CPA FR Note: Module 2 Presentation of Financial Statements

A: PRESENTATION OF FINANCIAL STATEMENTS

JUL 28, 2024

Share

LEARNING OBJECTIVES

After completing this module, you should be able to:

2.1 explain and apply the requirements of IAS 1 with respect to a complete set of financial statements and in relation to the considerations for the presentation of financial statements

2.2 outline and explain the requirements of IAS 8 for the selection of accounting policies

2.3 explain and apply the accounting treatment and disclosure requirements of IAS 8 in relation to changes in accounting policies, and changes in accounting estimates and errors

2.4 explain and discuss the required treatment for both adjusting and non-adjusting events occurring after the reporting period in accordance with IAS 10

2.5 explain and apply the requirements of IAS 7 with respect to preparing a statement of cash flows

2.6 discuss how a statement of cash flows can assist users of the financial statements to assess the ability of an entity to generate cash and cash equivalents

2.1 COMPLETE SET OF FINANCIAL STATEMENTS

Financial Statements must provide the following information:

Assets

Liabilities

Equity

Income and expenses, including gains and losses

Contributions by and distributions to owners in their capacity as owners

Cash flows

A complete set of financial statements contains (IAS 1 – para 10):

a statement of financial position as at the end of the period

a statement of P/L and OCI for the period

a statement of changes in equity for the period

a statement of cash flows for the period

notes, which include accounting policies and other explanatory information

comparative information regarding the preceding period

a statement of the financial position as at the beginning of the earliest comparative period when any of the following occurs:

an accounting policy is applied retrospectively

items in the financial statements are retrospectively restated

items in the financial statements are reclassified.

Segment Reporting (IFRS 8)

Purpose: IFRS 8 requires entities to disclose information to help users evaluate the nature and financial effects of business activities and the economic environments in which they operate (IFRS 8, para. 20).

Disclosure Requirements:

Factors for Identifying Segments: Disclose factors used to identify reportable segments, such as differences in products/services, geographical areas, regulatory environments, or a combination.

Management Judgments: Disclose judgments made if operating segments are aggregated.

Products and Services: Describe types of products and services each reportable segment derives revenue from.

Operating Segment Definition:

Business Activities: Component that generates revenues and incurs expenses.

Reviewed Results: Operating results regularly reviewed by the chief operating decision maker (e.g., general manager, managing director, or CEO).

Discrete Financial Information: Availability of separate financial information (IFRS 8, para. 5).

Reporting Focus: Identify and report on operating segments using the same basis as internal decision makers.

Financial Information Disclosure for Reportable Segments:

Profit or Loss Measure

Total Assets and Liabilities

Revenues from External Customers

Revenues from Transactions with Other Segments

Interest Revenue and Expense

Depreciation and Amortisation

Material Items of Income and Expense

Equity Method Results for Associates and Joint Ventures

Income Tax Expense or Income

Material Non-cash Items (excluding Depreciation and Amortisation) (IFRS 8, para. 23)

Fair Presentation and Compliance with IFRS (IAS 1)

Fair Presentation: Financial statements must present fairly the entity’s financial performance, position, and cash flows (IAS 1, para. 15).

Application of IFRSs, with necessary additional disclosures, is presumed to result in fair presentation (IAS 1, para. 15).

Compliance Statement: Entities must explicitly and unreservedly state compliance with IFRSs in the notes to the accounts, ensuring all IFRS requirements are met (IAS 1, para. 16).

Departures from IFRS Requirements:

Disclosure Requirements:

State management’s belief that departure provides fair presentation.

Confirm compliance with IFRSs, except for the departure.

Describe the IFRS, nature of departure, required and adopted treatments, and reasons for departure.

Provide financial impact of the departure on each item in the financial statements (IAS 1, para. 20).

Australian Context:

Corporations Act Compliance: Financial statements must comply with accounting standards (s. 296).

True and Fair View: If compliance does not provide a true and fair view, additional disclosures are required to give a true and fair view (s. 297).

Other General Features (p.65):

1. Going Concern (p.65):

Definition: A business assumed to meet its financial obligations when due and operates without the threat of liquidation for at least the next 12 months or the specified accounting period.

Requirement: Financial statements must be prepared on a going concern basis unless management intends to liquidate the entity, cease trading, or has no realistic alternative (IAS 1, para. 25).

Disclosure: There is no specific requirement to disclose that an entity is a going concern, as it is an implicit assumption. However, if an entity is not a going concern, this must be disclosed along with the reasons and the basis of preparation of the financial statements.

Uncertainty: If there is significant uncertainty about the entity’s ability to continue as a going concern but financial statements are still prepared on that basis, details of the uncertainty must be disclosed (IAS 1, para. 25).

Assessment: Management should consider all available information about the future, up until 12 months after the reporting period (IAS 1, para. 26).

2. Accrual Basis (p.65):

Requirement: Except for cash flow information, financial statements must be prepared under accrual accounting principles (IAS 1, para. 27).

Importance: Accrual basis accounting provides users with richer information about the financial performance and position of an entity compared to the cash basis.

Recognition: Items are recognized as assets, liabilities, equity, income, and expenses when they meet the definitions and recognition criteria in the Conceptual Framework (IAS 1, para. 28).

3. Materiality and Aggregation (p.65):

Aggregation: Transactions and events are aggregated into classes according to their nature or function to determine line items presented in the financial statements (IAS 1, para. 30).

Presentation: Each material class of similar items must be presented separately, and dissimilar items must be presented separately unless they are immaterial (IAS 1, para. 29).

Materiality:

Information is material if it could reasonably be expected to influence the primary users' decision-making.

The nature or magnitude of information, or both, can influence materiality. This assessment must be made by the entity.

Information is obscured if communicated in a way that has a similar effect to omitting or misstating that information (e.g., vague language, incorrect classification).

4. Offsetting (p.66):

Prohibition: Offsetting of assets and liabilities or income and expenses is generally prohibited unless required or permitted by IFRS (IAS 1, para. 32).

Rationale: Offsetting can obscure relevant information and detract from users' ability to understand transactions and events (IAS 1, para. 33).

Example: IFRS 15 permits offsetting when recognizing revenue after trade discounts and volume rebates (IAS 1, para. 34).

5. Frequency of Reporting (p.66):

Annual Reporting: Entities must present a complete set of financial statements at least annually (IAS 1, para. 36).

