Chapter 4

Calculating POP When provided a mutual fund’s NAV and sales charge percentage, the POP can be calculated as the NAV/ (100% - Sales Charge %). Example: If a mutual fund has an NAV of $10 and has a 4% sales charge, the POP = $10 NAV / (100% - 4% sales charge), or $10.42.

Mutual Fund Suitability- When deciding on a mutual fund investment, the investor’s investment objectives are the primary consideration. Fees are of secondary importance. Note that the size of the fund is typically the least important factor. Breakpoint Sale A breakpoint sale is a violation where a registered rep suggests that an investor purchases a mutual fund just below the point at which they would receive a discounted sales charge. For example, if there is a breakpoint at $250,000, suggesting the customer only invest $249,000 is a violation.

Money Market Fund- Money market funds are mutual funds consisting of money market securities, which are debt securities with maturities of one year or less. Because of the nature of the securities they invest in, money market funds are extremely safe and highly liquid. These funds generally attempt to maintain a stable NAV of $1.00 per share, though the price can fluctuate above or below that amount. Investments in a money market fund are least exposed to currency risk as the investments are held in US dollars. They would be subject to inflationary risk.

Average cost basis- Average cost basis is a method used to determine the cost of shares redeemed from a mutual fund or sold from another investment. It is calculated by dividing the total cost of all shares purchased by the total number of shares owned. This is important for tax purposes. When shares are redeemed (or sold depending on the security), investors would need to determine whether they were sold for a profit or for a loss. The difference between the selling price and the average cost basis is the capital gain or loss.

Mutual Fund Dividends- Mutual fund cash dividends are taxable for investors regardless of whether they are taken in cash or reinvested back into the fund. Mutual Fund Board of Directors At least 40% of a mutual fund’s board of directors must be independent, meaning they do not have significant business relationships with the fund.

Impact of Dividends on NAV- The NAV of a mutual fund share will decrease by the amount of the dividend on the ex-date. This is because the fund is paying out cash so the fund’s assets will fall.

ETF vs Mutual Fund Expenses- Because mutual funds are actively managed, they typically have higher fees for investors than ETF

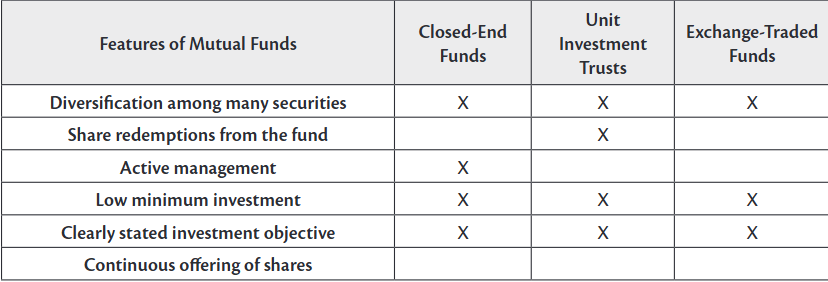

Management investment company—An investment company, such as a mutual fund or closed-end fund, that hires an investment adviser to actively select and manage a securities portfolio to achieve a stated investment goal

◆Mutual fund—A type of management investment company that makes a continuous offering of brand new, redeemable shares to investors, also referred to as an open-end fund

◆Redeemable—A type of investment company security, such as a mutual fund and a unit investment trust, for which there is no secondary market or investor-to-investor trading; instead the security is directly bought from and sold back to the issuer.

◆Net asset value (NAV)—The value of a mutual fund and the basis of what investors pay, calculated as the total assets of the fund minus its total liabilities

◆Forward pricing—The method by which mutual funds calculate the purchase and redemption prices, which are based on the next NAV calculation after the order is received

◆Breakpoints—Offer mutual fund investors discounts off the sales charge based on the dollar amount invested

◆Closed-end fund—A type of investment company that issues exchange-traded shares that reflect actively managed portfolios

◆Unit investment trust (UIT)—A type of investment company that issues redeemable securities representing an undivided interest in a fixed trust, in which there is no active management of the portfolio

◆Exchange-traded fund (ETF)—An exchange-traded investment company that is designed to closely track the performance of a specific benchmark, sector, or index

Open-end investment company securities, which are also known as mutual funds, are the most popular type of investment company security. Each fund must have a clearly defined investment objective. This investment objective can only be changed by a majority vote of the fund’s outstanding shares

for open ended funds- POP = (NAV + sales charge)

The custodian is an institution that acts as the caretaker of the fund’s securities. It holds in safekeeping all of the securities purchased by the investment company for its portfolio.

Transfer Agent- Mutual funds contract a transfer agent to handle transactions with customers. The transfer agent’s responsibilities include the following:

◆Issuing, redeeming, and cancelling fund shares

◆Handling the distribution of dividend and capital gains to shareholders, and

◆Sending out trade confirmations when shares are purchased or sold

The board of directors hires an investment adviser to take responsibility for the following:

◆Invest the cash and securities held in the fund’s portfolio

◆Implement the objectives outlined by the board, and

◆Manage day-to-day trading of the portfolio

The fund contracts a sponsor, also called a distributor or an underwriter, to sell its shares. The sponsor has an annually renewable written contract with the mutual fund company that permits it to buy shares from the fund at net asset value.

