Macroeconomics Final Exam Review

What do economists study?

How individuals, businesses, and governments make choices to allocate resources to satisfy their wants and needs

How is macroeconomics different from microeconomics?

Microeconomics: focuses on individual economic agents (like households and firms)

Macroeconomics: studies the overall economy, including inflation, unemployment, economic growth

What does it mean if a production possibilities curve is:

Linear?

Constant opportunity cost

Bowed?

Increasing opportunity cost

What is opportunity cost? How can you measure it on a production possibilities frontier?

Opportunity Cost: The cost of decision making measured as the sacrificed value or utility of the next best option.

Can be measured by comparing the quantity of one good sacrificed to produce another

Review the supply and demand model:

Law of Supply: Direct relationship between price and QS

Law of Demand: Inverse relationship between price and QD

What causes movement along the curve?

Changes in Price Level

What causes a shift of demand? Supply?

Demand: Changes in consumption, income, or expectations

Non-Price Determinants of Demand:

Buyer Expectation

Related Goods

Annual Income

Number of Buyers

Desires and Tastes

Supply: Changes in production costs, capital, or expectations

Non-Price Determinants of Supply:

Producer expectations

Government Regulations

Other sellers

Various Taxes

Input costs

Different (new) production technology

Environment

Review the circular flow model of the free market. Be able to identify and explain the exchange that takes place in both the factor and product markets.

What is GDP? What are the components? Which is the largest component in US GDP?

GDP (Gross Domestic Product): Total dollar value of all final goods and services produced within a nation’s borders in a given period of time.

Components of GDP = Consumer Spending + Gross Private Investment + Government Spending + Net Exports

Consumption is the largest component of GDP

What is the difference between “real” and “nominal?”

Real: Measured in unchanging, fixed prices (“adjusted for inflation”)

Nominal: Measured in current prices (“not adjusted for inflation”)

What is unemployment? Who is included and who isn’t? How is it calculated?

Unemployment: Members of the labor force who are not working but are actively seeking work (within the past 4 weeks).

The unemployment formula is (unemployed/labor force)*100

What is inflation? How is it calculated? What causes inflation?

Inflation: A steady increase in prices of goods and services over time; money becomes less valuable and the opportunity cost of holding cash increases.

The inflation rate formula is ((Price 2 - Price 1)/Price 1)*100

Causes of inflation include:

Cost Push Inflation: Higher input costs cause businesses to increase prices of goods and services

Demand Pull Inflation: Higher demand for products cause businesses to increase prices (law of supply)

Quantity Theory: When the central bank increases the quantity of currency in circulation, it devalues the currency that is already in circulation.

What is Fiscal policy?

Government efforts to promote full employment and price stability

Two tools of fiscal policy?

Taxation and Government Spending

Who controls fiscal policy?

The Government

Discretionary vs Automatic?

Discretionary Fiscal Policy: Involves policy makers passing laws to enact fiscal policy objectives.

Automatic Fiscal Policy: takes place without policy makers having to pass new laws or approve new spending.

Expansionary vs Contractionary?

Expansionary Fiscal Policy: Government policy used to combat recession (high unemployment);

Increase in Govt. Expenditures/Decrease Income/Corporate Taxes

AD increases

PL increases

GDP increases

Unemployment rate decreases, but Inflation increases

Contractionary Fiscal Policy: Government policy used to combat inflation; Decrease in Govt. Expenditures/Increase Income/Corporate Taxes

AD decreases

PL decreases

GDP decreases

Inflation decreases, but unemployment increases

Review the AS/AD Model

Aggregate demand components

AD = C + Ig + G + Xn

C = Consumption

Ig = Business Spending

G = Government Expenditure

Xn = Net Exports (Exports - Imports)

Difference between Short Run and Long Run Aggregate Supply

Short-Run Aggregate Supply (SRAS): Supply curve that slopes upward due to sticky resource prices.

Long-Run Aggregate Supply (LRAS): Supply curve that is perfectly inelastic at the level of full output; shows that the aggregate price level does not affect aggregate output in the long-run

Components of SRAS and LRAS

Long-Run Aggregate Supply (LRAS): Capital, Labor, Technology, only shifts if there is a permanent change in factors of production or production technology

Short-Run Aggregate Supply (SRAS):

Input Prices

Domestic Resource Prices

Wages (75% of all business costs)

Cost of capital

Raw Materials (commodity prices)

Foreign Resource Prices

Strong $ = lower foreign resource prices

Weak $ = higher foreign resource prices

Market Power

Monopolies and cartels that control resources control the price of those resources

Increases in Resource Prices = SRAS decreases; Decreases in Resource Prices = SRAS increases

Productivity = total output/total inputs

More productivity = lower unit production costs = SRAS increasesLess productivity = higher unit production costs = SRAS decreases

Legal-Institutional Environment

Taxes and Subsidies

Taxes ($ to gov’t) on business increase per unit production cost = SRAS decreases

Subsidies ($ from gov’t) to business reduce per unit production cost = SRAS increases

Government Regulation

Government regulation creates a cost of compliance = SRAS decreases

Deregulation reduces compliance costs = SRAS increases

Per-unit production cost = total input cost/total output

Recessionary and Inflationary gaps

Recessionary Gap: Output gap that is created when aggregate demand decreases; prices fall below the expected price level (unexpected deflation or disinflation), and unemployment rises above the natural rate. AD

Inflationary Gap: Output gap created when aggregate demand increases; prices rise above the expected price level (unexpected inflation), and unemployment falls below the natural rate.

