Week 1 Introduction to Corporate Finance

Chapter 1: Introduction to Corporate Finance

What is Corporate Finance?

Understanding the purpose and nature of corporate finance is essential for forming companies.

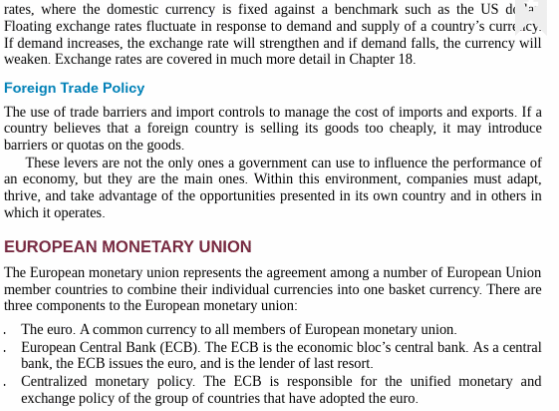

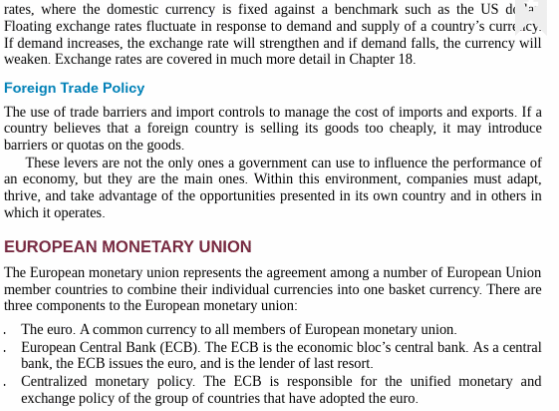

Corporate finance focuses on the financial activities related to running a corporation, primarily investment decisions, financing decisions, and working capital management.

Corporate finance is the area of finance dealing with the financial activities related to running a corporation. It primarily focuses on investment decisions, financing decisions, and working capital management. The goal of corporate finance is to maximize the value of the firm for its stakeholders through effective management of financial resources.

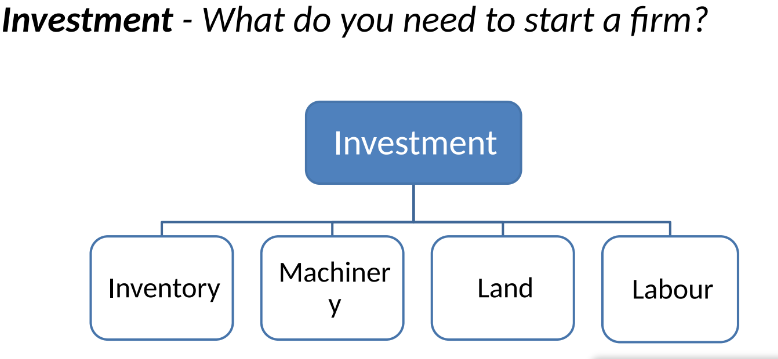

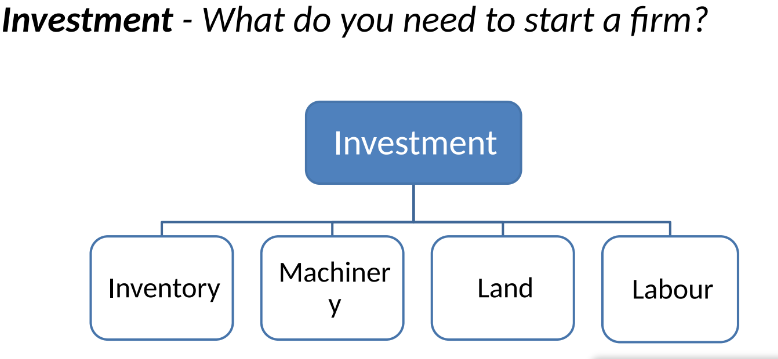

Key Concepts in Corporate Finance

Capital Budgeting:

The process of planning and managing a firm's long-term investments. This includes understanding which projects or assets will provide future cash flows.

