Wk5,6 - ECOS2002_Sem2_2024_Topic4

Key Components:

Price level and equilibrium output

Aggregate demand function

Aggregate supply function

Diminishing returns in short-run aggregate supply

Expectations in short-run aggregate supply

Natural level of output and long-run aggregate supply

Adjustment to long-run equilibrium

Macro policy implications

The aggregate demand function represents the total quantity of goods and services demanded across all levels of an economy at various price levels. The function is influenced by factors such as consumer spending, investment, government spending, and net exports. Mathematically, it can be expressed as:

[ AD = C + I + G + (X - M) ]

Where:

( AD ) = Aggregate Demand

( C ) = Consumption

( I ) = Investment

( G ) = Government Spending

( X ) = Exports

( M ) = Imports

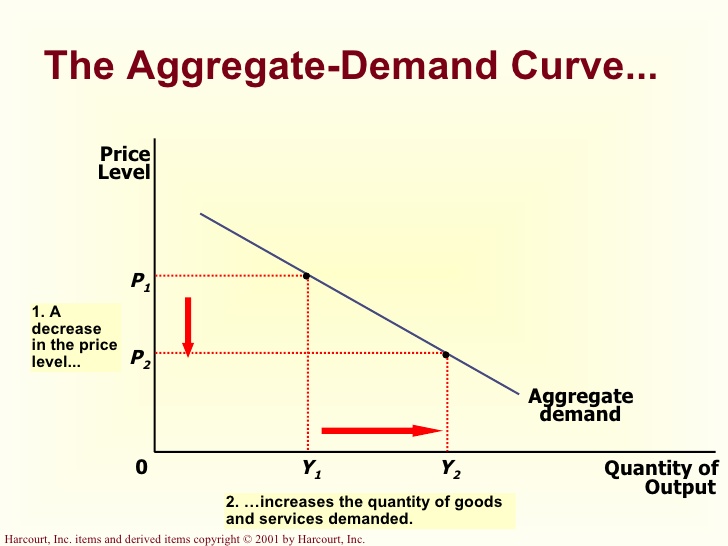

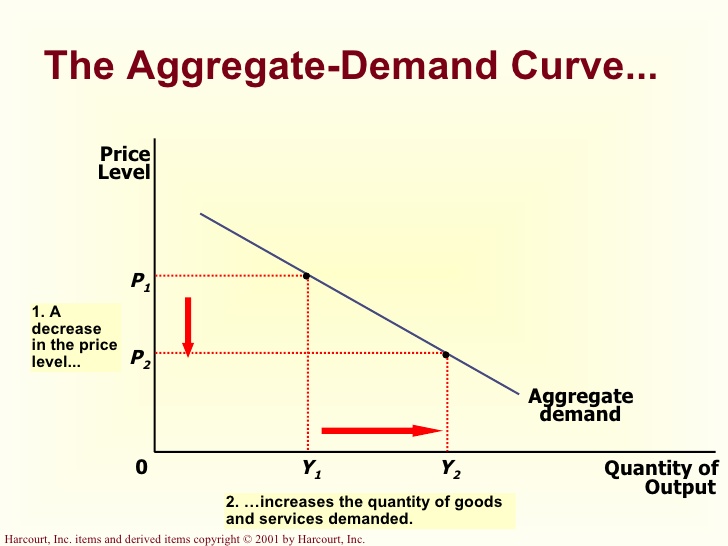

Downward Sloping AD Function:

Influenced by three mechanisms:

Monetary Policy Reaction Effect

Wealth Effect

International Competitiveness Effect

Changes in the Slope of the AD Curve

Flatter AD Curve: Caused by a decrease in the responsiveness of investment to changes in the interest rate.

Steeper AD Curve: Would occur if investment becomes more sensitive to interest rate changes.

Movement Along the AD Curve

Increase in the price level: Causes a movement along the AD curve rather than a shift.

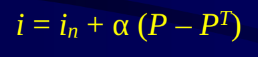

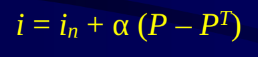

Monetary Policy Goals from central bank:

Aims to contain inflation and achieve a long-run price target.

Interest rate rule: the rate of interest adjusted to price level moving above and below target level.

( P = PT ) leads to ( i = in )

In: long-run “neutral” rate of interest

PT: the target price level

a: central bank response to deviation of actual from target price level

Graphical Representation:

Increase in price level leads to higher interest rates, reducing planned expenditure and output.

Price Target Adjustments:

Changes in ( PT ) reflect long-run monetary policy adjustments.

Impact of Price Level on Wealth:

Higher price levels reduce real portfolio wealth, decreasing consumption.

Wealth effect is weak due to inverse changes in debt value.

Open Economy Dynamics:

Higher price levels reduce competitiveness and net exports.

Effectiveness increases with the openness of the economy.

