accounting

Here’s a concise summary of your text:

Government and Regulatory Bodies: Provincial and federal governments use accounting information to levy taxes on individuals and businesses. Businesses must track and report various taxes, including sales tax, goods and services tax (GST), and harmonized sales tax (HST). Additionally, regulatory bodies like provincial securities commissions oversee financial disclosures for companies raising funds from the public.

Not-for-Profit Organizations: Non-profit entities, such as churches, hospitals, government agencies, universities, and colleges, rely on accounting information to make financial decisions, similar to profit-driven businesses.

Other Users: Employees and labor unions use financial data to negotiate wages, while consumer groups and the public monitor corporate earnings for economic insights.

Difference Between Internal and External Users of Accounting Information

1. Internal Users

These are individuals or groups within the organization who use accounting information for decision-making.

Examples of Internal Users:

Managers – Use financial data for planning, budgeting, and strategic decision-making.

Owners/Executives – Assess business performance and make investment decisions.

Employees & Labour Unions – Use financial information to negotiate wages, benefits, and job security.

Department Heads – Monitor departmental budgets and control expenses.

Purpose of Use:

Decision-making for business growth and efficiency

Budgeting and financial planning

Evaluating business performance

2. External Users

These are individuals or entities outside the organization who use financial information to assess the company’s financial health.

Examples of External Users:

Investors & Shareholders – Determine profitability and assess investment risks.

Creditors & Banks – Evaluate creditworthiness before lending money.

Government & Regulatory Bodies – Monitor tax compliance and enforce financial regulations.

Customers & Suppliers – Assess a company’s financial stability before entering long-term agreements.

General Public & Consumer Groups – Monitor economic impact and ethical business practices.

Purpose of Use:

Investment decisions

Loan approvals and risk assessment

Compliance with tax and legal regulations

Economic analysis and consumer protection

Key Difference:

Internal users focus on operational and strategic decision-making within the company.

External users analyze financial information to make investment, lending, and regulatory decisions about the company.

Meaning of Independence in Accounting

Independence in accounting refers to the requirement that accountants, particularly auditors, must remain unbiased and free from conflicts of interest when reviewing financial statements or providing accounting services. This ensures that financial information is reliable, objective, and not influenced by personal or financial relationships.

Example of Independence in Accounting

Example 1: An Auditor Reviewing a Company’s Financial Statements

Suppose an auditor is hired to audit XYZ Corporation.

If the auditor owns shares in XYZ Corporation or has a family member working there, their judgment could be biased.

To maintain independence, the auditor must not have any financial interest or close relationships with the company.

Example 2: An Accountant Preparing Financial Statements

An accountant working at a firm should not manipulate financial data to show a company’s financial health better than it actually is.

If the accountant is pressured by management to hide losses, they must remain independent and follow ethical accounting standards.

Why is Independence Important?

Prevents fraud and misrepresentation.

Ensures transparency and accuracy in financial reporting.

Builds trust with investors, stakeholders, and regulatory bodies.

Would you like more examples or clarification on any point? 😊

An audit is a financial examination that evaluates an organization's financial records and statements to ensure compliance with accounting standards and regulations. This process helps identify discrepancies, prevent fraud, and ultimately provides assurance that the financial statements are a true and fair representation of the organization's financial position.

Limited Liability Partnership (LLP) – Definition & Example

A Limited Liability Partnership (LLP) is a type of business structure where two or more partners operate a business with limited personal liability for the debts and actions of the partnership. This means that partners are not personally responsible for the business’s debts beyond their investment, and they are not liable for the negligence or misconduct of other partners.

Key Features of an LLP

✅ Limited Liability: Each partner is protected from personal liability for business debts and the wrongful acts of other partners.

✅ Pass-Through Taxation: Profits are taxed at the individual partner level, avoiding corporate taxes.

✅ Flexible Management: Unlike corporations, LLPs do not require a strict structure like a board of directors.

✅ Professional Services: Commonly used by professionals like lawyers, accountants, doctors, and consultants.

Example of an LLP

Example 1: Law Firm LLP

ABC Law LLP is a law firm owned by three partners: Alice, Bob, and Charlie.

Alice is responsible for contract law, Bob handles criminal law, and Charlie manages corporate law.

If Bob gets sued for malpractice, Alice and Charlie are not personally liable for his mistake.

Only Bob’s investment in the LLP is at risk, not his personal assets (house, car, etc.).

Example 2: Accounting Firm LLP

XYZ Accountants LLP is a partnership of certified accountants.

One partner, David, makes a tax filing error for a client.

The LLP can be held liable, but other partners will not be personally responsible for David’s mistake.

LLP vs. Other Business Structures

Feature LLP General Partnership Corporation | |||

Liability Protection | Yes | No | Yes |

Taxation | Pass-through | Pass-through | Double taxation (corporate & personal) |

Ownership Structure | Flexible | Flexible | More rigid (shareholders, board) |

Who Should Use an LLP?

🔹 Law firms

🔹 Accounting firms

🔹 Consulting businesses

🔹 Architectural firms

🔹 Medical practices

Would you like help with setting up an LLP or comparing it to another business structure? 😊

If the partnership cannot pay its debts, lenders can take each partner’s personal assets to pay the partnership’s debts.

Limited Liability Partnership (LLP)

each individuals only take resposibility in their actions

A corporation is a business owned by shareholders.

The corporation operates as an “artificial person” that exists apart from its owners and that conducts business in its own name. The corporation has many of the rights that a person has. For example, a corporation may buy, own, and sell property; the corporation may enter into contracts and sue and be sued.

If a proprietorship or partnership cannot pay its debts, lenders can take the owners’ personal assets to satisfy the business’s obligations. But if a corporation goes bankrupt, lenders cannot take the personal assets of the shareholders because the corporation is a separate legal entity, meaning that shareholders are only liable for the debts of the corporation up to the amount they have invested.

recievable : asset

payable: liability

Financial Accounting (FA) and Managerial Accounting (MA) serve distinct purposes and audiences within an organization. Here's a differentiation:

Aspect Financial Accounting (FA) Managerial Accounting (MA) | ||

Primary Purpose | To provide financial information to external users, such as investors, creditors, and regulators. | To provide internal management with information for decision-making and strategy. |

Audience | External stakeholders (e.g., shareholders, government, creditors). | Internal stakeholders (e.g., managers, executives). |

Focus | Historical performance (past financial results). | Future-oriented (projections, budgets, forecasts). |

Regulation | Governed by standards like GAAP or IFRS. | Not regulated; tailored to internal needs. |

Reporting Frequency | Periodic (e.g., quarterly, annually). | As needed (e.g., daily, weekly, monthly). |

Format | Standardized formats and statements (e.g., income statement, balance sheet, cash flow statement). | Flexible formats depending on management's needs (e.g., reports, dashboards). |

Scope | Broad; covers the entire organization. | Detailed; can focus on specific segments, departments, or projects. |

Key Metrics | Financial metrics like profit, revenue, and costs. | Operational metrics like cost efficiency, performance, and variances. |

Time Orientation | Historical data. | Both historical and forward-looking data. |

Confidentiality | Publicly available to comply with reporting requirements. | Typically confidential and used internally. |

Summary:

FA focuses on providing a clear and standardized financial picture to external parties.

MA is about providing relevant and flexible information to aid internal decision-making and improve operational efficiency.Here’s the differentiation and examples for the four main financial statements:

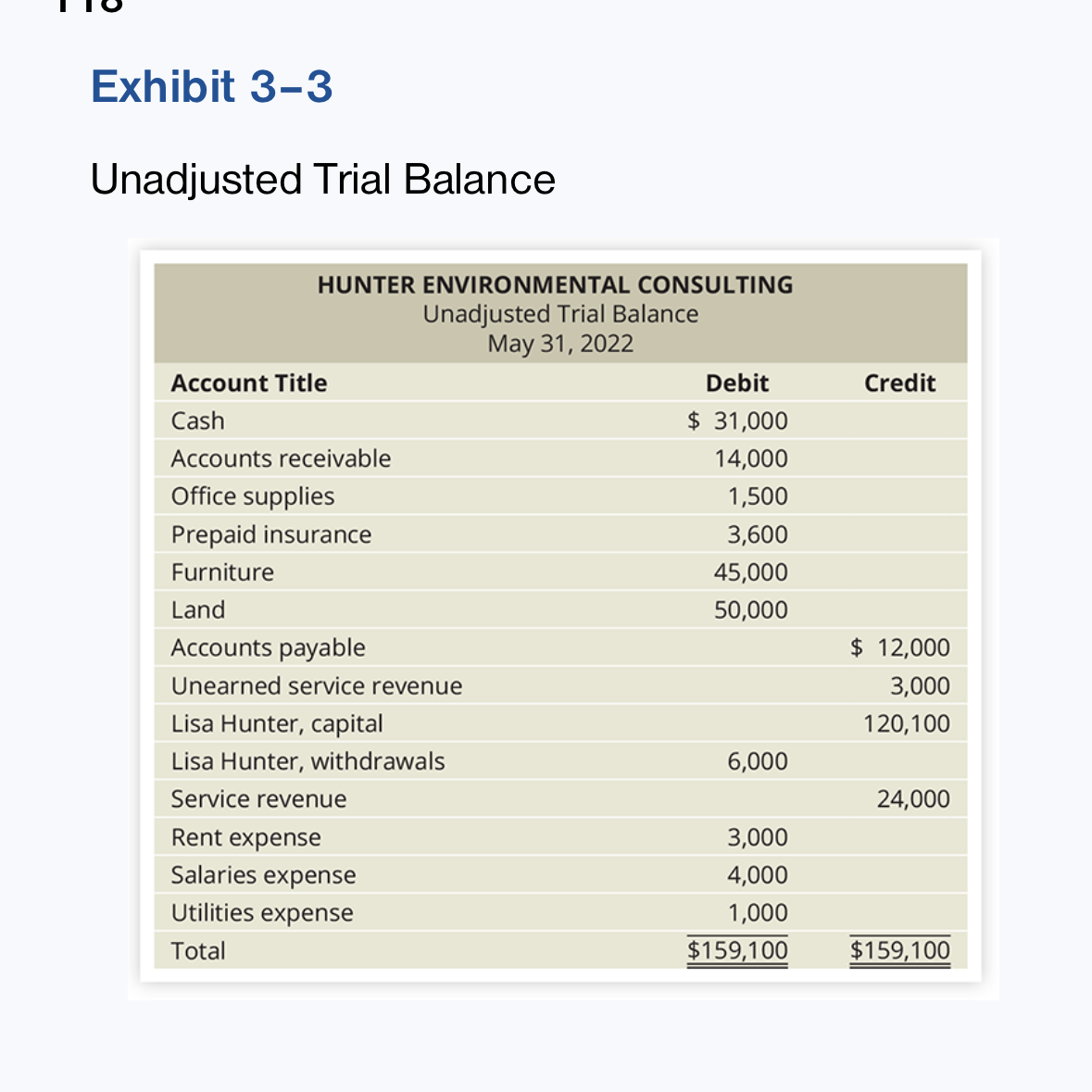

1. Balance Sheet

Definition: A snapshot of an organization’s financial position at a specific point in time. It shows assets, liabilities, and equity.

Purpose: To assess the company’s financial stability and liquidity.

Example:

Assets: Cash $50,000; Accounts Receivable $30,000; Equipment $100,000.

Liabilities: Accounts Payable $40,000; Loans $60,000.

Equity: Common Stock $50,000; Retained Earnings $30,000.

Total Assets = Total Liabilities + Equity

$180,000 = $100,000 + $80,000.

2. Income Statement (Profit and Loss Statement)

Definition: A report of the company’s financial performance over a period, showing revenues, expenses, and profit or loss.

Purpose: To measure profitability over time.

Example:

Revenue: Sales $200,000.

Expenses: Cost of Goods Sold (COGS) $120,000; Operating Expenses $50,000.

Net Income: $200,000 - $170,000 = $30,000.

3. Statement of Cash Flows

Definition: Shows the company’s cash inflows and outflows over a period, divided into operating, investing, and financing activities.

Purpose: To analyze liquidity and cash management.

Example:

Operating Activities: Cash received from customers $150,000; Cash paid for expenses $100,000.

Investing Activities: Purchase of equipment ($20,000).

Financing Activities: Loans received $30,000.

Net Cash Flow: $150,000 - $100,000 - $20,000 + $30,000 = $60,000.

4. Statement of Owners’ Equity

Definition: Shows changes in the owners’ equity over a period, including contributions, withdrawals, and retained earnings.

Purpose: To track ownership changes and retained earnings.

Example:

Beginning Equity: $70,000.

Net Income: $30,000 (from Income Statement).

Owner Contributions: $10,000.

Withdrawals/Dividends: ($5,000).

Ending Equity: $70,000 + $30,000 + $10,000 - $5,000 = $105,000.

These financial statements collectively provide a comprehensive view of a company’s financial health. Let me know if you need further clarification!

The vertical line divides the account into its left and right sides, with the account title at the top. For example, the Cash account appears in the following T-account format:

The left side of the account is called the debit side, and the right side is called the credit side. They are often abbreviated as Dr and Cr.

Even though left side and right side may be more convenient, debit and credit are what they are called in a business environment.1

Debits are not “good” or “bad.” Neither are credits. Debits are not always increases, and credits are not always decreases. Debit simply means left side, and credit means right side.

CASH AFFECTS CAPITAL

Jan 21st 2025

why do we need to adjust entry? Adjusting entries are necessary to ensure that the financial statements accurately reflect the company's financial position and performance at the end of an accounting period. They help to align revenues and expenses with the period in which they were incurred, ensuring that the matching principle is upheld.

recognize the revenue after finishing the service ( doesn’t matter if they don’t pay you) as it must be recorded in the period it was earned, regardless of when the cash is received.

the income statement is always first and is followed by the balance sheet, which reflects the company’s overall financial position, including assets, liabilities, and equity, ensuring that all adjustments made during the accounting period are accurately presented.

unearned revenue happens when you receive revenue before performing the service

( debit cash, credit unearned revenue)

prepaid expense is an advance payment for goods or services to be received in the future, which is recorded as an asset until the service is performed or the goods are received (debit prepaid expense, credit cash).

unearned revenues = liability

prepaid expense = asset

you owe your employee their salary, what is your journal entry? To record the salary owed to an employee, the journal entry would be: debit salary expense and credit salaries payable.

amortization is the process of gradually writing off the initial cost of an intangible asset over its useful life, reflecting the asset's consumption and ensuring accurate financial reporting.

