UNIT 3- Aggregate Demand and Supply

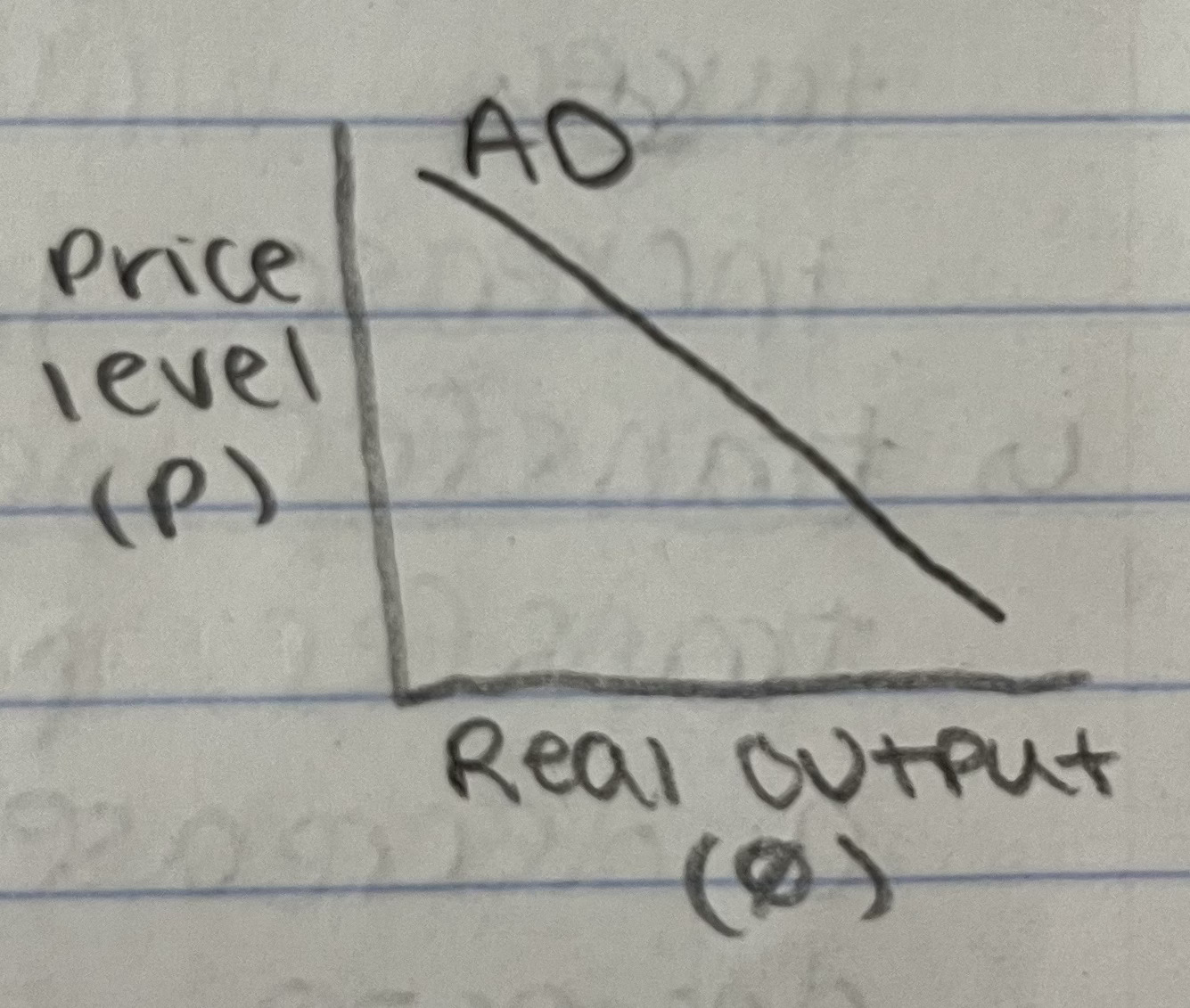

Aggregate Demand (AD)

Aggregate Demand

Aggregate demand = the relationship between the quantity of goods and services demanded and the price level

Aggregate Demand Curve

Differs from the curve of an individual product because there’s no substitution effect

Downward sloping curve

real balance effect → as the price level falls, cash balances (money people hold) will purchase more

at a low price level, the money you have will buy more

interest rate effect → lower price levels will lower interest rate, which changes investment

Keynes Effect → price level changes interest rate, which changes investment

foreign purchases effect → lower prices make domestic goods more attractive than foreign goods

lower prices increases net exports

Determinants of Aggregate Demand (AD Shifters)

Changes in consumption

consumer confidence → if consumers are confident about the economy, there will be an increase in aggregate demand

tax policy → a decrease in income taxes will increase consumption; an increase in tax will decrease consumption

transfer payments → an increase in transfer payments will increase consumption; a decrease in transfer payments will decrease consumption

inflationary expectations → if consumers expect higher prices in the future, there will be an increase in consumption; if consumers expect lower prices in the future, there will be a decrease in consumption

Changes in investment

expectation of the business firm → if business firms are confident in the economy, there will be an increase in investment; if they’re pessimistic, they’ll decrease investment

changes in interest rate → if interest rates decrease, investment will increase; if interest rates increase, investment will decrease

government policies effect interest rates

Changes in government purchases

an increase in government spending increases aggregate demand

a decrease in government spending decreases aggregate demand

Changes in net exports

an increase in net exports will increase aggregate demand

a decrease in net exports will decrease aggregate demand

Aggregate Supply (AS)

Aggregate Supply

Aggregate supply = the relationship between the output produced and the price level

