MRU - Price ceilings and price floors

Price ceilings

- Price ceiling: maximum price allowed by law

- it has five effects

- shortages

- reductions in product quality

- wasteful lines and other search costs

- a loss in gains from trade

- a misallocation of resources

Introduction

- In 1971, President Nixon, in an effort to control inflation, declared price increases illegal. Because prices couldn’t increase, they began hitting a ceiling. With a price ceiling, buyers are unable to signal their increased demand by bidding prices up, and suppliers have no incentive to increase quantity supplied because they can’t raise the price.

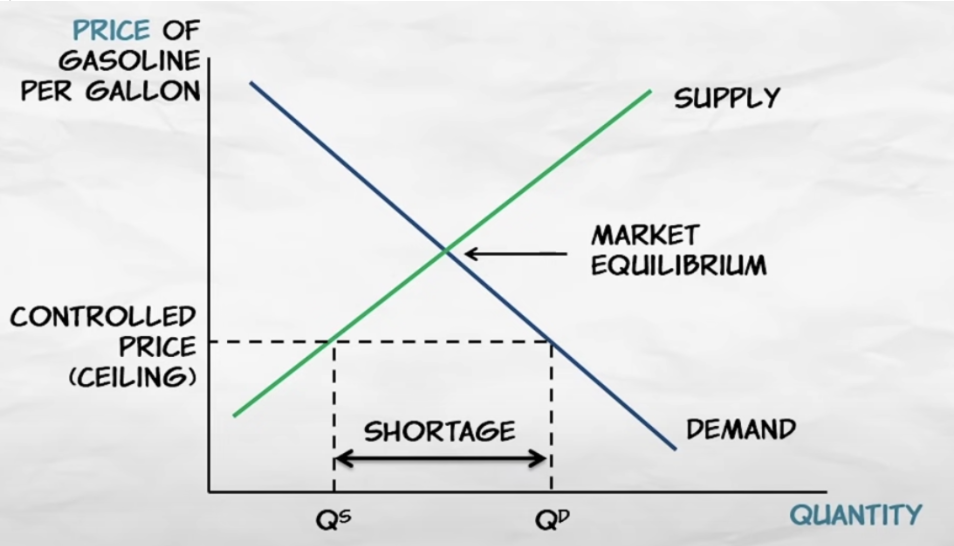

- What results when the quantity demanded exceeds the quantity supplied? A shortage! In the 1970s, for example, buyers began to signal their demand for gasoline by waiting in long lines, if they even had access to gasoline at all. As you’ll recall from the previous section on the price system, prices help coordinate global economic activity. And with price controls in place, the economy became far less coordinated.

Shortages and quality reduction

- When Qd > Qs, sellers have more customers than goods.

- They can cut quality and costs, and still sell everything they want to sell at the controlled price.

- With a surplus of buyers, sellers have less of an incentive to give good service.

Lines and search costs

- Price controls do not eliminate competition

- Competition for scarce goods is an ever present force under all forms of social organization.

- Price controls change the form that competition takes.