This process allows businesses to match expenses with revenues in the appropriate accounting periods, ultimately providing a clearer picture of financial performance.

Depreciation: Similar to amortization, depreciation is the allocation of an asset's cost over its useful life, but it applies to tangible assets. This process helps in accurately reflecting the wear and tear of physical assets over time, ensuring that financial statements depict a true and fair view of the company's financial position.

salvage value is the estimated residual value of a tangible asset at the end of its useful life, which can be considered when calculating depreciation. This value is important as it affects the total depreciation expense that will be allocated over the asset's useful life. ( you can sell it after using it) This potential resale value can also influence decisions regarding asset disposal and replacement, providing businesses with additional financial flexibility.

you buy a 25k car, you gonna sell it after 5 years of use, therefore the amortization expense each year is 5k

the value of the furniture that year is 25k -5k = 20k

On April 1, 2023, you prepaid 3 months of rent for a total of $18,000. Give your adjusting entry to record rent expense at April 30, 2023. Include the date of the entry and an explanation. Then, using T-accounts, post to the two accounts involved and show their balances at April 30, 2023.

Adjusting Entry for Rent ExpenseDate: April 30, 2023

Rent Expense

Debit: $6,000

Prepaid Rent

Credit: $6,000

Explanation: To record one month of rent expense for April 2023, recognizing the portion of prepaid rent that has been used.

T-Accounts:

Rent Expense

date | debit | credit | Balance |

April 30, 2023 | $6,000 | $6,000 |

Prepaid Rent

date | debit | credite | Balance |

April 1, 2023 | $18,000 | $18,000 | |

April 30, 2023 | $6,000 | $12,000 |

At April 30, 2023, the balances show that $6,000 of rent expense has been recorded, and $12,000 remains in prepaid rent for the following months.

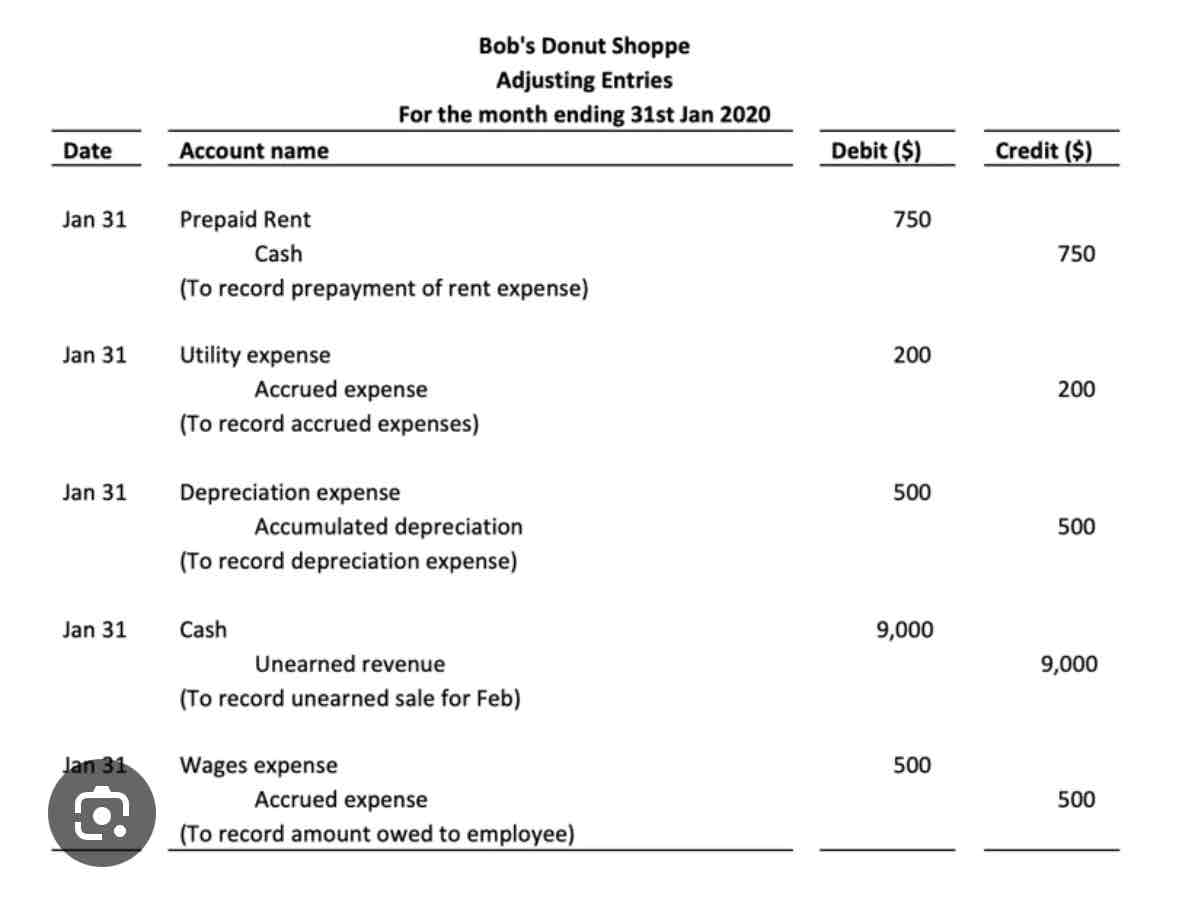

E3–7 Journalize the entries for the following adjustments at January 31, the end of the accounting period:

Amortization, $5,000.

Debit Amortization Expense for $5,000 credit Accumulated Amortization for $5,000

Prepaid insurance used, $500. Debit Insurance Expense for $500 Credit Prepaid Insurance for $500.

Interest expense accrued, $400. Debit Interest Expense for $400 Credit Interest Payable for $400.

Employee salaries owed for Monday through Thursday of a 5-day workweek; the weekly payroll is $16,000. Debit Salaries Expense for $12,800 (representing 4/5 of the weekly payroll) Credit Salaries Payable for $12,800.

Unearned service revenue that becomes earned, $2,000. Debit Unearned Revenue for $2,000 Credit Service Revenue for $2,000.

The distinction between permanent accounts and temporary accounts lies in their purpose and how they are handled at the end of an accounting period:

Permanent Accounts:

Definition: These accounts carry their balances forward into the next accounting period. They reflect the ongoing financial position of the business.

Examples:

Assets: Cash, Accounts Receivable, Supplies, Equipment, etc.

Liabilities: Accounts Payable, Salaries Payable, Unearned Revenue, etc.

Owner's Equity: Capital account (e.g., "I. Prust, Capital").

Key Features:

Balances are not closed or reset.

They appear on the balance sheet.

Temporary Accounts:

Definition: These accounts are used to track financial activity for a specific accounting period. Their balances are reset to zero at the end of the period by transferring them to a permanent account (typically Owner’s Capital or Retained Earnings).

Examples:

Revenue Accounts: Consulting Revenue, Sales Revenue, etc.

Expense Accounts: Salaries Expense, Utilities Expense, Supplies Expense, etc.

Drawing or Withdrawal Accounts: Owner Withdrawals or Drawings.

Key Features:

Closed at the end of the period to summarize the period’s activity.

They appear on the income statement (revenues and expenses) or the statement of owner's equity (withdrawals).

How to Identify:

Does the account appear on the balance sheet?

If yes, it’s a permanent account.

If no, it’s a temporary account.

Is the account tracking activity for a specific period?

If yes, it’s a temporary account.

Does the balance carry over into the next period?

If yes, it’s a permanent account.

If no (it gets reset), it’s a temporary account.

Would you like examples applied to your business? Let me know!

The closing process is an essential step in accounting to prepare for the next accounting period. Here's why we close the trial balance:

1. Reset Temporary Accounts to Zero

Temporary accounts (revenues, expenses, and withdrawals) are used to track activity for a specific accounting period.

At the end of the period, these accounts must be reset to zero to begin the new period fresh and ensure the new period does not include prior period activity.

This ensures accurate financial reporting for each accounting period.

2. Transfer Balances to Permanent Accounts

The balances of temporary accounts are transferred to Owner's Capital (or Retained Earnings in a corporation).

This step updates the owner’s equity to reflect the results of the period:

Net Income (or Net Loss) is added to or deducted from the capital account.

Withdrawals reduce the capital account.

3. Prepare the Accounts for the Next Period

Closing ensures that temporary accounts are cleared, making it easier to measure the new period's performance without interference from previous data.

Permanent accounts (assets, liabilities, and capital) carry forward into the next period, providing the opening balances for the new period.

4. Ensure Accurate Financial Statements

Closing the trial balance ensures that the information on the financial statements (income statement, statement of owner’s equity, and balance sheet) is finalized and accurate.

This process aligns the accounting records with the matching principle, ensuring revenues and expenses are recorded in the period they occur.

Summary of the Closing Process:

Close Revenues to Income Summary.

Close Expenses to Income Summary.

Close Income Summary to Owner's Capital.

Close Withdrawals to Owner's Capital.

By performing these steps, businesses ensure their accounting records are accurate and ready for the next period. Let me know if you'd like a practical example of the closing process!

CHAPTER 5

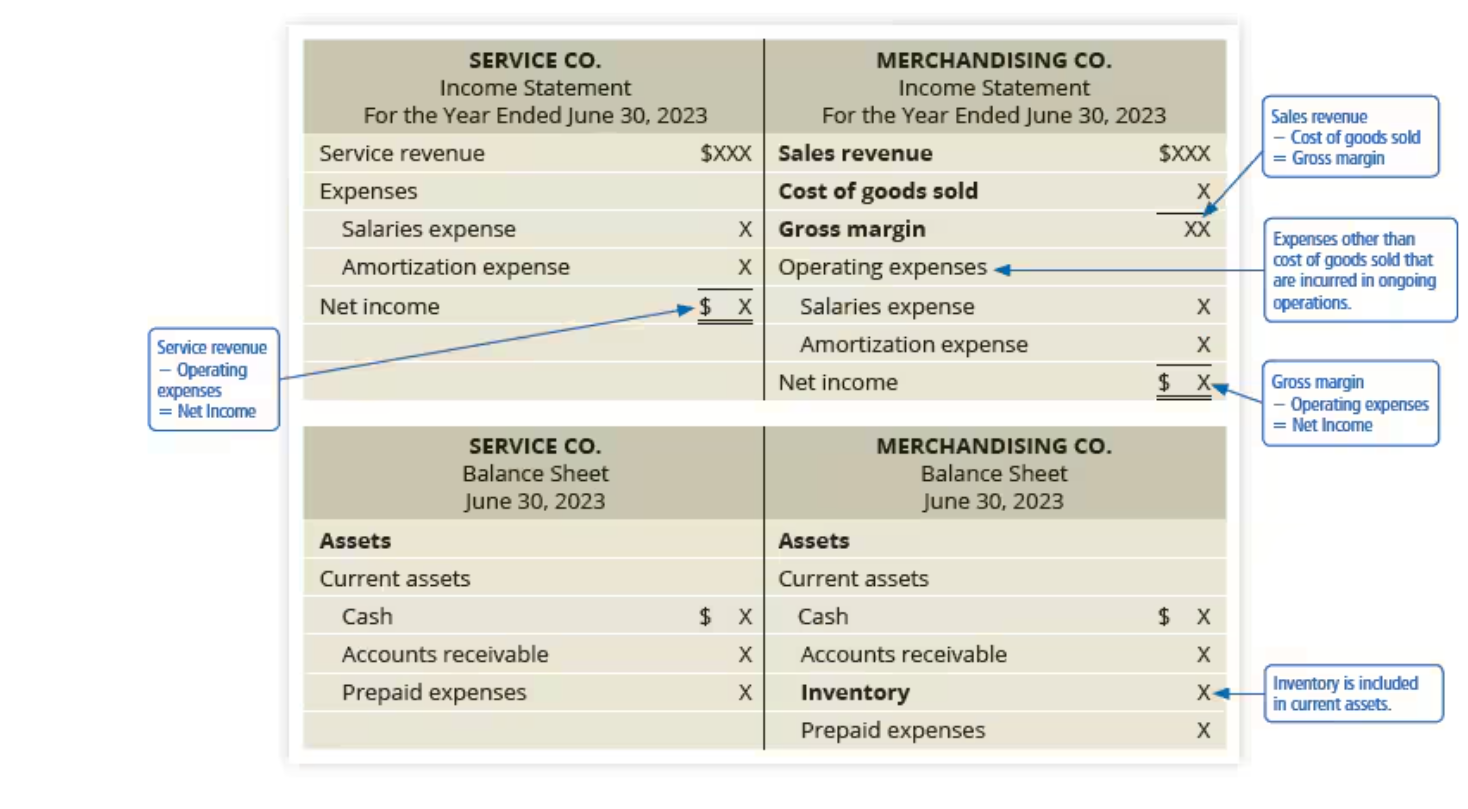

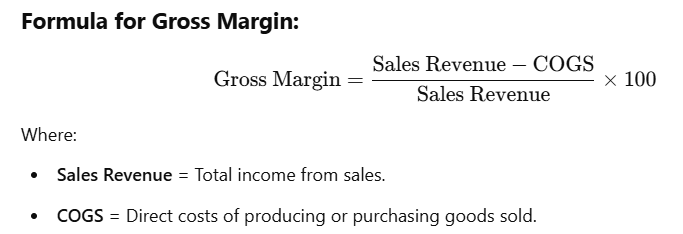

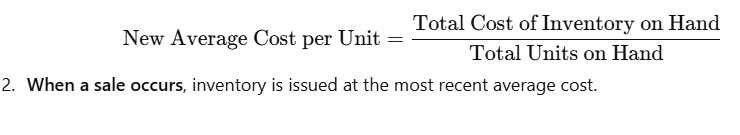

Gross Profit (or Gross Margin) Formula:

The missing blanks in the sentence are:

Gross Profit = Sales Revenue – Cost of Goods Sold (COGS)

This means that the gross profit a company earns is the sales revenue (the amount collected from customers) minus the cost of goods sold (the expense incurred in purchasing or producing those goods).

