Week 3 Financial Statement Analysis

Fundamentals of Corporate Finance

Lecture Overview

Annual Report: Overview of key financial statements.

Ratio Analysis: Techniques for analyzing firm performance through financial ratios.

Du Pont Identity: An approach to break down Return on Equity (ROE).

Using Financial Statement Information: Strategies for analyzing financial data over time and against peers.

The Annual Report

Key Components:

Statement of Financial Position (Balance Sheet): Snapshot of financial standing at a specific time.

Assets: What the firm owns (e.g., cash, inventory).

Liabilities: What the firm owes (e.g., debts, obligations).

Equity: Difference between assets and liabilities.

Income Statement: Measures firm performance over a period.

Revenues: Income earned from business activities.

Expenses: Costs incurred in earning revenues.

Statement of Cash Flows: Shows cash inflows and outflows during a period.

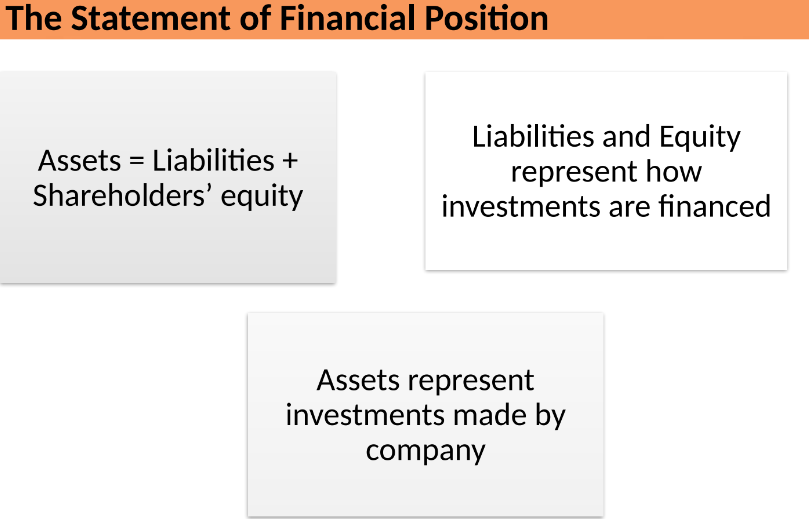

Statement of Financial Position

Equation: Assets = Liabilities + Shareholders' Equity

Assets: Represent investments made by the company.

Liabilities and Equity: Indicate how those investments are financed.

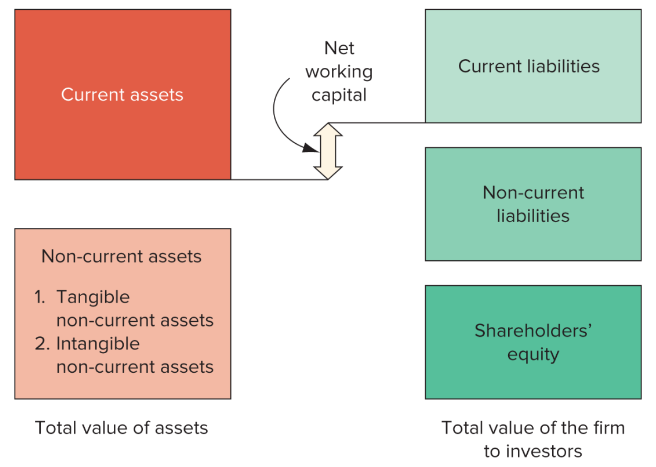

Components:

Current Assets: Cash, accounts receivable, inventory (used within a year).

Non-Current Assets: Property, plant, equipment, intangible assets.

Current Liabilities: Obligations due within a year.

Non-Current Liabilities: Long-term obligations due later.