Change in Period: If the reporting period changes, financial statements may cover a shorter or longer period, but this change and the reason must be disclosed.

52-week Period: Some entities may report using a 52-week period instead of an annual period (IAS 1, para. 37).

6. Comparative Information (p.67):

Purpose: Comparative information enhances inter-period comparability, helping users assess trends for predictive purposes (IAS 1, para. 43).

Requirement: Entities must present comparative information for all amounts reported in the current period’s financial statements unless IFRS permits or requires otherwise (IAS 1, para. 38).

Minimum Presentation: As a minimum, two statements for each financial statement must be presented (IAS 1, para. 38A).

Retrospective Application: A third statement of financial position is required if an accounting policy is applied retrospectively, items are restated, or items are reclassified, and this has a material effect on the financial position (IAS 1, para. 40A).

Reclassification: When items are reclassified, comparative amounts should also be reclassified, unless impracticable (IAS 1, para. 41). If impracticable, the reasons and nature of adjustments must be disclosed (IAS 1, para. 42).

7. Consistency (p.67):

Requirement: Entities should retain the same presentation and classification of items from one period to the next.

Change: Changes are only permitted if there is a significant change in operations, management believes a change is necessary for a more appropriate presentation, or it is required by an IFRS (IAS 1, para. 45).

Example: A significant change in operations might occur following the disposal of a major line of business (IAS 1, para. 46).

2.2 ACCOUNTING POLICIES

Selection of Accounting Policies (IAS 8)

Definition: Accounting policies refer to the specific principles, bases, conventions, rules, and practices applied by an entity in preparing and presenting financial statements (IAS 8, para. 5).

Examples: Decisions on whether to capitalize or expense borrowing costs and whether to value non-current assets at cost or fair value.

Hierarchy for Selection: Management must select and apply accounting policies based on a hierarchy that complies with relevant accounting standards and IASB interpretations.

Professional Judgment: When specific IFRS requirements do not apply, management should use professional judgment to develop and apply policies that result in information that is:

Relevant to users' economic decision-making needs.

Reliable, representing the financial position, performance, and cash flows faithfully, reflecting economic substance, free from bias, prudent, and complete in all material respects (IAS 8, para. 10).

Consistency of Accounting Policies (IAS 8)

Purpose: Consistent application of accounting policies allows for comparison of financial statements over time to identify trends (IAS 8, para. 15).

Application: Policies must be applied consistently for similar transactions, events, and conditions unless a different treatment is specifically required or allowed by an IFRS (IAS 8, para. 13).

Example: IAS 16 allows different measurement bases for different classes of property, plant, and equipment (e.g., land and buildings at fair value, office furniture at cost).

Disclosure of Accounting Policies (IAS 1)

Importance: The adoption of specific accounting policies can significantly impact how profits and financial position are reported, influencing economic decisions and managerial accountability evaluations.

Requirements: Notes to the financial statements must present information about the specific accounting policies used (IAS 1, para. 112(a)).

Significant Policies: Disclosure must include:

Measurement bases used in preparing the financial statements.

Other relevant accounting policies that aid in understanding the financial statements (IAS 1, para. 117).

Alternatives: Disclosure of the accounting policy used is especially useful when alternatives are allowed under IFRS (e.g., measurement of plant at cost or fair value).

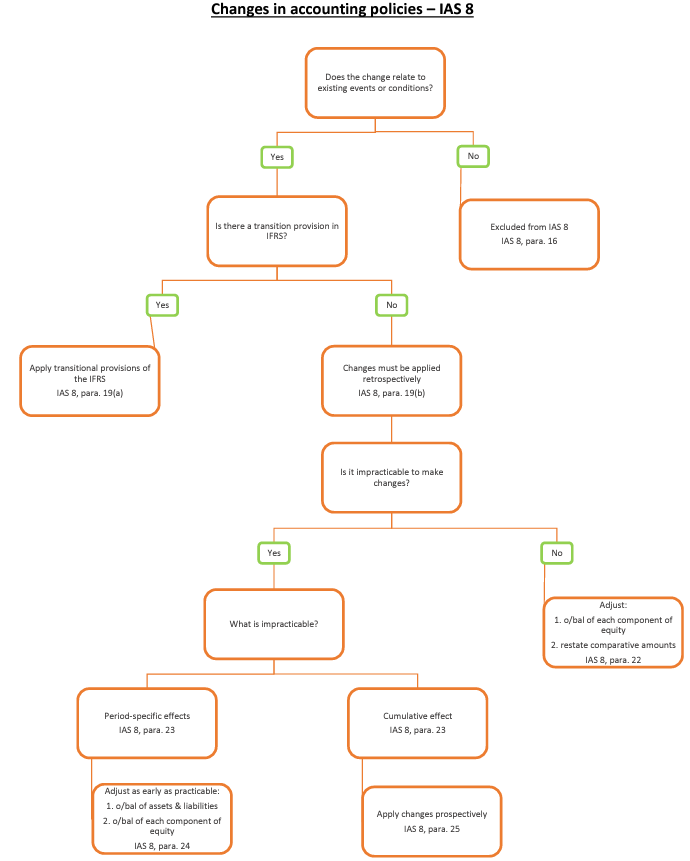

Changes in Accounting Policies (IAS 8)

Permitted Changes: Changes are allowed only if:

Required by an IFRS.

They result in more reliable and relevant information about the entity's financial position, performance, or cash flows (IAS 8, para. 14).

Not Considered Changes:

Applying a policy to transactions that differ substantively from previous ones.

Applying a new policy to previously non-occurring or immaterial transactions (IAS 8, para. 16).

Application of Changes:

If due to a new IFRS, apply the transitional provisions in the IFRS (IAS 8, para. 19(a)).

Without transitional provisions, or if voluntary, apply changes retrospectively (IAS 8, para. 19(b)).

Retrospective Application: Adjust prior period comparatives to ensure comparability with the current period.

Adjust the opening balance of each equity component affected by the change.

Restate other comparative amounts for each prior period as if the new policy had always been applied (IAS 8, para. 22).

Impracticable Adjustments: If impracticable, apply the new policy from the earliest practicable date, making corresponding adjustments to affected equity components (IAS 8, para. 24).

Disclosures for Changes in Accounting Policies

For IFRS-Required Changes:

Title of the IFRS.

Nature of the policy change.

Adjustment amounts for current and prior periods, and the impact on earnings per share, if applicable.

Transitional provisions and their effects on future periods.

