Week 11 (Chapter 6)

Topics

Autoregressive predictive models

Statistical inference - the Yule-Walker estimator

Statistical inference - the OLS estimator

Nonstationarity

Autoregressive Predictive Models

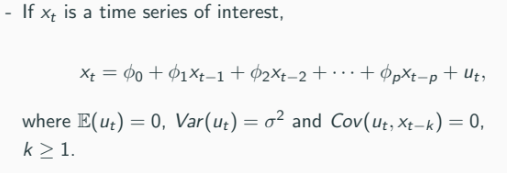

Time series prediction often uses autoregressive (AR) models.

We use past value to predict the present value.

Many macroeconomic time series are nonstationary, and methods to deal with this will be considered.

Mean and Variance of a Stationary AR Process

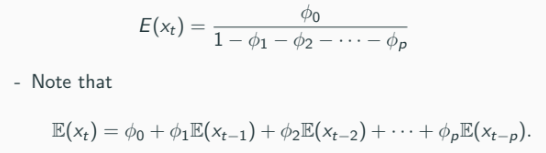

The mean of a stationary AR(p) process is given by:

Strict or weak stationarity implies

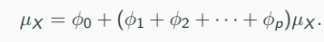

Thus

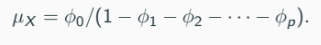

Rearranging terms, we find:

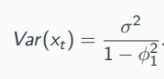

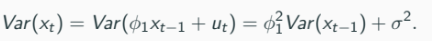

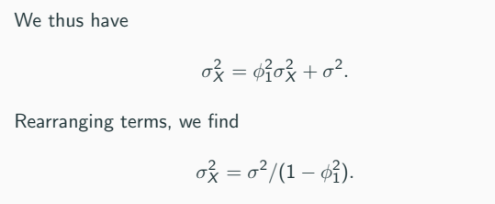

In the case with p = 1 (assume), the variance of a stationary AR(p) process is given by:

Note that

(Weak/Covariance) stationarity implies

An important observation: the variance of Xt is inflated by the persistence ϕ of the AR model.

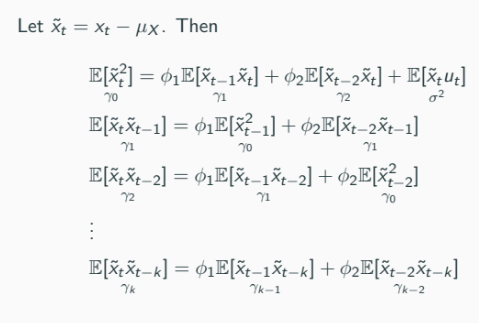

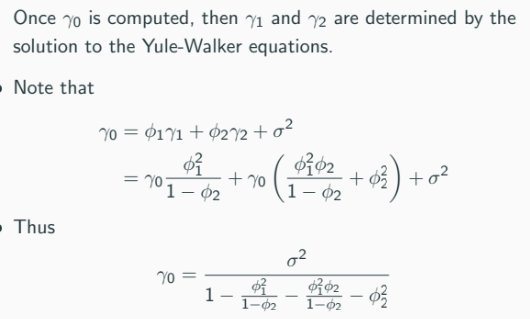

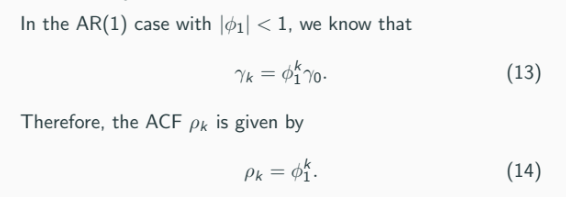

Autocovariances of a Stationary AR(p) Process

The autocovariances and autocorrelation functions can be computed by solving the Yule-Walker equations.

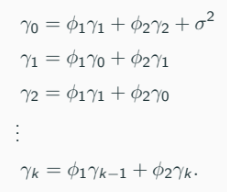

The Yule-Walker equations (for T = 2, t + 1 and t +2) are given by

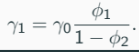

Autocovariances γ1, …, γk can be computed.Suppose that we want to compute γ1 and γ2 (this compute is not the estimate), From the second equation:

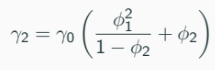

From the third equation:

Statistical Inference - The Yule-Walker Estimator

Two conventional estimators of (ϕ1, …, ϕp) are

Yule-Walker estimator (conventional and widely known)

OLS estimator

In many economic time series, p ≥ 1 seems to be more natural.

