MTP S2-26

Management Tools & Principle

Session 2

Chapter 1: Developing a Business Mindset

Gross domestic product (GDP) = PIB

What is a business?

Business are organizations.

An Organization is a Group of people with a common purpose (goals) and created structure (means).

Types of businesses

For-profit organizations: Organizations that provide goods and/or services with a profit and “asset building” motive.

Not-for-profit organizations: Organizations that provide goods and services without having a profit motive; these are also called nonprofit organizations.

!!! This does not mean that they do not make a profit.

Goods-producing businesses: Create value by making “things,” most of which are tangible.

Goods can be tangible (car) and intangible (software)

Goods-producing businesses are often capital-intensive businesses.

Service businesses: Create value by performing activities that deliver some benefit to customers.

Service businesses tend to be labor-intensive businesses.

What business do?

Business: Any profit-seeking organization that provides goods and/or services designed to satisfy the customers’ needs. It creates value by transforming lower-value inputs into higher-value outputs.

Example:

![]()

Each business adds value to the input.

Revenue (aka. income): Money that a company brings in (money income) through the sale of goods and services.

Profit: Money left over after all the costs involved in doing business have been deducted from the revenue.

In very general terms: Profit= Revenue (money income) - Expenses (money outcome)

!!! Profit =/= Cash:

Profit: accounting term =/= Cash: reality

“Accounted Profit” does not guarantee the reception of the money (we account when we sell, not when we get paid) AND there are expenses which are “not paid” in the period they are accounted (Amortization and Depreciation).

Business Model: A concise description of how a business generates or intends to generate revenue.

(How the company Creates and Exchanges Value).

Source of innovations

Alexander Osterwalder “Business Model Generation”

Small business model changes can translate into large scale disruption of industries.

Ex: meal-kit industry, gobble innovated by pre-chopping ingredients.

Ex: Spotify.

Comparison of business models between: Amazon/Carrefour, Lufthansa/Ryanair, Netflix/YouTube.

Competitive advantage: Aspect of a product or company that makes it more appealing to its target customers. It can be anything that distinguishes your value proposition in front of your consumer.

Risk/Reward vs Moral Hazard

![]()

What is Management?

Who knows? Business Mindset

Major environments of business

![]() Social environment: Trends and forces in society at large (demographics, education level, purchasing power...). It can affect demand, composition of the workforce, and the “appropriate” way of doing business.

Social environment: Trends and forces in society at large (demographics, education level, purchasing power...). It can affect demand, composition of the workforce, and the “appropriate” way of doing business.

Stakeholders: Anyone affected by a company’s decisions/activities

!!! Stakeholders =/= Shareholders

Technological environment: Forces resulting from the practical application of science to innovations, products, and processes. (medical advancements, availability of technology...)

Disruptive technologies: they change the nature of an industry. They can create or destroy entire companies (internet, email, phone, electric cars…)

Economic environment: conditions and forces that affect the cost and availability of goods, services, and labor, shaping the behavior of buyers and sellers.

Legal and regulatory environment: Laws and regulations at local, state, national and international levels.

Market environment: target customers, influences on the behavior of those customers, and competitors with similar products.

Functional areas in an enterprise

Manufacturing, production and operations: Defines How the company makes what it makes (products) or does what it does (services).

Operations management: management of the people and processes involved in creating goods and services. Operations managers take decisions about purchasing, logistics and facilities management.

Ex: Purchasing, logistics, facilities management, quality control, …

Marketing: Understand and identify opportunities in the market, develop the products to address those opportunities, create brand and promotion strategies, set prices and distribution channels.

The sales function develops relationships with potential customers and persuades customers, transaction by transaction, to buy the company’s goods and services.

Research and development (R&D): Functional area responsible for conceiving and

designing new products.

Information technology (IT): Systems that promote communication and information usage through the company, or that allow companies to offer new services to their customers.

Finance and Accounting: Getting the funds it needs to operate, monitoring and controlling how those funds are spent, keep records for managers and outside audiences (investors, tax).

The jobs related to accounting are management accountant, internal auditor, public accountant, and forensic accountant (investigating financial crimes).

The jobs related to finance are controller, treasurer and finance officer, credit manager, and cash manager.

Human resources (HR): Recruiting, hiring, developing, and supporting employees.

Business services: Help company with legal needs, banking, real estate, and other areas.

Also in the book

Barrier to entry: Any resource or capability a company must have before it can start competing in a given market.

There is a high barrier to entry for capital-intensive businesses because they require large amounts of equipment to get started and to operate.

Barriers to entry can also include government testing and approval, tightly controlled markets, strict licensing procedures, limited supplies of raw materials, and the need for highly skilled employees.

The seven key traits of professionalism: striving to excel, being dependable and accountable, being a team player, communicating effectively, demonstrating a sense of etiquette, making ethical decisions, and maintaining a positive outlook.

Professionalism: The quality of performing at a high level and conducting oneself with purpose and pride.

Etiquette: The expected norms of behavior in any particular situation.

Session 3

Chapter 2: Understanding basic economics.

Define economics, and why scarcity is central.

Economy: The total sum of all the economic activity within a given region (The economy of the city of Segovia, of Segovia province, of CyL, of Spain, of the European Union...)

Economics: The study of how a society uses its scarce resources to produce and distribute goods and services.

Microeconomics: How consumers, businesses, and industries determine the quantity of goods demanded/supplied at different prices.

Macroeconomics: “Big picture” issues in an economy: competitive behavior among firms, effect of government policies, and overall resource allocation issues.

Factors of Production: resources owned by a certain country/society.

Every good or service is created from a combination of 5 factors of production.

The 5 Factors of Production:

Natural resources: Land, forests, minerals, water, fuels, ...

Human resources: People who work in an organization or on its behalf.

Capital: Funds that finance the operations of a business + physical elements used to produce goods and services (machinery, tractors, computers).

Entrepreneurship: Willingness to take the risks to create and operate new businesses.

Knowledge (Know-How): Expertise gained through experience or association.

Scarcity: A condition of any productive resource that has a finite supply. Scarcity generates competition and forces trade-offs.

Opportunity cost: The value of the most appealing alternative not chosen. Trade-offs force us to choose alternatives and generate opportunity costs.

Major types of economic systems.

Economic system: Policies that define a society’s particular economic structure. Rules by which a society allocates resources.

Planned ⬄Free Market

![]()

Free Market System: Decisions about what and how much to produce are made by the market’s buyers and sellers, not the government.

Capitalism: Economic system based on economic freedom and competition.

Planned System: Government controls most of the factors of production and regulates their allocation.

Socialism: Public ownership/operation of key industries combined with private ownership and operation of less-vital industries.

Nationalization: A government’s takeover of selected companies or industries.

Privatization: Turning over services once performed by the government and allowing private businesses to perform them instead.

Demand and supply.

Demand: The quantity of a certain product or service that buyers are willing and able to purchase at different price points.

Supply: The quantity of a certain product or service that sellers are willing and able to sell at different price points.

Demand curve: A graph of the quantities of a product that buyers will purchase at various prices.

Supply curve: A graph of the quantities of a product that sellers will offer for sale, regardless of demand, at various prices.

Equilibrium point: Point at which quantity supplied equals quantity demanded.

Macroeconomic issues essential to understanding the economy.

Competition in a Free-Market System

Competition: Rivalry among businesses for the same customers.

Pure Competition (The opposite of a Monopoly): So many buyers and sellers exist that no single buyer or seller can individually influence market prices.

Companies are price-takers.

Peter Thiel – Zero to One: “Pure competition is considered both “the ideal” and the “default” state of business”: why?

Monopoly (The Opposite of a Pure Competition): One company dominates a market to the degree that it can control prices. It can be pure monopoly that happens naturally, or regulated monopoly created by the government.

!!! Monopolistic competition: A situation in which many sellers differentiate their products from those of competitors in at least some small way.

Oligopoly: Market situation in which a very small number of suppliers, sometimes only two, provide a particular good or service.

