Chapter 1 | Accounting in Business

Importance of Accounting

Accounting is an information and measurement system that identifies, records, and communicates an organization’s business activities

Users of Accounting Information

External Users:

Shareholders

Lenders

External auditors

Nonmanagerial employees

Regulators

Internal Users:

Purchasing managers

Human resource managers

Production managers

Research and development managers

Marketing managers

Fundamentals of Accounting

Ethics are beliefs that separate right from wrong

Good Ethics are good business

Ethical Decision Making Steps:

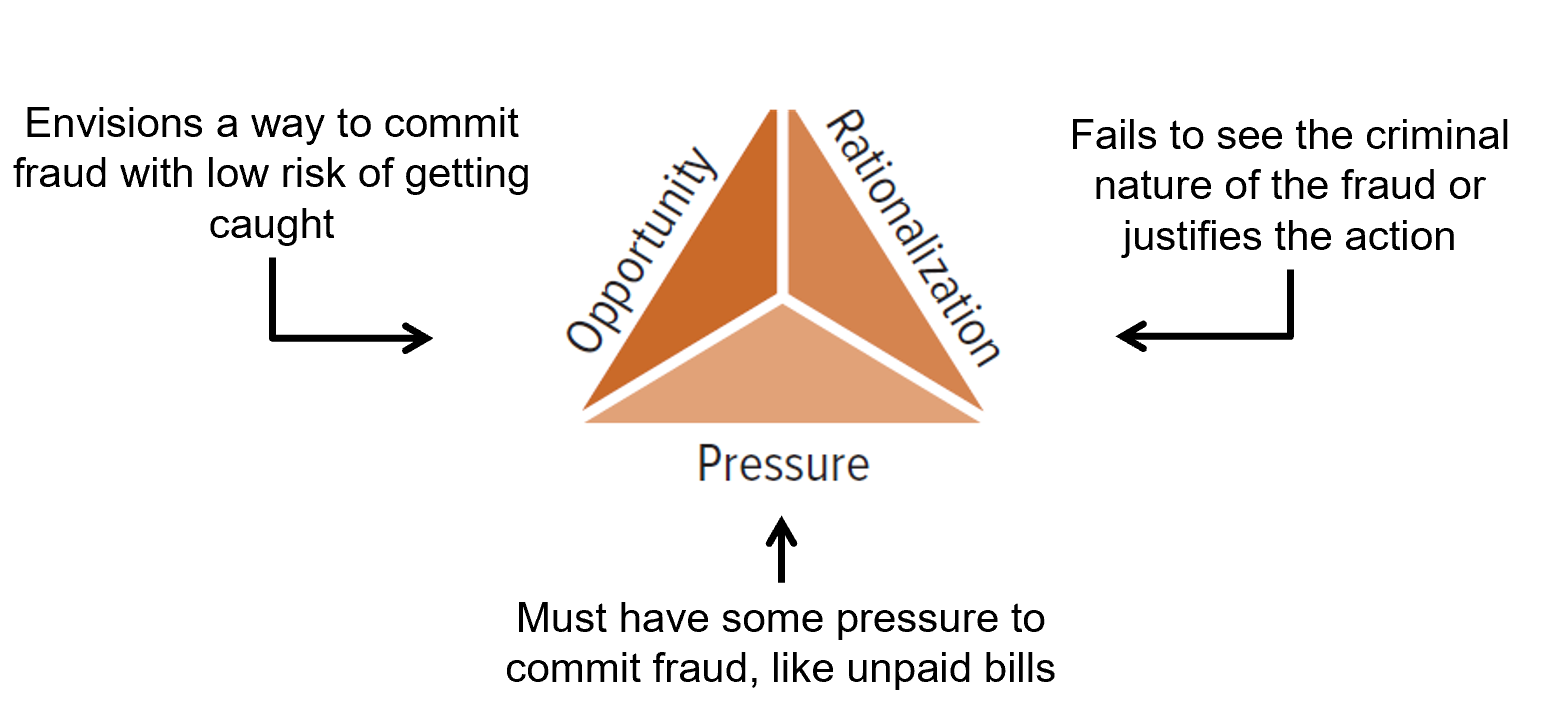

Fraud Triangle

Generally Accepted Accounting Principles – GAAP

(Financial accounting is governed by concepts and rules known as GAAP)

Relevance: Relevant information affects decisions of users

Faithful Representation: Faithful representation means information accurately reflects business results

FASB: The Financial Accounting Standards Board (FASB) is given the task of setting GAAP from the Securities and Exchange Commission (SEC).

