Economics 12HL Unit 4

The Global Economy

Gains from trade (5/8/24)

international trade → buying and selling goods/services across international borders

impacts GDP calculations (exports → X, imports → M)

GDP=C+I+G+X-M

countries export products when the domestic price is lower than the world price (Pd<Pw)

30 = quantity demanded domestically

50 = quantity supplied domestically

there is a surplus as quantity supplied exceeds quantity demanded (at the world price) which causes the country to export the surplus (20)

countries import products when the domestic price is higher than the world price (Pd>Pw)

90 = quantity demanded domestically

20 = quantity supplied domestically

there is a shortage as quantity demanded exceeds quantity supplied (at the world price) which causes the country to import the shortage (70)

free international trade (free trade) → trade without any restrictions

no government intervention

effects:

maximizes competition

provides most benefits

benefits from international trade

producers

greater efficiency

access to capital

access to more/better resources

access to larger markets

economies of scale

consumers

lower prices

competition increases supply and incentivizes efficiency

greater choice

access to more/better products (not always better)

countries

foreign exchange

efficiency in resource allocation

specialization

do what you do best and trade for the rest

increased economic growth

access to technology, skills, ideas

peace

Absolute and Comparative advantage (6/8/24)

absolute advantage → ability of one country to produce a good using fewer resources than another country

that country can produce more of a good than another country when given the same resources

theory of absolute advantage (Adam Smith) → specialization and trade make countries better off

allows for increased competition in both countries

point E and point F → with trade

both countries consume more than they would have been able to produce

comparative advantage → ability of one country to produce a good at a lower opportunity cost than another country

lower relative cost

theory of comparative advantage (David Ricardo) → all countries can benefit from specialization and trade

allows for increased consumption in both countries

applicable even when one country has absolute advantage in both goods

limitations: (7/8/24)

interferes with necessary structural changes over time

developing countries need to transition out of the primary sector

primary sector → low value added so low income (ex: agriculture)

excessive specialization is risky

overspecialized countries are vulnerable to unforeseen changes

depends upon unrealistic assumptions

factors of production are assumed to be fixed

labour and capital are mobile

education and training affects quality

technology is assumed to be fixed

employment of resources is assumed to be full

free trade is assumed

products are assumed to be homogenous

transportation costs are ignored

law of comparative advantage → results in greater global output and consumption beyond the PPC

only works when either one country has one absolute advantage and/or countries face different opportunity costs

both countries consume more than they could have produced (cottonia at B, microchippia at A)

case of parallel PPCs

one country has absolute advantage in the production of both goods

both countries face equal opportunity costs in the production of both goods

comparative advantage does not exist → no benefit to specialization and trade

very unusual

sources of comparative advantage (7/8/24)

differences in factor endowments (factors of production)

used in manufacturing

helps determine what a country should specialize in

differences in levels of technology

impacts efficiency and productivity

Tariffs (12/8/24)

trade protection → government intervention in international trade

use of trade restrictions (trade barriers)

prevention of imports (despite comparative disadvantage)

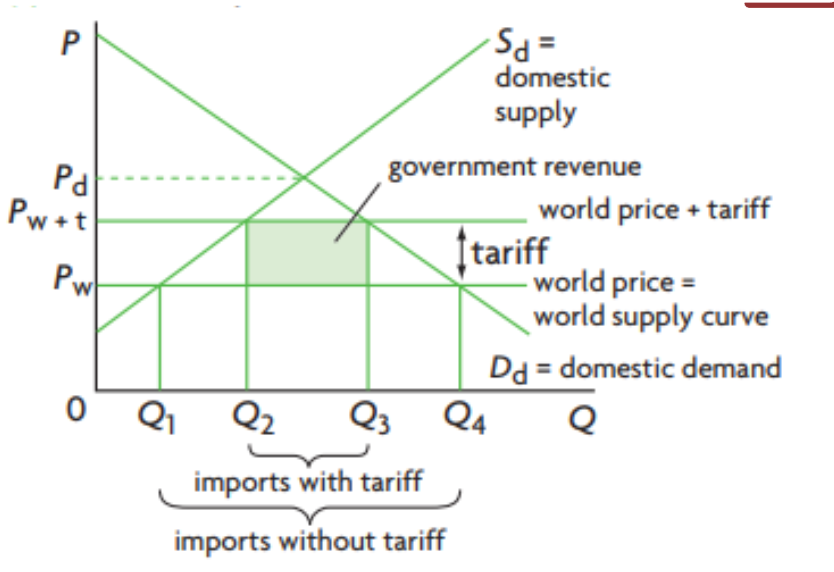

tariff → tax on imported goods (customs duties)

most common form of trade restriction

protects domestic industries from foreign competition → inefficiency

generates tax revenue (government)

winners → less efficient domestic producers, efficient domestic producers, domestic employment, foreign producers, domestic income

losers → domestic consumers, foreign producers, domestic income distribution (regressive tax), global efficiency, resource allocation

