UNIT 4- Money and Monetary Policy

Definition of Money

Money = anything that society accepts as payment for goods and services

Functions of Money

Medium of Exchange

used by people when they buy and sell goods and services

Unit of Measurement (Account)

money specifies the value of something

Store of Value

money is a way to store value from the time people receive it to the time people spend it

putting money away for future use

Characteristics of Money

Money should be portable, divisible, durable, familiar, acceptable, not easily reproduced, stable in value (limited supply)

Types of Money

Commodity

money that has value apart from its use as money

gold, silver, etc.

Representative

money that can be exchanged for something else of value

Fiat

money that has no value except as its use as money

dollar bills

Demand Deposits/Debit Cards

checking account money

Money Supply Measurements

M1

narrowest definition of money supply

consists of currency in circulation (largest part), demand deposits, and travelers checks

M2

everything in M1 plus near money

near money = savings accounts, small time deposits (deposits less than $100,000), money market mutual funds held by individuals

M3

everything in M2 plus large time deposits (deposits over $100,000), money market mutual funds held by institutions

most broad definition of money supply

Liquidity = the ease with which assets can be turned into money

M1 is most liquid because your cash, checking account, and travelers checks are all liquid cash

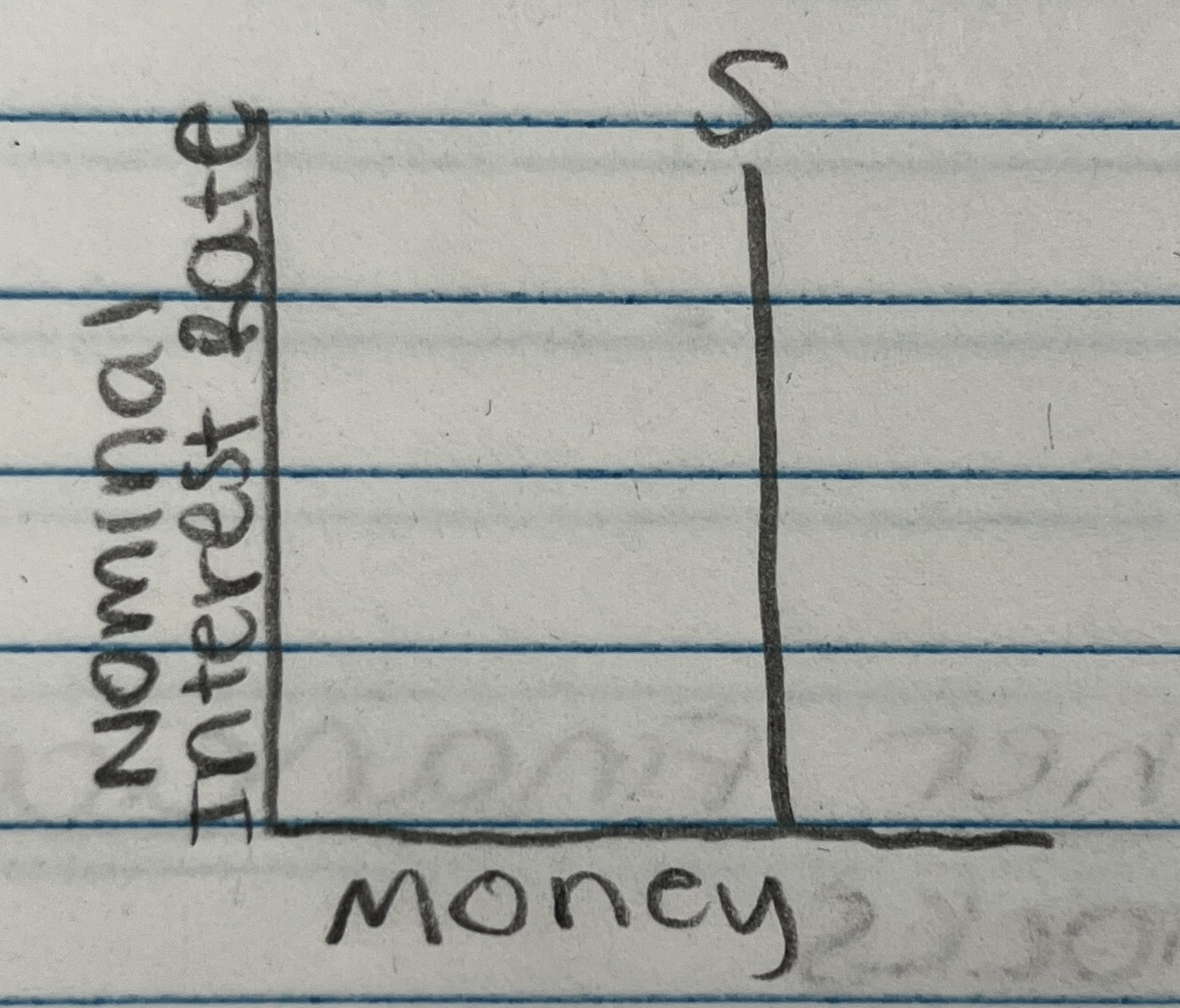

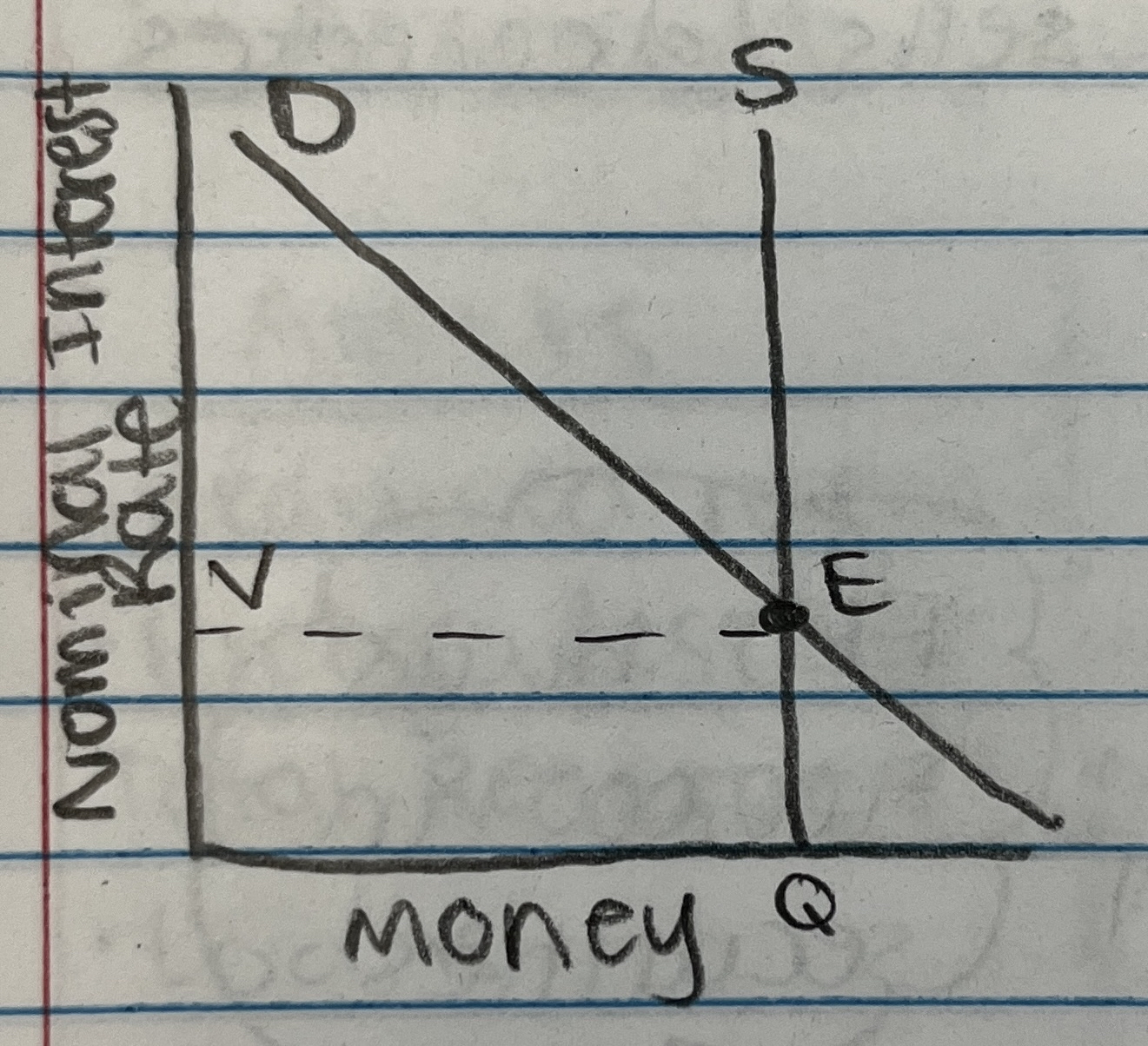

Money Supply Curve

vertical because interest rate is controlled by Federal Reserve System

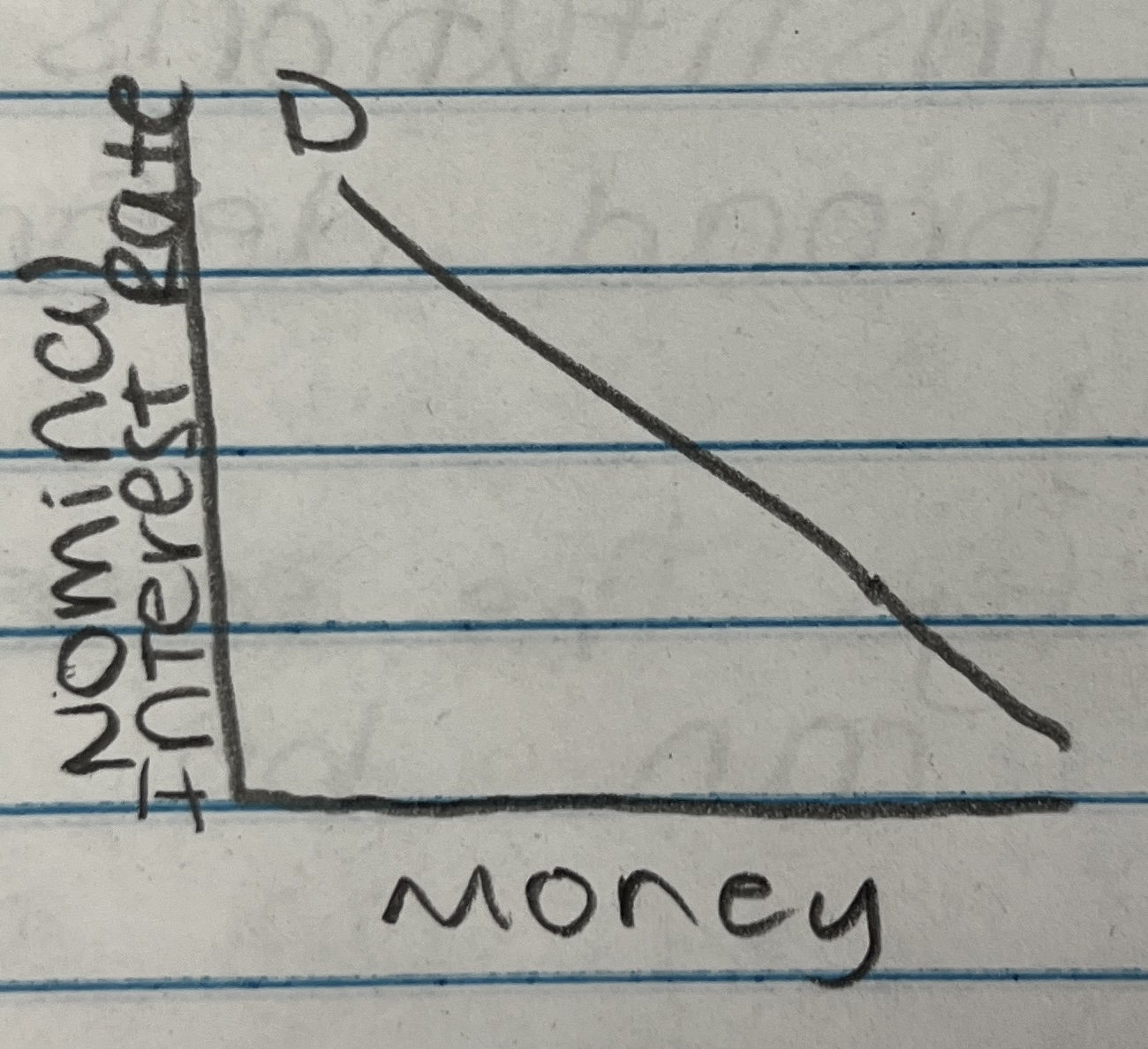

Money Demand

Determinants of Money Demand

Aggregate price level → as price level increases, demand for money increases

Changes in Real GDP → real GDP increases, demand for money increases

Changes in technology → Venmo… less money is needed

Changes in regulations → interest rates on checking accounts… people put more money into checking accounts

