Ch 20 - Macroeconomic Objectives: Low and Stable Rate of Inflation

Managing the change in the average price of level and achieving low and stable inflation rate → key objectives of government macroeconomic policy

Inflation: is the sustained increase in general price levels in an economy

Disinflation: fall in the rate of inflation in an economy

Deflation: sustained decrease in the general price levels in an economy

Consumer Price Index (CPI): the price index governments use to measure the rate of inflation

- Weighted on the basis of consumer expenditure

- Annual percentage in the change in the index is the inflation rate

Constructing a weighted price index:

- Price index value = current year price / base year price * 100

- Weighted index = weight * price / 100

- Rate of inflation = percentage change in the weighted index

Limitations of measuring inflation:

- One-off changes in price

- Variation between countries

- Change in quality of goods

- Types of retailer prices vary

- Regional variation

Demand pull inflation: occurs when a rise in aggregate demand in the economy causes pulls in the price level in the economy to increase

- Illustrates a rise in AD, leads to a rise in the average price level

Inflationary gap: periods of demand pull inflation lead to inflationary gap where the short run equilibrium is at a level of real GDP above the full employment level of income

- actual output is above potential output

Cost push inflation: occurs when there is a reduction in the short run AS in the economy and price level is pushed up by rising costs

- Rising costs causes the short run AS to shift which leads to a rise in average price level and a fall in real output

The SRAS curve will shift to the left is the cost of these factors increases:

- Wage push inflation: when wage rises faster than output unit or average costs rise

- Higher prices if firms choose to pass on the increase in unit costs as a higher price

Raw material costs: cost push inflation can be caused by rising commodity prices when increase the cost of manufactured goods

Capital costs: if the prices of machinery and equipment

Effects of inflation:

- Impacts cost of living; price level rises in the economy the cost to households increases

- Inflation has a negative effect on disposable incomes of households where wages cannot keep up with the increase in average price level

- Reduces competitiveness

Deflation: negative rate of inflation where there is sustained fall in the general level of prices in an economy

Demand side deflation: deflation can occur because of a fall in AD and typically occurs in a recession

Supply side deflation: deflation that occurs on the supply side arises when the AD curve shifts to the right and leads to a higher output at lower prices

- It is called “good deflation” as it is associated with higher level of real GDP

Effects of deflation:

- Reduced growth and deflation

- Falling consumer consumption

- Redistribution of goods

- Rise on spending power

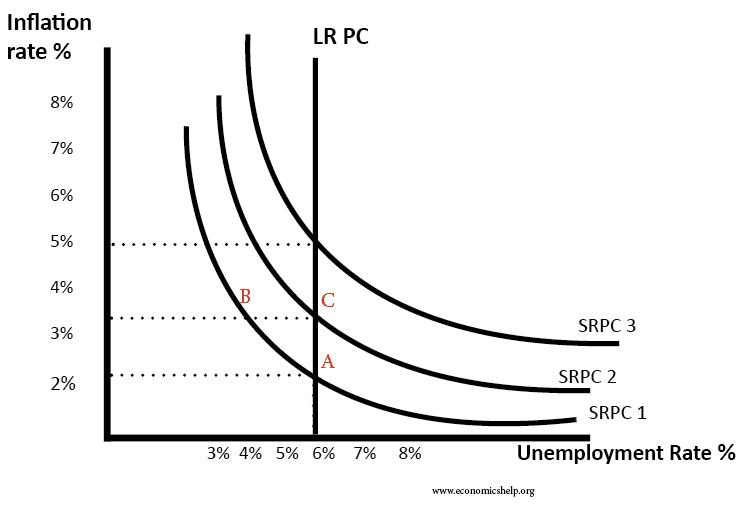

Phillips curve: graph which represents the rate of unemployment and rate of change of money wages. Indicated that wages tend to rise faster when unemployment is low