regressive tax → same % tax but greater % of income depending on income level

ex: $100 tax is different %income for different people

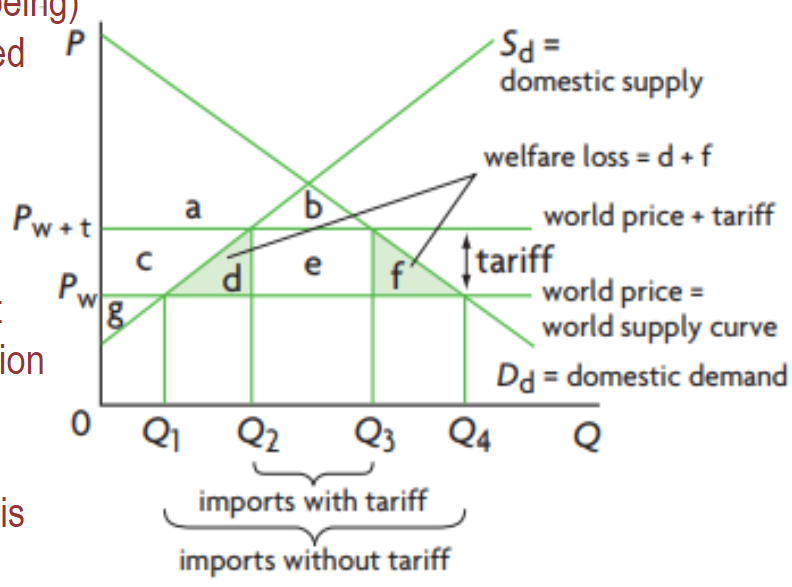

welfare effects (economic well-being)

consumer surplus (CS) → reduced

transferred to government, producers, or just lost due to inefficiency and reduced consumption

producer surplus (PS) → increased

taken from consumers

social surplus is reduced (total)

was → CS=a+b+c+d+e+f, PS=g

now → CS=a+b, PS=c+g. DWL (deadweight loss)=d+f, government revenue=e

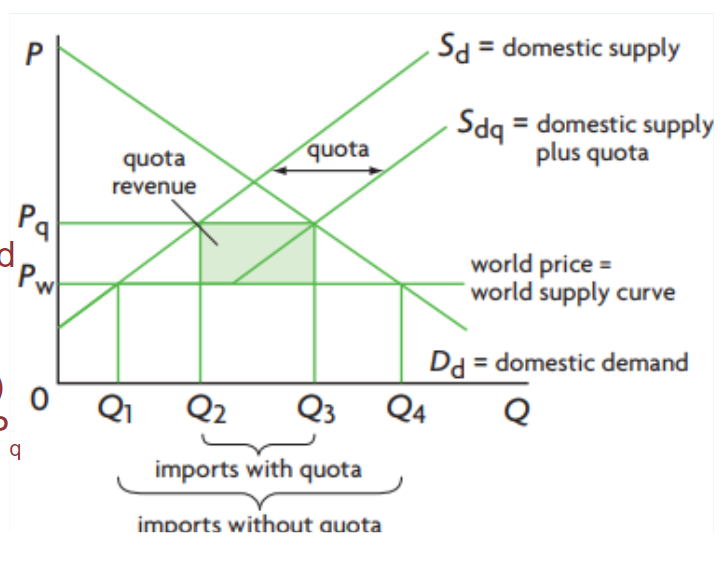

Import Quotas (13/8/24)

legal limit on imports

limits quantity of a certain good over a particular period of time (ex: 1 year)

limits foreign competition for domestic industries

government issues a limited amount of “import licenses”

not license like driving license, more like tickets

recipients gain quota revenues (quota rents)

importers buy at Pw and sell at Pd (Pd>Pw) OR were selling at Pw and are now selling at Pd (foreign producers)

winners → efficient domestic producers, less efficient domestic producers, domestic employment, holders of licenses

losers → domestic consumers, domestic income distribution, global efficiency, resource allocation

neutral → government

no revenue generated, unlike tariffs

uncertain: foreign producers

might balance out (wins and losses)

Pd>Pw, but less quantity can be imported → depends if they have a license

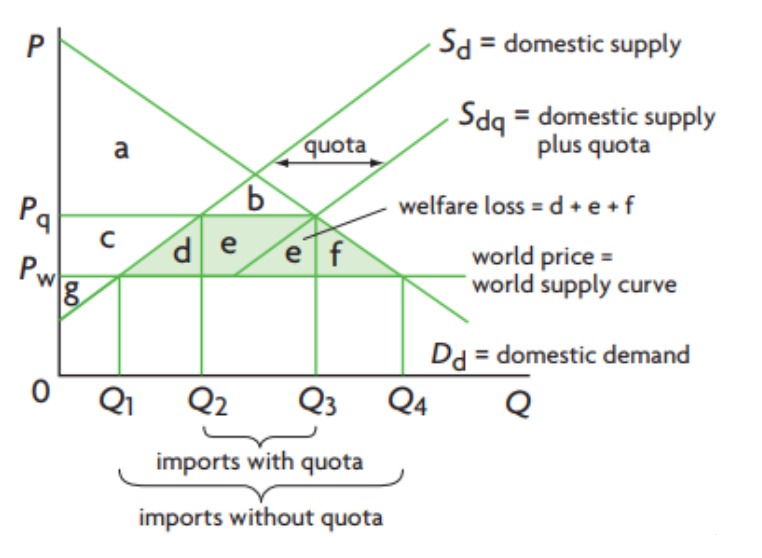

welfare effects (economic well-being)

CS is reduced

PS increases

was → CS=a+b+c+d+e+f, PS=g

now → CS=a+b, PS=c+g, DWL=d+e+f

DWL comes from inefficiency and reduced consumption

social surplus is reduced

Tariffs and Quotas (14/8/24)

tariff VS quota

same but tariffs generate tax revenues (less DWL)

therefore tariff > quota

tariffs

domestic consumers: higher price, lower quantity (-)

domestic producers: higher price, increased quantity (+)

government: increased revenue (+)

foreign producers: decreased quantity sold (-)

welfare loss: inefficiency and reduced consumption (-)

import quotas

domestic consumers: higher price, lower quantity (-)

domestic producers: higher price, increased quantity (+)

government: no impact (…)

foreign producers: higher price (?), decreased quantity (?)

welfare loss: inefficiency and reduced consumption and reduced CS (-)

same as tariff but it moves the supply curve, not the price (price moves with supply)