Money Demand Curve

Time Value of Money

the earlier you start saving, the more you’ll have in the future

Other Financial Instruments

Stocks

own part of a company through owning shares

Bonds

loans to the government or corporations

Equation of Exchange

MV = PQ

M = money supply

V = velocity

number of times money is spent

P = price level

Q = quantity real (output)

P x Q = nominal GDP

MV = nominal GDP

How is Money Created?

Loans

when money is loaned, the money supply increases

when loans are paid off, the money supply goes down

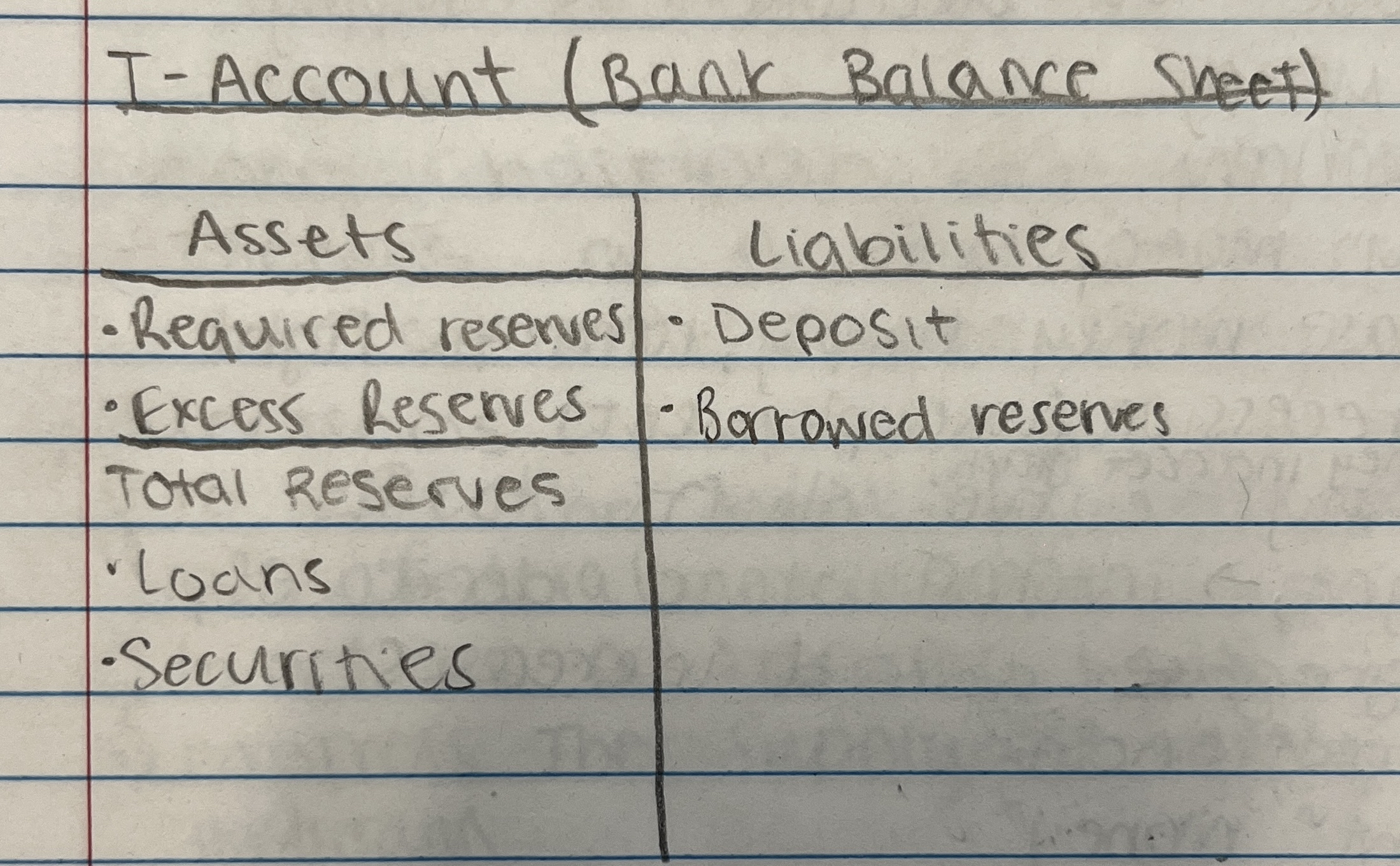

Reserves

Required Reserves → quantity of reserves (or money) banks are required to hold

Excess Reserves → quantity of reserves (or money) banks hold in excess of required reserves

“fully loaned” or “loaned up” → zero excess reserves

banks get ability to lend money by excess reserves

Total Reserves → required reserves + excess reserves

Federal Reserve System

Organization

12 regional banks - each one has a President

Washington D.C. - 7 Member Board of Governors (serve 14 year terms)

every 2 years, someone’s term expires

President of U.S. nominates someone for the seat when a spot is open

one chairman of the seven → serves a 4 year term

current: Jerome Powell

Functions

to serve the banking needs of the federal government

to act as a bankers bank

controls the supply of money (most important)

looks at unemployment rate, inflation rate, economic growth, etc… uses that to control supply

