Economic Way of Thinking - 6. Unintended Consequences

- Like physicists discover the rules of the universe, the economic way of thinking uncovers the principles at work with regard to people's choices and the consequences.

Catastrophe and confusion

- Can we reasonably expect free market institutions to effectively coordinate plans when all hell breaks loose, such as a natural disaster?

- Looting and other violent activities are not a failure of the market exchange process, they represent instead a spontaneous disregard for the prevailing rules of the game.

- Markets don’t coordinate plans perfectly, nor does the government enforce property rights perfectly. This type of social disorder represents governmental imperfection: its inability to effectively monitor and enforce private and public property.

- Example: basic needs increase prices during a storm, not because sellers want to profit, but because demand rises.

- Those prices moved even higher after the storm and increased in other parts of the country that were not affected by the storm at all. People in Congress find this confusing. The economist doesn’t.

- Noneconomists and critics call the corresponding increase in price price gouging.

- The price spike reflects the market process at work: The increase in demand and decrease in supply lead to a higher price. That higher price reflects the greater relative scarcity.

- These goods became more scarce, more valuable, before, during, and after the storm’s fury.

- The higher price allows for the continued tendency toward plan coordination.

- Sellers want to provide more because of the higher prices, further helping during an emergency.

The urge to fix prices (price ceilings)

- What about price controls?

- We could change the rules of the game. intervene in free markets and make it illegal for people to charge, or offer, a price above the federally mandated maximum price.

- "What's a fair price?"

- Fair to whom? To consumers? Forget about suppliers.

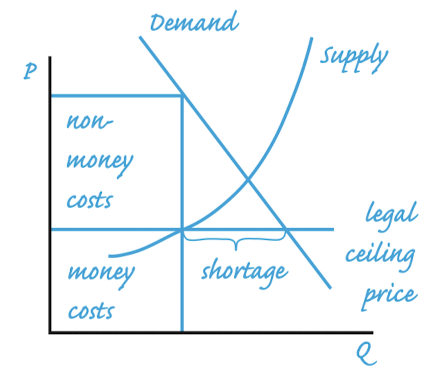

- Economists call a legally maximum price, intended to help consumers, a price ceiling.

- Sellers respond by cutting back output so they don't go out of business.

- Consumers can't satisfy their planned purchases, there will be shortage.

- If people can't compete for scarce goods by bidding with higher prices, they will start competing with other resources, such as time.

- The price is legally lowered, but not the cost to the consumer.

- Scarcity is unavoidable, shortages can be prevented by letting prices rise.

- We spot a shortage in real life whenever we find the nonmonetary costs of acquisition rising in the attempt to obtain scarce goods and services.

- If suppliers can't raise prices, they will look to other ways to turn the situation to their advantage.

- They could reduce hours of operation because they can sell out their entire weekly allocation in less time.

- Example: this is why apartments can't be found in New York, a ceiling on rent has been imposed.

- Sellers then might discriminate on other factors, such as age or race, because they know that other consumers will come anyway.

- They also have less incentive to maintain good quality products, since their products will be sold anyway.

- "You don't like? Leave. There are others banging down my door for this."

- Ironically, higher ceilings make fewer goods available to those who were targeted to benefit from the controls.

Criminal incentives

- When production and distribution go underground, those with a comparative advantage in crime rise to the top of the heap.

- The book gives the example of the 1920s Prohibition of alcohol.

- The market for alcohol didn't disappear, it just moved underground.

- The demand curve remained stable, while supply became inelastic.

- The result was a surge in price and considerable profit opportunities for those willing to take the risk and break the law.

- Production will also be geared towards the stronger drinks, since suppliers are equally likely to get caught with producing beer or whisky. Whisky fetches a higher price, so that's what they will make.

- This caused the rate of alcohol poisoning to spike.

- This is not market failure, rather, failure of government to effectively enforce its own rules of the game.

Supports and surpluses (price floors)

- A price floor is a legally mandated minimum price set on a particular good or service.

- Established to improve prospects for suppliers.

- Both floors and ceilings represent an attempt to transfer wealth from one group in the market to the other.

- Price supports on (agricultural) goods do benefit producers, but that benefit comes from a corresponding loss to others.

- If a price floor is established, how would consumers respond to the higher price?

- They would plan to purchase less, as the higher price sets off a decrease in quantity demanded.

- Sellers would be stuck with unsold goods.

- Planned consumption decreases while planned output increases.

- Government would have to step in and purchase the surplus output.

- A higher tax will be imposed on taxpayers to finance the government's purchases.

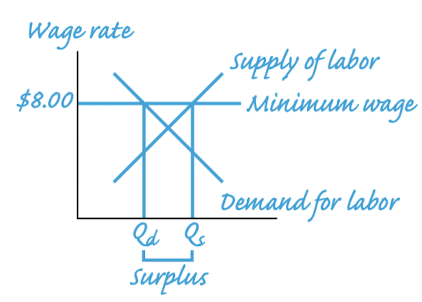

The minimum wage

The supply and demand for services work like any other supply and demand curves.

For the minimum wage to work, it must be set above the market-clearing wage rate. But if it’s effective, it generates unintended consequences.

- A surplus of labor will result.

- First, the quantity demanded will fall in response to the higher wage rate. That’s another way of saying that some workers will be fired.