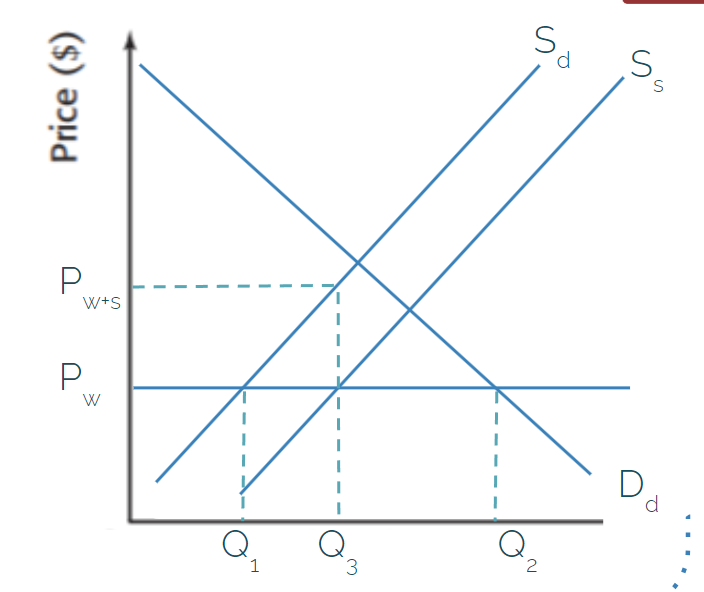

Production Subsidies (15/8/24)

subsidy → payment by the government to a firm for each unit of output produced

production subsidy → protects domestic firms from foreign competition

export subsidy → protects domestic firms that export to foreign countries

subsidy is the effect of production, not the cause (incentivizes)

production subsidy → protectionist measure that pays domestic firms for each unit of output produced

allows firms to remain competitive against imports

domestic consumers pay Pw, domestic firms receive Pw+s

shifts the product supply curve

by the amount per unit subsidy

all output for domestic market only

winners: efficient domestic producers, less efficient domestic producers, domestic employment

losers: foreign producers, government budget, taxpayers, global efficiency, resource allocation

neutral: domestic consumers

face the same price regardless

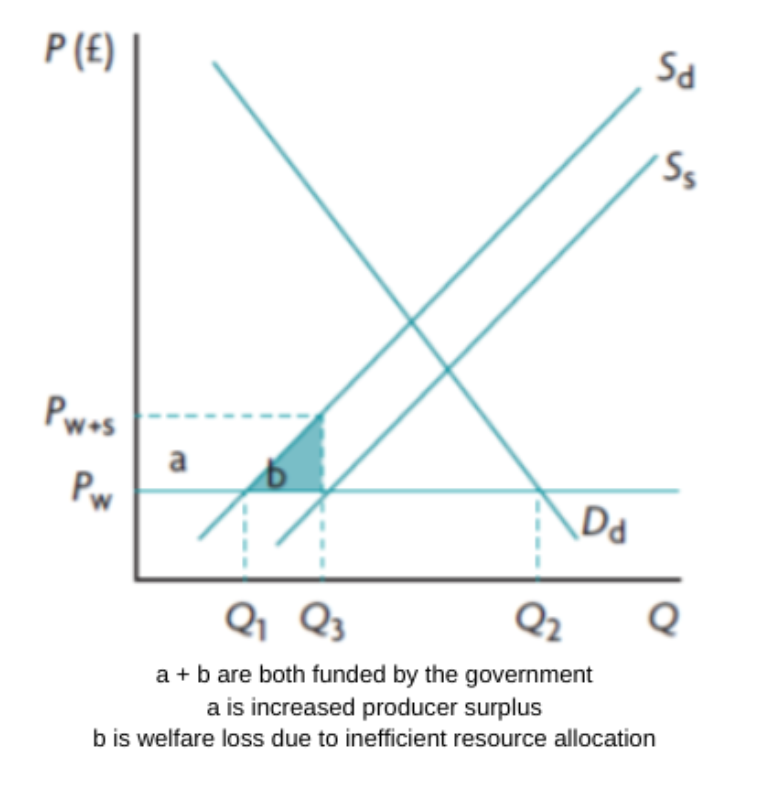

welfare effects

CS is not affected

PS increases at the expense of the government

DWL from inefficient production

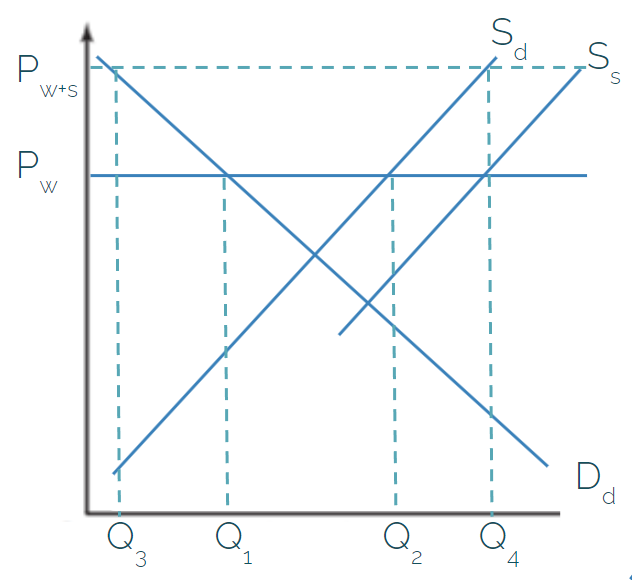

Export Subsidies (19/8/24)

protectionist measure that pays domestic firms for each unit of output produced and exported

allows exporting firms to compete in foreign markets (Pw>Pd)

the world price stays the same, domestic supply curve shifts

increases domestic price to Pw+s

winners: efficient domestic producers, less efficient domestic producers, domestic employment

losers; domestic consumers, government budget, taxpayers, domestic income distribution, foreign producers, global efficiency, resource allocation

domestic producers face two prices when the export subsidy is implemented

foreign market → Pw + subsidy (Pw+s)

domestic market → Pw

domestic < foreign, so they choose the foreign market

forces domestic producers to match the foreign price, which increases price (Pw → Pw+s)

