Chapter 9

no standy charge - since the car is owneed my employee

disability insurance premium - its in the notes in previous chapters or something. ch 3 i think: 2 slides.

in the slides it says group disability plan, its the same thing ch 3 page 42 & 43 its the same treatment.

do we have to consider the transfer of divident to spouse?

all answers for this assignment is from chapter 1 - 10.

dividend tax credit - is one of the tax credit

child support payment and spousal payment the tax treatment is in - chapter 9 - in the slides

how do u know if allowance is reasonable .. based on km driven .. automobile allowance, if its not exceeding certain limit, but it doesnt apply to this case. since its not per km fee.. but its not reasonable (its lump sum or something ppl yappin about) chapter 3 page 39

andrew owning land - ten annual installment - on slides it says max 5 years, so when calc captal gain do we have to use 5 or do we use 10, the reserve is 5 and then u cut the captial gain for 5 or something,.

cca - chapter 3 & 5 & 8 is it only self employed than can claim cca, (SLIDE 63 CH 3) EMPLOYEE CAN deduct on automobile, so yes we can deduct it. CCA —> earns employment income, using the car for employment.

personal employment use percentage - chapter 8 go to book to take out detail CH 8 SLIDE 46 - change in use automobile - because the percentage has changed it went from 60% to 80%)

max deductable RRSP - which criteria it goes into - in which part should we include this deduction, its not division c, its in other deduction from income (chapter 9) so it will be included in net income

1 worksheet for each income

ch 4 ssp

ch 9 questions are good comprehensive plan, lsat 2 questions for ssp you can see how they present the answers

transfer of tuition - if spouse is paying, you can transfer to spouse, (CH4 P 42) but cant transfer to grandparent or parent. you can do both spousal tax credit and tuition fee credit but nothing can be transfered to parent

gift mvf - 500 ch 3 pg 22 - hotel - exluce long service payment of others, it shouldnt be 500 apparently, see if the gift is related to employment - because then you treat it

ADD everything more than 500 thats not performace related, is it above 500 aggregate,

multiple choice on this chapter:

Reg savings plants

RESPs

RDSPS

TFSAs

TOSI - trasnfer income to spouse or kids, CRA says you have to tax it in the max tax rate so there is no benefit to reduce your tax.

Pension benefit: ITA 56(1)(a)(i)

payments from registeres persion plan, CPP and OAS

Retiring Allowance

added to income fully subject to tax

Death Benefit

say you are employee of a company and you pass away

the person entitled to receive the death benefit will be subject to tax, other than the first 10,000 is exempt.

RRSP Withdrawals

ITA 56

Payments from DPSP

Home buyers plan - RRSP Withdrawals

need to repay back to the plan (will be a minimum repayment)

Lifelong

Scholarships

included in net income if exceed the exemption

in most cases they are excepted if meet requirements:

have to be full time student ina qualiying education program at a designated insitution

Research grants

included in income

but can be reduced by unreimbursed research cost

Social Assistance ITA 56 (1)(u)

included in net income - added because we want to work out a number of elibibilty tax. you are supporting a disabled person over 17, in order to get full tax credit, the disabled person income must be lower

deducted from taxable income

Workers compensation

included in net income

deducted from taxable income

need to add to income, and then deduct it.

Subdivision e

CPP Contribution on Employee Earning ITA 60

max ccp 3,754: only 3123 eligable for CPP tax credit, remained is 631, so 631 is a deduction from income.

Employer: matching CPP contribution of 3754

Self imployedL

7508 - 3123 (so same as employee)

you can deduct that supposed to paid my employer: so you can deduct the 3754, since you paid both halves of the CPP

Moving expenses - TESTED ON EXAM (PROBLEM QUESTION)

Eligiable Relocation :

the move must be within canada? - normally yes. but it can also be oversees, as long as you remain to be a resident of canada throughout the absense

- for questions she will just give within canada

No moving Expense:

employer receives moving allowance or reimbursed

employer paid expense

should be able to tell what CAN OR CANNOT be deducted (SLIDE 14)

Deduct?

