MRU - Taxes and subsidies

* pendiente de agregar graficas

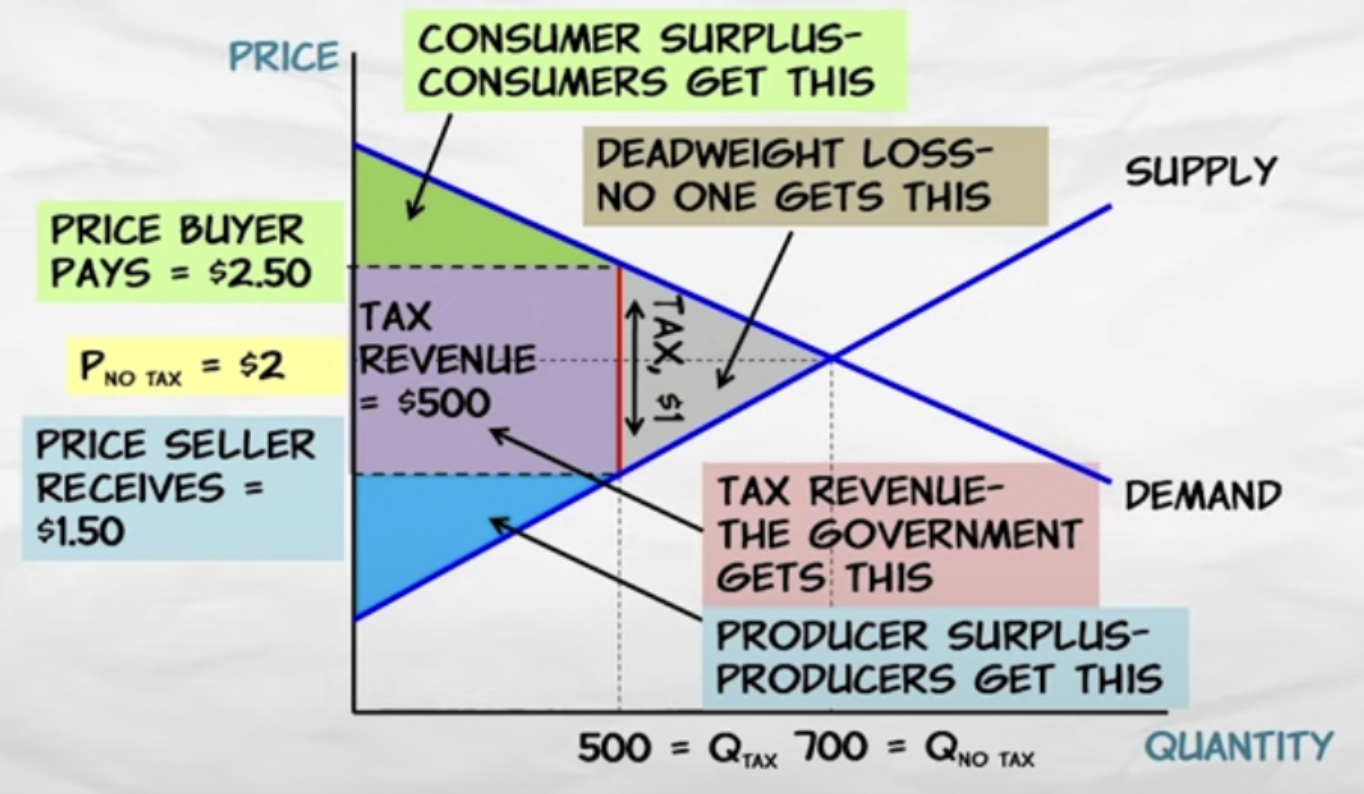

Commodity taxes

A commodity tax is a tax on goods.

Who pays the tax does not depend on who writes the check to the government.

The economic incidence is not the same as the legal incidence.

Who pays the tax does depend on the relative elasticities of demand and supply.

It depends on the law of supply and demand, not the law of congress.

Commodity taxation raises revenue (for the government) and creates lost gains from trade.