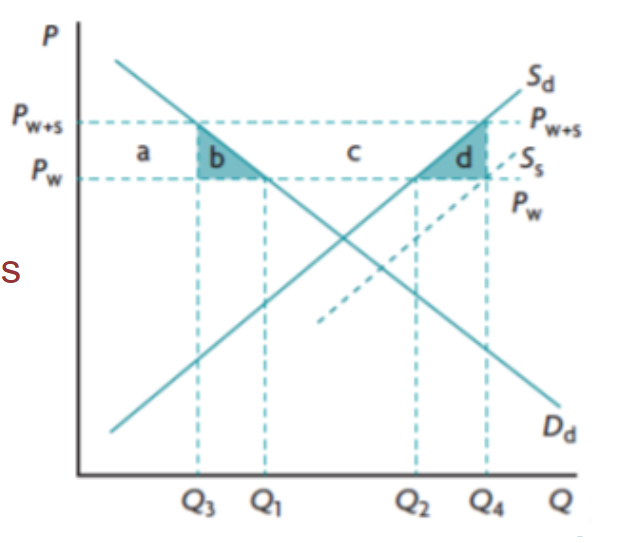

welfare effects

CS is reduced

higher price lower quantity

all transferred to firms (domestic producers)

PS is increased

at the expense of domestic consumers and government

social surplus is reduced

DWL → b+d

Exchange Rates (20/8/24)

the rate at which one currency can be exchanged for another (price of a currency)

number of units of a foreign currency that correspond to the domestic currency

necessary mechanism for international trade to exist

foreign exchange market (FOREX) → global marketplace that allows for the trading of one currency for another

necessary for international transactions

supports the continuous flow of money in and out of countries

individuals, firms, banks, governments, etc.

demand creates supply (only in FOREX)

foreign demand = domestic supply since it is exchanging, not buying

if I buy 10 USD for 150k IDR, the demand for USD increases as I am requesting USD in exchange for 150K IDR. at the same time, the supply for IDR increases as I am supplying IDR into the market in exchange for USD.

consequences of currency appreciation (increasing value of particular currency)

imports become cheaper and exports more expensive (decreased net exports)

worsening trade balance (increasing trade deficit)

decreasing cost-push and demand-pull inflationary pressure

cyclical unemployment

indeterminate impact on economic growth

indeterminate impact on living standards

consequences of currency depreciation (decreasing value of particular currency)

imports become more expensive and exports cheaper (increased net expors)

improving trade balance (decreasing trade deficit)

increasing cost-push and demand-pull inflationary pressure (factors of production)

job growth

indeterminate impact on economic growth

indeterminate impact on living standards

The Trade Protection Debate (22/8/24)

arguments for trade protection (trade restrictions) → despite known inefficiencies / misallocation of resources

infant industries → new domestic industry that is without economies of scale (in a developing country)

ex: pharmaceuticals

may disincentivize efficiency (-)

national security → some industries are essential for national defense

not an economic argument, but political/military

ex: aircraft, weapons

may be overextended (ex: steel) (-)

health and safety standards

imported goods might fall short (ex: food, medicine, etc.)

may actually be an administrative barrier (-)

LEDC (least economically developed country) diversification

opposite of specialization

LEDCs are often dependent on a limited number of commodities

difficult to identify (-)

anti-dumping

dumping: selling a good in an international market below the cost of production

due to export subsidies

difficult to justify → may actually be administrative barriers (-)

balance of payments correction

outflow of money > inflow of money

imports > exports

risk of retalliation (-)

arguments against trade protection

misallocation of resources

less efficient markets

retalliation

potential for trade war

increased costs

raw materials and capital are more costly

higher prices

true for tariffs, quotas, and administrative barriers

less Qd

less choice

fewer options to satisfy needs/wants

result of decreased competition

domestic firms lack incentive to become more efficient

lack of competition permits inefficiencies

reduced export competitiveness

inefficient firms must charge more than foreign competition

foreign demand for products is typically greater than domestic

Preferential Trade Agreements (PTA) (26/8/24)

form of economic integration (trade policies that increase interdependence)

agreement to lower/remove trade barriers

ensures easier access to specific markets in 2+ member countries

may include cooperation on additional issues (ex: labor/environmental standards)

promotes trade liberalization

bilateral trade agreement (mutual agreement between 2 countries)

regional trade agreement (according to geographic region)

multilateral trade agreement (legally binding agreement between 3+ countries)

accomplished through the World Trade Organization (WTO)

Administrative Barriers (27/8/24)

protectionist measures that impose bureaucratic standards and regulations on foreign firms

‘red tape’ checks and procedures that create obstacles for imports

overly concerned with procedure at the cost of efficiency/common sense

costly → both time and money

ex: customs inspections/valuations, packaging requirements, strict health/safety/environmental

winners: efficient domestic producers, less efficient domestic producers, domestic employment

losers: domestic consumers, foreign producers, global efficiency, resource allocation

Trading Blocs (2/9/24)

group of countries that have agreed to reduce barriers to trade to encourage free/freer trade

amongst those in the bloc

includes free trade areas, customs unions, and common markets

free trade area (FTA)

group of countries agree to eliminate trade barriers among members

most common intergration → relatively low degree

members can pursue their own policies with non-member countries

creates dependence upon the country with the lowest non-member barriers to trade (-)