There are two main types of mutual funds: actively managed funds and index funds.

In an actively managed fund, a fund seeks to exceed the average returns of the market through security selection and trading activity.

Index mutual funds are passively managed and operate with limited trading activity. These will be discussed later in this section.

When a UIT reaches the termination date specified at its creation, the trust

May be either liquidated or extended as determined by the board of directors of the trust.

Is dissolved and no longer active.

Correct Answer: A UIT is created for a specified period of time. Its termination date is established at the time the trust is created, and the trust is dissolved when that date is reached.

Can refile with the SEC for a subsequent primary offering.

Is sold and proceeds are retained by the UIT sponsor.

A mutual fund is best described as which two of the following?

I. an open-end investment company

II. a closed-end investment company

III. a security that is exempt from the provisions of the Securities Acts of 1933 and 1934

IV. a security that is subject to the provisions of the Securities Acts of 1933 and 1934

Correct- I & IV

An investor is interested in an investment opportunity in which he can have an ownership interest in a specific portfolio of bonds for the next 20 years, and does not have to pay high management fees. Which of the following investments is most suitable?

A closed end bond fund, a fixed income mutual fund, a structured note, units in a bond UIT

Correct: Units in a bond UIT: Unit investment trusts hold a specified portfolio of investments for a defined period that is established at the creation of the trust. Because their portfolios are fixed, investors are not subject to high management fees.

An investor is interested in purchasing an interest in a diversified portfolio of domestic and international securities at a "cheap" price. Which of the following investment opportunities may be appropriate for this investor?

Shares of a global market index fund available at a POP of $5.00

Shares of an international equity closed-end fund priced at $13.33 when the NAV is $13.32

A purchase of world bond open ended fund at the price next calculated

Shares of a global income fund with an NAV of $17.01 but trading at current price of $16.44. The purchase of closed-end fund shares when they are trading at a discount from their NAV is seen as an opportunity to buy assets more cheaply than their calculated value. Mutual fund shares must be purchased at their POP, so this opportunity is available only with closed-end or ETF fund shares.

current price of $16.44

Which fund continuously issues and redeems shares based on investor demand?

A: Open-End Fund

Mutual fund shares are offered through continuous public offerings,

Mutual funds are a popular choice among investors because of the features they offer. Major selling points include:

◆Professional management—Fund managers do the research, select the securities, and monitor the performance.

◆Diversification—Because they invest in a range of companies and industries, mutual funds keep investors from putting all of their eggs in one basket. This helps spread risk and protect the shareholders from the failure of a single company.

◆Affordability—Most mutual funds can be purchased for a relatively low dollar amount for both initial investment and subsequent purchases.

◆Liquidity—Mutual fund shares can be easily redeemed at any time for the current net asset value (NAV) plus any redemption fees. Shareholders will receive the price that is next calculated when they make a redemption request.

Flashcard 2

Q: Which fund has a fixed number of shares traded on an exchange?

A: Closed-End Fund

Flashcard 3

Q: How are Open-End Fund shares priced and transacted?

A: Priced at NAV once per day; purchased and redeemed directly with the fund

Flashcard 4

Q: How are Closed-End Fund shares priced and transacted?

A: Priced by market supply/demand; bought/sold on exchanges at market price (which may differ from NAV)

Flashcard 5

Q: What types of securities can each fund issue?

A: Open-End: Common shares only

Closed-End: Common, preferred, and debt securities

Flashcard 6

Q: What share classes and fees are common in each fund type?

A: Open-End: A, B, C shares with 12b-1 fees

Closed-End: Single share class with brokerage commissions; no 12b-1 fees

Flashcard 7

Q: Which fund permits short selling and margin purchases?

A: Closed-End Funds (Open-End Funds do not)

Which investment vehicles offer a continuous primary offering to investors?

A: Mutual Funds only

Flashcard 2

Q: Which fund types issue a fixed number of shares/units through an IPO?

A: Closed-End Shares, UITs, and ETFs

Flashcard 3

Q: Which products allow redemption of shares at NAV?

A: Mutual Funds and UITs

Flashcard 4

Q: Which fund types trade on an exchange?

A: Closed-End Shares and ETFs

Flashcard 5

Q: Which products typically have an actively managed portfolio?

A: Mutual Funds and Closed-End Shares

Flashcard 6

Q: Which products typically have a fixed portfolio?

A: UITs and ETFs

Flashcard 7

Q: Which investment vehicles have a stated termination date?

A: UITs only

Flashcard 8

Q: Which of the following distribute dividends and capital gains to investors?

A: Mutual Funds, Closed-End Shares, UITs, and ETF