If impracticable to apply retrospectively, disclose the circumstances and application method (IAS 8, para. 28).

For Voluntary Changes:

Nature of the change.

Reasons for providing more reliable and relevant information.

Adjustment amounts for current and prior periods, and the impact on earnings per share, if applicable.

Adjustment amounts for periods before those presented, if practicable.

If impracticable to apply retrospectively, disclose the circumstances and application method (IAS 8, para. 29).

2.3 Revision of Accounting Estimates and Correction of Errors

Changes in Accounting Estimates (IAS 8)

Nature of Estimates: Due to inherent uncertainties in business activities, many financial statement items require estimations, such as bad debts, inventory obsolescence, fair value of financial assets and liabilities, useful lives of depreciable assets, and warranty obligations (IAS 8, para. 32).

Recognition of Changes: A change in accounting estimate must be recognized prospectively by including it in profit or loss:

In the period of the change, if the change affects only that period.

In the period of the change and future periods, if the change affects both (IAS 8, para. 36).

Adjustments:

Adjustments due to changes in estimates should be recognized in the current reporting period or both current and future periods, depending on the impact (IAS 8, para. 36).

Relevant adjustments to assets, liabilities, and equity items should be made in the period of the change (IAS 8, para. 37).

Disclosures: Specific disclosures are required about the nature and amount of the revision in accounting estimates, including the effect on the current reporting period and, if practicable, the effect on future periods (IAS 8, para. 39).

Material Errors in Prior Period (IAS 8)

Non-compliance with Standards: Financial statements do not comply with accounting standards if they contain material errors or immaterial errors made intentionally to achieve a particular presentation (IAS 8, para. 41).

Correction of Material Errors: When material errors are discovered in subsequent reporting periods, IAS 8 requires retrospective correction of the error in the first set of financial statements issued after the error’s discovery.

A 'catch-up' adjustment must be made from the date the error was made. If this affects profit or loss from a period not covered by the financial statements, the adjustment is made to the opening balance of retained earnings.

Disclosure Requirements: When a prior period error is corrected, IAS 8 requires disclosure of:

The nature of the prior period error.

The amount of the correction for each prior period presented, to the extent practicable, for each affected financial statement line item and for basic and diluted EPS if IAS 33 applies.

The amount of the correction at the beginning of the earliest prior period presented.

If retrospective restatement is impracticable for a prior period, disclose the circumstances that led to this condition and describe how and from when the error has been corrected (IAS 8, para. 49).

2.4 Events After the Reporting Period (IAS 10)

Objective of IAS 10

Purpose: To prescribe when an entity should adjust its financial statements for events occurring after the reporting period and the disclosures required about such events in the notes to the financial statements (IAS 10, para. 1).

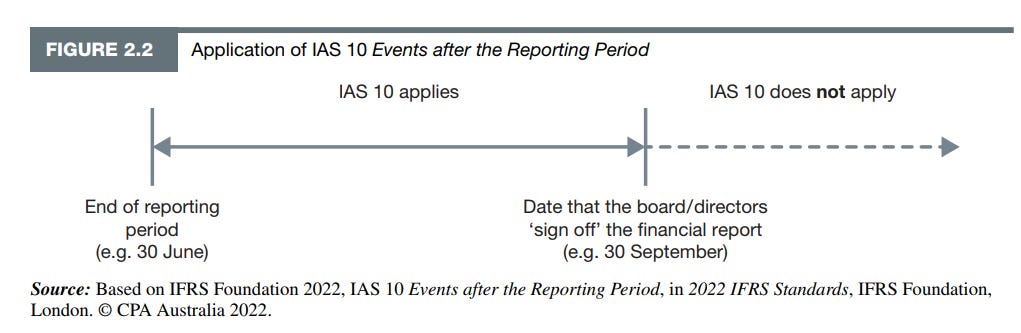

Definition: An event after the reporting period is a favourable or unfavourable event occurring between the end of the reporting period and the date when the financial statements are authorised for issue (IAS 10, para. 3).

Date of Authorisation: Events after this date do not qualify as events after the reporting period. For a company, this date is typically when directors sign the Directors’ Declaration attached to the financial report.

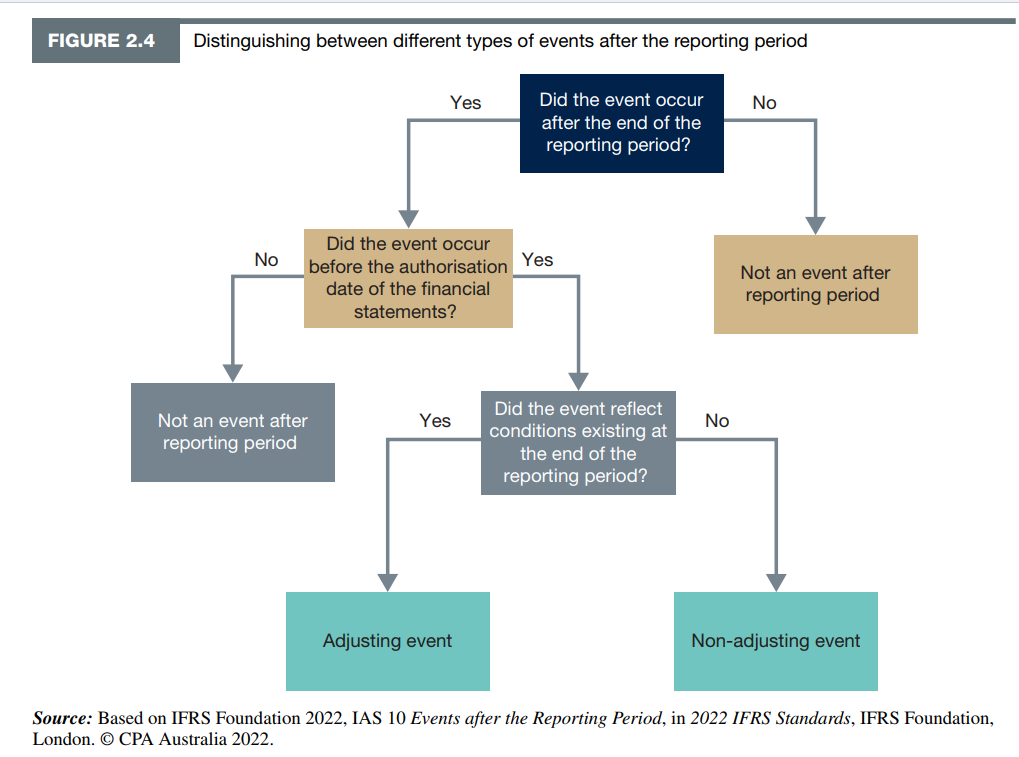

Types of Events After the Reporting Period

Adjusting Events: Provide new or further evidence of conditions that existed at the end of the reporting period (IAS 10, para. 8).

