1. Sensitivity Analysis

Page 1: Introduction to What-if Analysis

Topic: What-if Analysis (Sensitivity Analysis) for Linear Programming

Instructor: Rim Jaber

Course: ADM2302

Page 2: Understanding the Assumptions

Assumption: Model parameters are known with certainty.

Reality: Model parameters are estimates and can change.

Example: Referring to the RMC Problem for context.

Page 3: The RMC Example

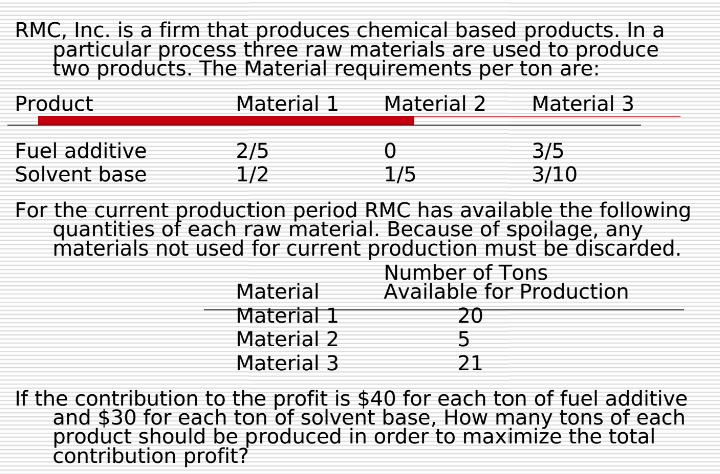

Company Overview: RMC, Inc. produces chemical-based products using three raw materials for two products.

Material Usage per Product:

Fuel Additive:

Material 1: 2/5 tons per ton

Material 2: 0 tons

Material 3: 3/5 tons per ton

Solvent Base:

Material 1: 1/2 tons per ton

Material 2: 1/5 tons per ton

Material 3: 3/10 tons per ton

Available Material for Production:

Material 1: 20 tons

Material 2: 5 tons

Material 3: 21 tons

Profit Contribution:

Fuel Additive Profit: $40/ton

Solvent Base Profit: $30/ton

Goal: Determine tons of each product to maximize total profit.

Solution:

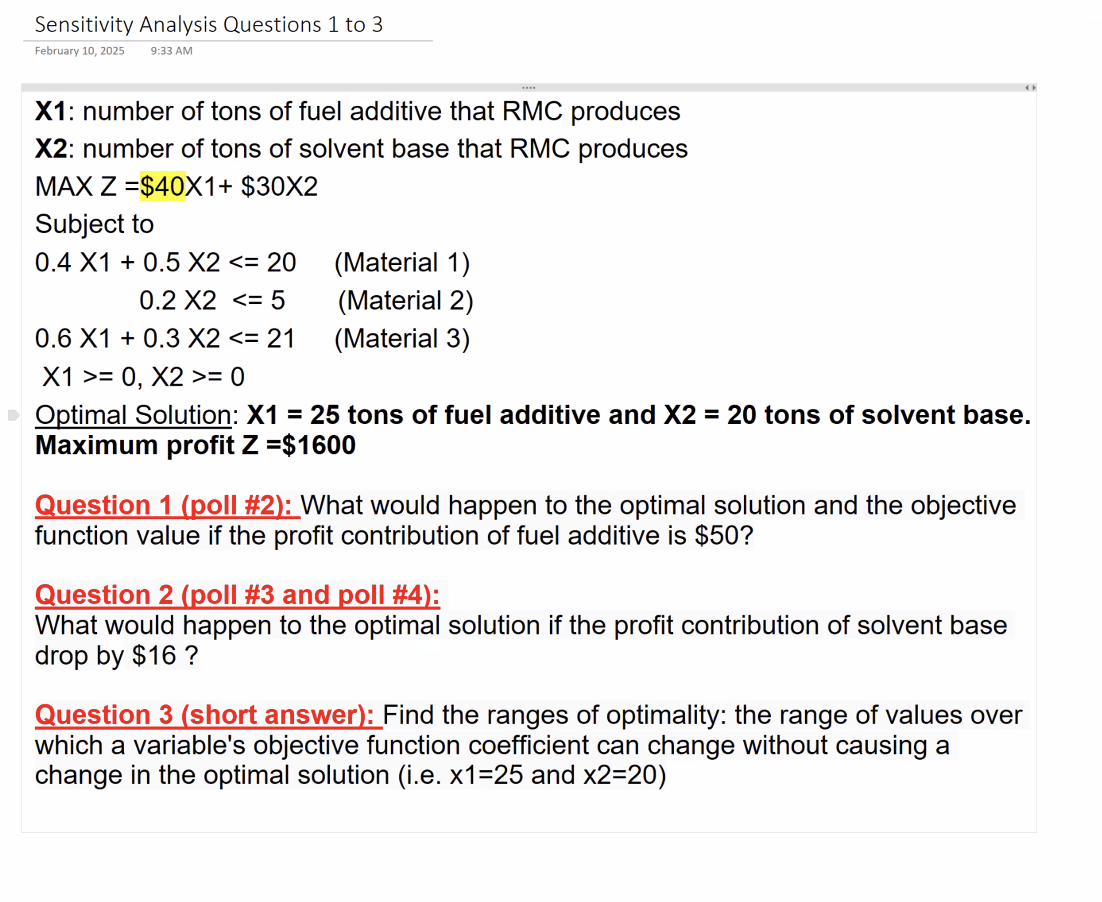

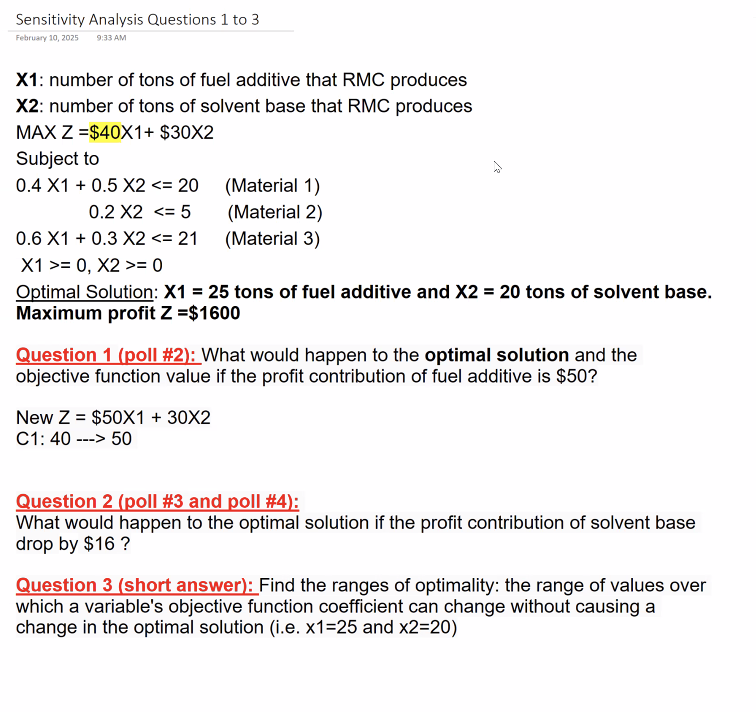

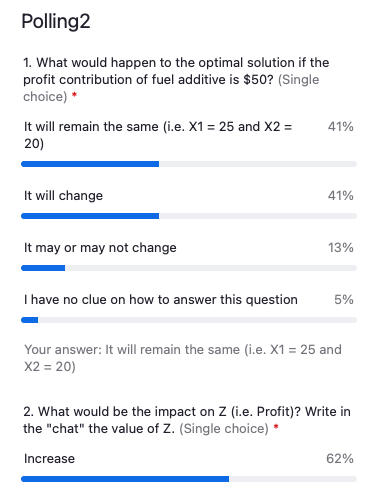

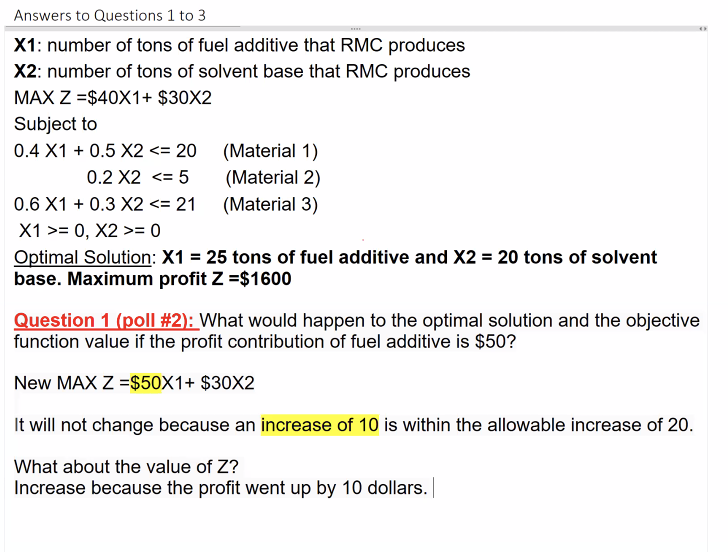

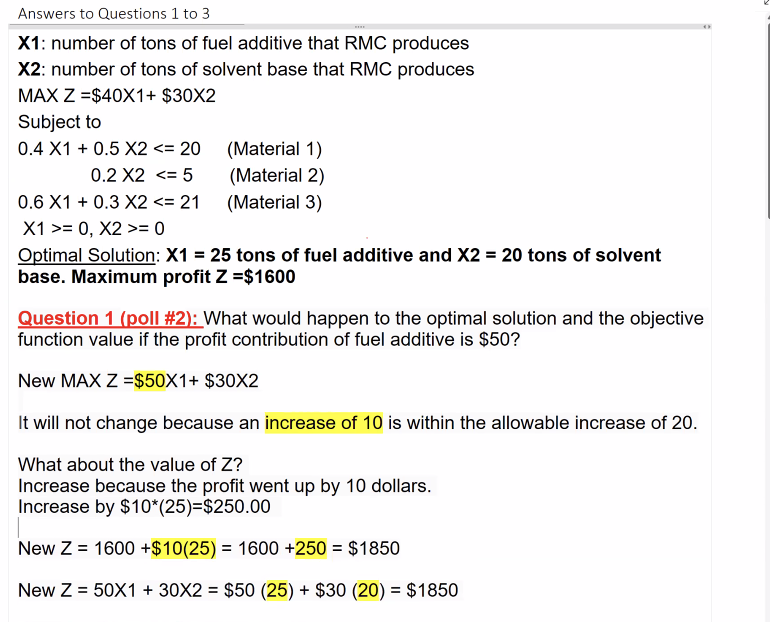