I don’t like country O but country A does and I’m in a FTA with A so I’ll get O’s products from A

ex: USMCA, CAFTA, ANZFTA, EFTA

customs union

group of countries agree to eliminate trade barriers among members AND adopt a common policy towards all non-member countries (FTA+)

members act together in all negotiations with non-members

no need for ‘rules of origin’

more complicated (-)

ex: Mercosur, GCC, ECOWAS

common market

group of countries agree to eliminate trade barriers among members AND adopt a common policy towards all non-member countries AND agree to eliminate all restrictions on movement of the factors of production (FTA++)

labour and capital can move freely across borders

most efficient allocation of factors of production

extremely complicated → countries lose autonomy (-)

ex: EU, SACU

possible advantages

increased competition

expansion into larger markets

economies of scale

lower prices and greater choice

increased investment

improved resource allocation

productive efficiency and economic growth

stronger bargaining power (with non-member countries)

peace and political stability

possible limitations

inferior to WTO’s multilateral approach

aims for free trade for all

unequal distribution of gains and some losses

loss of sovereignty

Trade Creation and Trade Diversion (2/9/24)

trading blocs change patterns of trade → through reduced trade barriers

trade between non-member nations is discouraged → through trade barriers

trade creation → higher cost products are replaced low cost imports through a customs union

original products may have imported or domestically produced

combines comparative advantage and trade liberalization

increases consumption, greater productive efficiency, greater allocative efficiency, increases social welfare

trade diversion → lower cost imports (from non-member countries) are replaced by higher cost imports (from member countries) through a customs union

is an argument against trading blocs and for multilateral trade liberalizations (WTO)

decreases consumption, productive inefficiency, allocative inefficiency, decreases social welfare

long-term benefits still (likely) outweigh the costs

political relationships

economic integration

if I trade within my trading bloc, member countries will buy my products too

Monetary Union (3/9/24)

a common market that requires market countries to adopt a single common currency and a common central bank (FTA+++)

responsible for one monetary policy

has strict membership requirements

ex: rate of inflation, interest rate, debt to GDP ratio

many similarities to a fixed exchange system

RWE → EU (eurozone countries)

Evaluation of monetary union (5/9/24)

advantages

single currency encourages price transparency

allows consumers and firms to easily compare prices

promotes competition and efficiency

single currency eliminates transaction costs

conversion fees are always paid → not anymore

encourages trade and investment → supports allocative efficiency

single currency eliminates exchange rate risk and uncertainty

exchange rates typically fluctuate

benefits importers, exporters, consumers, and investors

encourages trade and investment → supports allocative efficiency

single currency promotes inward investment

encourages investment from outsiders → appeal of expanded market and single currency → supports economic growth

low rate of inflation give rise to low interest rates

member countries are deeply concerned with inflation (single monetary policy)

to remain competitive

encourages investment → supports economic growth

encourages consumption spending → increases output

disadvantages

loss of sovereignty

loss of domestic monetary policy

each member country is affected differently by shared monetary policy

varying positions in the business cycle

varying levels of inflation/unemployment

loss of exchange rates as a mechanism for adjustment

unable to depreciate/devalue

when seeking balance of trade / trying to counter inflation

convergence requirements constrain fiscal policy

economic/financial requirements

potentially limiting expansionary fiscal policy

ex: debt deficit limits

The World Trade Organization (WTO) (9/9/24)

the only global international organization dealing with the rules of trade between countries

responsible for WTO agreements

help producers, exporters, and importers conduct their business

negotiated and signed by the bulk of the world’s trading countries and ratified in their parliaments

objectives → lengthy and complex legal trade documents that encourage:

non-discrimination, open trade, predictability + transparency, fair competition, support for LDCs, protection of the environment, inclusion

six functions:

administrating WTO agreements

forum for trade negotiations

handling trade disputes

monitoring national trade policies

cooperation with other international organizations

technical assistance and training for developing countries

criticisms

WTO allows unfavourable treatment of LDCs

MDCs continue to subsidize agricultural products

MDC → more developed countries

MDCs receive greater tariff reductions

exposed to non-tariff barriers

protection of intellectual property increases costs of technology

MNCs not required to purchase supplies locally

MNC → multinational company

WTO fails to distinguish between developed and developing economies

only recognize/protect LDCS → LEAST

developing countries _> infant industry ptoection

developing countries may need to diversify

reduce reliance on primary commodities

WTO ignores environmental issues

encourages removal of trade barriers against countries with low standards

permits subsidies on harmful products (ex: agriculture, coal, transporation)