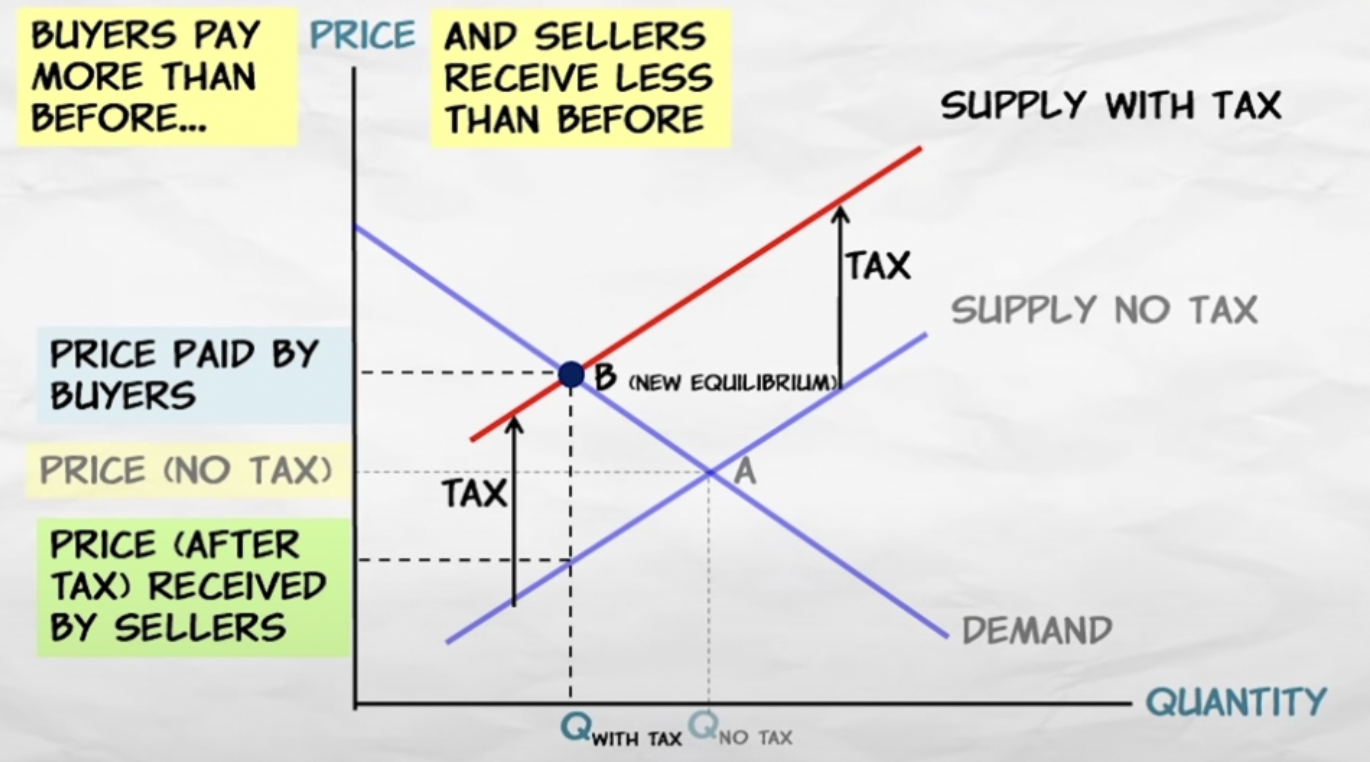

A tax on sellers shifts the supply curve up by the tax.

Buyers pay more than before and sellers receive less than before.

There is less quantity exchanged.