Capital Structure:

Refers to how a firm raises and manages long-term financing. It involves the mix between debt (loans, bonds) and equity (stock sales).

Working Capital Management:

Deals with managing short-term assets and liabilities to ensure the firm remains liquid and operationally efficient.

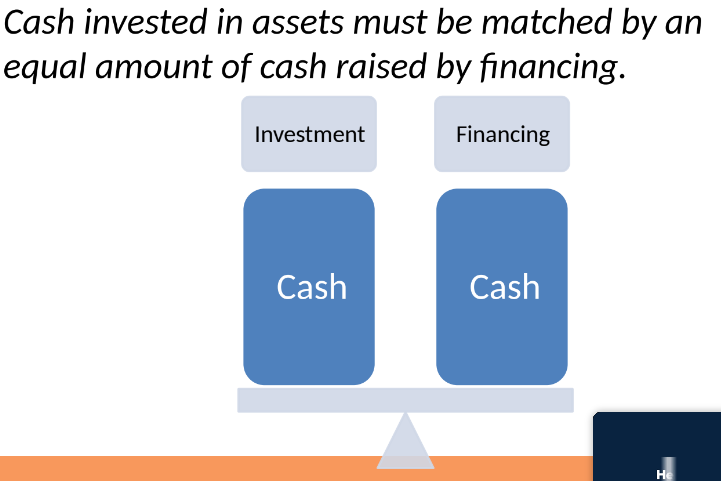

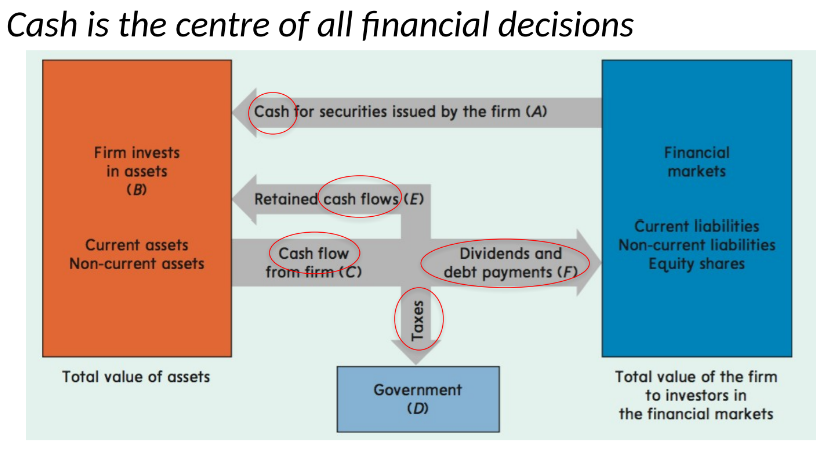

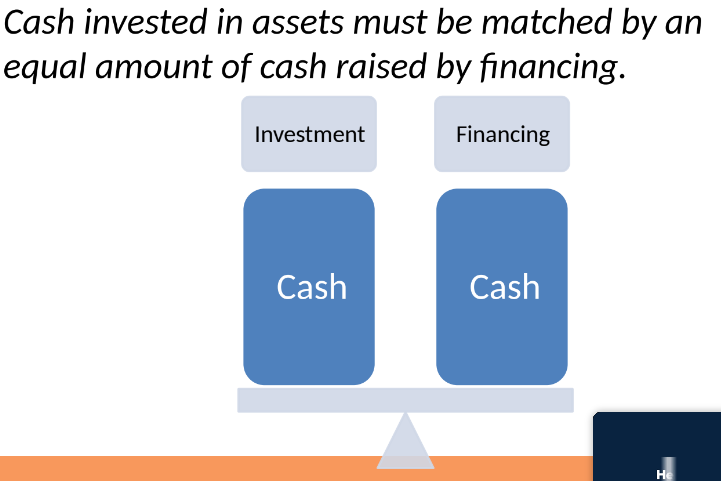

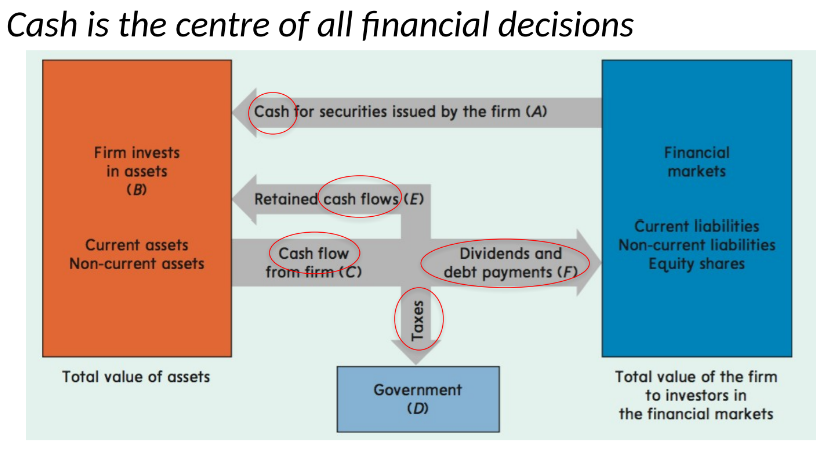

Importance of Proper Cash Management

Cash invested in assets must be matched by an equivalent amount raised through financing. Careful management is crucial to maintain liquidity.

