Lecture 3 Financial Mathmatics 2

Note on Interest Rates and Cash Flow Analysis

Page 4: Finding the Rate

Determining Interest Rates

Necessary for evaluating future cash flows.

Important for:

Return on investment.

Interest rate on loans.

Single Cash Flow/Perpetuity Evaluation

Rearranging PV or FV equations to solve for r:

Formula: ( r = \left( \frac{FV_n}{PV} \right)^{\frac{1}{n}} - 1 )

Cash Flow Streams (Annuities)

Use Excel or financial calculators for precise values.

Trial and error for rough estimations.

Page 5: Example Problem

Investment Scenario

Invested: $863.75 today.

Future Value: $1,000 in 5 years.

Calculation

Rearranged formula: ( 863.75 = \frac{1000}{(1 + r)^5} )

Result: Rate of return is 2.97%.

Page 6: Finding the Number of Periods (n)

Rearranging Equations

Formula: ( n = \frac{\ln(FV/PV)}{\ln(1 + r)} )

Example Problem

Car purchase: $20,000 needed.

Current investment: $15,000 at 10% per year.

Calculate time to reach $20,000.

Page 7: Finding Cash Flow - Loan Example

Loan Structure

Principal: Amount borrowed.

Repayments include principal and interest.

Amortization table used to track payments.

Principal Owing

Present value of loan repayment cash flows.

Page 8: Loan Problem

Car Purchase Loan

Amount: $10,000 for 5 years at 5% interest.

Questions to Consider

Annual payment amount.

Principal paid in year 4.

Interest paid in year 4.

Amortization table creation.

Page 9: Loan Solutions

Annual Payment Calculation

Formula: ( PV = C \left( \frac{1 - (1 + r)^{-N}}{r} \right) )

Result: Annual payment is $2,309.75.

Principal Paid in Year 4

Calculation: Principal paid = $2,095.01.

Interest Payment in Year 4

Interest = $214.74.

Amortization Table

Detailed breakdown of payments over 5 years.

Page 12: Summary So Far

Understanding PV and FV Calculations

Rearranging Formulas for Missing Variables

Considerations for Real-Life Applications

Loan/mortgage payment frequencies.

Interest rate quotations.

Page 13: Future Value and Compounding

Compounding Mechanics

Interest earned on principal and previously earned interest.

Simple vs. Compound Interest

Simple interest: Interest on principal only.

Compound interest: Includes interest on interest.

Page 14: Example Problem - Compound Interest

Investment Scenario

$100 at 10% for 5 years.

Calculations

Compound FV: $161.05.

Simple Interest: $50.

Interest on interest: $11.05.

Page 16: Simple Interest for Less Than a Year

Calculation Method

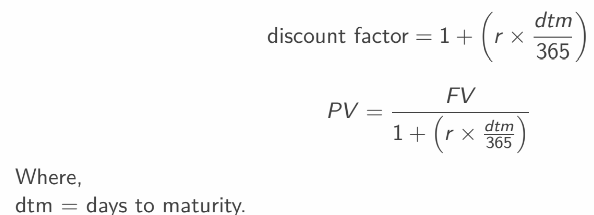

Discount factor:

Page 17: Compounding Frequency Impact

Continuous Compounding

Formula: ( FV_{\infty} = PV \times e^{r \times n} ).

Page 21: Different Types of Rates

Annual Percentage Rate (APR)

Simple interest earned in one year.

Effective Annual Rate (EAR)

Total interest earned including compounding.

Equivalent n-Periodic Rate (r)

Discount rate for adjusting cash flows.

Page 22: APR Details

APR Characteristics

Nominal interest rate, does not account for compounding.

Required disclosure on loans and savings.

Page 24: Effective Annual Rate (EAR)

Conversion from APR

Formula: ( 1 + EAR = \left(1 + \frac{APR}{m}\right)^m ).

Page 26: Compounding Effect

Comparison of Compounding Intervals

Higher frequency leads to higher EAR.

Page 28: EAR to Periodic Discount Rate

Conversion for Non-Annual Cash Flows

Formula: ( r_{per period} = (1 + EAR)^{\frac{1}{n}} - 1 ).

Page 32: APR to Discount Rate

Conversion Steps

Convert APR to EAR.

Convert EAR to r for cash flow frequency.

Page 36: Nominal vs. Real Interest Rate

Definitions

Nominal: Before inflation.

Real: Adjusted for inflation.

Fisher Equation: ( 1 + r_{nominal} = (1 + r_{inflation})(1 + r_{real})