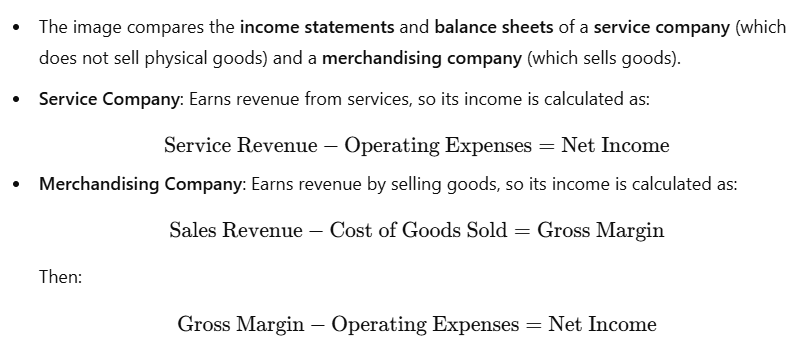

Comparison of Service vs. Merchandising Company:

Balance Sheet Differences:

The Service Company has current assets like cash, accounts receivable, and prepaid expenses.

The Merchandising Company has inventory as an additional current asset, since it purchases goods for resale.

Sales Revenue Explained

Sales Revenue is the total amount of money a company earns from selling goods or services before subtracting any expenses. It is also called "Revenue", "Sales", or "Top Line" because it appears at the top of the income statement.

Formula for Sales Revenue:

Sales Revenue=Number of Units Sold×Price per Unit\text{Sales Revenue} = \text{Number of Units Sold} \times \text{Price per Unit}

If a company sells 1,000 shirts at $20 each, the sales revenue is: 1,000×20=20,0001,000 \times 20 = 20,000

Types of Sales Revenue:

Gross Sales Revenue: The total revenue before any deductions.

Net Sales Revenue: Adjusted revenue after subtracting returns, discounts, and allowances.

Example in Merchandising Business:

For a store like Walmart:

If Walmart sells 100,000 smartphones at $500 each, the sales revenue is: 100,000×500=50,000,000100,000 \times 500 = 50,000,000

Why is Sales Revenue Important?

It is the starting point for calculating profitability.

It helps businesses track performance and growth.

Investors analyze revenue trends to assess a company’s market strength.

Would you like further clarification on how sales revenue impacts financial statements?

Difference Between Sales Revenue and Service Revenue

Sales revenue and service revenue are both types of revenue that a business can earn, but they come from different activities.

Feature | Sales Revenue (Merchandising/Manufacturing) | Service Revenue (Service-Based Business) |

|---|---|---|

Definition | Revenue earned from selling physical goods or products. | Revenue earned from providing services to customers. |

Example Businesses | Retail stores (Walmart, Costco), manufacturers, e-commerce stores, grocery stores. | Consulting firms, law firms, hospitals, salons, IT support companies. |

Revenue Formula | Sales Revenue = Number of Units Sold × Price per Unit | Service Revenue = Number of Services Provided × Price per Service |

Cost Considerations | Includes Cost of Goods Sold (COGS) (cost to buy/make products). | Does not have COGS but has Operating Expenses (salaries, rent, etc.). |

Financial Statement | Appears under Sales Revenue in the Income Statement of a merchandiser. | Appears as Service Revenue in the Income Statement of a service company. |

Examples:

Sales Revenue Example (Retail Store)

A clothing store sells 500 jackets at $50 each.

Sales Revenue = 500 × $50 = $25,000

Service Revenue Example (Consulting Firm)

A consulting company provides 100 hours of consulting at $200 per hour.

Service Revenue = 100 × $200 = $20,000

Key Takeaway:

Sales Revenue comes from selling products.

Service Revenue comes from providing services.

Some companies (e.g., auto dealerships) may have both types of revenue.

Would you like more examples or further clarification? 😊

Difference Between Cost of Goods Sold (COGS) and Cost of Sales

Both Cost of Goods Sold (COGS) and Cost of Sales refer to the expenses incurred to produce or acquire goods and services sold by a business. However, they have slight differences in how they are used.

Term | Cost of Goods Sold (COGS) | Cost of Sales |

|---|---|---|

Definition | The direct costs associated with producing or purchasing physical goods that a company sells. | The total costs incurred in selling a product or service, including COGS and additional selling expenses. |

Used By | Manufacturers and Merchandisers (Retailers, Wholesalers, etc.) | Service Companies and sometimes Merchandising Businesses. |

Includes | - Raw materials- Direct labor- Manufacturing costs- Wholesale purchase costs (for retailers) | - Cost of Goods Sold (COGS)- Additional selling costs (e.g., marketing, distribution) |

Example | - A furniture manufacturer calculates COGS as wood, screws, paint, and labor costs used in making chairs. | - A consulting firm’s cost of sales may include employee salaries, office rent, and travel expenses. |

Financial Statement | Appears under Sales Revenue in the Income Statement of a manufacturer or retailer. | Appears in service-based company income statements where there are no physical goods involved. |

Key Difference:

COGS applies to businesses that sell physical products.

Cost of Sales is a broader term that can include COGS plus other sales-related expenses.

In service-based businesses, Cost of Sales is used instead of COGS since there are no tangible goods.

Would you like further clarification with specific business examples? 😊

What is Gross Margin?

Gross Margin represents the percentage of revenue a company retains after deducting the Cost of Goods Sold (COGS) or Cost of Sales. It shows how efficiently a business produces or purchases its products relative to sales revenue.

Gross Margin vs. Gross Profit:

Gross Profit = Sales Revenue – COGS (dollar amount).

Gross Margin = (Gross Profit ÷ Sales Revenue) × 100 (percentage).

Why is Gross Margin Important?

Measures profitability before operating expenses.

Helps businesses set prices and control production costs.

Investors use it to compare companies in the same industry.

Inventory

The business’s inventory includes all goods that the company owns and expects to sell to customers in the normal course of operations. Inventory is an asset reported in the current assets section of the balance sheet.What Goes into Inventory Cost?

The cost of inventory on a merchandiser’s balance sheet represents all the costs incurred to bring the merchandise to the point of sale. Suppose SAIL purchases sleeping bags from a manufacturer in Asia. SAIL’s cost of a sleeping bag would include the following:

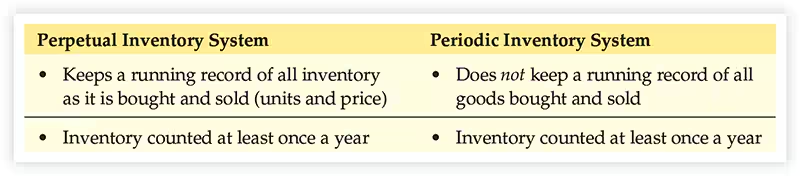

1. Periodic Inventory System

Used by small businesses that sell low-cost items (e.g., small grocery stores, restaurants).

Does not keep a daily record of inventory.

Instead, the business counts inventory periodically (e.g., once a year) to determine how much is left.

This method is simpler and cheaper but less accurate for daily tracking.

2. Perpetual Inventory System

Used by larger businesses with modern technology.

Automatically updates inventory and cost of goods sold every time a purchase or sale happens.

Uses bar codes and scanners (like at supermarkets) to keep real-time records.

Even with automation, businesses still do a physical count at least once a year to check for errors (e.g., theft, spoilage).

Key Difference

Feature | Periodic System | Perpetual System |

|---|---|---|

How often is inventory updated? | Occasionally (e.g., yearly) | Continuously (real-time) |

Technology required? | No special technology needed | Uses computers & scanners |

Best for | Small stores, restaurants | Large retailers, supermarkets |

Accuracy | Less accurate for daily tracking | More accurate |

how businesses record inventory purchases and take advantage of purchase discounts

Inventory Purchase on Account (May 27 Entry)

Slopes buys ski jackets and ski pants for $700 but does not pay immediately.

Since it is bought "on account," the journal entry records:

Increase in Inventory (Debit: $700)

Increase in Accounts Payable (Credit: $700)

Understanding Purchase Discounts

Some suppliers offer discounts for early payment.

Example: "2/15, n/30" (2% discount if paid within 15 days, otherwise full payment in 30 days).

If Slopes pays within 15 days, they can deduct 2% of $700 = $14, reducing their total cost.

Payment with Discount (June 10 Entry)

Slopes pays within 15 days (June 10), so they get the 2% discount.

The payment entry:

Debit Accounts Payable ($700)

Credit Cash ($686)

Credit Inventory ($14)

Why Credit Inventory?

The discount reduces the cost of the inventory, so instead of recording a "discount earned," the company adjusts inventory cost downward.

Why Do We Debit Accounts Payable When Paying for Inventory?

When Slopes originally purchased the inventory on account (May 27), the company credited (increased) Accounts Payable by $700. This means Slopes owes $700 to the supplier.

Now, when Slopes pays on June 10:

Since they are making a payment, they need to remove (decrease) the liability from their records.

Accounts Payable is a liability account, and liabilities decrease with a debit.

This is why we debit Accounts Payable for $700—to show that Slopes no longer owes this amount.

The Full Journal Entry (June 10, Payment with Discount)

Account | Debit | Credit |

|---|---|---|

Accounts Payable | $700 | - |

Cash | - | $686 |

Inventory | - | $14 |

Why Do We Credit Inventory Instead of "Discount Earned"?

Instead of recording the $14 discount as "other income," we reduce the cost of inventory.

This means the actual cost of inventory is $686, not $700.

Key Takeaways

We Debit Accounts Payable ($700) because it was initially credited (increased) when we made the purchase on May 27.

Paying the supplier removes the liability from our books.

We Credit Cash ($686) because that's the actual amount we paid.

We Credit Inventory ($14) because the discount reduces the cost of the inventory.

The ski pants now cost $686 instead of $700 in Slopes' accounting records.

What If Slopes Pays After the Discount Period (June 25)?

If they miss the 15-day discount period:

Account | Debit | Credit |

|---|---|---|

Accounts Payable | $700 | - |

Cash | - | $700 |

No inventory adjustment is needed because no discount was received.

Final Thought

In double-entry accounting, every transaction must balance.

Debiting Accounts Payable removes the liability.

Crediting Cash reflects the actual payment.

Crediting Inventory adjusts the cost of goods due to the discount.

Payment After Discount Period (June 25 Entry)

If Slopes misses the 15-day window, they must pay the full $700.

The entry:

Debit Accounts Payable ($700)

Credit Cash ($700)

What Does This Mean?

Companies save money if they pay early.

Purchase discounts reduce inventory costs.

The Accounts Payable account must always be $0 once payment is made.

Businesses track discounts carefully using computerized systems to maximize savings.

debit memo is used when the seller sells the wrong model and the buyer needs to adjust the invoice to reflect the correct item and price.

Purchase Allowances

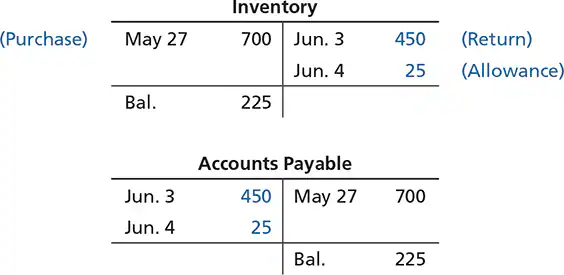

Now assume that one pair of the Neige ski pants was damaged in shipment to Slopes. The damage is minor, and Slopes decides to keep the ski pants in exchange for a $25 allowance from Neige. To record this purchase allowance, Slopes makes this entry:

The entry is as follows.

Assume that Slopes has not yet paid its liability to Neige. After these return ($450) and allowance ($25) transactions are posted, Slopes’ accounts will show these balances:

The return and the allowance had two effects:

They decreased Slopes’ liability, which is why we debit Accounts Payable.

They decreased the net cost of the inventory, which is why we credit Inventory.

FOB: who pays the shipping charges?

FOB Term | When Ownership Transfers | Who Pays Freight? | Who Bears Risk in Transit? |

|---|---|---|---|

FOB Shipping Point | When goods leave the seller's location | Buyer | Buyer |

FOB Destination | When goods reach the buyer's location | Seller | Seller |

The buyer does not pay for freight while the goods are still at the seller’s location.

Under FOB Shipping Point, the buyer pays freight because they own the goods once they leave the seller.

Under FOB Destination, the seller keeps ownership and pays freight until delivery.

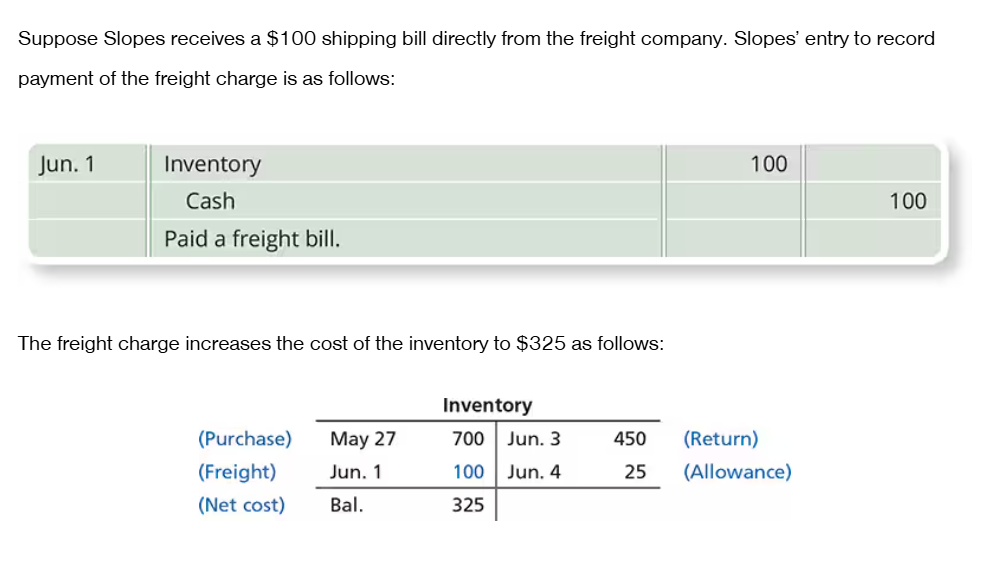

Freight-in is the transportation cost on purchased goods. freight-in is paid by the buyer and is included in the cost of inventory, thus impacting the overall cost of goods sold when the inventory is sold.