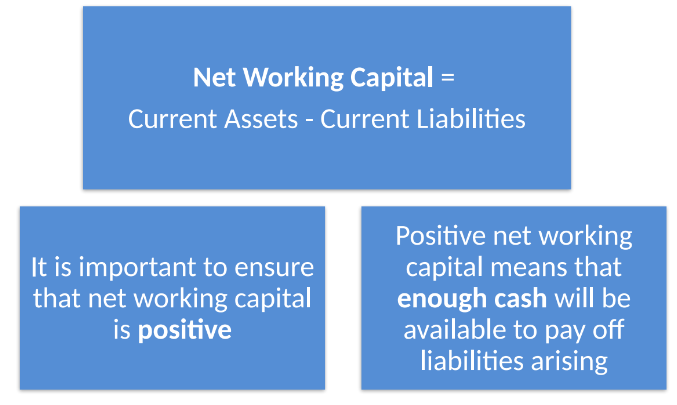

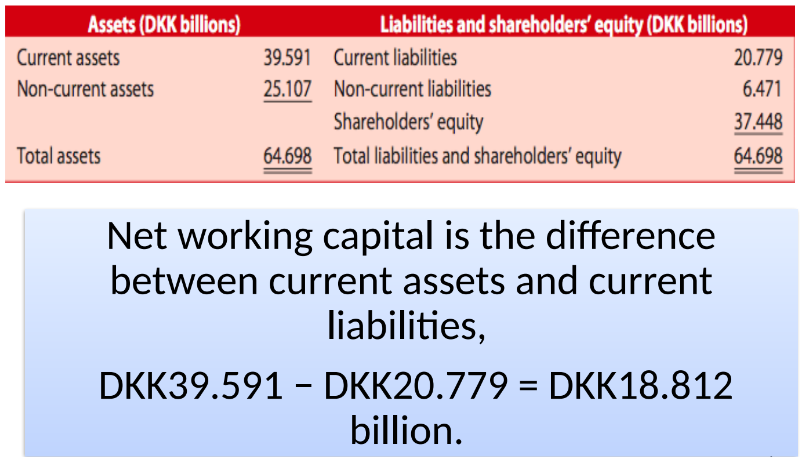

Net Working Capital: Current Assets - Current Liabilities.

Important for ensuring enough cash is available to pay off liabilities.

Book Value vs. Market Value

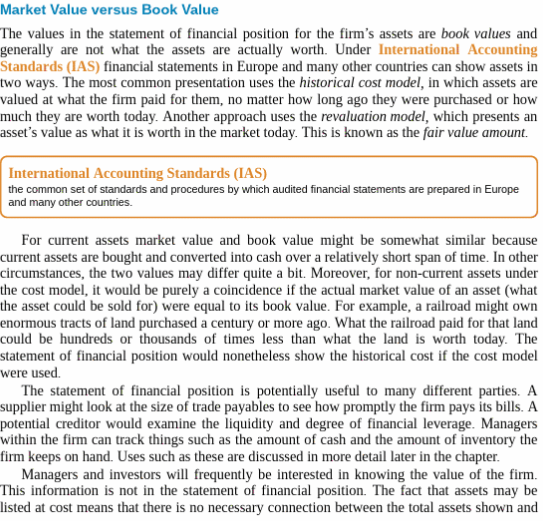

Book Value: Recorded historical cost of an asset, adjusted for impairments and depreciation.

Market Value: The price attainable by selling the asset in the market; can fluctuate based on demand.

Example:

Machine bought for £100,000 with £20,000 depreciation.

Current market price of £90,000 leads to:

Net Book Value = £100,000 - £20,000 = £80,000.

Profit = Market Value - Book Value = £90,000 - £80,000 = £10,000.

Income Statement

Purpose: Measures performance over a specific timeframe.

Components: Revenues, Expenses, and Net Income calculation.

Analysis Techniques:

Trend Analysis: Comparison of line items across multiple periods.

Ratio Analysis: In-depth evaluation through calculated ratios.

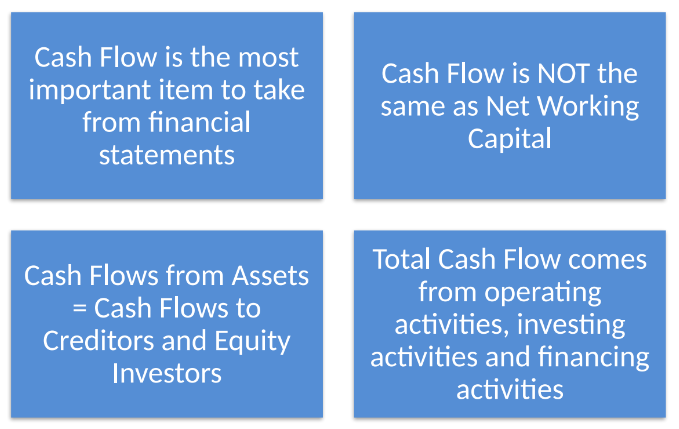

The Cash Flow Report

Importance: Indicates financial health through cash management.

Components:

Operating Activities: Cash flows from business operations.

Investing Activities: Cash flows relating to the acquisition or sale of assets.

Financing Activities: Cash flows relating to borrowing and repaying debt, or issuing equity.

Ratio Analysis

Purpose: Analyze and compare financial performance.