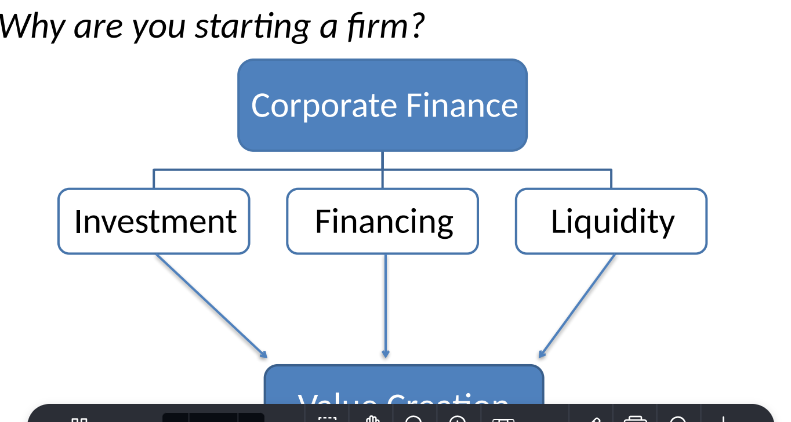

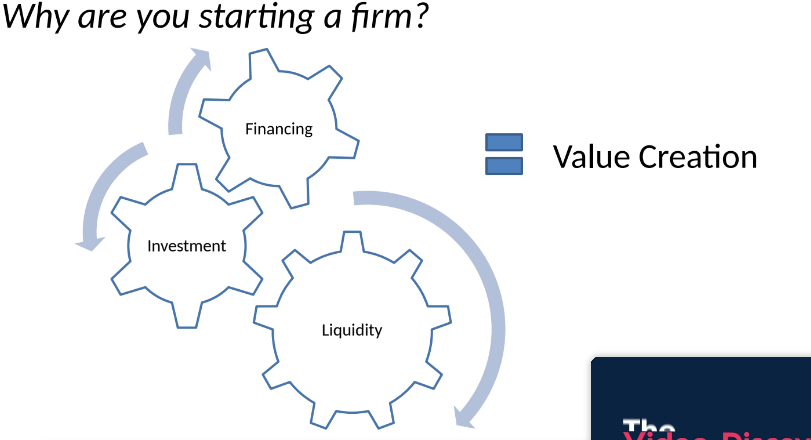

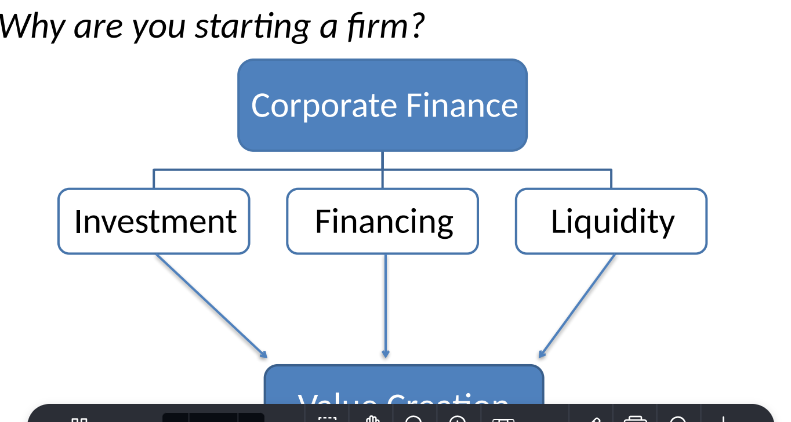

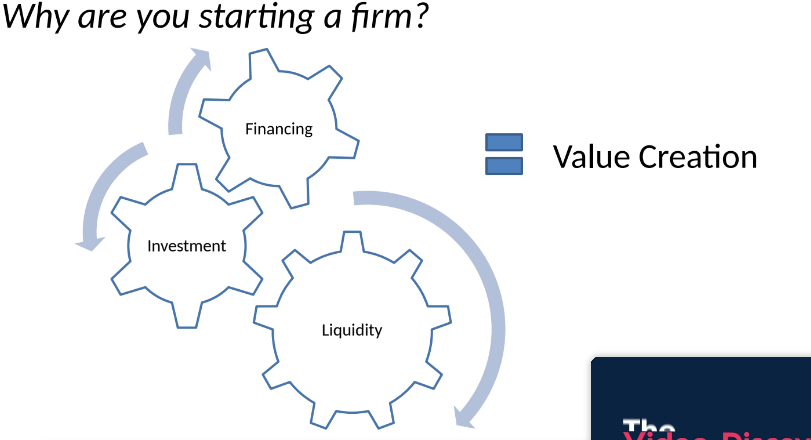

Value Creation in Corporate Finance

The fundamental purpose of starting a firm is often tied to creating value for stakeholders through effective investment, financing, and liquidity decisions.

The fundamental purpose of starting a firm is often tied to creating value for stakeholders through effective investment, financing, and liquidity decisions.

Financial Management Decisions

The financial manager must make decisions regarding:

Mixture of long-term debt and equity. Determining the optimal mix of funding sources to finance long-term investments.

