Nominal interest rates refer to the stated interest rate on a loan or investment, without adjusting for inflation, whereas real interest rates take into account the effects of inflation, providing a more accurate reflection of the purchasing power of the interest earned or paid.

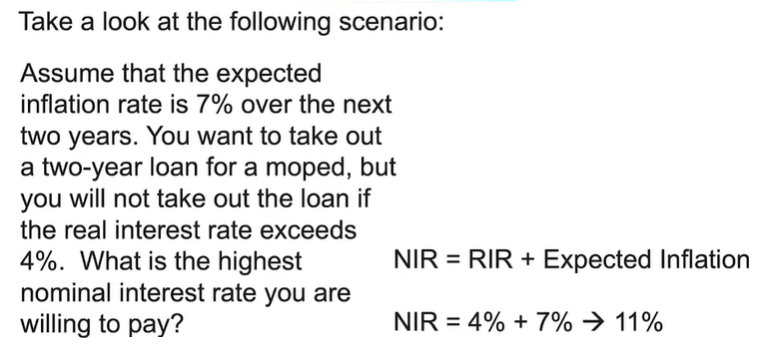

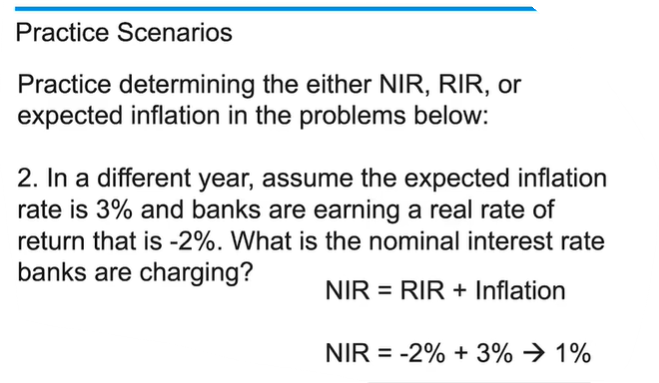

The fisher equation:The Fisher equation describes the relationship between nominal interest rates, real interest rates, and inflation, expressed as:

[ i = r - pi]

where ( i ) is the nominal interest rate, ( r ) is the real interest rate, and ( \pi ) is the inflation rate.

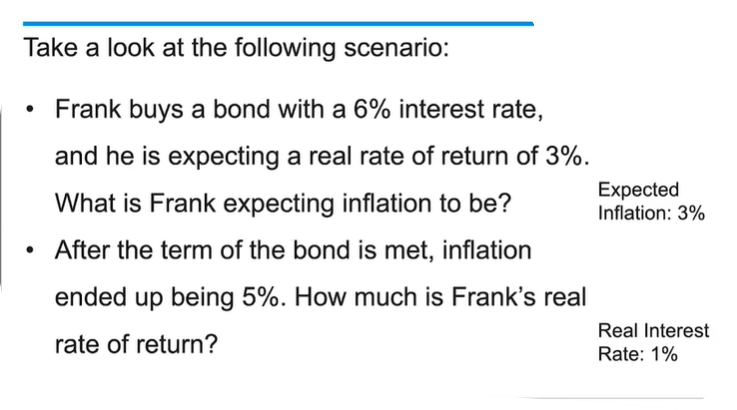

Expected vs Actual Inflation

Effects of Expected and Unexpected inflation on real interest rates

Unanticipated inflation: lenders, borrowers, and savers make decisions about loaning, borrowing, or saving based on what they expect or anticipate inflation to be over the term of their loan or saving

Lucas is better off, as the anticipated return on investment would have been 3%, but, with inflation, it could have been higher than 8%, leading to Lucas paying the bank with dollars of less value

Borrowers under unexpected inflation are always better off.

This is because the real value of the money they repay is less than what they initially borrowed, effectively reducing the cost of their loans. Conversely, lenders face losses as the purchasing power of the repayments decreases.

Note

Note Studied by 29 people

Studied by 29 people Note

Note Studied by 5 people

Studied by 5 people Note

Note Studied by 12 people

Studied by 12 people Note

Note Studied by 34 people

Studied by 34 people Note

Note Studied by 3 people

Studied by 3 people Note

Note Studied by 10130 people

Studied by 10130 people Knowt

Knowt