Chapter 6: Elasticity, Consumer Surplus, and Producer Surplus

Price elasticity of demand - Responsiveness of consumers to a price change

- Relatively elastic - Modest price changes cause large changes in quantity purchased

- Relatively inelastic - Substantial price changes cause small changes in quantity purchased

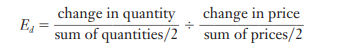

- Elasticity of demand = Percent change in quantity demanded of product X / Percent change in price of product X

- Midpoint formula - Averages the 2 prices and the 2 quantities as reference points for computing percentages

Why use percentages?

- Choice of units can arbitrarily affect impression of buyer responsiveness

- Can correctly compare consumer responsiveness to changes in prices of different products

Ignore minus sign + present absolute value of elasticity coefficient to avoid ambiguities

Interpretations of elasticity of demand

- Elastic - Specific percent change in price results in a larger percent change in quantity demanded; elasticity of demand greater than 1

- Inelastic - Specific percent change in price results in a smaller percent change in quantity demanded; elasticity of demand less than 1

- Unit elasticity - Percent change in price is equal to resulting percent change in quantity demanded; elasticity of demand equals 1

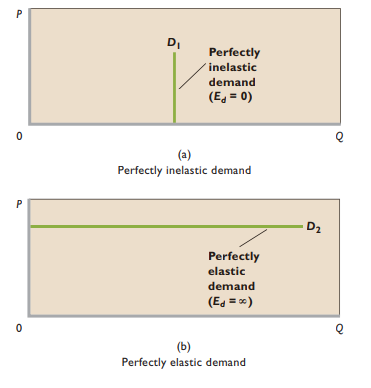

- Perfectly inelastic - Price-elasticity coefficient equals 0; no response to change in price

- Perfectly elastic - A small price reduction causes buyers to increase purchases from 0 to all they can obtain; price-elasticity coefficient equals infinity

Total revenue - Total amount seller receives from sale of a product in a particular time period; price * quantity sold

Total-revenue test - Test to infer whether demand is elastic or inelastic

- Elastic - Decrease in price → Increase in total revenue

- Inelastic - Decrease in price → Decrease in total revenue

- Unit elastic - Increase or decrease in price → Total revenue unchanged

Price elasticity along a linear demand curve

- Price elasticity coefficient for a demand curve declines as we move from higher to lower prices

- Changes from more elastic to more inelastic

- Slope cannot be used to judge elasticity

Determinants of price elasticity of demand

- Substitutability - More substitute goods available → Greater price elasticity of demand

- Proportion of income - Higher the price of a good relative to consumers’ incomes → Greater price elasticity of demand

- Luxuries vs. necessities - Good considered to be luxury rather than necessity → Greater price elasticity of demand

- Time - Longer time period → Greater price elasticity o demand (consumers have more time to adjust to changes in price)

Applications of price elasticity of demand

- Large crop yields - Demand for farm products is highly inelastic; increases in output → lower prices of farm products + total revenues of farmers

- Excise taxes - Levying excises on products w/ inelastic demand

- Decriminalization of illegal drugs - Legalization → Would reduce drug trafficking by taking the profit out of it (would reduce street prices)

Price elasticity of supply - How easily/quickly producers can shift resources b/w alternative uses

- Elastic - Quantity supplied by producers relatively responsive to price changes

- Inelastic - Quantity supplied relatively insensitive to price changes

- Elasticity of supply = Percent change in quantity supplied of product X / Percent change in price of product X

- Market period - Period that occurs when the time immediately after a change in market price is too short for producers to respond with a change in quantity supplied

- Short run - Period of time too short to change plant capacity but long enough to use the fixed-sized plant more or less intensively

- Ex. Farmer cannot change land or machinery, but can change amount of labor + fertilizer

- Long run - Period of time that is long enough for firms to adjust plant sizes + for firms to enter or leave the industry

- Ex. Farmer has time to acquire more land and machinery + more farmers may be attracted to tomato farming by higher prices

Applications of price elasticity of supply

- Antiques + reproductions - High prices of antiques result from strong demand + limited, highly inelastic supply

- Volatile gold prices - Price of gold increases sometimes, decreases other times; inelastic supply of gold → small changes in demand produce large changes in price

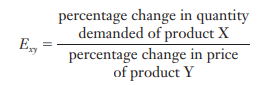

Cross elasticity of demand - How sensitive consumer purchases of one product are to a change in the price of another product

- Cross price elasticity = Percent change in quantity demanded of product X / Percent change in price of product Y

- Substitute goods - Increase in price of good X → Increase in demand for good Y

- Complementary goods - Increase in price of good X → Decrease in demand for good Y

- Independent goods - 2 products being considered are unrelated

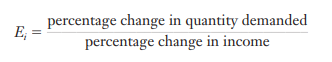

Income elasticity of demand - Degree to which consumers respond to a change in their incomes by buying more or less of a particular good

- Income elasticity = Percent change in quantity demanded / Percent change in income

- Normal goods - Income rises → Demand increases

- Inferior goods - Income rises → Demand decreases

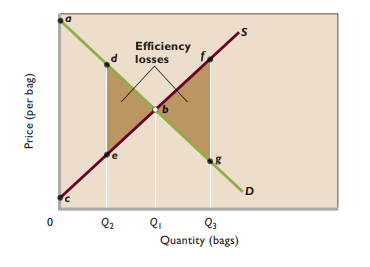

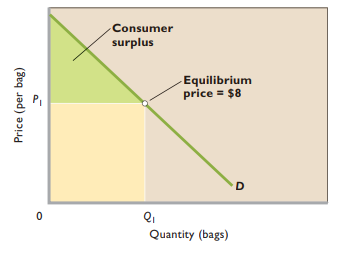

Consumer surplus - Benefit surplus received by consumers in a market

- Difference between the maximum price a consumer is willing to pay and the actual price

- Arises b/c all consumers pay equilibrium price even though many are willing to pay more than that

- Add together individual consumer surpluses → Obtain collective consumer surplus in market

- Consumer surplus + price are inversely related

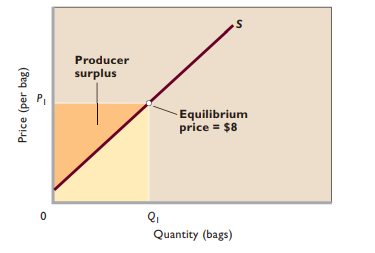

Producer surplus - Benefit surplus received by producers in a market

- Difference between the actual price a producer receives and the minimum acceptable price

- Arises b/c most sellers willing to accept lower-than-equilibrium price if that’s required to sell the product

- Add together individual producer surpluses → Obtain collective producer surplus in market

- Producer surplus + price are directly related

Efficiency

- Productive efficiency - Competition forces producers to use best techniques + combos of resources

- Allocative efficiency - Correct quantity of output produced relative to other goods + services

- When consumer surplus + producer surplus is at maximum size

- MB = MC

- Maximum willingness to pay = minimum acceptable price

- Competitive markets produce equilibrium prices + quantities that maximize consumer + producer surplus

- Efficiency losses - Reductions of combined consumer + producer surplus

- Deadweight loss - Efficiency loss to society

- Example: Producing an item for which the maximum willingness to pay is $7 and the minimum acceptable price is $10 subtracts $3 from society’s net benefits