Unit 2

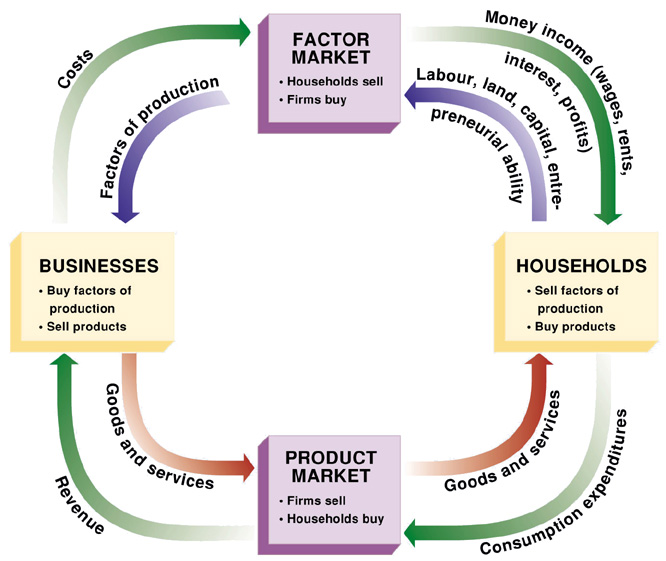

Circular-Flow Diagram

Simple model of macroeconomics representing inflows and outflows.

Contains households and firms

household - a person or group of people who share income

firm - an organization that produces goods and services for sale

Expanded Circular-Flow Diagram

inflow must equal outflow

government, households, firms, rest of the world

Gross Domestic Product (GDP)

GDP - total value of all final goods and services produced in the economy during a given year.

Three ways to calculate GDP:

value added approach - survey firms and add up their contributions to the value of final goods and services

expenditure approach - to add up aggregate spending on domestically produced final goods and services in the economy

consumer spending + investment spen + gov purchases + exports - imports

income approach - add up the total factor income earned by households from firms in the economy, including rent, wages, interest, and profit

IF IF U -

Intermediate goods/services

Financial assets and transfer payments

Inputs used in production

Foreign-produced goods and services

Used goods

aggregate output - the total quantity of final goods and services the economy produces.

real gdp - the total value of all final goods and services produced in the economy during a given year, calculated using the prices of a selected base year in order to remove the effects of price changes.

comes with information about what the base year is.

nominal gdp - gdp at current prices.

chain linking - the method of calculating changed in real GDP using the average between the growth rate calculated using an early base year and the growth rate calculated using a late base year.

adopted measure by u.s. national accounts

GDP per capita - GDP divided by the size of population; equivalent to the average GDP per person.

eliminates effect of differences in population size.

useful for comparison of labor productivity.

not sufficient measure of real gdp.

Unemployment

employment - people are currently holding a job in the economy, either full time or part time.

retired and disabled do not count

unemployment - people are actively looking for work but aren’t currently employed

unemployed considered to be “jobless, looking for jobs, available for work.”

labor force - equal to the sum of employed and unemployed.

labor force participation rate - percentage of population aged 16+ that is in the labor force.

labor force/population age 16+ x 100

unemployment rate - percentage of the total number of people in the labor force who are unemployed

# of unemployed workers/labor force x 100

estimated based on surveys sent to 60,000 american families

indicator of how difficult it is to find a job in the economy

Overstating and Understating Employment

Unemployment never falls to zero, despite many unemployed.

discouraged workers - nonworking people who are capable of working but have given up looking for a job due to the state of the job market.

understated unemployment because they were originally looking for jobs, but gave up

known as marginally attached - would like to be employed and have looked for a job in the recent past but are not currently looking for work.

marginally attached workers ended their job search for a reason other than belief that no job was available for them.

not included when calculating the unemployment rate.

underemployed - workers who would like to work more hours or who are overqualified for their jobs.

Job Creation and Destruction

structural changes in technology can result in job loss & creation.

ex: employment rise in high-tech industries because of the new technologies emerging.

Types of Unemployment

frictional unemployment - unemployment due to the time workers spend in job search.

workers lose a job and chose to not take the first new job offered.

always exist in the economy

job search - workers who spend time looking for employment.

structural unemployment - unemployment that results when workers lack the skills required for the available jobs, or there are more people seeking jobs in a labor market than there are jobs available at the current wage rate.

Wages - Money

minimum wage government mandated floor on the price of labor.

binded minimum wages are for less skilled workers

lead to structural unemployment

labor unions are organizations between workers to maintain or improve it

lead to structural employment

exercise bargaining power by threatening firms with a labor strike.

greater bargaining power = higher wages demanded

efficiency wages - wages that employers set above the equilibrium wage rate as an incentive for better employee performance.

natural rate of unemployment - unemployment rate that arises from the effects of frictional plus structural unemployment.

natural unemployment = frictional unemployment + structural unemployment

cyclical unemployment - the deviation of the actual rate of unemployment from the natural rate.

actual unemployment = natural unemployment + cyclical unemployment

unemployment rates are lower for experienced than low-skilled workers.

in result, their wages are higher than low skilled

Inflation

real wage - the wage rate divided by the price level to adjust for the effects of inflation or deflation

real income - income divided by the price level to adjust for the effects of inflation or deflation

inflation rate - the percentage increase in the overall level of prices per year

inflation rate = price level in year 2 - price level in year 1/ price level in year 1 × 100

shoe-leather costs - the increased costs of transactions caused by inflation

allusion to wear and tear caused by extra running around that takes place when people try to avoid holding money

menu cost - the real costs of changing listed prices

unit-of-account costs - arise from the way inflation makes money a less reliable unit of measurement

not useful because of inflation - worth of a dollar changes over time

effect of inflation on borrowers/lenders are nominal and real interest rates

nominal interest rates - the interest rate actually paid for a loan

real interest rate - the nominal interest rate minus the rate of inflation

inflation discourages from long-term contracts

disinflation - the process of bringing the inflation rate down

difficult an costly

Module 15

aggregate price level - measure of the overall level of prices in the economy.

price index - measures the cost of purchasing a given market basket in a given year. The index value is normalized so that it is equal to 100 in the selected base year.

price index in given year = cost of market basket in a given year/ cost of market basket in base year x 100

inflation rate = price index in year 2 - price index in year 1/price index in year 1 × 100

consumer price index - measures the cost of the market basket of a typical urban american family.

surveys sent to ifferent industries; food, housing, clothing, education, etc.

producer price index - measures the prices of goods and services purchased by producers.

regarded as warning sign

gdp deflator - 100 times the ratio of nominal gdp to real gdp in that year

onflation rises nonimal but not real