Business Cycles

Business cycles: Fluctuations in the rate of growth that an economy experiences over a period of several years.

Recession: A period during which national income, employment, and production all fall. It is defined as at least six months of decline in the GDP.

!!! Economic expansion (growing economy) vs economic contraction (falling economy).

Unemployment

Unemployment rate: The portion of the labor force (everyone over 16 who has or is looking for a job) currently without a job.

![]()

Inflation and deflation

Inflation: Economic condition in which prices rise steadily throughout the economy.

Deflation: An economic condition in which prices fall steadily throughout the economy.

Purchasing power: Le pouvoir d’achat

Deregulation and role of governments.

Government’s Role in a Free-Market System:

Protecting stakeholders

Fostering competition

Encouraging innovation and economic development

Stabilizing and stimulating the economy.

Regulation: Relying more on laws and policies than on market forces to govern economic activity.

Deregulation: Removing regulations to allow the market to prevent excesses and correct itself over time with market forces.

Stabilizing and Stimulating the Economy:

Monetary policy: Government policy and actions taken by the country’s central bank (Federal Reserve in the US; EU Central Bank in Europe) to regulate the nation’s money supply.

Fiscal policy: Strategy for the use of government revenue collection and spending to influence the business cycle.

Major Type of Tax:

![]()

Measuring economic activity.

Economic Measures and Monitors

Economic indicators: Statistics that measure the performance of the economy.

Leading Indicators – Show Future Predictions.

Lagging Indicators – Show Confirmation of past events.

Price Indexes

Consumer price index (CPI): Monthly statistic that measures changes in the prices of a representative collection of consumer goods and services.

Producer price index (PPI): Statistical measure of price trends at the producer and wholesaler levels.

Gross domestic product (GDP): Value of all the final goods and services produced by businesses located within a nation’s borders; excludes outputs from overseas operations of domestic companies.

Session 4

Chapter 3 The global Marketplace.

Money and Banking

The meaning of money

Money: A generally accepted means of payment for goods and services; serves as a medium of exchange, a unit of accounting, a store of value, and a standard of deferred value.

Money has four essential functions:

A medium of exchange: to facilitate transactions.

A unit of accounting: Provide value in transaction.

A temporary store of value: Can be accumulated (saved)

A standard of deferred payment: It can represent debt obligations.

Fiat money: Official currencies issued and maintained through government fiat, or proclamation/decree: EUR, USD, Pesos, Cordobas, Yuan, Yens.

The term "fiat" is a Latin word that is often translated as "it shall be" or "let it be done."

Fiat currencies only have value because the government maintains that value; there is no utility to fiat money in itself.

Characteristics of Money (Currency, not cash)

Any currency should be: Divisible, Portable, Acceptable, Scarce, Durable, and Stable in Value

Money supply: The amount of money in circulation at any given time.

M1 consists of cash held by the public and money deposited in a variety of checking accounts (Money spendable now)

M2 consists of M1 plus savings accounts, balances in retail money-market, mutual funds, and short-time deposits (Money that could be spendable fairly soon)

Cryptocurrency: Currency represented by digital tokens: Bitcoin, Ethereum, Solana.

It appeals to many people because of its anonymity and because its value can't be manipulated by central banks in the same way fiat currencies can.

Cryptocurrencies such as Bitcoin are digital currencies not backed by real assets or tangible securities. They are traded between consenting parties with no broker and tracked on digital ledgers.

Central Banks

Central Banks regulate banks and implement monetary and fiscal policy.

Ex: Federal Reserve: Central bank of the U.S.; European Central Bank (ECB); Bank of China; Bank of England, others.

The Fed's Major Responsibilities:

Conducting monetary policy as required by Congress, with three objectives: maximizing employment, keeping prices stable, and keeping inflation under control.

Maintaining the stability of the financial system by minimizing systemic risks (financial risks that extend beyond any single bank or other company)

Supervising and regulating individual financial institutions. Ensuring a secure and efficient payment system to support financial transactions, including providing an adequate supply of currency and processing checks and electronic payments.

Protecting consumers and promoting community development by ensuring fair lending, fair housing, and community reinvestment.

![]()

Banking concepts

Federal funds rate: The interest rate that member banks charge each other to borrow money overnight from the funds they keep in their Federal Reserve accounts.

Three mechanisms to adjust the federal funds rate:

Buying and selling: Treasury bonds, bills, and notes. Most powerful tool.

Adjusting reserve requirements

Lending through the discount window

Discount rate: The interest rate that member banks pay when they borrow funds from the central Banks.

Prime rate: The interest rates a bank charge its best loan customers.

The Federal Deposit Insurance Corporation FDIC: To protect money in customer accounts and to manage the transition of assets whenever a bank fails. Banks pay a fee to join the FDIC network, and in turn, the FDIC guarantees to cover any losses from bank failure up to a maximum of $250,000 per account.

(NCUA) The National Credit Union Administration: Provides regulatory supervision and account protection for credit unions.

Fannie Mae and Freddie Mac:

Investment banks: Firms that offer a variety of services related to initial public stock offerings (IPOs), mergers and acquisitions (M&A), and other investment matters.

Investment banks provide some combination of the following services:

Facilitating mergers, acquisitions, sales, and spin-offs of companies

Underwriting initial public offerings (when a company sells shares of stock to the public for the first time)

Managing and advising on investments

Raising capital (such as by selling bonds) on behalf of corporate or government clients

Advising on and facilitating complex financial transactions

Investing in or lending money to companies

Providing risk management advice

"Making markets" for clients, which involves acting as an interim buyer or seller to help clients acquire or divest assets.

Commercial banks: Banks that accept deposits, offer various checking and savings accounts, and provide loans; note that this label is often applied to banks that serve businesses only, rather than consumers.

Private banking: for wealthy individuals and families.

The major types of commercial banks:

Retail banks serve consumers with checking and savings accounts, debit and credit cards, and loans for wthmes, cars, and other major purchases.

Merchant banks offer financial services to businesses, particularly in the area of international finance. Merchant banking is sometimes more narrowly defined as the management of private equity investments, making it more akin to investment banking.

Thrift banks, also called thrifts, or savings and loan associations, offer deposit accounts and focus on offering home mortgage (=hypothèque) loans.

Credit unions are not-for-profit, member-owned cooperatives that offer deposit accounts and lending services to consumers and small businesses. Note that thrifts and credit unions do not refer to themselves as banks, but the broad definition of banking used here distinguishes them from investment banks.

Private banking refers to a range of services for wealthy individuals and families, such as managing real estate and other investments, setting up trust funds, and planning philanthropic giving.

BANKING'S ROLE IN THE ECONOMY:

Banking plays an essential role in the modern economy, but safe and stable banking is a vital social need.

Fintech: (ex. Betterment) Fintech refers to a wide range of technological innovations.

that have the potential to improve financial services and, in some instances, radically disrupt them. Five major categories of fintech innovations include making financial services more inclusive, improving efficiency of financial activities, strengthening security of financial systems, improving the customer experience in financial services, and enhancing financial decision making.

Fintech involves a variety of technologies, including artificial intelligence (AI), cloud computing, and mobile apps, with both customer-facing and back-office technologies.

Nedbanks: Banks that provide services entirely through mobile and digital channels. (Ex. N26)

Economic globalization: The increasing integration and interdependence of national economies around the world.

Why nations trade

Why countries and companies trade internationally.

Focusing on relative strengths: specialization and exchange will increase a country’s total output and allow trading partners to enjoy a higher standard of living.

Expanding markets: Many companies have ambitions too large for their own backyards.

Pursuing economies of scale: By expanding their markets, companies can benefit from economies of scale, which enable them to produce goods and services at lower costs by purchasing, manufacturing, and distributing higher quantities.

Acquiring materials, goods, and services: No country can produce everything its citizens want at prices they're willing to pay, so companies and consumers alike reach across borders to find what they need.