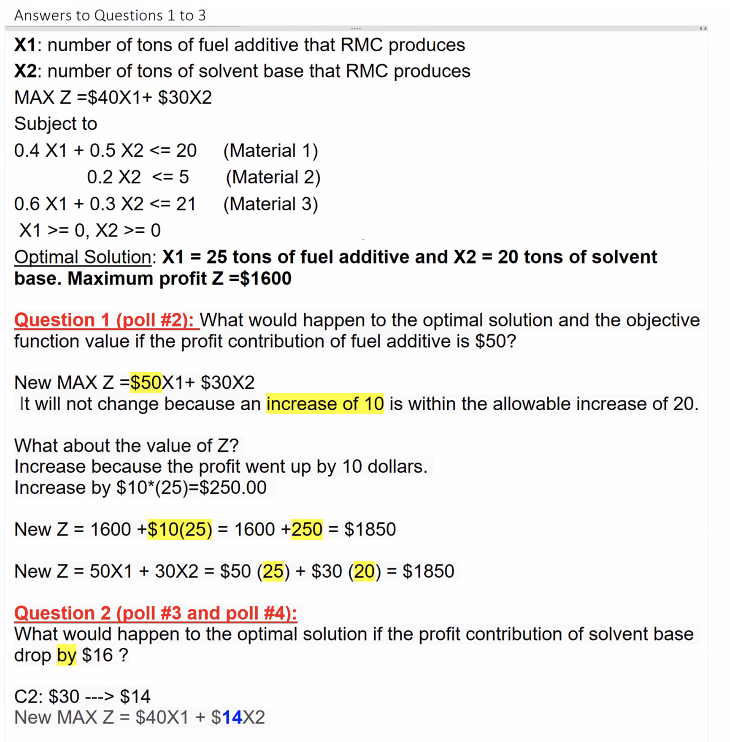

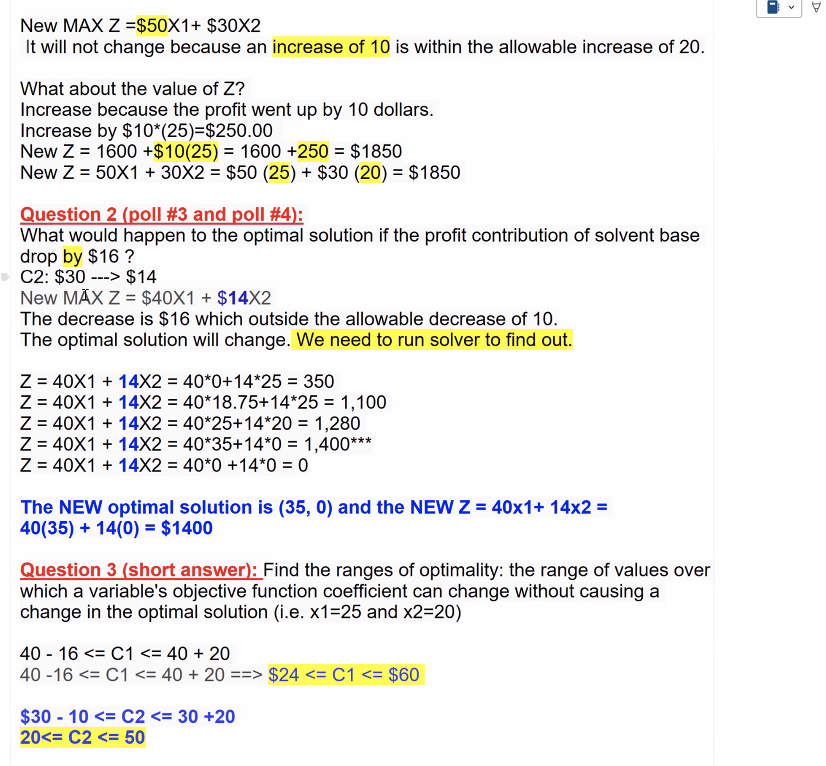

it will remain the same because between $40 and $50 there is a change of 10 which is allowable because it is within