Factors Influencing Slope:

Sensitivity of aggregate planned expenditure to price level changes.

Openness of the economy, wealth-dependent expenditures, and monetary policy behavior.

Causes of Shifts:

Fiscal policy changes, investment booms/slumps, exchange rate fluctuations, and independent monetary policy changes.

Illustration of Shifts:

Various scenarios leading to shifts in the AD curve.

Rationale for Upward Slope:

Rising profits, wages, and diminishing marginal productivity return of variable inputs.

To maintain profit margin.

The slope indicates the degree of diminishing marginal return.

Components of Price Equation:

( P = (W.l + V.z + d.g.F)(1+r) )

Variables include wages, material prices, capital stock, and depreciation.

Key Assumptions:

Fixed productive capacity and prices of capital goods in the short run.

Constant mark-up and wages.

Impact of Diminishing Returns:

Increased output leads to higher costs due to diminishing returns on labor and materials.

Relationship Between Output and Costs:

Higher output increases costs, leading to higher price levels.

Factors Causing Shifts:

Changes in wages and material input prices.

Wage Negotiation Influences:

Based on expected price levels and various economic factors.

Concept of Natural Level of Output:

Output converges to its natural level where competitive equilibrium is established.

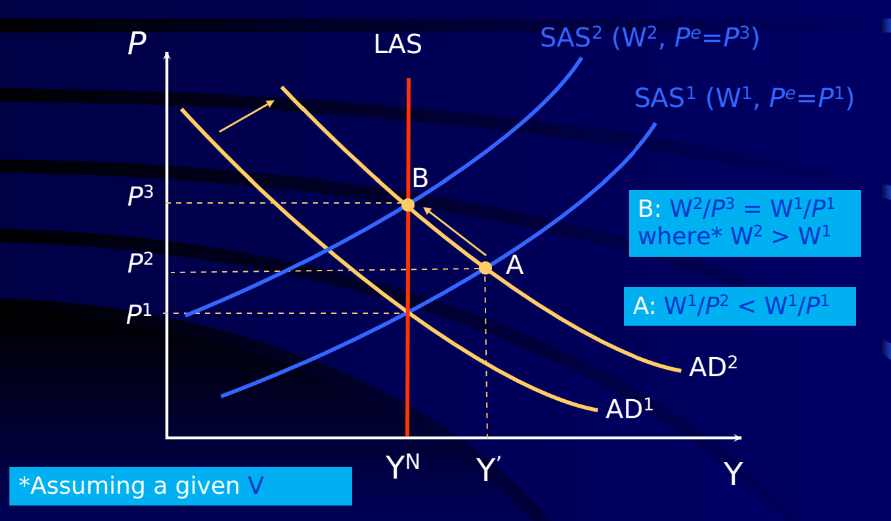

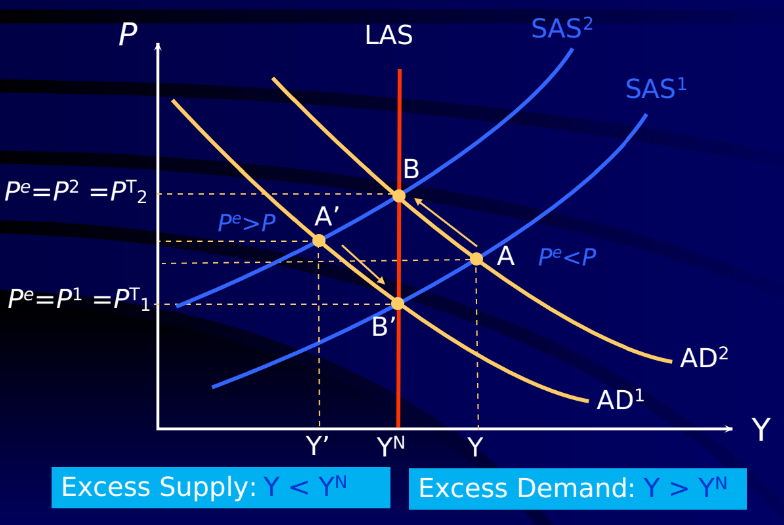

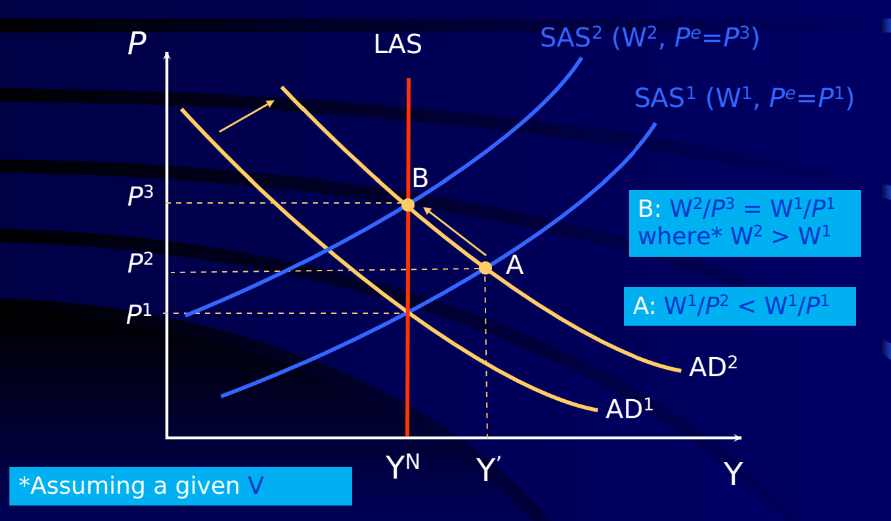

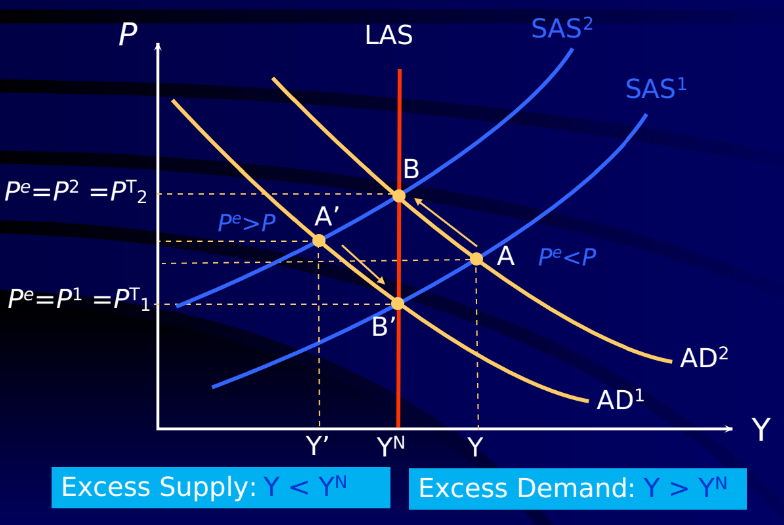

Changes in economy that affects short run and long run equilibrium

Given the situation where demand shifts rightward from AD1 to AD2:

Economy experiencing higher price level

Output exceeds potential output

employment level exceed capacity

short run aggregate supply curve shifts leftward

Economy’s actual output return back to potential output at even higher price level

Any changes toward the economy, it will always adjust itself toward the target potential output.

Components of Natural Unemployment Un:

Frictional and structural unemployment.

Can’t be reduced by raising aggregate demand or lowering real wage.

Requires supply-sides policies, not demand sides:

laissez-faire approach: stresses labour market deregulation and welfare reform

interventionist approach: government adopts measures to improve skills and labour mobility

What is cyclical unemployment? unemployment that occurs due to changes in the market, e.g. recession = more unemployment.

What is frictional unemployment? unemployed but are looking for a job.

What is structural unemployment? mismatch of skills and experiences between labour and labour market.