Types of Ratios:

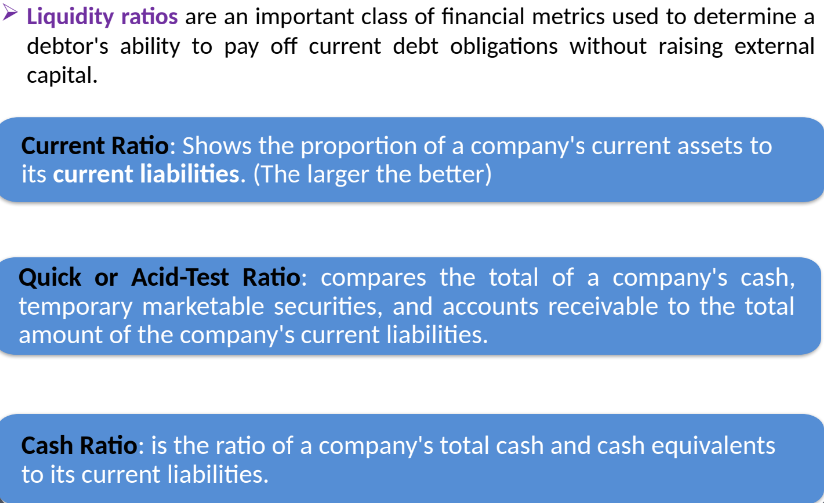

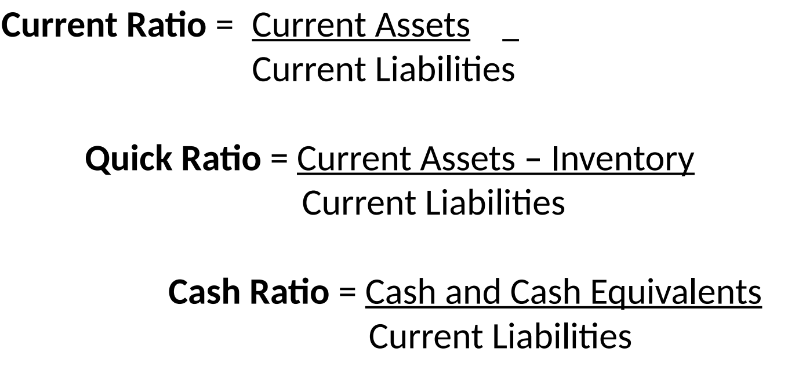

Liquidity Ratios: Assess short-term financial health.

Current Ratio, Quick Ratio, Cash Ratio.

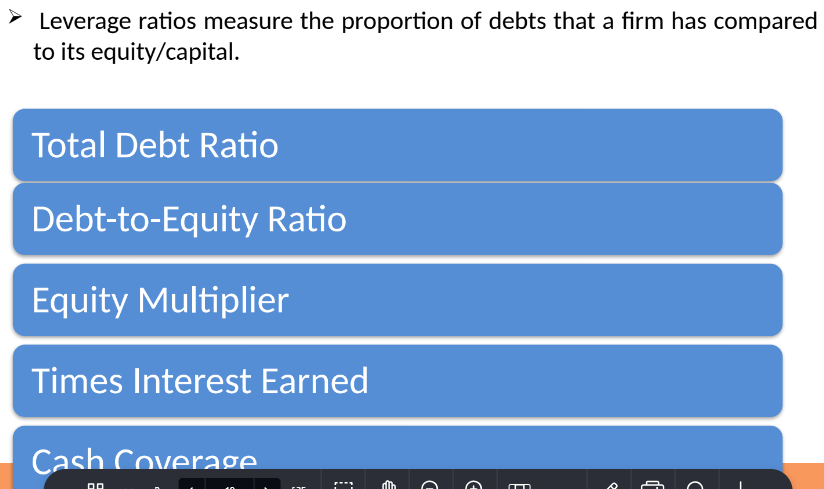

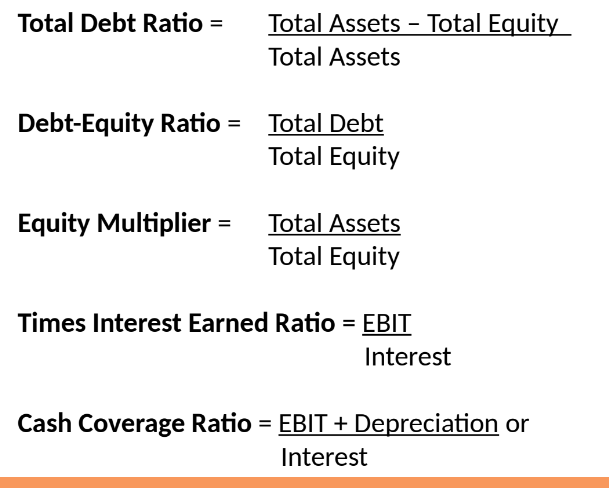

Leverage Ratios: Measure debt levels relative to equity.