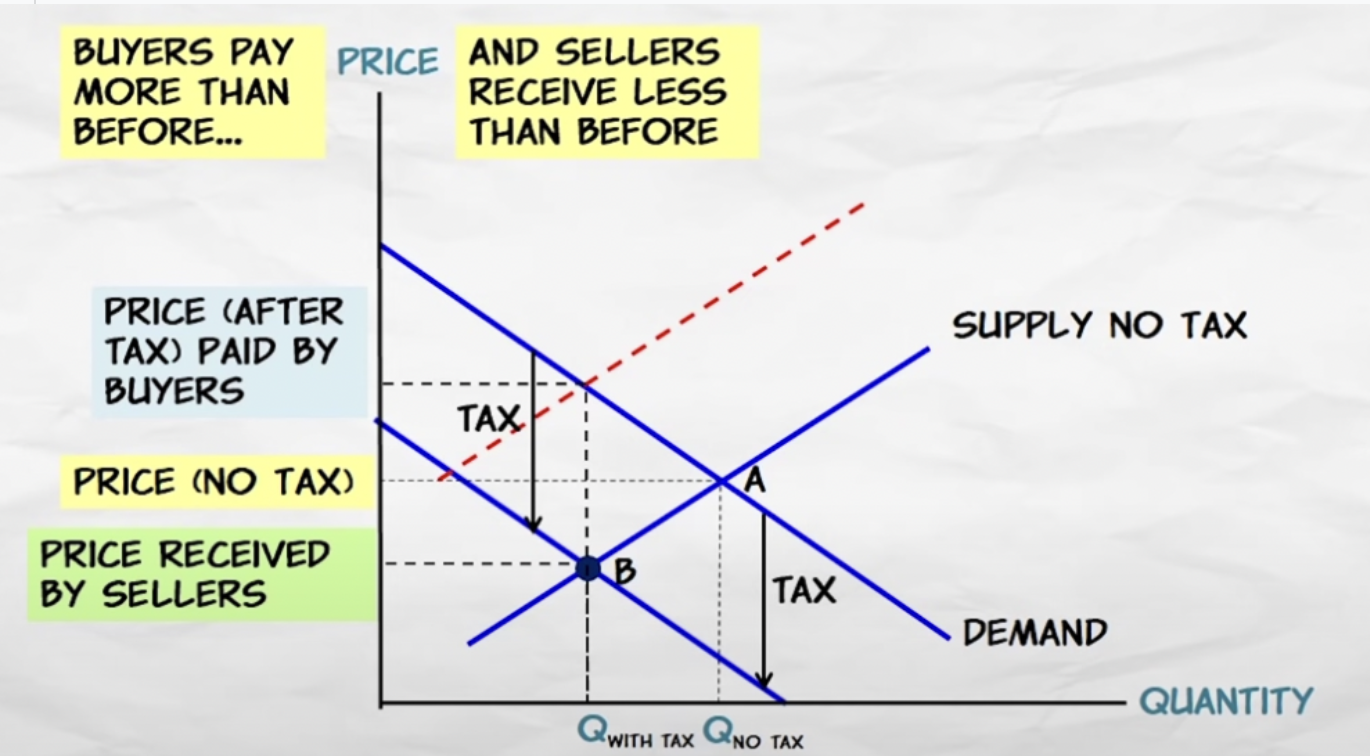

A tax on buyers shifts the demand curve down by the tax.

It reduces willingness to pay.

Both taxes have the same effect if the amount of the tax is the same, both sellers and buyers will have to pay.