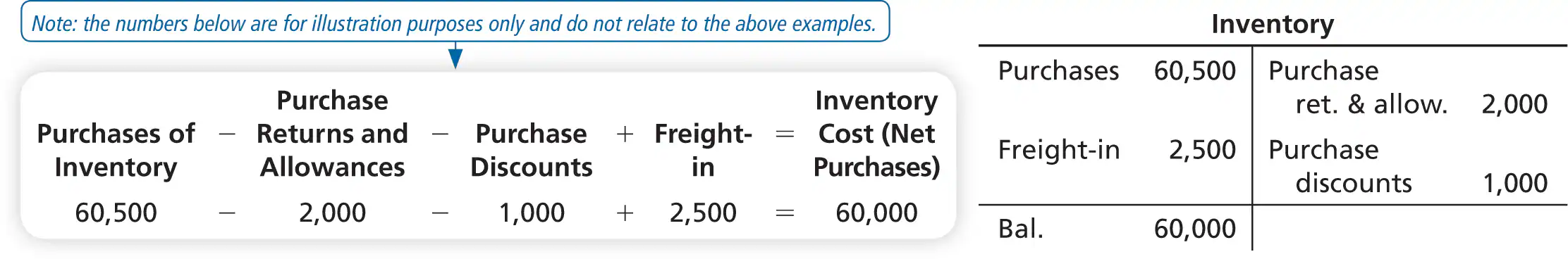

this calculation is applied to buyers, not sellers. It represents how a buyer determines the net cost of inventory purchases.

Explanation of the Calculation (For Buyers)

This formula helps a business determine the actual cost of inventory after accounting for:

Purchase returns and allowances (goods sent back or price reductions).

Purchase discounts (discounts for early payment).

Freight-in (shipping costs for receiving the inventory).

Breaking It Down:

Purchases of Inventory: $60,500 (Total before any deductions)

Less: Returns & Allowances: -$2,000 (Inventory returned to the supplier or price reductions)

Less: Purchase Discounts: -$1,000 (Discount for early payment)

Add: Freight-in: +$2,500 (Shipping cost paid by the buyer)

Final Inventory Cost (Net Purchases): $60,000

Why Is This for Buyers, Not Sellers?

Buyers track inventory costs because they need to record the actual cost of goods for financial reporting and profitability analysis.

Sellers, on the other hand, would record Sales Revenue, Cost of Goods Sold (COGS), and Freight-out (if they cover shipping costs under FOB Destination).

Freight-in applies to buyers, while freight-out applies to sellers (which is not included in this calculation).

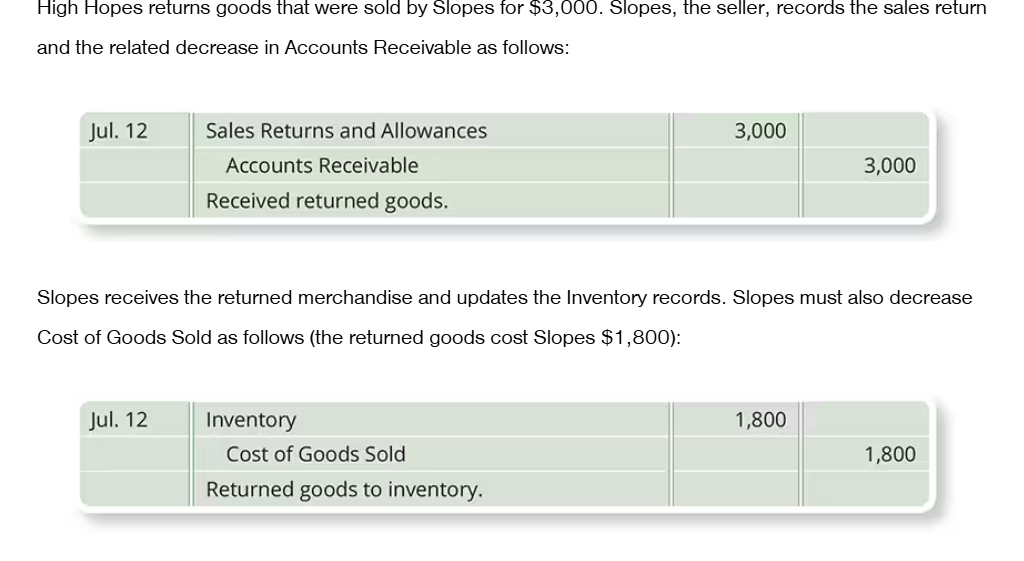

A sales return: The customer may return goods to Slopes Ski Shop.

A sales allowance: Slopes may grant a sales allowance to reduce the amount of cash to be collected from the customer.

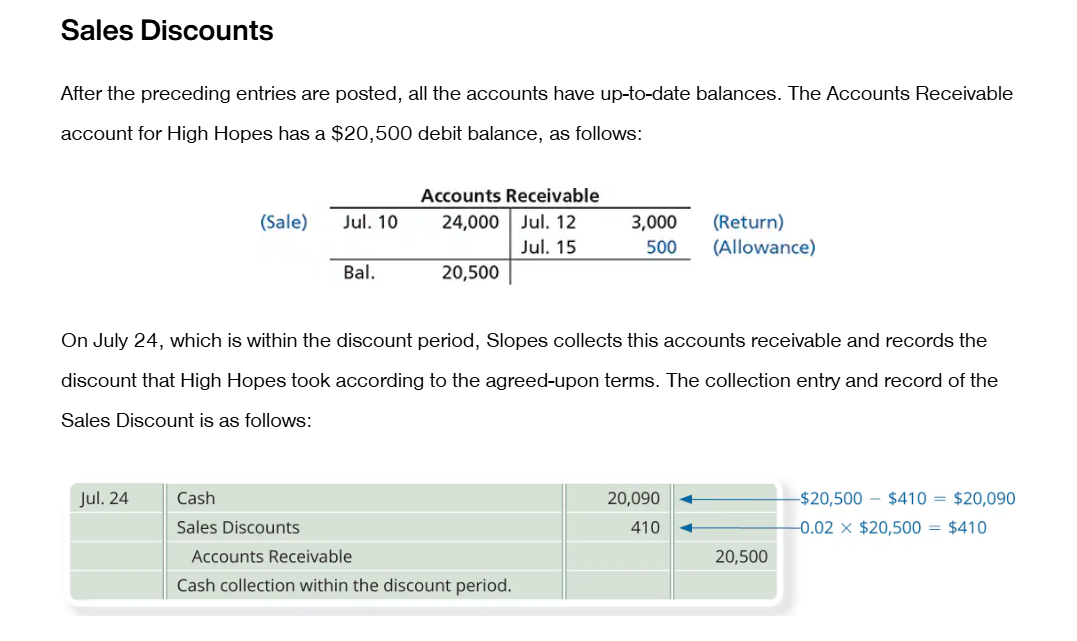

A sales discount: If the customer pays within the discount period—under terms such as 2/10, n/30—Slopes collects the discounted (reduced) amount. No discount is recorded for a quantity, or volume, discount.

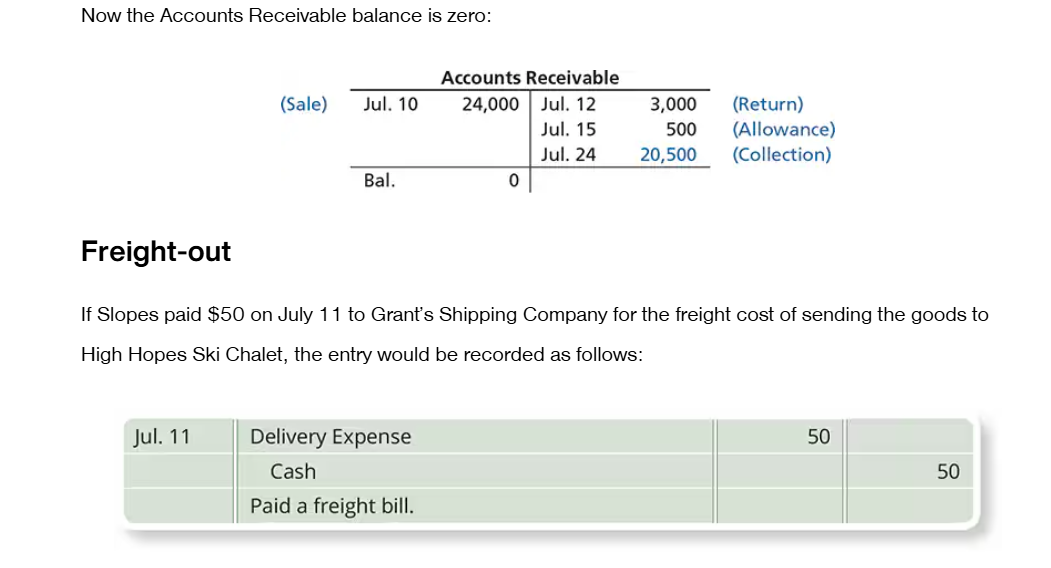

Freight-out: Slopes may have to pay delivery expense to transport the goods to the buyer’s location.

Sales Allowance

The seller reduces the price instead of taking back the product.

It is recorded as a contra-revenue account (reduces total sales revenue).

Usually occurs due to minor defects, incorrect pricing, or late delivery.

No physical return of goods is involved.

CHAP 5 SUMMARY

Breakdown and Explanation of Chapter 5 Class Notes (12th Edition - Revised)

This chapter focuses on merchandising operations and the accounting cycle for businesses that buy and sell goods, like Superstore, Walmart, 7-11, and Costco. These businesses make money by buying products from suppliers at a lower price and selling them at a higher price, which creates gross profit.

📌 PART 1: Merchandising Operations & Accounting for Inventory

What is a Merchandising Business?

A business that buys and resells products instead of providing services.

Example: Costco buys items in bulk at a lower price and resells them to consumers at a higher price.

Types of Inventory Accounting Systems

There are two systems to track inventory:

Perpetual Inventory System (Main Focus)

Inventory is updated immediately after each purchase or sale.

Cost of Goods Sold (COGS) is updated automatically.

Example: A grocery store using barcode scanners to update inventory in real-time.

Periodic Inventory System

Inventory is counted at the end of a period (e.g., monthly, yearly).

COGS is calculated using this formula: COGS=Beginning Inventory+Purchases−Ending Inventory\text{COGS} = \text{Beginning Inventory} + \text{Purchases} - \text{Ending Inventory}

Example: A small clothing boutique doing a physical stock count every quarter.

Key Inventory Terms

Beginning Inventory: The stock a company has at the start of the accounting period.

Goods Available for Sale (GAS): Beginning Inventory+Purchases=GAS\text{Beginning Inventory} + \text{Purchases} = \text{GAS}

Ending Inventory: The stock left at the end of the accounting period.

COGS: The cost of the inventory that was sold.

📌 PART 2: Purchasing & Selling Inventory

1⃣ Recording Inventory Purchases

Purchases are recorded as an increase (debit) to Inventory.

If discounts, returns, or allowances are given, they are recorded as a decrease (credit) to Inventory.

Freight-in costs (shipping costs paid by the buyer) are added to inventory.