Travel cost (taxpayer and family)

moving household effect (moving truck & temporary storage)

meal/lodging at new or old residence max for 15 days (hotel)

Lease cancellation costs - when you cancel your lease early

Selling costs - old residence

costs of acquiring new residence - real estate cost, commision payment, (if taxpayer owned an old residence) - if you are just renting / are a tenant of the old house, then it will not be treated as a deductible

$5,000 interest, taxes, and utilities - old residence - struggling to sell old house so you still have vacant house.

cost of revising legal documents

Meals

$23 per meal per person

Mileage

$x per kilometer - depending on which province,

Tax planning

important if costs shared with employee

employer pays for employees non-deductible costs

costs of visits to new location

loss on old house

1st $15,000

½ of excess over $15,000

this doesnt create a taxable benefit.

Excersice 9.1

6,000 is a taxable amount

she can deduct 6,400 and 1,200

we can arrange for the employer to pay for the non deductable cost 1,300, and give me 4,700 in cash, so then only 4,700 is taxable.

2000 is your income at new location

ITA 118.1 before orange example. says exam and in practice problems

Medical expense tax credit: ita 118.2 - will be tested in exam. (problem question)

MEDICAL expense gunna be harded question in exam most likely - as well as assignment.

Dont need to know LSVCCs for exam. - ITA 127.4

Refundable Tax Credits:

FOR EXAM ONLY:

Gst/HST Tax Credit and Refundable

Home renovation stuff not included in exam. - look at own time

FINAL EXAM: given diff scenarious , give what the tax payable, work out the tax credit, need to know what the tax credit is for the situation, hmw : given 4-5 short scenarious tehy are indipendentt, tax payable is also needed, need to knwo the 5 tax brackets, how many tax credit, what are the ones that are relevant, and how much. - 1 QUESTION from this chapter in EXAM.

2 children from seperate spouces, 1 is eligible, so would be eligible for the disiblity tax credit are they also elgibile under the canada care giver tax credit?

ita 118(1)(b)(b.1) - canada caregiver amount for child

yes it is eligible.

Week 11

1. Describe the four-step process used to determine net federal income tax payable for individuals, the common taxable income deductions, and their place in that process.

Step 1 – Net income = Division B (predominantly Subdivisions a to e)

Step 2 – Taxable income = Division C

ITA 2(2) defines taxable income as net income (ITA 3) plus any additions and minus any deductions found in Division C. There are no division C additions or individual tax payers.

Step 3 – Gross tax = Division E (Subdivision a)

Step 4 – Personal tax credits = Division E (Subdivision a)

Result = Net income, income tax payable or refund

= this set of rules is reffered to as the alternative minimum tax or AMT.

2. Describe the purpose of the rules related to lump-sum payments and how they apply (P 11-9 to 11-14).

3. Explain how transaction-based losses differ from source-based losses, the exceptions to transaction-based losses, how they ft into net income under ITA 3, and what happens when

there is insuffcient income to apply them in the year they occur (P 11-15 to 11-29).

4. Explain how personal tax credits play a role in loss planning (P 11-30 to 11-31).

5. Explain and be able to apply how current-year losses become loss carry overs and the impor-tance of ITA 3 in that process (P 11-32).

6. Describe the various types of loss carry overs, their carry over period, and their restrictions, if any (P 11-33).

7. Calculate and apply the loss carry over provisions applicable to non-capital losses (P 11-34 to 11-38).

8. Calculate and apply the loss carry over provisions applicable to net capital losses, including the conversion of a net capital loss carry over to a non-capital loss carry over (P 11-39 to 11-45).