Non-Adjusting Events: Reflect conditions that arose for the first time after the end of the reporting period (IAS 10, para. 3).

Adjusting Events

Characteristics: Provide additional information about items that existed at the end of the reporting period, helping to determine the correct amounts for financial statements.

Example: A court case existing at the end of the reporting period but settled afterwards.

Actions:

Adjust the amounts recognised in the financial statements if the new information relates to presented items.

Make changes to note disclosures if the new information concerns the notes to the financial statements.

Non-Adjusting Events

Characteristics: Do not relate to a condition existing at the end of the reporting period.

Example: A major business combination change, such as the acquisition or disposal of a subsidiary.

Actions:

Disclose the nature of the event and an estimate of its financial effect in the notes to the financial statements if the event is material (IAS 10, para. 21).

If an estimate cannot be made, a statement to that effect should be included.

Dividends Declared After Reporting Period

Recognition: Should not be recognised as a liability at the end of the reporting period, even if declared from profits derived prior to the period end (IAS 10, para. 12).

Reason: Such dividends do not meet the liability definition as they do not represent a present obligation at the end of the reporting period (IAS 10, para. 13).

Treatment: Regarded as a non-adjusting event and disclosed in the notes to the financial statements.

Going Concern Issues After Reporting Period

Management's Determination: If management decides after the reporting period to liquidate the entity or cease trading, or has no realistic alternative but to do so, financial statements should not be prepared on a going concern basis (IAS 10, para. 14).

Treatment: The new information about going concern is treated as an adjusting event. Financial statements should be presented using liquidation values instead of going concern basis.

2.5 : The Impacts of Technological Advancements on the Presentation of Financial Statements (p.79):

It is common practice for financial statements to be released 3 months after the end of the reporting period and thus even more work is needed to identify and recognise the effects of adjusting and non- adjusting events to somehow still maintain reasonable timeliness of information disclosed.

This practice and the need to disclose events after the reporting period will change soon as technological advancements allow entities to prepare financial reports instantaneously through powerful cloud-based management applications that can automatically generate reports that combine an entity’s structured financial data with narrative analysis.

Those reports are not only prepared faster but can be updated automatically as new events occur; they can also be subject to less human errors as human intervention is kept at a minimum.

Summary of 2.3: The Concept of Other Comprehensive Income and Total Comprehensive Income

Definition and Components:

• Other Comprehensive Income (OCI): Items of income and expense not recognized in profit or loss, as required or permitted by IFRSs.

• Calculation:

• OCI = Total Comprehensive Income – Profit/Loss for the period

• Total Comprehensive Income = Profit/Loss + OCI

Components of OCI:

• Gains and losses from the revaluation of property, plant, and equipment (IAS 16) or intangible assets (IAS 38)

• Remeasurements of defined benefit plans (IAS 19)

• Translating financial statements of a foreign operation (IAS 21)

• Investments in equity instruments designated as fair value through OCI (IFRS 9)

• Hedging instruments in cash flow hedges (IFRS 9)

• Changes in the time value of options (IFRS 9)

Recognition of Items Outside Profit or Loss:

• Corrections of errors or changes in accounting policies (IAS 8)

• Items required or permitted by other IFRSs to be excluded from profit or loss

Contributions and Reductions in Equity:

• Recognized directly in the cash flow statement (e.g., issue of new shares, share buybacks, dividends)

• Other items reflected in the statement of profit or loss and OCI

Summary of 2.4: IAS 1 – Disclosures and Classification

Presentation Options:

• Single statement of profit or loss and OCI

• Two separate statements: a statement of profit or loss and a statement of comprehensive income

Single Statement (Statement of P/L and OCI):

• Must include:

• Profit or loss

• Total OCI

• Comprehensive income for the period

Two Statements (Statement of P/L and Statement of Comprehensive Income):

• Statement of P/L includes incomes and expenses, ending with profit or loss for the period

• Statement of comprehensive income starts with profit or loss and adds OCI items

Required Line Items (Profit or Loss):

• Revenue (separately showing interest revenue and insurance revenue)

• Finance costs

• Share of profit or loss of associates and joint ventures

• Specific gains and losses from financial asset reclassifications

• Tax expense

• Discontinued operations

Expenses Classification:

• By nature: Descriptive presentation (e.g., employee benefits, depreciation)

• By function: Purposeful presentation (e.g., cost of sales, administration expenses)

• Choice depends on the entity’s nature and industry factors

• Disclosure of expense nature required when classified by function

Separate Disclosure of Material Items:

• Nature and amounts of material income and expense items must be disclosed (e.g., inventory write-downs, restructuring costs)

Information Presented with OCI:

• Items of OCI classified by nature, grouped into those reclassified to profit or loss and those not

• Share of OCI of equity-accounted associates and joint ventures

• Income tax relating to each OCI item disclosed either in the statement or notes

Treatment of Totals:

• Net profit after income tax and OCI figures transferred to the statement of changes in equity

Part C: Statement of Changes in Equity

2.9 IAS 1 Presentation of Financial Statements: Disclosures of Changes in Equity (p.91)

• The statement of changes in equity explains and reconciles movements in an entity’s equity (net assets) over a reporting period.

• Two primary sources of change in owners’ equity are:

1. Transactions with owners in their capacity as owners.

2. The total income and expenses generated by the entity’s activities (IAS 1, para. 109).

• IAS 1 requires the following disclosures in the statement of changes in equity:

• Total comprehensive income, allocated between non-controlling interests and owners of the parent (para. 106(a)).

• The effect on each equity component of any retrospective adjustments required by IAS 8 (para. 106(b)).

• A reconciliation between the opening and closing balance of each equity component, with separate disclosure of changes resulting from profit or loss, other comprehensive income (OCI), and transactions with owners (para. 106(d)).

• Revaluation of assets/liabilities must be included in changes to equity.