2⃣ Recording Sales

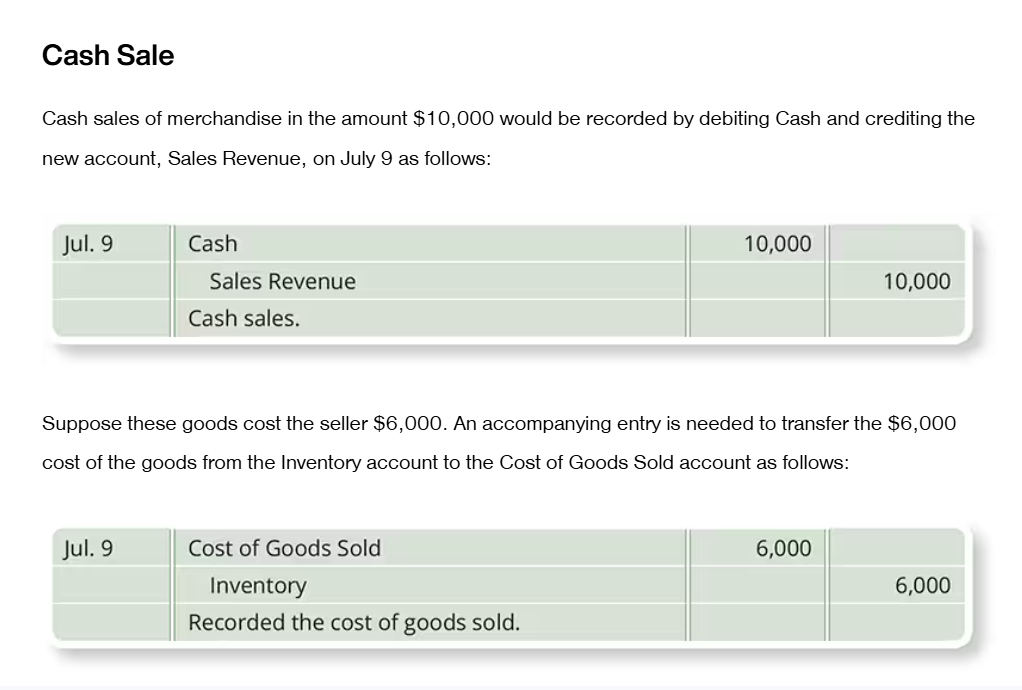

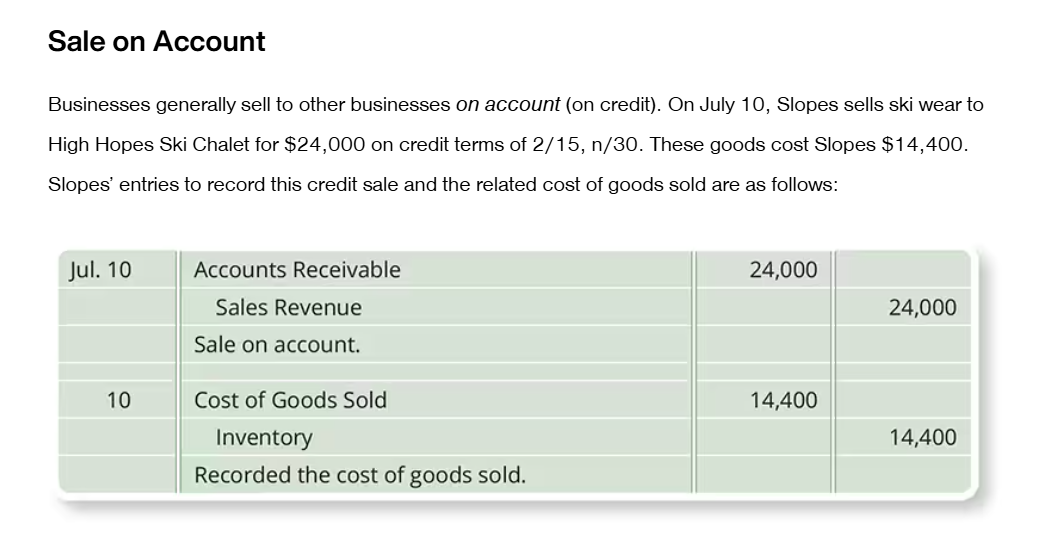

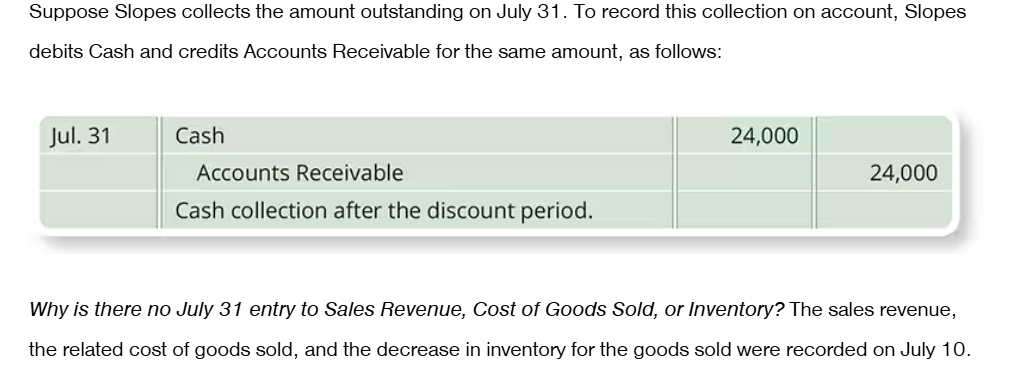

Sales transactions involve two entries:

Recognizing the sale

Debit: Cash or Accounts Receivable

Credit: Sales Revenue

Recording COGS (cost of inventory sold)

Debit: Cost of Goods Sold (COGS)

Credit: Inventory

Sales Discounts & Returns

Sales Discounts: Incentives for customers to pay early.

Sales Returns & Allowances: Products returned by customers, recorded as a decrease in revenue.

3⃣ Freight Costs (Shipping Costs)

FOB Shipping Point: Buyer pays for shipping (recorded as Freight-in under Inventory).

FOB Destination: Seller pays for shipping (recorded as Freight-out under Selling Expense).

📌 PART 3: Adjusting & Closing Entries

1⃣ Physical Count of Inventory Adjustments

If accounting records show more inventory than the actual count, adjust downward:

Debit: COGS

Credit: Inventory

If actual count is higher than records, check for unrecorded purchases. If found:

Debit: Inventory

Credit: Cash or Accounts Payable

2⃣ Multi-Step Income Statement

A more detailed income statement that separates operating income from other income/expenses:

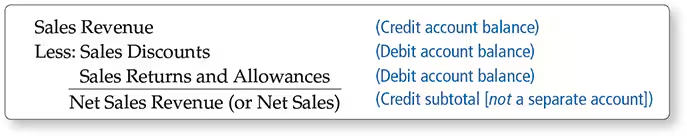

Net Sales Revenue = Total Sales - Discounts - Returns & Allowances

COGS

Gross Margin = Net Sales - COGS

Operating Income (from core business)

Other Income & Expenses (non-core activities)

Net Income

📌 PART 4: Closing Entries for Merchandising Companies

Closing entries follow the same four-step process but include COGS, sales discounts, returns, and allowances.

Example: At the end of the year, all temporary accounts are closed to prepare for the next period.

📌 PART 5: Evaluating a Merchandising Business

1⃣ Gross Margin Percentage

A key indicator of profitability: Gross Margin Percentage=Gross MarginNet Sales Revenue×100\text{Gross Margin Percentage} = \frac{\text{Gross Margin}}{\text{Net Sales Revenue}} \times 100

Example:

If a store sells a textbook for $100, and the cost was $70, then:Gross Margin = $30

Gross Margin % = 30%

2⃣ Inventory Turnover Ratio

Measures how efficiently a company sells inventory: Inventory Turnover=COGSAverage Inventory\text{Inventory Turnover} = \frac{\text{COGS}}{\text{Average Inventory}}

Example:

Company A: 8 times per year

Company B: 12 times per year

Company B is more efficient because it sells inventory faster.

🔹 Final Summary

Key Concept | Explanation |

|---|---|

Merchandising Business | A business that buys and sells goods (e.g., Walmart, Costco) |

Perpetual vs. Periodic Inventory System | Perpetual updates continuously; Periodic updates at the end of the period |

COGS Calculation | Beginning Inventory + Purchases - Ending Inventory |

FOB Shipping Point vs. FOB Destination | Determines who pays for shipping (buyer or seller) |

Sales Revenue Recording | Two entries: 1) Recognizing revenue, 2) Recording inventory reduction |

Multi-Step Income Statement | Separates core operating income from other revenues/expenses |

Gross Margin Percentage | Measures profitability (higher % = more profit per sale) |

Inventory Turnover Ratio | Measures how quickly inventory is sold (higher = better efficiency) |

📌 Why Is This Important?

Helps businesses track inventory efficiently.

Ensures accurate financial reporting.

Prevents errors & fraud in financial statements.

Helps business owners make better pricing & purchasing decisions.

Would You Like a Deeper Breakdown on Any Topic? 🤔💡

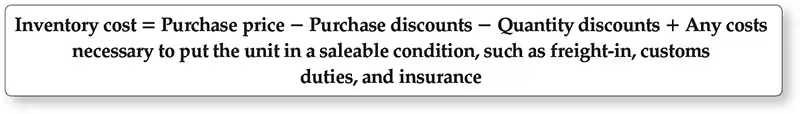

CHAPTER 6

The equation in the image explains how to calculate the inventory cost of an item, which represents the total cost incurred to acquire inventory and make it ready for sale. Here’s a breakdown of the components:

Purchase Price – The initial cost of acquiring the inventory item before any adjustments.

Purchase Discounts – Any reductions in price offered by the supplier, such as trade discounts or promotional discounts.

Quantity Discounts – Discounts received for purchasing in bulk. These reduce the cost per unit.

Additional Costs (Added to Inventory Cost):

Freight-in – The cost of transporting the goods to the business location.

Customs Duties – Taxes imposed on imported goods.

Insurance – Cost of insuring the inventory while in transit.

Why is this important?

This formula ensures that the total cost of inventory reflects all expenses necessary to make the goods available for sale, rather than just the purchase price. This helps in accurate pricing, profit calculations, and financial reporting.

Would you like an example calculation?

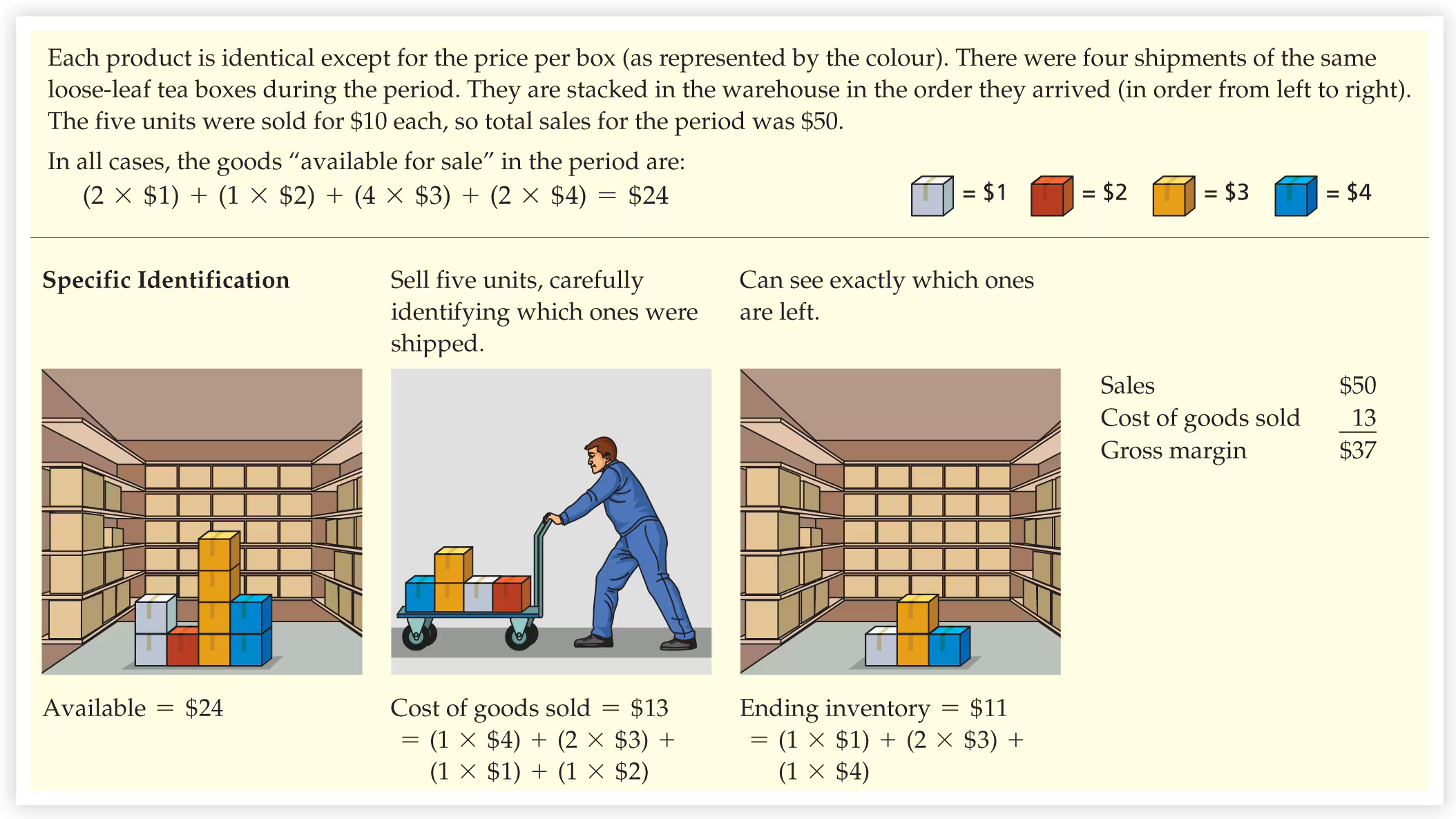

specific unit cost method is a way to classify goods based on its specific price

first in first out is used in company who sells identical product with identical price

ex: sell old milk inventory before the new one

weighted average cost: 1 product for $4, 2 for $6

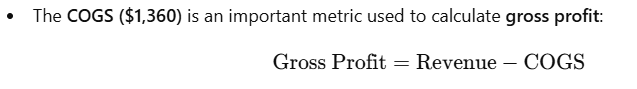

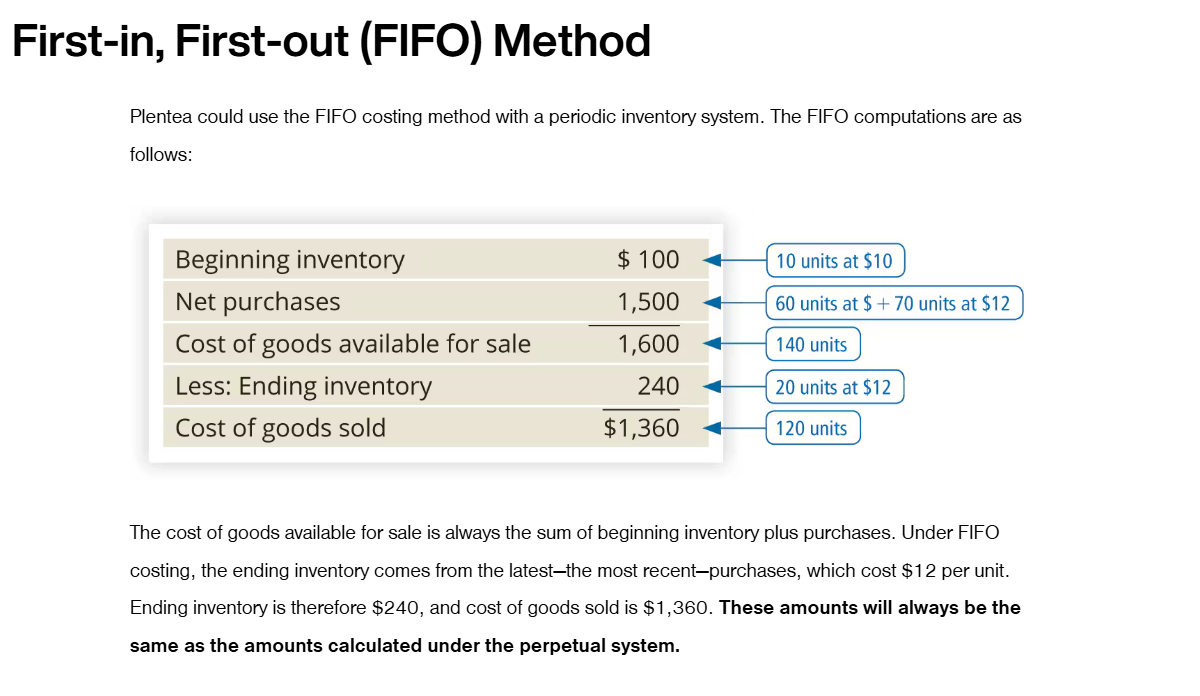

FIFO assumes that goods in first are sold first; therefore, the last goods purchased are left in ending inventory.