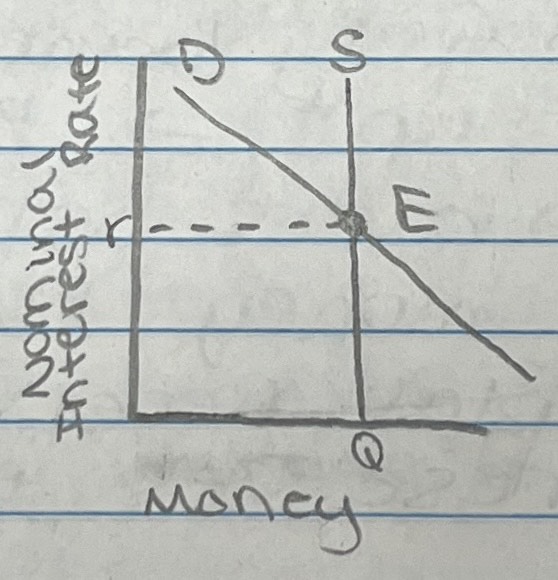

Money Market Equilibrium

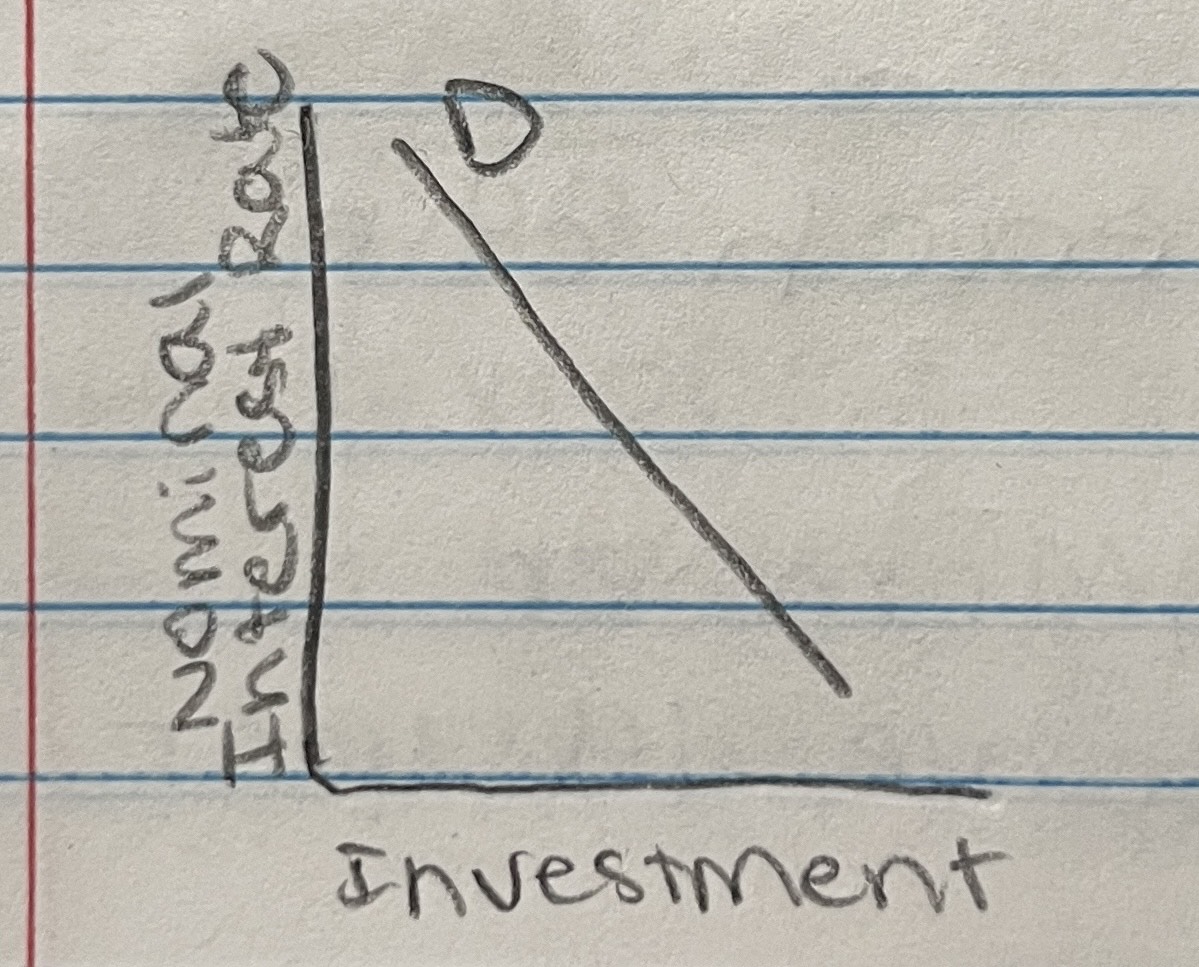

Investment Demand Curve

gross private domestic investment

low interest rate, increase investment

high interest rate, less investment

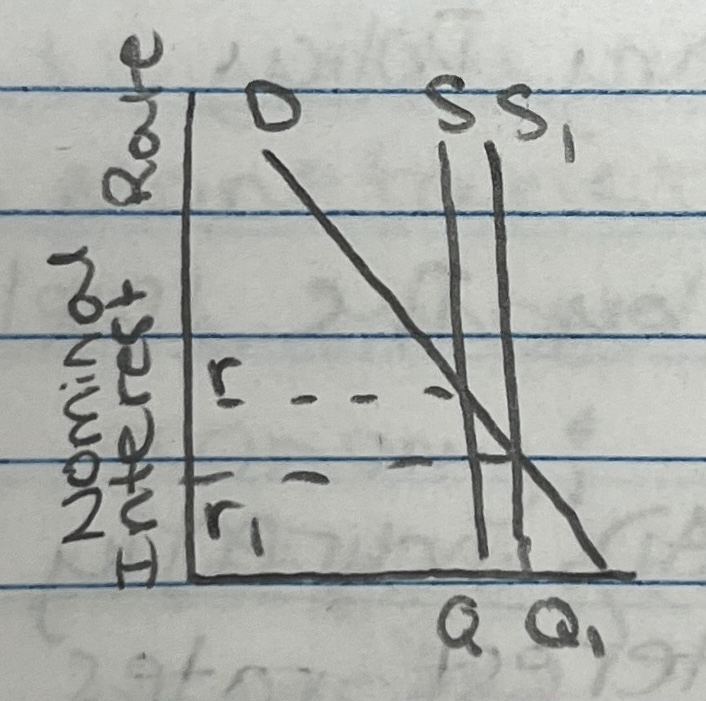

Monetary Policy

the deliberate actions on the part of the Federal Reserve to either increase or decrease the supply of money

Expansionary:

“easy” money

increase money supply, used to fight a recession (unemployment)

money market graph, supply curve shifts to the right → interest rate decreases, aggregate demand increases

Contractionary:

“tight” money

decrease money supply, used to fight inflation

money market graph, supply curve shifts to the left → interest rate increases, aggregate demand decreases

Tools of the Federal Reserve System

Reserve Requirements

most powerful tool of the FED

least often adjusted

defined as a specific percentage of bank deposit liabilities

a deposit to the bank is a liability to them

someone deposits $1,000 and RR is 10%, bank is required to hold $100, $900 goes into excess reserves can be loaned out

expansionary policy: decrease RR

contractionary policy: increase RR

money multiplier = 1 / required reserves

multiple expansion of money supply = money multiplier x initial excess reserves

T-Account (Bank Balance Sheet)

Discount Rate

rate the FED charges banks to borrow money from the Federal Reserve

expansionary: decrease discount rate

contractionary: increase discount rate

Open Market Operations

FOMC (Federal Open Market Committee)

7 member board of governors

New York Federal Reserve Bank President

4 Federal Reserve Bank Presidents that serve on a rational basis

most common tool of the FED

FED purchase or sale of government securities (bonds/T-bills)

expansionary: FED purchases (increase bank reserves)

contractionary: FED sells (decreases bank reserves)

Federal Funds Rate: the rate of interest one bank charges another for loans

Open Market Operations influences the Federal Funds Rate

buying securities → lower federal funds rate

selling securities → raise federal funds rate

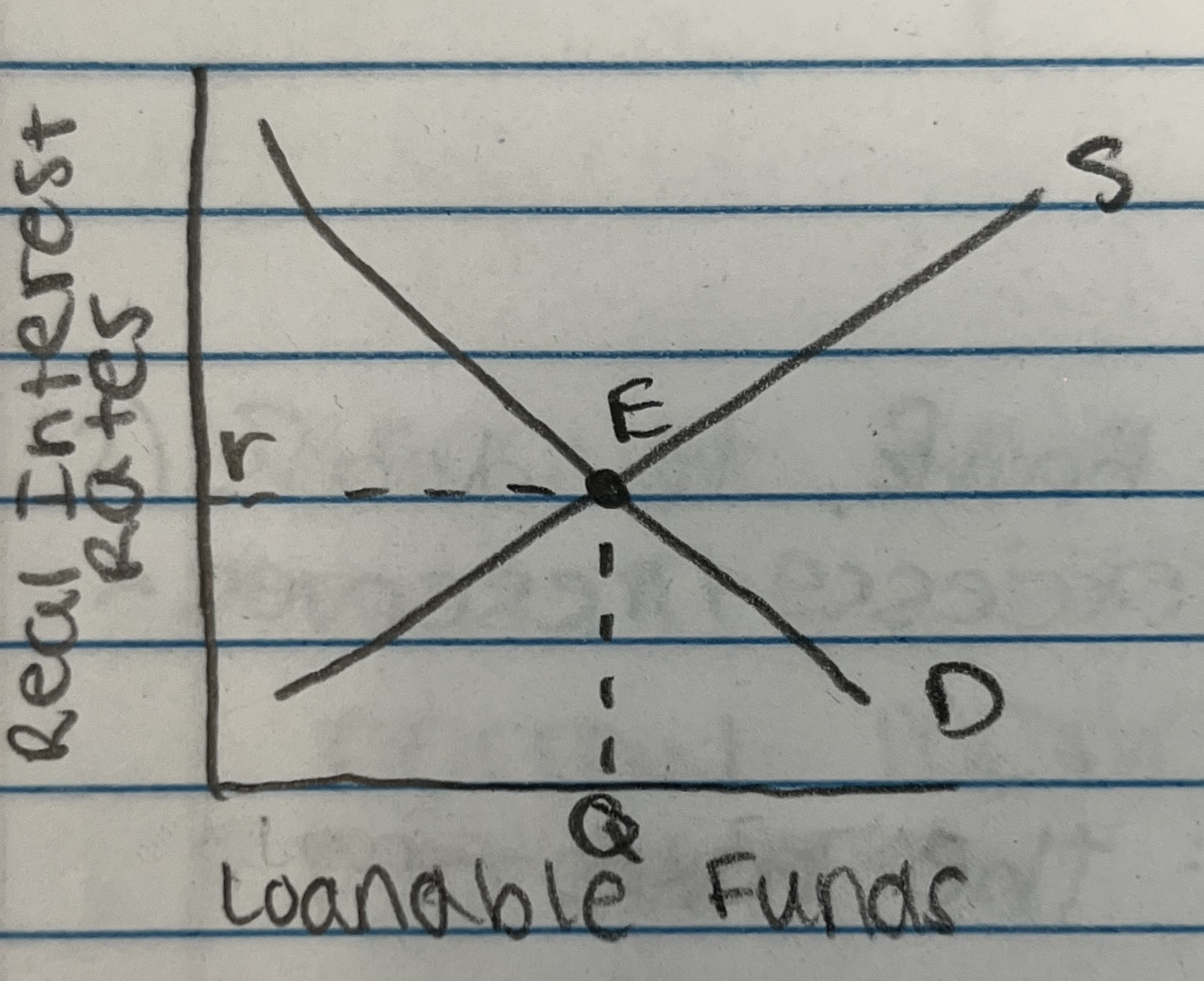

Money Market Graph v. Loanable Funds Graph

Money Market Graph

deals with short term loans

Loanable Funds Graph

deals with real rate of interest

