Wk11 - Lecture ECOS2002 Topic 7 Sem 2 2024

Chapter 14: Consumption

Page 3: Theories of Consumption

Keynesian Consumption Function: Based on current disposable income (absolute income hypothesis).

Forward-looking Consumption Theories:

Permanent Income Hypothesis (PIH): Consumption depends on long-run average income that people expect to receive

This means that temporary changes in income have less impact on consumption than stable, expected income levels. The hypothesis helps explain consumer behavior and savings patterns over time.

Life-Cycle Hypothesis (LCH): Consumption based on expected lifetime income and wealth.

Page 4: Permanent Income Hypothesis (PIH)

Permanent income refers to the average income that individuals expect to receive over their lifetime, influencing their consumption decisions.

Developed by Milton Friedman in the 1950s.

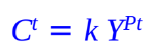

According to this, people consume a constant fraction of their expected income, aka permanent income.

Consumption Function:

( k ): Marginal propensity to consume out of permanent income.

YPt: permanent income, depends on interest rates, individual income, etc.

Estimating Permanent Income: The purpose of this formula is to help individuals assess their long-term expected income, which influences their consumption patterns.

Yt: actual income in period t

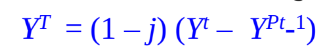

j: adaptive revision parameter (j<1)

YPt-1: estimate of permanent income in period t-1

There are two components to the permanent income formula, when estimate the permanent income, an individual would like to assess:

last year’s estimate.

some fraction of the differences in actual income and last year’s estimate.

—> By estimating permanent income, individuals are able to differentiate between temporary income fluctuations and their stable, expected income levels. This distinction informs their consumption decisions, leading to more consistent consumption behavior over time.

emphasizes that temporary changes in income have less impact on overall consumption than stable, expected income levels.

Page 5: Adaptive Expectations Formation in PIH

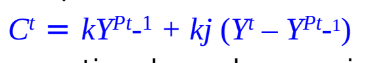

PIH Consumption Function based on adaptive ‘error-learning’ (substitute the previous equation together in page 4)

This equation implies current consumption depends on period t-1 permanent income and the adaptive adjustment, kj, to the deviation of actual from permanent income.

Marginal Propensities to Consume from the equation above:

Long-run MPC: ( k ) for a permanent income

Short-run MPC: ( kj ) of a deviation of actual from estimated permanent income, multiplied with 1-j = transitory income.

The short-run marginal propensity to consume equals the change in consumption divided by the change in actual income.

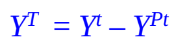

Transitory income = actual income - permanent income

Transitory income refers to earnings that are not expected to be permanent or recurring. This type of income can arise from one-time events, such as bonuses, windfalls, or temporary jobs. It contrasts with permanent income, which is expected to be stable and ongoing over time.

Substituting the “estimate permanent income” formula to the transitory income formula:

allows individuals to differentiate between stable, expected income levels and temporary income fluctuations.

Page 6: Implications of the PIH

Consumption changes primarily with changes in permanent income, according to value of k.

Little change in consumption with transitory income changes, represented by the small value of short run multiplier kj, where j<1.

Friedman’s view: Demand-management policies have limited long-term impact on consumption, assumed that marginal propensity to consume out of transitory income is 0.

—> The consumption function above now can be rewritten as this in the long run. Since in the long run, fluctuation cancel out thus transitory income consumption times 0.

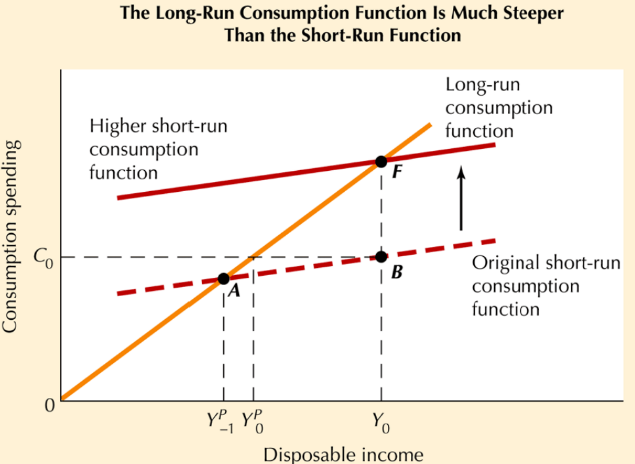

Page 7: Short-run vs Long-run Consumption in PIH

Long-run consumption function is steeper than the short-run function.