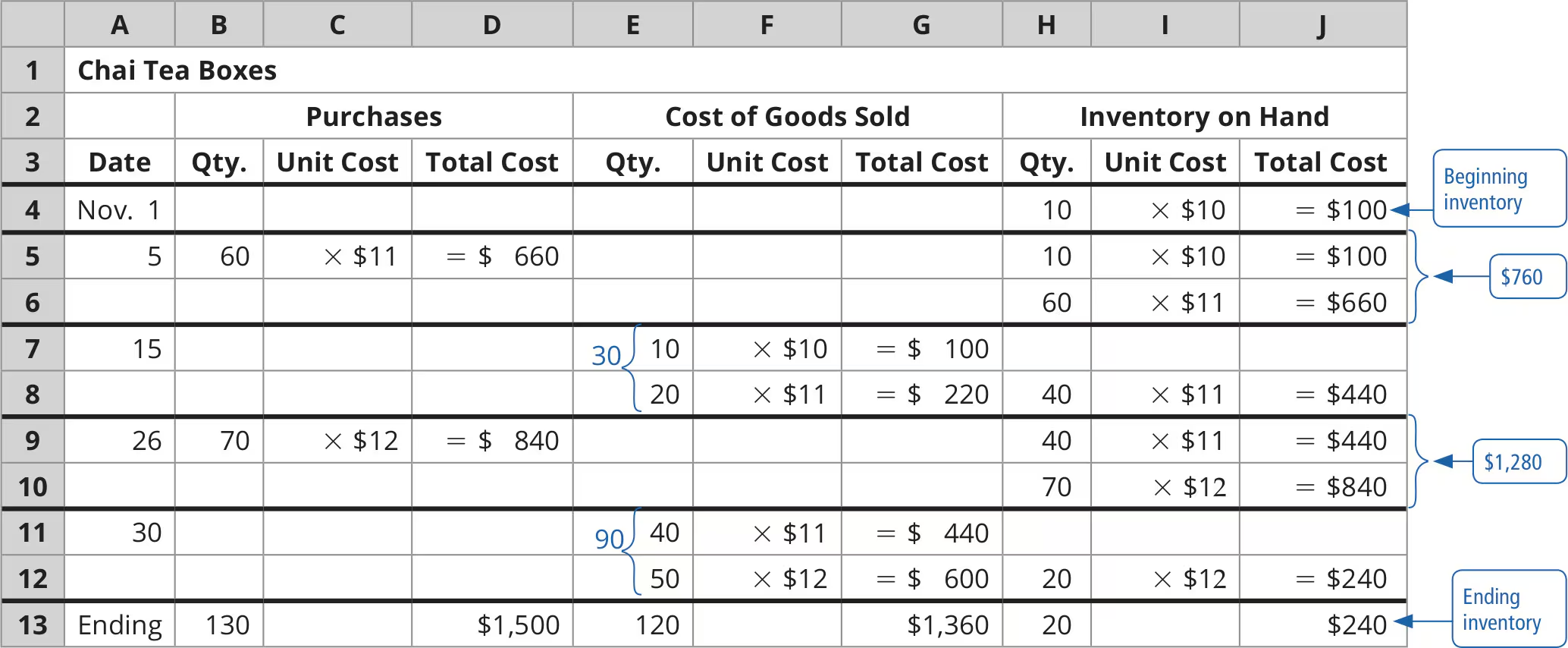

Perpetual Inventory Record is

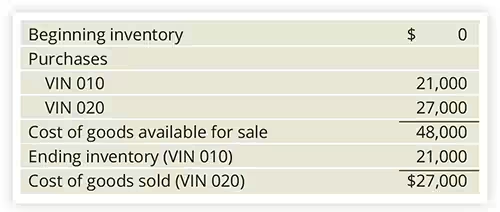

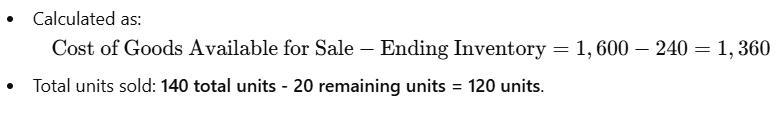

This image represents a Cost of Goods Sold (COGS) calculation, which is used in inventory accounting to determine the cost of items sold during a specific period. Let's break it down step by step:

Components in the Calculation:

Beginning Inventory ($100)

This represents the inventory on hand at the start of the period.

In this case, it consists of 10 units at $10 each (10 × $10 = $100).

Net Purchases ($1,500)

This is the cost of additional inventory purchased during the period.

The breakdown shows:

60 units purchased at $11 each → 60 × $11 = $660

70 units purchased at $12 each → 70 × $12 = $840

Total net purchases = $660 + $840 = $1,500

Cost of Goods Available for Sale ($1,600)

This is the total inventory cost available before selling any units.

Less: Ending Inventory ($240)

This represents the cost of inventory that remains unsold at the end of the period.

The breakdown shows:

20 units at $12 each (20 × $12 = $240).

Cost of Goods Sold (COGS) ($1,360)

This represents the cost of the inventory that was sold during the period.

Key Takeaways:

This method tracks how inventory flows through a business.

The COGS ($1,360) is an important metric used to calculate gross profit:

Ending inventory ($240) remains as an asset on the balance sheet.

Would you like to see how this changes under different inventory valuation methods (FIFO, LIFO, Weighted Average)?

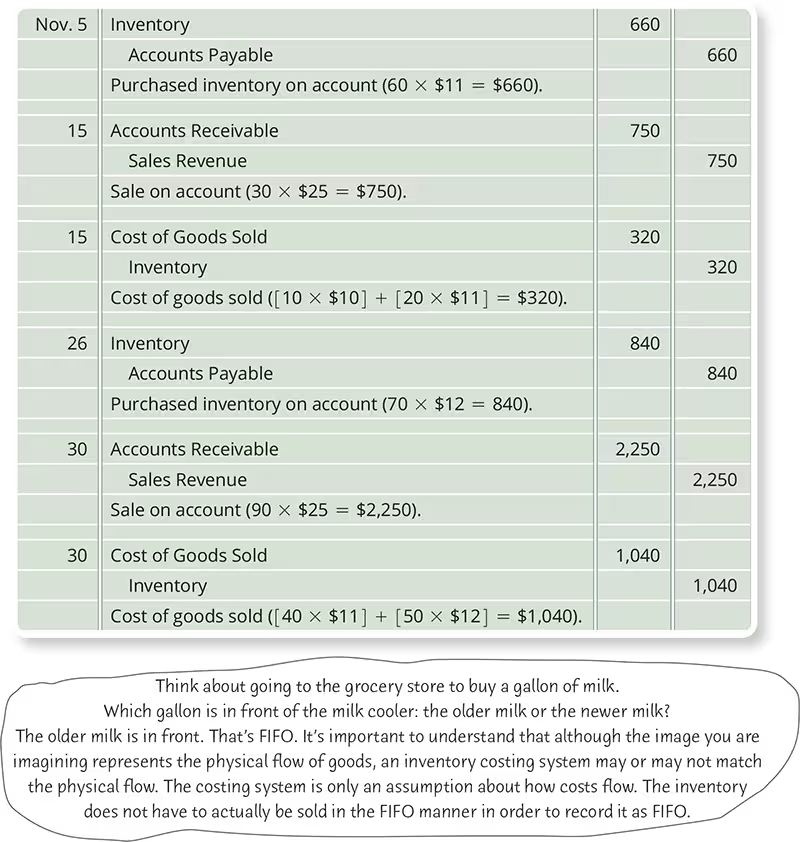

Moving-Weighted-Average-Cost (MWAC) Method

The Moving-Weighted-Average-Cost (MWAC) method is used in inventory accounting to continuously update the average cost of inventory each time a purchase is made. This method smooths out price fluctuations by averaging costs over time.

How it Works

Every time a purchase is made, the new weighted-average cost per unit is recalculated

FIFO AND MOVING WEIGHTED AVERAGE COST

COMPARISON

Cost of Goods Sold (COGS)

Under FIFO, COGS is $1,360, which is slightly lower.

Under Moving-Average, COGS is $1,368, which is higher.

Why? FIFO sells older (cheaper) inventory first, while Moving-Average smooths out costs over time, often leading to higher COGS if prices are rising.

Gross Margin

Under FIFO, gross margin is $1,640 (higher).

Under Moving-Average, gross margin is $1,632 (lower).

Why? Since FIFO results in lower COGS, it produces a higher gross margin, whereas Moving-Average spreads the cost, leading to a slightly lower gross margin.

Effect of Price Changes

FIFO: If inventory costs are increasing, FIFO results in lower COGS and higher profits (but higher taxes).

Moving-Average: This method provides smoother cost fluctuations since each purchase updates the average cost.

Which Method is Better?

FIFO is better when prices are rising because it reports higher profits (but also higher taxes).

Moving-Average is useful for stability and is commonly used in perpetual inventory systems.

What Does Ending Inventory Mean?

Ending Inventory refers to the value of the goods that remain unsold at the end of an accounting period. It represents the remaining stock available for future sales and is recorded as an asset on the balance sheet.

Understanding Ending Inventory in FIFO

FIFO (First-In, First-Out) Method assumes that the oldest inventory (purchased first) is sold first.

The remaining inventory consists of the most recent purchases.

In this case, the ending inventory consists of 20 units at $12 each, which gives: 20×12=24020 \times 12 = 240

This means $240 worth of inventory remains unsold at the end of the period.

Why Is Ending Inventory Important?

Financial Reporting – It affects the balance sheet (as an asset) and the income statement (through COGS).

Tax Implications – A higher ending inventory reduces COGS, leading to a higher taxable income.

Business Planning – Helps businesses determine how much stock is left for future sales and avoid overstocking or shortages.

Would you like a deeper explanation with another example?

consistency suggests that the company always use 1 method - FIFO or moving weighted average cost

Comparability - whether there is a change in method, it should be reported to be comparable to the year before

Disclosure Principle

Definition: Companies must provide sufficient financial information for stakeholders to make informed decisions.

Importance: Ensures transparency, reliability, and comparability.

Example: If one company uses FIFO and another uses Weighted-Average Costing, a banker comparing net incomes should be aware of these differences to avoid misjudging financial health.

Application: Inventory valuation methods, categorization of inventory (e.g., raw materials, work-in-process, finished goods) should be disclosed.

Materiality Constraint

Definition: Companies should follow strict accounting rules only for items that significantly impact financial decisions.

Importance: Saves time and resources by allowing minor, immaterial transactions to be treated more flexibly.

Example: A company purchasing $5 worth of office supplies may expense it immediately instead of recording it as inventory.

Application: Small inventory costs can be expensed rather than capitalized.

Accounting Conservatism

Definition: When in doubt, record financial information in a way that minimizes the risk of overstating assets or income.

Importance: Prevents misleading financial statements and protects investors.

Key Principles:

Anticipate losses but not gains.

Record assets at the lowest reasonable value and liabilities at the highest.

Prefer recognizing expenses over assets in uncertain situations.

Example: If inventory’s market value drops below cost, the company should write it down to reflect the lower value rather than waiting for a possible price recovery.

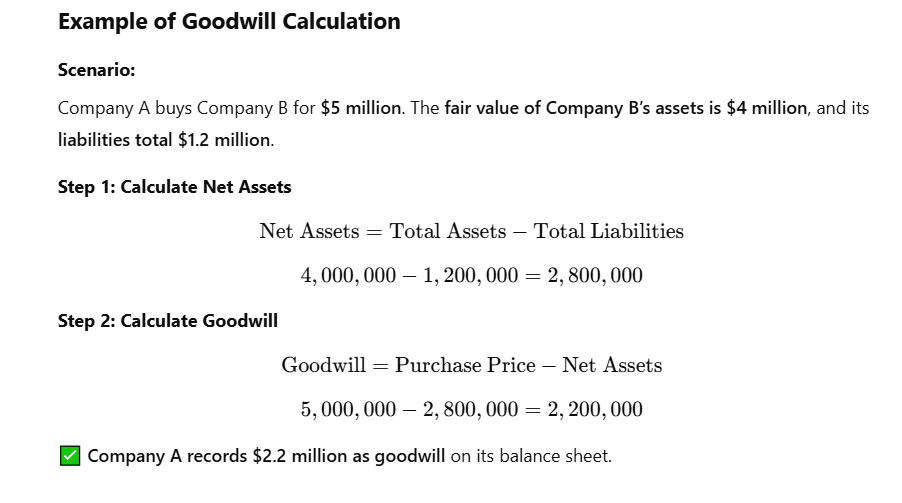

The lower-of-cost-and-net-realizable-value rule (abbreviated as LCNRV) shows accounting conservatism in action.

Lower-of-Cost-and-Net-Realizable-Value (LCNRV) Rule: Explanation & Example

What is LCNRV?

The Lower-of-Cost-and-Net-Realizable-Value (LCNRV) Rule is an accounting principle based on conservatism, ensuring that inventory is not overstated on the financial statements. It requires businesses to report inventory at the lower of:

Cost (the original purchase price)

Net Realizable Value (NRV) (the expected selling price minus any costs to sell or complete the item)

If NRV is lower than the cost, the inventory must be written down to reflect the lower value. This prevents overstating assets and income.

Example of LCNRV in Action

Scenario:

A company has 100 units of a product that originally cost $50 each. However, due to a market downturn, the selling price drops. The company estimates it can now sell each unit for $45, but will incur $3 per unit in selling costs.