What are some factors that affect structural unemployment?

structure of economy

skills and location mismatch

technological change

education requirement

industry laws and regulation

social welfare

Is there any difference in Wage-Price Flexibility and Wage-Price Rigidity?

Wage-price flexibility refers to the ability of wages and prices to adjust freely in response to changes in supply and demand within the market.

Wage-price rigidity denotes the resistance of wages and prices to adjust downward, even in the face of economic downturns or decreased demand.

Debate in Macroeconomics:

Flexibility proponents argue for efficient and smooth market adjustments.

Rigidity proponents highlight market imperfections in the labor market and other factors prevent efficient wage-price adjustments, potentially leading to prolonged periods of unemployment and economic stagnation.

Monetary policy refers to the actions taken by a central bank to manage the money supply and interest rates to influence economic activity.

Money neutrality is the concept that changes in the money supply do not affect real economic variables (like output and employment) in the long run, only nominal variables (like prices).

Relationship:

In the short run, monetary policy can affect real variables due to price and wage stickiness.

In the long run, money neutrality suggests that changes in the money supply will only affect price levels, not real output.

Impact of Fiscal Policy:

Crowding out occurs when fiscal expansion leads to higher prices and interest rates.

Key Components:

Price level and equilibrium output

Aggregate demand function

Aggregate supply function

Diminishing returns in short-run aggregate supply

Expectations in short-run aggregate supply

Natural level of output and long-run aggregate supply

Adjustment to long-run equilibrium

Macro policy implications

The aggregate demand function represents the total quantity of goods and services demanded across all levels of an economy at various price levels. The function is influenced by factors such as consumer spending, investment, government spending, and net exports. Mathematically, it can be expressed as:

[ AD = C + I + G + (X - M) ]

Where:

( AD ) = Aggregate Demand

( C ) = Consumption

( I ) = Investment

( G ) = Government Spending

( X ) = Exports

( M ) = Imports

Downward Sloping AD Function:

Influenced by three mechanisms:

Monetary Policy Reaction Effect

Wealth Effect

International Competitiveness Effect

Changes in the Slope of the AD Curve

Flatter AD Curve: Caused by a decrease in the responsiveness of investment to changes in the interest rate.

