Week 1 Making Investment Decision with NPV

Recap of Material from FINC2011

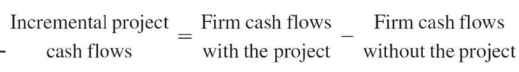

Incremental Cash Flow: Refers to the additional cash flow a firm receives from undertaking a new project. It is vital in project valuation as it identifies relevant cash flows.

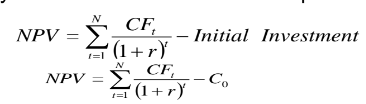

Net Present Value (NPV): The criterion used for investment decisions:

Accept projects with a positive NPV

Reject projects with a negative NPV

NPV Formula: sum of all cash flows (CF) discounted (r) to present time (t) of investment subtract initial investment spending (C0).

Cash flow is not the same as accounting profit, accounting profit is simply showing how well the company performs.

NPV discounting rules

5 general rules for discounting:

Discount cash flows, not profits

Discount incremental CFs and ignore non-incremental CFs

Treat inflation consistently

Separate investment and financing decision

Forecast cash flows after taxes

Rule 1

Use cash flows rather than accounting income.

as NPV is dependent on the project's free cash flow, not accounting profit.

Cash flow is not the same as accounting profit, accounting profit is simply showing how well the company performs.

Within discounting cash flows, there are some accounting terms we should pay attention to:

Capital expenditure (CAPEX) = current expenditure (e.g. COGS) + capital expenditure (e.g. depreciation).

Capital expenditure affects cash flow does not profit, while depreciation affects profits but not cash flows. This can be seen through the differences in accounting profit and cash flow.

To change from accounting profit to cash flow, add depreciation (not a cash outflow) and subtract capital expenditure (cash outflow).

Accounting profit (pretax) = revenues - expenses - depreciation.

Working Capital (WC), the difference between short-term assets and short-term liabilities.

NWC = current assets - current liabilities = inventory + receivables + payables + accruals.

Accounts receivable: customer unpaid bills. Account payable: your unpaid bills. Accrual: unpaid wages or tax.

Some mistakes in investment calculation: forget WC, forget that WC may change during project, forget that WC is recovered at the end.

Rule 2

The value of the projects depends on all additional cash flow; here are 4 common incremental effects:

Pay attention to externalities: Include both positive (e.g. synergies) and negative externalities (e.g. cannibalization) related to the project.

Recognize after-sales CFs: managers should forecast all incremental cash flows from the aftermarkets. e.g. parts and accessories after buying a car.

Remember salvage value: plant and equipment maybe sold at the end of project or redeploy elsewhere.

Pay tax on capital sales = salvage sale price - book value.

Book value = original purchase price - accumulated depreciation.

If capital sales for a profit = taxable; for a loss = tax shield.

Cash saved from having to buy new assets is also a positive CF.

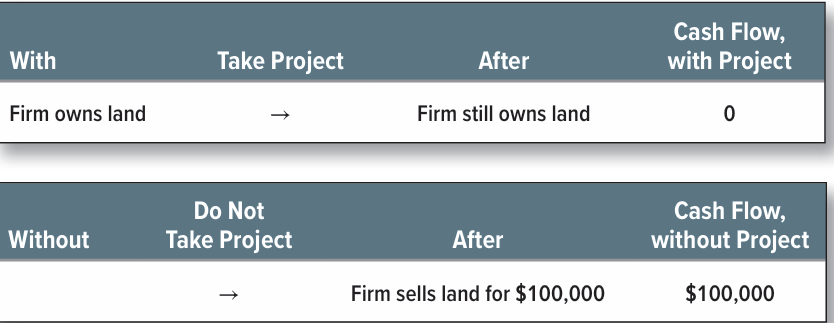

Account for opportunity costs: cash flows from the next best alternative use of the resources.

Here are 2 non-incremental effect:

Sunk costs, already incurred costs, e.g. R&D, Services

Overhead costs, indirect costs of operations, e.g. rent, salaries, utility, etc.

