3.6.1 Government Intervention

Govt. intervene in two ways to promote competition in a market:

Competition policy - Laws to ensure competition in a market - CMA, OFCOM,OFWAT - Aim = ‘Protecting Public Interest’

Regulation - Direct controls on firms to aim to solve market failure - ‘policing’

‘Assess ways in which govt. intervention can promote competition in a market’

Define - Market competition = Price and non price competition between firms in a market with relatively low barriers to entry - compete on market share, revenue ect.

Competitive markets:

Relatively low concentration rations

relatively low barriers to entry/exit

No dominant monopoly in a market

Pretty contestable

Prices set at competitive levels - absence of collusion

Government can intervene:

Direct - Policy, regulation

Indirect - Info to influence consumers

Liberalisation of a market:

Lowering entry barriers for new firms

Breaking up dominant/ legal monopolies

Privitisation of industry / competitive tendering ( PFI = Newman college )

Regulation on monopolies and oligopolies:

Tough responses to anti-competitive behaviour i.e. collusion/cartel activity by imposing harsh fines if not imprisonment

Block monopolistic mergers and takeovers

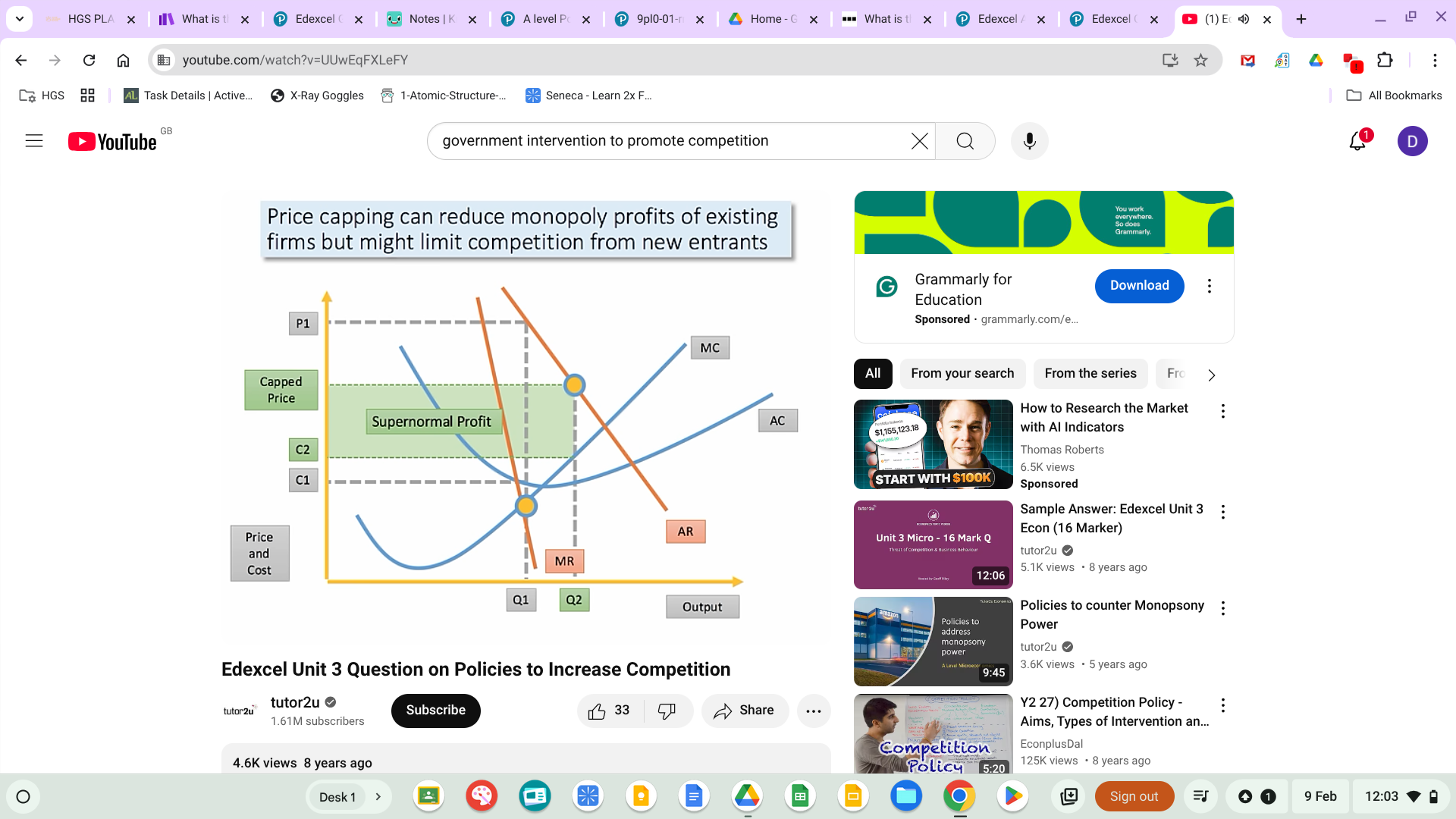

Price capping to control excess SNP - price caps ( max prices ) - prevent excess pricing

Improving the flow of info to consumers

Ensuring quality, standards and choice

Ensure technological innovation - interest of consumers - profit not just going straight to shareholders

Subsidies and taxation:

Subsidies for new coming businesses to lower their start up costs which will encourage new entrants ( i.e. renewable energy )

Taxation relief/patents to encourage creative destruction in markets

Managing state aid control - doesn’t distort the market i.e. country to country

Limits of intervention

Liberalisation/dereg:

Some industries are naturally more competitive than others with higher barriers to entry/ exit

Natural monopoly argument -intervention may cause more harm than good

Privatisation itself does little to promote competition - it would requite other competition policies

What matters is the contestability of the market nit ownership

Price caps ( i.e. max prices ) may simply just make it more expensive for new entrants to enter a market - this will simply deter them

State aid ( subsidies ) may just keep inefficient firms in the market

May simply be better off letting market forces doing their jobs - most monopolies don’t last long due to X inefficiencies - best off letting them go bankrupt rather than intervening which is also costly

