Chapter 5

Chapter 5: Communicating and Analyzing Accounting Information

Learning Objectives

5-1 Understand the people involved in the accounting communication process: regulators, managers, directors, auditors, information intermediaries, and users, including their roles and guidance from legal/professional standards.

5-2 Identify steps in the accounting communication process (press releases, annual reports, quarterly reports, SEC filings, online information services) and their significance.

5-3 Recognize and apply different financial statement and disclosure formats used by companies, and analyze gross profit percentage.

5-4 Analyze company performance via return on assets and its components, plus effects of transactions on financial ratios.

Understanding the Business

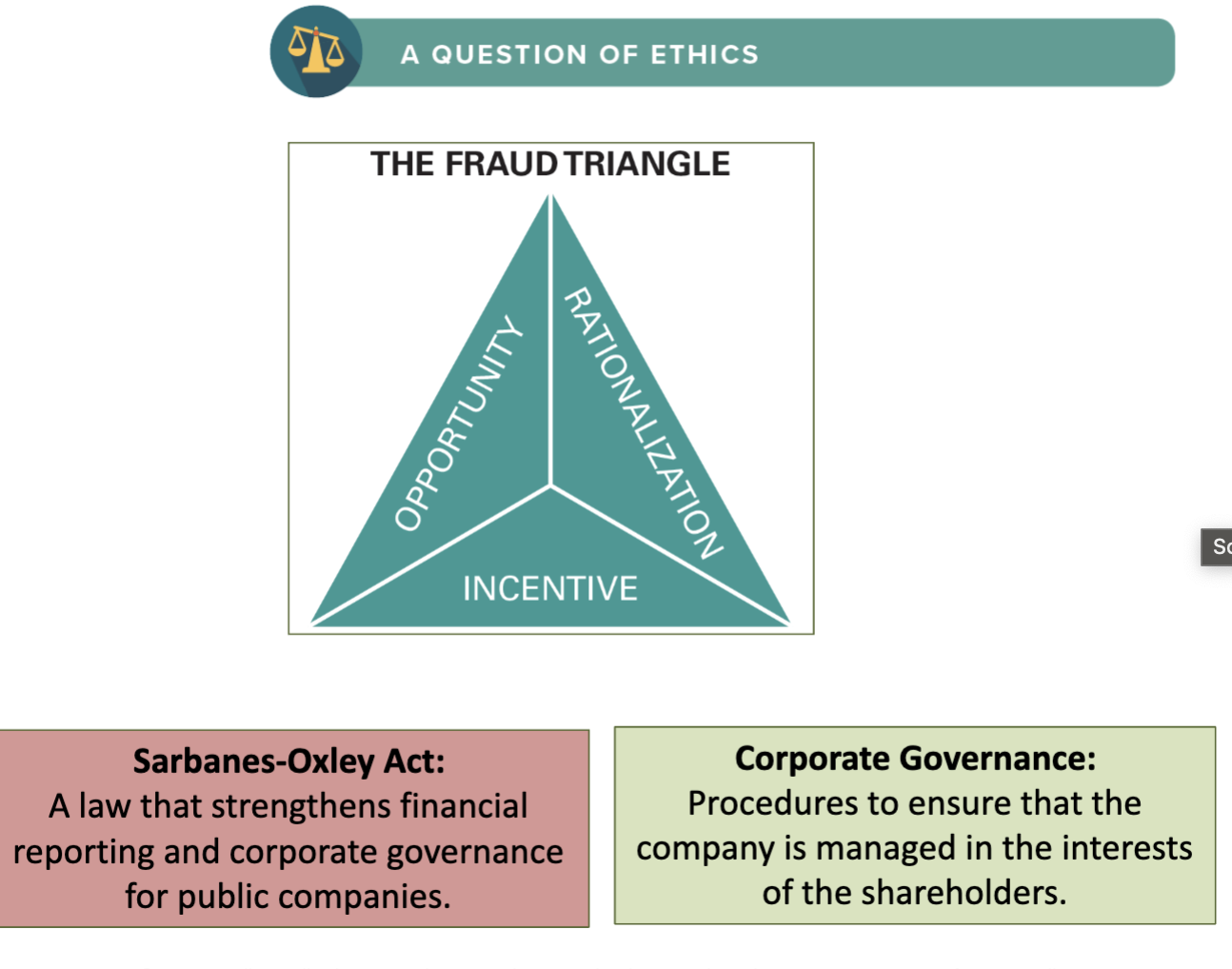

Corporate Governance

Definition: Procedures ensuring management aligns with shareholders' interests.