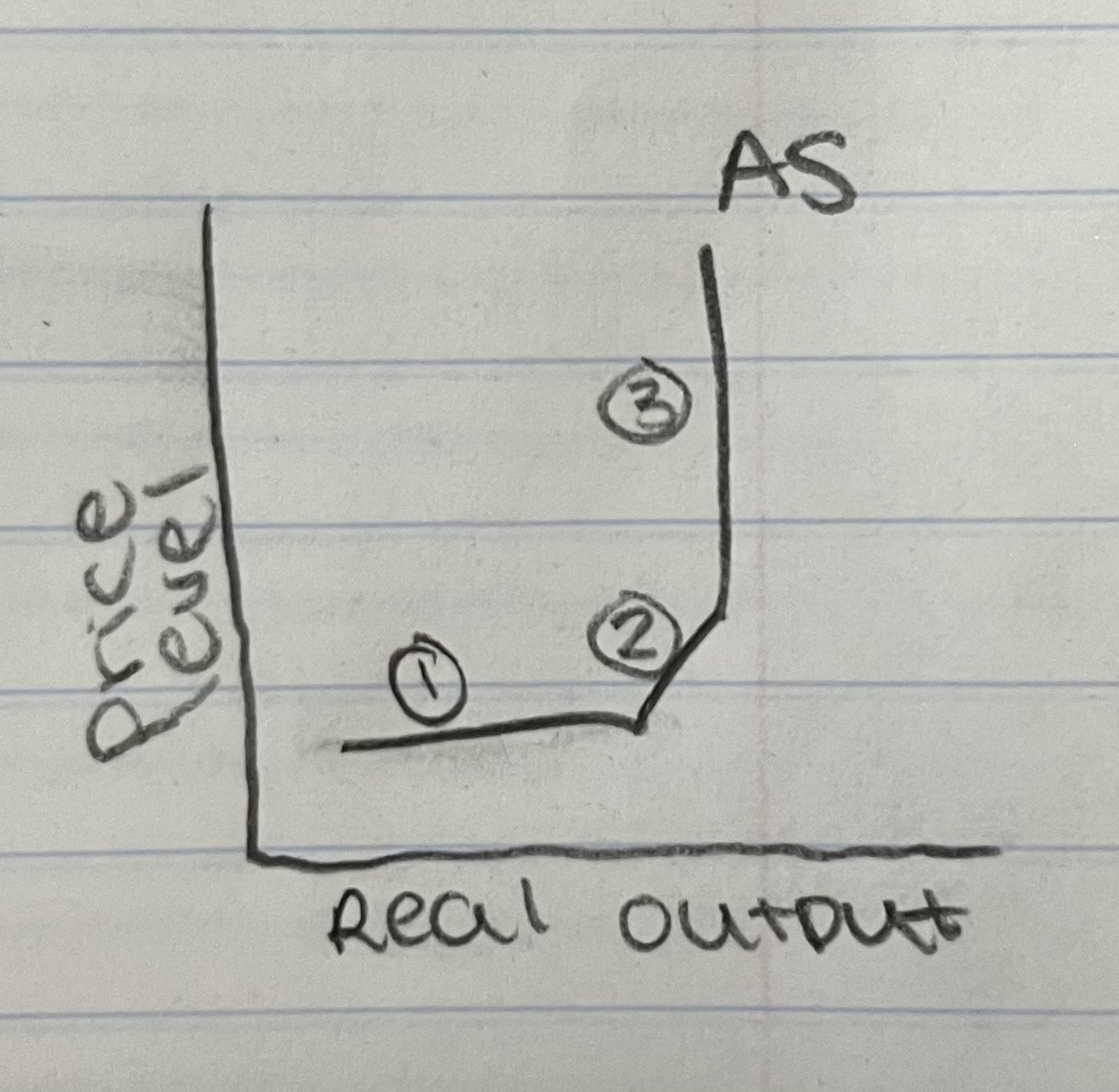

Aggregate Supply Curve (Short Run)

In the short run, prices and wages are not flexible downward

they’re “sticky”

In the short run, there can be periods of unemployment

Horizontal/Keynesian Range → low levels of output; unemployment; recession; you can increase output, price levels don’t change

Intermediate Range → economy is nearing full employment; price levels start to go up

Vertical/Classical Range → full employment in the short run; you can’t generate anymore output

Determinants of Aggregate Supply (AS Shifters)

Prices of inputs

resources, wages, energy costs

price of inputs increases, aggregate supply decreases

price of inputs decreases, aggregate supply increases

Productivity and technology

if workers become more productive/develop better technology, aggregate supply will increase

Available supplies of labor and capital

if labor force grows or improves in quality, aggregate supply will increase

if capital stock increases, aggregate supply increases

if supply of natural resources increases, aggregate supply increases

Government regulations

if the government regulates industry more strictly, aggregate supply will decrease