- there are other ways of competing

- some may try to bribe the owners

- use political connections

- be willing to wait in line, this costs money

- willingness to pay = time price + money price

- buyers bid up the price by arriving earlier

- this pushes up the time cost

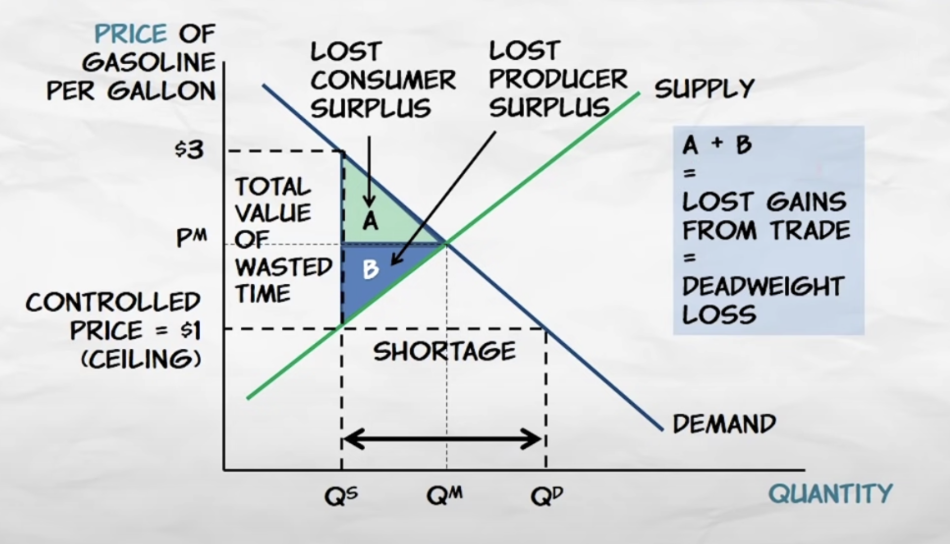

- paying in time is more wasteful

- money payments go to the seller

- time payment is lost, it benefits no one

Deadweight loss

when mutually profitable gains from trade are not fully exploited, we have lost a consumer and producer surplus, a deadweight loss

Misallocation of resources

- Distorted price signals cause resources to be misallocated.

- no price, no signal, no incentive

- a good is used in low value uses even when there's not enough for high value uses

- prevents highest valued uses from outbidding lower value uses

- allocation will be sort of random

- we dont get the best use of a resource

Price floors

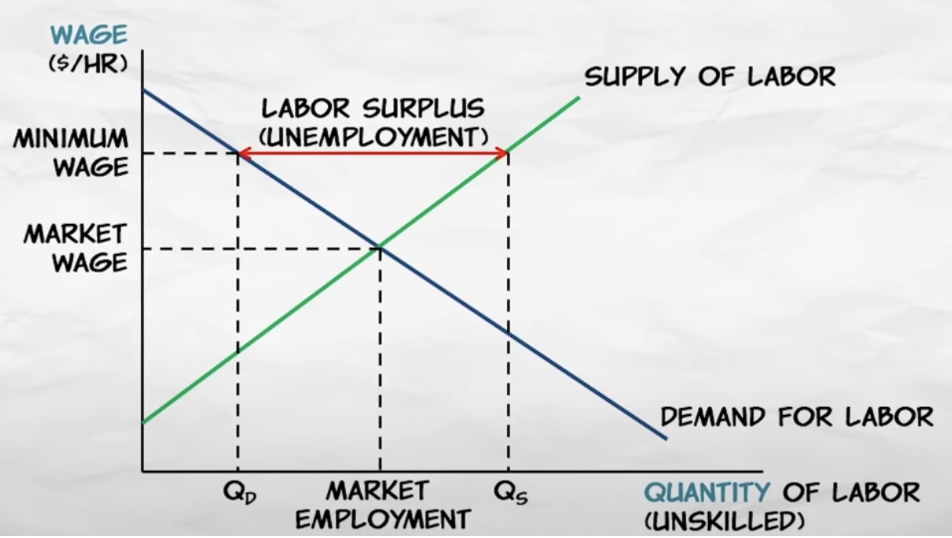

price floor: a minimum price allowed by law

price floors create:

- surpluses

- lost gains from trade

- wasteful increases in quality

- misallocation of resources

they are less common than price ceilings

an example is minimum wage

- at best, the minimum wage raises the wages of some low skill and young workers, most of whose wages would have increased anyway as they became more skilled

- at worst, the minimum wage will increase prices and create serious unemployment

creates a deadweight loss

producer surplus is given up in favor of quality so sellers can compete

- the cost of quality was higher than the value to the customers

- customers prefer lower fares instead of quality

prevents competition

Price controls and communism

- Communism can be tought of as a system of universal price controls

- price cant give signals to properly allocate resources