Keeping up with customers

Keeping up with competitors

Economies of scale: Savings from buying parts and materials, manufacturing, or marketing in large quantities.

Balance of trade: Total value of the products a nation exports minus the total value of the products it imports, over some period of time.

Trade surplus: A favorable trade balance created when a country exports more than it imports.

Trade deficit: An unfavorable trade balance created when a country imports more than it exports.

Balance of payments: The sum of all payments one country receives from another country minus the sum of all payments it makes to other countries, over some given period of time.

The balance of payments includes the balance of trade, plus the net dollars received and spent on foreign investment, military expenditures, tourism, foreign aid, and other international transactions.

Two key measurements of a nation's level of international trade are the balance of trade and the balance of payments.

Foreign Exchange Rate Currency Valuation

Foreign exchange: The conversion of one currency into an equivalent amount of another currency.

Exchange rate: The rate at which the money of one country is traded for the money of another.

A currency can be strong or weak.

Floating exchange rate system: a currency's value or price fluctuates in response to the forces of global supply and demand. The supply and demand of a country's currency are determined in part by what is happening in the country's own economy.

![]()

Free trade: International trade unencumbered by restrictive measures.

It has positive and negative connotations (competition, health, safety...). It produces winners and losers, but the winners gain more than the losers lose, so the net effect is positive.

Government Intervention in International Trade

Protectionism: Government policies aimed at shielding a country's industries from foreign competition.

When a government believes that free trade is not in the best interests, it can intervene in several ways:

!!! Tariffs: Taxes levied on imports

Import quotas: Limits placed on the quantity of imports a nation will allow for a specific product.

Embargo: A total ban on trade with a particular nation (a sanction) or of a particular product.

Restrictive import standards: requiring special licenses for doing certain kinds of business and then making it difficult or expensive for foreign companies to obtain such licenses.

Export subsidies: Financial assistance in which producers receive enough money from the government to allow them to lower their prices in order to compete more effectively in the global market.

Antidumping measures: !!! dumping: Charging less than the actual cost or less than the home-country price for goods sold in other countries.

Sanctions: embargoes (total or partial) that revoke a country's normal trade relations status (often as alternative to war).

Major organizations in international trade

The world Trade Organization (WTO): Permanent forum for negotiating, implementing, and monitoring international trade and for mediating trade disputes among the 160 member countries.

The International Monetary Fund (IMF): Monitors global financial developments, provides technical advice and training, provides short-term loans to countries that are unable to meet their financial obligations, and work to alleviate poverty in developing economies. 188 member countries.

World Bank: UN Agency involved in funding hundreds of projects around the world aimed at addressing poverty, health and education in developing countries.

Trading blocks

Trading blocs: Organizations of nations that remove barriers to trade among their members and that establish uniform barriers to trade with non-members nations. (Exp. NAFTA, EU, ASEAN, UNASUR, GAFTA)

European union: 27 countries that have eliminated hundreds of local regulations, variations in product standards, and protectionist measures that once limited trade among member countries. Many members implemented the EURO.

Asia-Pacific Economic Cooperation (APEC): 21 countries working to liberalize trade in the Pacific Rim, 40% world population, long-term goal of encouraging trade and investment among member countries and helping the region achieve sustainable economic growth.

USMCA Agreement (Former NAFTA): U.S., Canada and Mexico: free flow of goods/services/capital

AfCFTA: certain African countries.

Forms of international business activity

![]()

Importing: Purchasing goods or services from another country and bringing them into one's own country.

Exporting: Selling and shipping goods or services to another country.

International Licensing: Agreement to produce and market another company's product in exchange for a royalty or fee.

International Franchising: Selling the right to use a business system, including brand names, business processes, trade secrets, and other assets.

International Strategic Alliances and JVs: long-term partnerships between two or more companies to jointly develop, produce, or sell products.

!!! Foreign direct investment (FDI): Investment of money by foreign companies in domestic business enterprises.

Multinational corporations (MNCs): Companies with operations in more than one country.

Cultural and legal differences in the global business environment.

Culture: A shared system of symbols, beliefs, attitudes, values, expectations, and norms for behavior.

Ethnocentrism: Judging all other groups according to the standards, behaviors, and customs of one's own group.

Stereotyping: Assigning a wide range of generalized and often false attributes to an individual based on his or her membership in a particular culture or social group.

Cultural pluralism: The practice of accepting multiple cultures on their own terms.

Tax haven: A country whose favorable banking laws and low tax rates give companies the opportunity to shield some of their income from higher tax rates in their home countries or other countries where they do business.

Strategic choices when considering international markets.

Strategic approaches to international markets

!!! Multidomestic strategy: A decentralized approach to international expansion in which a company creates highly independent operating units in each new country.

Global strategy: A highly centralized approach to international expansion, with headquarters in the home country making all major decisions.

Transnational strategy (also known as “Glocal” (Global local): A hybrid approach that attempts to reap the benefits of international scale while being responsive to local market dynamics.

Designing international expansion in terms of …

Products: Which fits the destination market? Should we Customize them?

Customer Support: How to deal with technical assistance, installation or post sales?

Promotion Campaign: Standardization or customization?

Pricing: Should we adapt to every market? Standard?

Staffing: Expats? Locals? A mix of both?

Session 4 (Asynchronous “Management History Module”)

Early management: In 1776, Adam Smith published The Wealth of Nations, in which he argued the economic advantages that organizations and society would gain from the division of labor (or job specialization)—that is, breaking down jobs into narrow and repetitive tasks.

Industrial revolution: A period during the late eighteenth century when machine power was substituted for human power, making it more economical to manufacture goods in factories than at home.

4 management theory: classical, behavioral, quantitative, and contemporary.

Each of the four approaches contributes to our overall understanding of management, but each also a limited view of what it is and how to best practice it.

![]()

![]()

Classical approach

First studies of management, which emphasized rationality and making organizations and workers as efficient as possible. Two major theories compose the classical approach: scientific management (Frederick W. Taylor, the husband-wife team of Frank and Lillian Gilbreth), and the general administrative theory.

Scientific management: An approach that involves using the scientific method to find the “one best way” for a job to be done.

Therbligs: A classification scheme for labeling basic hand motions.

General administrative theory: An approach to management that focuses on describing what managers do and what constitutes good management practice. They use general administrative theory when they perform the functions of management and structure their organizations so that resources are used efficiently and effectively.

Principles of management: Fundamental rules of management that could be applied in all organizational situations and taught in schools.

Henri Fayol’s described the five functions that managers perform (planning, organizing, commanding, coordinating, and controlling) and 14 principles of Management.

Bureaucracy: A form of organization characterized by division of labor, a clearly defined hierarchy, detailed rules and regulations, and impersonal relationships.

Characteristics of Weber’s Bureaucracy: ![]()

Behavioral Approach

Organizational behavior (OB): The study of the actions of people at work.

The early OB advocates (Robert Owen, Hugo Munsterberg, Mary Parker Follett, and Chester Barnard) contributed various ideas, but all believed that people were the most important asset of the organization and should be managed accordingly.

Hawthorne Studies: A series of studies during the 1920s and 1930s that provided new insights into individual and group behavior.

Elton Mayo: people’s behavior is largely impacted by group factors and standards.

Quantitative approach

Quantitative Approach (management science): The use of quantitative techniques to improve decision making. It involves applying statistics, optimization models, information models, computer simulations, and other quantitative techniques to management activities. Linear programming, for instance, is a technique that managers use to improve resource allocation decisions.

Total quality management (TQM): A philosophy of management that is driven by continuous improvement and responsiveness to customer needs and expectations.

Contemporary approach

System: A set of interrelated and interdependent parts arranged in a manner that produces a unified whole.

Closed system: System that are not influenced by and do not interact with their environment.

Open system: Systems that interact with their environment.