SEC: A U.S. government agency that oversees proper use of GAAP by companies that sell stock and debt to the public.

IASB: The International Accounting Standards Board (IASB) is a group (consisting of individuals from many countries) that issues International Financial Reporting Standards (IFRS), which identify preferred accounting practices. The FASB and IASB are working to reduce the differences between U.S. GAAP and IFRS.

Conceptual Framework

Objectives: To provide information useful to investors, creditors, and others.

Qualitative Characteristics: To require information that has relevance and faithful representation.

Elements: To define items in financial statements

Recognition and Measurement: To set criteria that an item must meet for it to be recognized as an element; and how to measure that element

Accounting Principles

Measurement principle (Cost principle): Accounting information is based on actual cost. Actual cost is considered objective

Revenue recognition principle: 1.Recognize revenue when goods or services are provided to customers and 2.at an amount expected to be received from the customer.

Expense recognition principle (matching principle): A company records its expenses incurred to generate the revenue reported.

Full disclosure principle: A company reports the details behind financial statements that would impact users’ decisions in the notes to the financial statements.

Accounting Assumptions:

Going-Concern: The business is presumed to continue operating instead of being closed or sold.

Monetary Unit: Transactions and events are expressed in monetary, or money, units

Time Period: The life of a company can be divided into time periods, such as months and years

Business Entity: A business is accounted for separately from other business entities, including its owner

Accounting Constraint

Information disclosed by an entity must have benefits to the user that are greater than the costs of providing it.

Cost-benefit constraint: says that only information with benefits which are greater than their costs need to be disclosed.

Materiality: is sometimes included as a constraint and is the ability of information to influence decisions.

Conservatism and Industry Practices: are sometimes included as accounting constraints, also.

Business Entity Structures

Sole Proprietorship: a business owned by one person

Partnership: is a business owned by two or more people, called partners, which are jointly liable for tax and other obligations

Corporation: is a business legally separate from its owner or owners, meaning it is responsible for its own acts and its own debts.

Limited Liability Company (LLC): includes one or more members who are not personally liable for the LLC’s debts.