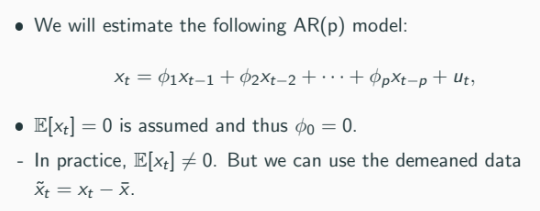

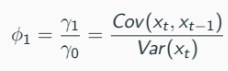

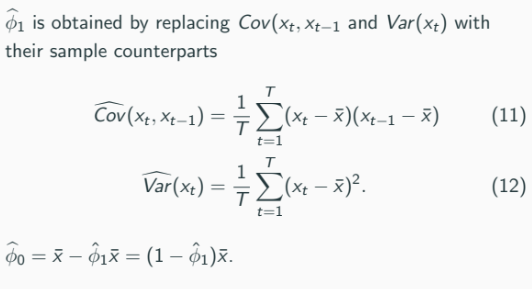

Yule-Walker Estimation: AR(1)

Remember: our coefficients here are the correlation between past and present value.

For t = 2, we have t at present and past. For t = 1, only present. ‘t’ in sigma here is basically ‘n’.

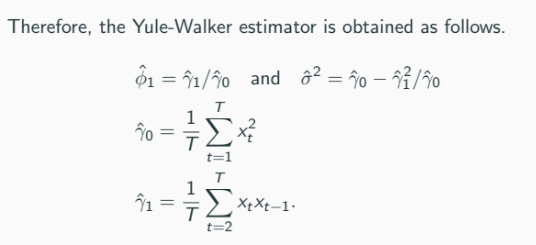

Asymptotic Properties

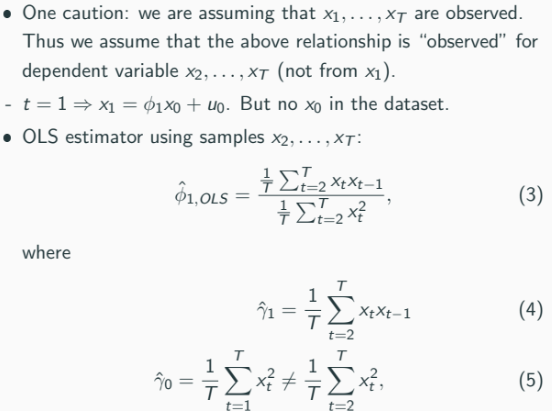

Statistical Inference - The OLS Estimator

OLS Estimation

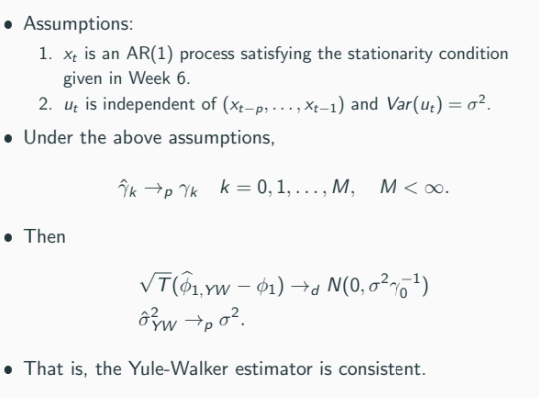

We will now consider the OLS estimation of

xt = ϕ1x{t-1} + ϕ2x{t-2} + ··· + ϕpx{t-p} + utThis may be viewed as a linear regression model and x{t-1}, …, x{t-p} may be viewed as regressors.

It is easy to estimate the above model using OLS. But we will focus on the case p = 1, i.e.,

xt = ϕ1x{t-1} + utOLS estimation is straightforward.

The reason that they are not the same even though the properties of the estimate is very similar, is the account for the ‘time size’.

OLS accounts for both the ‘time’ size, T = 2, but y0 only account for 1 ‘time’ size, T = 1. Thus, the OLS might be smaller since we have to account for the correlation between the two past value of OLS compared to the variance only for the YW (covariance of itself = variance).

In other words: YW only present time autocovariance (when lag is zero, its the variance), it does not explicitly adjust for past value like OLS.

→ Another different between YW and OLS estimates is that OLS depends on the lagging components for its numerator and denominator, hence ‘t’ = 2. Whereas YW uses the variance of itself and doesn’t depend on lagging component (except the numerator), hence the difference in ‘t’.

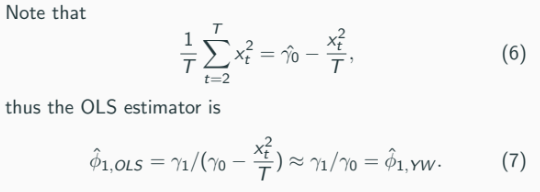

However, the difference between ϕ̂{1,YW} and ϕ̂{1,OLS} is small if the sample size is large enough.

Asymptotic Equivalence

Two estimators are not numerically identical (summary of previous point).