primary source of loanable funds is savings

deals with long term loans

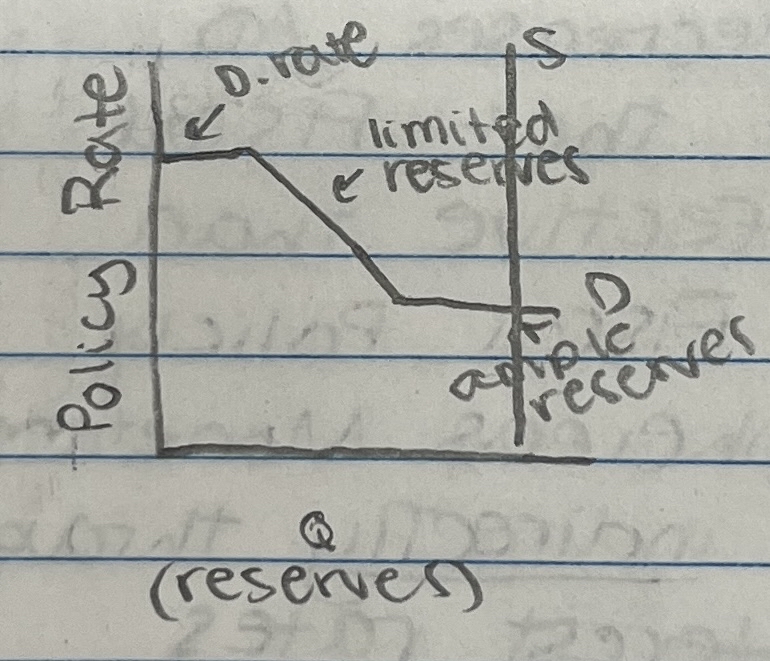

Limited vs. Ample Reserves

Limited Reserves

reserves are scarce

a small change in supply of reserves shifts the money supply and will change the interest rates

Ample Reserves

banks hold high levels of excess reserves, so changes in supply of reserves won’t change the interest rate

Interest on Reserved Balances (IORB) — the interest paid by the Fed on balances held on reserve

increasing the IORB will lead to banks holding more reserves and lending less

lowering the IORB will lead to banks holding less reserves and lending more

changing the IORB will change the policy rate

Differing Views of Monetary Policy

Keynes

output is determined by the level of AD

Monetary Policy affects AD indirectly through its effect on interest rates

Expansionary Monetary Policy decreases interest rates, which increases investment, which increases AD

Contractionary Monetary Policy increases interest rates, which decreases investment, which decreases AD

Keynesians believe that Fiscal Policy is more effective than Monetary Policy - Fiscal Policy works directly whereas Monetary Policy affects AD indirectly through its effect on interest rates

Monetarist Theory

Milton Friedman

Importance of the Equation of Exchange: MV = PQ

increase M by 3%-5%, real GDP will increase by 3%-5%

velocity must be constant

increase M by <3%, real GDP will fall and may cause a recession

increase M by >5%, leads to inflation

upward sloping AS curve

Monetarists believe money has the most direct effect on the economy; Fed should target money growth rates and not interest rates