Module Overview and Assessment

Course title: Corporate Finance & Financial Strategies

Week 1 focus: Coursework & Corporate Governance

Course Leader/University: Dr Sanjukta Brahma, Glasgow Caledonian University (GCU)

Contact details are provided for module leader and team members (email and room numbers on the Britannia Building)

Semester context: University for the Common Good

Module overview and readings

Topics/Reading list:

Introduction: Coursework & Corporate Governance – Ch. 1

Measuring Corporate Performance – Ch. 4

Time Value of Money – Ch. 5

Equity Markets and Stock Valuation – Ch. 7

Risk, Return and the Opportunity Cost of Capital – Ch. 11

Investment Appraisal Criteria – Ch. 8

International Financial Management – Ch. 22

Bond Markets and Bonds Valuation – Ch. 6

WACC and Company Valuation – Ch. 13

Capital Budgeting – Ch. 9 & 10

Options – Ch. 23

Exam Revision – (no chapter specified)

These chapters provide the theoretical and practical foundations for coursework and exams.

Lecture 1: Goals and Governance of the Corporation

Topic Covered:

What is a Corporation?

Goals of the Corporation

Investment and Financing Decisions

Agency Problems, Executive Compensation, and Corporate Governance

The Ethics of Maximizing Value

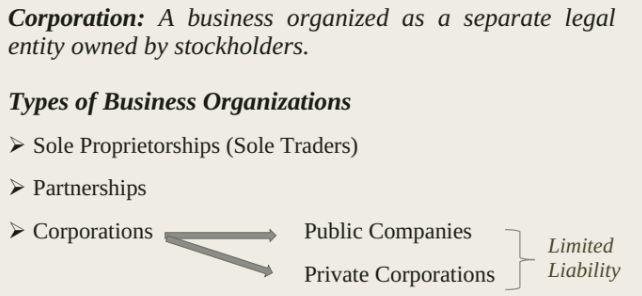

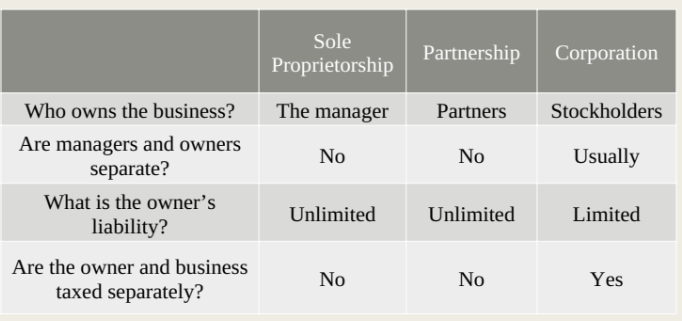

What is a Corporation?

Types of Business Organizations (Detailed comparison)

Sole Proprietorship: Simplest form, owned by one individual, fully responsible for debts.

Partnership: Owned by two or more individuals, sharing profits and liabilities according to partnership agreement.

Corporation: Separate legal entity, offering limited liability to owners (shareholders), easier access to capital.

Limited Liability Company (LLC): Combines the benefits of a corporation's limited liability with the flexibility of a partnership.

Forms of Business Organizations (McGraw Hill concepts)

Sole Proprietorship

Owned and managed by one person

Very easy to form

Profits taxed as personal income

Unlimited liability

Life of company linked to life of owner

Funding limited by owner's wealth

Partnership

Easy to form; requires a partnership agreement

Can have limited and unlimited partners

Partnership terminated when a partner dies or leaves

Difficult to raise cash

Profits taxed as personal income

Generally controlled by general partners; major decisions may require votes

Limited Corporation (Limited Liability Company common framing)

Articles and Memorandum of Incorporation required

Limited liability

Profits taxed at corporate rate

Board of directors

Life of company hypothetically unlimited

Articles of Incorporation vs Memorandum of Association

Articles of Incorporation: Name, intended life, business purpose, number of authorized shares, rights of different share classes, nature of shareholder rights, initial board size