Determining the appropriate level of borrowing. Evaluating how much debt is beneficial for the firm without jeopardizing its financial health.

Evaluating the least expensive sources of funds. Identifying and selecting funding sources that minimize cost and maximize value.

Managing cash and inventory levels efficiently. Ensuring that the firm maintains sufficient liquidity while optimizing operational efficiency.

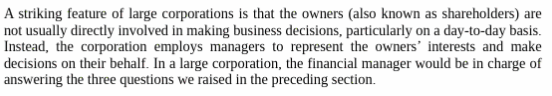

Responsibilities of a Financial Manager

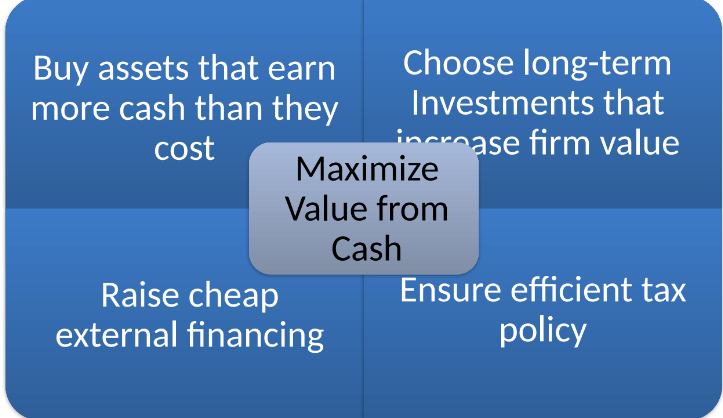

Buy assets that generate more cash than they consume.

Choose long-term investments that enhance firm value.

Raise capital efficiently while considering external financing.

Implement effective tax policies to maximize firm value.

Strive to maximize cash utilization.