Sarbanes-Oxley Act: Legislation that enhances financial reporting and corporate governance for public companies.

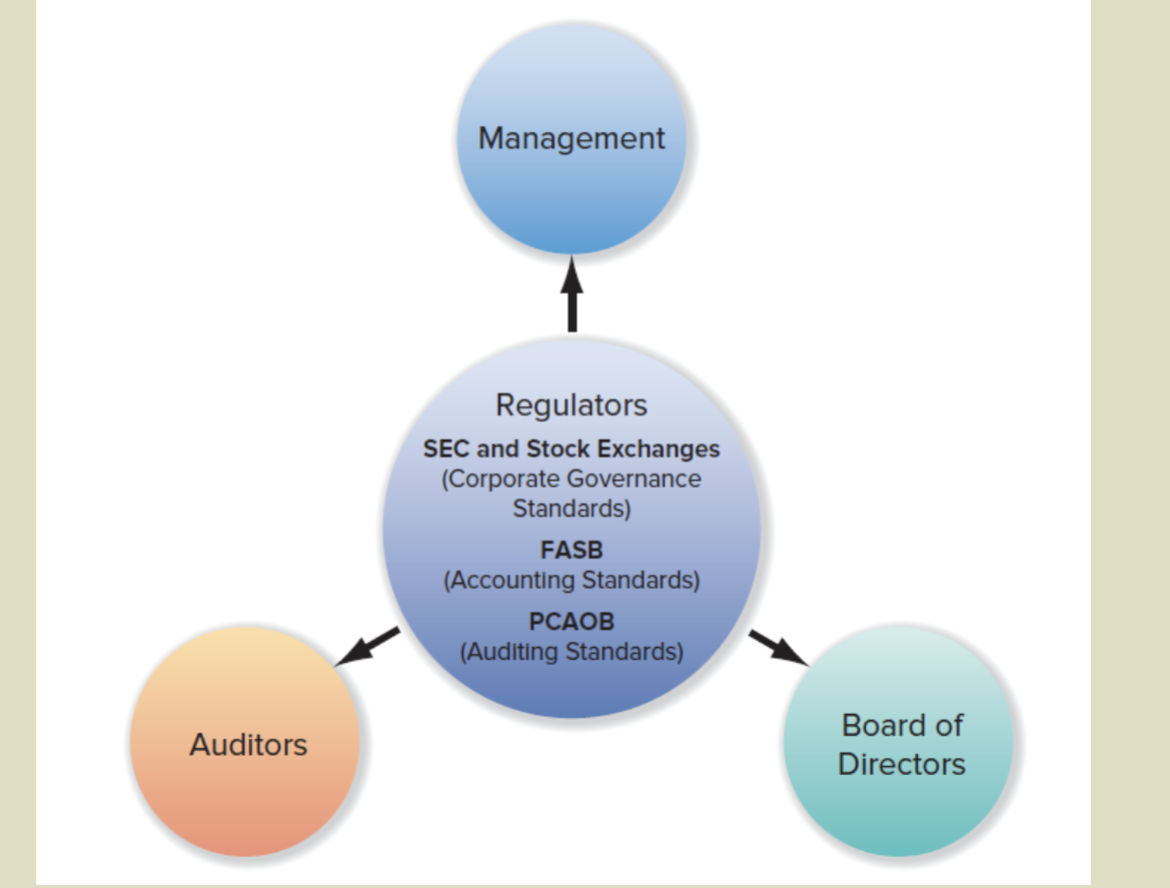

Key Participants in the Accounting Communication Process

Regulators

Securities and Exchange Commission (SEC): Protects investors and maintains market integrity.

Financial Accounting Standards Board (FASB): Sets generally accepted accounting principles (GAAP).

Public Company Accounting Oversight Board (PCAOB): Establishes auditing standards for public company auditors.