Memorandum of Association: The rules by which the corporation is organized

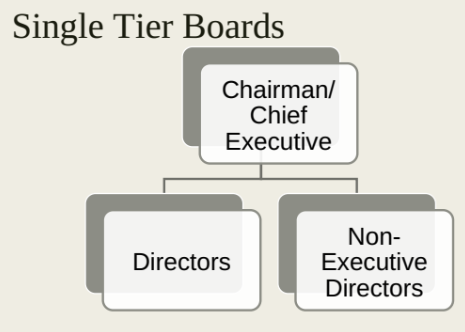

Board Structures: Single-Tier vs Two-Tier

Single-Tier Boards (Unitary):

Chairman/CEO; Directors; Non-Executive Directors

Board reports to shareholders; shareholders elect directors at AGM

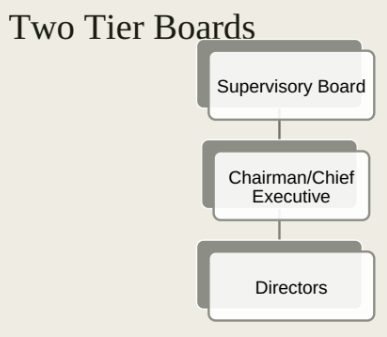

Two-Tier Boards (Supervisory):

Supervisory Board; Chairman/CEO; Directors

Board reports to supervisory board; supervisory board elects directors

Supervisory board includes representation from banks, government, trade unions, and other stakeholders

Global Context: Unitary vs Two-Tier across jurisdictions

Unitary board structure emphasized in many markets; two-tier structures found in some European contexts

British and German board structures summarized (Hillier reference)

Unitary: Board reports to shareholders; shareholders elect directors at AGM

Two-Tier: Board reports to supervisory board; supervisory board includes stakeholder representation

Goals of the Corporation

Shareholders desire wealth maximization

Profit maximization: Which profits? – Year-specific profits vs. market value vs. market share

Opportunity cost of capital: Minimum acceptable rate of return set by investment opportunities in financial markets

The Investment Trade-Off

Tangible vs Intangible Assets

Tangible assets: e.g., aircraft, machinery, physical capital

Intangible assets: e.g., R&D, software, brand value

Examples:

Delta Air Lines: Purchase new planes (tangible)

GlaxoSmithKline: R&D expenditures (intangible)

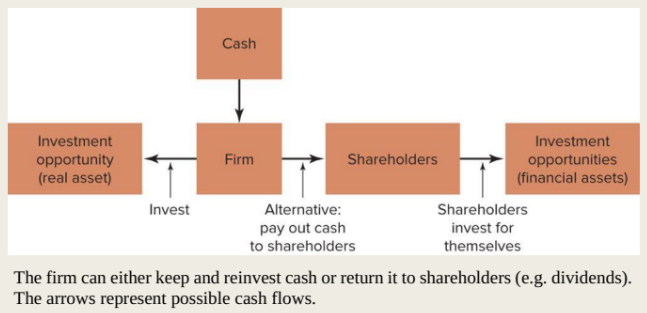

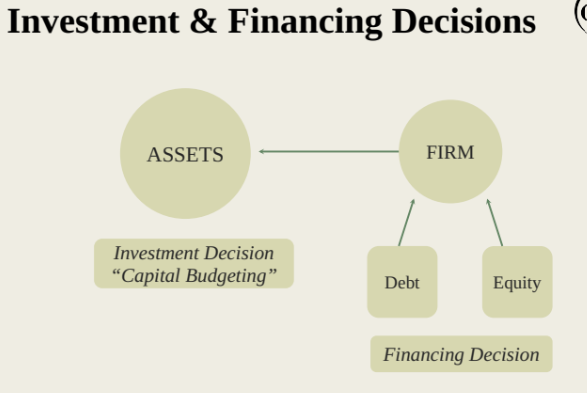

Investment Decisions

Capital Budgeting Decision: Decision to invest in tangible or intangible assets

Capital budgeting is the planning process used by companies to evaluate potential major investments or expenditures, such as purchasing new equipment, building a new plant, or launching a new product. It involves analyzing a project's expected cash flows and comparing them to the cost of the investment to determine whether it will generate a satisfactory return.