the allowable increase of 20 (0.4X1+0.5X2<=20)

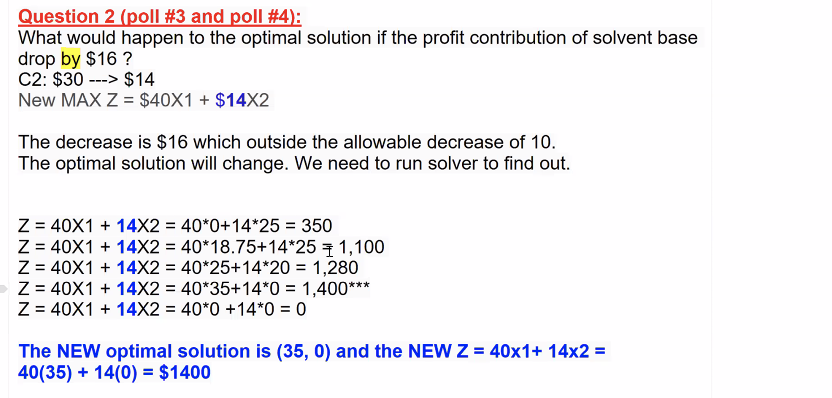

The new optimal solution would now be (35,0) because the profit contribution of solvent based has dropped (Q2)

