Finance notes chap 1-6

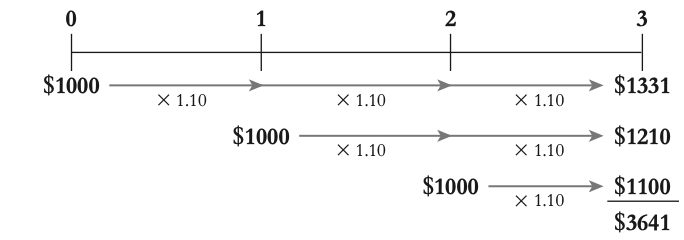

Finance notes

Chap 1 : Corporation + financial markets

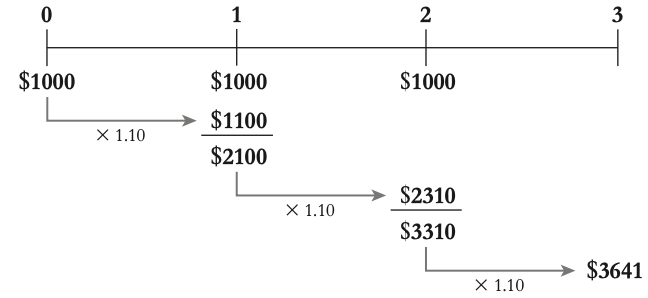

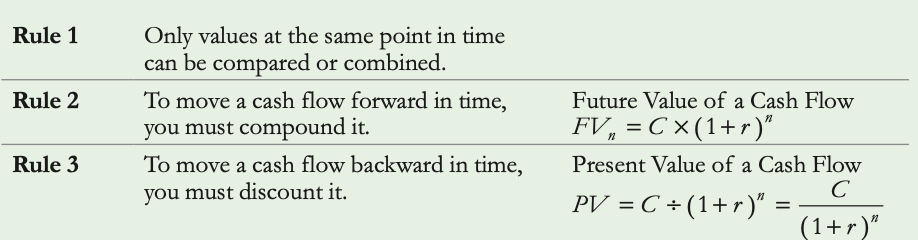

Before the gov could take the ownerships of corporations, something they can’t do now . In 1819, the U.S. Supreme Court ruled that corporations have the same property rights as individuals, protecting them from government seizure. This decision helped make modern business corporations. Nowadays, corporations are everywhere, but they face new challenges, like the 2008 financial crisis. This made the government change rules and ask questions about controlling companies.

Understanding corporate finance remains crucial amid changing political agendas and global tensions. The book focuses on how corporate financial decisions are made and introduces different organizational forms and the role of stock markets in trading ownership shares.

- 4 types of firms

sole proprietorships, partnerships, limited liability companies, and corporations

Sole proprietorships

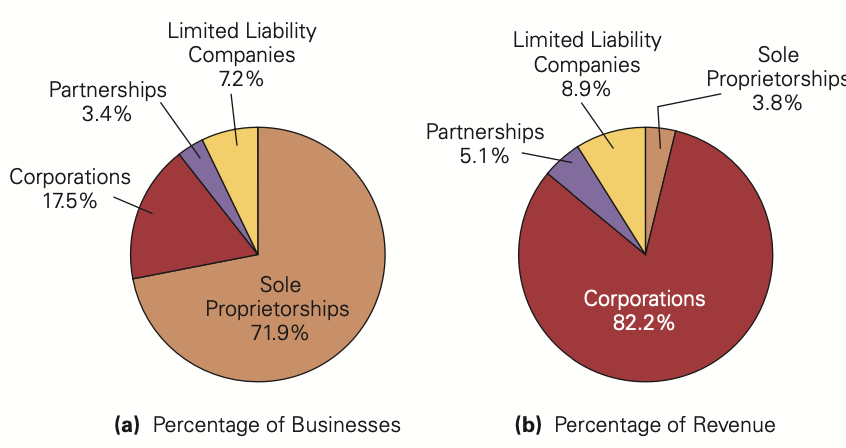

a business owned and run by one person. Sole proprietorships are usually very small with few, if any, employees. They are the most common type of firm in the world, nearly 72% of businesses in the US are part of them.

Sole proprietorships share the following key characteristics:

- They're easy to start because it's just one person running the show, which is why many new businesses choose this setup.

- The downside is that there's no legal separation between the owner and the business. So, only one person can own it, and others can't invest in it.

- The owner is personally responsible for all the business debts. If the business can't pay its debts, the owner has to use personal assets to cover them. If they can't, they might have to declare bankruptcy.

- A sole proprietorship lasts only as long as the owner wants it to. It's also hard to sell or transfer ownership.

Once a business gets big enough to borrow money without the owner risking everything, they often switch to a different type of business structure to limit their liability.

Partnership

It’s like sole proprietorships but it has multiple owners.

- All partners are responsible for the business's debts. This means that any partner can be asked to pay off all the business's debts if needed.

- If one partner leaves or dies, the partnership ends, unless the partnership agreement says otherwise. There might be options like buying out the leaving partner to avoid closing down.

Some businesses, like law firms or doctor groups, stick with partnerships because the owners' reputations are a big part of the business. Having personal liability makes clients trust that the owners will work hard to keep their good reputation.

In a limited partnership, there are two types of owners: general partners and limited partners. General partners have the same rights and responsibilities as partners in a regular partnership—they're personally responsible for the business's debts. But limited partners have less risk—their liability is only up to the amount they've invested. They can't lose personal stuff to pay off the business's debts. Also, if a limited partner leaves or dies, it doesn't end the partnership, and their share can be sold to someone else. However, limited partners can't make decisions for the business.

Industries like private equity funds and venture capital funds often use limited partnerships. In these, a few general partners put in their own money and get more money from outside investors who become limited partners. The general partners decide how to invest all the money, and the outside investors just watch how their investments are doing without getting involved in the business decisions.

Limited liabilty compaines

A Limited Liability Company (LLC) is similar to a limited partnership, but without a general partner. This means that all owners have limited liability, and they can also be involved in running the business.

LLCs are a newer concept in the United States, starting in Wyoming in 1977 and last established in Hawaii in 1997. However, internationally, companies with limited liability have been around for much longer. In Germany, they've been known as Gesellschaft mit beschränkter Haftung (GmbH) for over 100 years, and similar structures exist in other European and Latin American countries, such as Société à responsabilité limitée (SARL) in France, SRL in Italy, and SL in Spain.

Corporartions

A corporation is a separate legal entity from its owners, meaning it has its own legal powers and responsibilities. It can enter contracts, acquire assets, and is protected under the U.S. Constitution. The key point is that the corporation is solely responsible for its obligations, not its owners, and vice versa.

To form a corporation, it needs approval from the state where it incorporates. This process is more expensive than starting a sole proprietorship. Many choose to incorporate in Delaware due to its favorable legal environment. Lawyers often help create a charter and bylaws to govern the corporation.

Ownership in a corporation is through shares of stock, and there's no limit to the number of owners. Each owner, or shareholder, owns a fraction of the company. They receive dividends, which are payments from the corporation to its shareholders, usually based on the amount of stock they own.

One unique aspect of a corporation is that anyone can own its stock, regardless of expertise. This allows for easy trading of shares and attracts outside investors. This ability to raise capital from investors has made corporations dominant in the economy.

For example, Walmart, one of the largest corporations globally, had over 2 million employees and $560 billion in revenue in 2021. The top six U.S. companies by sales volume in 2021 generated over $2 trillion in sales, surpassing the total sales of more than 25 million U.S. sole proprietorships.

Tax implications for corporate enetiites

The different types of firms are taxed differently. As a corporation is a separate legal entity, a corporation’s profits are taxed separately from its owners’ tax obligations. In effect, shareholders of a corporation pay taxes twice. Concept known as double taxation. This means that the corporation pays taxes on its profits, and then shareholders also pay taxes on the dividends they receive from those profits.

Double Taxation Example:

- Corporate Taxation:

- Imagine a corporation earns $8 per share before taxes.

- The corporation must pay corporate taxes on its profits. Let's say the corporate tax rate is 25%.

- So, 25% of $8 is $2. This means the corporation pays $2 in taxes per share.

- Dividend Distribution:

- After paying corporate taxes, the corporation distributes the remaining profits to its shareholders as dividends.

- In our example, if $2 is paid in taxes, then the remaining $6 is distributed as dividends to shareholders.

- Shareholder Taxation:

- Shareholders receive the dividends, but they are also taxed on this income. Let's say the tax rate on dividend income for shareholders is 20%.

- So, shareholders must pay 20% of $6, which is $1.20, in taxes on the dividends they receive.

- Overall Tax Impact:

- After all taxes are paid, shareholders end up with $6 (dividends) - $1.20 (taxes on dividends) = $4.80 per share.

- This means out of the original $8 earned per share, shareholders end up with only $4.80 after taxes. The remaining $3.20 ($2 in corporate taxes + $1.20 in taxes on dividends) is paid in taxes overall.

- This results in an effective tax rate of $3.20 / $8 = 40%

To fix this issue of double taxation, some corporations opt to become S Corporations. They allow profits to be directly allocated to shareholders without being taxed at the corporate level. This means the profits "pass through" to shareholders, who report their share of the income on their personal tax returns and pay taxes accordingly. While shareholders still pay taxes on these profits, they don't face double taxation as seen in traditional corporations. This can be advantageous for smaller businesses or startups where double taxation could significantly impact profits.

- Challenges with S Corporation Status: While S Corporation status offers tax advantages, it comes with certain restrictions. For instance, S Corporations cannot have more than 100 shareholders, and all shareholders must be U.S. citizens or residents. Additionally, S Corporations cannot have certain types of shareholders, such as other corporations or partnerships.

Most countries, including the U.S., offer some relief from double taxation for investors in corporations. For example, the U.S. has reduced the tax rate on dividend income compared to other sources of income, making it more favorable for investors.

1.2. ownership vs control of corporations

In a corporation, it's common for ownership and direct control to be separate. This is because there are often many owners, each of whom can freely trade their stock. Instead of the owners, direct control of the corporation typically lies with the board of directors and the chief executive officer (CEO).