In economics, the long-run consumption function is typically steeper than the short-run function due to several factors:

Income Adjustment: In the long run, consumers adjust their consumption based on permanent income rather than temporary changes.

Wealth Effects: Over time, changes in wealth influence consumption more significantly.

Expectations: Long-term expectations about income and economic conditions lead to more pronounced consumption responses.

These factors contribute to a greater sensitivity of consumption to changes in income in the long run compared to the short run.

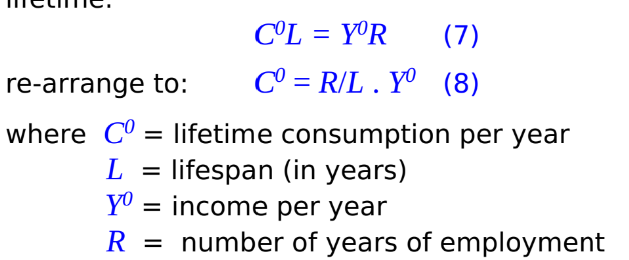

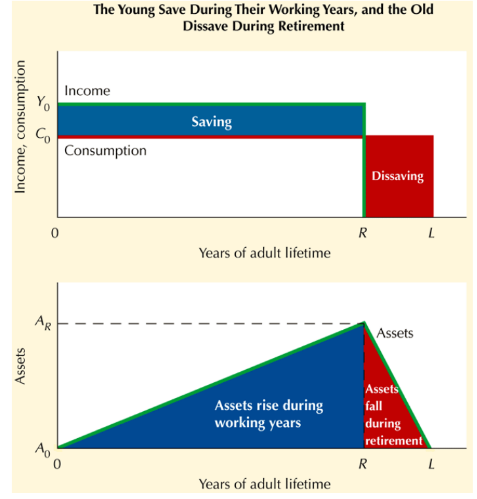

Page 8: Life-Cycle Hypothesis (LCH)

Proposed by Franco Modigliani in the 1950s, people would try to stabilise their consumption over their entire lifetime.

Lifetime Consumption Equation:

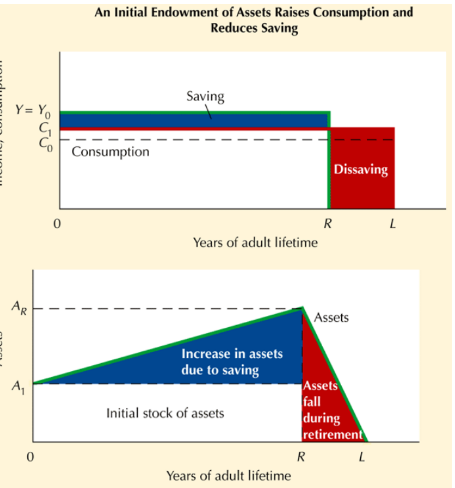

Incorporates assets for financing consumption, A0.

Page 9: Implications of the LCH

Explains positive association of saving and income.

Temporary income changes (increase/decrease) affect lifetime consumption and saving behavior (higher/lower) in cyclical years (boom/recession).

Demographic changes impact long-term saving ratios. e.g. aging = decline in long-run saving.

Page 10: Behavior of Consumption, Saving, and Assets under LCH

Young saves during working years, old dissaving during retirement.

Page 11: Consumption, Saving, and Assets with Initial Endowment

Initial assets increased consumption and reduce saving.

Page 12: Consumption as Social Behavior

Relative Income Hypothesis (RIH): Consumption decisions are socially determined in the sense that they reflect social status, slow adjustment during income changes.

e.g. when income decline, people reduce their consumption as they try to maintain their living standard. When income increase, people will try to increase their social status through higher more prestigious consumption.

Economic downturn: MPC rise to maintain living standard.

Economic upturn: MPC decline to rebuild saving to acquire durable goods to raise social status.

Chapter 15: Explaining Investment

Investment is key to understanding growth and cyclical activity.

Affects both aggregate demand and productive capacity. Increase in investment will augment productive capacity.

Consumptions as a proportion of GDP, is fairly stale investment is variable, changing in an irregular cyclical pattern.

