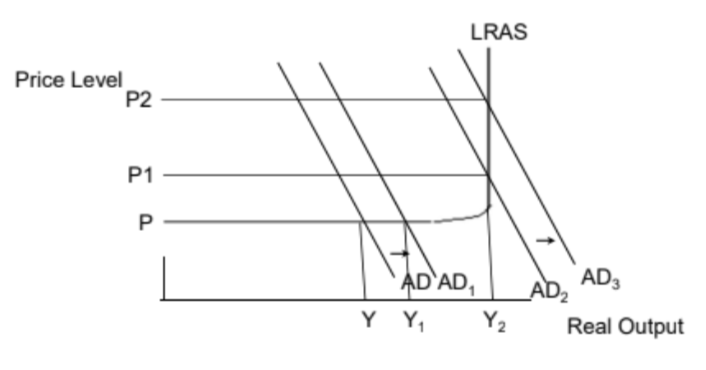

Inflation can be caused by two main factors: too much demand (demand-pull inflation) or rising costs (cost- push inflation)

Excessive increases in aggregate demand can occur for a variety of reasons:

- Consumer spending may rise excessively. Interest rates could be low and consumers are spending large amounts on credit cards.

- Firms may substantially increase their investment spending. Perhaps in response to the large demand

- The government might be increasing its spending substantially, or it could be cutting taxes

- World demand for UK exports may be rising because of a boom in the world economy

The level of inflation that occurs depends upon how large the increase in demand is and how near the economy is to full employment. This is the level of employment where all factors of production in the economy are fully employed. An increase in demand at full employment will lead to inflation, but not economic growth.

Inflation may also occur because of changes to the supply side of the economy.

Cost-push inflation occurs because of rising costs.

Wages and salaries account for about 70% of national income and hence an increase in wages are normally the single most important cause of increases in the costs of production.

Imports can rise in price. An increase in the price of raw materials and semi-manufactured goods will makes costs higher and feed into the price.

Profits can be increased by firms by putting up their prices.

Government can raise indirect taxes or reduce subsidies, thus raising prices

Measuring inflation

- The ONS finds out the what British households buy through the Living Costs and Food Survey. They then create an average basket of goods of about 700 goods to track the prices of (as it isn’t possible to track every price change).

- The government will record the prices these goods are sold at in different shops in a Price Survey. The average prices of the 700 items are then calculated.

- The average inflation rate is then calculated. Each individual price change is weighted according to how important it is in the typical household’s budget.

- An index number is then given to the level of prices. The level of prices in one year is called ‘100’ and the change in prices is compared to this base figure

CPI is used

- As the inflation target

- Valuing state pensions RPI is used

- To set interest rates on student loans

- For index-linked government bonds

The price level is measured in the form of an index. So if the price index were 100 today and 110 in on year’s time, then the rate of inflation would be 10 per cent.

If the index was 115 in year 3 the rate of inflation would be around 4.5 = (5/110) x 100

If the index was 125 in year 4 the rate of inflation would be 8.7 = (10/115) x 100

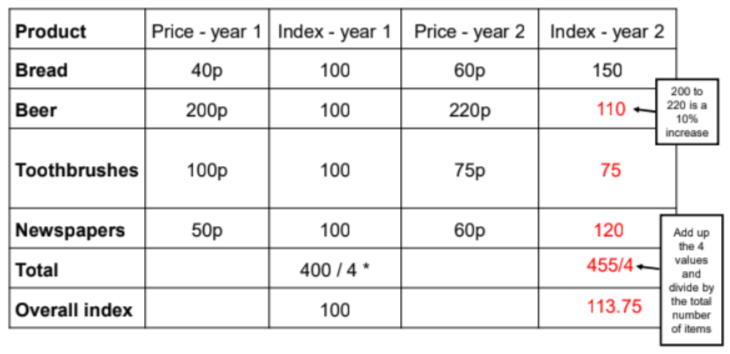

Calculating a price index is a complicated process. Prices of a range of goods need to be recorded on a regular basis.

In the UK we use the retail price index (RPI) and the consumer price index (CPI). On the same day of the month 110,000 prices are recorded for a variety of items across the country. These results are averaged out to find the average price of goods and the figure is then converted into index number form.