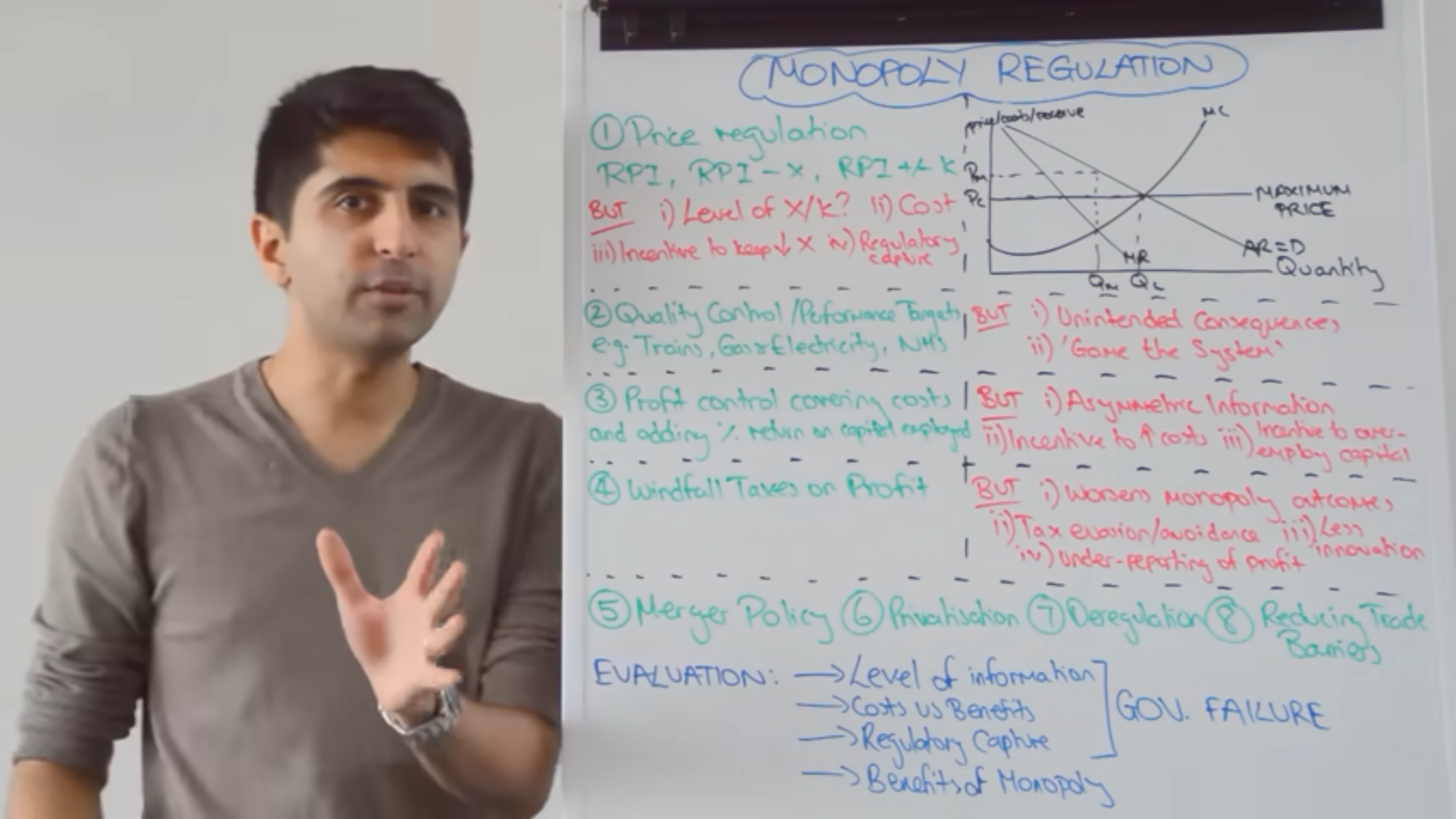

Monopoly regulation

Price regulation

RPI- X = RPI being the rate of inflation and X being the percentage or amount the monopoly should’ve gained in efficiency

Aim: To promote efficiency in monopolies which will in turn hopefully keep prices down for consumers

If monopolies are efficient and keep costs low then they can increase prices for less than RPI and still make sufficient if not more profit margins

RPI ± K = RPI being the rate of inflation and K being the added amount to allow for capital investment ( happens a lot in the water industry )

K must be greater than RPI or below if they believe that prices can increase less than inflation rate

Aim:

Set prices at allocative efficency as they would be in a competitive market - MC=MR

Advantages:

The regulator can set price caps depending on the state of climate/ industry

Incentive if a firm can cut costs by more than X this will increase their profit margins

Surrogate competition - prevents abuse of monopoly power

Great community effects - if capital investment involved per say infrastructure

May improve the quality of products

Evlt :

Information failure - how can the govt. know the sufficient levels of X or K ?? - Not perfect information - i.e. if levels of X is too high may end up firms leaving the market as making a loss

Costly and very difficult to set - opportunity cost of tax payers money - AND incentive for regulatory body to keep decreasing X every years despite cost efficienct behaviours of firms

If too struct this can stifle investment /promote offshoring

If a firm becomes more efficient than X then they are penalised for being too efficient

If K is too low then firms may not have enough to invest

May have negative effects on quality

Regulatory capture - contacts of regulators - go soft

Quality control/standards

Trains on time/ delays they’re allowed to have per day

Gas and electricity - can’t cut for OAP if in financial trouble

NHS - GP per patient per hour

Emergency services to react to emergencies in 8 mins or less

Evlt :

Unintended consequences - quality of product/ service in an attempt to meet regulations - in turn, be less efficient

Loop holes - i.e. trains making longer journeys to prevent potential delays

Profit control

Profit control by adding a % rate of return on capital employed

This is where the govt. look at profit made by a firm and set a reasonable profit level that they ‘should’ be making

What they deem as excessive profitability

I.e. wind fall tax

Evlt:

Incentive to increase costs as they’re going to be covered

To over employ capital

Assymetric info - over import capital employed and over report costs so the level of regulator profit is higher

Less innovation / dynamic efficiency - by taxing profits govt. limits this

PFI

This changes the model of funding on large scale investments for private firms to build infrastructure/ schools - repaid gradually over 25 years by the govt.