Contingency approach (situational approach): A management approach that recognizes organizations as different, which means they face different situations (contingencies) and require different ways of managing. If … then we do …

Session 5

Chapter 5: Forms of Business Ownership

Ownership Models

Ownership: propriété

Owner: propriétaire

Liability: responsabilité

Sole Proprietorships

Sole proprietorship: A business owned by a single person (may have employees) / The person and the business are the same person.

Unlimited liability: A legal condition under which any damages or debts incurred by a business are the owner’s personal responsibility.

Advantages of Sole Proprietorships

Simplicity – easy and cheap process of creation

Single layer of taxation – Easy process

Privacy–no need to report on the business.

Flexibility and control - You own the place!

Fewer limitations on personal income–All the business makes (after tax) is yours!

Personal satisfaction – You are your boss!

Disadvantages of Sole Proprietorships

Financial liability

Very demanding on the owner

Limited managerial perspective

Resource limitations

No employee benefits for the owner

Finite life span

Partnerships

Partnership: an unincorporated company owned by two or more people.

A partnership can be general or limited.

General Partnership: A partnership in which all partners have joint authority to make decisions for the firm and joint liability for the firm’s financial obligations.

Limited Partnership: A partnership in which one or more persons act as general partners, run the business, and have the same unlimited liability as sole proprietors. The remaining owners are limited partners who do not participate in running the business and who have limited liability (limited to their contribution).

Limited liability: A legal condition in which the maximum amount each owner is liable for is equal to whatever amount each invested in the business.

Advantages of Partnerships:

Simplicity

Single layer of taxation

More resources than with sole proprietorship

Cost sharing

Broader skill and experience base

Longevity

Disadvantages of Partnerships

Unlimited liability

Potential for conflict

Expansion, succession, and termination issues

Partnership Agreement: Document that reflects investment percentages, profit- sharing percentages, management responsibilities and other expectations of each owner, decision-making strategies, succession and exit strategies, criteria for admitting new partners, and dispute-resolution procedures.

!!! Master limited partnership (MLP): A partnership that is allowed to raise money by selling units of ownership to the general public.

Limited liability partnership (LLP): A partnership in which each partner has unlimited liability only for his or her own actions and at least some degree of limited liability for the partnership as a whole.

Corporation

Corporation: A legal entity, distinct from any individual person, that has the power to own property and conduct business.

Shareholders: Investors who purchase shares of stock in a corporation.

Stakeholder: is a party that has an interest in a company and can either affect or be affected by the business. The primary stakeholders in a typical corporation are its investors, employees, customers, and suppliers.

!!! A shareholder is a Stakeholder, but a Stakeholder is not necessarily a Shareholder.

Private Corporation: A corporation in which all the stock is owned by only a few individuals or companies and is not made available for purchase by the public.

Public corporation: A corporation in which stock is sold to anyone who has the means to buy it.

Advantages of Corporations:

Ability to raise capital.

Liquidity: A measure of how easily and quickly an asset such as corporate stock can be converted into cash by selling it

Longevity

Limited liability

Disadvantages of Corporations:

Cost and complexity

Reporting requirements

Managerial demands

Possible loss of control

Double taxation

Short-term orientation of the stock market

!!! S corporation: A type of corporation that combines the capital-raising options and limited liability of a corporation with the federal taxation advantages of a partnership.

Benefit corporation: A profit-seeking corporation whose charter specifies a social or environmental goal that the company must pursue in addition to profit.

!!! Limited liability company (LLC): Structure that combines limited liability with the pass-through taxation benefits of a partnership.

Number of shareholders is not restricted, nor is members’ participation in management.

Corporate Governance

Corporate Governance: Policies, procedures, relationships, and systems in place to oversee the successful and legal operation of the enterprise.

Also refers to the responsibilities and performance of the board of directors specifically.

![]()

Shareholders

Proxy (Attention vient souvent à l’exam): A document that authorizes another person to vote on behalf of a shareholder in a corporation.

Shareholder activism: Activities undertaken by shareholders to influence executive decision making in areas ranging from strategic planning to social responsibility.

Corporate Governance

Board of Directors: group of professionals elected by the shareholders as their representatives, with responsibility for the overall direction of the company and the selection of top executives. The Chairman oversees the Board of Directors.

Corporate Officers

Corporate officers: The top executives who run a corporation (hired by the Board of Directors):

Chief executive officer (CEO): The highest-ranking officer of a corporation. Other C levels: CFO, CTO, CHRO, CBDO, CMO...

Mergers and Acquisitions as growth strategy

Merger and acquisitions

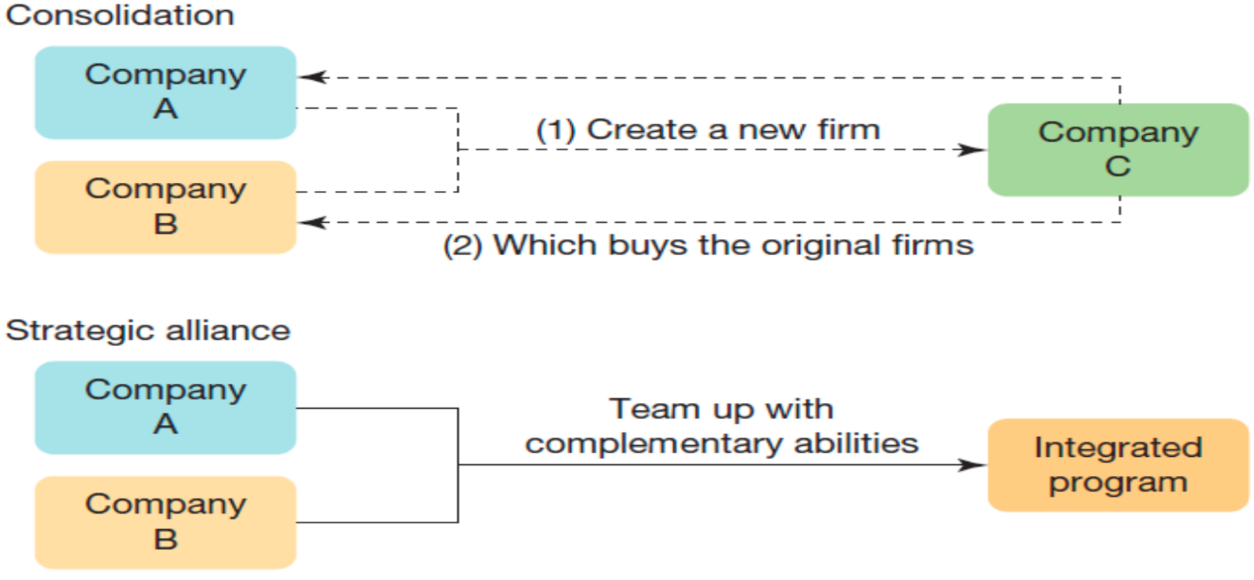

![]()

Merger: Two companies combine and perform as a single entity.

Acquisition: One company buys a controlling interest in the voting stock of another company.

Hostile takeover: Acquisition of another company against the wishes of management.

!!! Leveraged Buyout (LBO): Acquisition of a company’s publicly traded stock, using funds that are primarily borrowed, using the acquired assets to pay back the loans used to acquire the company.

Advantages of Mergers and Acquisitions:

Increase buying power as a result of their larger size (economies of scale)

Increase revenue by cross-selling products to each other’s customers.

Increase market share by combining product lines.

Gain access to expertise, systems, and teams (synergies)

Sometimes is the best or only way to grow in a mature market.

Disadvantages of Mergers and Acquisitions:

Executives have to agree how the merger will be done.

Managers need to agree who will be in charge.

Difficulties blending product lines, branding strategies, and advertising and sales efforts.

Difficulties blending cultures.

Companies must often deal with layoffs.