Index numbers

Index numbers are a useful way of expressing economic data time series and comparing / contrasting information.

An index number is a figure reflecting price or quantity compared with a base value. The base value always has an index number of 100.

The index number is then expressed as 100 times the ratio to the base value.

Note that index numbers have no units e.g. £, Euros or $

Measuring inflation

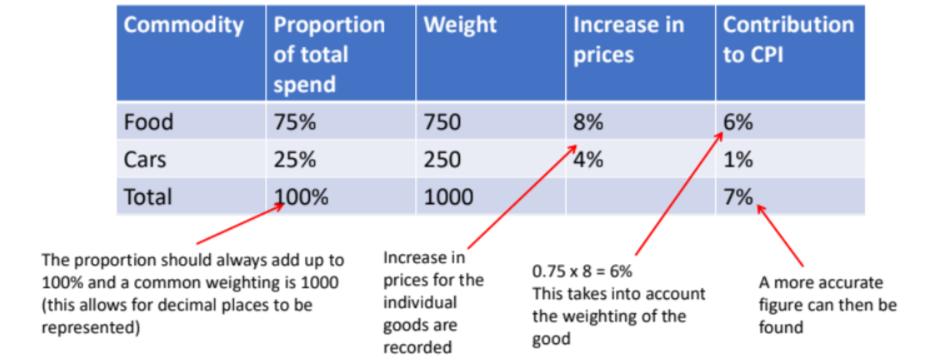

Changes in the price of food is more important than changes in the price of things such as tobacco. Therefore the figures are weighted before the final index can be calculated.

In order to calculate a weighting it is important to know how money is spent. In the case of the RPI, the Expenditure and Food survey is used.

Each year a few thousand houses keep track of their expenditure for one month. From these figure it is possible to see how an average family spends its money.

Costs of inflation

A sustained rise in price level is generally considered to be a problem. The higher the rate of inflation the greater the economic cost.

Decline in relative competitiveness domestically and internationally

Menu costs. Higher rates of inflation may cause menu costs, which means firms have to change price lists quite often.

Boom and bust economic cycles. If inflation is caused by unsustainable economic growth then the economic boom may be followed by a recession.

Creates uncertainty. Higher rates of inflation are disliked by business because it makes it more difficult to predict future costs.

Redistribution. Inflation may cause redistribution of income from savers to borrowers. This is because inflation reduces the value of money.

Real wages

Hyperinflation risk

- Firms

- Higher prices reduce certainty and make business owners less likely to invest

- Firms will have to pay higher wages to maintain worker’s real standards of living

- Firms will have to spend money changing their promotional material such as adverts and special pricing as inflation will increase their costs and lead to them having to change their prices (menu costs)

- If prices are higher in the UK than in France then there will be less demand for UK products causing exports to fall

- Inflation can lead to increases in interest rates- raising the costs of borrowing to firms

- Consumers

- Inflation erodes the purchasing power of money so consumers cannot buy as much

- Consumers will waste time looking for a bargain as they mistakenly believe that individual firms are price gouging when instead the general price level is rising (shoe leather costs)

- Workers

- Reduced certainty and higher wage costs may lead to workers being made redundant

- A decline in demand for UK products could lead to unemployment in those industries

- Government

- If prices are higher in the UK than abroad then there will be less demand for UK products causing exports to fall and as prices are cheaper abroad UK consumers will import better value foreign goods, creating a balance of payments deficit

- The drop in exports, causes a decrease in AD and hence an increase in spare capacity and unemployment…

- …This would have a negative impact on the fiscal deficit

Positives of inflation

- Inflation erodes the value of debt.

- This would have a positive impact on inequality as the rich are net savers, whilst people who are less well-off tend to be net borrowers.

- Companies can use inflation to lower wages.

- Governments can inflate away debt, use fiscal drag to raise revenues

Problems with CPI as a measure of inflation

- Does not include housing costs e.g. mortgage payments or rent (appox. 15-20% of income spent)

- It is not representative of those with atypical spending e.g. non-car owners or vegetarians

- Sampling problems (only about 60% respond to survey)

- Tastes / fashions change more quickly than once a year for the basket

- Does not account for quality changes