WTO ignores labour issues

ex: child labour

WTO members have unequal bargaining power

LDCs often silent in fear of retalliation

includes agenda setting

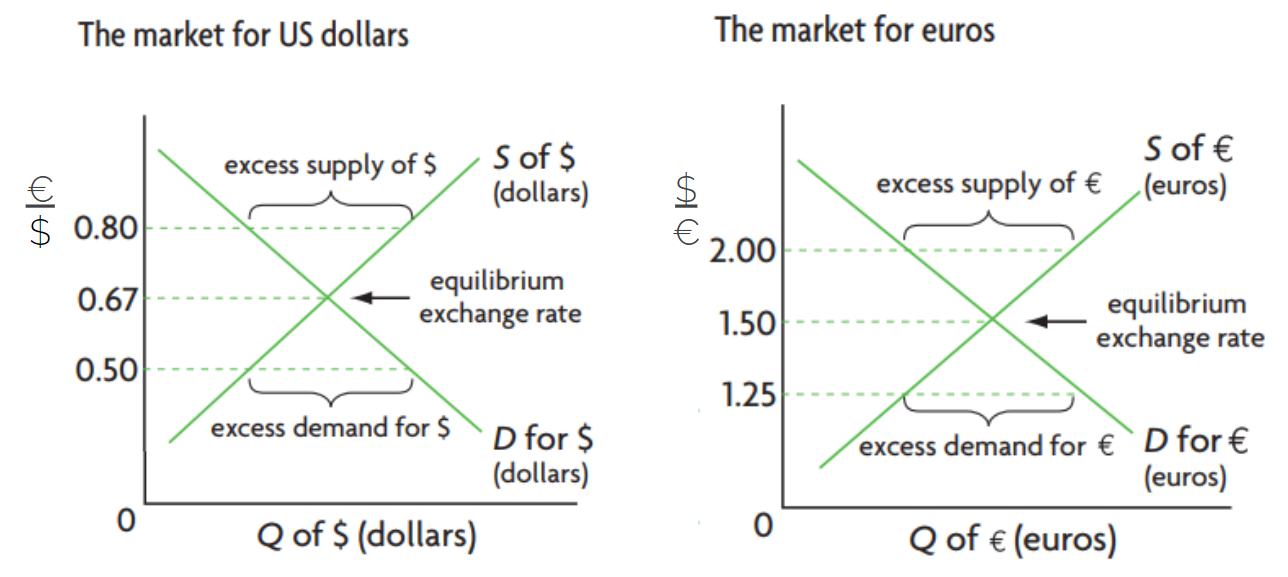

Floating exchange rates (18/9/24)

an exchange rate determined entirely by market forces

supply and demand determine equilibrium (Qd=Qs)

no government intervention

no central bank interaction

free float / flexible exchange rate

downward sloping demand curve

currency demand occurs when there are inflows of foreign currencies into a country

upward sloping supply curve

currency supply occurs when there are outflows of domestic currency out of a country

prices are reciprocals of one another

the quantity on the x axis will always be the denominator on the y axis

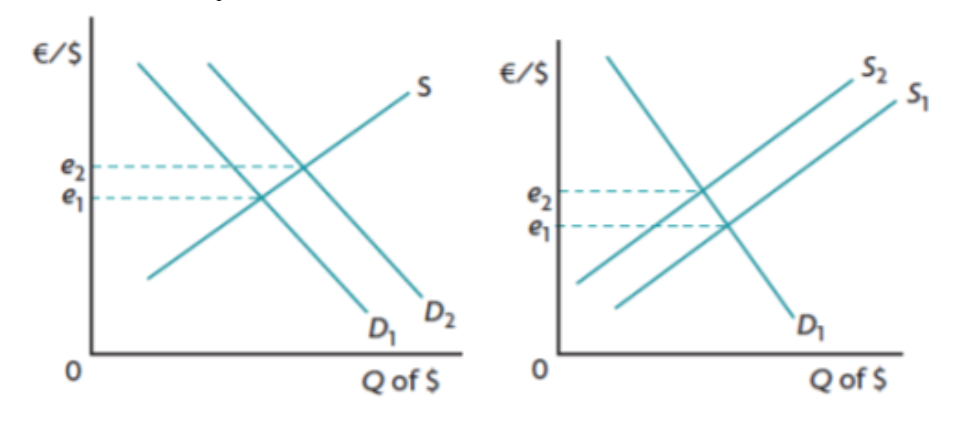

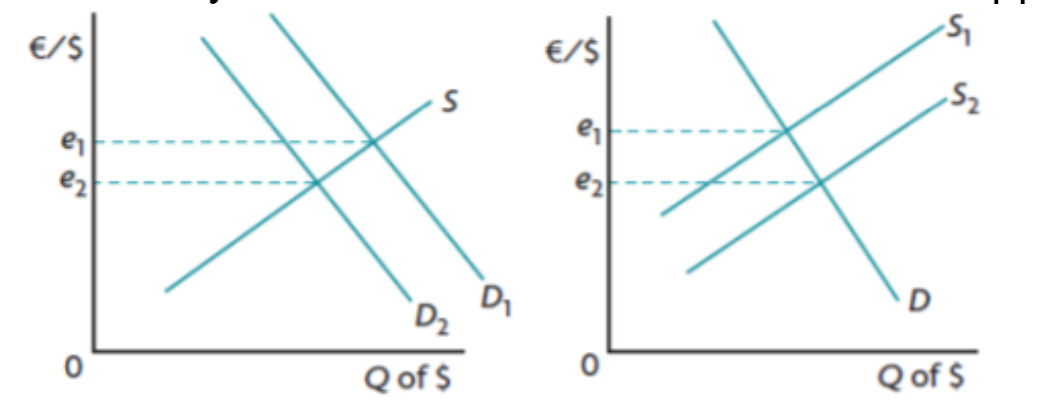

currency appreciation → increase in currency’s value (in relation to another)

caused by increased demand or decreased supply

increase in price (value)

currency depreciation → decrease in currency’s value (in relation with another)

caused by decreased demand or increased supply

causes of change in demand and supply for a currency

foreign demand for exports

goods and services

domestic demand for imports

goods and services

inward/outward foreign direct investment

expanding operations of MNCs

inward/outward portfolio investment

financial instruments

remittances

overseas nationals send money back

speculation

currency as a financial asset

saving in hopes of appreciation

relative inflation rates

general price levels

relative interest rates

price of money

relative growth rates

increased wages and consumption

central bank intervention

reserves of FOREX currencies

strengths

policy makers have great flexibility → no need for central banks to hold foreign reserves