Part D: Statement of Financial Position

2.10 Format of the Statement of Financial Position (Balance Sheet) (p. 94)

• IAS 1 prescribes that the Balance Sheet should include presentation and disclosure requirements for assets and liabilities.

• There is no strict format for the statement of financial position, but it must include minimum disclosures for line items (IAS 1, para. 54).

• Entities must judge whether to present additional line items based on:

• Nature and liquidity of assets.

• Function of assets within the entity.

• Amounts, nature, and timing of liabilities (IAS 1, para. 58).

• The number of shares authorized, issued, and fully paid does not need to be included, while investments accounted for using the equity method do.

2.11 Presentation of Assets and Liabilities (p.95)

• Entities must present current and non-current assets and liabilities separately, except when a liquidity-based presentation is more reliable and relevant.

• Under the liquidity basis, assets and liabilities are presented in order of liquidity (IAS 1, para. 60).

• For entities with a clear operating cycle, current and non-current classifications provide reliable and relevant information (IAS 1, para. 62).

• Financial institutions often use the liquidity basis due to the critical nature of their solvency (IAS 1, para. 63).

• Entities must disclose amounts expected to be recovered or settled after 12 months if an asset or liability line item combines amounts due within and after 12 months (IAS 1, para. 61).

Current Assets and Current Liabilities (p.95)

• An asset is classified as current if it:

• Is expected to be realized or intended to be sold or consumed in the normal operating cycle.

• Is held primarily for trading purposes.

• Is expected to be realized within 12 months after the reporting period.

• Is cash or a cash equivalent, unless restricted for at least 12 months after the reporting period (IAS 1, para. 66).

• Examples of current assets: cash and cash equivalents, inventories, trade receivables, current tax receivable, and prepayments.

• Examples of non-current assets: property, plant, and equipment, intangibles, investments, and deferred tax.

• A liability is classified as current if it:

• Is expected to be settled in the normal operating cycle.

• Is held primarily for trading purposes.

• Is due to be settled within 12 months after the reporting period.

• Does not have an unconditional right to defer settlement beyond 12 months after the reporting period (IAS 1, para. 69).

• Current liabilities: bank overdraft, trade payables, accruals for operating costs, and employee wages.

• Non-current liabilities include financial liabilities that provide long-term financing not due within 12 months unless there are unresolved covenant breaches (IAS 1, para. 71).

2.12 IAS 1 Presentation of Financial Statements: Disclosures in the Notes to the Statement of Financial Position (p.96)

• Further subclassifications depend on the size, nature, and function of amounts involved and are usually presented in the notes.

• IAS 1 examples:

• Items of property, plant, and equipment disaggregated into classes (IAS 16).

• Receivables disaggregated into trade customers, related parties, prepayments, and other amounts.

• Inventories disaggregated into finished goods, work-in-process, and raw materials (IAS 2).

• Provisions disaggregated into employee benefits and other provisions.

• Equity capital and reserves disaggregated into paid-up capital, retained earnings, and other reserves.

2.13 Tips on How to Analyse a Statement of Financial Position (p.97)

1. Review the value of total assets: Has it increased or decreased? Determine the drivers behind the change and whether it is due to current or non-current assets.

2. Review the value of total liabilities: Has it increased or decreased? Determine the drivers and whether the change is due to current or non-current liabilities.

3. Review the value of total equity (net assets): Is it positive? Has it increased from the previous period? Consider the stage of the business lifecycle, as mature businesses tend to have greater retained earnings.

4. Analyze the relationship between current assets and current liabilities: This indicates liquidity. A current ratio of 2:1 is a general rule, meaning current assets should be approximately twice the size of current liabilities.

Part E: IAS 7 Statement of Cash Flows (p.99)

2.14 How Does a Statement of Cash Flows Assist Users of Financial Statements (p.99)

• IAS 7 helps users understand how an entity:

• Generates future cash flows.

• Meets financial commitments as they fall due, including servicing borrowings and paying dividends.

• Funds changes in the scope or nature of its activities.

• Obtains external finance (IAS 7, paras 4 and 5).

• Useful for predicting future cash flows, evaluating management decisions, determining the ability to pay dividends and repay debt, showing the relationship of net profit to changes in cash balances, and assessing revenue and earnings quality.

2.15 Information to be Disclosed (p.100)

Cash and Cash Equivalents (p.100)

• Cash: cash on hand and demand deposits.

• Cash equivalents: short-term, liquid investments readily convertible to cash with insignificant risk of changes in value (IAS 7, para. 6).

• Short maturity (3 months or less from acquisition date); investments in equity securities do not qualify (IAS 7, para. 7).

• Bank overdrafts repayable on demand and fluctuating from positive to overdrawn are included (IAS 7, para. 8).

Classification of Cash Flows (p.100)

• Report cash flows classified by operating, investing, and financing activities (IAS 7, para. 10).

Operating Activities (p.100)

• Relate to the principal revenue-producing activities and not from investing or financing activities (IAS 7, para. 6).

• Report using either:

• Direct method: major classes of gross cash receipts and payments disclosed.

• Indirect method: profit or loss adjusted for non-cash income and expenses, accruals, and items for investing and financing activities (IAS 7, para. 18).

• Interest paid (borrowing costs) as operating cash outflow, interest received as investing cash inflow, dividends paid as financing cash outflow.

Investing Cash Flows (p.101)

• Relate to acquisition and disposal of long-term assets and other investments not in cash and cash equivalents (IAS 7, para. 6).

• Identified by analyzing movements in non-current asset accounts in the statement of financial position.

Financing Cash Flows (p.102)

• Result in changes in the size and composition of contributed equity and borrowings (IAS 7, para. 6).

• Relate to debtholders and equity participants (IAS 7, para. 17).

2.16 Common Methods Adopted on How to Prepare a Statement of Cash Flows (p.102)

• Three common methods:

1. Worksheet method (e.g., Excel™).

2. Formula method.

3. ‘T’ account reconstruction method.

Formula Method (p.103)

Reporting Cash Flows on a Net Basis (p.104)

• Normally reported on a gross basis; net basis is allowed in limited circumstances.

• IAS 7 allows net basis for:

• Cash receipts and payments on behalf of customers.

• Cash receipts and payments for items with quick turnover, large amounts, and short maturities (IAS 7, para. 22).

• Example: rents collected by an agent on behalf of property owners (IAS 7, para. 23).

• Example: principal amounts related to credit card customers (IAS 7, para. 23A).