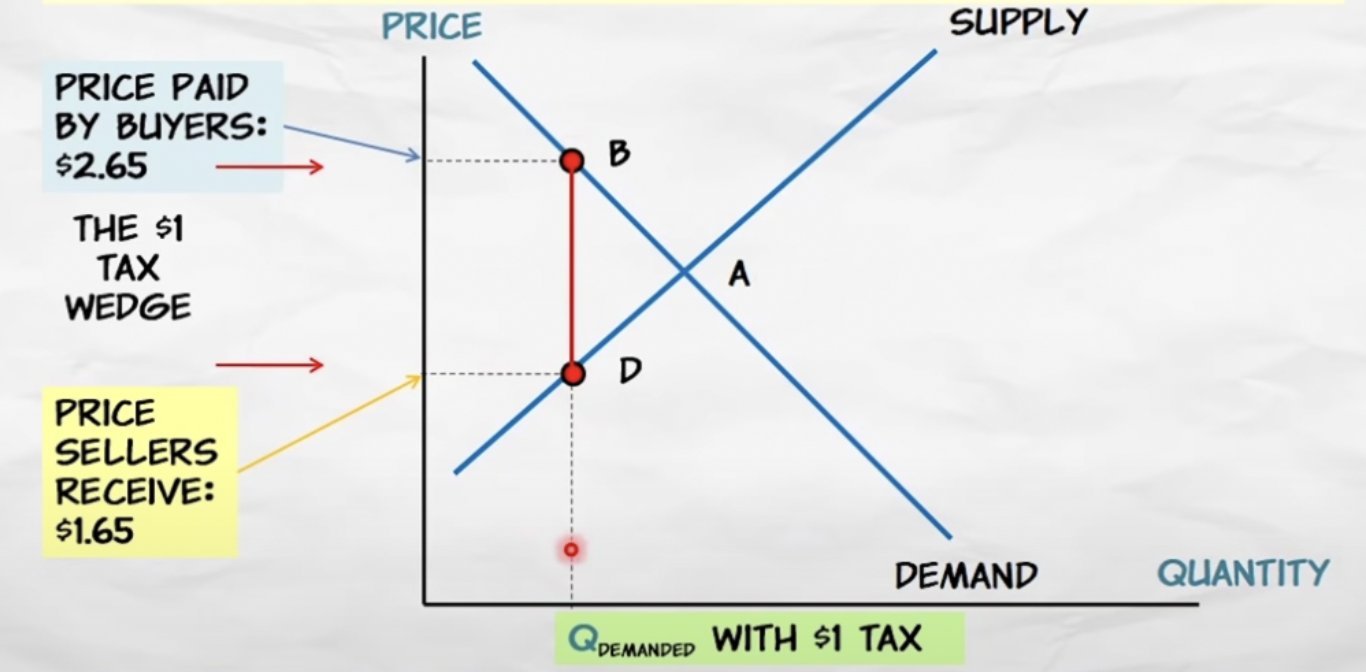

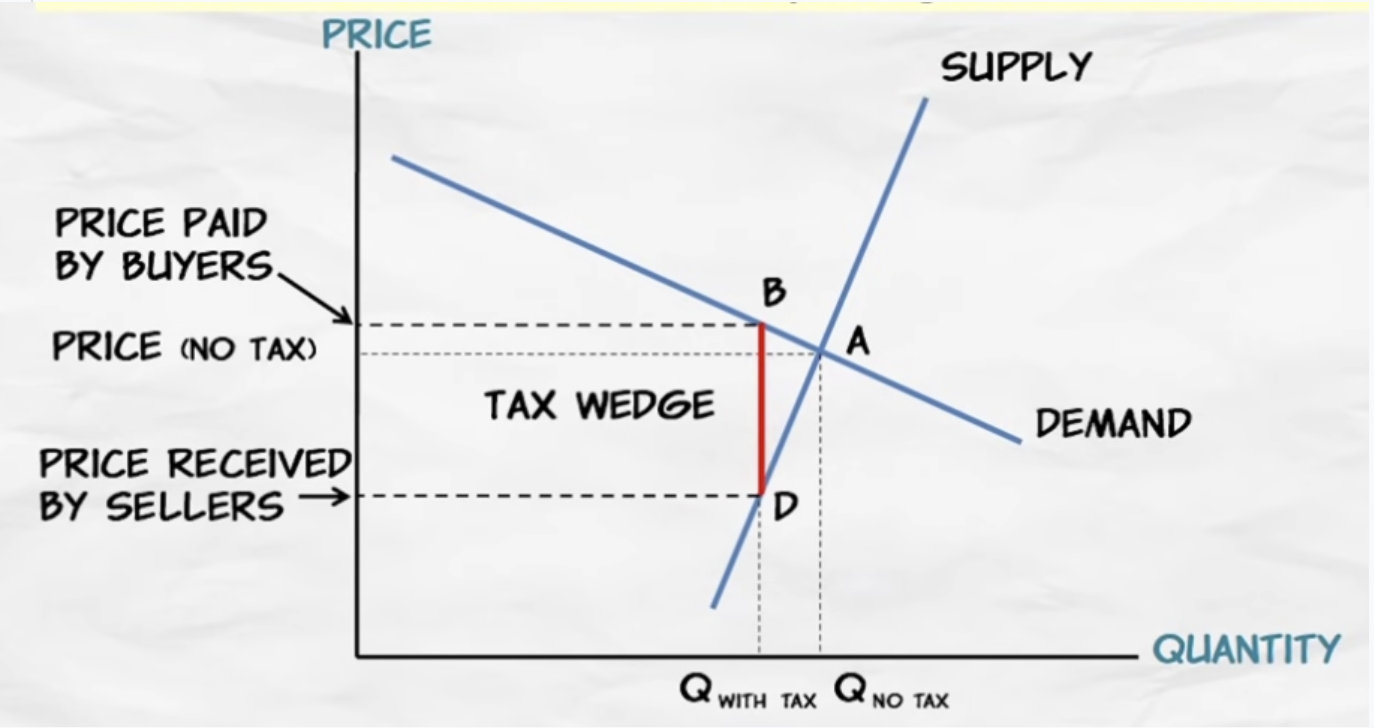

Since it doesn't matter whether buyers or sellers are taxed, we can graph the tax as a simple "wedge"

We drive it into the graph until the top hits the demand curve and the bottom the supply curve.

Who pays the tax?