![]()

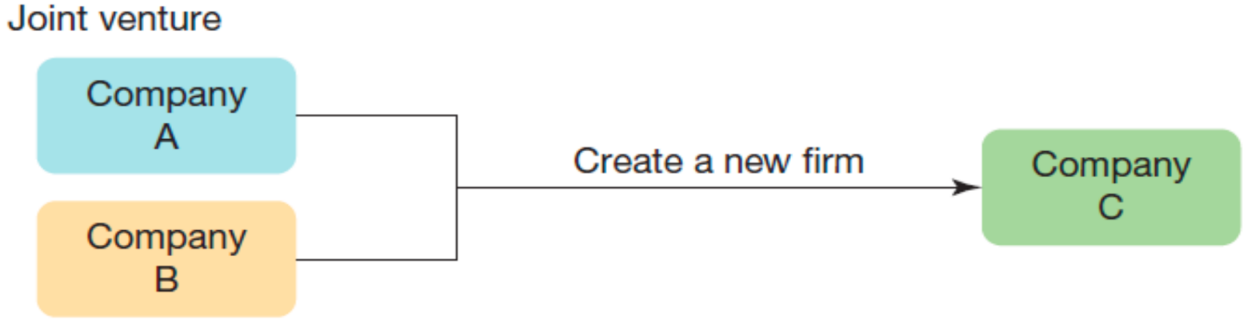

Strategic Alliances and Joint Ventures

Strategic Alliances and Joint Ventures

Strategic Alliance: Long-term partnership between companies to jointly develop, produce, or sell products.

Joint venture: A separate legal entity established by two or more companies to pursue shared business objectives.

Session 6

Chapter 6: Entrepreneurship and Small-Business Ownership

The Entrepreneurship Impact (Joan Roig, Mercadona):

Without entrepreneurs there are no companies

Without companies there is no employment

Without employment there is no wealth

Without wealth there is no social development

EU Entrepreneurship: Small and medium-sized enterprises (SMEs) are the backbone of Europe's economy. They represent 99% of all businesses in the EU. In the past five years, they have created around 85% of new jobs and provided two-thirds of the total private sector employment in the EU. The European Commission considers SMEs and entrepreneurship as key to ensuring economic growth, innovation, job creation, and social integration in the EU.

SME: 10-250 employees, 2-43 million € on the balance sheet.

Entrepreneurship:

“Entrepreneurship is the pursuit of opportunity beyond resources controlled” (Harvard Business School)

The capacity and willingness to develop, organize and manage a business venture along with any of its risks to make a profit.

The process by which either an individual or a team identifies a business opportunity and acquires and deploys the necessary resources required for its exploitation.

Entrepreneurship identifies and exploits opportunities, handling situations of uncertainty and complexity.

‘Entrepreneurs are the crazy people who work 100 hours a week, so they don’t have to work 40 hours for someone else.’ Brad Sugars (Int’l Business Coach)

The Evolution of Entrepreneurship

Factors influencing the “new” entrepreneurship:

Globalization: More markets, more competition

IT: As a facilitator of the entrepreneurship process (one human and a laptop create a company)

Knowledge: Has become the most important resource, above materials, location or other factors of production.

Roles of Small Businesses in the Economy

They provide jobs.

They introduce new products.

They meet the needs of larger organizations.

They inject a considerable amount of money into the economy.

They take risks that larger companies sometimes avoid.

They cover segments and niches that larger companies cannot afford to cover.

They provide specialized goods and services.

Characteristics of Small Businesses:

Most small firms have a narrow focus.

Small businesses have to get by with limited resources.

Small businesses often have more freedom to innovate.

Entrepreneurial firms find it easier to make decisions quickly and react to changes in the marketplace.

Why People Start Their Own Companies:

More control over their futures

Tired of working for someone else

Passion for new product ideas

Pursue business goals that are important to them on a personal level.

Inability to find attractive employment anywhere else.

Motivations of Spanish Entrepreneurs (M.I.T. Technology Review 2015): Entrepreneurs were asked to define SUCCESS:

Self-Realization: Reach happiness through your professional activity.

Purpose: Positive contribution to society through the project.

Innovation: Creation of new products or services that will add value to society.

Excellence: Outstanding performance that leads to reaching the objectives.

Benefits: Revenues that will justify the long-term sustainability of the project.

Business Start-up Options:

Create a New Business

Buy an Existing Business

Buy into a Franchise System

Business plan: A document that summarizes a proposed business venture, its goals, and plans for achieving those goals.

Advisory board: A team of people with subject area expertise or vital contacts who help a business owner review plans and decisions.

Business incubators: Facilities that house small businesses and provide support services during the company’s early growth phases.

Business Start-Up Option:

![]()

Why new businesses Fail:

![]()

Financing Options for Small Businesses

Seed money: The first infusion of capital used to get a business started – (FFF and Angel Investors).

!!! Angel investors: Private individuals who invest money in start-ups, usually earlier in a business’s life and in smaller amounts than VCs are willing to invest, or banks are willing to lend.

Microlenders: Organizations, often not-for-profit, that lend smaller amounts of money to business owners who might not qualify for conventional bank loans.

Crowdfunding: Soliciting project funds, business investment, or business loans from members of the public.

!!! Venture capitalists (VCs): Investors who provide money to finance new businesses or turnarounds in exchange for a portion of ownership, with the objective of reselling the business at a profit. Normally associated with companies in the growth stage that have obtained “market fit”.

Initial public offering (IPO): A corporation’s first offering of shares to the public.

Funding

Valuation: How much is the company worth.

PreMoney: before the new investment is IN the company.

PostMoney: after the new investment is IN the company.

PostMoney = PreMoney + New Investment

!!! Dilution: Current shareholders see their Stake (%) go down as new investments arrive

New Stake (%) = Old Stake x PreMoney/PostMoney

41,7% = 50% x 500.000/600.00

The Franchise Alternative

Franchise: A business arrangement in which one company (the franchisee) obtains the rights to sell the products and use various elements of the business system of another company (the franchisor).

Franchisee: A business owner who pays for the rights to sell the products and use the business system of a franchisor.

Franchisor: A company that licenses elements of its business system to other companies.

Advantages of Franchising:

Combines some of the freedom of working for yourself with many of the advantages of being part of a larger, established organization.

Name recognition, national advertising programs, standardized quality of goods and services, and a proven formula for success.

Disadvantages of Franchising:

Agree to follow the business format.

Little control over decisions the franchisor makes that affects the entire system.

Don’t have the option of independently changing your business in response to market changes.

Session 7 (Asynchronous Goiko Grill)

Read all notes in a notebook.

Session 8

Chapter 7: Management Roles, Functions, and Skills

The importance of management, and the tree management roles.

Management: The process of planning, organizing, leading, and controlling to meet organizational goals.

Environmental analysis Tools:

![]()

Manager: Managers work in an always-changing environment of extreme complexity and uncertainty.

The 3 Roles of Management

Managerial roles: Behaviors and activities involved in carrying out the functions of management.

All managerial roles can be grouped in 3 categories:

1. Interpersonal roles

2. Informational roles

3. Decision making roles

Interpersonal roles: Providing leadership to employees, acting as a liaison between groups, networking, and fostering relationships.

Informational roles: Gathering information from inside and outside the organization, sharing information: The Executive Dashboard – Control board for managers.

Decisional roles: Facing an endless stream of decisions, some which need to

be made on the spot (decisions lead to ACTION)

There is a tendency of pushing down decision-making to lower layers of the organization.

The Management Functions

The 4 Functions of Management:

Planning: Objective: “what do we want to achieve”

Organizing: Means and Tasks: “Who, and How, does What?”

Leading: Execution/Motivation: “making things happen”

Controlling: Check: “Are we on the right track?”

The Planning Function

Planning: Establishing objectives and goals for an organization and determining the best ways to accomplish them. Planning: analyzing the environment + developing strategies.

Strategic plans: Plans that establish the actions and the resource allocation required to accomplish strategic goals. Defined for periods of two to five years and developed by top managers.

The Strategic Planning Process

![]()

Defining the Mission, Vision, and Values

Mission statement: A brief statement of why an organization exists; in other words, what the organization aims to accomplish for customers, investors, and other stakeholders.