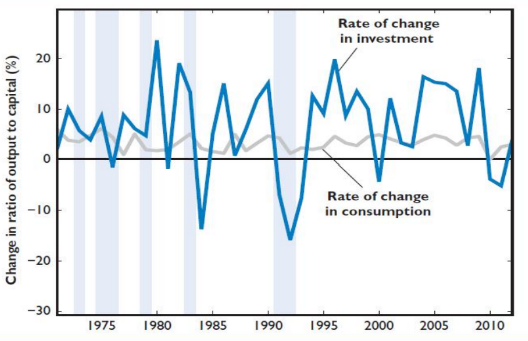

Page 14: Variability of Investment vs Consumption

Investment is more variable than consumption, but consumption is larger in proportion to GDP.

Investment is considered the key driver to cyclical movement of GDP in capitalist countries.

Page 16: Accelerator Theory of Investment

The accelerator theory of investment posits that investment levels are influenced by changes in output or demand. This theory highlights the relationship between economic activity and capital investment decisions.

When demand increases, firms invest more to expand production capacity, leading to a multiplier effect on economic growth. Conversely, if demand falls, investment decreases, potentially leading to a slowdown in the economy.

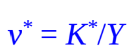

Desired Capital-Output Ratio, v*: determined principally by technical conditions of production.

K*: capital stock desired to produce the output

Y: output

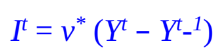

Net investment It, in period t is equal to change in capital stock in period t.

Simple accelerator equation:

Simple accelerator equation states that investment depends on required changes in capital stock in order to produce the demand-satisfied output.

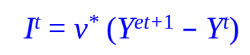

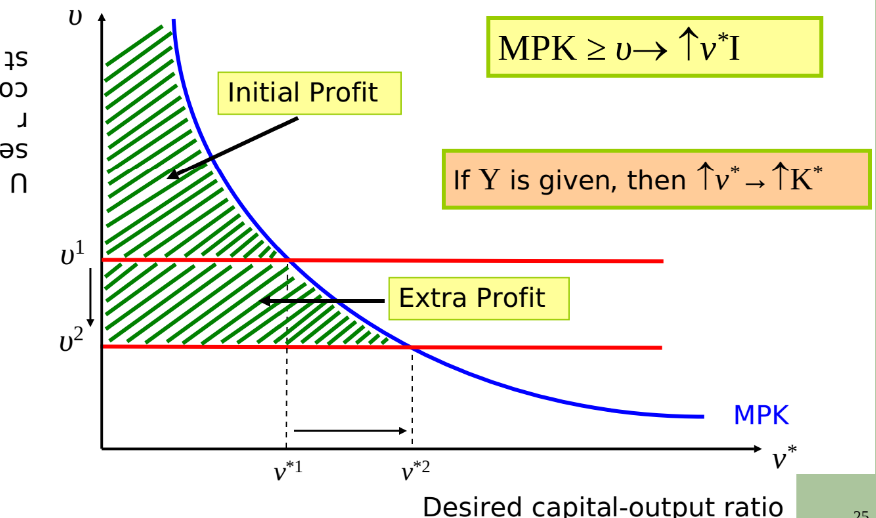

Investment can be adjusted to the expectation of demand condition. Yet+1 is expected demand (output) in period t+1 for which Kt capital stock is required.

—>Investment depends on the required changes in capital stock in order produce the output to satisfy demand.

Page 18: Limitations of Simple Accelerator Theory

Assumes expected demand in t+1 equals actual demand in t, which oversimplifies reality.

constant desired capital-output ratio v*, implies degree of productive capacity is constant.

Firm can smoothly adjust actual capital stock to desired through investment. However, adjustment of capacity often occurs at discrete time intervals over long period and not instantaneously.

I/Y, investment/output ratio does not have a consistent relationship to growth in RGDP

Limitations of Simple Accelerator Theory in Economics

Assumption of Linear Relationships: The theory assumes a direct linear relationship between investment and output, which may not hold in real-world scenarios.

Ignores External Factors: It does not account for external economic factors such as inflation, interest rates, and government policies that can influence investment decisions.

Static Analysis: The theory is often static and does not consider dynamic changes in the economy over time.

Over-Simplification: It simplifies complex investment behaviors and motivations of firms, neglecting factors like technological changes and market competition.

Short-Term Focus: The accelerator effect is primarily focused on short-term investment responses, overlooking long-term planning and strategies.

Page 20: Flexible Accelerator Theory

The flexible accelerator theory allows for adaptive expectations in determining expected demand and adjusting investment based on expected growth in that demand.