balance of payments is achieved automatically

automatic adjustments to excess demand or supply

naturally provides downward pressure on high inflation

limitations

uncertainty for stakeholders

currency speculation can be destabilizing

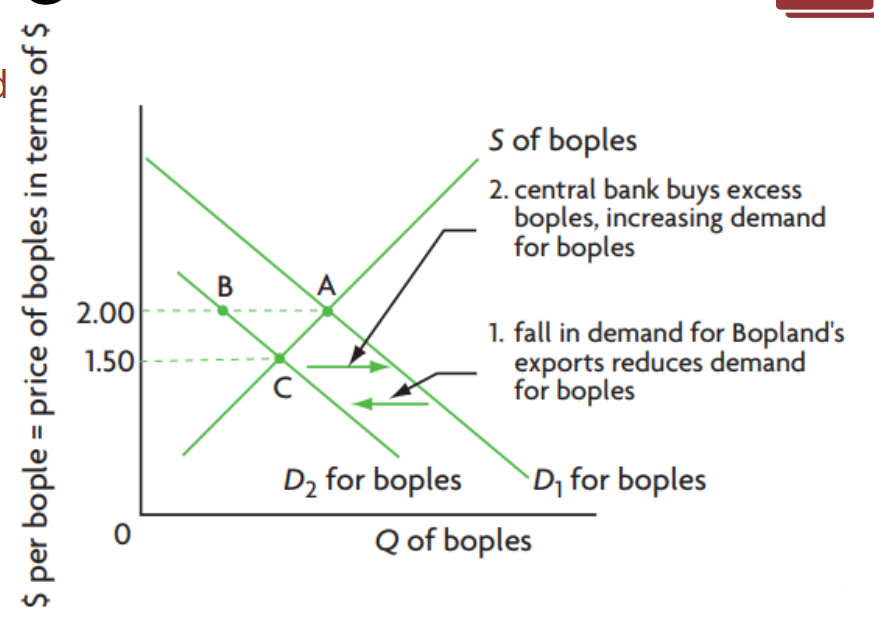

Fixed exchange rates (19/9/24)

an exchange rate that is fixed by a country’s central bank and not permitted to change freely

“pegging” → verb for definition above (relative to another country’s currency)

requires constant central bank intervention

manipulating demand/supply of currencies → mostly buying/selling reserve currencies

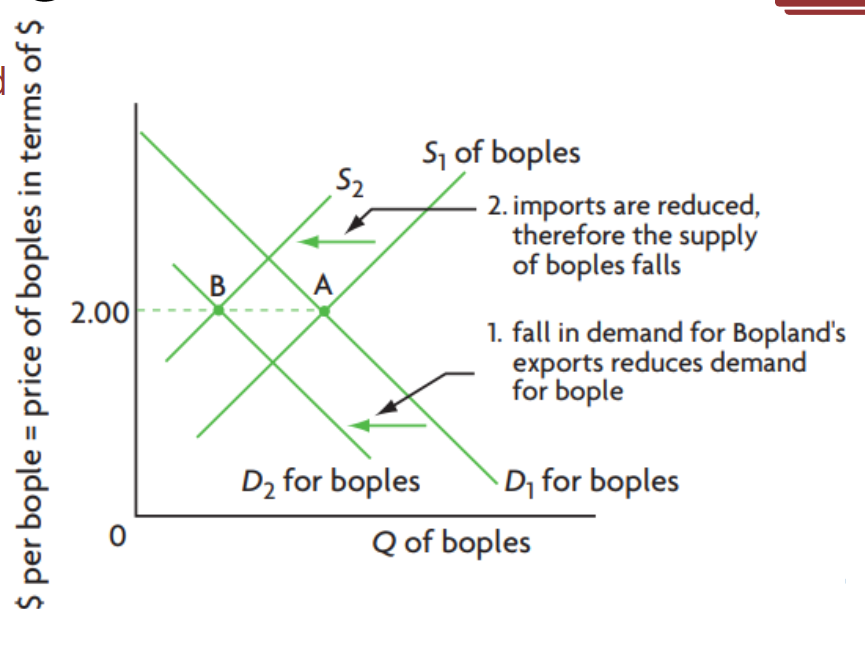

fall in demand for exports reduce demand (D1→D2)

central bank buys excess of the country’s currency, increasing demand (D2→D1)

fall in demand for exports reduce demand (D1→D2)

imports are reduced, so supply of the currency falls (S1→S2)

central bank must respond to excess demand for currency

caused by increased demand or decreased supply

ex: increasing exports or decreasing imports

can buy foreign currency (domestic supply)

central bank must respond to excess supply of currency

caused by increased supply or decreased demand

ex: increasing imports or decreasing exports

can buy domestic currency (using foreign reserve supply)

until they run out of foreign currencies

additional measures to maintain a fixed rate

response to excess supply of domestic currency:

increase interest rates

attracts inflow of foreign currency

(-) contractionary monetary policy may cause recession

borrow from abroad

access to foreign currency

(-) increasing foreign debt

efforts to limit imports

decreases excess domestic supply

contractionary policy to decrease spending → (-) potential recession

trade protection policies → (-) potential retalliation by trade partners

devaluation of a currency

officially and deliberately decreasing the value of a pegged currency

looks similar to depreciation of a floating currency

results in cheaper exports and more expensive imports

revaluation of a currency

officially and deliberately increasing the value of a pegged currency

looks similar to appreciation of a floating currency

results in cheaper imports and more expensive exports

strengths

high degree of certainty for stakeholders

very little speculation activity

limitations

requires constant monitoring to eliminate disequilibrium

requires central banks to hold sufficient FOREX reserves

policy makers have little flexibility → most maintain fixed exchange rate

requires contractionary fiscal policies to keep exports competitive during inflation

imbalance of payments is not easily corrected

Managed exchange rates (26/9/24)

an exchange rate determined by market forces but periodically influenced by a country’s central bank

“managed float”

combines floating and fixed systems

closer to floating

intervention aims for short term stability

prevention of large and abrupt fluctuations

fluctuations discourage investment and spending

typically buying/selling currencies

generally done within upper and lower ‘bands’

freedom to float within a determined range

consequences of overvalued currencies (greater than equilibrium free market value)

cheaper imports → cheaper capital and raw materials

helpful for LDCs to grow manufacturing

(-) expensive exports, worsening trade balance, increased competition for domestic firms, domestic unemployment

may need to be devalued

consequences of undervalued currencies (lower than equilibrium free market value)

considered cheating (unfair competitive advantage) → “dirty float”

cheaper exports, growth of export industries, job creation

(-) expensive imports, cost-push inflation

may need to be revalued

both overvalued and undervalued currencies only occur in fixed and managed systems, not free floats

BOP accounts (14/10/24)

BOP → balance of payments

record of all transactions between a country’s residents and the rest of the world

over a defined period (ex: one quarter)

households, firms, and government

ex: imports/exports, travel, financial investments, foreign direct investment, etc.