Also called: Investment decision or Capital Expenditure (CAPEX) decision

Recent Investment Decisions (Illustrative Examples)

Delta Air Lines (U.S.): Ordered 100 Airbus A321 airliners

ExxonMobil (U.S.): Offshore oil discovery development in Guyana

Facebook (U.S.): Acquires Two Big Ears (British VR audio company)

Fiat Chrysler (Italy): Spins off its Ferrari luxury car unit

GlaxoSmithKline (U.K.): Spends 3.6\text{ billion} on R&D for new drugs

Lenovo (China): Plans to build a new manufacturing facility in India to produce PCs and smartphones

LVMH (France): Acquires high-end perfumery Maison Francis Kurkdjian

Procter & Gamble (U.S.): Spends over 7\text{ billion} on advertising

Financing Decisions

Financing Decision: Choice of sources and amounts of financing

A financing decision is a decision made by a company about how to raise funds to finance its operations, investments, or growth — primarily through debt, equity, or a mix of both.These decisions are influenced by factors such as cost of capital, market conditions, and the company's financial strategy. Additionally, companies must weigh the risks and benefits associated with each financing source to determine the most suitable approach for their objectives. The right financing decision can significantly impact a company's overall financial health and its ability to compete effectively in the market.

Capital Structure: The mix of long-term debt and equity financing

(Capital structure refers to the way a company finances its overall operations and growth by using different sources of funds, primarily debt and equity.)

Financing Decisions (Examples of recent actions)

Delta Air Lines: Issues 1\,\text{billion}, 5-year bond; Reinvests cash generated from operations; Leases large new office building in San Francisco

ExxonMobil: (unspecified) debt actions

Facebook: Leases large new office building (financing of real estate)

Fiat Chrysler: Repays 1.8\text{ billion} of bank debt

GlaxoSmithKline: Issues additional short-term euro debt

Lenovo: Issues 500\text{ million} of dollar bonds and 850\text{ million} of preferred shares

LVMH: Partly finances acquisitions by issuing debt

Procter & Gamble: Buys back 4.6\text{ billion} of stock and pays a 7.2\text{ billion} dividend

Capital Budgeting or Financing Decisions?

Determine whether the following are capital budgeting or financing decisions:

Intel spends 7\,\text{billion} to develop a new microprocessor (capital budgeting)

BMW borrows 350\,\text{million} euros (financing)

Royal Dutch Shell builds a pipeline to bring natural gas onshore from an offshore platform (capital budgeting)

Avon spends €200\,\text{million} to launch a new cosmetics range (capital budgeting)

Pfizer issues new shares to buy a small biotech company (financing)

Real vs Financial Assets

Real assets: Acquired to produce goods and services; used in production (e.g., factories, machinery, IT systems)

Financial assets: Claims to income generated by real assets (e.g., shares, bank loans, bonds)

Real assets are physical and tangible resources that are used in the production of goods and services. These include assets like land, buildings, machinery, and equipment. They have intrinsic value and are essential for running the operational side of a business.

On the other hand, financial assets are intangible instruments that represent a claim to ownership or a right to future income. Examples include shares, bonds, and bank deposits. Unlike real assets, financial assets do not have physical form and their value depends on the performance or promise of an underlying entity or contract.

While real assets are used to create value, financial assets are used to store or transfer value in the financial system.