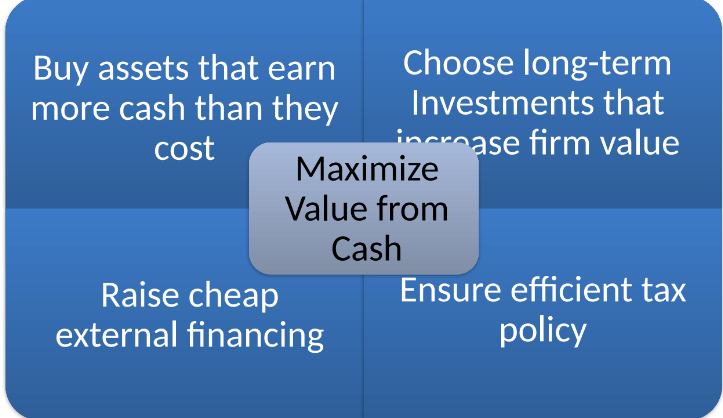

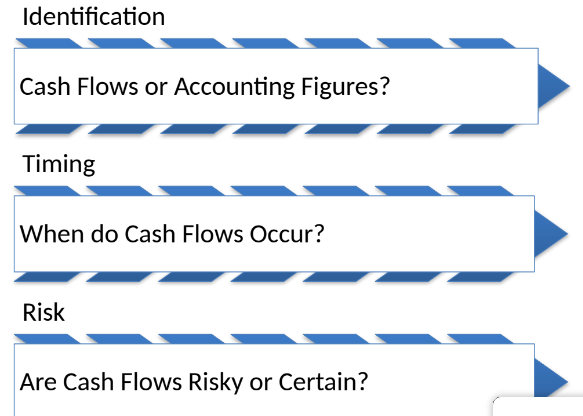

Cash Flow Considerations

Identification: Distinguishing between actual cash flows versus accounting profits. t's essential to distinguish between actual cash flows and accounting profits. This means recognizing that profits reported on financial statements might not translate directly into available cash.

Timing: Understanding when cash flows occur is critical for effective management. Understanding the timing of cash flows is critical for effective cash management. This involves knowing when cash is expected to be received and when it needs to be paid out, which helps avoid liquidity issues.

Risk: Assessing whether cash flows are stable or subject to uncertainty. Assessing the stability of cash flows is important. Financial managers must evaluate whether cash flows are consistent or subject to uncertainty, as this impacts planning and financial stability.

The Goal of Financial Management

The primary aim across all financial management practices: Maximize Firm Value.

Secondary considerations may include maximizing profits, survival, or growth.

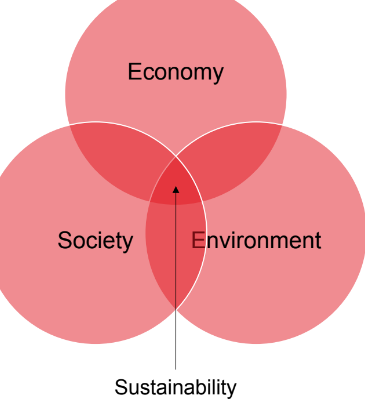

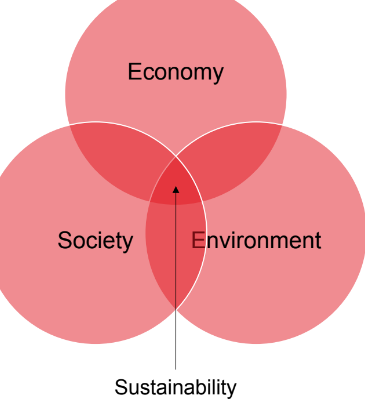

Sustainability and the Triple Bottom Line

People: Optimizing workforce contributions and improving human capital. How can you get the most out of your company’s workforce? What investments can you make to create value for shareholders through improving the human capital of your workers and operations that affect the welfare and productivity of your people? How do you measure success?

Planet: Engaging in environmentally sustainable practices. What activities does your firm engage in that maximizes its positive impact on the environment and sustainable operations? How do you measure success?

Profit: Focusing on maximizing financial profitability.