Step 1: Calculate Net Realizable Value (NRV)

NRV=Selling Price−Selling Costs\text{NRV} = \text{Selling Price} - \text{Selling Costs}NRV=45−3=42\text{NRV} = 45 - 3 = 42

Step 2: Compare Cost and NRV

Cost per unit: $50

NRV per unit: $42

Since NRV ($42) is lower than cost ($50), we must write down the inventory.

Step 3: Calculate the Write-Down Amount

Write-down=(Cost−NRV)×Total Units\text{Write-down} = (\text{Cost} - \text{NRV}) \times \text{Total Units}=(50−42)×100=8×100=800= (50 - 42) \times 100 = 8 \times 100 = 800

The company must recognize an $800 inventory write-down as an expense on the income statement.

The new inventory value reported on the balance sheet is $4,200 instead of $5,000.

Why is LCNRV Important?

Prevents Overstatement of Assets → Ensures inventory reflects realistic market conditions.

Follows Accounting Conservatism → Anticipates losses but does not recognize gains until realized.

Ensures Reliable Financial Reporting → Investors and lenders see a fair valuation of inventory.

Would you like a more detailed breakdown or another example? 😊

Impairment in Accounting

Impairment in accounting refers to a permanent decrease in the value of an asset, meaning the asset is worth less than its recorded value on the balance sheet. This occurs when an asset’s recoverable amount (the higher of its fair market value or its value in use) falls below its carrying amount (book value).

Why Does Impairment Happen?

Changes in market conditions (e.g., economic downturns).

Obsolescence (e.g., outdated technology).

Physical damage (e.g., fire or natural disaster).

Decline in asset performance (e.g., lower-than-expected sales from a purchased business).

Example of Impairment

Example 1: Impairment of Equipment

A company purchases machinery for $500,000, expecting it to last 10 years. After 3 years, new technology makes the machine obsolete, reducing its fair market value to $200,000, while its book value is $350,000. (It represents the original cost of the asset minus any accumulated depreciation, amortization, or impairment losses.)

🔹 Impairment Loss Calculation:

Impairment Loss=Carrying Value−Recoverable Amount\text{Impairment Loss} = \text{Carrying Value} - \text{Recoverable Amount}Impairment Loss=350,000−200,000=150,000\text{Impairment Loss} = 350,000 - 200,000 = 150,000

Accounting Entry:

Dr. Impairment Loss (Expense) $150,000

Cr. Machinery (Asset) $150,000

This reduces the machinery’s value on the balance sheet and recognizes an expense in the income statement.

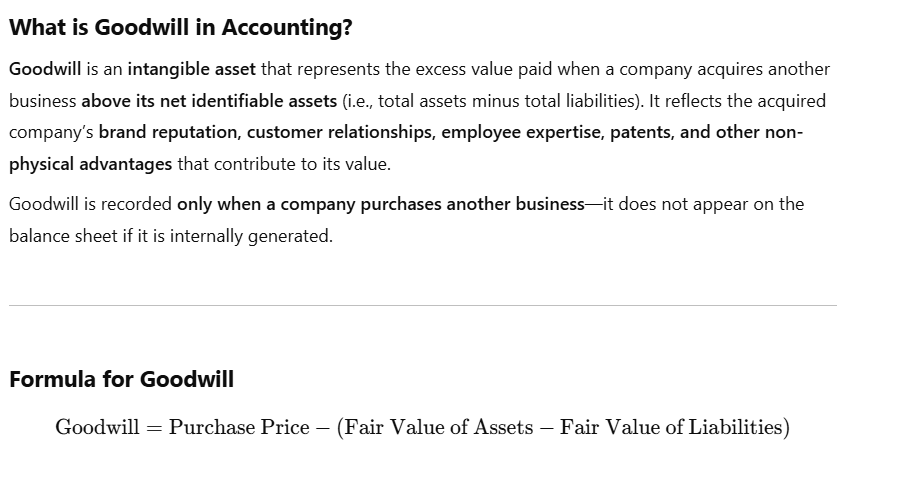

Example 2: Impairment of Goodwill

A company buys another business for $2 million, including $500,000 of goodwill. A year later, the acquired business is underperforming, and an assessment shows its recoverable amount is $1.5 million.

/

🔹 Impairment Loss Calculation:

Impairment Loss=2,000,000−1,500,000=500,000\text{Impairment Loss} = 2,000,000 - 1,500,000 = 500,000

Since goodwill is an intangible asset, it is written off completely.

Accounting Entry:

Dr. Impairment Loss (Expense) $500,000

Cr. Goodwill $500,000

Key Takeaways

✔ Impairment reflects a significant, permanent drop in asset value.

✔ The loss is recorded as an expense, reducing net income.

✔ Impairment cannot be reversed for goodwill but can sometimes be adjusted for other assets.

Would you like an industry-specific example? 😊

Difference Between Impairment and Impairment Reversal

Aspect | Impairment | Impairment Reversal |

|---|---|---|

Definition | A permanent reduction in an asset's book value due to a decline in its recoverable amount. | The increase in an impaired asset’s recoverable amount, allowing partial or full reversal of the previous impairment. |

Cause | Occurs due to market declines, obsolescence, physical damage, poor financial performance, or legal changes. | Happens when asset conditions improve, such as market recovery, technological upgrades, or better financial performance. |

Accounting Treatment | The impairment loss is recorded as an expense in the income statement, and the asset’s book value is reduced. | The impairment reversal is recorded as a gain in the income statement, increasing the asset’s value (up to the original cost). |

Reversibility | Irreversible for goodwill but can be reversed for tangible and intangible assets (excluding goodwill). | Allowed for most assets except goodwill. |

Example | A company purchases equipment for $500,000. Due to market decline, its value drops to $350,000, so an impairment loss of $150,000 is recorded. | If the market recovers and the equipment’s fair value rises to $400,000, an impairment reversal of $50,000 is recorded (but not exceeding the original $500,000). |

Key Takeaways:

✔ Impairment reduces asset value permanently, while impairment reversal restores it when conditions improve.

✔ Goodwill impairments cannot be reversed, but most other assets can have reversals.

✔ Both impact financial statements, affecting profitability and asset valuation.

Would you like a real-world company example to illustrate this further? 😊

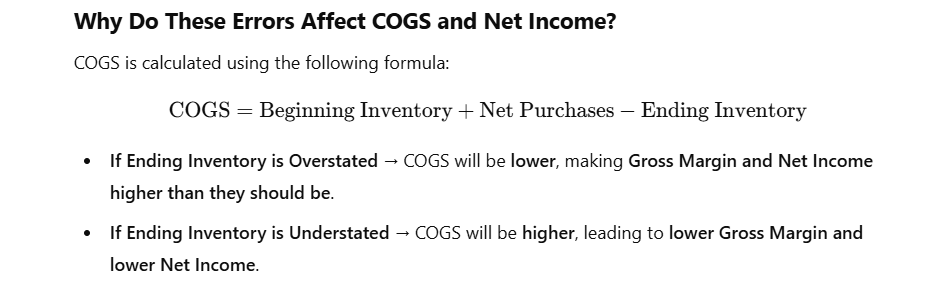

Ending Inventory Overstated → The inventory value recorded at the end of the period is higher than it should be.

Ending Inventory Understated → The inventory value recorded at the end of the period is lower than it should be.

Effects of Ending Inventory Errors

Item | Ending Inventory Overstated | Ending Inventory Understated |

|---|---|---|

Sales Revenue | Correct | Correct |

Beginning Inventory | Correct | Correct |

Net Purchases | Correct | Correct |

Cost of Goods Available for Sale | Correct | Correct |

Ending Inventory | ERROR: Overstated | ERROR: Understated |

Cost of Goods Sold (COGS) | Understated (Lower COGS) | Overstated (Higher COGS) |

Gross Margin | Overstated (Higher profit) | Understated (Lower profit) |

Operating Expenses | Correct | Correct |

Net Income | Overstated (Higher profit) | Understated (Lower profit) |

✔ Ending Inventory Errors Affect Net Income: Overstating inventory inflates profit, while understating it reduces profit.

✔ COGS is Inversely Affected: Overstated inventory lowers COGS, while understated inventory increases COGS.

✔ Sales Revenue is Unaffected: Because revenue is recorded separately from inventory errors, it remains correct.

✔ Long-Term Impact: Inventory errors can carry over to the next period, affecting future financial statements.

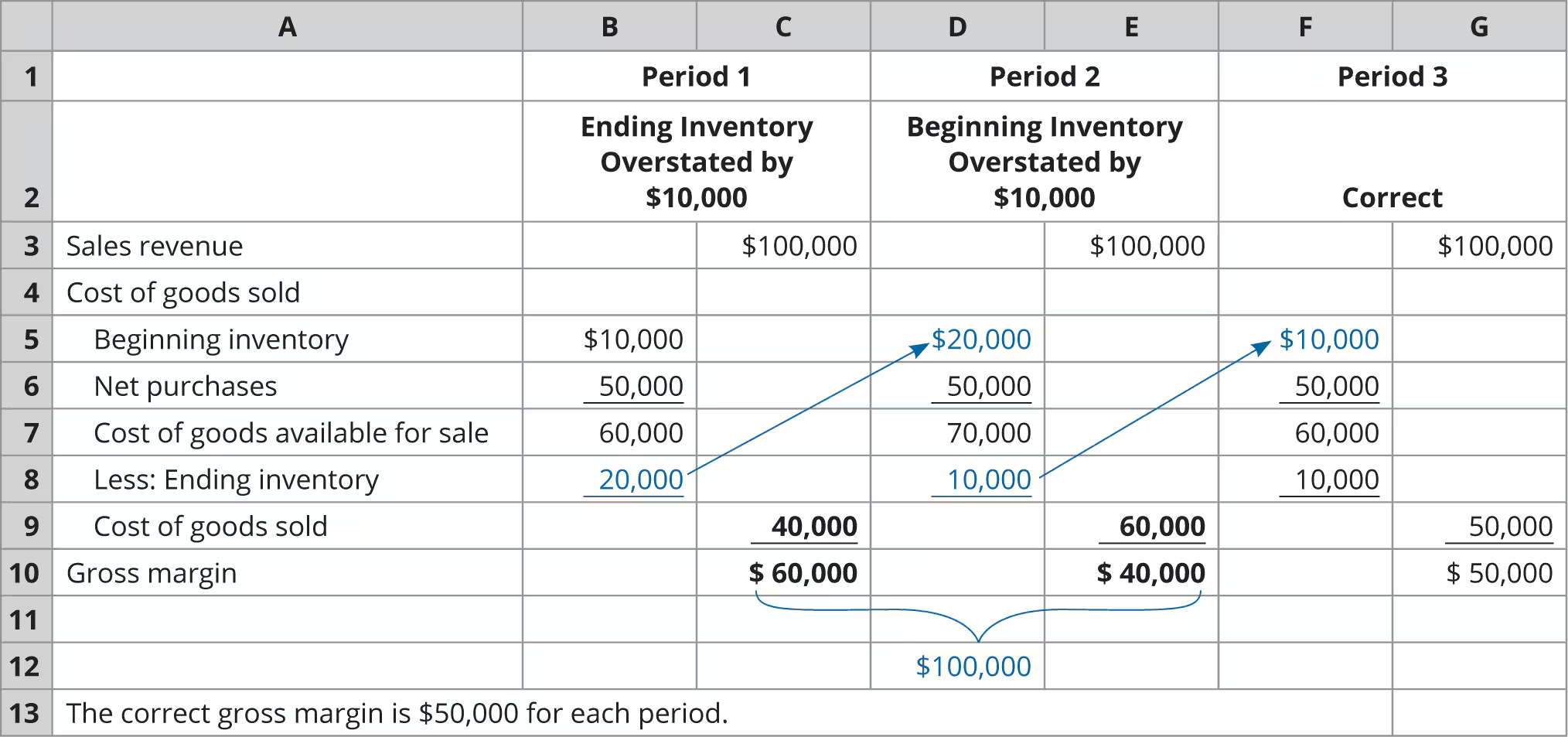

Period 1 (Ending Inventory Overstated by $10,000)

Ending inventory is recorded at $20,000 instead of $10,000.

Since COGS = Cost of Goods Available for Sale - Ending Inventory, overstating ending inventory lowers COGS to $40,000.

Gross margin is overstated at $60,000 instead of the correct $50,000.

This means net income appears higher than it should be.

Period 2 (Beginning Inventory Overstated by $10,000)

The overstated ending inventory from Period 1 becomes the beginning inventory for Period 2 ($20,000 instead of $10,000).

This inflates COGS to $60,000 instead of the correct $50,000.

Since Gross Margin = Sales Revenue - COGS, the overstatement of COGS leads to a lower gross margin ($40,000 instead of $50,000).

This means net income appears lower than it should be.

Period 3 (Corrected)

The error no longer carries over, and the correct inventory and COGS values are restored.

Gross margin returns to the correct value of $50,000.

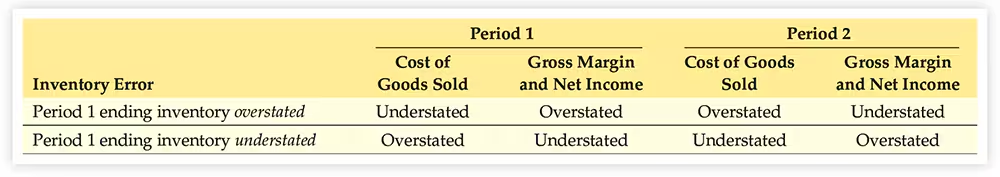

Inventory Error | Period 1 (Effect on Financial Statements) | Period 2 (Effect on Financial Statements) |

|---|---|---|

Ending Inventory Overstated | - COGS is understated (because ending inventory is subtracted from cost of goods available for sale). - Gross margin & net income are overstated (due to lower COGS). | - COGS is overstated (as beginning inventory is overstated). - Gross margin & net income are understated (due to higher COGS). |

Ending Inventory Understated | - COGS is overstated (because a lower ending inventory increases COGS). - Gross margin & net income are understated (due to higher COGS). | - COGS is understated (as beginning inventory is understated). - Gross margin & net income are overstated (due to lower COGS). |

✔ Inventory errors reverse over time – Overstatement in one period lowers profit in the next, and vice versa.