Explains the reason of being, defines the soul of the organization, why we are here.

Vision statement: An inspirational expression of what a company aspires to be.

Where do we want to get?

Values statement: An articulation of the principles that guide a company’s decisions and behaviors.

SWOT Analysis

![]()

What’s wrong with SWOT?

A two-way classification of forces in INTERNAL and EXTERNAL is stronger than the four-way of the SWOT analysis.

Because classification of factors in S W O and T can be arbitrary

Conclusion: Circumstances influence the classification!! (Environment influences the strategy)

Developing Forecasts

Forecasts (=prévision): predictions about the future (what will happen, when will happen and how will happen)

Quantitative forecasts: Typically based on historical data or tests and often involve complex statistical computations.

Qualitative forecasts: Based on intuitive judgments.

Establishing Goals and Objectives:

Goal: A broad, long-range target or aim.

Objective: A specific, short-range target or aim.

SMART objectives: specific, measurable, attainable, relevant, time limited.

The Organizing Function

Organizing: The process of arranging resources to carry out the organization’s plans.

Management pyramid: An organizational structure divided into top, middle, and first-line management.

![]()

Top Managers: Highest level of the organization’s management hierarchy. Responsible for setting strategic goals; they have the most power and responsibility in the organization. They plan long-term goals.

Middle Managers: Those in the middle of the management hierarchy. They develop plans to implement the goals of top managers and coordinate the work of first-line managers. They plan mid-term objectives to meet the strategic long-term goals.

First-line managers: Those at the lowest level of the management hierarchy. They supervise the operating employees and implement the plans set at the higher management levels.

The Leading Function

Leading: Guiding and motivating people to work toward organizational goals. Leading is about MAKING THINGS HAPPEN.

Types of Intelligence present in Leaders

Cognitive intelligence: Involves reasoning, problem solving, memorization, and other rational skills.

Emotional intelligence: Measure of a person’s awareness of and ability to manage his or her own emotions.

Social intelligence: Looking outward to understand the dynamics of social situations and the emotions of other people, in addition to your own.

Leadership Styles

![]()

Autocratic leaders: Leaders who do not involve others in decision making.

Democratic leaders: Leaders who delegate authority and involve employees in decision making.

Laissez-faire leaders: Leaders who leave most decisions up to employees, particularly those concerning day-to-day matters.

Participative management: Associated to Democratic Leaders - A philosophy of allowing employees to take part in planning and decision making.

Employee empowerment: Associated to Laissez-Faire Leaders - Granting decision-making and problem-solving authorities to employees so they can act without getting approval from management.

Coaching and Mentoring

Coaching: Helping employees reach their highest potential by meeting with them, discussing problems that hinder their ability to work effectively, and offering suggestions and encouragement to overcome these problems.

Mentoring: A process in which experienced managers guide less- experienced colleagues in the nuances of office politics, serving as a role model for appropriate business behavior, and helping to negotiate the corporate structure.

Building a Positive Organizational Culture

Organizational culture: A set of shared values and norms that support the management system and that guide management and employee behavior.

Creating the Ideal Culture in Your Company: ![]()

The Controlling Function

Controlling: The process of measuring progress against goals and objectives, and correcting deviations if results are not as expected.

Establishing Performance Standards

Standards: Criteria against which performance is measured.

!!! Benchmarking: Collecting and comparing processes and performance data from other companies.

Quality: A measure of how closely a product conforms to predetermined standards and customer expectations

!!! Balanced scorecard: A method of monitoring the performance from four perspectives: finances, operations, customer relationships, and the growth and development of employees and intellectual property.

Crisis management: Procedures and systems for minimizing the harm that might result from some unusually threatening situations.

Types of managerial skills

Interpersonal skills: Skills required to understand other people and interact effectively with them.

Technical skills: The ability and knowledge to perform the mechanics of a particular job.

Administrative skills: Skills in information gathering, data analysis and other aspects of managerial work.

Conceptual skills: Ability to understand the relationship of parts to the whole.

Decision-making skills: Ability to identify a decision situation, analyze the problem, weigh the alternatives, choose an alternative, implement it, and evaluate the results.

Session 9

‘The concept of strategy’ Grant, Contemporary Strategy Analysis.

Strategy

Strategy: Is the means by which individuals and organizations achieve their objectives.

“Strategy is about achieving success”. Without ACTION strategies are of little use.

The 4 factor that leads to success:

Goals that are consistent and long term

Deep understanding of the Environment

Resource Appraisal: evaluating the resources available.

Effective Implementation: action

Internal and external factors linked by the strategy; analysis needs to be consistent.

!!! Strategic Fit: coordination and connection between external and internal environment.

!!! Internal Fit: Alignment of individual internal strategies with one another – Internal connection and coordination.

Activity System: (Michael Porter) “Strategy is the creation of a unique and differentiated position (competitive advantage) involving a different set of activities” (Value Chain)

Evolution of the View of Strategy

Evolution of Environment:

More unstable

More unpredictable

More complex and turbulent

Consequences:

Less detailed planning

More guidelines

More flexibility

Higher importance for strategy

Strategy – Do firms need it?

Strategy helps management of organizations:

As a decision support (reducing the decision options)

Facilitating coordination between all parties involved

Helping focus on the long-term goals – Strategy if forward looking.

Some Notes About Strategy

Distinguishing strategy from tactics:

Strategy is the overall plan for deploying resources to establish a favorable position.

Tactic is a scheme for a specific manoeuvre.

Characteristics of good strategic decisions:

They should be...

Important

Involve a significant commitment of resources.

Not easily reversible

What is Real Strategy?

Premise: Strategy begins in the thoughts of the organizational leaders

Then, 2 levels of Strategy are resulting:

Intended Strategy: Mission, vision, values and competitive statement – Shows STATEMENT (willingness) and serves as communication means.

Real Strategy: Is realized as ACTION and it is, hence, OBSERVABLE.

Corporate and Business Strategy/ What are they?

Strategic Choices can be summarized in 2 questions:

1. Where to Compete?

Defines the Corporate Strategy- Broader Perspective

Responsibility of Top Management (C-level). Corporate Strategy defines the scope.

Products we supply (what’s our business)

Customers we serve.

Places where we operate.

2. How to Compete?

Defines the Business Strategy- Specific Perspective

Responsibility of Senior Management (Middle

Management)

What are our competitive advantages?

Business Strategy defines how to compete.

How Should Strategy be Created/Defined? Formal vs Informal Approach

How is Strategy Created?

Intended Strategy: Strategy as conceived by the leader.

Emergent Strategy: Interpretation of the intended strategy to adapt it to changing circumstances.

Realized Strategy: The actual strategy that is implemented (Normally 10%-30% of Intended)

![]()

Mintzberg’s Critique of Formal Strategic Planning

The fallacy of prediction: The future is unknown.

The fallacy of detachment: Impossible to divorce formulation from implementation.

The fallacy of formalization: Impedes flexibility, spontaneity, intuition and learning.

Value Chain

Business is an exchange of value. The organization generates value by transforming lower value inputs into higher value outputs. Value is not created as a block; but as the addition of small pieces of value created in the chain of the different individual activities the organization performs.

These individual activities which add value, are known as "Key Activities". The set of these Key Activities is what we call “The Value Chain”.

By studying the different key activities and the value that they provide individually, we will be able to identify what activities create more value and differentiation (Competitive Advantage) in our offer; and which create less or none. This analysis will help us decide where we should put more effort and where we should put less.

Value Chain: The entire series of organizational work activities that add value at each step from raw material to finished products.

WHAT IS IT USED FOR? (value Chain)

To identify and analyze the COMPETITIVE ADVANTAGES of an organization in the INTERNAL ENVIRONMENT and EXTERNAL ENVIRONMENT (Industry Value Chain).

WHAT INFORMATION PROVIDES? (value Chain)

What activities provide more or less value?