Managers

Role: Responsible for financial statement information accuracy; required to certify reports to the SEC.

Key Personnel:

Chief Executive Officer (CEO): Highest officer responsible for overall company operations.

Chief Financial Officer (CFO): Highest financial/accounting officer.

Board of Directors

Function: Oversees management to safeguard shareholders’ interests.

Audit Committee: Ensures integrity of accounting and financial reporting, hires auditors, meets separately with auditors.

Exhibit 5.1

Independent Auditors

Requirement: Publicly traded companies must be audited by an independent CPA firm.

Responsibilities: Verify financial statements' fairness through an unqualified audit opinion, which enhances credibility for investors.

Information Intermediaries

Users of Financial Data: Investors utilize websites, information services, and analysts for data and analyses.

SEC Filings: Companies use EDGAR service for electronic filing, making it accessible for analysis.

Financial Analysts: Generate earnings forecasts and recommendations based on company data.

Steps in the Accounting Communication Process

Disclosure Process

Fair Disclosure (Regulation FD): Mandates equal access to company news for all investors, prohibiting insider trading on undisclosed information.

Earnings Announcements: Public companies release quarterly/annual earnings via press releases, often followed by conference calls.

Managers and other insiders are prohibited from trading their

company’s shares based on nonpublic (insider) information so that no

party benefits from early access.Public companies announce quarterly and annual earnings through a

press release as soon as the verified figures (audited for annual and

reviewed for quarterly earnings) are available.Many companies follow these press releases with a conference call

during which senior managers answer analysts’ questions about the

results. These calls are open to the public.

Annual Reports vs. 10-K Forms

Private Companies: Annual reports are simpler with basic financial statements and notes.

Public Companies: Must follow SEC guidelines in Form 10-K, which includes:

Business description and strategy.

Management discussion on financial condition and results.

Comprehensive financial statements and related disclosures.

Quarterly and Other SEC Reports

Public Companies' Quarterly Reports (Form 10-Q): Include partial information reflecting updates since the last annual report.

Form 8-K: Reports material events not yet disclosed to investors.

Financial Statement Formats and Analysis

Key Characteristics

Comparative Financial Statements: Report current and prior performance for comparison.

Subtotals and Classifications: Different formats can exist between companies; clarity is essential.

Additional Disclosures: Notes accompanying financial statements provide vital insight that aids analysis.