✔ Short-term misstatements can mislead financial decisions – Overstating profit may give a false impression of business success.

✔ COGS is inversely affected by inventory errors – A higher ending inventory reduces COGS, while a lower ending inventory increases COGS.

✔ The total impact balances out – While one period may have an inflated profit, the next period experiences a corresponding drop, correcting the mistake.

Example of a Company Detecting & Correcting an Inventory Error

Case: Retail Store Inventory Misstatement

📌 Company: A clothing retailer

📌 Issue: After conducting a physical inventory count, the store found that its system showed $150,000 in inventory, but the actual count was $135,000.

📌 Error Type: Overstated inventory ($15,000 overstatement)

📌 Impact: The company had been understating COGS, inflating gross profit and net income.

🔹 Correction Process:

1⃣ Adjusted COGS upward by $15,000 to reflect the missing inventory.

2⃣ Reduced gross margin and net income accordingly.

3⃣ Strengthened internal controls by requiring more frequent inventory counts and reconciliation of sales records.

Journal Entry to Correct Overstatement:

pgsqlDr. Cost of Goods Sold $15,000 Cr. Inventory $15,000

CHAPTER 8

"PART 1"

1⃣ Cash

💰 What is included in cash?

Cash on hand

Petty cash

Cash deposits in banks/trust companies

Cash equivalents (e.g., Treasury Bills)

Petty Cash vs. Cash Equivalents: What's the Difference?

Term | Definition | Purpose | Example |

|---|---|---|---|

Petty Cash | A small amount of physical cash kept on hand for minor, everyday expenses. | Used for small, immediate purchases that are too small for checks or credit. | Office supplies, coffee for employees, postage, minor repairs. |

Cash Equivalent | Short-term, highly liquid investments that can be easily converted to cash within 3 months. | Used for safety and liquidity, ensuring businesses have access to cash quickly. | Treasury bills, money market funds, short-term government bonds. |

Key Differences:

💰 Petty Cash = Actual physical cash, typically a small amount.

🏦 Cash Equivalents = Investments that are almost as good as cash, but earning some interest.

Would you like a real-world example of how businesses use these? 😊

🔹 Key Points about Cash:

Most liquid asset of an organization.

Downside: Easily stolen due to high liquidity.

2⃣ Internal Control

🛡 Definition:

A management-designed process to ensure:

✅ Reliable financial reporting

✅ Efficient operations

✅ Compliance with laws/regulations

📌 Internal Control Objectives (Ex 8-2, pg 463):

Increase operational efficiency

Prevent & detect errors/fraud

Protect assets & records

Ensure accurate, reliable financial data

3⃣ Sarbanes-Oxley & Canadian Bill 198

📜 Key Takeaways:

Mandates internal control reviews

Management must take responsibility for accurate financial reporting

4⃣ Fraud & The Fraud Triangle

🔺 Why does fraud happen?

1⃣ Opportunity – Weak internal controls make fraud easier

2⃣ Pressure –

External: Personal debt, financial struggles

Internal: Feeling undervalued, lack of a raise

Summary in One Sentence:

Internal controls help prevent fraud, protect assets, and ensure financial accuracy, but weak controls create opportunities for fraud, which is often driven by financial pressure.

Would you like me to simplify this further or create a visual diagram for better understanding? 😊

1⃣ Why Does Fraud Happen? - The Fraud Triangle

The Fraud Triangle explains the three main reasons why people commit fraud:

🔹 Opportunity → Weak internal controls allow fraud to happen.

🔹 Pressure → Financial stress (e.g., personal debt, feeling underpaid).

🔹 Rationalization → Justifying fraud ("The company is rich, no one will notice").

2⃣ The 5 Components of Internal Control (CRIME)

🔍 C.R.I.M.E. is an acronym for effective internal control:

Component | Description |

|---|---|

C - Control Procedures/Environment | Leadership sets the ethical tone (“Tone at the Top”). |

R - Risk Assessment | Identifying potential risks that threaten the company. |

I - Information System | Tracking assets, profits, and losses. |

M - Monitoring of Controls | Ensuring internal controls function correctly. |

E - Environmental Controls | Rules and processes to enforce compliance. |

3⃣ Internal Control Procedures

An effective internal control system should have:

✔ Reliable & ethical personnel

✔ Clear responsibility assignments

✔ Proper authorization procedures

✔ Separation of duties (to prevent fraud)

Operations & accounting must be separate.

Custody of assets & accounting must be separate.

Authorization of transactions & custody of assets must be separate.

✔ Internal & external audits

✔ Use of documentation & electronic controls

✔ Physical security measures (fireproof vaults, burglar alarms)

4⃣ Internal Controls for E-Commerce (Ex 8-5 & 8-6)

🔴 Pitfalls/Risks:

Stolen credit card numbers

Computer viruses & Trojans

Identity theft

Phishing scams

Unauthorized access to confidential data

🛡 Security Measures:

Encryption → Protects data by scrambling it mathematically.

Firewalls → Limits access through PINs & secure passwords.

5⃣ Limitations of Internal Controls

⚠ Not Foolproof! Common weaknesses:

❌ Collusion – Multiple employees working together to bypass controls.

❌ Cost-Benefit – If controls are too expensive, they may not be worth implementing.

Detailed Breakdown of Key Concepts

🟡 PART 2: The Bank Reconciliation

💰 What is Bank Reconciliation?

Bank reconciliation is the process of comparing two sets of cash records:

1⃣ The Cash Account in the Company’s General Ledger (GL) → Internal record.

2⃣ The Bank Statement → External record showing actual bank balance.

🔎 Why is Bank Reconciliation Important?

✔ Ensures accuracy between company records and bank records.

✔ Identifies timing differences (e.g., deposits in transit, outstanding checks).

✔ Detects errors made by either the company or the bank.

✔ Helps prevent fraud by spotting unauthorized withdrawals or deposits.

🔄 Common Reasons for Differences in Cash Balances

Type | Definition | Effect on Reconciliation |

|---|---|---|

Outstanding Checks | Checks issued by the company but not yet cleared by the bank. | Subtract from bank balance. |

Deposits in Transit | Deposits recorded by the company but not yet processed by the bank. | Add to bank balance. |

Bank Fees | Charges deducted by the bank (e.g., service fees, overdraft fees). | Subtract from company records. |

Interest Earned | Interest credited by the bank to the company’s account. | Add to company records. |

NSF (Non-Sufficient Funds) Checks | Customer checks that bounced due to insufficient funds. | Subtract from company records. |

📌 Steps to Perform a Bank Reconciliation:

Compare the bank statement and company’s cash account.

Adjust the bank statement balance (add deposits in transit, subtract outstanding checks).

Adjust the company’s cash account (add bank interest, subtract bank fees and NSF checks).

Ensure adjusted balances match.

Make journal entries for any company-side adjustments.

📌 Exercises: Starter 8-9 & 8-10, Exercises 8-10 to 8-12

🟢 PART 3: Internal Controls Over Cash Receipts

🔒 Why Are Internal Controls Over Cash Receipts Important?

✔ Prevents theft & fraud – Cash is easily stolen if controls are weak.

✔ Ensures proper record-keeping – Avoids discrepancies in financial reports.

✔ Reduces errors – Ensures that cash received matches recorded transactions.

1⃣ Over-the-Counter Cash Receipts (e.g., Retail, Restaurants, Small Businesses)

✅ Best Practices for Handling Cash Transactions:

✔ Cash Register Placement – Customers should see the amount entered.

✔ Receipts Issued – Ensures every transaction is documented.

✔ Controlled Access to Cash Drawer – Should only open for transactions.

✔ Daily Deposits & Reconciliation – All cash must be deposited daily, and sales records compared to machine tapes.

2⃣ Electronic Cash Receipts (e.g., PayPal, Credit/Debit Cards, Interac, Online Payments)

✅ Best Practices for Digital Transactions:

✔ Monitor for fraud – Credit card fraud & chargebacks are common.

✔ Encryption – Secure transactions with encryption protocols.

✔ Firewalls & Anti-Fraud Systems – Limit unauthorized access.

✔ Two-Factor Authentication (2FA) – Extra layer of security for payments.

3⃣ Cash Receipts by Mail (For Companies Receiving Payments via Checks, Invoices, etc.)

✅ Best Practices for Mailed Payments:

✔ Mailroom Employees Open Mail – Ensures separation of duties.

✔ Payments Sent to Treasurer for Deposit – Reduces risk of funds being misused.

✔ Accounting Department Records Transactions – Keeps records accurate.

✔ Reconciliation Process – Compare deposits with remittance slips.

✔ Lockbox System – Payments go directly to the bank, bypassing company employees.

📌 Exercises: Starter 8-11 & 8-12

🟠 Cash Short and Over

📊 Definition:

An account that tracks cash discrepancies (when actual cash received does not match recorded cash sales).

If there is a net debit balance, it's recorded as Cash Short and Over (Expense Account).

If there is a net credit balance, it's recorded as Cash Over (Revenue).

A large balance signals weak internal controls.

📌 Example Journal Entry:

👉 If sales revenue is $15,000, but cash received is only $14,980 (short by $20):

Journal Entry:

DR Cash 14,980

DR Cash Short and Over 20

CR Sales Revenue 15,000

(To record daily cash sales)

📌 Exercise: 8-20 (Solution says 8-19)

🔵 Internal Controls and Cash Payments

📑 1⃣ Payment by Cheque (Why It’s Important?)

✔ Provides proof of payment.

✔ Requires authorized signatures (preferably two).

✔ Signing official reviews supporting documents before signing.

📦 2⃣ Controls Over Purchases & Payments

✅ Typical Steps in a Purchase-to-Payment Process:

✔ Purchase Order Sent → Company sends order to supplier.

✔ Supplier Ships Goods & Sends Invoice.

✔ Receiving Department Checks Goods → Verifies with a receiving report.

✔ Accounting Reviews Everything → Ensures all documents match.

✔ Cheque Issued to Supplier.

⚡ Technology’s Impact on Payment Processing

Automation reduces human involvement, making payments faster.

Security & fraud controls must evolve with online transactions.

📌 Starter 8-13

🛑 Limitations of Internal Controls

⚠ Even with strong internal controls, there are still risks!

Limitation | Why It’s a Problem? |

|---|---|

Collusion | Employees can work together to bypass controls. |

Cost-Benefit Issue | Some controls are expensive to implement and may not be worth the cost. |

📌 Summary in One Sentence:

Bank reconciliation ensures cash records match the bank, internal controls protect cash transactions, and fraud risks must be managed with strong security, especially in e-commerce and digital payments.

Would you like me to create a visual diagram summarizing these sections? 😊

Breakdown of PART 4: Internal Controls Over Petty Cash & Payments

🔹 What is Petty Cash?

Petty cash is a small amount of cash that companies keep on hand for minor expenses that are too small to justify writing a check or using electronic payments.

📌 Examples of Expenses Paid with Petty Cash:

Office supplies (pens, paper, stamps)

Employee reimbursements for small purchases

Delivery or courier fees

Minor repairs and maintenance

🔹 Internal Controls Over Petty Cash

Because petty cash is physical money, strong controls are needed to prevent theft and misuse.

✅ Best Practices for Managing Petty Cash:

✔ Designate a Custodian – One responsible person should manage the petty cash fund.

✔ Secure Location – Petty cash should be locked in a safe place.

✔ Use Petty Cash Tickets/Vouchers – Every petty cash transaction should be recorded with a receipt.

✔ Track Payments – Each payment must be supported by a petty cash ticket or voucher.

✔ Replenishment Process – No journal entries are made for petty cash transactions until the fund is replenished.

🔹 How to Record Petty Cash Transactions?

💰 1⃣ Creating the Petty Cash Fund

When a company establishes a petty cash fund, they record it as follows:

📌 Example: Assume on February 28, the company sets up a $400 petty cash fund.

Journal Entry:

DR Petty Cash 400

CR Cash 400

(To establish the petty cash fund)

This means $400 is moved from the regular cash account into the petty cash fund.

💳 2⃣ Replenishing the Petty Cash Fund

At the end of each month, the custodian reviews all vouchers and the remaining cash. If the balance is less than expected, the difference is recorded under Cash Short and Over (for errors or missing cash).

📌 Example: On March 31, petty cash has:

$230 in cash left

$164 in vouchers for expenses

$6 missing

📌 Journal Entry to Replenish the Petty Cash Fund:

DR Office Supplies 46

DR Delivery Expense 34

DR Selling Expense 84

DR Cash Short and Over 6

CR Cash 170

(To replenish the petty cash fund)

💡 Explanation:

The company records expenses separately (office supplies, delivery, and selling expenses).

The missing $6 is recorded as Cash Short and Over (to track discrepancies).

The total amount withdrawn from the bank to replenish petty cash is $170.

🔼 3⃣ Increasing the Petty Cash Fund

If the company decides to increase the petty cash fund by $100, they make this journal entry:

DR Petty Cash 100

CR Cash 100

(To increase the petty cash fund)

🔽 If the petty cash fund is reduced, the reverse entry is made.

🔹 Summary of Petty Cash Accounting Process

Step | Action | Journal Entry? |

|---|---|---|

1⃣ Creating Petty Cash Fund | Set aside a fixed amount of cash for small expenses | ✅ Yes |

2⃣ Making Payments | Use vouchers to track expenses | ❌ No |

3⃣ Replenishing the Fund | Record expenses & cash short/over when adding cash | ✅ Yes |

4⃣ Adjusting the Fund | Increase or decrease the total petty cash amount | ✅ Yes |

📌 Exercises: 8-19, E8-20, E8-21 (Solutions provided on Brightspace for Problem 8-7B).

📌 Key Takeaways:

✔ Petty cash is used for small, everyday expenses.

✔ A custodian manages the fund and ensures all payments have receipts.

✔ No journal entries are made for payments until the fund is replenished.

✔ If cash is missing, it is recorded under "Cash Short and Over."

Would you like a visual diagram explaining the petty cash process? 😊

Knowt

Knowt