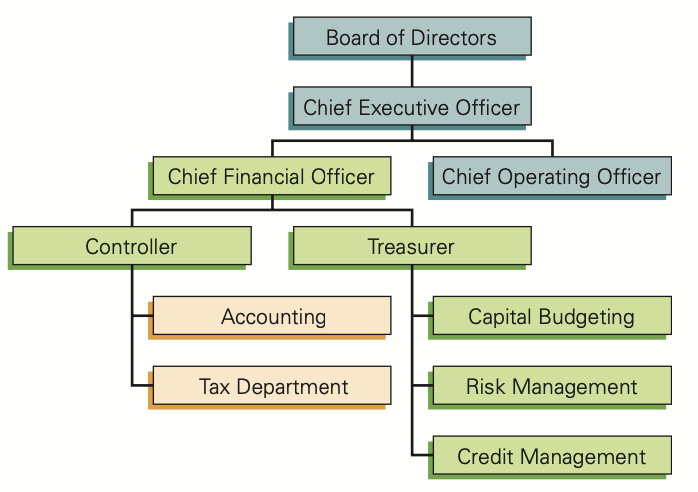

In a corporation, the management team plays a crucial role in decision-making and overseeing the company's operations. Here's how the corporate management team is typically structured:

Corporate management team

Board of Directors:

- The board of directors is elected by the shareholders and holds the ultimate decision-making authority in the corporation.

- Shareholders typically have one vote per share in electing the board members, and those with more shares have more influence.

- The board sets rules on corporate governance, including the compensation of top managers, and monitors the company's performance.

- When a few shareholders own a significant portion of the stock, they may have the right to appoint directors or even serve on the board themselves.

Chief Executive Officer (CEO):

- The CEO is responsible for running the corporation and executing the policies set by the board of directors.

- They oversee the day-to-day operations of the company and work to achieve its strategic objectives.

- The CEO is often the highest-ranking executive in the company and reports directly to the board of directors.

Management Team:

- The CEO may delegate operational responsibilities to other members of the management team, depending on the size and structure of the corporation.

- The size and composition of the management team can vary from one corporation to another.

- The chief financial officer (CFO) is typically a key member of the management team and is responsible for managing the company's finances and financial risks. They often report directly to the CEO.

Organizational Structure:

- The organizational chart of a corporation typically outlines the hierarchy of positions within the company, including key roles such as CEO, CFO, and other senior executives.

- The separation of powers between the board of directors and the CEO may not always be distinct, and it's not uncommon for the CEO to also serve as the chairman of the board.

In summary, the corporate management team, consisting of the board of directors, CEO, and other senior executives, collaborates to set policies, oversee operations, and drive the company towards its goals.

The financial manager

The financial manager within a corporation plays a crucial role in three main areas:

1. Investment Decisions:

- The financial manager evaluates and makes decisions about where to invest the firm's money.

- They assess the costs and benefits of various investment opportunities to determine which ones will generate value for the shareholders.

- These decisions shape the company's activities and its ability to achieve its goals.

2.Financing Decisions:

- After deciding on investments, the financial manager determines how to finance them.

- They choose between raising additional funds from shareholders (equity) or borrowing money (debt) to finance large investments.

- The financial manager considers the characteristics of each source of funds and their impact on the company's overall financial structure.

3. Cash Management:

- The financial manager ensures the company has enough cash on hand to meet its daily operational needs.

- They manage working capital, which involves balancing short-term assets and liabilities.

- Effective cash management is crucial, especially for young or growing companies, as it can significantly impact their success.

Finance in Times of Disruption:

- In response to the 2008 financial crisis, the U.S. government enacted the Dodd-Frank Wall Street Reform and Consumer Protection Act to reform financial regulation.

- The Act aims to promote financial stability, end "too big to fail" practices, protect taxpayers from bailouts, and safeguard consumers from abusive financial practices.

Cash Management Importance:

- The financial manager ensures the company has sufficient cash to fund its operations and investments.

- Cash management is critical for companies, even those with successful products, as significant cash is often required for product development and market launch.

- Examples include Apple's secretive development of the iPhone, Boeing's production of the 787, and Audi's investment in self-driving technology.

Overall, the financial manager's responsibilities are essential for the company's financial health, strategic decision-making, and long-term success. They play a crucial role in managing investments, financing, and cash to ensure the company's growth and profitability.

Goal of the firm : The goal of a firm should ideally be aligned with the interests of its owners, but determining this can be hard, especially in corporations with multiple shareholders. Each shareholder may have different priorities and interests. However, in many cases, shareholders' interests converge when it comes to decisions that increase the value of their shares. Despite their diverse backgrounds and preferences, shareholders generally benefit when management decisions enhance the value of their investments.

Firm & society

Decisions that increase the value of a firm's equity can often be beneficial for society by creating valuable products and services for customers and generating job opportunities. However, problems arise when these decisions harm others or the broader society.

Ex : a corporation that pollutes the environment w/o bearing the costs of cleanup imposes negative externalities on society.

To address such issues, appropriate public policies and regulations are necessary to ensure that corporate interests align with societal interests. Effective regulations can prevent corporations from imposing harm on others and promote actions that benefit society overall while still allowing firms to pursue shareholder value maximization in a responsible manner.

Top of Form

Ethics & incentives within corporations

The separation of ownership and control in corporations can lead to conflicts of interest between managers and shareholders, known as agency problems. Managers may prioritize their own self-interest over the interests of shareholders. To address these issues, several mechanisms are put in place:

- Compensation Contracts: Managers' compensation contracts are designed to align their interests with those of shareholders. Compensation often includes bonuses tied to the firm's performance or stock options, incentivizing managers to make decisions that increase shareholder wealth.

- Board Oversight: Boards of directors are responsible for monitoring managerial actions and ensuring they act in the best interests of shareholders. Independent compensation committees and advisory boards help prevent excessive compensation and maintain accountability.

- Market for Corporate Control: A poorly performing company may become a target for a hostile takeover by corporate raiders. Shareholders dissatisfied with management can sell their shares, leading to a decline in stock price and making the company vulnerable to acquisition by an entity aiming to replace the board and management.

- Shareholder Activism: Shareholders have the power to influence managerial decisions through voting and shareholder proposals. Dissatisfied shareholders may pressure the board to replace underperforming executives.

Additionally, managers are increasingly expected to consider the interests of stakeholders beyond shareholders, such as employees, customers, and communities, in their decision-making. This approach, known as stakeholder capitalism, acknowledges that decisions impacting stakeholders can ultimately affect shareholder value.

When a corporation faces financial distress and is unable to repay its debts, control of the firm may pass to debt holders through bankruptcy proceedings. However, bankruptcy does not always result in liquidation; creditors may choose to restructure the firm and continue operations if it remains profitable, ensuring ongoing value creation for stakeholders

1.3. stock market Bottom of Form

The stock market plays a crucial role in providing liquidity to investors and establishing a market price for a company's shares. Here's how it functions:

- Liquidity: The stock market allows investors to buy and sell shares quickly and easily. Liquidity is essential because it provides investors with the flexibility to enter and exit their investments as needed. For example, if an investor needs to sell their shares to raise cash, they can typically do so on the stock market without much difficulty.

- Market Price Determination: The stock market determines the price of a company's shares through the forces of supply and demand. When more investors want to buy a stock, its price increases, and when more investors want to sell, its price decreases. This constant fluctuation in prices reflects investors' perceptions of a company's value and prospects.

- Feedback Mechanism: Share prices in the stock market provide continuous feedback to managers about investors' views of their decisions. If a company announces positive news or achieves strong financial results, its stock price may rise, signaling investor confidence in management's actions. Conversely, negative news or poor performance may lead to a decline in the stock price, indicating investor concerns.

- Research and Trading: Participants in the stock market, such as investors, analysts, and traders, conduct research and analysis to evaluate companies and make investment decisions. This research contributes to price discovery and helps investors make informed choices about buying or selling stocks.

Overall, the stock market serves as a platform for investors to trade securities, determine market prices, and provide feedback to companies and their management teams. This dynamic environment allows for efficient capital allocation and contributes to the functioning of the economy.

Primary Market: When a corporation itself issues new shares of stock and sells them to investors, it does so on the primary market.

In the primary market, newly issued securities, such as stocks or bonds, are sold for the first time directly by the issuing company to investors. Companies use the primary market to raise capital by issuing new shares of stock or bonds. Investors purchase these newly issued securities directly from the issuing company through methods like initial public offerings (IPOs) or seasoned equity offerings (SEOs). The primary market facilitates the direct transfer of funds from investors to the issuing company. Once the securities are sold in the primary market, they are subsequently traded in the secondary market.

Secondary Market: After this initial transaction between the corporation and investors, the shares continue to trade in a secondary market between investors without the involvement of the corporation

The secondary market is where already issued securities are traded among investors without the involvement of the issuing company. Investors buy and sell previously issued securities, such as stocks and bonds, on organized exchanges like the New York Stock Exchange (NYSE) or the Nasdaq, or through over-the-counter (OTC) markets. The secondary market provides liquidity to investors by enabling them to buy and sell securities easily and quickly. Prices of securities in the secondary market are determined by supply and demand dynamics and reflect investors' perceptions of a company's value and future prospects. Most of the trading activity in the stock market occurs in the secondary market, as investors frequently buy and sell shares among themselves without involving the issuing company.

Top of Form

In summary, the primary market is where new securities are issued and sold by companies to raise capital, while the secondary market is where previously issued securities are traded among investorsBottom of Form

Traditional Trading Venues:

New York Stock Exchange (NYSE): Historically, the NYSE was a prominent stock exchange where most trading occurred on its trading floor in lower Manhattan. Market makers, known as specialists, facilitated trades by matching buyers and sellers. They posted bid (buy) and ask (sell) prices for each stock, ensuring liquidity by always being willing to take the other side of the trade. Investors typically bought at the ask price and sold at the bid price, with the difference between them known as the bid-ask spread. The NYSE specialized in single-market maker per stock.

Nasdaq: Unlike the NYSE, Nasdaq didn't have a physical trading floor; all trading was done electronically or over the phone. Nasdaq featured multiple market makers for each stock, competing with one another. Market makers posted bid and ask prices on the Nasdaq network, visible to all participants. They earned profits from the bid-ask spread, with customers buying at the ask price and selling at the bid price. Nasdaq's structure allowed for increased competition among market makers, potentially resulting in narrower bid-ask spreads and lower transaction costs for investors.

Top of Form

New Competition and Market Changes:

In the early 2000s, the NYSE and Nasdaq dominated U.S. stock trading, but their share declined due to competition from electronic exchanges and alternative trading systems. By 2012, these newcomers handled over 50% of trades.

With this shift, official market makers largely vanished as trading became electronic. Anyone can now make a market by posting a limit order, specifying a set amount and price to buy or sell a stock. The bid-ask spread, determined by limit orders, reflects the best prices to buy and sell.

Traders posting limit orders provide liquidity, while those executing immediate market orders are "takers" of liquidity. Liquidity providers risk orders becoming outdated, prompting high-frequency traders (HFTs) to exploit price changes. HFTs use computers to place, update, and execute trades rapidly, profiting from liquidity provision and exploiting outdated orders.

- Limit Orders and Liquidity: Traders who post limit orders set specific prices at which they are willing to buy or sell a stock. This adds liquidity to the market because it provides options for others to trade against.