if the government eases regulations, aggregate supply increases

government regulation is a cost of production

Business taxes

cost of production

business taxes increase, aggregate supply decreases

business taxes decrease, aggregate supply increases

Government subsidies

if the government cuts subsidies to businesses, aggregate supply decreases

if the government raises subsidies to businesses, aggregate supply increases

subsidies = funding; giving money to

Reduce taxes on savings

capital gains = profit after the selling of an asset

capital gains get taxed

dividends = amount that companies give back to shareholders

dividends get taxed

interest → earning interest on money that gets taxed

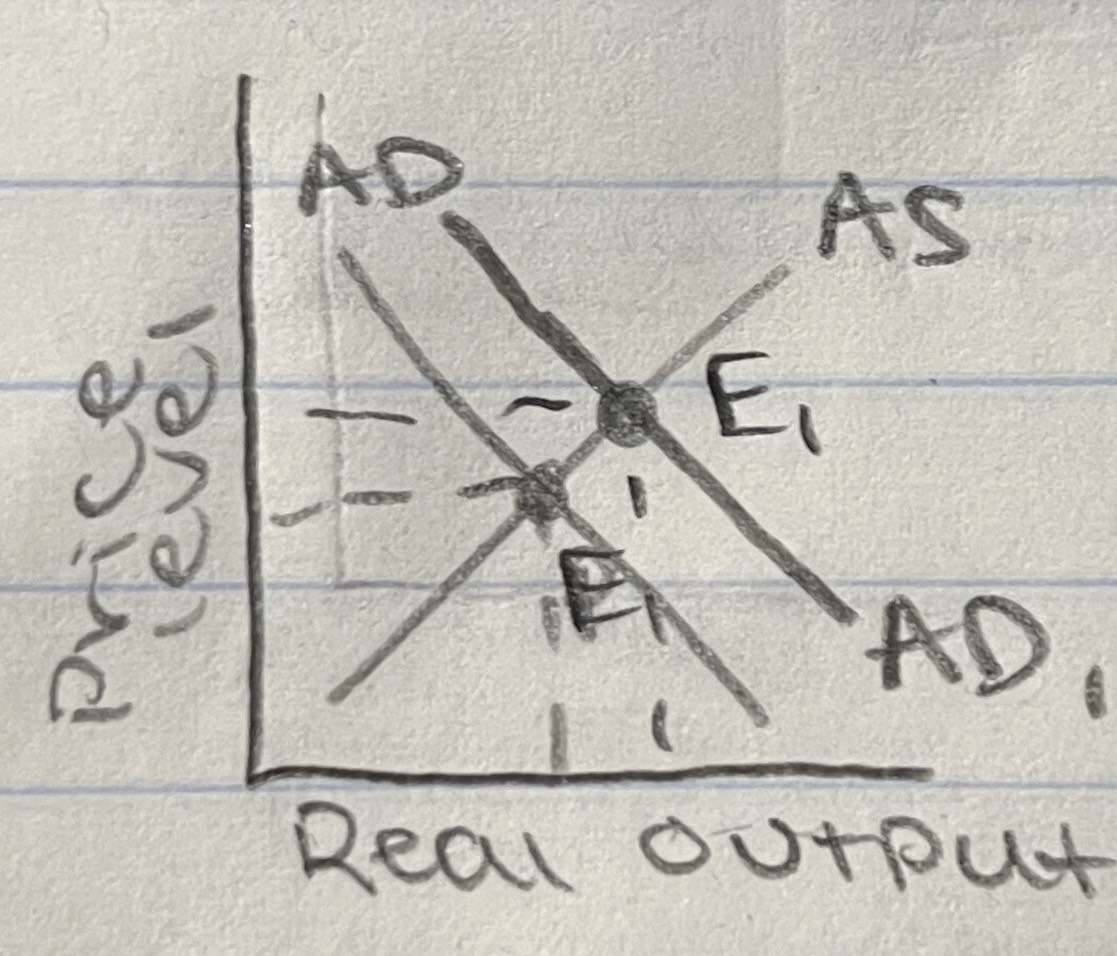

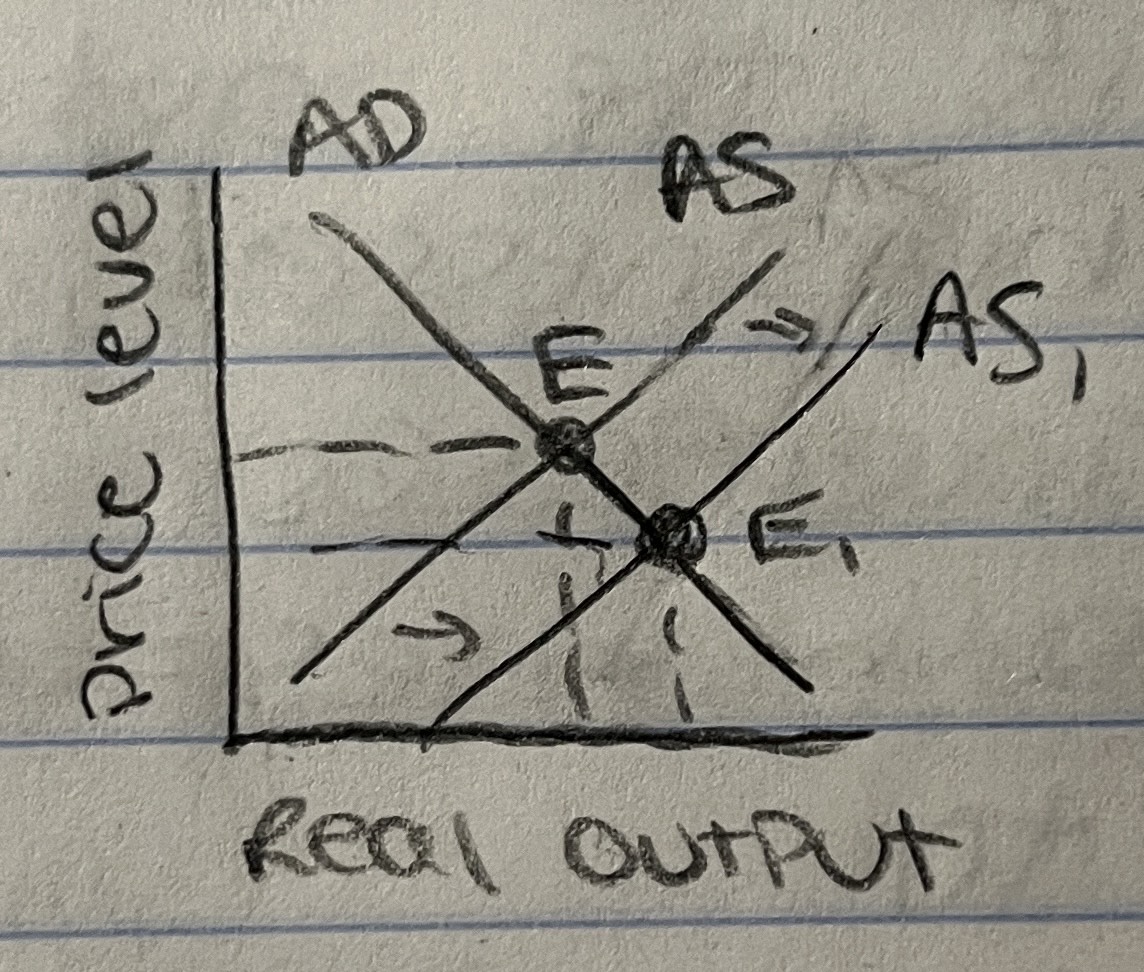

Equilibrium of Aggregate Demand and Supply

Increase in Aggregate Demand

Price level increases

Output increases

Employment increases

Output and employment are tied

output goes up, employment goes up

output goes down, unemployment goes up