Rule 3

Treat inflation consistently.

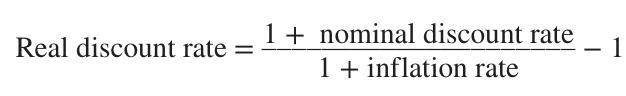

When there are cash flows in the future (nominal cash flow), discount it to present value with the appropriate nominal rate. The same can be said with real CF.

Note: if the question asks for “real cash flow” instead of present value, it is not discounted using the nominal rate, it’s the inflation rate.

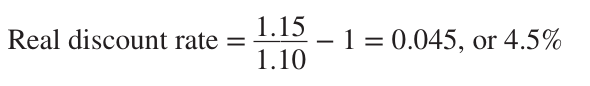

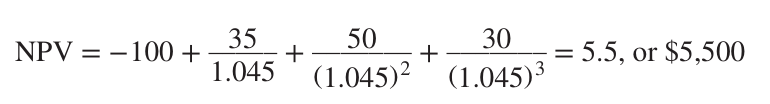

Example of exchanging rate and calculating NPV:

Rule 4

Exclude financing costs (e.g. debt interest, loan repayments, etc.) from investment decisions by assuming all-equity financing.

Exclude interest payment also since it is included in debt financing investment.

Rule 5

Consider tax impacts on pretax cash flows and discount the net amount to present value.

For depreciation:

Depreciation tax shield = tax * depreciation.

When doing NPV, we don’t need to calculate tax shield because subtracting depreciation reduced our EBITDA so less tax.

For capital gain on sale of equipment:

Tax on capital sale = tax * capital sales.

If firm makes a loss, tax authorities do not send the money for proportion of the loss. Firm can carry the losses forward and offset future tax.

Project Analysis Cashflow

3 components of project’s CF:

Total CF = CF from capital investment + Operating CF + CF from investment in working capital

CF from capital investment: up-front cost and retrievable at the end through salvage sale.

Operating CF (all 3 yield the same result)

= revenues - expenses - taxes.

= after-tax profit + depreciation.

= (revenues- expenses) x (1 - tax rate) + (tax rate x depreciation).

CF from investment in working capital: would represent 0 (if question states otherwise) since:

inventory requires cash up front and customer slow to pay bills = -CF

inventory sold and account receivables are collected later on = +CF

Examples

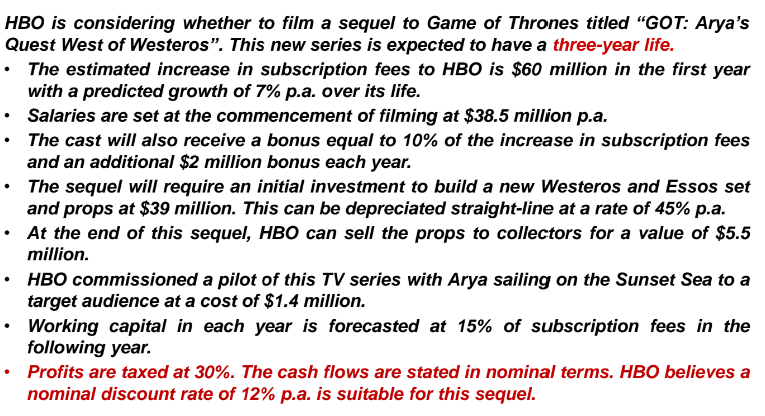

Example: HBO Investment Decision

→ In the tax part: firstly, find taxable income, then tax from depreciation. In this example, we found the taxable income after Operating CF; then we find the tax shield (receivables) on depreciation. The tax shield amount of 5.265 covered the 4.05 amount, so the remaining amount have to pay to tax authorities is 1.215.

→ If the tax payables are in negatives, that is tax receivables.