- Market Orders and "Takers" of Liquidity: Traders who place market orders buy or sell immediately at the best available price. They "take" liquidity because they are executing trades based on existing orders in the market.

- Risk for Liquidity Providers: Traders who provide liquidity by posting limit orders risk their orders becoming outdated if market conditions change. For example, if new information affects stock prices, their orders may no longer be attractive.

- High-Frequency Traders (HFTs): These traders use computer algorithms to quickly place, update, and execute trades based on market conditions. They profit by both providing liquidity (matching trades) and taking advantage of outdated orders, exploiting price changes in the market.

Dark pools

Dark pools are private trading platforms where investors can buy and sell stocks without publicly displaying their orders, allowing for potentially better prices but with less transparency compared to regular stock exchanges.

Dark Pools: Dark pools are alternative trading systems where orders are not displayed publicly like on regular exchanges. Instead, investors can trade at potentially better prices, but their orders may not be immediately filled.

Advantages: Traders use dark pools to get better prices and keep their trading strategies private.

Competition: With dark pools included, there are around 50 venues for stock trading in the US. These venues compete for order volume, focusing on providing liquidity (many orders) to attract traders.

Different Rules: Exchanges experiment with various rules to attract liquidity providers and discourage traders who exploit outdated orders. Some pay for posting limit orders, while others charge for market orders or high-frequency trading.

Market Evolution: Stock markets are continually evolving, with changes in rules and competition among venues. The future of stock trading remains uncertain as new developments unfold.

1.4. Finance & technology

The relation between financial innovation and technical innovation has become known as Fintech.

Telecommunications

Telecommunications in finance refers to the use of communication technologies to facilitate trading and information exchange in the financial markets.

- The introduction of telegraph in the 1840s revolutionized finance by enabling real-time transmission of stock prices between distant locations, leading to faster and more efficient trading. This also led to the development of the first stock ticker system, which transmitted stock prices over telegraph lines. Over time, communication technologies evolved, eventually transitioning to digital CRT technology systems and then to computers and the Internet. Today, some traders use microwave technology to achieve the highest possible speeds in transmitting information and orders, further enhancing market efficiency.

Top of Form

Bottom of Form

Security & Verification

security and verification technology in finance has a long history of development. It started with ancient methods like writing to keep track of transactions. Later, technologies like the telegraph and fax machine helped banks verify transactions faster over long distances.

Nowadays, the finance industry is pioneering a new technology called blockchain. Blockchain allows transactions to be recorded securely in a public database without needing a central authority like a bank. It was first used for cryptocurrencies like Bitcoin. This technology has the potential to change how financial transactions are done by making them more transparent and secure. However, its success depends on whether it's better than current methods.

Automation of banking services

In the world of consumer banking, automation has played a significant role in enhancing services. The introduction of the automatic teller machine (ATM) in 1967 marked the beginning of automated customer service, allowing people to perform various banking tasks without the need for human interaction. Today, automation in banking extends to tasks such as account opening, fund transfers between different institutions, bill payments, and even loan applications and approvals, all achievable without speaking to a bank representative.

Recent advancements in technology have led to the emergence of smartphone apps like PayPal's Venmo, Tencent's WeChat, and Block's Cash App, enabling individuals to make instant payments and money transfers effortlessly. In developing countries, cellular phones have become gateways to automated banking services, providing millions of people access to the modern financial system.

Moreover, the rise of robo-advisors presents a potential disruption to traditional investment advising. These computer programs offer personalized investment recommendations, aiming to replace human financial advisors. Whether consumers will embrace these automated services with the same enthusiasm as they did with ATMs remains uncertain, but the trend towards automation in banking services continues to reshape the industry.

Big data & machine learning

n the realm of finance, the concept of "big data" has been integral long before the term was coined. Financial institutions have recognized the value of collecting and utilizing data for decision-making purposes. Newspapers historically stored security prices, and with the rise of computers, companies like Bloomberg emerged, focusing on data collection and dissemination. In the 1990s, stock exchanges began offering trade-by-trade data, laying the foundation for what is now considered big data.

Today, investors have access to an extensive array of financial data at minimal cost, empowering them with insights into the companies they invest in. This abundance of data also enables firms and policymakers to make more informed decisions.

Machine learning algorithms have become crucial in predicting market price changes. Early attempts at identifying repeatable patterns in data were less successful, but with advancements in technology and computing power, companies like Renaissance Technologies and D.E. Shaw developed sophisticated pattern recognition software that accurately predicts short-term price movements. Their success is partly attributed to investors' tendency to conceal their advantage by spreading out their trades over time, a behavior that can be exploited to forecast future price moves. However, as algorithms compete and traders adjust their strategies to become less predictable, forecasting future price moves becomes increasingly challenging, leading to a technological arms race.

The availability of data has not only enhanced targeting in various sectors but has also revolutionized financial services. Start-ups like SoFi, LendingClub, and Upstart, along with established lenders like Capital One, utilize machine learning to make more informed lending decisions beyond basic credit scores. Similarly, insurance providers structure their offerings using big data. While these advancements open new markets and potentially reduce costs, there are concerns about higher-risk customers facing increased service costs or being denied service altogether based on machine learning algorithms.

Compétions

Technological advances have also paved the way for non-financial organizations to offer financial services. Companies like Apple, PayPal, and Google provide payment services traditionally offered by banks, while Amazon and Square offer business loans leveraging the data they collect on vendors. This intense competition is expected to drive further innovation in the financial industry.

Given finance's historical track record of embracing new technologies, continued investment in fintech is anticipated. The resulting innovations will likely continue reshaping the financial industry, offering both substantial profits to early adopters and significant value to end-users and the broader economy.

Top of Form

Chap 2 : intro to financial statement analysis Bottom of Form

Top of Form

Despite this broad ownership, stock ownership remains the primary tie investors have to the company. Therefore, it's crucial for investors to learn about a company before investing. Financial statements play a vital role in this process by communicating essential financial information regularly.Bottom of Form

Bottom of Form

2.1. Firms’ Disclosure of Financial Information

Financial statements are essential accounting reports containing past performance information issued periodically by firms, typically quarterly and annually.

Public companies in the United States are mandated to file these statements with the U.S. Securities and Exchange Commission (SEC) quarterly on Form 10-Q and annually on Form 10-K. Additionally, they must send an annual report with financial statements to shareholders.

While private companies also prepare financial statements, they are not obligated to disclose them publicly. These statements serve as crucial tools for investors, financial analysts, creditors, and internal managers, providing insights for corporate financial decisions.

Preparation of financial statements

Financial statements must adhere to Generally Accepted Accounting Principles (GAAP) to ensure accuracy and comparability across firms. Auditors, neutral third parties, are hired to verify the accuracy of annual financial statements prepared according to GAAP.

However, due to varying accounting standards globally, international companies face complexity in financial reporting. To address this, the International Financial Reporting Standards (IFRS) were established, aiming for global harmonization of accounting standards.

Differences between U.S. GAAP and IFRS are in inventory valuation, R&D expenses, impairment charges, and financial instruments treatment. While the SEC requires U.S. firms to report using U.S. GAAP, they may provide supplemental information using IFRS. The CFO's role has evolved post-crisis to include a broader focus on risk management, capital allocation, and advising business leaders. Key lessons from the financial crisis include prioritizing liquidity, building robust control infrastructure, and acting swiftly to address challenges.

Types of financial statements :

- the balance sheet,

- the income statement,

- the statement of cash flows

- the statement of stockholders’ equity.

These financial state- ments provide investors and creditors with an overview of the firm’s financial performance.

2.2. the balance sheet

The balance sheet, or statement of financial position,lists the firm’s assets and liabilities, providing a snapshot of the firm’s financial position at a given point in time.

The balance sheet is divided into two parts (“sides”), with the assets on the left side and the liabilities on the right. The assets list the cash, inventory, property, plant, and equipment, and other investments the company has made; the liabilities show the firm’s obligations to creditors. Also shown with liabilities on the right side of the balance sheet is

The balance sheet is divided into two parts (“sides”), with the assets on the left side and the liabilities on the right. The assets list the cash, inventory, property, plant, and equipment, and other investments the company has made; the liabilities show the firm’s obligations to creditors. Also shown with liabilities on the right side of the balance sheet is

Assets = Liabilities + stockholder equity

Ex : 177,7 = 155,5 + 22,2 ( as seen in the picture)

Assets

Assets are resources owned by a company that provide future economic benefits. They are classified into current assets and long-term assets on the balance sheet.

- Current Assets: These are assets expected to be converted into cash or used up within one year. They include:

- Cash and Marketable Securities: Easily convertible, low-risk investments.

- Accounts Receivable: Amounts owed to the company by customers who purchased goods or services on credit.

- Inventories: Raw materials, work-in-progress, and finished goods.

- Other Current Assets: Miscellaneous items like prepaid expenses.

- Long-Term Assets: These assets provide benefits beyond one year. They include:

- Property, Plant, and Equipment (PP&E): Tangible assets like real estate and machinery used for more than a year. Depreciation is deducted annually to account for wear and tear.

- Goodwill and Intangible Assets: Recorded when a company pays more for another company than the book value of its tangible assets. Represents intangible assets like brand names, patents, and customer relationships.

- Other Long-Term Assets: Various items such as non-operating property, startup costs, long-term investments, and property held for sale.

The total assets = currents assets + LT assets

Liabilities

Liabilities represent a company's obligations to other parties and are classified into current and long-term liabilities on the balance sheet.

- Current Liabilities: These are obligations expected to be settled within one year and include:

- Accounts Payable: Amounts owed to suppliers for goods or services purchased on credit.

- Short-term Debt: Repayments of debt due within the next year.

- Accrued Expenses: Amounts owed for expenses like salaries, taxes, and unearned revenue.

The difference between current assets and current liabilities yields the net working capital, which is the short-term capital available to run the business.

- Long-Term Liabilities: These are obligations extending beyond one year and include:

- Long-term Debt: Loans or debt obligations with maturities exceeding one year, often used for major investments or asset purchases.

- Leases: Contracts obligating the firm to make regular payments for using assets like buildings.

- Deferred Taxes: Taxes owed but not yet paid due to differences between financial reporting and tax regulations.

Long-term liabilities help finance large-scale investments or acquisitions and are crucial for sustaining a company's operations over time.

Understanding a company's liabilities helps assess its financial health, debt management, and ability to meet its obligations in the short and long term.

Top of Form

Stockholdler’s equity Bottom of Form

Stockholders' Equity, also known as shareholders' equity or net worth, represents the residual interest in the company's assets after deducting its liabilities. It reflects the value of the shareholders' ownership stake in the company.