Real vs Financial Assets – Quick Checks

Examples and classification:

A patent: Real asset

A share of stock issued by Wells Fargo: Financial asset

A blast furnace in a steelmaker factory: Real asset

A mortgage loan for a home: Financial asset

A successful advertising campaign by FedEx: Real asset (intangible asset, marketing asset)

An IOU from your brother-in-law: Financial asset

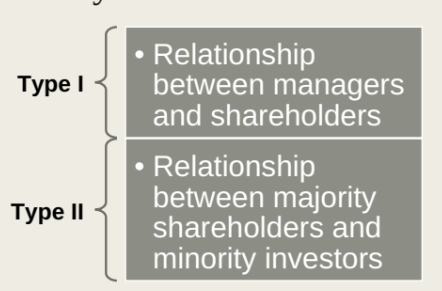

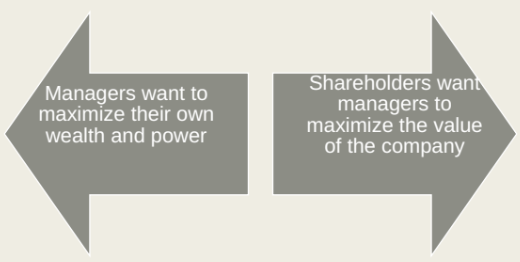

The Agency Problem

Agency problem arises from separation of ownership and control

Managers act as agents for stockholders but may pursue their own interests

Agency problems arise when stakeholders’ interests do not coincide

Agency cost: Value lost from agency problems or from mitigating such problems

Agency Theory: Types and Relationships

Management Goals

Agency Costs

Costs of resolving problematic agency relationships

Do Managers Act in Shareholders’ Interests?

Managerial compensation: Performance-based pay

Control of the firm: Are shareholders powerful?

Shareholder rights: Ability to call managers to account

Proxy voting: Shareholders grant authority to vote their shares

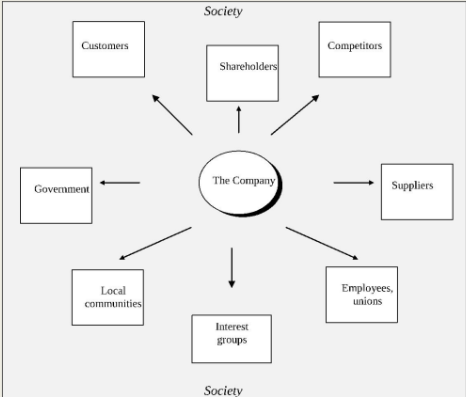

Stakeholders and Corporate Governance

Corporate Governance

Definition: The laws, regulations, institutions, and corporate practices that protect shareholders and other investors

Elements of good corporate governance:

Well-designed compensation packages

Legal requirements

Board of directors

Activist shareholders

Takeovers

Information for investors

Executive Compensation

Purpose: Mitigate agency costs by aligning executives’ incentives with firm performance

Structure: Fixed base salary + annual award tied to earnings or other performance measures (e.g., stock price)

At senior levels: Compensation often includes shares and stock options

Vesting: Managers may keep shares only if they stay with the firm or meet performance criteria

Executive Pay Across Countries (Cross-country patterns)

Across countries, pay structures show variations in: base salary, short-term incentives, long-term incentives, guaranteed pay

Data samples include: France, Switzerland, United Kingdom, Germany, Italy, United States, etc. (Long-term vs Short-term incentives and guarantees vary by country)

Ethics of Maximizing Value

Adam Smith quote (1776):

It is not from the benevolence of the butcher, the brewer, or the baker that we expect our dinner, but from their regard to their own interest.

We address ourselves to their self-love, not their humanity, when seeking value

Key points:

In most cases, maximizing value and doing good are not in conflict; successful firms tend to have satisfied customers and loyal employees

Unwritten rules of behavior: a firm’s reputation is among its most important assets

Ethical issues do arise in business as in other areas of life

Greenwashing

Definition: Promoting green initiatives or images while operating in damaging or contrary ways to the stated environmental goals

Motivation: Creating perceived benefits such as higher stock price, more customers, or favorable partnerships

Reality: Many large corporations devote real resources to sustainability programs and social welfare, though skepticism remains about greenwashing