Advantages:

Introduce competition into a market

Efficiency - private sector is usually more efficient due to price comp

Positive externalities - may be cheaper in LR

Disadvantages:

Profit organisations - incentives to keep costs low which may in turn have an effect on quality - i.e Newman

Risk lies with govt. and tax payers money - opportunity costs

Adds to public sector debt

*

Merger Controls

CMA can investigate any merger that gains 25% or more market share

They can either ban the merger

OR if the merger simply creates a monopoly outcome in one areas they can force firms to sell of some stores to competitors to promote competitive outcomes

Government intervention to promote competition and conestability

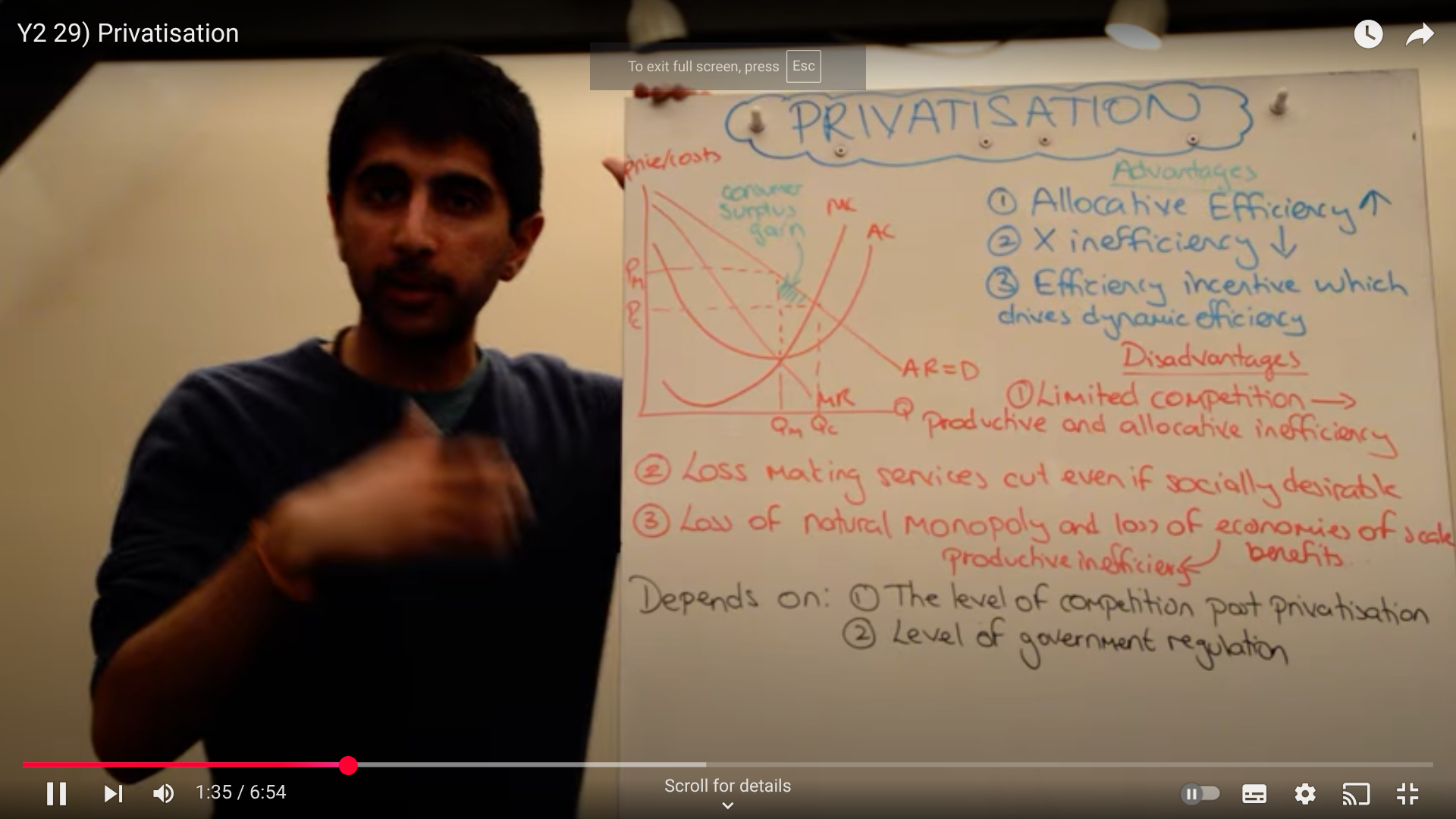

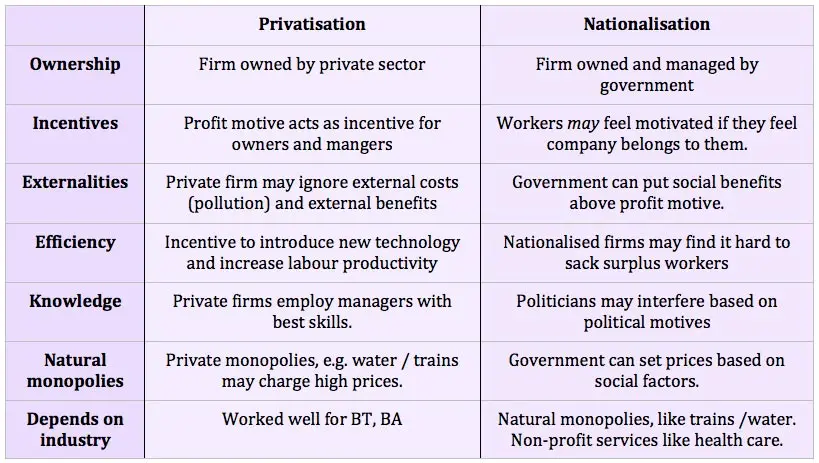

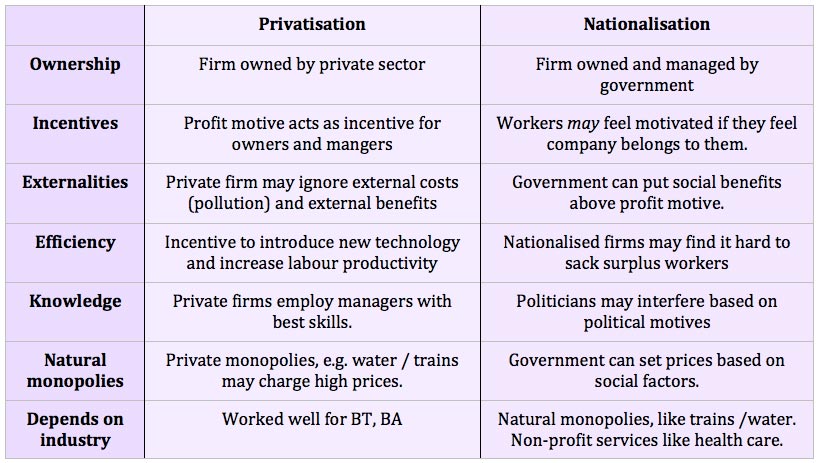

Privatisation - the sale of state owned companies back to the private sector - i.e. through stock market

Royal Mail was privatised

Aim - Run firms more efficiency gains through more competition and profit motive

Movement towards competitive outcomes at MC=MR

Advantages:

Allocative efficiency - lower prices - higher output - non price competition

Reduction in X inefficiency as firms will drive down costs in order to remain competitive

Efficiency incentives which drives dynamic efficiency to gain an advantage - hopefully leading to lower prices for consumers

Disadvantages:

Assumption that there is going to be high levels of competition - productive and allocative inefficiency - firms don’t need to operate at the lowest point of AC curve nor strive to hit highest level of quality

Firms are not going to want to run a business that is making a loss even if they are socially desirable

Loss of natural monopoly - state ran - who benefited from economies of scale - loss of efficiency now - can’t exploit EoS

Evlt:

Success depends on the level of competition

The level of government intervention / regulation i.e. existence of monopolies/oligopolies

Govt. can regulate dependent on whether firms are producing what are socially desirable / taking into consideration external costs/benefits

PFI

This changes the model of funding on large scale investments for private firms to build infrastructure/ schools - repaid gradually over 25 years by the govt.