- Formula : Total assets – Total liabilities . It represents the book value of equity, which is an accounting measure of the firm's net worth.

- Historical Cost vs. True Value: Assets listed on the balance sheet are often recorded at historical cost rather than their current market value. For example, property, plant, and equipment are recorded at their acquisition cost net of depreciation. However, the actual value of these assets today may be different from their historical cost.

- Unrecorded Assets: Many valuable assets, such as intellectual property, brand reputation, customer relationships, and employee expertise, are not captured on the balance sheet. These intangible assets contribute to the firm's overall value but are not reflected in its book value of equity.

Understanding stockholders' equity provides insights into the financial health and value of a company from the perspective of its shareholders. However, it's essential to recognize that the balance sheet may not fully capture all the company's assets and their true value.

MArket value vs Book value

Market value and book value are two different measures of a company's equity, reflecting different perspectives on its worth:

- Book Value of Equity: This is the value of shareholders' equity as reported on the company's balance sheet ( the OG price), adjusted for depreciation). It represents the accounting value of the company's assets minus its liabilities. Book value is based on historical cost and may not accurately reflect the current market value of the company's assets.

Ex : If you have a car. Its book value is what you paid for it originally, minus any depreciation. So, if you bought it for $20,000 and it's now worth $15,000 after some years, its book value is $15,000.

- Market Value of Equity: Also known as market capitalization, it represents the total value of a company's outstanding shares in the stock market. Market value is determined by the current market price per share multiplied by the total number of shares outstanding. It reflects investors' expectations about the company's future performance and growth prospects. (Market value is what you can actually sell it for today.)

Ex : Now, imagine you want to sell that car. The market value is what someone is willing to pay for it right now. Maybe you find a buyer willing to pay $18,000 for your car. That's its market value.

Key Points:

- Market value often exceeds book value, especially for successful firms, because investors anticipate future earnings and growth potential.

- The market-to-book ratio, also known as the price-to-book (P/B) ratio, compares a company's market value to its book value of equity. A ratio greater than 1 indicates that the market values the company's assets higher than their historical cost.

- Variations in the market-to-book ratio reflect differences in fundamental firm characteristics and the value added by management.

- Companies with high market-to-book ratios are often considered growth stocks, while those with low ratios may be classified as value stocks.

In the context of a company:

- Book value is what the company's assets are worth according to its financial records.

- Market value is how much investors think the company is worth based on its stock price.

When market value is higher than book value, it means investors believe the company's assets are worth more than what's recorded on paper. This usually happens with growing or successful companies.

Understanding the relationship between market value and book value provides insights into investor perceptions and expectations regarding a company's financial health and growth prospects.

Top of Form

Bottom of Form

ExampleTop of Form

Market Versus Book Value

Problem : If Global has 3.6 million shares outstanding, and these shares are trading for a price of $14 per share, what is Global’s market capitalization? How does the market capitalization compare to Global’s book value of equity in 2022?

Solution : Global’s market capitalization is ( 3.6 million shares ) × ( $14 share ) = $50.4 million. This market capitalization is significantly higher than Global’s book value of equity of $22.2 million. Thus, investors are willing to pay 50.4 22.2 = 2.27 times the amount Global’s shares are “worth” according to their book value.

Market-to-Book Ratio. In Example 2.1, we computed the market-to-book ratio (also called the price-to-book [P/B] ratio) for Global, which is the ratio of its market capital- ization to the book value of stockholders’ equity.

Market-to-Book Ratio = Market Value of Equity / Book Value of Equity

Enterpise value Bottom of Form

Enterprise value is the total cost to buy a company, including its stock value, debt, and minus any cash it has.

- Enterprise Value: This is like the total cost to buy a company. It includes everything you need to pay to take over the business.

- Market Value of Equity: This is the value of the company's stock, which we talked about earlier.

- Debt: This is how much the company owes to others.

- Cash: This is how much money the company has in the bank.

So, to find the enterprise value, you add up:

- The market value of the company's stock,

- The debt the company owes, and

- Then, you subtract any cash the company has because if you buy the company, you'll get that cash back.

Example:

- If the market value of a company's stock is $100 million,

- Its debt is $50 million,

- And it has $20 million in the bank,

Then, the enterprise value would be $100 million (stock) + $50 million (debt) - $20 million (cash) = $130 million. So, it would cost about $130 million to buy the whole company.

2.3. the income statement

The income statement or statement of financial performance5 lists the firm’s revenues and expenses over a period of time.

Earning Calculations

The income statement shows the revenue and expenses of a company over a period of time. It starts with the total sales revenue and subtracts the cost of sales to calculate the gross profit.

- Example: Gross profit is calculated as Total Sales Revenue minus Cost of Sales: $1,000,000 - $500,000 = $500,000.

- Explanation: Gross profit reflects the profit generated from sales revenue after deducting the direct costs of producing the goods or services sold.

Then, it deducts operating expenses such as administrative costs and depreciation to find the operating income.

- Example: Operating income is calculated as Gross Profit minus Operating Expenses and Depreciation: $500,000 - ($200,000 + $50,000) = $250,000.

- Explanation: Operating income, also known as earnings before interest and taxes (EBIT), reflects the profit from operations before considering interest expenses and taxes.

After accounting for other income and expenses, it computes the earnings before interest and taxes (EBIT).

Explanation: EBIT represents the company's earnings before deducting interest expenses and income taxes.

By subtracting interest expenses and taxes, the statement arrives at the net income, which represents the profit attributable to the company's shareholders. This net income is often reported as earnings per share (EPS), indicating the profit earned per share of stock outstanding. Diluted EPS considers the potential impact of additional shares from stock options or convertible bonds, providing a more conservative measure of earnings per share.

- Net Income:

- Example: After paying taxes of $50,000, the company's net income is $150,000 ($200,000 - $50,000).

- Explanation: Net income, also known as the bottom line, represents the company's profit after deducting all expenses, including taxes.

- Earnings Per Share (EPS):

- Example: If the company has 100,000 shares outstanding, its EPS would be $1.50 ($150,000 / 100,000). ( Net income / shares outstanding)

- Explanation: Earnings per share is the portion of a company's net income attributable to each outstanding share of its common stock, indicating its profitability on a per-share basis.

What is the diff between gross profit and net income? The main difference between gross profit and net income is that gross profit only considers the direct costs of production, while net income accounts for all expenses, including operating expenses, interest, taxes, and other non-operating costs. Net income provides a more comprehensive view of a company's profitability compared to gross profit.

What is diluted EPS? Diluted earnings per share (EPS) is a measure of a company's earnings per share calculated by considering the potential impact of dilutive securities, such as stock options, convertible bonds, or preferred stock, that could increase the number of shares outstanding.

2.4. Statement of cash flows

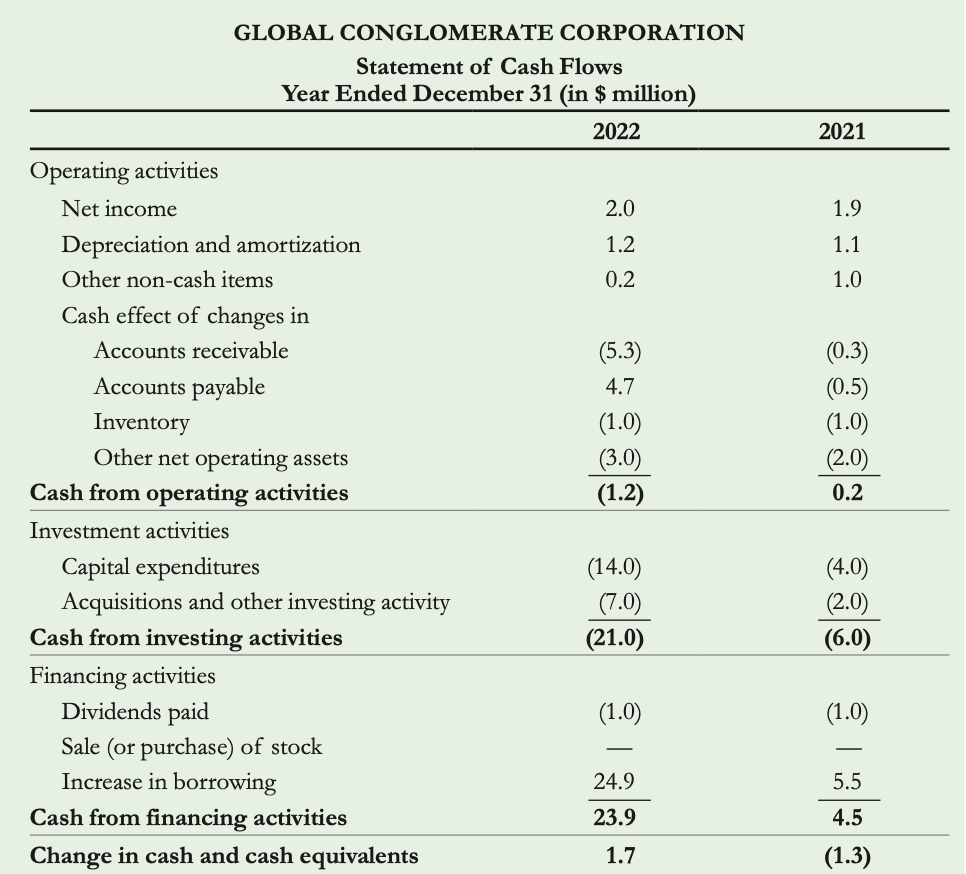

The Statement of Cash Flows is a financial statement that provides information about a company's cash inflows and outflows over a specific period. It helps investors understand how much cash the company has generated and how it has been used.

Operating Activities

This section starts with the company's net income from the income statement and then adjusts it by adding back non-cash expenses and accounting for changes in working capital.

- Purpose: It shows how much cash the company has generated or used in its core operations, providing insights into its ability to generate cash from its primary business activities , considering both cash and non-cash transactions.

- Adjusting for Non-Cash Items:

- Definition: Non-cash items, such as depreciation and amortization, are added back to net income because they are not actual cash outflows.

- Example: In 2022, Global had depreciation and amortization expenses of $1.2 million, which were added back to the net income of $2.0 million, resulting in a total cash flow from operating activities of $3.2 million.

- Adjusting for Changes in Working Capital:

- Accounts Receivable: When sales are recorded but cash has not been received yet, the increase in accounts receivable is deducted from net income because it represents additional lending to customers, reducing cash available.

- Accounts Payable: Increases in accounts payable are added back to net income because they represent borrowing from suppliers, increasing cash available.

- Inventory: Increases in inventory are deducted from net income because they represent cash expenses for the firm.

- Other Current Assets and Liabilities: Changes in other current assets and liabilities, excluding cash and debt, are also accounted for.