Long-run adjustment

Full Output (aka Potential output)

Potential Output: The normal level of output for the economy given the available factors of production. Shows the level of real GDP that the economy would produce if all input prices were completely flexible.

What is monetary policy?

Monetary Policy: Federal Reserve policy used to maintain and manage economic fluctuations and achieve price stability (low inflation rate) and full employment (4-6% unemployment)

What are the tools?

Open Market Operations: The purchase and sale of U.S. government bonds by the Fed

Reserve Requirements:

Regulations on the minimum amount of reserves that banks must hold against deposits

Protect against bank runs or financial panics

10% on M1

Influences how much money banks can create from each deposit (reserves)

Increase in RRR, banks must hold more reserves, loan out less

Decrease in RRR, banks must hold less reserves, loan out more

RRR: Set by the Fed, minimum amount that must be held by the bank; 10% of M1

Required Reserves: the portion/percentage of a money deposit that must be held by the bank; may not be loaned out, protect the bank against withdrawals on demand deposits

Excess Reserves: bank reserves in excess of the reserve requirement set by the Fed; reserves of cash more than the required amounts; may be loaned out or used for withdrawals on demand deposits

T-Account: simplified accounting statement that shows changes in the banks assets and liabilities

Reserves/loans = assets

Deposits = liabilities

Deposit Expansion Multiplier (Money Multiplier): A formula that helps determine how much money the banking system can create with each dollar of reserves. =(1÷RRR)

Money Creation: Principal x MM

Higher the RRR, less to loan out

Administered Interest Rates

Discount Rate: The interest rate that the Federal Reserve charges commercial banks for short-term loans. Always 0.5% higher than the Federal Funds Rate.

Lender of last resort

Banks borrow from Fed when reserves are too low b/c of too many loans or withdrawals

Lower DR → Higher borrowing; Higher DR → Lower borrowing

Federal Funds Rate: The interest rate that commercial banks charge each other for short-term loans. Always 0.5% less than the Discount Rate.

Who is in control?

The Federal Reserves (The Fed): The central bank of the United States. Established by congress in 1913, they are responsible for promoting full employment and price stability by changing the supply of money in circulation.

Central Bank - institution designed to oversee the banking system and regulate the quantity of money in the economy

7 member board of governors

appt. by president, confirmed by senate to 14 year terms

led by chairman, appt. by president and confirmed by senate to 4 year term

comprised of 12 federal district reserve banks

The Federal Open Market Committee (FOMC): The group of 7 governors general and 5 district bank presidents that vote on the monetary policy actions of the Federal Reserve.

Expansionary vs Contractionary policy?

Expansionary Monetary Policy (Easy Money): Fed Buys Bonds → FFR decreases → Lower interest rates → Increased Borrowing → Increased Spending → Economic Growth, Higher Employment

Contractionary Monetary Policy: Fed Sells Bonds → FFR increases → Higher Interest rates → Decreased Borrowing → Decreased spending → Economic decline,

Limited vs Ample reserves?

Limited Reserves (Money Market):

Ample Reserves:

Review the money market graph.

Demand for money

Supply of money

Know the following terms:

Liquidity

Bond/Treasury Securities

M1

What is measured by the interest rate?

Borrower’s perspective?

Lender’s perspective?

If the economy enters a recession:

What can the Federal Reserve do to help restore full employment?

What can Congress do to restore full employment?

If the economy is experiencing high inflation:

What can the Federal Reserve do to help restore stable prices?

What can Congress do to help restore stable prices?

What are the unintended consequences of expansionary fiscal policy (crowding out)? Explain.

Review the loanable funds model.