Aim is that the private sector controls and manages public sector investment projects but the govt. ultimately pays for it gradually over time

The govt. takes competitive bids for an investment project and then buys it

2007/08 9bn was spent on this - gradually declined since

I.e. Alder Hey Children’s Hospital in Liverpool

Advantages:

Introduce competition into a market - private sector is a better manager than the govt. - fixed price contract - productively efficient

Efficiency - private sector is usually more efficient due to price comp

Positive externalities - social benefits as brings forward economic investment - may be cheaper in LR

Disadvantages:

Profit organisations - incentives to keep costs low which may in turn have an effect on quality - i.e Newman College was PFI - water leakages

Risk lies with govt. and tax payers money - opportunity costs

Adds to public sector debt

Promotion of smaller business

Small and Medium Sized Enterprises (SMEs) are important for creating a competitive market.

They create jobs, stimulate innovation and investment and promote a competitive environment.

Governments aim to improve access to finance and reduce barriers to entry, which will make it easier for smaller firms to enter the market.

Schumpeter, an economist, proposed the idea of ‘creative destruction’. This is the idea that new entrepreneurs are innovative, which challenges existing firms. The more productive firms then grow, whilst the least productive are forced to leave the market. This results in an expansion of the economy’s productive potential.

Deregulation:

Excessive regulation is also called ‘red tape’. It can limit the quantity of output that a firm produces.

For example, environmental laws and taxes might result in firms only being able to produce a certain quantity before exceeding a pollution permit.

Excessive taxes, such as a high rate of corporation tax, might discourage firms earning above a certain level of profit, since they do not keep as much of it. This might limit the size that a firm chooses, or is able to, grow to.

Government intervention to protect suppliers and employees

Nationalisation: The process of taking an industry into the public sector and govt.

Examples include the NHS, Scottish Water, and the East Coast line

The railway industry in the UK was nationalised after 1945

Advantages:

Greater potential for EoS in certain industries - lead to greater allocative efficiency and lower AC

Greater provision of goods/ services - positive externalities - the needs and wants of society will be met = allocative efficiency and lower prices = consumer surplus

Less likely for market failures - socially optimum level - all costs will be weighed up - under consumption/ production may be corrected which existed in the private sector

Public sector can be a tool for micro economic control - maintain pay rises or pay cuts - reducing inflationary pressures - or rising employment during recession

Natural Monopoly - Many key industries nationalised were natural monopolies. This means the most efficient number of firms in the industry is one. This is because fixed costs are so high in creating a network of water pipes, there is no sense in having any competition. A private natural monopoly could easily exploit its monopoly power and set higher prices to consumers. Government ownership of a natural monopoly prevents this exploitation of monopoly power.

Disadvantages:

Possibilities for diseconomies of scale - due to being too large - coordination, communiction ect

Lack of an incentive to minimise cost - x inefficiency - lead to higher economic waste

Complacent and wasteful production as they lack the economic incentive of profit

Lack of SNP - less likely to be dynamically efficient - technological innovation may be non existence - no R&D for non price competition

Opportunity cost - burden of the tax payer - i.e. wages, assets from private sector - in a period of austerity and high national debt - can the govt. really afford this? Could better benefits have been brought about by using TR in different areas ?

Higher prices and lower quantities - monopoly outcomes? - due to minimal competition - allocative inefficieny

Moral hazard - when individuals who take the risk do not bear the consequences of the fall outs if the decision goes wrong - i.e. tax payer over the govt.

Political priorities i.e. risk not taken due to upcoming election

Evaluation:

Funding vs delivery - huge costs but if society get better delivery of key industries this is arguably worth it

PPP? - PFI better ? - best of both worlds

Strong regulation of private sector industries may be better

Competitive private sectors may be better than nationalisation - lower prices and efficiency gains

Size and objective of firms - of they’re large and benefit from EoS - nationalisation may result in diseconomies of scale - objectives - they’re not all profit max firms !?