- Example: Global's accounts receivable increased by $5.3 million from 2021 to 2022. This increase is deducted from net income to reflect the negative impact on cash flow from operating activities

Investment Activities

This section lists the cash used/required for investment purposes, such as purchasing or selling assets like property, plant, and equipment (capital expenditures), or making investments in other companies.

- Purpose: It highlights the company's investment decisions and capital expenditures, indicating how it is allocating its resources for future growth or strategic purposes.

Here's how it works:

- Capital Expenditures (CapEx):

- Definition: Capital expenditures are investments made by the company in new property, plant, and equipment (PP&E).

- Explanation: While capital expenditures do not immediately impact the income statement as expenses, they represent cash outflows for the company.

- Example: In 2022, Global spent $21 million in cash on capital expenditures, indicating investments in new assets like buildings, machinery, or equipment.

- Other Investments:

- Definition: This category includes other long-term investments made by the company, such as acquisitions of other businesses or purchases of marketable securities.

- Explanation: These investments are also cash outflows for the company and are deducted from the cash flow from operating activities.

- Example: If Global acquired another company during the year or purchased marketable securities, the cash spent on these activities would be deducted from the cash flow from operating activities.

Overall, the investment activities section reflects the cash spent by the company on acquiring or improving assets, as well as on other long-term investments.

Top of Form

Bottom of Form

Financing Activities:

This section shows the flow of cash between the company and its investors, including activities such as issuing or repurchasing stocks, paying dividends, borrowing or repaying debt, and other financing transactions.

- Purpose: It reveals how the company is financing its operations and growth, whether through equity or debt, and how it is managing its capital structure.

Overall, the Statement of Cash Flows provides valuable insights into a company's liquidity, solvency, and financial flexibility, helping investors assess its ability to meet short-term obligations, fund future growth initiatives, and generate returns for shareholders.

Top of Form

Here's a breakdown:

- Dividends Paid:

- Definition: Dividends paid to shareholders represent a cash outflow from the company.

- Explanation: Dividends are the portion of the company's earnings distributed to its shareholders as a return on their investment.

- Example: In 2022, Global paid $1 million in dividends to its shareholders, indicating the cash outflow used to distribute profits.

- Retained Earnings:

- Definition: Retained earnings represent the portion of net income that is not paid out as dividends but retained by the company for reinvestment or other uses.

- Explanation: It reflects the amount of earnings reinvested back into the company for future growth.

- Example: If Global's net income was $2 million and it paid out $1 million in dividends, its retained earnings for the year would be $1 million.

- Stock Issuance or Repurchase:

- Definition: This includes cash received from issuing new shares of stock or cash spent on repurchasing existing shares.

- Explanation: Issuing stock raises capital for the company, while repurchasing stock reduces the number of outstanding shares.

- Example: If Global issued new shares during the year to raise funds or repurchased some of its own stock, these transactions would be reflected in this section.

- Changes in Borrowing:

- Definition: This reflects the cash inflows or outflows from changes in short-term and long-term borrowing.

- Explanation: Increases in borrowing represent cash inflows as the company raises capital through debt issuance.

- Example: If Global borrowed additional funds during the year, the cash received from borrowing would be included in this section.

The final line of the financing activities section summarizes the net cash inflows or outflows from financing activities. This section helps investors understand how the company is financing its operations and investments and whether it is relying more on debt or equity financing.

Bottom of Form

2.5. Other Financial statement information

Statement of Stockholders’ Equity

This statement breaks down the stockholders’ equity from the balance sheet into components like retained earnings and net sales of stock.

- It helps track changes in equity over time. For example, if a company had no stock sales or repurchases, its stockholders’ equity would increase by the amount of retained earnings.

Change in stockholders’ equity = Retianed earnings + Net sales of stocks

= Net income – Dividends + sales of stock – repurchases of stock

Management Discussion and Analysis (MD&A)

It’s where the company’s management provides info on recent performance, significant events, and future plans. It discusses the company's strategies, goals, and potential risks it faces. It also discloses any off-balance sheet transactions, which are arrangements that could affect the company's future performance but aren't listed on the balance sheet.

Notes to the Financial Statements

These are detailed explanations accompanying the financial statements. They clarify accounting assumptions, provide information on subsidiaries or product lines, detail stock-based compensation plans, and outline debt types and repayment schedules. Notes also cover acquisitions, leases, taxes, and risk management activities. They're crucial for interpreting the financial statements fully.

Example 2.3 illustrates how companies report sales revenues by product category and calculate percentage growth to forecast future revenues. For instance, if a product category showed the highest growth rate in one year, analysts can use that rate to estimate its revenues for the next year.

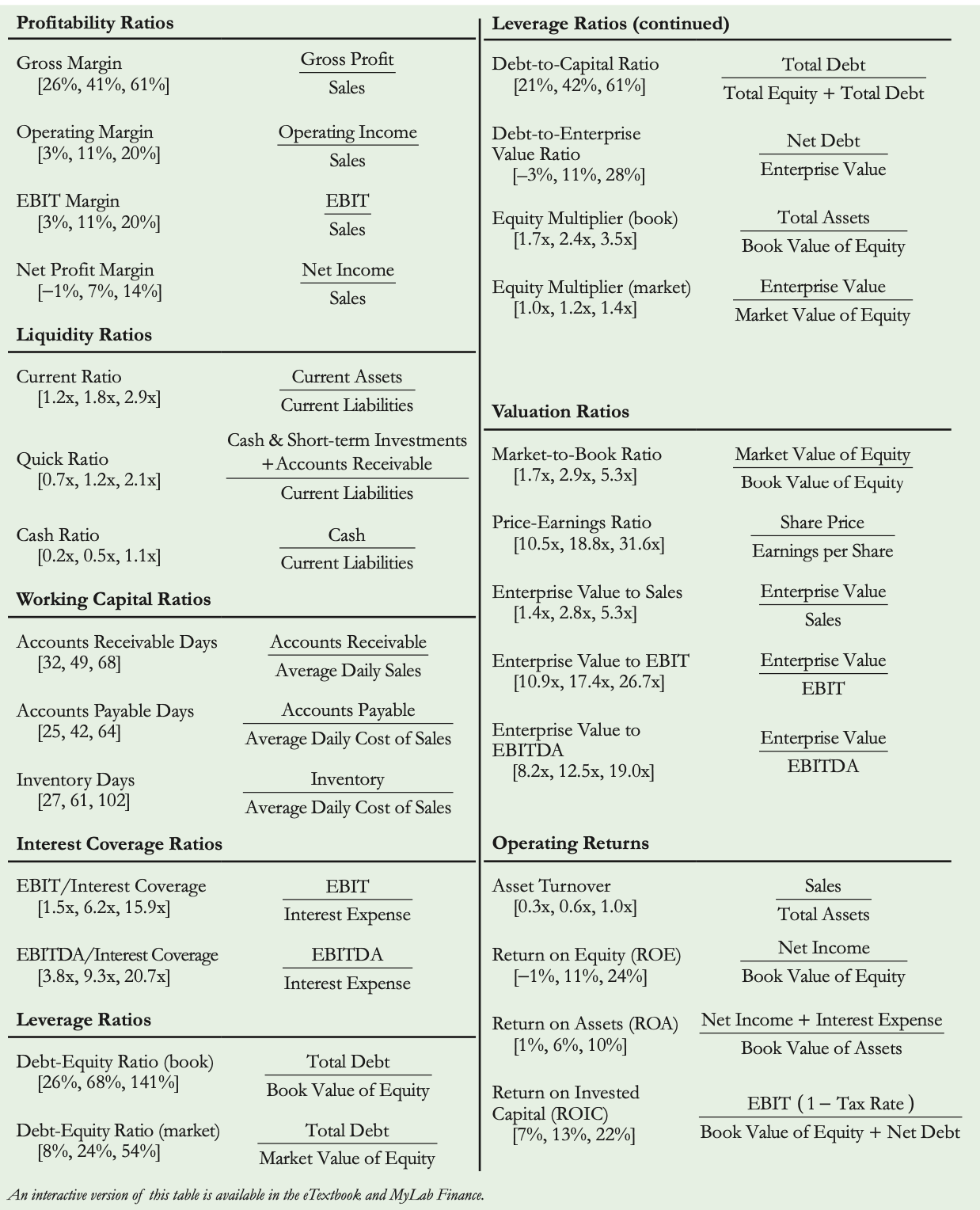

2.6. Financial statement analysis

Financial ratios are used to assess the financial health and performance of a company by analyzing its financial statements. These ratios provide insights into various aspects such as profitability, liquidity, leverage, and valuation. Here's a simplified explanation of some key financial ratios mentioned in the text:

- Profitability Ratios: These ratios measure the company's ability to generate profits relative to its revenue.

- Gross Margin: Percentage of revenue retained after subtracting the cost of goods sold.

- Operating Margin: Operating income as a percentage of revenue.

- EBIT Margin: Earnings Before Interest and Taxes (EBIT) as a percentage of revenue.

- Net Profit Margin: Net income as a percentage of revenue.

- Liquidity Ratios: These ratios assess the company's ability to meet its short-term obligations.

- Current Ratio: Current assets / current liabilities.

- Quick Ratio: (Current assets - Inventory) / current liabilities.

- Cash Ratio: Cash and cash equivalents / current liabilities.

- Working Capital Ratios: These ratios measure the efficiency of the company's working capital management. ( unit : dys)

- Accounts Receivable Days: Average number of days it takes to collect accounts receivable.

- Accounts Payable Days: Average number of days it takes to pay accounts payable.

- Inventory Days: Average number of days inventory is held.

- Interest Coverage Ratios: These ratios indicate the company's ability to cover interest expenses.

- EBIT/Interest Coverage: Earnings Before Interest and Taxes (EBIT) divided by interest expenses.

- EBITDA/Interest Coverage: Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) divided by interest expenses.

- Leverage Ratios: These ratios assess the company's debt levels.

- Debt-Equity Ratio: Total debt divided by total equity.

- Debt-to-Capital Ratio: Total debt divided by total debt plus total equity.

- Valuation Ratios: These ratios assess the company's valuation in the market.

- Price-Earnings (P/E) Ratio: Market price per share divided by earnings per share.

- Enterprise Value to EBITDA: Enterprise value divided by EBITDA.

- Operating Returns: These ratios measure the company's returns from its operations.

- Return on Equity (ROE): Net income divided by shareholders' equity.

Return on Assets (ROA): Net income plus interest expenses divided by total asse

Return on Assets (ROA): Net income plus interest expenses divided by total asse

ts.

Dupont Identity

The DuPont Identity is a powerful analytical tool used to break down a firm's return on equity (ROE) into its component parts, providing insights into the drivers of profitability. It expresses ROE as the product of three ratios: net profit margin, asset turnover, and equity multiplier.