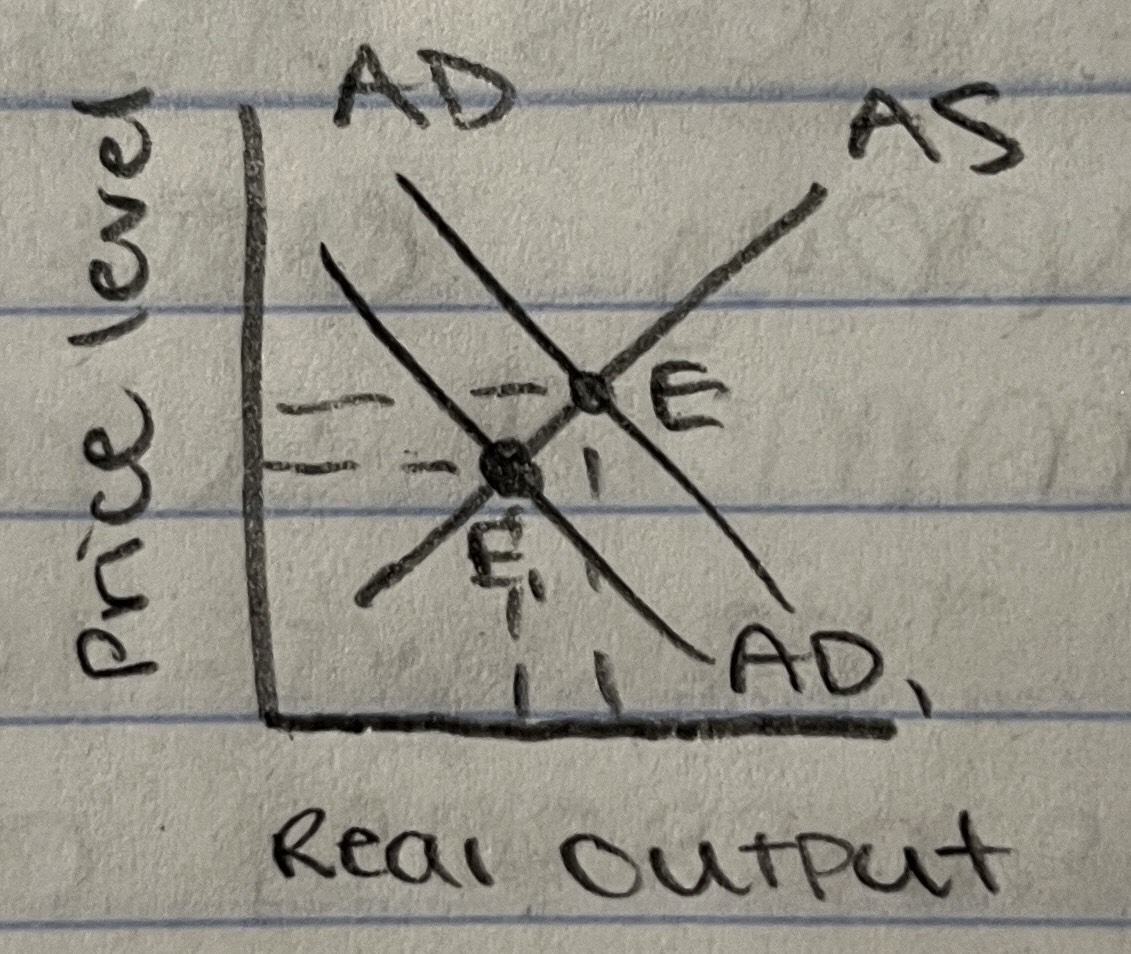

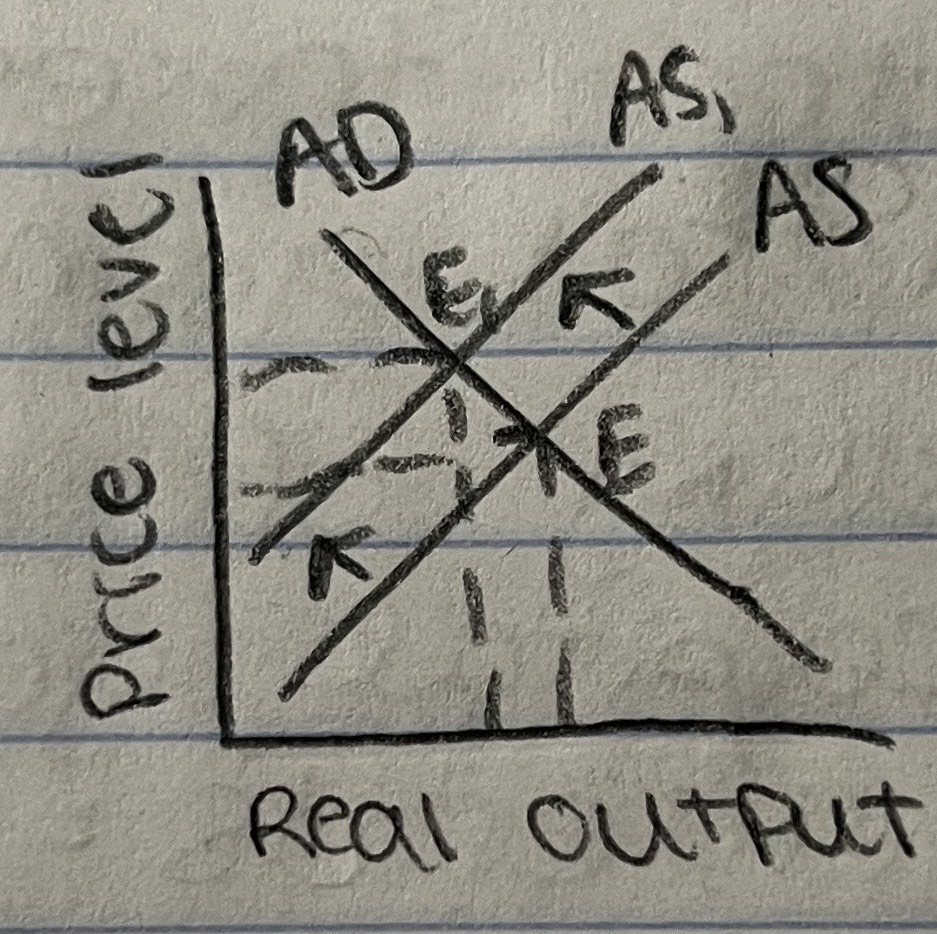

Decrease in Aggregate Demand

Price level decreases

Output decreases

Employment decreases

Increase in Aggregate Supply

Price level decreases

Output increases

Employment increases

Decrease in Aggregate Supply

Price level increases

Output decreases

Employment decreases

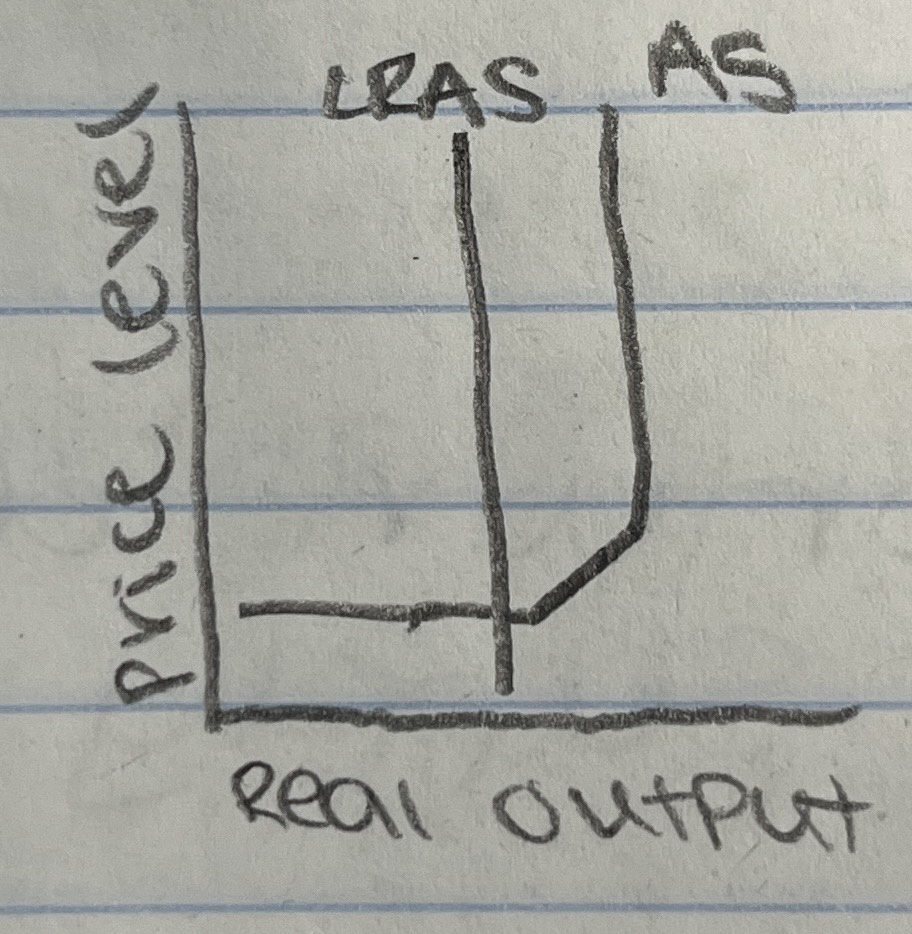

Short Run vs. Long Run Aggregate Supply

Short Run

Not a definitive time range

When prices and wages are sticky (inflexible)

Full employment at high level of output

You can produce more in the short run because you use your resources more intensively in the short run

you can require people to work A LOT of hours, but you can’t sustain that in the long run

Output level will fall unless long run aggregate supply is increased

Long Run

Wages and prices are flexible, can adjust

We’ll always have full employment in the long run

Fixed technology, efficient use of resources

Long run aggregate supply curve will shift if we develop more or better resources or have improvements in technology

economic growth

Keynesian vs. Classical Theory

Keynesian Theory

Output and employment are determined by the level of Aggregate Demand/Expenditures

demand side theory

Savers and investors are two different people, therefore; interest rates don’t automatically adjust to the level of savings; savings doesn’t always equal investment

Wages and prices are “sticky” (unions and monopoly power of business)

Unemployment is a reality

Economy CANNOT automatically adjust

government needs to take an active role in order for economy to achieve full employment

Aggregate supply curve is horizontal

only vertical at full employment (when government takes an active role)

Classical Theory

Say’s Law: supply creates its own demand

Interest rates automatically adjust to the level of savings; investment will offset the loss in savings

Wages and prices are flexible downward; full employment is always achieved

Economy can correct itself to full employment with little or no government intervention necessary (Laissez-faire)