What activities are more or less profitable?

What activities are more or less costly?

The balance between cost and value provided of an activity.

What activity is best for us considering our Resources and Capabilities?

What activity dominates the Chain?

Other

HELPS US UNDERSTAND (value Chain):

How Value is Produced

How Value is Processed

How Value is Distributed

How Value is connected and transferred among the different Key Activities

How much is value costing us?

Example: Tea= Preparation= Cup= Location= Service= Price

Competitive Advantage: The KEY to the success of a company:

What makes the company unique and better than competitors?

How we fight off our competition

How we show our clients our superior value

A distinctive edge

Not a general “attribute that a company has as a whole”

It emerges from the different individual KEY ACTIVITIES

Should be Sustainable in time.

Should be difficult to replicate.

Three Groups of Competitive Advantages:

Being the CHEAPEST: Ryanair

Being the BEST: Apple...

Being UNIQUE: Monopolistic companies

Contingency Theory: There is no single best way of organizing or managing. The best way to design, manage and lead an organization depends upon circumstances.

Session 10

Chapter 8: Organization and Teamwork

Four major types of organization structures

Organization structure: A framework to divide responsibilities, ensure accountability, and distribute decision-making authority. A poorly designed structure can create enormous waste, confusion, and frustration for employees, suppliers, and customers.

Organization chart: Diagram that shows how employees/tasks are grouped and the lines of communication and authority. (The visual representation of the Organizational Structure).

The Organizational chart designs the organization for it to accomplish its goals and objectives (strategic Plan). The organization design must serve the strategy (not the opposite).

![]() Formal Organization vs. Informal Organization

Formal Organization vs. Informal Organization

Organization Chart example:

Agile organization: A company whose structure, policies, and capabilities allow employees to respond quickly to customer needs and changes in the business environment. It has a strong response capacity.

3 Steps process to Define an Organization Structure

1. Identifying Core Competencies (vital activities for the business (those that create value and competitive advantages))

2. Identifying Job Responsibilities (aka. Division of Labor)

3. Defining the Chain of Command

I. Spam of Management/Control

II. Centralization vs. decentralization (delegation of authority)

Identifying Core Competencies

Core Competencies: Activities that a company considers central and vital to its business.

How do we generate value? Where are our competitive advantages?

Identifying Job Responsibilities (division of labor)

Division of Labor: The degree to which organizational tasks are broken down into separate jobs.

What is our level of specialization?

![]()

What advantages and disadvantages do each?

Defining the Chain of Command (Span of Control)

Chain of Command: Pathway for the flow of authority from one management level to the next.

Span of Management/Control: The number of people under one manager’s control

How many people report to a certain manager’s control?

![]()

Line organization: A chain of command system that establishes a clear line of authority flowing from the top down.

!!! Line-and-staff organization: An organization system that has a clear chain of command but that also includes functional groups of people who provide advice and specialized services.

Examples: PA to CEO; Technical consultant to Operations Manager; Market Analyst to Marketing Director...

![]()

Centralization VS Decentralization

Centralization: When decision-making authority is at the top of an organization, we say the organization is Centralized.

Decentralization: When there is delegation of decision-making authority to employees in lower-level positions, we say the organization is Decentralized

Organizing the Work Force (Departmentalization)

Organizing the Workforce

Departmentalization: Grouping people within an organization according to:

1. Functions (Marketing, Finance…)

2. Divisions (Product, geography…)

3. Matrix (both functions and divisions)

4. Network (partners, suppliers…)

Organizing the Workforce

Functional structure: Grouping workers according to the similarity in their skills, resource use, and expertise (Finance, marketing, Operations…)

Divisional structure: Grouping departments according to similarities in product (Coca- Cola), processes (Cemex), customers (Nokia), geography (Multinational companies).

Matrix Structure

!!! Matrix structure: Structure in which employees are assigned to both a functional group and a project team (thus using functional and divisional patterns simultaneously).

Do you know any Matrix-based companies?

![]()

Network Structure

Network structure: A structure in which individual companies (Normally partners and suppliers) are connected electronically to perform selected tasks for a small headquarters organization.

Also called virtual organization. Examples: EPC contractors, Software development company.

Advantages and disadvantages?

Session 11

Micro-Environment Analysis 5 Forces: Attractiveness of Industry

![]()

5 forces: model to analyze industry:

Buyers (bargaining power)

Suppliers (bargaining power)

Rivalry among competitors

Substitutes (threat of substitution)

New Entrants (threat of new entrants and existing entry/exit barriers)

Bargaining Power of Buyers

Premise: Buyers always try to reduce price

Their bargaining power will reduce our profitability IF:

It buys a high percentage of total sales.

It can threaten to buy from others.

It can threaten to self-produce (Zara, Wall Mart, Mercadona)

Bargaining Power of Suppliers

Bargaining power of a supplier is high and will reduce our profitability IF:

There are very few suppliers (Crude Oil)

Its product is unique (De Beers diamonds)

The cost of change to another supplier is high (Oracle) – It can threaten to integrate forward (M&A)

If we are a small buyer

Threat of Substitutes

If there are many substitutes (not competing products) to our product, we cannot raise prices without losing sales (i.e., raw materials, commodities)

If clients can change easily, prices (and profitability) will be low.

Threat of New Entrants

Entry Barriers reduce the threat of new entrants.

Examples of barriers of entry are:

Economies of scale of established companies (Telecoms, Electrical Power Grids,)

Very high entry costs (capital intensive: Oil refinery)

Distribution channels well established protected (Coca-Cola distributors)

Strong differentiation

Rivalry among Competitors

High Rivalry reduces profitability:

If there are many companies in the industry

If the market is not growing (% of market share wars) – If fixed costs are high: overproduction.

If exit barriers are high (airlines)

If little product differentiation

Summary and Conclusions

5 FORCES ANALYSIS (External Microenvironment)

LOW | MEDIUM | HIGH | COMMENTS | |

Buyers (bargaining power) | ||||

Suppliers (bargaining power) | ||||

Rivalry among competitors | ||||

Substitutes (threat of substitution) | ||||

New Entrants (entry/exit barriers) |

CONCLUSIONS (answers MUST be supported)

Is the market attractive?

Is the market friendly? (Will we be welcomed?)Is there room for us?

Macroenvironment:

![]()

Analysis PESTEL:

Political Environment (democracy, wars,)

Economic Environment (crisis, growth,)

Social/Demographic Environment (Aging,) – Technological Environment (Internet, biotech) – Legal Environment (Security, Taxation)

Political (Issues) Environment:

Taxation (Basque Region, Ireland)

Privatization/Nationalizations

Environmental legislation

Security (Argentina-Repsol)

Public Investment-Infrastructure

Stability governments

Economic Environment

Interest rates and inflation

Consumer confidence

Economic cycle (growth or recession)

Unemployment

Gross and per-capita income

Labor legislation and costs

Social Environment

Demography (Japan vs China)

Social values (marriage, one parent families,)

Lifestyles (outdoor vs traditional,)

Tastes and shopping behavior (Malls vs Shops)

Education levels (Norway vs Sudan)

Technological Environment

New products (mp3 vs cd; tablets, smartphones)

Inventions (Hybrid cars)

R+D spending

Information Technology (skype vs phone)

Technological transfers (mobile in Portugal leaps)

Environmental conscience:

Climate change

Natural resources

Recycling regulation

Energy sources

Legal environment:

Labor laws (US vs Spain)

Regulations (Financial market regulation, banking industry)

Tax codes

Summary and Conclusions

PESTEL ANALYSIS (External MACRO Environment)

LOW | MEDIUM | HIGH | COMMENTS | |

POLITICAL | ||||

ECONOMICAL | ||||

SOCIAL | ||||

TECHNOLOGICAL | ||||

ENVIRONMENTAL | ||||

LEGAL |

CONCLUSIONS (answers MUST be supported)

Is the global environment attractive in general terms?

Any medium-high risks to take into consideration

Will they interfere critically in our plans?

