Ch 8 - Methods of Government Intervention in Markets

%%Indirect tax, subsidies, and price controls:%%

Indirect tax: a tax on spending/expenditure

- Government taxes the firm which increases its costs

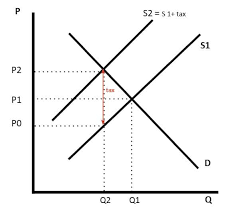

Specific tax diagram:

- Supply curve shifts vertically by the amount of tax

- Less product supplied at every price

- Increase in price

- Vertical shift upward of the amount of tax

- Specific tax fixed amount of tax imposed on a product

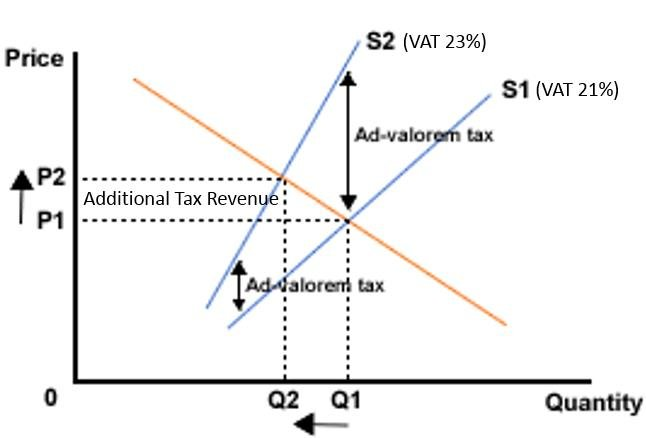

A percentage tax (Ad Valorem): the tax is the percentage of the selling price

Percentage tax increases as the selling price increases

As price rises the tax will too

Effect of taxes on consumers, producers, government and market as a whole:

- Before tax, firm’s revenue was given

- When a tax is implemented, the firm passes it on to the consumer by raising prices

- At that price, an excess of supply is present

- Price falls to a new equilibrium

- The consumer is now paying at a higher price

Burden of the tax: who pays the tax

- Producer only receives tax per unit

- Firm’s revenue decreases

- As a result of those changes, the government gains tax revenue. The market falls which leads to unemployment

DEED:

- Define

- Explain all key concepts

- Example from the real world

- Diagram

CLASPP:

- Conclusions

- Long and short term effects

- Assumptions

- Stakeholders

- Priorities

- Pros and cons

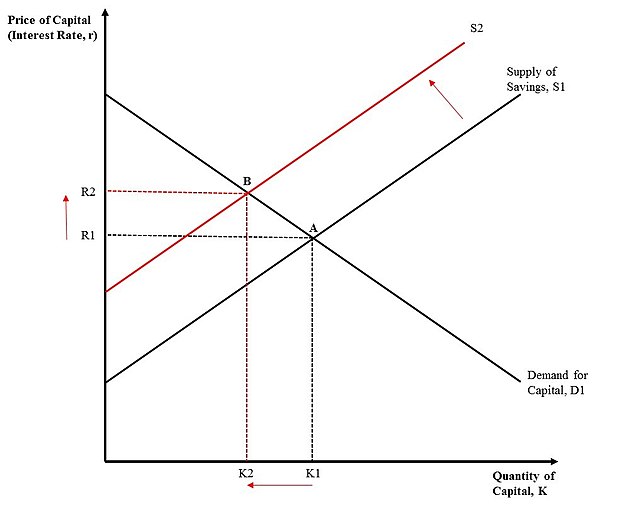

The tax burden and elasticity: The outcome of the share of tax burden, size of market and amount of producer/government revenue depends on the PED and PES

Rules of tax elasticity graphs:

- When PED=PES, the burden of tax will be equal between consumers and producers

- When PED>PES, burden of tax will be greater on producer

- When PED<PES, burden of tax will be greater for consumer large tax revenue

- Governments place taxes on producers with relatively inelastic demand such as cigarettes and alcohol

- Market will not reduce in size since consumers are price insensitive → protects unemployment

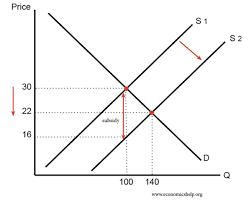

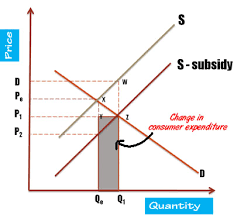

Subsidy: an amount of money paid by the government to a firm per unit of output

- Given a subsidy, costs are lowered → more supply

- Percentage subsides → rare, we focus on specific subsides

- Supply curve shifts to the right → shifts by amount of subsidy

Why do governments give subsidies?