9. Explain the special rules for applying net capital losses on the death of an individual (P 11-46 to 11-49).

10. Describe the circumstances under which an ABIL can occur, how it is treated in determining net income and taxable income, and the interaction with the capital gains deduction (P 11-50 to 11-60).

11. Explain the difference between a restricted farm loss and an unrestricted farm loss and the loss carry overs that apply when there is insuffcient net income to apply them in the year they arise (P 11-61 to 11-65).

12. Explain the purpose of the capital gains deduction together with the type of property to which it applies (P 11-66 to 11-73)

13. Apply the provisions of the capital gains deduction (P 11-74 to 11-89).

14. Explain the importance of selectively applying loss carry overs in the optimum way possible and describe some of the basic income tax planning points to keep in mind when choosing which losses to apply (P 11-90 to 11-94)

15. Describe basic federal income tax payable (P 11-95 to 11-100).

16. Explain the circumstances under which taxable dividends can be transferred between spouses or common-law partners. Apply the transfer and determine whether it is benefcial in specifc cases (P 11-101).

17. Explain how the eligible amount of a donation is determined, the impact of an “advantage,” and how the legal concept of a donation differs from that of the ITA (P 11-102 to 11-110)

18. Explain how the ITA treats donations of property to registered charities, how it affects the 75% annual limit and any special treatment to certain non-cash donations such as publicly listed shares. In addition, calculate the charitable donations tax credit for donations of various types of property (P 11-111 to 11-127).