Total Debt Ratio, Debt-to-Equity Ratio.

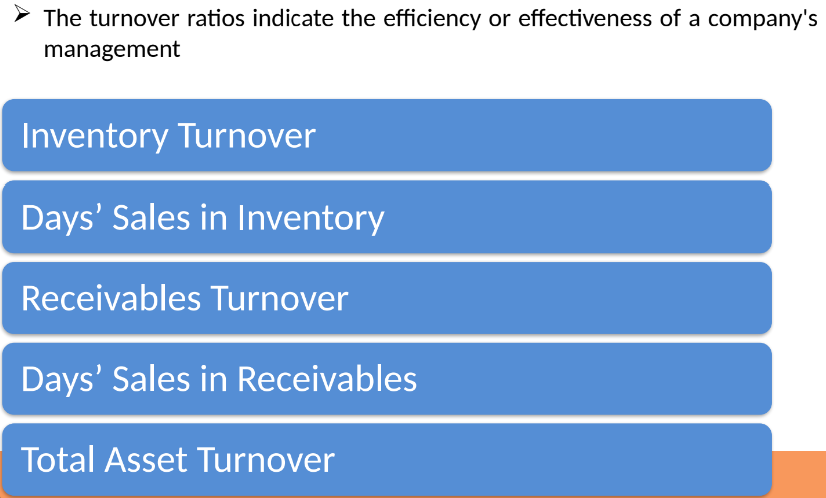

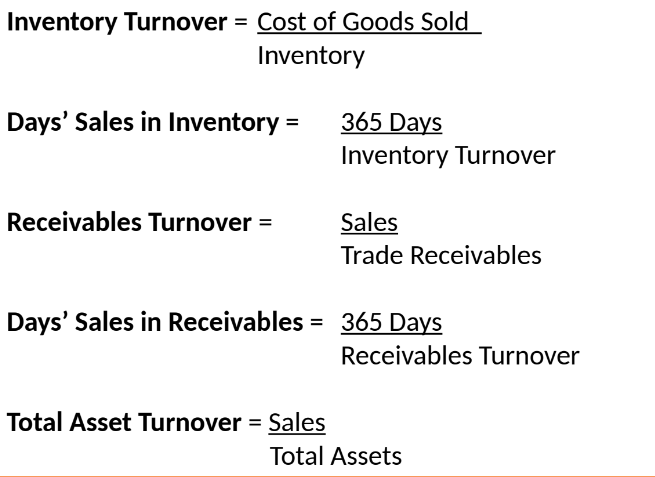

Turnover Ratios: Evaluate efficiency.

Inventory Turnover, Total Asset Turnover.

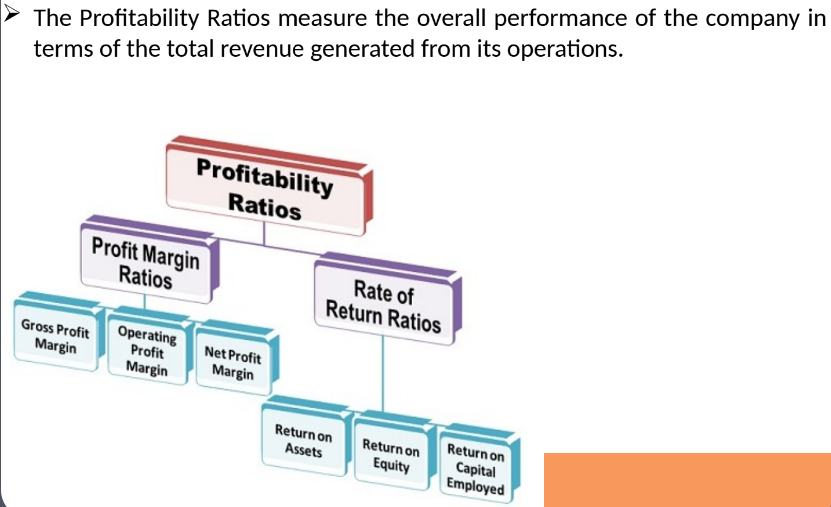

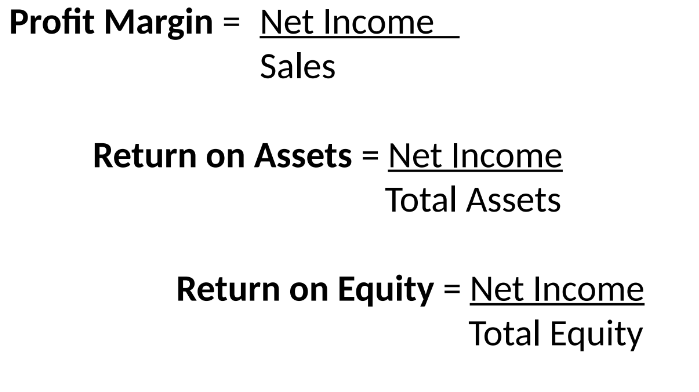

Profitability Ratios: Assess company efficiency in generating profits.