Other Information to be Disclosed in the Statement of Cash Flow or Notes (p.104)

• Cash flow items include interest and dividends, income taxes, and loss of control of subsidiaries (IAS 7, paras 31, 35, 39, and 40).

• Disclose significant cash and cash-equivalent balances not available for group use (IAS 7, para. 48).

• Example: exchange controls or legal restrictions (IAS 7, para. 49).

• Disclosure of undrawn borrowing facilities for future cash needs is encouraged (IAS 7, para. 50).

Consolidated Financial Statements (p.105)

• Parent entity must prepare consolidated financial statements disclosing group

CPA FR Note: Module 2 Presentation of Financial Statements

A: PRESENTATION OF FINANCIAL STATEMENTS

JUL 28, 2024

Share

LEARNING OBJECTIVES

After completing this module, you should be able to:

2.1 explain and apply the requirements of IAS 1 with respect to a complete set of financial statements and in relation to the considerations for the presentation of financial statements

2.2 outline and explain the requirements of IAS 8 for the selection of accounting policies

2.3 explain and apply the accounting treatment and disclosure requirements of IAS 8 in relation to changes in accounting policies, and changes in accounting estimates and errors

2.4 explain and discuss the required treatment for both adjusting and non-adjusting events occurring after the reporting period in accordance with IAS 10

2.5 explain and apply the requirements of IAS 7 with respect to preparing a statement of cash flows

2.6 discuss how a statement of cash flows can assist users of the financial statements to assess the ability of an entity to generate cash and cash equivalents

2.1 COMPLETE SET OF FINANCIAL STATEMENTS

Financial Statements must provide the following information:

Assets

Liabilities

Equity

Income and expenses, including gains and losses

Contributions by and distributions to owners in their capacity as owners

Cash flows

A complete set of financial statements contains (IAS 1 – para 10):

a statement of financial position as at the end of the period

a statement of P/L and OCI for the period

a statement of changes in equity for the period

a statement of cash flows for the period

notes, which include accounting policies and other explanatory information

comparative information regarding the preceding period

a statement of the financial position as at the beginning of the earliest comparative period when any of the following occurs:

an accounting policy is applied retrospectively

items in the financial statements are retrospectively restated

items in the financial statements are reclassified.

Segment Reporting (IFRS 8)

Purpose: IFRS 8 requires entities to disclose information to help users evaluate the nature and financial effects of business activities and the economic environments in which they operate (IFRS 8, para. 20).

Disclosure Requirements:

Factors for Identifying Segments: Disclose factors used to identify reportable segments, such as differences in products/services, geographical areas, regulatory environments, or a combination.

Management Judgments: Disclose judgments made if operating segments are aggregated.

Products and Services: Describe types of products and services each reportable segment derives revenue from.

Operating Segment Definition:

Business Activities: Component that generates revenues and incurs expenses.

Reviewed Results: Operating results regularly reviewed by the chief operating decision maker (e.g., general manager, managing director, or CEO).

Discrete Financial Information: Availability of separate financial information (IFRS 8, para. 5).

Reporting Focus: Identify and report on operating segments using the same basis as internal decision makers.

Financial Information Disclosure for Reportable Segments:

Profit or Loss Measure

Total Assets and Liabilities

Revenues from External Customers

Revenues from Transactions with Other Segments

Interest Revenue and Expense

Depreciation and Amortisation

Material Items of Income and Expense

Equity Method Results for Associates and Joint Ventures

Income Tax Expense or Income

Material Non-cash Items (excluding Depreciation and Amortisation) (IFRS 8, para. 23)

Fair Presentation and Compliance with IFRS (IAS 1)

Fair Presentation: Financial statements must present fairly the entity’s financial performance, position, and cash flows (IAS 1, para. 15).

Application of IFRSs, with necessary additional disclosures, is presumed to result in fair presentation (IAS 1, para. 15).

Compliance Statement: Entities must explicitly and unreservedly state compliance with IFRSs in the notes to the accounts, ensuring all IFRS requirements are met (IAS 1, para. 16).

Departures from IFRS Requirements:

Disclosure Requirements:

State management’s belief that departure provides fair presentation.

Confirm compliance with IFRSs, except for the departure.

Describe the IFRS, nature of departure, required and adopted treatments, and reasons for departure.

Provide financial impact of the departure on each item in the financial statements (IAS 1, para. 20).

Australian Context:

Corporations Act Compliance: Financial statements must comply with accounting standards (s. 296).

True and Fair View: If compliance does not provide a true and fair view, additional disclosures are required to give a true and fair view (s. 297).

Other General Features (p.65):

1. Going Concern (p.65):

Definition: A business assumed to meet its financial obligations when due and operates without the threat of liquidation for at least the next 12 months or the specified accounting period.

Requirement: Financial statements must be prepared on a going concern basis unless management intends to liquidate the entity, cease trading, or has no realistic alternative (IAS 1, para. 25).

Disclosure: There is no specific requirement to disclose that an entity is a going concern, as it is an implicit assumption. However, if an entity is not a going concern, this must be disclosed along with the reasons and the basis of preparation of the financial statements.

Uncertainty: If there is significant uncertainty about the entity’s ability to continue as a going concern but financial statements are still prepared on that basis, details of the uncertainty must be disclosed (IAS 1, para. 25).

Assessment: Management should consider all available information about the future, up until 12 months after the reporting period (IAS 1, para. 26).

2. Accrual Basis (p.65):

Requirement: Except for cash flow information, financial statements must be prepared under accrual accounting principles (IAS 1, para. 27).

Importance: Accrual basis accounting provides users with richer information about the financial performance and position of an entity compared to the cash basis.

Recognition: Items are recognized as assets, liabilities, equity, income, and expenses when they meet the definitions and recognition criteria in the Conceptual Framework (IAS 1, para. 28).

3. Materiality and Aggregation (p.65):

Aggregation: Transactions and events are aggregated into classes according to their nature or function to determine line items presented in the financial statements (IAS 1, para. 30).

Presentation: Each material class of similar items must be presented separately, and dissimilar items must be presented separately unless they are immaterial (IAS 1, para. 29).

Materiality:

Information is material if it could reasonably be expected to influence the primary users' decision-making.

The nature or magnitude of information, or both, can influence materiality. This assessment must be made by the entity.

Information is obscured if communicated in a way that has a similar effect to omitting or misstating that information (e.g., vague language, incorrect classification).