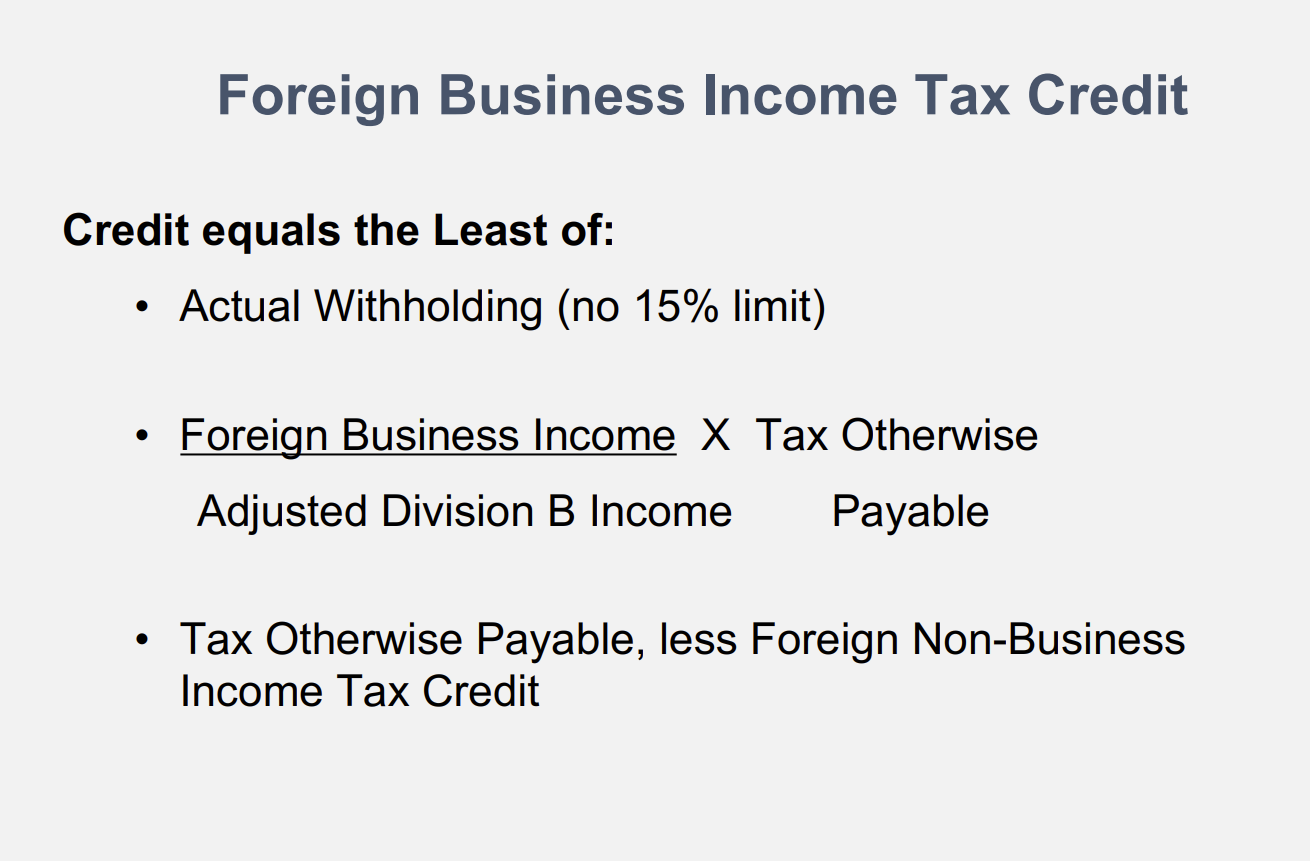

19. Explain the purpose of the foreign tax credit, the Canadian income tax treatment of the pay-ment of foreign income and proft taxes and be able to calculate both the foreign business and non-business income tax credits (P 11-128 to 11-138).

20. Explain the purpose and reasons for the AMT and the circumstances under which it is likely to apply (P 11-139 to 11-141).

21. Apply the provisions of the AMT (P 11-142 to 11-157)

22. Review a personal income tax return completed using the ProFile T1 tax preparation software program (P 11-158).

LOSSES will be tested in final exam as a PROBLEM QUESTION.

yappin a lot about cgd and agl alot

taxable gain

FMV - Cost

divided by 2

100,000 - 80,000 = 20,000 / 2 = 10,000

credit base = extra 25%, purpose is to match 100% of the income. so that you can have more deduction for tax credit. special treatement for gift of capital property.

SHE WILL TEST ON ELECTION, BUT NOT ON THE CALCULATION ONLY THE CONCEPT OF ELECTION.

Election: • In general, if FMV > ACB/UCC of Capital Property – Taxpayer can elect any value between FMV and ACB/UCC for the purpose of determining Donations Tax Credit (with exceptions) = CONCEPT

went fast through slides 41-44

dont need to know calculation for exam, just need to know pick the lower between actual withholding and foreign non bus-income

compare the three and choose lowest, so only need to know concept not the calculation for exam

Concept of AMT:

in cnada theres lots of high income people, so they can pay less,but poeple get mad why rich ppl pay less,

c = first 40k is excemted from tax

multiply by a the minimum tax percent

NEEED TO KNOW THIS ONLY:

No calculation.

pick the greater, compare the amt and regulat tax

concept: challenge the wealthy people. so public wont be as upset. DONT NEED TO KNOW CALCULATIONNNN just know the formula and concept.

data analytics - 1 or 2 MCQ

ch8 - capital gain

ch 9 - other income and deduction

ch 10 - rrsp

ch 11 - cdg - hard concept to learn lalalala

ch 4 - lots of tax credits

do prinipcal residence

gain reduction formula practice problems

personal use property: personal enjoyment (not for business)

listed personal property (LLP) - know the 5 types of property (jewlery, drawings,

chapter 8 excercise 11:

sailboat - personal use (PUP) captial gain = POD - ACB = 68,000 - 43,000 = 25,000

oil painting - LPP 25,000 - 1,000 (has to be atleast 1,000) = 24, 000

personal automobile = PUP = capital gain = 15,000 - 33,000 = (18,000)

PUP LPP

25,000

/ 24,000

0 no (18,000) ← LOSS ON DESPOSITION CANNOT CLAIM ANY DEDUCTION

/ (28,000

25,000 0

x ½ tax

= 12,500 (look from last year do you have a carry forward cost) carry forward the $4,000