The more elastic side of the market will pay a smaller share of a tax, and viceverse.

Elasticity = escape

Example: social security taxes.

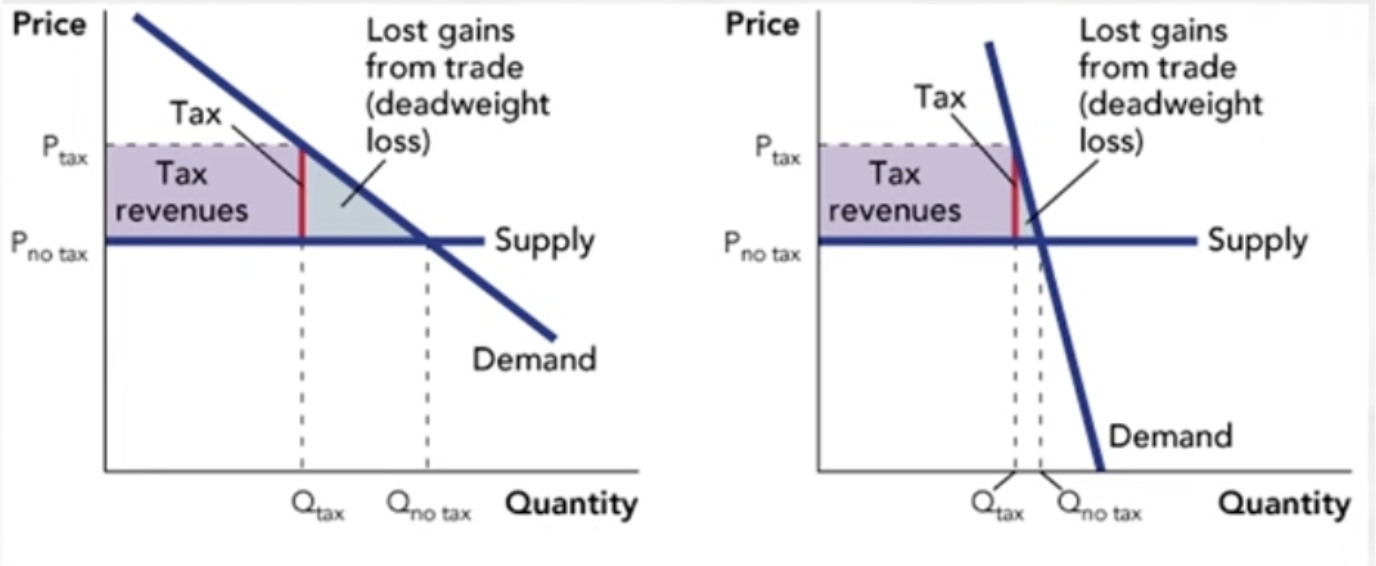

Tax revenue and deadweight loss

A tax generates revenue for the government and creates a deadweight loss.