4. Offsetting (p.66):

Prohibition: Offsetting of assets and liabilities or income and expenses is generally prohibited unless required or permitted by IFRS (IAS 1, para. 32).

Rationale: Offsetting can obscure relevant information and detract from users' ability to understand transactions and events (IAS 1, para. 33).

Example: IFRS 15 permits offsetting when recognizing revenue after trade discounts and volume rebates (IAS 1, para. 34).

5. Frequency of Reporting (p.66):

Annual Reporting: Entities must present a complete set of financial statements at least annually (IAS 1, para. 36).

Change in Period: If the reporting period changes, financial statements may cover a shorter or longer period, but this change and the reason must be disclosed.

52-week Period: Some entities may report using a 52-week period instead of an annual period (IAS 1, para. 37).

6. Comparative Information (p.67):

Purpose: Comparative information enhances inter-period comparability, helping users assess trends for predictive purposes (IAS 1, para. 43).

Requirement: Entities must present comparative information for all amounts reported in the current period’s financial statements unless IFRS permits or requires otherwise (IAS 1, para. 38).

Minimum Presentation: As a minimum, two statements for each financial statement must be presented (IAS 1, para. 38A).

Retrospective Application: A third statement of financial position is required if an accounting policy is applied retrospectively, items are restated, or items are reclassified, and this has a material effect on the financial position (IAS 1, para. 40A).

Reclassification: When items are reclassified, comparative amounts should also be reclassified, unless impracticable (IAS 1, para. 41). If impracticable, the reasons and nature of adjustments must be disclosed (IAS 1, para. 42).

7. Consistency (p.67):

Requirement: Entities should retain the same presentation and classification of items from one period to the next.

Change: Changes are only permitted if there is a significant change in operations, management believes a change is necessary for a more appropriate presentation, or it is required by an IFRS (IAS 1, para. 45).

Example: A significant change in operations might occur following the disposal of a major line of business (IAS 1, para. 46).

2.2 ACCOUNTING POLICIES

Selection of Accounting Policies (IAS 8)

Definition: Accounting policies refer to the specific principles, bases, conventions, rules, and practices applied by an entity in preparing and presenting financial statements (IAS 8, para. 5).

Examples: Decisions on whether to capitalize or expense borrowing costs and whether to value non-current assets at cost or fair value.

Hierarchy for Selection: Management must select and apply accounting policies based on a hierarchy that complies with relevant accounting standards and IASB interpretations.

Professional Judgment: When specific IFRS requirements do not apply, management should use professional judgment to develop and apply policies that result in information that is:

Relevant to users' economic decision-making needs.

Reliable, representing the financial position, performance, and cash flows faithfully, reflecting economic substance, free from bias, prudent, and complete in all material respects (IAS 8, para. 10).

Consistency of Accounting Policies (IAS 8)

Purpose: Consistent application of accounting policies allows for comparison of financial statements over time to identify trends (IAS 8, para. 15).

Application: Policies must be applied consistently for similar transactions, events, and conditions unless a different treatment is specifically required or allowed by an IFRS (IAS 8, para. 13).

Example: IAS 16 allows different measurement bases for different classes of property, plant, and equipment (e.g., land and buildings at fair value, office furniture at cost).

Disclosure of Accounting Policies (IAS 1)

Importance: The adoption of specific accounting policies can significantly impact how profits and financial position are reported, influencing economic decisions and managerial accountability evaluations.

Requirements: Notes to the financial statements must present information about the specific accounting policies used (IAS 1, para. 112(a)).

Significant Policies: Disclosure must include:

Measurement bases used in preparing the financial statements.

Other relevant accounting policies that aid in understanding the financial statements (IAS 1, para. 117).

Alternatives: Disclosure of the accounting policy used is especially useful when alternatives are allowed under IFRS (e.g., measurement of plant at cost or fair value).

Changes in Accounting Policies (IAS 8)

Permitted Changes: Changes are allowed only if:

Required by an IFRS.

They result in more reliable and relevant information about the entity's financial position, performance, or cash flows (IAS 8, para. 14).

Not Considered Changes:

Applying a policy to transactions that differ substantively from previous ones.

Applying a new policy to previously non-occurring or immaterial transactions (IAS 8, para. 16).

Application of Changes:

If due to a new IFRS, apply the transitional provisions in the IFRS (IAS 8, para. 19(a)).

Without transitional provisions, or if voluntary, apply changes retrospectively (IAS 8, para. 19(b)).

Retrospective Application: Adjust prior period comparatives to ensure comparability with the current period.

Adjust the opening balance of each equity component affected by the change.

Restate other comparative amounts for each prior period as if the new policy had always been applied (IAS 8, para. 22).

Impracticable Adjustments: If impracticable, apply the new policy from the earliest practicable date, making corresponding adjustments to affected equity components (IAS 8, para. 24).

Disclosures for Changes in Accounting Policies

For IFRS-Required Changes:

Title of the IFRS.

Nature of the policy change.

Adjustment amounts for current and prior periods, and the impact on earnings per share, if applicable.

Transitional provisions and their effects on future periods.

If impracticable to apply retrospectively, disclose the circumstances and application method (IAS 8, para. 28).

For Voluntary Changes:

Nature of the change.

Reasons for providing more reliable and relevant information.

Adjustment amounts for current and prior periods, and the impact on earnings per share, if applicable.

Adjustment amounts for periods before those presented, if practicable.

If impracticable to apply retrospectively, disclose the circumstances and application method (IAS 8, para. 29).

2.3 Revision of Accounting Estimates and Correction of Errors

Changes in Accounting Estimates (IAS 8)

Nature of Estimates: Due to inherent uncertainties in business activities, many financial statement items require estimations, such as bad debts, inventory obsolescence, fair value of financial assets and liabilities, useful lives of depreciable assets, and warranty obligations (IAS 8, para. 32).

Recognition of Changes: A change in accounting estimate must be recognized prospectively by including it in profit or loss:

In the period of the change, if the change affects only that period.

In the period of the change and future periods, if the change affects both (IAS 8, para. 36).

Adjustments:

Adjustments due to changes in estimates should be recognized in the current reporting period or both current and future periods, depending on the impact (IAS 8, para. 36).

Relevant adjustments to assets, liabilities, and equity items should be made in the period of the change (IAS 8, para. 37).

Disclosures: Specific disclosures are required about the nature and amount of the revision in accounting estimates, including the effect on the current reporting period and, if practicable, the effect on future periods (IAS 8, para. 39).