Gains and Losses on Foreign Currency

Income Transactions

Capital Transactions (200 dollars , gain and loss first 200 dollar is not taxable/deductable)

Securities l

Regular capital gain/loss

Foreign currency capital gain/loss (due to the fluctuation - there in an example of the 200 rule on the lecture slide - important must need to know tha t

Deemed Dispositions - at FMV

Business to Personal Use

Personal to Business Use

Deferral Provisions

Small Business Investments

Replacement Property

PAY ATTENTION TO HOMEWORK

Moving Expenses Deduction

Calculation - person is told to move him belongings and work somewhere what is the maximum moving expense - HOMEWORK LOTS OF EXAMPLES

Child Care Cost Deduction

Calculation (boarding fees, etc) usually lower income spouse would be claming this, but theres certain cases where higher income spouse can. —> MAYBE SHE EMPHASIZED THIS TWICE CUZ ITLL BE IN EXAM?

Annual limit

Periodic limit

Generally claimed by lower income spouse but with exceptions

Spousal and Child Support Payment

Annuity Receipts (acquired with after-tax funds)

use money to buy annuity, you have to add it to income, and capital portion you can something, theres a slide with examples

CHAPTER 9 EXCERCISE 9

max child care expense deduction

exam purpose she will give net income - for the income its equal to income before deducting expenses

Net income base 14,000 + 5,500

the wife cant claim, the husband is the lower income spouse, but is there certain things that the higher income spouse (the wife) that can make her also get the claim.

total child care expenses = 10,500, who can make the claim and why (prison, studying full time/part time) —> SHE SAID MAKE SURE —> you have to calc according to periodic limit

/ MR sampras

LEAST OF THE 3:

1 actual cost 10,500

2 annual limit 18,000 (3 kids - below 7 year old : 8,000: annual limit, other 2 kids: 5,000 ×2)

3 2/3 of earned income 13,000 (19,500 ×2/3) (she will give this in exam)

= Least is 10,500

= side note: you cant deduct it from other income other deduction ( duh its chapter 9)

RESP

govt can contribute

tax implication upon withdrawal: the person who receives the money: student: its capital withdrawal no need to pay money, and something else

TFSA

dont have to pay tax

Non arms length transfer

l Position of Transferor & Position of Transferee —> there maybe implication,

Transfer of Non-Depreciable Assets

Transfer of Depreciable Assets (ITA 13(7(e))

POD > Transferor’s Capital Cost

POD < Transferor’s Capital Cost

PAY ATTENTION TO EXAMPLES IN CLASS AND HOMEWORK

Death of Taxpayer – capital property at death

Non-Depreciable Property

Depreciable Property

Income Attribution Rules

Applicable to Property Income and Capital Gains

Property transferred to:

Spouse - capital gain stuff will go back to the transferers hands

Related minor - capital gain, the minor will be taxed on that

l Tax on Split Income (TOSI)

distribute - taxed in the hands of the recipient at max

RRSP

RRSP Deduction Limit A+B - only need to know that for exam

Calculation Balance brought forward, in current year add on limit which is equal to lesser than 18% of your income in previous year, than minute the PA of previous year

Formula

RRSP Dollar Limit

Earned Income - whats included in earned income and whats not included

PA of previous year

Chapter 10 - 3 straightforward exam - Need for exam, what is earned income.

82,000 - EI (after 3,000 deduction)

12,500 - business loss

4,200 taxable dividend

18,000 deductible spousal support to her fromer spouse

what is earned RRSP

Employment income = 82,000 + 3,000 = 85,000

Business Loss = (12,500)

taxable dividend is not included neither is interest

spousal support is included=tax payer so minus (18,000)

= 54,000 × 18%

compare to the RRSp dollar limit and see which ones less i think, this is in CPA sheet so dont need to know.

captial gain, divident, interest = are not included

how about she changed it to deductable child support payment = it wont be included in the calculation. ONLY spousal support is included.