- Net Profit Margin: This ratio measures the firm's profitability by expressing how much profit the company generates from each dollar of sales. It is calculated as net income divided by sales.

- Asset Turnover: Asset turnover indicates how efficiently a company is utilizing its assets to generate revenue. It is calculated as sales divided by total assets.

- Equity Multiplier: The equity multiplier represents the degree of financial leverage used by the firm, indicating how much assets are financed by equity versus debt. It is calculated as total assets divided by shareholder's equity (or book value of equity).

Formula : Net prfot marign x asset turnover x equity multiplier

- Walmart:

- Net profit margin = $13.7 billion / $572.8 billion ≈ 2.39%

- Asset turnover = $572.8 billion / $244.9 billion ≈ 2.34

- Equity multiplier = $244.9 billion / $83.3 billion ≈ 2.94

- ROE = 2.39% × 2.34 × 2.94 ≈ 16.4%

- Target:

- Net profit margin = $6.9 billion / $106 billion ≈ 6.51%

- Asset turnover = $106 billion / $53.8 billion ≈ 1.97

- Equity multiplier = $53.8 billion / $12.8 billion ≈ 4.20

- ROE = 6.51% × 1.97 × 4.20 ≈ 53.9%

Despite having lower asset turnover, Target achieves a higher ROE than Walmart due to its higher net profit margin and leverage.

If Target had a similar equity multiplier to Walmart, its ROE would have been: = 6.51% × 2.34 × 2.94 ≈37.7%

TargetROE=6.51%×2.34×2.94≈37.7%

This calculation assumes Target's leverage (equity multiplier) is the same as Walmart's, leading to a hypothetical ROE.

q

The Enron and WorldCom scandals were two prominent cases of corporate financial fraud in the early 2000s. Enron, once praised as innovative, used deceptive accounting methods to inflate its financial performance, ultimately leading to its bankruptcy filing in 2001. Similarly, WorldCom engaged in accounting fraud by misclassifying expenses as capital expenditures to overstate its earnings. These scandals prompted the enactment of the Sarbanes-Oxley Act in 2002, aimed at improving financial reporting transparency and corporate governance. Despite regulatory efforts, financial scandals like the Wirecard case in Germany continue to underscore the ongoing challenges in ensuring financial integrity and regulatory compliance.

Chap 3 : Financial Decision Making and the Law of One Price

Microsoft's decision to enter a bidding war with Google and Yahoo! for a stake in Facebook in 2007 was based on a careful assessment of the costs and benefits. They evaluated the potential revenues from advertising sales on Facebook, along with the appreciation of their stake in the company.

- By using the Valuation Principle, which relies on current market prices to determine the value of costs and benefits, Microsoft could compare the benefits of the investment against its costs. This principle allowed them to calculate the net present value (NPV) of the decision, indicating whether the cash value of benefits exceeded the cash value of costs at the present time. Ultimately, Microsoft's decision proved profitable, as the value of their stake in Facebook appreciated significantly by the time of Facebook's IPO in 2012. The concept of the Law of One Price, which asserts that equivalent investment opportunities in competitive markets must have the same price, underpins the valuation process in financial decision-making.

3.1. Valuing decisions

Objectif : how to make decisions that increase the value of the firm to investors

This involves these skills:

Marketing: to forecast the increase in revenues resulting from an advertising campaign

Accounting: to estimate the tax savings from a restructuring

Economics: to determine the increase in demand from lowering the price of a product

Organizational Behavior : to estimate the productivity gains from a change in management structure

Strategy: to predict a competitor’s response to a price increase Operations: to estimate the cost savings from a plant modernization

Analyzing costs & benefits

1st step in decision making identifying the costs & benefits of a decision, then it’s to quantify them .

When making decisions, iwe need to understand the costs and benefits involved. First, we identify what we stand to gain (benefits) and lose (cost). Then, we put a number on these gains and losses to compare them effectively ( quantify them) .

EXAMPLE:

Imagine a jewelry maker has the chance to trade 400 ounces of silver for 10 ounces of gold today. But because gold and silver have different values, it's not enough to just count ounces—we need to figure out their cash value today to compare them properly.

For the silver, let's say it's worth $25 per ounce in the market right now. So, 400 ounces of silver equals $10,000 today. Now, for the gold, let's assume it's valued at $1900 per ounce today. That means the 10 ounces of gold are worth $19,000 today.

Now that we've put both the costs and benefits in terms of cash value today, we can compare them. The jewelry maker stands to gain $19,000 from the gold but will lose $10,000 from the silver, resulting in a net gain of $9000 today. So, by making the trade, the jewelry maker will end up $9000 richer. That's how analyzing costs and benefits helps make smart decisions

Using market prices to determine cash values

In a competitive market, where goods can be bought and sold at the same price, that price determines the cash value of the goods. The decision maker's opinions or preferences don't alter this value as long as a competitive market exists.

Example 3.1 competitve market prices determine value

Problem: You have just won a radio contest and are disappointed to find out that the prize is four tickets to the Def Leppard reunion tour (face value $40 each). Not being a fan of 1980s power rock, you have no intention of going to the show. However, there is a second choice: two tickets to your favorite band’s sold-out show (face value $45 each). You notice that tickets to the Def Leppard show are being bought and sold online for $30 apiece and tickets to your favorite band’s show are being bought and sold at $50 each. Which prize should you choose?

Solution : The key to making the right choice between the two prize options lies in understanding market prices, not personal preferences or the face value of the tickets:

- Four Def Leppard tickets are worth $30 each online, totaling $120.

- Two tickets to your favorite band's show are worth $50 each, totaling $100.

Choosing the Def Leppard tickets and selling them would give you $120, which is more than enough to buy two tickets to your favorite band's show and still have $20 left over for a T-shirt.

- This decision-making process is guided by the Valuation Principle in finance, which states that the value of an asset is determined by its competitive market price. By evaluating costs and benefits using these market prices, we can determine whether a decision will increase the wealth of the firm or its investors.

EX 3.2. applying the valuation principle

Problem: You are the operations manager at your firm. Due to a pre-existing contract, you have the oppor- tunity to acquire 125 barrels of oil and 1500 pounds of copper for a total of $12,000. The cur- rent competitive market price of oil is $80 per barrel and for copper is $4 per pound. You are not sure you need all of the oil and copper, and are concerned that the value of both commodities may fall in the future. Should you take this opportunit

Solution : To decide whether to seize the opportunity, let's evaluate its costs and benefits using current market prices:

125 barrels of oil at $80 per barrel (125 x 80) = $10,000 today

1500 pounds of copper at $4 per pound (1500x4) = $6000 today

The total cost is $12,000 (10,000+ 6000-12,000).

However, the combined market value of the oil and copper is $16,000. So, the net value of the opportunity is $4000 today, indicating a positive outcome.

Even if you don't require all the oil and copper immediately, or anticipate a decline in their value, you can still sell them at current market rates, fetching $16,000. Therefore, taking this opportunity would benefit the firm, increasing its value by $4000.

3.2 interest rates & time value of money

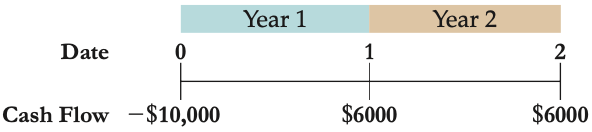

For most financial decisions costs and benefits occur at different points in time. For example, typical investment projects incur costs up front and provide benefits in the future.

The time value of money

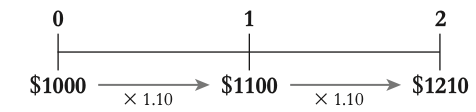

The time value of money refers to the principle that a dollar received today is worth more than a dollar received in the future. This is because money today can be invested or earn interest, increasing its value over time.

EX: if you have $1 today and invest it in a bank account with a 7% interest rate, you will have $1.07 at the end of one year.

Therefore, when evaluating investment opportunities w/ cash flows occurring at different points in time, it's essential to consider the time value of money. Simply subtracting future benefits from present costs ignores this principle and may lead to incorrect evaluations.

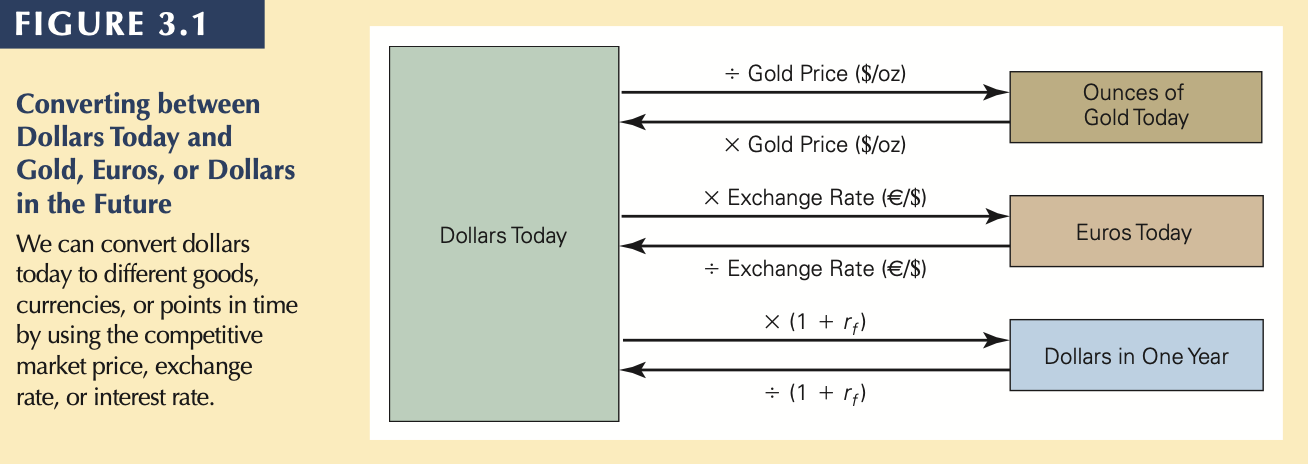

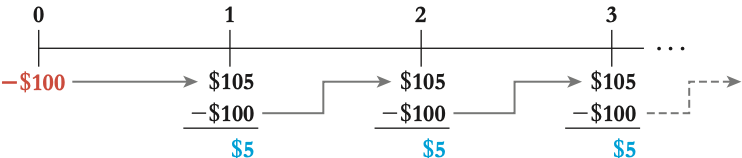

The Interest Rate: An Exchange Rate Across Time

The interest rate serves as an exchange rate across time, allowing us to convert money from one point in time to another. Just as an exchange rate enables us to convert money from one currency to another, the interest rate allows us to exchange money from one time period to another. This rate, known as the risk-free interest rate, represents the market price today of money in the future.