Aggregate supply curve is vertical

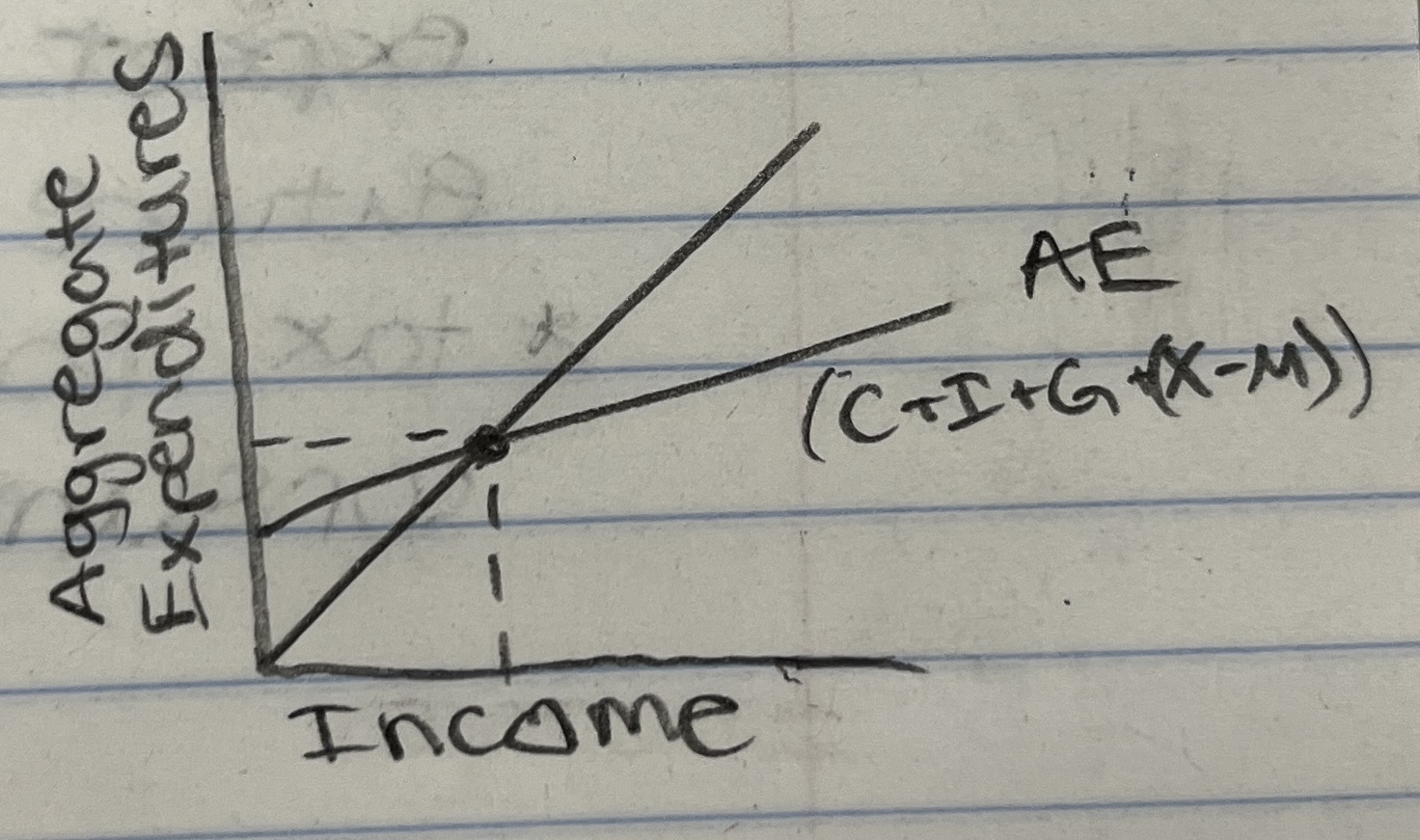

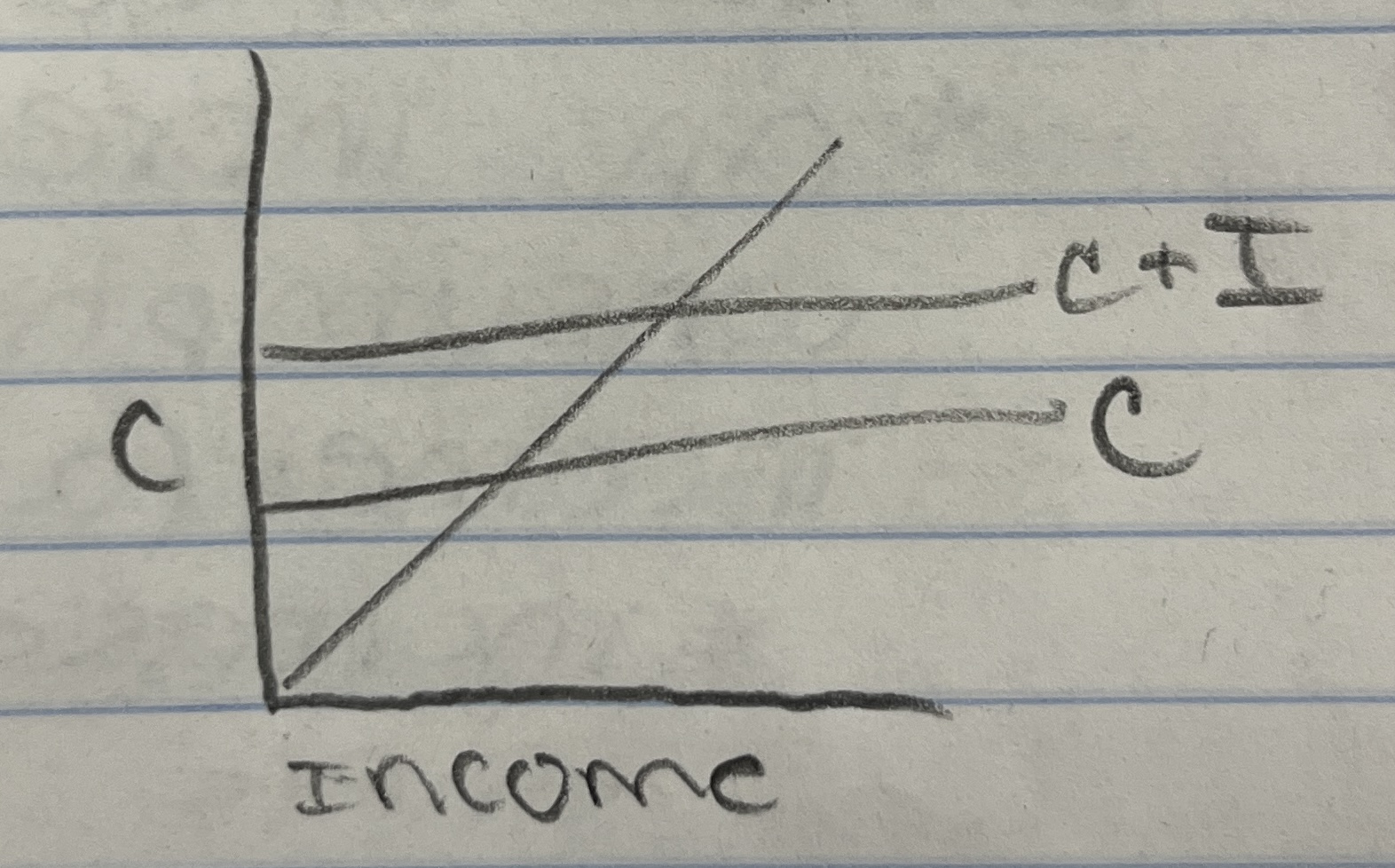

Keynesian- Income Expenditure Model (AE Model)

Assumes a fixed price level

Strength: you can see the effects of changes in consumption, investment, and government spending on the equilibrium level

1) Consumption and savings

Two types of consumption:

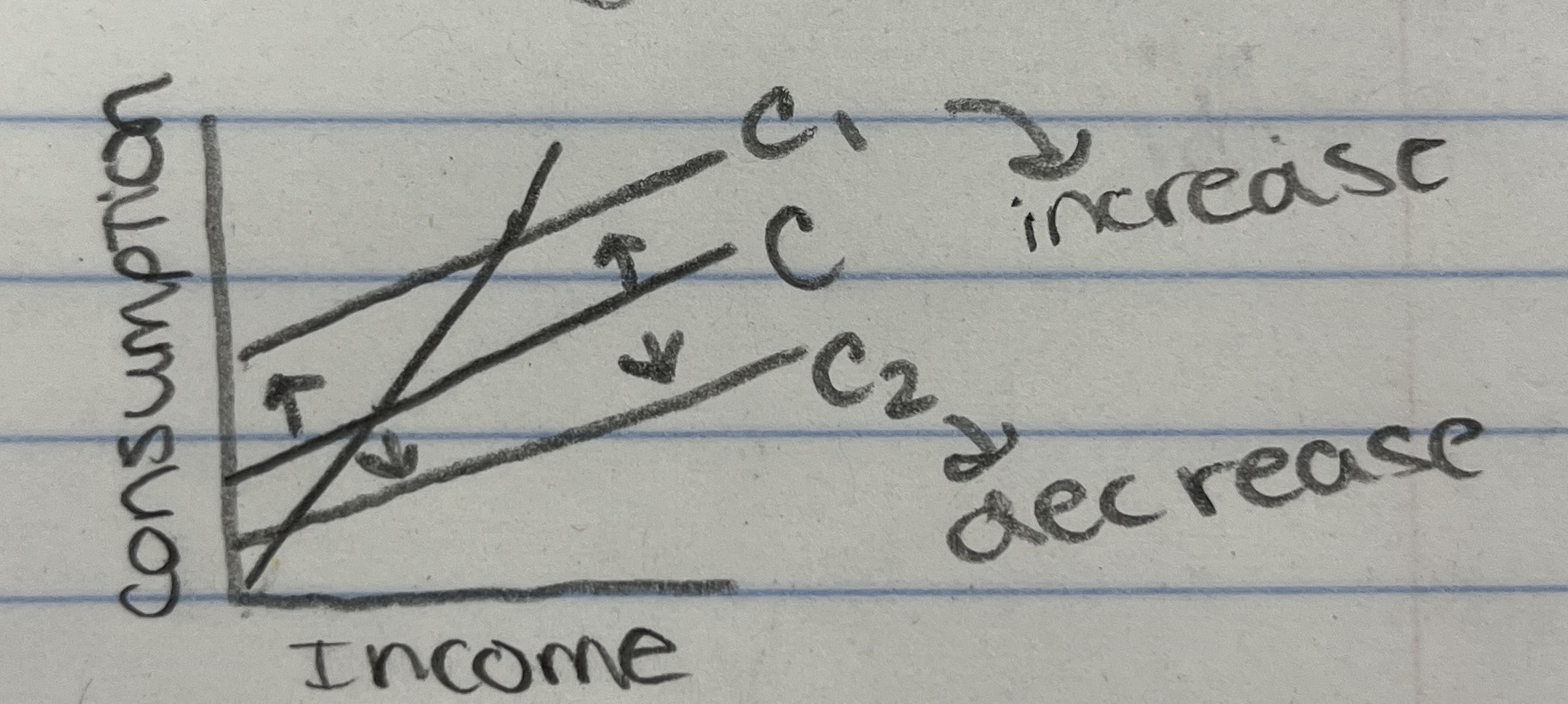

Induced consumption

an increase or decrease in consumption caused by an increase or decrease in consumer incomes

Autonomous consumption

an increase or decrease in consumption at all levels of income (a shift)

increase shifts up, decrease shifts down

changes in real wealth → real wealth increases, consumption increases; real wealth decreases, consumption decreases

price level → price level decreases, consumption increases; price level increases, consumption decreases

consumer debt → consumer debt decreases, consumption increases; consumer debt increases, consumption decreases

consumer confidence → consumer confidence increases, consumption increases; consumer confidence decreases, consumption decreases

inflationary expectations → consumers expect higher prices in the future, consumption increases; consumers expect lower prices in the future, consumption decreases

tax policy → income taxes decrease, consumption increases; income taxes increase, consumption decreases

Marginal Propensity to Consume (MPC)

percentage of disposable income consumers spend on goods and services

(change in consumption / change in disposable income)

Marginal Propensity to Save (MPS)

percentage of disposable income consumers save

(change in savings / change in disposable income)

MPS + MPC = 100%

2) Investment

Determinants:

expected rate of profit → expected rate of profit is high, increase in investment; expected rate of profit is low, decrease in investment

real interest rates → real interest rates are low, investments will increase; real interest rates are high, investments will decrease

3) Spending Multiplier

the amount by which equilibrium GDP changes with a change in expenditures

(change in equilibrium / change in Aggregate Expenditure)

(1 / (1-MPC)) or (1 / MPS)

higher MPC, higher multiplier

4) Total Change in Real GDP (Income)

(initial change in spending x multiplier)

5) Tax Multiplier

(-MPC / MPS)