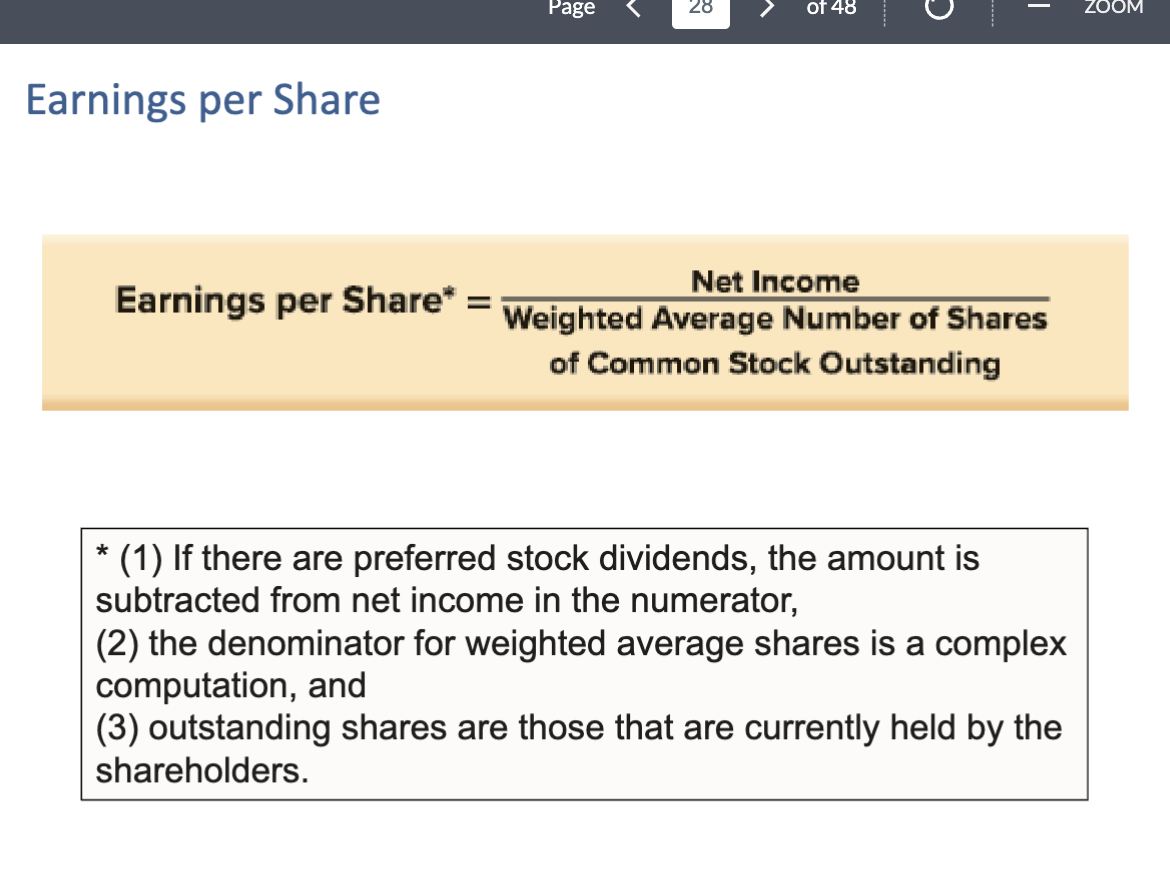

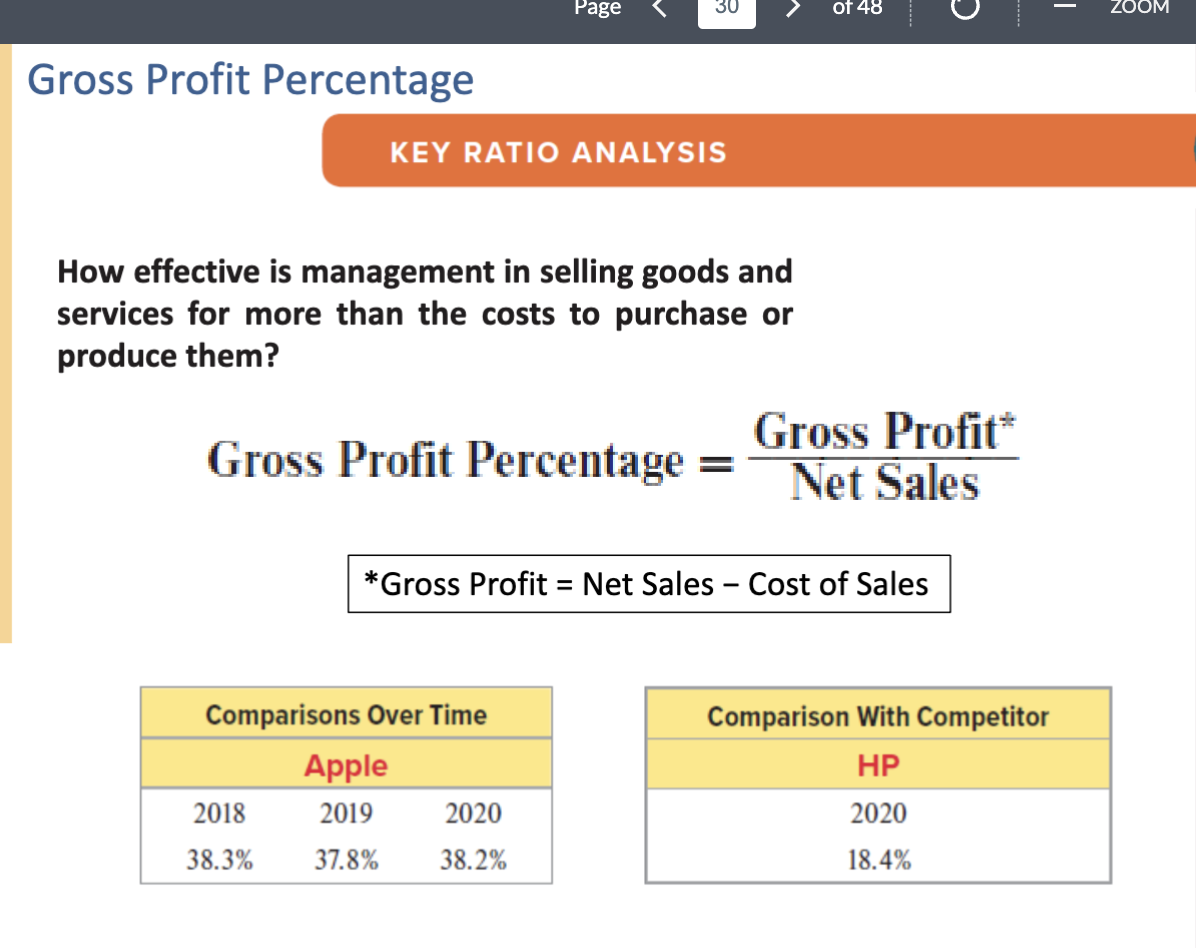

Gross Profit

Gross Profit Calculation: Difference between net sales and cost of goods sold, an important indicator of operational efficiency.