Deadweight loss is the value of the trades not made because of the tax.

Deadweight losses are larger the more elastic the demand curve.

If the demand is inelastic, a tax will not deter many trades.

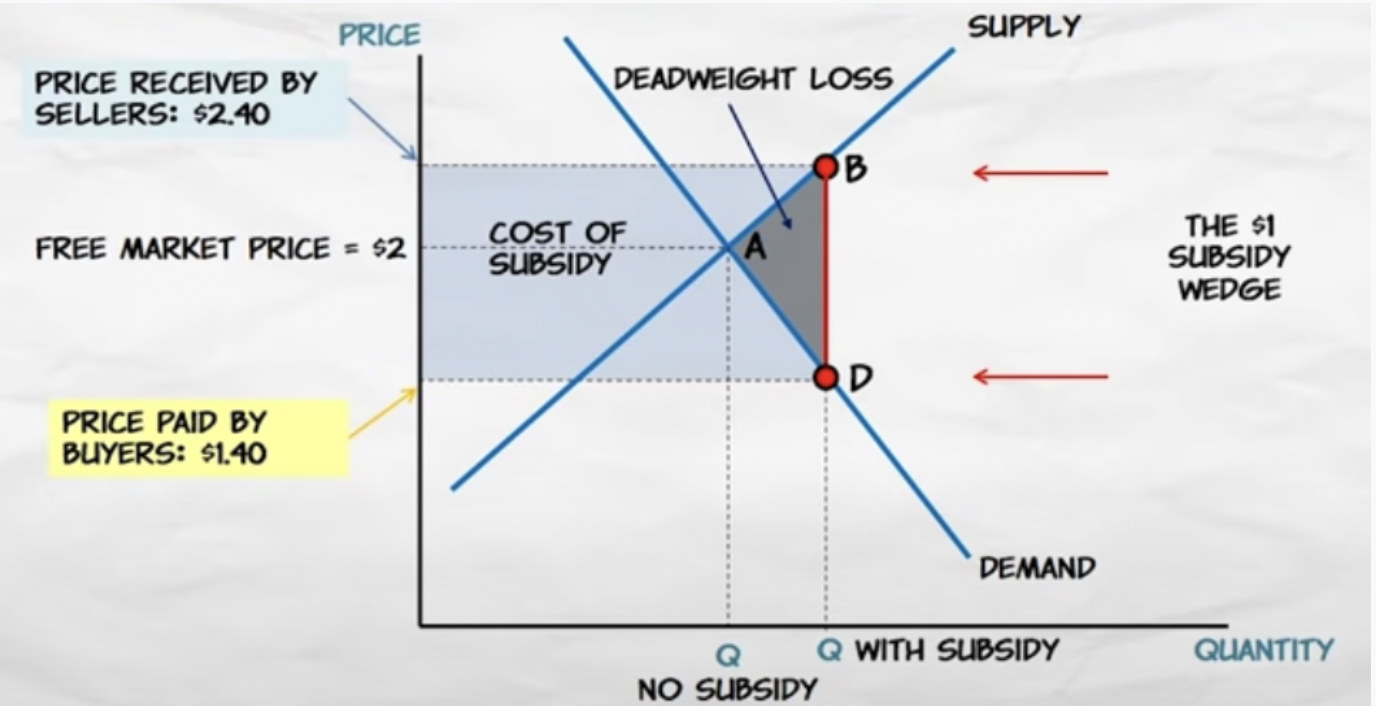

Subsidies

A subsidy is a "negative tax", where the government gives money to consumers or producers.

Who gets the subsidy does not depend on who receives the check from the government.

Who benefits from the subsidy does depend on the relative elasticities of demand and supply.

Subsidies must be paid for by taxpayers and they create inefficient increases in trade (deadweight loss).

The cost to the suppliers exceeds the value to the demanders.

No elasticity = no entry

No one to grab up the resources

A wage subsidy costs the government money but increases employment, and reduces welfare payments.