Remember its the LAST YEAR INCOME - sometimes question gives more than one year and you have to pick which ones

always remember you can always carry forward the deduction.

options at retirement

money continues rolling

use the money to buy anniuty - then need to tax it but can spread it out over number of years

or just take out money and tax it (no one else will go for this)

Spousal RRSP

attribution rules, so take out money not at this time or around this time to avoid it

RRSP l Non-taxable withdrawal (repayment) l Home Buyer’s Plan l Lifelong Learning Plan

RPP l Employer Contributions l Employee Contributions

DPSP

RRIF l Only transfers from other plans

chapter 11:

Different Types of Losses l Listed Personal Property Losses l Net Capital Losses l Non-Capital Losses l Regular Farm Losses l Restricted Farm Losses

Treatment of Losses l Carry back l Carry forward

Non capital losses (E (employment income loss, etc) - F ( income in a year) - D (firm loss)

Allowable Business Investment Loss (ABIL) - cover calculation from notes

chapter 11 - 5

determine amount of ABIL in 2023

capital gain deduction to offset taxable gain = 13.000

capital gain on publicly traded shares = 18,000

captial loss on arms length disposition of shares on as SBC(small business corporation) = 50,000

employment income = over 200,000

business investment loss = 50,000

Less: lifetimes CGD (26,000)

/ 24,000 x 50% = 12,000 —> ABIL

/ how about life time capital gain? the 26,000 will then become the ordinary capital loss and can offset the capital taxable gain (based on life time capital deduction you’ve claimed before Lifetime CGD)

26,000 - one have of which is deductable

Taxable captial gain is 18,000/2 = 9,000

Allowable capital loss: (13,000) which is half of the 26,000

so 9,000 - (13,000) = 4,000 will be carred over ( either backaward or forward since there isnt enought right now to offset

ABIL IS IMPORTATN NEED TO KNOW THIS.

Lifetime Capital Gain Deduction

Charitable Donations - Gifts of Capital Property

Alternative Minimum Tax (AMT) - wealthy people.

l Net Income for Tax Purpose

capital gain, bsuiness income, employment income, then minute division c deduction.

Just need to know federal tax: 15 - 33

Non refundable tax credit - if tax payable is not big enough you cannot enjoy, no one will give you money

refundbale tax credit - cra will give you cash back

tax credit: depends on the condition need to know the base (given on sheet) - Practice homework.

3-4 questions for this, there are two refundable tax credit

basic tax credit examples: - do the homework

excersize 4-4:

infirm spouse and infirm adult child

20 year old no income mental infirmity

spouse 5,600 net income

SPOUSE

can claim spousal credit

base: 15,000 - 5,600 (take out any net income made my spouse) + 2,499 (add for infirmity even tho theres no disability tax credit) = 11, 899

Son

cant do elligable dependent tax credit - since their married

caregiver amount for the child 2,499 - cant give because child is not under age 18

only thing that can be given is the canada care giver credit = 7,999 (there is no income)

11,899 + 7,999 = 19,898 × 15% =

excercise: 4-5

single parent : takes care of 9 year old daughter

9 year old: physical infirmity no disability tax

what is tax credit for janice

eligible dependance tax credit - single parent slay = 15,000 - 0 (since no income)

caregiver for a child (under a seperate section) = 2,499

15,000 + 2,499 = 17,499

( REMEMBER ON THE NOTES PAGE 16 DEPENDANT TAX CREDIT THERES TWO CONDIITONS - second scenario - if child is not under 18, so we cant use this 2,499)

if janice was 20 years old she wouldnt have gotten the caregiver for a child since shes not under 17 BUT she would meet criteria for being not under 18 for eligiable depedance tax credit)

charity and medical - not on the cpa,

DONATION IS IMPORTANT

POLITICAL IS IMPORTANT