Gross Profit Percentage: Measures how effectively management sells products over their costs.

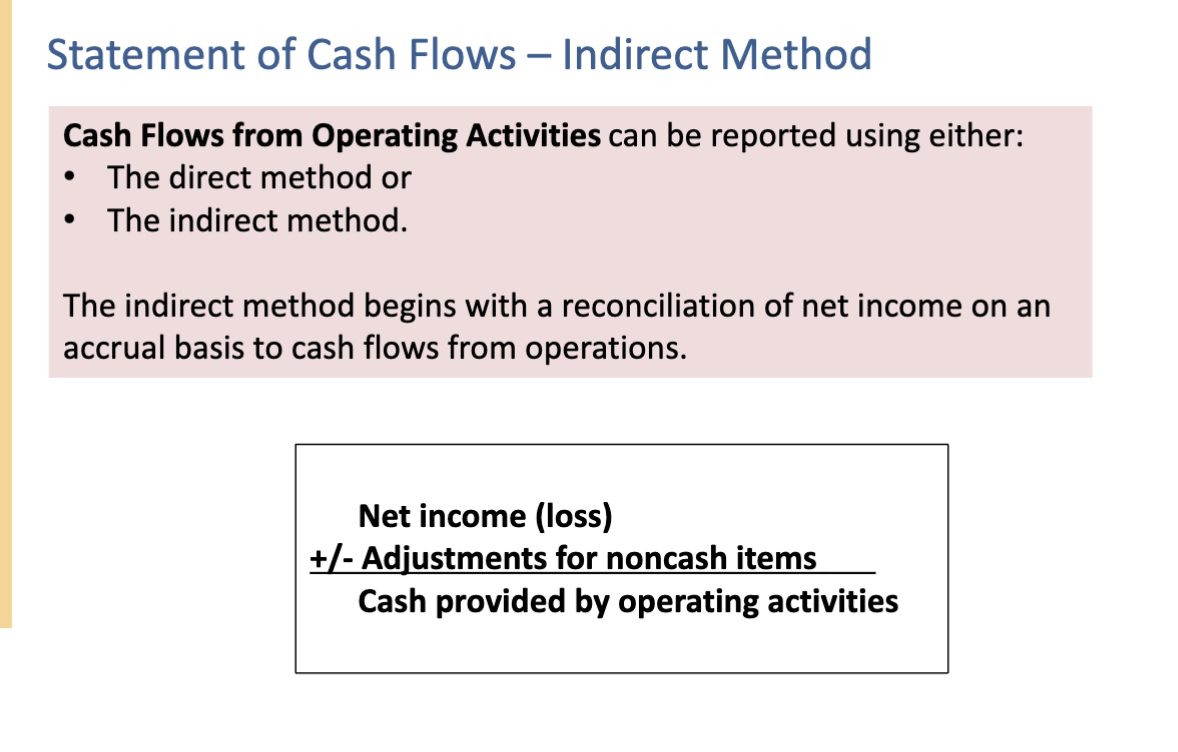

Statement of Cash Flows

Sections:

Operating Activities: Cash flows related to income.

Investing Activities: Cash associated with asset purchases and sales.