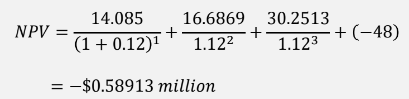

NPV Calculation Example for HBO

Total expected cash flows are calculated across years, along with necessary deductions (salaries, initial outlay, taxes).

Analyze whether the project increases shareholder wealth based on derived NPV (calculated to be -$0.589 million indicating likely rejection of the project).

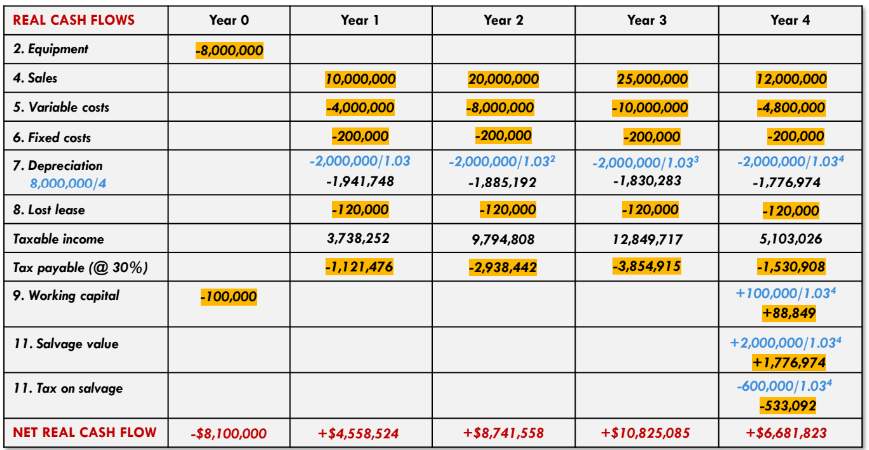

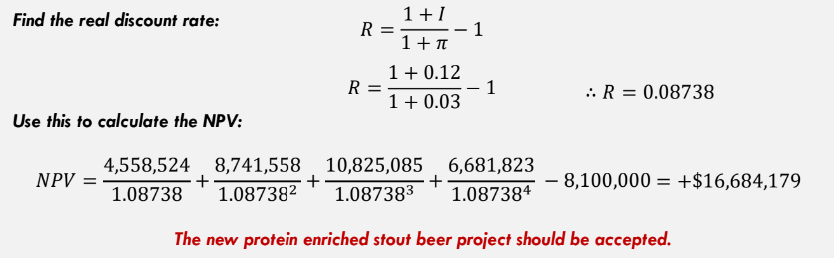

Example: Coopers Brewery Investment Analysis

Selecting Between Competing Projects

Choose the project with the higher NPV when facing mutually exclusive options (when they have equal lives).

If they don’t have equal lives, pick the one with lower EAC.

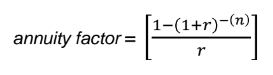

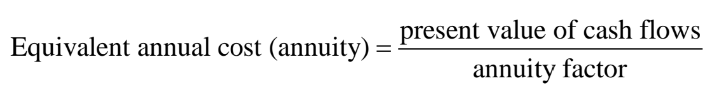

Useful tool: Convert PV of cash flows into equivalent annual cash flows (EAC) for better comparisons.

Four complications in decision-making include:

Timing decision: when to commence project

Horizon decision: long or short-lived equipment.

Replacement decision.

Capacity decision: cost of using spare capacity.

Timing Decision

Investment Timing Decision: Projects with positive NPV may benefit from delayed execution for better conditions.

Horizon Decision

Equipment Selection: Comparing mutually exclusive investments, consider both NPVs generated and calculate EAC to guide choices between different investable assets.

We pick the one with lower EAC.

There are a few assumptions we made when doing calculation:

Inflation is zero.

All calculations are made after-tax.

Replacement Decision

We can work on annuity CF or equivalent annual cash flows of the new machine, and compare it against the old machine to see which one generate higher CF.

Capacity Decision

We also calculated equivalence annual cash flow by discounting to see whether we pay for the new system for it to continue production.