Exemption Clause

Key Term: Exemption Clause

Definition: A term in a contract that seeks to exclude or limit liability for breach of contract or negligence.

Common Locations: Found in standard form contracts, car parks, supermarkets, swimming pool changing rooms, train tickets.

Purpose of Exemption Clauses

Excludes claims related to defects or limits liability to the price of goods.

Raises fairness concerns, especially for parties with no choice but to accept them.

Courts review the whole contract to establish the parties' intention.

Determining Binding Nature of Exemption Clauses

Rules of Incorporation: How clauses are introduced into contracts.

Contra Proferentem Rule: Ambiguities are interpreted against the drafting party.

Statutory Limitations: Governed by the Unfair Contract Terms Act 1977 (UCTA) and Consumer Rights Act 2015 (CRA).

Incorporation Methods

By Signature

Generally binding regardless of reading.

Key Case: L'Estrange v Graucob (1934) - Signing binds to the contract terms unless fraud or misrepresentation occurs.

Exception: Curtis v Chemical Cleaning Co (1951) - Misrepresentation can invalidate the clause even if signed.

Reasonable Notice

Must be clearly brought to the attention of the other party before or at contract formation.

Key Cases:

Parker v South Eastern Railway Co (1877) - Reasonable notice found through ticketing.

Olley v Marlborough Court Hotel (1949) - Timing of notice and contract formation matters.

Chapelton v Barry UDC (1940) - Tickets presented like a receipt cannot exclude liability.

Previous Course of Dealings

Relevant if there's a consistent history between the parties.

Key Cases:

Spurling v Bradshaw (1956) - History creates assumptions of terms.

Hollier v Rambler Motors (1972) - Infrequent dealings insufficient to assume incorporation.

Contra Proferentem Rule

Ambiguous clauses are interpreted against the party seeking to rely on them.

Key Cases:

Houghton v Trafalgar Insurance Co Ltd (1954) - Ambiguity favoured the insured.

Andrews Brothers Ltd v Singer & Co Ltd (1934) - Ambiguous terms limiting liability were narrowly interpreted.

The rule is less strict in commercial contracts but still strong for consumer contracts (s69 CRA).

Statutory Limitations on Exemption Clauses

Unfair Contract Terms Act 1977 (UCTA):

S2(1): No exclusion for death or personal injury caused by negligence.

S2(2): Clauses limiting liability for other types of loss must be reasonable.

S11: Introduces a reasonableness test, where the party inserting the clause must demonstrate reasonableness.

Consumer Rights Act 2015 (CRA):

Protect consumers in contracts with traders.

S31: No exclusion for implied terms.

S57: Prohibits limiting liability for service-related implied terms.

S62: Fairness requirement for consumer contract terms, ensuring they do not create a significant imbalance.

S65: Absolute prohibition on excluding liability for death or personal injury due to negligence.

Evaluation of Protections

Combined common law and statutory protections create a robust system for consumers, ensuring clauses are clear, reasonable, and fair. This balance allows businesses to limit risks while safeguarding consumer rights.

Case Authorities

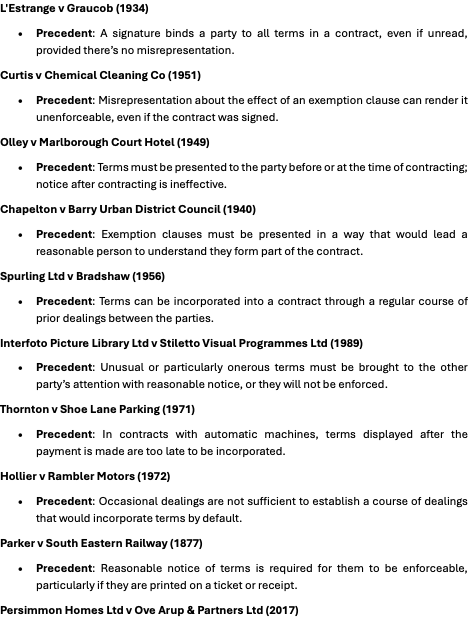

L'Estrange v Graucob (1934)

Precedent: A signature binds a party to all terms in a contract, even if unread, provided there’s no misrepresentation.

Curtis v Chemical Cleaning Co (1951)

Precedent: Misrepresentation about the effect of an exemption clause can render it unenforceable, even if the contract was signed.

Olley v Marlborough Court Hotel (1949)

Precedent: Terms must be presented to the party before or at the time of contracting; notice after contracting is ineffective.

Chapelton v Barry Urban District Council (1940)

Precedent: Exemption clauses must be presented in a way that would lead a reasonable person to understand they form part of the contract.

Spurling Ltd v Bradshaw (1956)

Precedent: Terms can be incorporated into a contract through a regular course of prior dealings between the parties.

Interfoto Picture Library Ltd v Stiletto Visual Programmes Ltd (1989)

Precedent: Unusual or particularly onerous terms must be brought to the other party’s attention with reasonable notice, or they will not be enforced.

Thornton v Shoe Lane Parking (1971)

Precedent: In contracts with automatic machines, terms displayed after the payment is made are too late to be incorporated.

Hollier v Rambler Motors (1972)

Precedent: Occasional dealings are not sufficient to establish a course of dealings that would incorporate terms by default.

Parker v South Eastern Railway (1877)

Precedent: Reasonable notice of terms is required for them to be enforceable, particularly if they are printed on a ticket or receipt.

Persimmon Homes Ltd v Ove Arup & Partners Ltd (2017)

Precedent: In commercial contracts, contra proferentem is applied less strictly, particularly if the parties are of equal bargaining power.

Chapelton v Barry UDC (1940)

Precedent: An exclusion clause on a ticket is ineffective if it is not made clear that the ticket forms part of the contract terms.

Henderson v Stevenson (1875)

Precedent: Terms must be clearly indicated on the face of a ticket or receipt to be binding, establishing transparency requirements.