Financing Activities: Cash relating to debt and equity transactions.

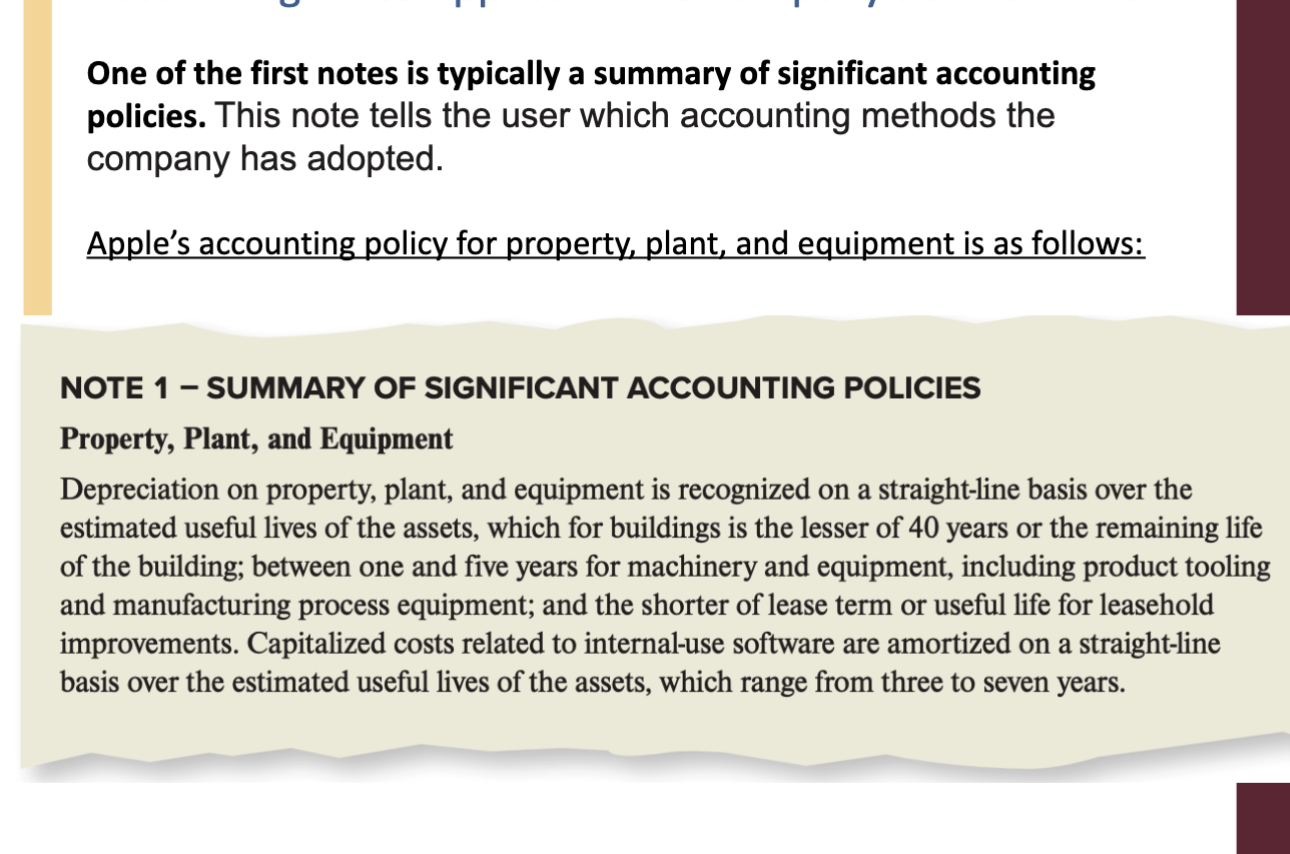

Notes and Disclosures

Importance of Notes

The notes to financial statements explain accounting rules,

provide additional details,

disclose relevant information not shown in main statements,

enhancing clarity and understanding.

Voluntary Disclosures

Companies may provide additional data beyond GAAP/SEC minimums, offering richer insight into financial health.

Global Accounting Standards

IFRS vs. U.S. GAAP: Major differences exist between these accounting frameworks; efforts are ongoing to bridge these gaps.