“balance of international payments”

credits = debits

credit → inflow, debit → outflow

inflow of payments received (credits) create foreign demand for country’s currency which is the supply for foreign currency

outlfow of payments made (debits) create domestic supply of nation’s currency which is the demand for foreign currency

BOP consists of three accounts

current account (4)

balance of trade in goods (X-M)

balance of trade in services (X-M)

income (inflows - outflows)

current transfers (inflows - outflows)

capital account (2)

capital transfers (inflows - outflows)

transactions in non-produced, non-financial assets (inflows - outflows)

capital account is relatively small and unimportant

financial account (4)

(foreign) direct investment (inflows - outflows)

portfolio investment (inflows - outflows)

reserve assets (inflows - outflows)

official borrowing (inflows - outflows)

The balance of payments (15/10/24)

there is interdependence between the three accounts

a deficit in one account will be offset by a surplus in another

sum of the three accounts will always be zero (“zero balance”)

credits match the debits; surpluses match the deficits

current account = -(capital account + financial account)

current = -(capital + financial + errors and omissions)

if a country has a current account deficit (exports < imports)

inflows (credits) < outflows (debits)

financial (and capital) accounts surplus provides foreign exchange to pay for deficit

zero balance is achieved

country consumes beyond PPC (more than they can produce)

if a country has a current account surplus (exports > imports)

inflows (credits) > outflows (debits)

surplus provides foreign exchange used to pay for financial (and capital) deficit/spending

zero balance is achieved

country consumes beyond PPC

The BOP and exchange rates (17/10/24)

relationship between current account and exchange rate

floating exchange rate system

current account deficit causes downward pressure on the exchange rate

increasing debits require outflows of domestic currency (increased supply = decreased value)

current account surplus causes upward pressure on the exchange rate

inflows of foreign currency must be exchanged (increased demand = increased value)

managed exchange rate system

central bank responds to current account surplus by buying foreign currency

done to avoid appreciation

central bank responds to current account deficit by selling foreign currency

done to avoid depreciation

fixed exchange rate system

central bank responds to current account surplus by increasing debits

ex: buy foreign currency, decrease interest rates, lend abroad

done to avoid revaluation

central bank responds to current account deficit by increasing credits

ex: sell foreign currency, increase interest rates, borrow from abroad

also can increase debits by limiting imports

done to avoid devaluation

relationship between financial account and exchange rate

financial account surplus is typically caused by investment in domestic economy from outside

foreign direct investment or response to high interest rates

increased demand for currency increases its value

financial account deficit is typically caused by investment in foreign economies

foreign direct investment or response to high interest rates

increased supply for currency decreases its value

Current account deficits and surpluses (29/10/24)

consequences of persistent current account surpluses (extended trade surplus, balanced with financial account)

low domestic consumption

production > consumption → lower standard of living

upward pressure on exchange rate

damage on domestic economy

insufficient domestic investment

caused by financial account deficit

reduced export competitiveness

due to currency appreciation

unemployment

workers begin to lose jobs

(+) downward pressure on price levels

demand-pull and cost-push

consequences of current account deficits (extended trade deficit, balanced with financial account)

downward pressure on exchange rate

imported inflation (from countries with higher prices)

need for high interest rates to attract inflows

contractionary monetary policy → discourages investment

foreign ownership of domestic assets (ex: U.S.)

satisfies need for credits in financial account

increasing levels of debt

risk of default → cannot pay the debt

poor international credit rating

considered less credit-worthy

cost of paying interest on loans (debt servicing)

opportunity cost

painful demand management policies

contractionary policies to limit imports (debits)

lower economic growth

result of contractionary policies and government paying interest on loans

policies to correct persistent current account deficits

expenditure reducing policies (aims to limit AD)

contractionary policies → reduces output, income, consumption, imports

(+) lower rate of inflation → more competitive exports

(-) likely recession → higher interest rates put upward pressure on exchange rates

expenditure switching policies (from imported to domestic goods)

trade protection

(-) retalliation, higher domestic prices, lower domestic consumption, misallocation of resources

depreciation

(+) benefits export industries

(-) demand-pull, cost-push inflation

supply-side policies (increase competitiveness)

ex: limit power of trade unions, reduce minimum wage/corporate taxes, deregulation

(+) greater potential output, downward pressure on inflation

(-) requires a lot of time

Marshall-Lerner condition → measure of effectiveness of devaluation/depreciation to reduce a trade deficit

if sum of the PEDs of imports and exports is greater than 1, devaluation/depreciation will improve trade balance

if sum of the PEDs of imports and exports is less than 1, devaluation/depreciation will reduce trade balance

if sum of the PEDs of imports and exports is equal to 1, devaluation/depreciation will not affect trade balance

suggests that a devaluing/depreciating country may initially experience a worsening trade balance, followed by a shrinking deficit, then a trade surplus

“J-curve” effect

result of initially low PED (due to time lags) that increases with time