Business Transactions and Accounting

Assets: resources a company owns or controls

Liabilities: creditors’ claims on assets

Equity: the owner’s claim on assets and is equal to assets minus liabilities

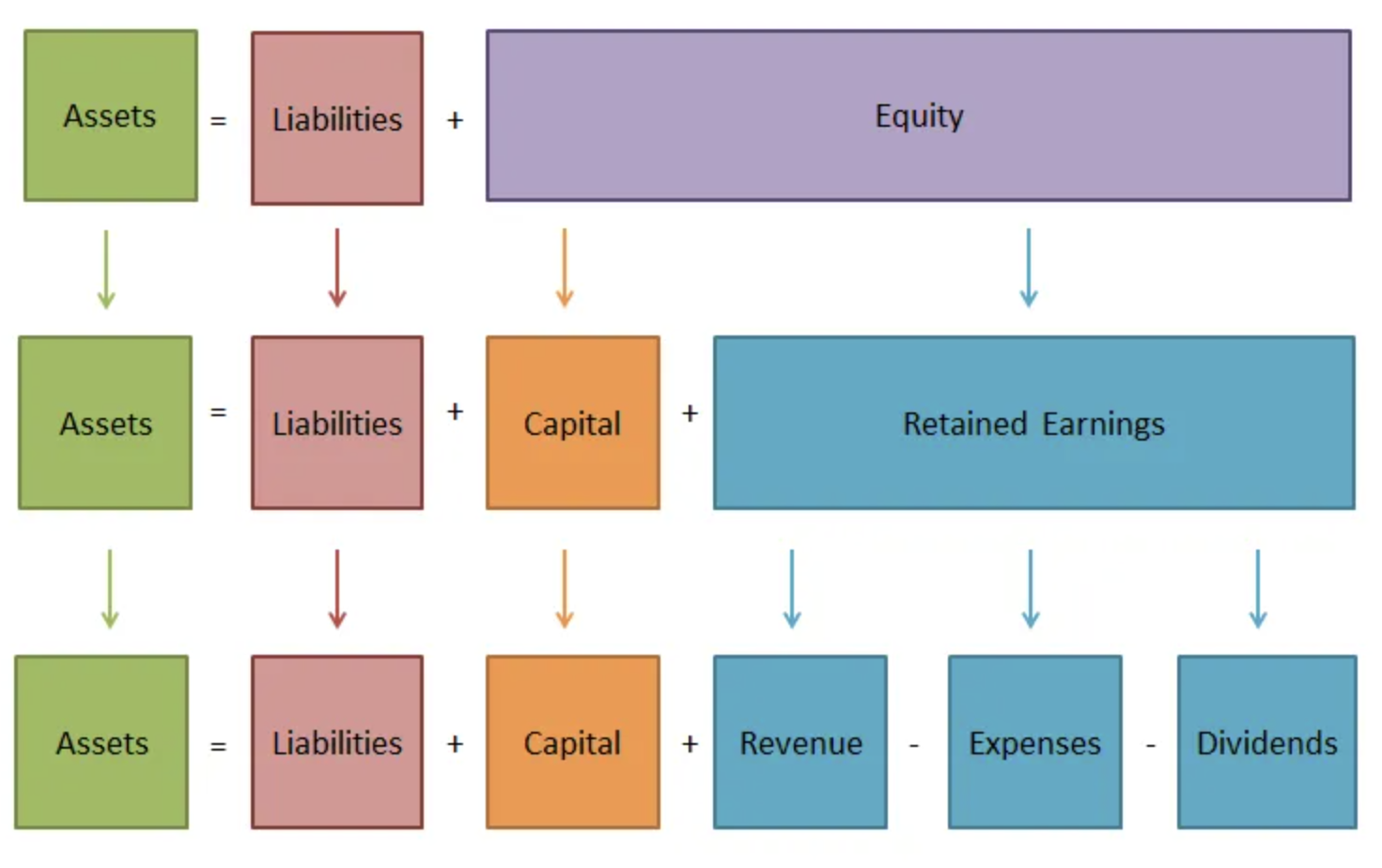

Accounting Equation

Assets = Liabilities + Equity

Write the Accounting Equation again: A= L + E

If total assets increase, then liabilities or equity must: increase

If total assets decrease, then liabilities or equity must: decrease

After EACH transaction, the accounting equation must ALWAYS: balance

Match the term with the appropriate definition.

__F___ Assets

__C___ Liabilities

__E___ Equity

__D___ Dividends

__B___ Revenues

__A__ Expenses

- Costs of selling products or services

- Sales of products or services to customers

- Amounts owed

- Distributions to stockholders

- Owners’ claims to resources

- Resources of a company

Categorize the Financial Claims - (Asset, Liability, or Stockholders’ Equity)

Cash Mortgage Supplies

Stock Merchandise Accounts Receivable

Accumulated Profits Accounts Payable Equipment

Buildings Business Loan Property

Plant Prepaid Insurance Debt

Expanded Accounting Equation

Contributed Capital > Common Stock: Inflows of cash from shareholders in exchange for stock

Retained Earnings > - Dividends: Payroll out distributions to shareholders. Reduces equity

> + Revenues: Sales of product or service. Increases Equity

> - Expenses: Costs of providing products or services. Reduces Equity

Financial Statements

Income Statement describes a company’s revenues and expenses and computes net income or loss over a period of time

Statement of Retained Earnings reports how retained earnings changes from net income (or loss) and from any dividends over a period of time

Balance Sheet describes a company’s financial position (types and amounts of assets, liabilities, and equity) at a point in time

Statement of Cash Flows identifies cash inflows (receipts) and cash outflows (payments) over a period of time.