- To lower prices of essential goods/increase consumption

- To guarantee the supply of goods in a necessary government

- Help producers compete overseas

- If the whole subsidy was given the price would drop (depending on elasticity)

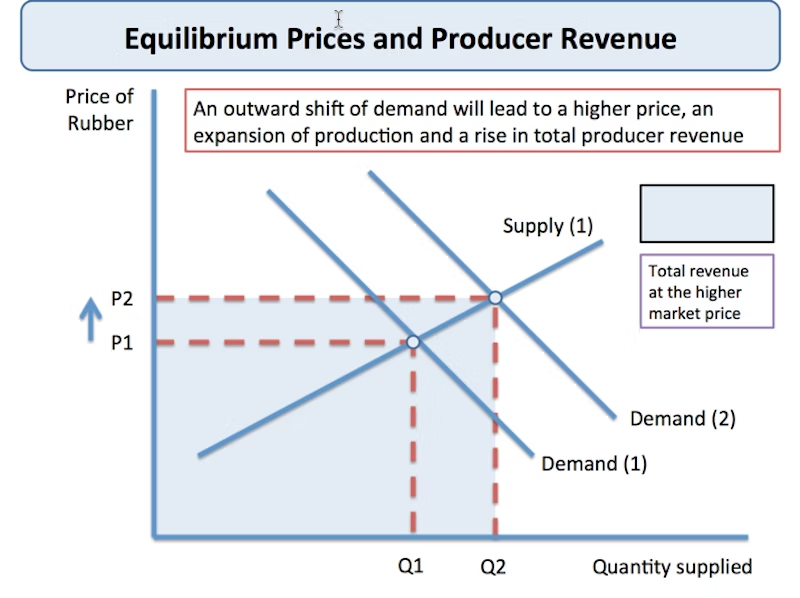

Producer revenue:

Before subsidy: firm makes P1Q1 in revenue

Subsidy of supply1 to demand 1 given by the government makes Q2P2 in revenue

Revenue increased by Q2 from Q1

Consumer expenditure: \n

Before subsidy, consumers could buy QePe, now, they can buy Q1P1

Total expenditure may increase or fall depending upon relative savings + extra expenditure

Government Expenditure:

- Government expenditure in BR1 and AR1

- Opportunity cost is present

Government can:

- Take opportunity cost from areas of spending

- Raise taxes (frowned upon)

- Borrow money, increase debt

Evaluation:

- In a free market, firms have to be more efficient to compete

- High income countries → dump their products in developing countries

- Can lead to overproduction: if there is high debate about subsidies given to farmers in high income countries

Government imposed price controls are necessary for consumers, producers, and societies Price controls:

- Minimum price

- Maximum price

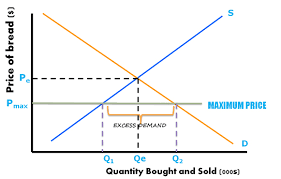

Maximum (low) price controls (ceiling price):

- Governments set a maximum price below the equilibrium:

- Prevents producers from raising the price above it

- Normally imposed on merit/necessary goods

An excess in demand leads to black market, shortage of goods needs to be eliminated through:

- A shift in demand curve to the left

- Shift supply curve to the right

- Offer subsidies to encourage production

- Goods directly produced by the government

- Release of old stock

Black market: economic activity that takes place outside government sanctioned channels

- Lets participants avoid government price controls and taxes

Minimum (high) price controls (floor prices):

- Where government sets the minimum price above the equilibrium price

- Prevents the producers from going below it

- Minimum price raises incomes for producers of goods and services that are important for foreign competition/price fluctuations)

- Minimum wage → workers earning a reasonable income

Maintaining minimum price:

- Government can eliminate excess supply by:

- Buying excess products or minimum price

- Creates a shift in demand curve to the left

- Producers could be limited by quotas

- Keeps price at a minimum

- Inefficiency due to lack of cost-conscious firms which are protected by minimum prices

Price ceiling → shortage → inefficiencies

- A price ceiling is set for goods and services which are heavily in demand, and cannot be surpassed past a certain price. This keeps prices of necessary goods low for those who need it. For example, prescription drugs (or such as insulin) and housing (rent) can have a price ceiling in order to make them more affordable for consumers

- However, keeping necessary products at a low and affordable price leads to a shortage in goods and services as they tend to sell out more often than if they were kept at its normal price. This leads to inefficiencies in the market, as it lowers the quality of the goods and services provided.

- A market is inefficient if there are missed opportunities. Everything has an opportunity cost, which is why when goods and services are cheaper, it dis-regulates the economy as the quality decreases.

Inefficient allocation to consumers: people who want it and are willing to pay don't get goods and people who are interested in the convenient price get it

Wasted resources: people spend money, time, and effort to deal with shortages

Inefficiently low quality: sellers offering low quality goods at a low price even though buyers prefer higher quality / higher prices

Black market: where goods and services are bought and sold illegally

Price floors cause inefficiency in:

- Inefficient allocation of sales: firms willing to sell at a lower price don't always get to do so

- Wasted resources

- The government can intervene to ensure that goods and services do not fall under a certain price. They are also responsible for generating demand to keep consumers interested.