EX: if the current annual interest rate is 7%, it means that by borrowing or investing at this rate , we can exchange $1 today for $1.07 in one year. This exchange rate factor, denoted as (1 + ), risk-free interest rate defines the conversion rate between dollars today and dollars in one year, without any risk.

When evaluating investment opportunities, it's important to consider the time value of money. This principle states that a dollar received today is worth more than a dollar received in the future, due to the ability to invest and earn interest. Therefore, costs and benefits occurring at different points in time must be adjusted to a common time frame for accurate comparison.

EX value of investment in 1yr: To evaluate the investment considering the time value of money, we first adjust the cost of $100,000 today to its equivalent value in one year using the interest rate of 7%. This gives us a cost of $107,000 in one year ( 100 000 x 1.07).

Think of this as the opportunity cost of spending $100,000 today; we're essentially giving up the $107,000 we would have if we left the money in the bank. Alternatively, if we borrowed $100,000, we would owe $107,000 in one year.

Now, both costs and benefits are in terms of "dollars in one year," allowing us to directly compare them : 105,000 − $107,000 = −$2000 in one year

In other words, we could earn $2000 more in one year by putting our $100,000 in the bank rather than making this investment. We should reject the investment: If we took it, we would be $2000 poorer in one year than if we didn’t.

EX value of investement today : To determine the value of the investment in terms of dollars today, we use the interest rate factor to convert the benefit of $105,000 in one year to its equivalent amount in present terms.

We divide the future benefit by the interest rate factor, which is (1.07 $ in one year $ today). This gives us: Benefit = ($105,000 in one year) ÷ (1.07 $ in one year $ today) = $105,000 × 1 today

This calculation results in $98,130.84 today. This amount represents the present value of receiving $105,000 in one year, considering the time value of money. It's also the amount the bank would lend to us today if we promised to repay $105,000 in one year. Therefore, $98,130.84 is the competitive market price at which we can "buy" or "sell" $105,000 in one year.

Now, we can compute the net value of the investment in terms of dollars today. Subtracting the present value of $100,000 from the cost of $100,000 today yields:

$98,130.84 - $100,000 = -$1869.16 today

Once again, the negative result indicates that we should reject the investment. Taking the investment would make us $1869.16 poorer today because we have given up $100,000 for something worth only $98,130.84

Present vs future value : Both approaches show that the decision to reject the investment remains the same, whether we consider the value in dollars today or dollars in one year.

if we convert from dollars today to dollars in one year,

( −$1869.16 today ) × (1.07 $ in one year $ today ) = −$2000 in one year

we see that the two results are equivalent, but expressed as values at different points in time.

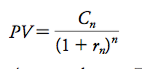

- Price Today of Money in the Future: When we talk about the value of money in the future, we need to consider how much it's worth in today's terms. For instance, if you're promised $1 a year from now, that $1 isn't worth as much if you had it in your hand today. The reason is you could invest that $1 today and earn some interest on it. So, to know its value today, we need to discount it.

- Discount Factor: The term 1/1+r , where r is the interest rate, represents this discount. EX: if the interest rate is 7%, then the discount factor is 1/1+0.07, which is approximately 0.93458. This means that $1 received in one year is worth about $0.93458 today.

- Risk-Free Interest Rate: This discount rate, represented by r, is also called the risk-free interest rate. It's called "risk-free" because it's the rate at which we can convert money from one point in time to another without any risk, like depositing money in a bank savings account.

So, in summary, the discount factor tells us how much less money received in the future is worth in today's terms, and the risk-free interest rate determines this discount factor.

EX 3.3 : comapring costs at different points in time

Problem : The cost of rebuilding the San Francisco Bay Bridge to make it earthquake-safe was approxi- mately $3 billion in 2004. At the time, engineers estimated that if the project were delayed to 2005, the cost would rise by 10%. If the interest rate were 2%, what would be the cost of a delay in terms of dollars in 2004?

Solution : If the project were delayed, it would cost $3 billion × 1.10 = $3.3 billion in 2005. To compare this amount to the cost of $3 billion in 2004, we must convert it using the interest rate of 2%:

$3.3 billion in 2005 ÷ ( $1.02 in 2005 $ in 2004 ) = $3.235 billion in 2004 Therefore, the cost of a delay of one year was

$3.235 billion − $3 billion = $235 million in 2004

$3.235 billion − $3 billion = $235 million in 2004

That is, delaying the project for one year was equivalent to giving up $235 million in cash.

We can use the risk-free interest rate to determine values in the same way we used competitive market prices.

3.3 present value & the NPV decision rule

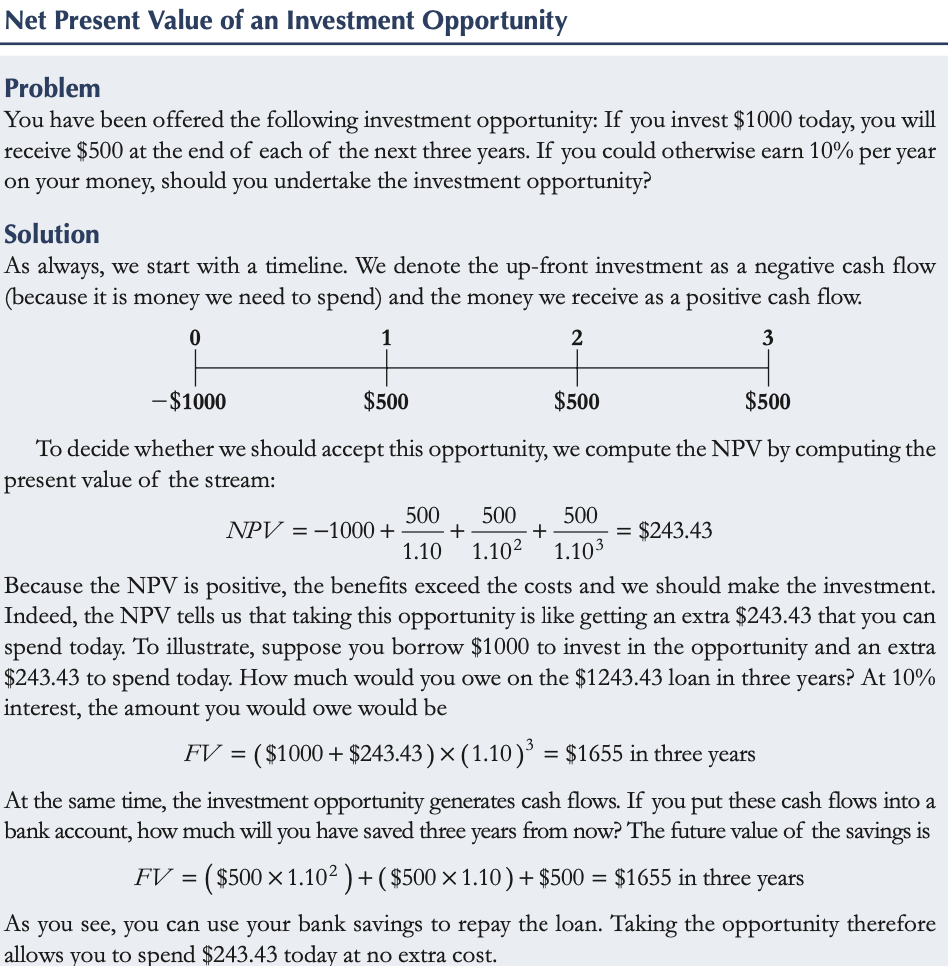

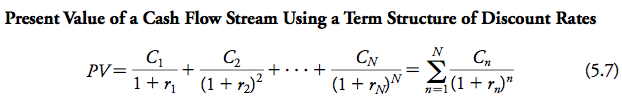

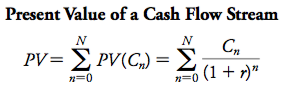

While we can compare costs and benefits at any point in time, most businesses prefer to evaluate them in terms of their present value, i.e., how much they are worth in cash today. This simplifies decision-making and makes it more practical. Building on the Valuation Principle, we introduce the concept of Net Present Value (NPV). NPV helps us determine the current value of a series of cash flows by discounting them back to the present using the risk-free interest rate.

- Golden Rule: The NPV Rule states that if the NPV of a project is positive, it's considered a good investment because it adds value to the company. But, if the NPV is negative, it suggests that the project would subtract value from the company and should be avoided.

Net present value

NPV is the difference between the present value of benefits and the present value of costs associated with a project or investment. 🡪 NPV = PV (Benefits) − PV (Costs)

In NPV calculations, positive cash flows represent benefits, while negative cash flows represent costs. We calculate the present value of each cash flow and then sum them up to find the NPV. 🡪 NPV = PV ( All project cash flows ) NPV is the total of the present values of all project cash flows.

Ex: Let's say your firm is offered an investment opportunity where you invest $500 today and receive $550 in one year with certainty. Using the risk-free interest rate of 8%, we calculate the present value of the benefit as $509.26 today.

- PV calculation : $550/$1.08 = $509.26

- NPV Calculation: $509.26 - $500 = . $9.26 today

Even if your firm doesn't have the $500 upfront, it can borrow $509.26 from the bank at the 8% interest rate and then take the project. What are your cash flows in this case?

Today : $509.26 ( loan ) − $500 ( invested in the project ) = $9.26 In one year: $550 ( from project ) − $509.26 × 1.08 ( loan balance ) = $0

This transaction leaves you with exactly $9.26 extra cash today and no future net obliga- tions.

Positive NPV: A positive NPV indicates that the investment decision adds value to the firm, making it a good decision regardless of your current cash situation or spending preferences.

In summary, NPV helps companies assess the value of investment opportunities by comparing the present value of benefits with the present value of costs

The NPV Decison rule

The NPV Decision Rule simplifies investment decisions by focusing on cash flows today. Here's a breakdown:

Definition: NPV Decision Rule states that when faced with investment options, choose the one with the highest NPV. This choice is akin to receiving the NPV amount in cash today.

For projects, if NPV is positive, accepting it increases the wealth of the firm and its investors. If NPV is negative, rejecting it avoids decreasing wealth. When NPV equals zero, there's no gain or loss from accepting or rejecting the project.

- Positive NPV: Projects with positive NPV should be accepted because they increase wealth. Essentially, their NPV represents the cash you'd receive today if you choose that option.

- Negative NPV: Projects with negative NPV should be rejected because accepting them would reduce wealth. Not pursuing them doesn't incur any cost.

- Zero NPV: Projects with zero NPV neither increase nor decrease wealth. They're not necessarily bad but don't add value either.

In essence, the NPV Decision Rule guides investment choices by considering the present value of costs and benefits. It ensures decisions contribute positively to firm value and align with investors' interests.