Demand for loanable funds

Supply of loanable funds

Impact on investment

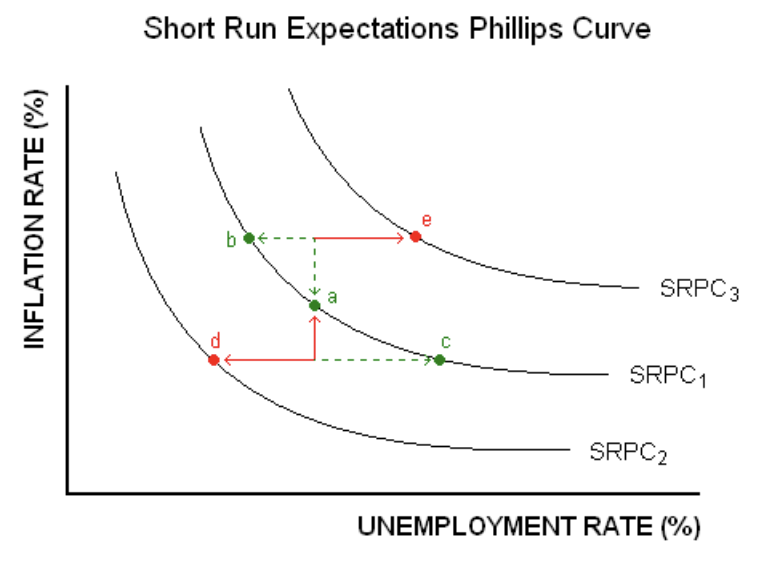

Review the Phillips Curve

Short Run Phillips Curve

Long Run Phillips Curve

Movement vs Shifting

How do exchange rates influence the balance of trade?

Hint: “WES & SID”

WES: Weaker; Exports Rise; Surplus balance of Trade

SID: Stronger; Imports Rise; Deficit balance of Trade

Review the determinants of currency supply and demand:

Fad Effect: If residents of one nation want the products of another nation they will supply their own money and demand the foreign products sold in that foreign currency.

Ex. Samsung releases a new VR headset in the USA.

If the opposite occurs, residents of a nation will supply less of their money to the international market and therefore reduce demand for the foreign currency.

Ex. Americans boycott French products.

Interest Rate Effect: If interest rates in a nation are higher than in other countries, foreigners will see that as an opportunity to move their money and earn more profit.

The demand of money in a country with high “real” interest rates will increase internationally.

Ex. The FED raises interest rates in the US; therefore, the US will experience more capital inflows from abroad

Foreigners will supply more of their currencies as they seek out better international profits.

Inflation Effect: If a country has high inflation, residents of the country will move their money overseas, seeking more stable economies.

This is often called “capital flight”

The high inflation residents will supply more of their money to the international market as they demand more foreign currencies that are more stable.

Ex. When Zimbabwe had hyperinflation in 2008-09, their demand for US currency increased.

Expectations: If a country is expected to grow faster and healthier than trading partners, investors will demand more of that country’s money.

Ex. Until very recently, the fastest growing economies in the world were the “BRIC” (Brazil, Russia, India, and China). Today, the most promising economies are MINT (Mexico, Indonesia, Nigeria, and Turkey).

Expansion: If a country is experiencing a domestic expansion of the economy, then consumers of that country will have more disposable income.

They will buy more products, including imports of all kinds.

This will increase the supply of their currency on the international market.

Ex. When the UAE experienced a real-estate boom in the early 2000’s, demand for foreign supercars exploded.

Contraction: If a country is experiencing a recession (contraction), then we assume that the consumers of that country will have less disposable income.

They will buy fewer products, including imports of any kind.

This will decrease the international supply of the currency of the contracting country.

Ex. During the great depression, imported goods were extremely rare in the USA.

Purchasing Power Parity: If products in a country become artificially cheap for foreigners to buy, they will increase the demand for the products and the currency of the “cheap” country.

As they snap up the products, the prices will re-adjust, thus re-establishing the “purchasing power parity” of the currencies involved.

Except in China

How does the exchange rate influence aggregate demand?

How do interest rates influence exchange rates and the balance of trade?

What is meant by the terms:

Capital Inflow: Money brought into the domestic country form exporting goods/services

Capital Outflow (aka Capital Flight): Money leaving the domestic country from importing goods/services

What is meant by the terms:

Appreciate: When a currency increases in value relative to other world currencies.

Depreciate: When a currency decreases in value relative to other world currencies.

What is a trade deficit? What is a trade surplus?

Trade Deficit: A situation where a country imports more than they export.

Trade Surplus: A situation where a country exports more than they import.

What is “specialization?”

Specialization: Allows each country to focus on producing things they are good at making and trade for everything else they want/need

What is meant by the term “Comparative Advantage?” How is it calculated?

Comparative Advantage: The ability to produce a good or service for a lower opportunity cost than others given the same amount of time and resources.

Cost of production/cost

Input Method (Factor Market): Taking the data provided and turning it into how much stuff each player can make

Output Method (Product Market)

What is meant by the term “Absolute Advantage?”

Absolute Advantage: The ability to produce more of a good/service than others given the same amount of time and resources.

How is it determined for output questions?

How is it determined for input questions?

What are the benefits of Free Trade?

Increased economic growth

Dynamic Business Climate

Lower government spending

Technology transfer

What are the costs (negative aspects) of Free Trade?

Increased job outsourcing

Theft of Intellectual Property

Crowding out domestic industries

Reduced Tax Revenue

Poor working conditions

Degradation of natural resources

Review the Balance of Payments.

Current Account: What kind of transactions are recorded?

Imports/Exports

Capital Account: What kind of transactions are recorded?

Credit

Debit

What is foreign direct investment? Examples?