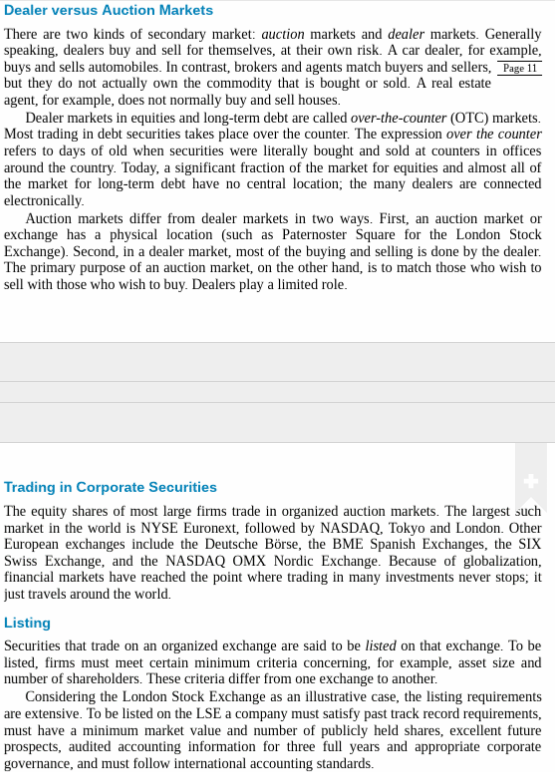

Financial Markets

Financing avenues available to firms include private investors, banks, equity markets, bonds, and short-term financing instruments.

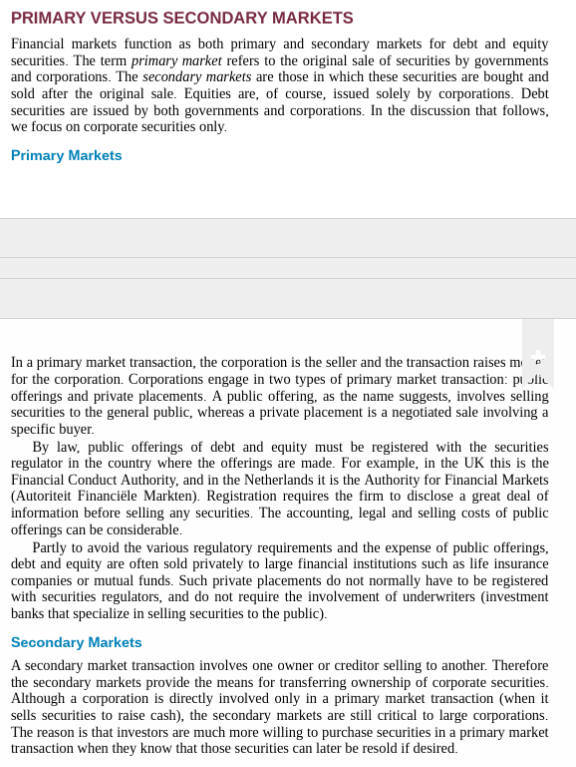

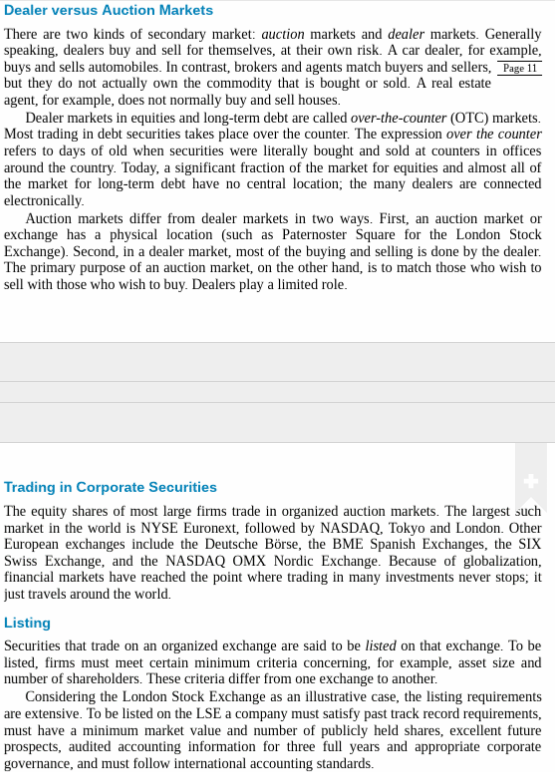

Primary Markets: Initial sale of securities.