if we change binding constraints then the corner points would change

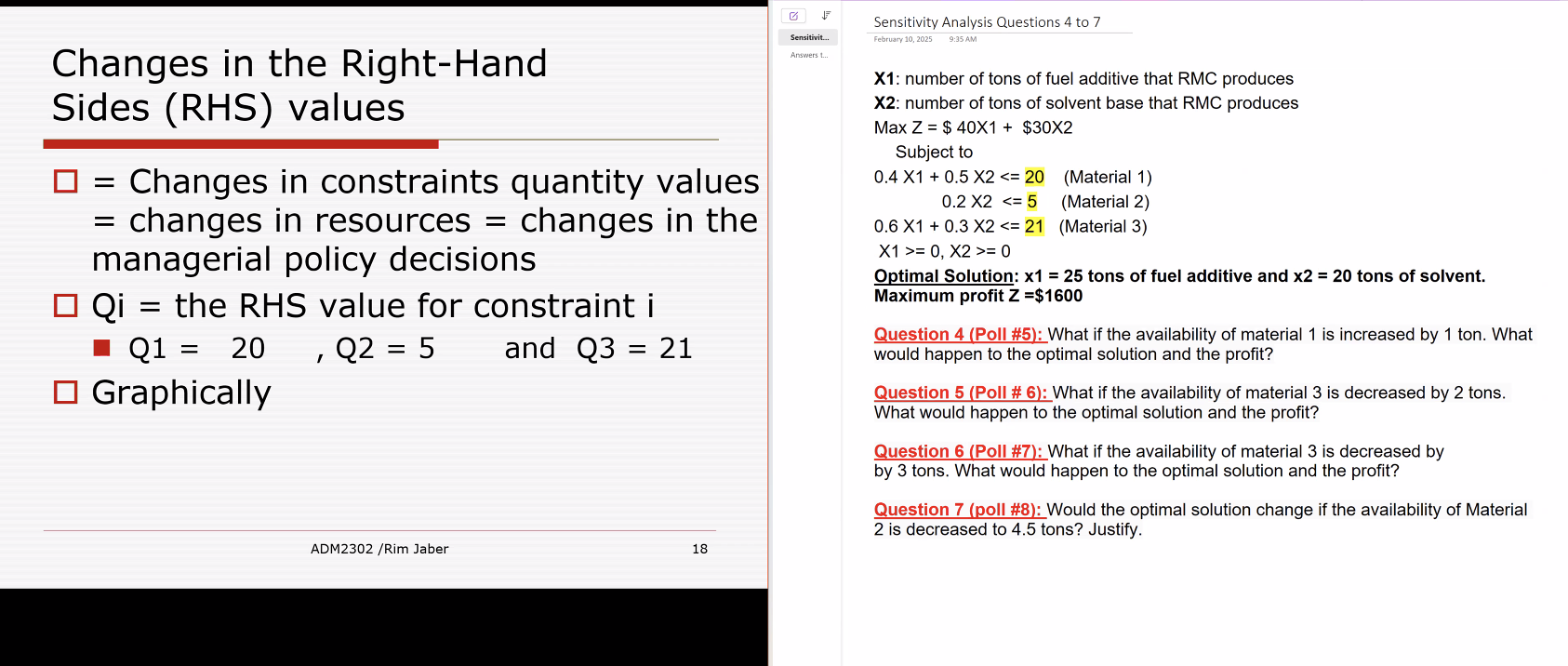

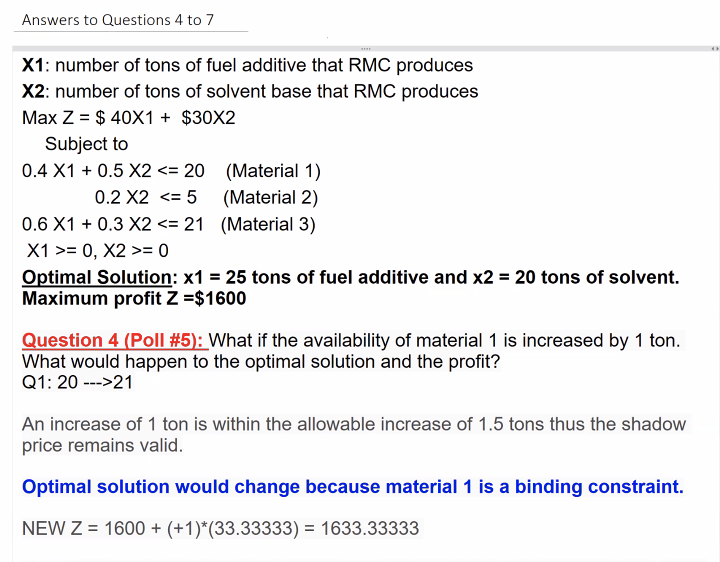

Page 4: Formulation of RMC Problem

Objective Function:

Maximize Z = $40 * x1 + $30 * x2

Constraints:

(2/5)x1 + (1/2)x2 ≤ 20 (Material 1)

(1/5)x2 ≤ 5 (Material 2)