This means that firms adjust their investment levels in response to changes in anticipated demand over time, emphasizing a more dynamic adjustment process in relation to economic conditions.

Allow for variation in v over time

capital formation is no longer assumed instantaneous but can occur over various time lags and at discrete intervals.

Page 21: Traditional Neo-classical Theory of Investment

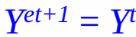

Suppose an inverse relationship between interest rates and aggregate investment, called the investment demand function.

The fundamental notion is that as the interest rate declines the cost of employing capital declines relative to the cost of labor, as given by the real wage, so being relatively cheaper is more profitable to employ a more capital-intensive technique

The investment demand function essentially represents the capital—labor substitution which occurs in the adjustment of the capital stock over time in response to a change in the interest rate

as capital-labour ratio increases, marginal productivity of capital MPK declines for a given technology (diminishing).

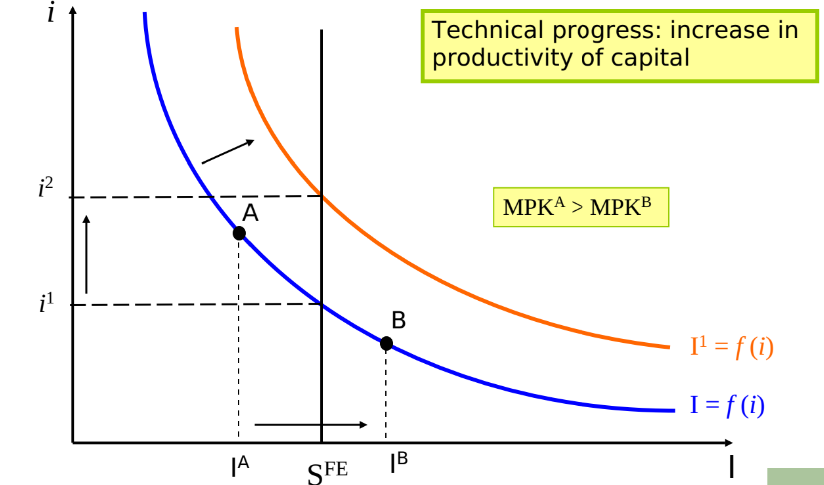

Page 23: Jorgenson’s Neo-classical Theory of Investment

Investment is a decreasing function of the interest rate based on user cost of capital in microeconomic analysis.

Investment decision making can apply to firms and industries too, not just macroeconomic.

Revolves around the concept of user cost of capital υ, which consists of 2 parts:

real rate of interest

depreciation rate on capital

Extra unit of capital will be purchased if the expected marginal product of employing the extra unit of capital is greater than the user cost

Desired capital-output ratio occurs where user cost equals marginal product of capital. A point at which profit is maximised in the production of a given output.

The extra profit can only happen in SR, since LR other firms will also invest causes cancel out of profit.

MPK function embodies factor substitution of capital for labour down along the curve.

Page 26: Policies Affecting Investment

Macroeconomic policy can influence user cost of capital, affecting investment levels.

e.g. lowering rate of interest/the real rate, monetary policy can promote higher investment.

By changing the government taxation (fiscal) policy (or interest rate, monetary policy), can influence investment:

a higher tax on firms’ profits raises the effective user cost of capital for firms

firms can cut corporate income tax by deducting the value of depreciation of plant and equipment.

—> government can affect investment by liberalizing or tightening tax laws.

Page 27: Critique of Interest-Elastic Investment Demand Function

Empirical evidence does not support a strong relationship between investment and interest rates.

Traditional neo-classical theory is only applicable to one commodity economy.

heterogeneous-commodity economy highlights the complexity of investment and capital-output relationships, as the marginal product of capital (MPK) is influenced by the varying characteristics of different commodities. The relationship between MPK and interest rate is not straightforward.

relative reduction in interest rate does not make capital intensive technique the most profitable, and vice versa.

Page 28: Specific Criticism of Jorgenson Theory

MPK-function is not independent of interest rates in a heterogeneous-commodity which is necessary for the determination of the desired capital-output ratio, v, and ultimately the aggregate level of investment.

K and Y can only be determined in value terms on the basis of the price of capital, the interest rate. Hence, as the interest rate changes so does MPK and not systematically decreasing with higher K/L.

Only one average profit-maximisation technique is relevant for the economy at the desired capital-output ratio is determined.

Because competition would ensure prices equal costs at which after risk, the rate of return/MPK on investment will equal the user cost of capital.