That is, ϕ̂{YW} ≠ ϕ̂{OLS}.

But, |ϕ̂{YW} - ϕ̂{OLS}| →_p 0, i.e., they are asymptotically identical.

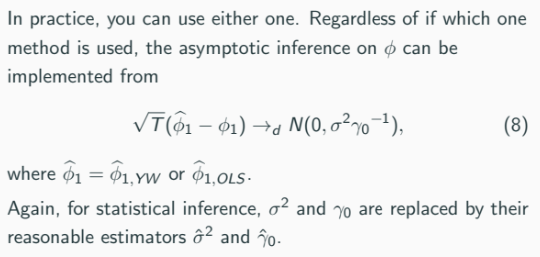

In practice, you can use either one.

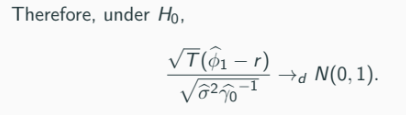

Statistical Inference

It may be of interest to test

H0 : ϕ1 = r against H1 : ϕ1 ≠ r

From the asymptotic results given for the Yule-Walker/OLS estimator ϕ̂1

Confidence interval can be constructed as well.

Forecasting

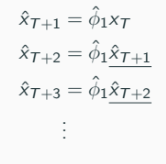

Once we estimate the model, the forecasts of future values x{T+1}, x{T+2}, … are given by

The forecasts are constructed recursively, as above.

Forecasting (Cont’d)

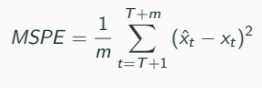

Forecasting accuracy measure: when x{T+1}, …, x{T+m} are realized

Forecasting model with smaller MSPE is regarded as better (obviously, smaller variance).

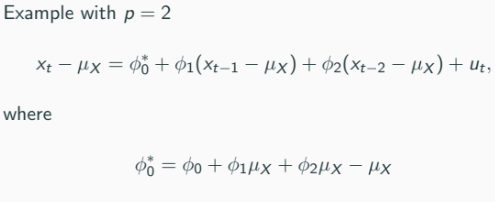

Model with an Intercept

Suppose that

xt = ϕ0 + ϕ1x{t-1} + u_tWe already know how to estimate this: OLS.

Alternatively, the Yule-Walker equation tells us that

Nonstationarity

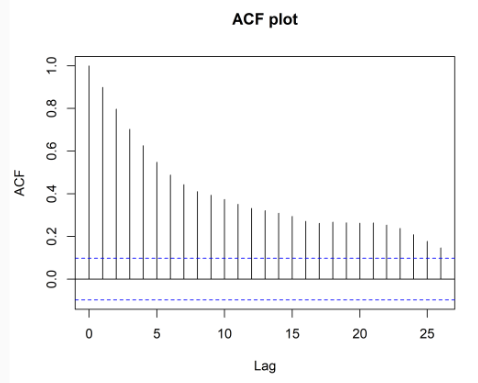

In practice, the use of the AR(p) predictive model may be often problematic since economic time series tends to be nonstationary.

That is, the ACF ρ_k decays to zero at a fast rate (we proved this in readings of 2150).

This is true in a more general case when p > 1.

As shown, the ACF plot time series is not stationary. It is more like the unit root/random walk model, i.e.,

xt = x{t-1} + u_t

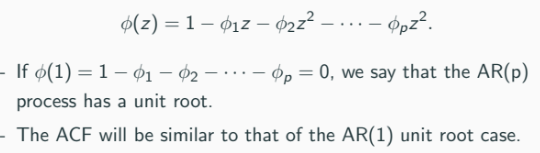

More generally, in the AR(p) case, the AR(p) equation is characterized by the polynomial

Differencing

Such a unit root process can be transformed into a stationary time series by taking differencing (repeatedly if necessary)

First-differenced time series: ∆xt = xt - x{t-1}.

First-differencing is sufficient for most economic time series.

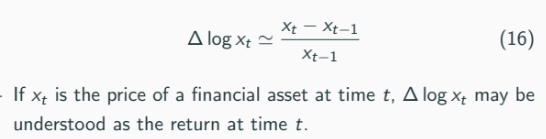

Sometimes, log-differencing is preferred:

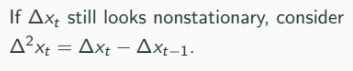

AR Predictive Model with Nonstationary Series

If the considered time series looks nonstationary (check its ACF), we may instead consider ∆xt (or ∆log xt).

The first differenced time series will be stationary in most cases.

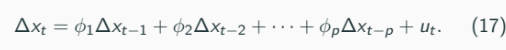

We then consider the following AR(p) model

We may apply the Yule-Walker/OLS estimation methods.