- Second, the quantity supplied will increase, as more people seek employment at the more attractive wage rate. The prospects of actually finding employment will fall as the surplus of labor emerges. This unintentionally generates unemployment in the unskilled labor market.

People believe that employers pay wages out of profits, so they wouldn't have to fire people.

- They believe that the quantity of labor services demanded is constant.

- They say that to be able to continue operations they can't lose people, so it's either pay more or close.

- This isn't true, as they can make other adjustments:

- Hours of operation

- Quality of service

Slavery goes global, again

- The book gives the example: the Sudanese government promoted a robust slave trade beginning in the 1980s.

- Western humanitarian organizations decided to raise funds to purchase slaves and free them.

- This unwittingly increased the demand for slaves and bid up their price.

- Consequently, more innocent people were captured and sold on the market.

Do costs determine prices?

- A high demand allows for higher prices.

- Costs don't depend only on supply.

- When sellers announce a price increase to the public, they like to say that the increase was compelled by rising costs.

- No sellers have announced that they were raising their prices because of increases in demand for their product, they resist pointing their finger at their customers.

- Good sellers try to charge what others charge and try to ensure that their costs don't exceed that price.

- The book gives the example of beef products.

- If people suddenly wanted to buy more beef, the seller would deplete his inventories quickly.

- So he would buy more, but so would other sellers.

- Cattle can't grow overnight, so it becomes more costly to acquire.

- The high demand caused a rise in costs, and therefore prices.

- Always think: cost to whom? Benefit to whom?

Framing economic questions correctly

- One must always be careful to pose economic questions correctly so they aren't misleading.

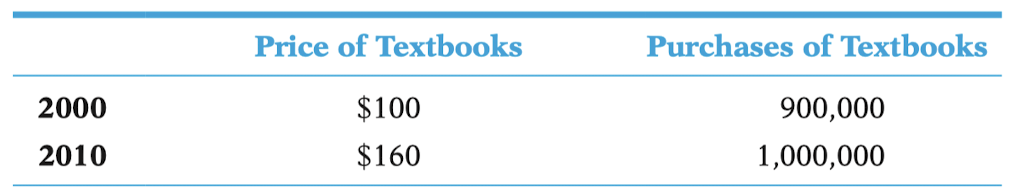

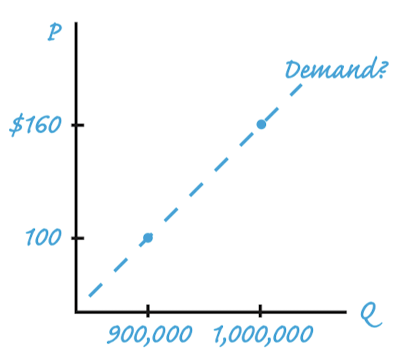

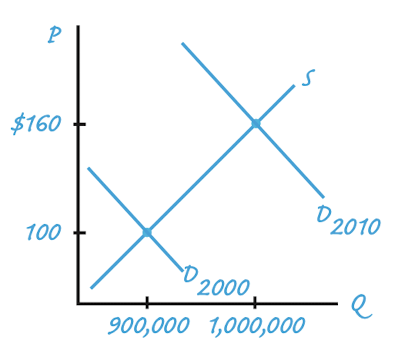

- For example, a table that looks like this, one would instinctively graph like this:

- It's actually graphed like this, because data doesn't speak for itself:

- Also be careful of people who speak in economic terms with conviction, but make the mistake of confusing terms.

- Don't confuse demand with quantity demanded.

Quick summary

- We continued our theme that the rules of the game affect supply and demand conditions by shaping incentives.

- The coordinating properties of the free-market system work just as effectively during catastrophes as they do during normal states of affairs. “Price gouging” is nothing more than rapid price increases due to dramatic changes in the plans of buyers and sellers.

- Incentives change, for example, when price controls are implemented into an otherwise free-market process. When a price control is effective, it unintentionally generates market discoordination.

- A price ceiling is a legally mandated maximum price. Whether a price ceiling is placed on gasoline or on a very different good, such as rent on apartment units, it creates a shortage. Price competition will tend to be replaced with nonprice or nonmonetary competition. The legally mandated lower price does not eliminate or even reduce the scarcity of the good under the control.

- A price floor, such as an agricultural price support or a minimum wage on unskilled labor, is a legally mandated minimum price. If effective, the price floor unintentionally generates a surplus. With agricultural commodities, that surplus is typically purchased by the government, representing a transfer of wealth from consumers (in the form of higher prices) and from taxpayers (in the form of a higher tax burden to pay for the government support programs). In the case of the minimum wage, the surplus comes in the form of unemployed workers, who are not bought (like agricultural goods) by the government itself. While those who maintain or find jobs at the minimum wage are better off (compared to what they would have earned at the free-market wage), those who are unemployed are simply out of luck.

- Prohibition on alcohol and drugs drives market processes underground. Those with a comparative advantage in crime are successors in the competitive process.

- There is no economic law that says costs of production determine price. It is wrong to suppose that we can choose between basing prices on costs or letting them be set by demand and supply, because the demand and supply process determines all costs.

- By altering relative costs in response to changing conditions, the demand and supply process sets prices that reflect the relative scarcities of goods and indicates how they can be used most economically.

- Prices that reflect changing relative scarcities coordinate the activities of people in a commercial society.

- Many different people use economic terms and concepts in ill-informed or misleading ways. Debunking their stories is part of the art of the economist.