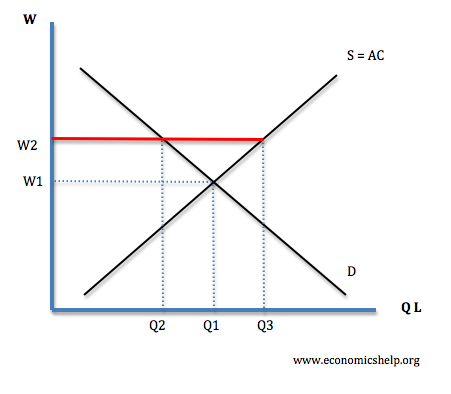

Evaluate the view that complete nationalisation will protect employees

K - Complete nationalisation refers to when an industry is completely taken over by the government and taken into the public sphere

A - This may protect employees as industries may turn into natural monopolies such as the water industry - more efficient to have one - as LRAC gradually decrease as output increases

Furthermore, as in the public sector, workers are far more protected - this may result in pay rises or rises in minimum wage

Or, if not, the public sector are far more responsive to trade unions than the private sector and therefore giving workers far more power over their own wages #

Because of this, increasing employee protection

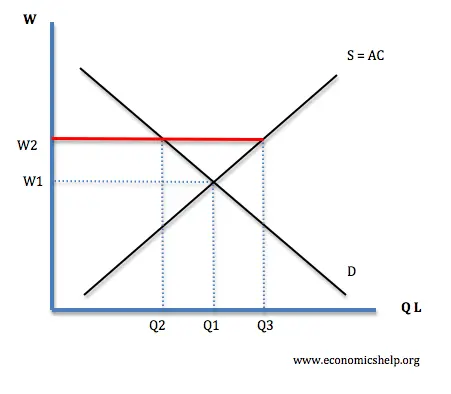

( insert TU wages diagram )

E - However, workers may not be protected - due to natural monopoly - workers have no other choice of employment - because of this, if they are receiving poor wages i.e. NHS employees 90% of junior doctors - strikes - they are unable to do much about this - monopsony power of labour - dob’t necessarily have to listen to trade unions

And a lack of incentive to keep costs low

X-inefficiency

May result in higher costs

To keep profit margins sufficient without increasing prices they may just reduce the size of the workforce resulting in unemployment

3.6.2 The impact of govt. regulation

Price - Go down to increase consumer surplus and reduce monopoly power

Profits - SNP is likely to decrease especially with price and profit caps and even quality standards due to costs - less dynamically efficient

Efficiency - Through privatisation as a market moves closer to a competitive level as does its efficency move towards allocative at MC=AR, also less dynamically efficient due to less SNP and hopefully more x efficient

However, free market economists argue that by operating in a competitive environment, firms have an incentive to become efficient. This is because they are forced to lower their average costs in order to profit maximise. This makes private sector firms more productively efficient.

Quality- Risk of reduce quality if firms are trying to keep costs down however if they are getting taxed on profit they may reinvest into R&D which will in turn improve quality.

Governments can ensure firms are meeting minimum targets, which ensures firms focus on increasing social welfare. For example, firms in the gas and electricity markets are regulated to ensure vulnerable groups, such as the elderly, are kept warm during colder months.

Choice - If governments regulate monopolies and encourage the start-up and growth of SMEs, consumer choice in the market widens, since there are more firms competing. A stringent price ceiling might force some suppliers out of the markets, which reduces the quantity supplied and narrows choice for consumers. If governments can reduce the price of a good or service, it could allow those on low and fixed incomes to access goods and services they previously could not afford to.

Limits to government intervention

Regulatory capture There is the risk of regulatory capture. This is when regulators start acting in the interests of the company, due to impartial information, rather than in consumer interests. This information disadvantage is a problem for regulators.

Asymmetric information The problem of asymmetric information can make it hard to determine what level a price cap should be imposed at. It is hard to determine government policies when intervening where there is market failure, since the extent to which the market fails involves a value judgement. For example, it is hard to decide what the cost of pollution to society is. Different individuals will put a different value on it, depending on their own experiences with pollution, such as how polluted their home town is. Without sufficient information, governments could make poor decisions and it could lead to a waste of scarce resources.