EX 3.4 ; The NPV Is Equivalent to Cash Today

Problem : Your firm needs to buy a new $9500 high-speed printer. As part of a promotion, the manu- facturer has offered to let you pay $10,000 in one year, rather than pay cash today. Suppose the risk-free interest rate is 7% per year. Is this offer a good deal? Show that its NPV represents cash in your pocket.

Solution : If you take the offer, the benefit is that you won’t have to pay $9500 today, which is already in PV terms. The cost, however, is $10,000 in one year. We therefore convert the cost to a present value at the risk-free interest rate:

PV (Cost) = ($10,000 in one year ) ÷ (1.07 $ in one year $ today ) = $9345.79 today The NPV of the promotional offer is the difference between the benefits and the costs:

NPV = $9500 − $9345.79 = $154.21 today

The NPV is positive, so the investment is a good deal. It is equivalent to getting a cash discount today of $154.21, and only paying $9345.79 today for the printer. To confirm our calculation, sup- pose you take the offer and invest $9345.79 in a bank paying 7% interest. With interest, this amount will grow to $9345.79 × 1.07 = $10,000 in one year, which you can use to pay for the printer.

We can also use the NPV decision rule to choose among projects. To do so, we must compute the NPV of each alternative, and then select the one with the highest NPV. This alternative is the one that will lead to the largest increase in the value of the firm.

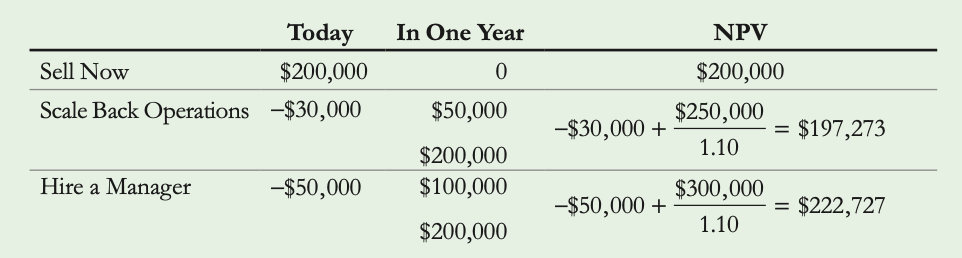

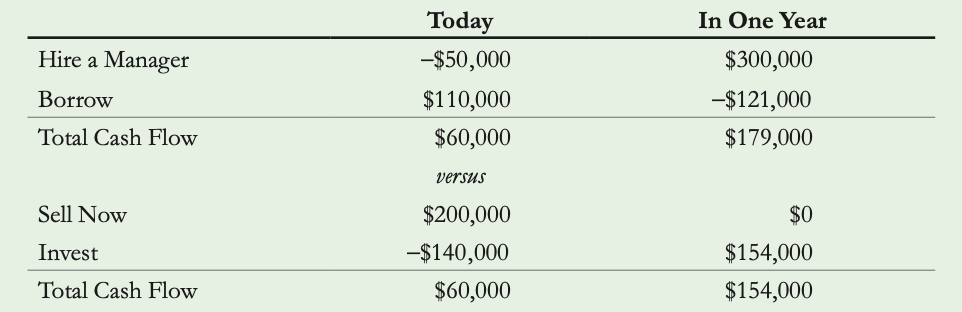

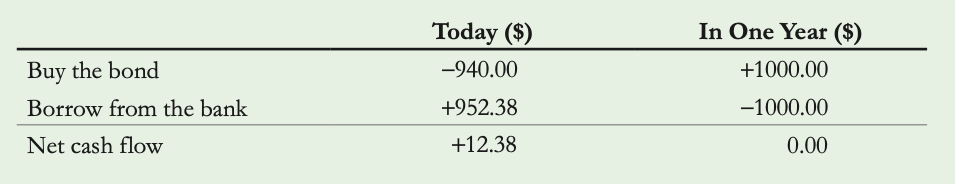

EX 3.5: Choosing among alternative plans Top of Form

Problem : Suppose you started a Web site hosting business and then decided to return to school. Now that you are back in school, you are considering selling the business within the next year. An investor has offered to buy the business for $200,000 whenever you are ready. If the interest rate is 10%, which of the following three alternatives is the best choice?

- Sell the business now.

- Scale back the business and continue running it while you are in school for one more year,

and then sell the business (requiring you to spend $30,000 on expenses now, but generating

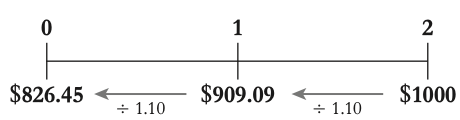

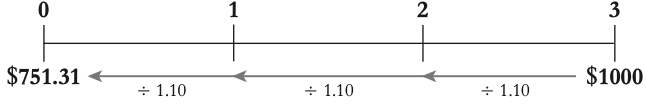

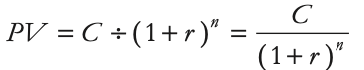

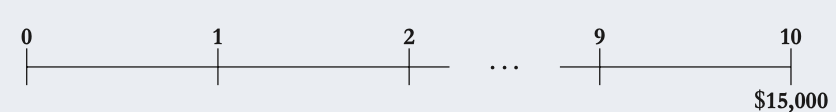

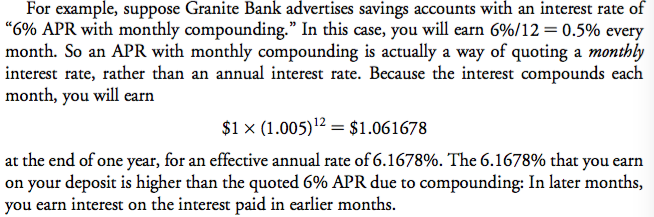

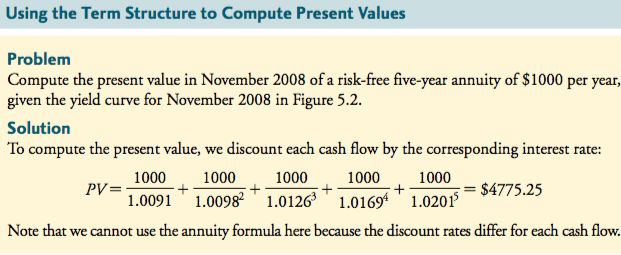

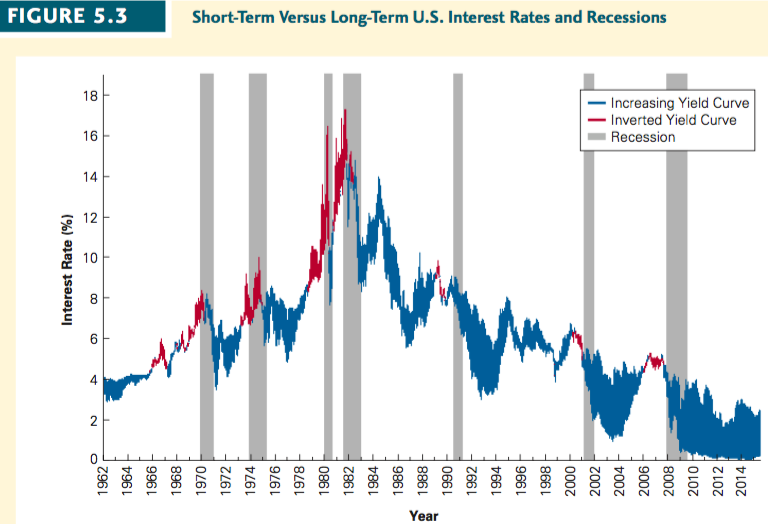

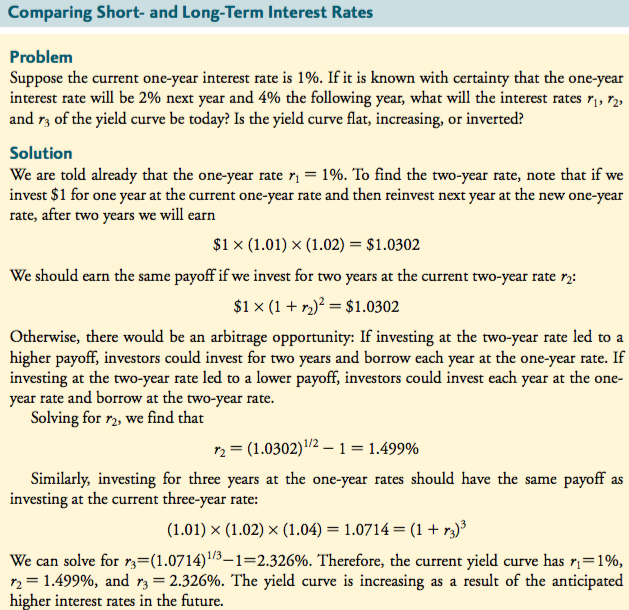

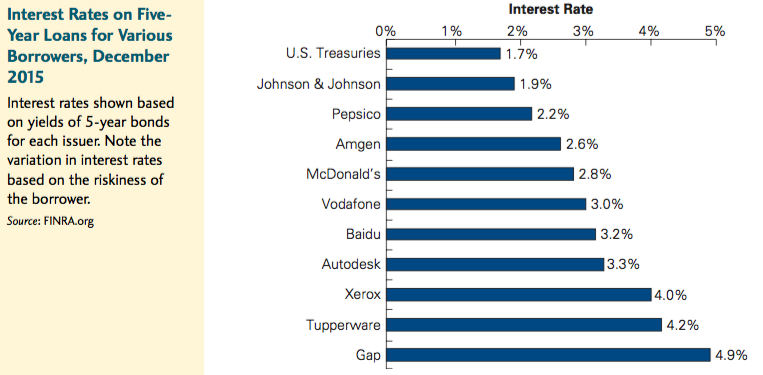

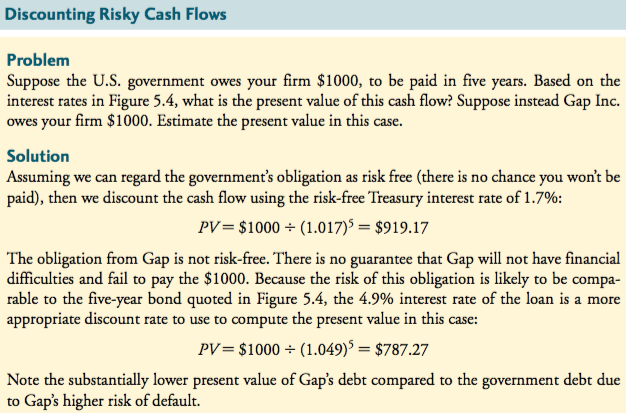

$50,000 in profit at the end of the year).