Secondary Markets: Resale of securities after the original issuance.

The Economic Environment

Corporate finance operates within the broader economic context influenced by macroeconomic policy levers: monetary policy, fiscal policy, and exchange rate policy.

Week 1 Introduction to Corporate Finance

Chapter 1: Introduction to Corporate Finance

What is Corporate Finance?

Understanding the purpose and nature of corporate finance is essential for forming companies.

Corporate finance focuses on the financial activities related to running a corporation, primarily investment decisions, financing decisions, and working capital management.

Corporate finance is the area of finance dealing with the financial activities related to running a corporation. It primarily focuses on investment decisions, financing decisions, and working capital management. The goal of corporate finance is to maximize the value of the firm for its stakeholders through effective management of financial resources.

Key Concepts in Corporate Finance

Capital Budgeting:

The process of planning and managing a firm's long-term investments. This includes understanding which projects or assets will provide future cash flows.

Capital Structure:

Refers to how a firm raises and manages long-term financing. It involves the mix between debt (loans, bonds) and equity (stock sales).

Working Capital Management:

Deals with managing short-term assets and liabilities to ensure the firm remains liquid and operationally efficient.

Importance of Proper Cash Management

Cash invested in assets must be matched by an equivalent amount raised through financing. Careful management is crucial to maintain liquidity.

Value Creation in Corporate Finance

The fundamental purpose of starting a firm is often tied to creating value for stakeholders through effective investment, financing, and liquidity decisions.

The fundamental purpose of starting a firm is often tied to creating value for stakeholders through effective investment, financing, and liquidity decisions.

Financial Management Decisions

The financial manager must make decisions regarding:

Mixture of long-term debt and equity. Determining the optimal mix of funding sources to finance long-term investments.

Determining the appropriate level of borrowing. Evaluating how much debt is beneficial for the firm without jeopardizing its financial health.

Evaluating the least expensive sources of funds. Identifying and selecting funding sources that minimize cost and maximize value.

Managing cash and inventory levels efficiently. Ensuring that the firm maintains sufficient liquidity while optimizing operational efficiency.

Responsibilities of a Financial Manager

Buy assets that generate more cash than they consume.

Choose long-term investments that enhance firm value.

Raise capital efficiently while considering external financing.

Implement effective tax policies to maximize firm value.

Strive to maximize cash utilization.

Cash Flow Considerations

Identification: Distinguishing between actual cash flows versus accounting profits. t's essential to distinguish between actual cash flows and accounting profits. This means recognizing that profits reported on financial statements might not translate directly into available cash.

Timing: Understanding when cash flows occur is critical for effective management. Understanding the timing of cash flows is critical for effective cash management. This involves knowing when cash is expected to be received and when it needs to be paid out, which helps avoid liquidity issues.

Risk: Assessing whether cash flows are stable or subject to uncertainty. Assessing the stability of cash flows is important. Financial managers must evaluate whether cash flows are consistent or subject to uncertainty, as this impacts planning and financial stability.

The Goal of Financial Management

The primary aim across all financial management practices: Maximize Firm Value.

Secondary considerations may include maximizing profits, survival, or growth.

Sustainability and the Triple Bottom Line

People: Optimizing workforce contributions and improving human capital. How can you get the most out of your company’s workforce? What investments can you make to create value for shareholders through improving the human capital of your workers and operations that affect the welfare and productivity of your people? How do you measure success?

Planet: Engaging in environmentally sustainable practices. What activities does your firm engage in that maximizes its positive impact on the environment and sustainable operations? How do you measure success?

Profit: Focusing on maximizing financial profitability.

Financial Markets

Financing avenues available to firms include private investors, banks, equity markets, bonds, and short-term financing instruments.

Primary Markets: Initial sale of securities.

Secondary Markets: Resale of securities after the original issuance.

The Economic Environment

Corporate finance operates within the broader economic context influenced by macroeconomic policy levers: monetary policy, fiscal policy, and exchange rate policy.