will always be negative

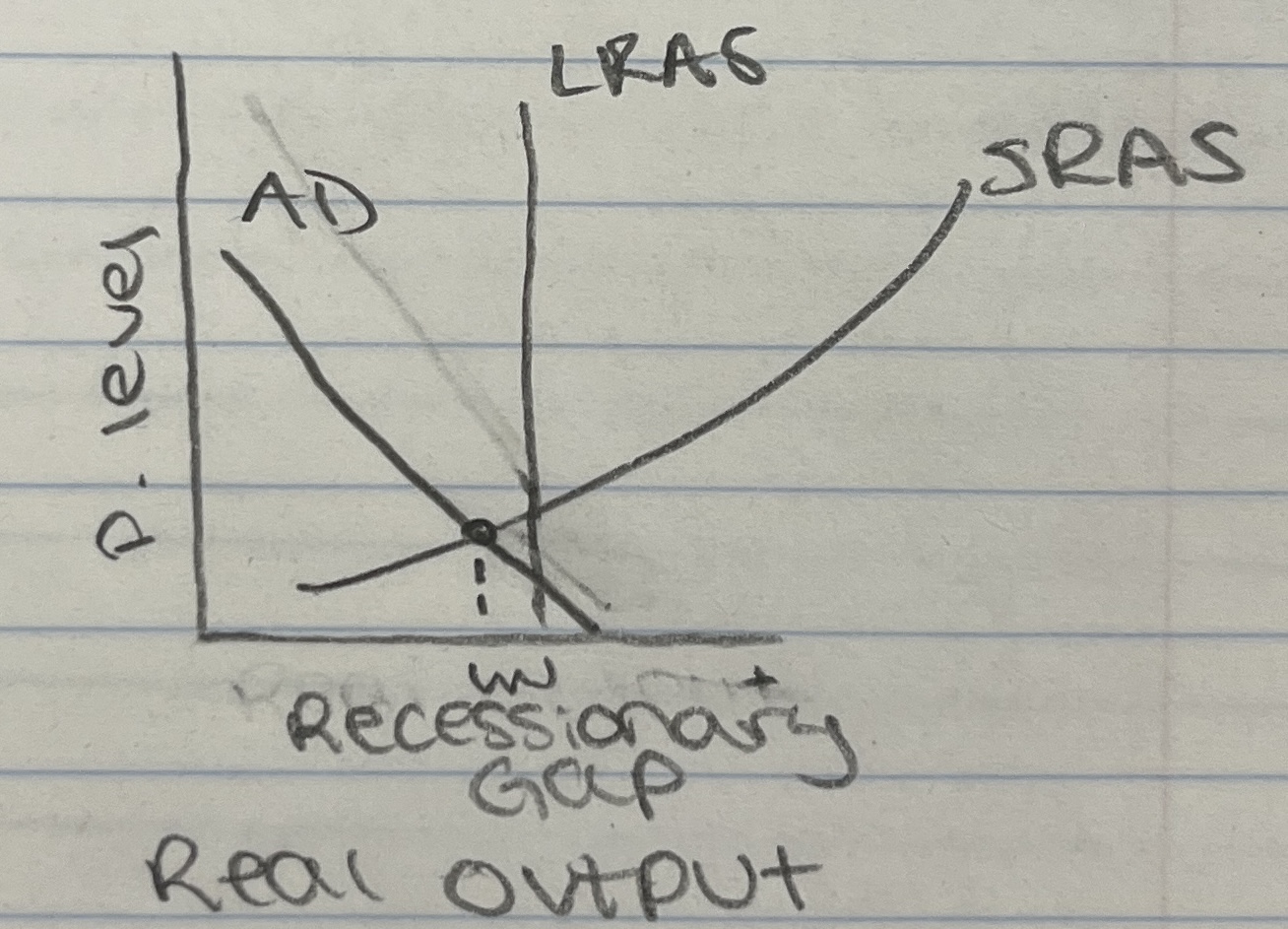

6) Recessionary Gap

occurs when equilibrium GDP falls short of full employment in a recession

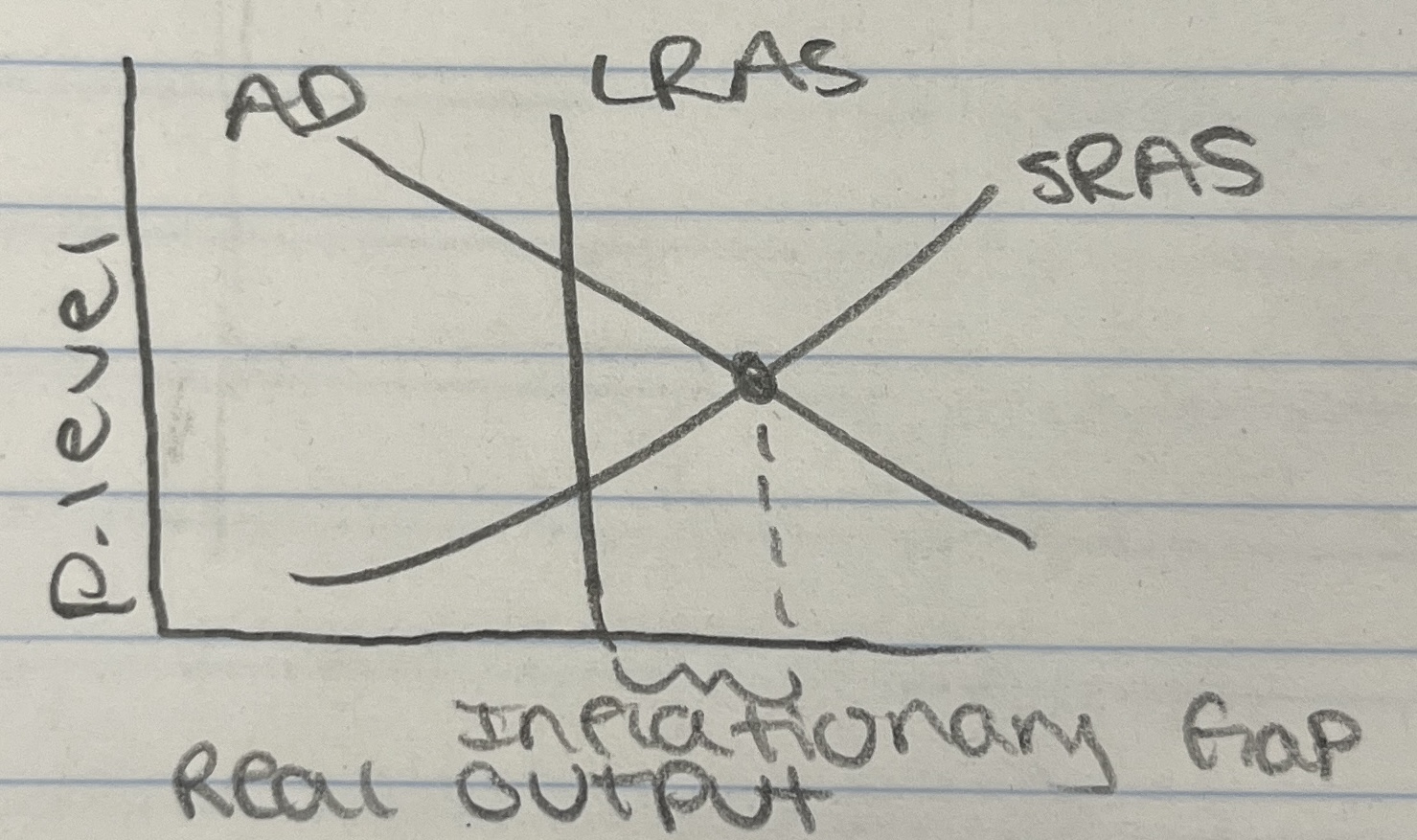

7) Inflationary Gap

occurs when equilibrium GDP exceeds full employment

Fiscal Policy

Fiscal Policy

Changes in Federal income taxes and government spending to affect the level of Aggregate Demand (AD)

Implemented by the President and Congress

people who make decisions on fiscal policy are elected

fiscal policy is heavily influenced by politics

Use of spending multiplier is helpful

tax multiplier is also helpful

Expansionary Fiscal Policy

The goal is to increase aggregate demand and is used during a recession

Decrease income taxes and/or increase government spending

Balanced budget = spending is equal to taxes

budget isn’t balanced during expansionary fiscal policy

spending more than you collect in taxes

deficit spending

Contractionary Fiscal Policy

The goal is to decrease aggregate demand and is used to fight inflation

Increase in income taxes and/or decrease in government spending

Government collects more and spends less

contributes towards a budget surplus

Discretionary Stabilizers

The government must pass a law or take some specific action to change tax or spending policies

Deliberate action by government

Automatic Stabilizers

A policy change that happens due to a change in the economy

Recession → government spending goes up because more people are collecting unemployment; government receiving less tax revenue

deficit spending

Expansion → government spending decreases because less people are collecting unemployment; government receving more tax revenue

surplus spending