Profit Margin, Return on Assets, Return on Equity.

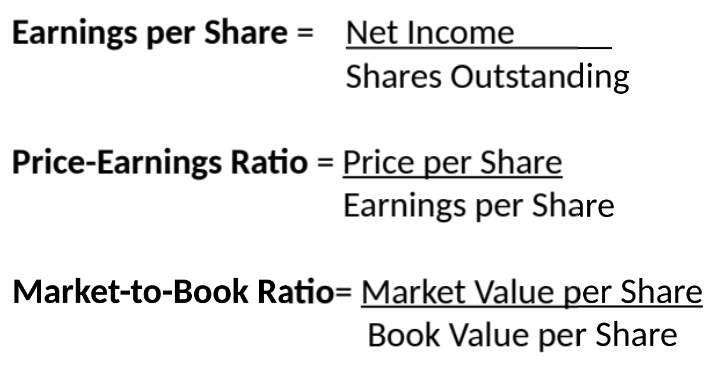

Market Value Ratios: Evaluate stock performance.

Earnings per Share, Price-Earnings Ratio.

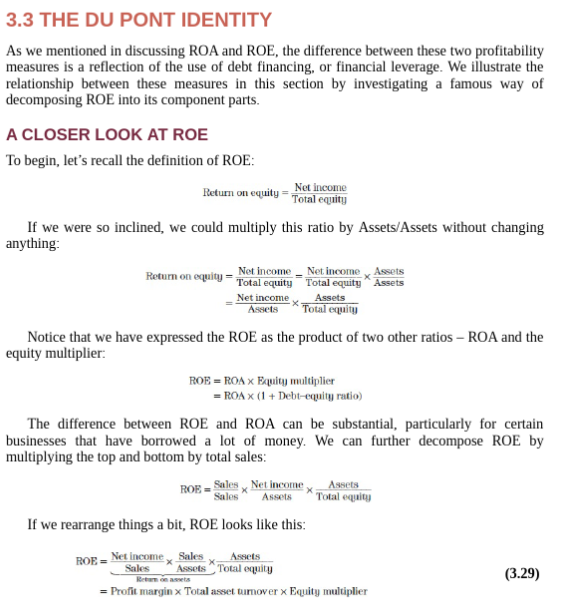

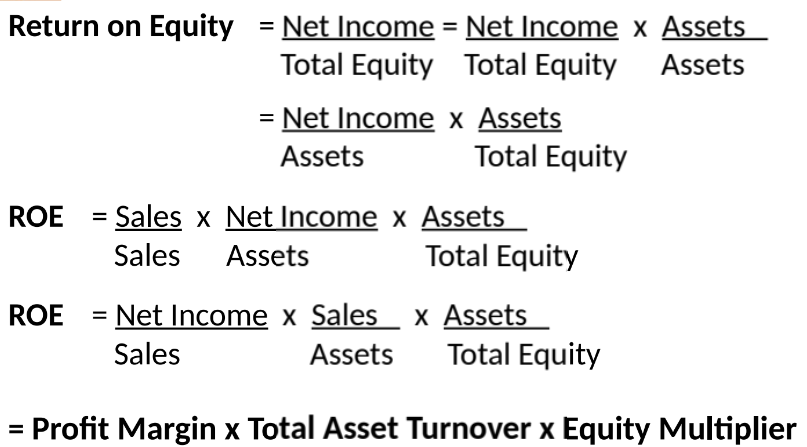

The Du Pont Identity

Overview: A tool to analyze and improve Return on Equity (ROE).

Components:

Profit Margin: Net Income/Sales.

Total Asset Turnover: Sales/Total Assets.

Financial Leverage: Total Assets/Total Equity.

Formula: ROE = Profit Margin x Total Asset Turnover x Equity Multiplier.

Using Financial Statement Information

Trend Analysis: Evaluates the same ratio over multiple years.

Peer Group Analysis: Compares a firm’s ratios with those in similar industries.

Aspirant Analysis: Compares with top-performing firms in the sector.

Financial Planning: Long-term planning through financial statements and sale percentages.