(3/5)x1 + (3/10)x2 ≤ 21 (Material 3)

x1 ≥ 0, x2 ≥ 0

Variables:

x1: tons of fuel additive

x2: tons of solvent base

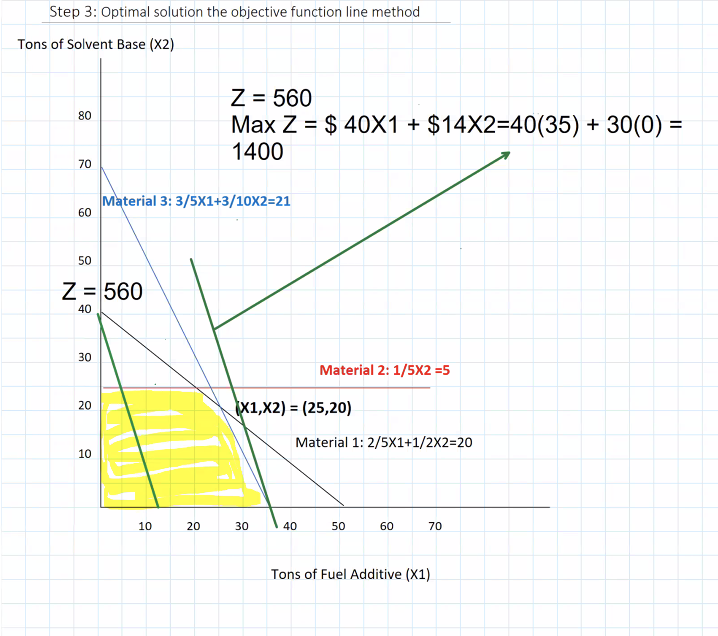

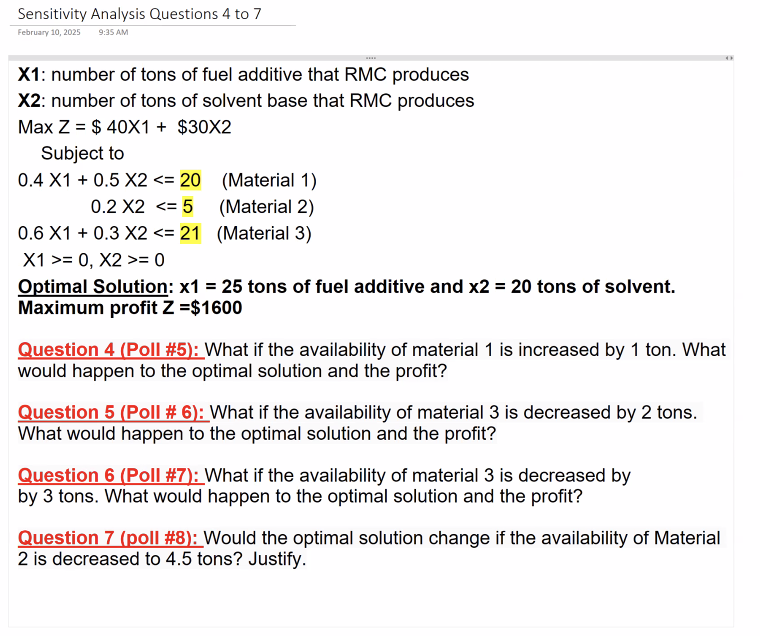

Page 5: The Feasible Region

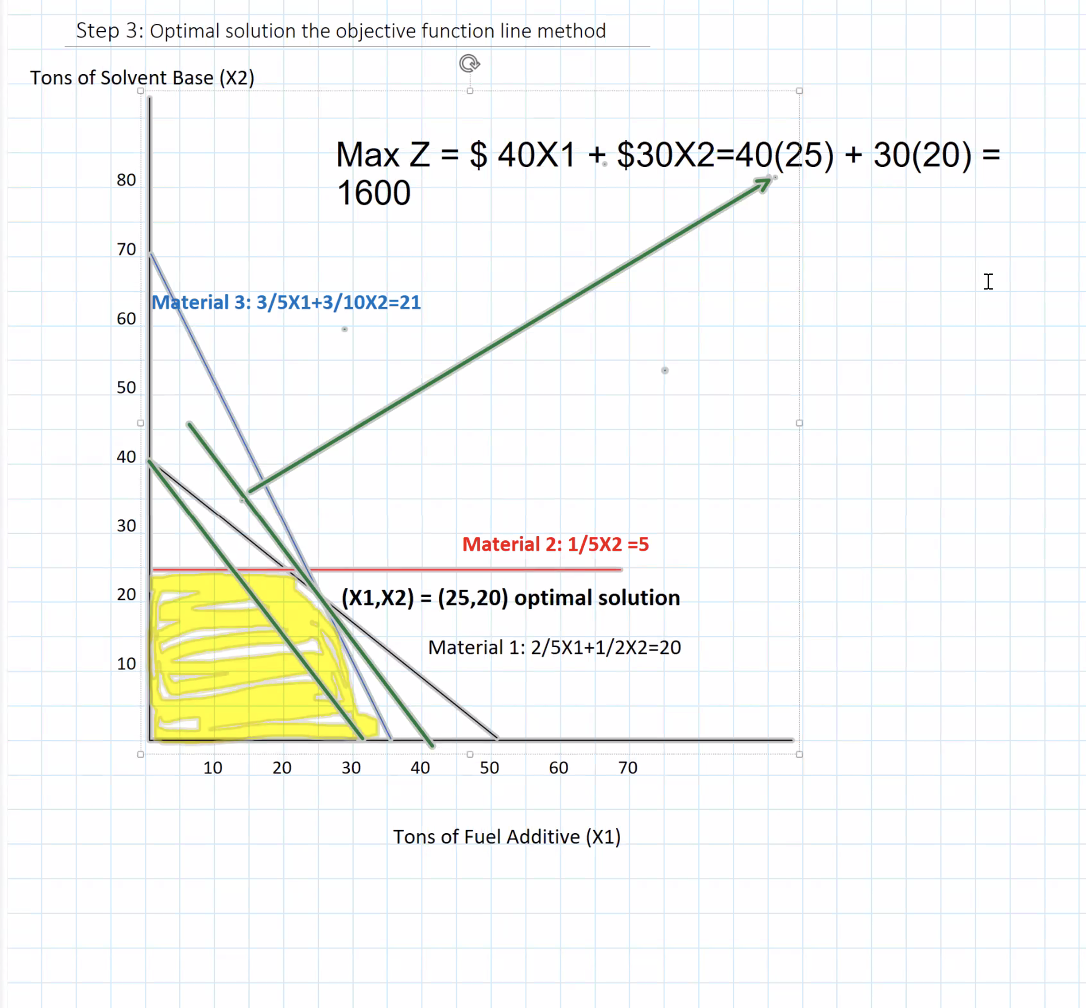

Graph:

x1 on horizontal axis

x2 on vertical axis

Constraints represented as lines:

2/5x1 + 1/2x2 = 20

1/5x2 = 5

3/5x1 + 3/10x2 = 21

Page 6: Finding Optimal Solution

Corner Points Identified:

(25, 20), (18.75, 25), (0, 25), (0, 0), (35, 0)

Optimal Solution using Corner Point Method:

Calculation of Z for each point

Page 7: Optimal Solution Analysis

Calculated Values of Z:

Z(25, 20) = $750

Z(18.75, 25) = $1500

Z(0, 25) = $0

Z(35, 0) = $1400

Z(25, 20) = $1600

Optimal Solution Found: at (25, 20)

Page 8: Objective Function Line Method

Maximum Isoprofit Line:

Represented as Z = $1600

Optimal Solution Point identified at (25, 20)

Page 9: Developing a Spreadsheet Model

Spreadsheet Reference: RMC_Problem.xlsx

Formula Examples:

fx =SUMPRODUCT(B5:C5,$B$3:$C$3)

Variables in Spreadsheet:

D5: Solution

D8 to D10: Material constraints analyzed

Page 10: Objective Cell Summary

Profit Totals:

Original: $0

Final Value: $1,600

Variable Cells:

x1 (Fuel Additive): 0 to 25

x2 (Solvent Base): 0 to 20

Binding Constraints Identified:

Material 1: Binding

Material 2: Not Binding

Material 3: Binding

Page 11: Sensitivity Report Overview

Variable Cells Summary:

Final Value, Reduced Cost, Objective Coefficient

Allowable increase/decrease for x1 (fuel additive) and x2 (solvent base)

Constraints Analysis: Shadow price evaluations

Page 12: What-if Analysis Explanation

Definition and Purpose: Sensitivity analysis questions the effect of parameter changes on optimal solutions

Page 13: Outline of Analysis Topics

Changes in Objective Functions Coefficients

Changes in Right-Hand Sides (RHS) Values

Shadow Prices

Range of Feasibility

Simultaneous Changes

Reduced Costs

Pricing out New Variables

Page 14: Changes in Objective Functions Coefficients

Understanding Coefficients (both are found from the objective function):

c1 for x1 (c1=40)

c2 for x2 (c2=30)

Goal of Sensitivity Analysis:

Determine range of c that keeps the current solution optimal.