Is there a way to mitigate them?

Session 12

Chapter 8 part 2

Team or workgroup: six common forms of teams

Organizing in Team

Team: Unit of two or more people who share a mission and collective responsibility as they work together to achieve a goal. Teams generate synergies.

Types of Teams

The type of Team we select will depend on:

1. Organization’s Strategic Goals (Organizational

Strategy)

2. The specific objective for forming the team (the

objective will define the nature of the team)

Problem-solving team: Meets to find ways of improving quality, efficiency, and the work environment (problem resolution) – They normally have limited life span, they disappear as the problem is resolved.

Self-managed team: Members are responsible for an entire process or operation (requires minimal supervision).

Fully self-managed teams select their own members.

Functional team (aka Vertical Teams): Members come from a single functional department which is based on the organization’s vertical structure.

Cross-functional team (aka Horizontal Teams): Draws together employees from different functional areas.

Task force (short –Term): Team of people from several departments who are temporarily brought together to address a specific issue (e.g., Covid-19 crisis team)

Committee (long-term): Team that may become a permanent part of the organization and is designed to deal with regularly recurring tasks (e.g., quality supervision committee)

Virtual Teams: Composed of members of different geographical locations. Little or none face to face interaction. Challenging but rewarding. (Very typical during project execution phase)

Advantages and/or disadvantages?

Advantages of Working on Teams:

Higher quality decisions

Increased diversity of views

Increased commitment to solutions and changes

Lower levels of stress and destructive internal competition

Improved flexibility and responsiveness

Disadvantages of Working on Teams

Inefficiency – Too much time to decide.

Group thinking – Tendency to think the same.

Diminished Individual Motivation – Diluted Motivation

Structural Disruption inside the organization – Too much power given to the team.

Excessive Workload – Team tasks in addition to existing individual tasks

Characteristics of Effective Teams:

Clear sense of purpose

Open and honest communication

Open to Creative thinking (Open minded)

Accountability to each other

Focus

Decision by consensus

![]() Team Members Assume one of These Roles:

Team Members Assume one of These Roles:

“Dual-Role” are often the most effective team leaders.

What happens as the Team Develops?

Cohesiveness: How committed team members are to their team’s goals

Cohesiveness is reflected in meeting attendance, team interaction, work quality, and goal achievement.

Norms: Informal standards of conduct that guide team behavior

How we do things around here…

Team Conflict: Constructive vs. Destructive

Constructive conflict: Brings issues into the open, increases the involvement of team members, and generates creative ideas for solving a problem.

Destructive conflict: Diverts energy from more important issues, destroys the morale of teams or individual team members, or polarizes or divides the team.

Solutions to Team Conflict

Proactive attention: Deal with minor conflict before it becomes major conflict. (Don’t let problems grow large)

Communication: Get those directly involved in a conflict to participate in resolving it.

Openness: Get feelings out in the open before dealing with the main issues. (be open to people’s points of view)

Research: Seek factual reasons for a problem before seeking solutions. (find the origin of the problems to find a solution)

Flexibility: Don’t let anyone lock into a position before considering

other solutions.

Fair play: Insist on fair outcomes from members.

Alliance: Get opponents to fight together against an “outside force”

instead of against each other.

Managing an Unstructured Organization

Unstructured organization: It doesn’t have a conventional structure but instead assembles talent as needed from the open market; the virtual and networked organizational concepts taken to the extreme

Most services are outsourced and interconnected. Organizations are quickly formed and dissolved as

the company moves forward.

Benefits of Unstructured Organizations for Companies and Worker ![]()

Challenges of Unstructured Organizations

![]()

Session 14 (Asynchronous- Zappos Case)

Read doc word zappos.

Session 16

Chapter 17: Financial information and accounting concepts

Accounting

Accounting: Measuring, (organizing), interpreting, and communicating financial information to support internal and external decision making.

Financial accounting: Preparing financial information for users outside the organization.

Management accounting: Preparing data for use by managers within the organization.

Bookkeeping: recordkeeping: the clerical aspect of accounting.

Accounting is:

Mandatory: legal and tax requirements

Necessary: to understand the company’s health and make management decisions.

Informative: to inform managers and stakeholders about the company’s performance.

Accounting is a language, it has:

A dictionary: plan general contable (spain)

Grammatical rules: accounting principles, GAAP (US)

Private accountants: In-house accountants employed by organizations and businesses other than a public accounting firm; also called corporate accountants.

Public accountants: Professionals who provide accounting services to other businesses and individuals for a fee.

Controller: The highest-ranking accountant in a company, responsible for overseeing all accounting functions.

Certified public accountants (CPAs): Professionally licensed accountants who meet certain requirements for education and experience and who pass a comprehensive examination.

Rules of accounting

GAAP (Generally Accepted Accounting Principles): Standards and practices used by publicly held corporations in the United States and a few other countries in the preparation of financial statements; on course to converge with IFRS.

International financial reporting standards (IFRS): Accounting standards and practices used in many countries outside the United States.

Audit: Formal evaluation of the fairness and reliability of a client’s financial statements.

External auditors: independent accounting firms that provide auditing services for public companies.

Sarbanes-Oxley: Informal name of comprehensive legislation designed to improve the integrity and accountability of financial information. This legislation was passed in the USA in2002 in the wake of several cases of massive accounting fraud (Enron, WorldCom...)

Assets: Any things of value owned or leased by a business.

Liabilities: Claims against a firm’s assets by creditors.

Owners’ equity: The portion of a company’s assets that belongs to the owners after obligations to all creditors have been met.

Accounting equation: assets – liabilities = owner’s equity

Double-entry bookkeeping and matching principle.

Double-Entry Bookkeeping: Method of recording financial transactions that requires a debit entry and credit entry for each transaction to ensure that the accounting equation is always kept in balance.

The Matching Principle: Expenses incurred in producing revenue must be deducted from the revenues they generate during the same accounting period.

Accrual basis: Accounting method in which revenue is recorded when a sale is made, and an expense is recorded when it is incurred: event focused.

Cash basis: Accounting method in which revenue is recorded when payment is received, and an expense is recorded when cash is paid Cash focused.

Depreciation: A procedure for systematically spreading the cost of a tangible asset over its estimated useful life. (an office, car, truck, table, computer...)

Amortization: A procedure for systematically spreading the cost of an intangible asset over its estimated useful life. (a patent, software, author rights...)

!!! Closing the books: Transferring net revenue and expense account balances to retained earnings for the period.

Fiscal year: any 12 consecutive months used as an accounting period (and be different from natural year).

Major financial statements.

3 basic documents:

Balance sheet statement: statement of a firm’s financial position on a particular date.

Income statement: Record of revenues and expenses, and profits-loss over a given period of time.

Statement of cash flow: Cash receipts and cash payments. (Sources and Uses of cash)

Current assets: Cash and items that can be turned into cash within one year (Liquidity).

Fixed assets: Assets retained for long-term use: land, buildings, machinery, and equipment (property, plant, and equipment).

Current liabilities: Obligations that must be met within 1 year (Maturity).

Long-term liabilities: Obligations that fall due more than a year from the date of the balance sheet.

Retained earnings: The portion of shareholders’ equity earned by the company but not distributed to its owners in the form of dividends: net income – dividends.

Revenues: (units x selling price)

Expenses: Costs incurred in the process of generating revenues

Net income: Profit or loss incurred by a firm: Revenues – expenses.

Cost of goods sold: Cost of producing or acquiring a company’s products for sale during a given period.

!!! Gross profit (gross margin): Net sales minus the cost of goods sold.

Operating expenses: Costs of operation that except the cost of goods sold.

!!! EBITDA (Not a GAAP item): Earnings before interest, taxes, depreciation, and amortization.

Ratio analysis.

Ratios: Accounting ratio is the comparison of two or more financial data which are used for analyzing the financial statements of companies. Thay are metrics of performance. Ratios have no value on their own.