Steeper AD Curve: Would occur if investment becomes more sensitive to interest rate changes.

Movement Along the AD Curve

Increase in the price level: Causes a movement along the AD curve rather than a shift.

Monetary Policy Goals from central bank:

Aims to contain inflation and achieve a long-run price target.

Interest rate rule: the rate of interest adjusted to price level moving above and below target level.

( P = PT ) leads to ( i = in )

In: long-run “neutral” rate of interest

PT: the target price level

a: central bank response to deviation of actual from target price level

Graphical Representation:

Increase in price level leads to higher interest rates, reducing planned expenditure and output.

Price Target Adjustments:

Changes in ( PT ) reflect long-run monetary policy adjustments.

Impact of Price Level on Wealth:

Higher price levels reduce real portfolio wealth, decreasing consumption.

Wealth effect is weak due to inverse changes in debt value.

Open Economy Dynamics:

Higher price levels reduce competitiveness and net exports.

Effectiveness increases with the openness of the economy.

Factors Influencing Slope:

Sensitivity of aggregate planned expenditure to price level changes.

Openness of the economy, wealth-dependent expenditures, and monetary policy behavior.

Causes of Shifts:

Fiscal policy changes, investment booms/slumps, exchange rate fluctuations, and independent monetary policy changes.

Illustration of Shifts:

Various scenarios leading to shifts in the AD curve.

Rationale for Upward Slope:

Rising profits, wages, and diminishing marginal productivity return of variable inputs.

To maintain profit margin.

The slope indicates the degree of diminishing marginal return.

Components of Price Equation:

( P = (W.l + V.z + d.g.F)(1+r) )

Variables include wages, material prices, capital stock, and depreciation.

Key Assumptions:

Fixed productive capacity and prices of capital goods in the short run.

Constant mark-up and wages.

Impact of Diminishing Returns:

Increased output leads to higher costs due to diminishing returns on labor and materials.

Relationship Between Output and Costs:

Higher output increases costs, leading to higher price levels.

Factors Causing Shifts:

Changes in wages and material input prices.

Wage Negotiation Influences:

Based on expected price levels and various economic factors.

Concept of Natural Level of Output:

Output converges to its natural level where competitive equilibrium is established.

Changes in economy that affects short run and long run equilibrium

Given the situation where demand shifts rightward from AD1 to AD2:

Economy experiencing higher price level

Output exceeds potential output

employment level exceed capacity

short run aggregate supply curve shifts leftward

Economy’s actual output return back to potential output at even higher price level

Any changes toward the economy, it will always adjust itself toward the target potential output.

Components of Natural Unemployment Un:

Frictional and structural unemployment.

Can’t be reduced by raising aggregate demand or lowering real wage.

Requires supply-sides policies, not demand sides:

laissez-faire approach: stresses labour market deregulation and welfare reform

interventionist approach: government adopts measures to improve skills and labour mobility

What is cyclical unemployment? unemployment that occurs due to changes in the market, e.g. recession = more unemployment.

What is frictional unemployment? unemployed but are looking for a job.

What is structural unemployment? mismatch of skills and experiences between labour and labour market.

What are some factors that affect structural unemployment?

structure of economy

skills and location mismatch

technological change

education requirement

industry laws and regulation

social welfare

Is there any difference in Wage-Price Flexibility and Wage-Price Rigidity?

Wage-price flexibility refers to the ability of wages and prices to adjust freely in response to changes in supply and demand within the market.

Wage-price rigidity denotes the resistance of wages and prices to adjust downward, even in the face of economic downturns or decreased demand.

Debate in Macroeconomics:

Flexibility proponents argue for efficient and smooth market adjustments.

Rigidity proponents highlight market imperfections in the labor market and other factors prevent efficient wage-price adjustments, potentially leading to prolonged periods of unemployment and economic stagnation.

Monetary policy refers to the actions taken by a central bank to manage the money supply and interest rates to influence economic activity.

Money neutrality is the concept that changes in the money supply do not affect real economic variables (like output and employment) in the long run, only nominal variables (like prices).

Relationship:

In the short run, monetary policy can affect real variables due to price and wage stickiness.

In the long run, money neutrality suggests that changes in the money supply will only affect price levels, not real output.

Impact of Fiscal Policy:

Crowding out occurs when fiscal expansion leads to higher prices and interest rates.