Page 15: Graphical Analysis of Coefficient Changes

Implication: Objective function coefficients do not affect feasible region size (the only thing that happens when changing the coefficients is a change in the slope of the objective function)

Range of Optimality:

x1: 24 ≤ c1 ≤ 60

x2: 20 ≤ c2 ≤ 50

Page 16: Impact on Value of Z

Zero value decision variable: Non-use does not change Z

Non-zero value decision variable: Affects Z positively or negatively

Page 17: Unit Profit Estimates

Question and Answer: What if profit estimates are inaccurate? A wide range of values ensures likely optimal solution integrity

Page 18: Changes in RHS Values

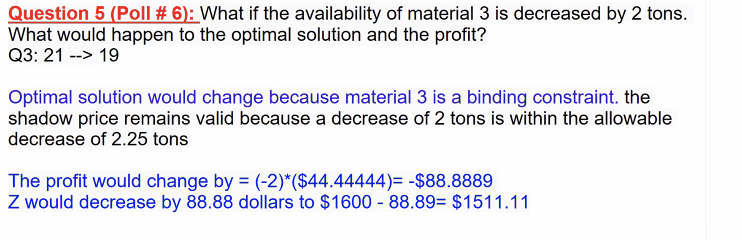

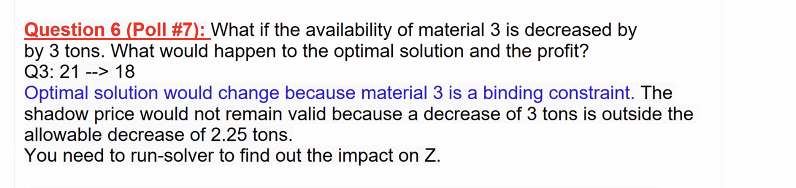

Impact of Changes in Constraints: Affect feasible region and optimal solution value

RHS Values: e.g., Q1 = 20, Q2 = 5, Q3 = 21

Page 19: Optimal Solution Assessment

Optimal Points: Evaluating through graphical representation

Page 20: Shadow Price Definition and Calculation

Understanding Shadow Prices:

Increase profits per additional resource unit

How to Determine: Increase RHS in spreadsheet, solve anew

Page 21: Shadow Prices in Context

Definitions:

Marginal profit & max price willing for resources

Profit decreases by 1 unit reduction

Page 22: Purpose of RHS Value Analysis

Objective: Examine small changes in RHS and their impact

Page 23: Range of Feasibility with RHS

Value Ranges:

Q1: 14 ≤ Q1 ≤ 21.5

Q2: 4 ≤ Q2

Q3: 18.75 ≤ Q3 ≤ 30

Page 24: Changes Analysis of Binding vs Non-Binding Constraints

Impact: Changes in binding constraints change optimal solution; non-binding do not affect profit unless within range

Page 25: Simultaneous Changes in Coefficients

Purpose: Determine potential changes in optimal solution under multiple coefficient changes simultaneously

Page 26: 100 Percent Rule for Objective Function Coefficients

Application: Total allowable changes must not exceed 100% to maintain optimal solution

Page 27: Example of 100 Percent Rule

Illustration: c1 and c2 adjustments confirmed the stability of the current optimal solution

Page 28: Example of Exceeding 100 Percent Rule

Outcome: Re-evaluate optimal solution needs resolving due to rule breach

Page 29: 100 Percent Rule for RHS

Sum of changes: Assess RHS adjustments under feasibility ranges

Page 30: Class Discussion Summary

Topic Validity and Examples discussed

Page 31: Reduced Cost Interpretation

Concept: Explanation of reduced costs for unused activities; relevant for analysis and strategy

Page 32: Indicator of Multiple Optimal Solutions

Criteria: Identifying zero optimal values and implications for solution stability

Page 33: Evaluating New Variables Introduction

Sensitivity Report uses: Assessing the impact of variable changes on current production

Page 34: Proposing New Products for Production

Example Evaluation of Ultra Base with material consumption and profit contribution

Page 35: Opportunity Cost Analysis

Checking shadow price validity; guiding production decisions based on opportunity cost assessment

Page 36: Additional Discussions from Class

Summary of solutions discussed in-depth during sessions

Page 37: Summary of Sensitivity Reports (Objective Function Coefficients)

Final Values: Review usage and changes in objective coefficients

Allowable Changes: Define operational ranges for coefficients

Page 38: Summary of Sensitivity Reports (Right-Hand-Sides)

Final Values and Shadow Prices: Implications for resource adjustments and their operational impact.