Material Errors in Prior Period (IAS 8)

Non-compliance with Standards: Financial statements do not comply with accounting standards if they contain material errors or immaterial errors made intentionally to achieve a particular presentation (IAS 8, para. 41).

Correction of Material Errors: When material errors are discovered in subsequent reporting periods, IAS 8 requires retrospective correction of the error in the first set of financial statements issued after the error’s discovery.

A 'catch-up' adjustment must be made from the date the error was made. If this affects profit or loss from a period not covered by the financial statements, the adjustment is made to the opening balance of retained earnings.

Disclosure Requirements: When a prior period error is corrected, IAS 8 requires disclosure of:

The nature of the prior period error.

The amount of the correction for each prior period presented, to the extent practicable, for each affected financial statement line item and for basic and diluted EPS if IAS 33 applies.

The amount of the correction at the beginning of the earliest prior period presented.

If retrospective restatement is impracticable for a prior period, disclose the circumstances that led to this condition and describe how and from when the error has been corrected (IAS 8, para. 49).

2.4 Events After the Reporting Period (IAS 10)

Objective of IAS 10

Purpose: To prescribe when an entity should adjust its financial statements for events occurring after the reporting period and the disclosures required about such events in the notes to the financial statements (IAS 10, para. 1).

Definition: An event after the reporting period is a favourable or unfavourable event occurring between the end of the reporting period and the date when the financial statements are authorised for issue (IAS 10, para. 3).

Date of Authorisation: Events after this date do not qualify as events after the reporting period. For a company, this date is typically when directors sign the Directors’ Declaration attached to the financial report.

Types of Events After the Reporting Period

Adjusting Events: Provide new or further evidence of conditions that existed at the end of the reporting period (IAS 10, para. 8).

Non-Adjusting Events: Reflect conditions that arose for the first time after the end of the reporting period (IAS 10, para. 3).

Adjusting Events

Characteristics: Provide additional information about items that existed at the end of the reporting period, helping to determine the correct amounts for financial statements.

Example: A court case existing at the end of the reporting period but settled afterwards.

Actions:

Adjust the amounts recognised in the financial statements if the new information relates to presented items.

Make changes to note disclosures if the new information concerns the notes to the financial statements.

Non-Adjusting Events

Characteristics: Do not relate to a condition existing at the end of the reporting period.

Example: A major business combination change, such as the acquisition or disposal of a subsidiary.

Actions:

Disclose the nature of the event and an estimate of its financial effect in the notes to the financial statements if the event is material (IAS 10, para. 21).

If an estimate cannot be made, a statement to that effect should be included.

Dividends Declared After Reporting Period

Recognition: Should not be recognised as a liability at the end of the reporting period, even if declared from profits derived prior to the period end (IAS 10, para. 12).

Reason: Such dividends do not meet the liability definition as they do not represent a present obligation at the end of the reporting period (IAS 10, para. 13).

Treatment: Regarded as a non-adjusting event and disclosed in the notes to the financial statements.

Going Concern Issues After Reporting Period

Management's Determination: If management decides after the reporting period to liquidate the entity or cease trading, or has no realistic alternative but to do so, financial statements should not be prepared on a going concern basis (IAS 10, para. 14).

Treatment: The new information about going concern is treated as an adjusting event. Financial statements should be presented using liquidation values instead of going concern basis.

2.5 : The Impacts of Technological Advancements on the Presentation of Financial Statements (p.79):

It is common practice for financial statements to be released 3 months after the end of the reporting period and thus even more work is needed to identify and recognise the effects of adjusting and non- adjusting events to somehow still maintain reasonable timeliness of information disclosed.

This practice and the need to disclose events after the reporting period will change soon as technological advancements allow entities to prepare financial reports instantaneously through powerful cloud-based management applications that can automatically generate reports that combine an entity’s structured financial data with narrative analysis.

Those reports are not only prepared faster but can be updated automatically as new events occur; they can also be subject to less human errors as human intervention is kept at a minimum.

Summary of 2.3: The Concept of Other Comprehensive Income and Total Comprehensive Income

Definition and Components:

• Other Comprehensive Income (OCI): Items of income and expense not recognized in profit or loss, as required or permitted by IFRSs.

• Calculation:

• OCI = Total Comprehensive Income – Profit/Loss for the period

• Total Comprehensive Income = Profit/Loss + OCI

Components of OCI:

• Gains and losses from the revaluation of property, plant, and equipment (IAS 16) or intangible assets (IAS 38)

• Remeasurements of defined benefit plans (IAS 19)

• Translating financial statements of a foreign operation (IAS 21)

• Investments in equity instruments designated as fair value through OCI (IFRS 9)

• Hedging instruments in cash flow hedges (IFRS 9)

• Changes in the time value of options (IFRS 9)

Recognition of Items Outside Profit or Loss:

• Corrections of errors or changes in accounting policies (IAS 8)

• Items required or permitted by other IFRSs to be excluded from profit or loss

Contributions and Reductions in Equity:

• Recognized directly in the cash flow statement (e.g., issue of new shares, share buybacks, dividends)

• Other items reflected in the statement of profit or loss and OCI

Summary of 2.4: IAS 1 – Disclosures and Classification

Presentation Options:

• Single statement of profit or loss and OCI

• Two separate statements: a statement of profit or loss and a statement of comprehensive income

Single Statement (Statement of P/L and OCI):

• Must include:

• Profit or loss

• Total OCI

• Comprehensive income for the period

Two Statements (Statement of P/L and Statement of Comprehensive Income):

• Statement of P/L includes incomes and expenses, ending with profit or loss for the period

• Statement of comprehensive income starts with profit or loss and adds OCI items

Required Line Items (Profit or Loss):

• Revenue (separately showing interest revenue and insurance revenue)

• Finance costs

• Share of profit or loss of associates and joint ventures

• Specific gains and losses from financial asset reclassifications

• Tax expense

• Discontinued operations

Expenses Classification:

• By nature: Descriptive presentation (e.g., employee benefits, depreciation)

• By function: Purposeful presentation (e.g., cost of sales, administration expenses)

• Choice depends on the entity’s nature and industry factors

• Disclosure of expense nature required when classified by function

Separate Disclosure of Material Items:

• Nature and amounts of material income and expense items must be disclosed (e.g., inventory write-downs, restructuring costs)

Information Presented with OCI:

• Items of OCI classified by nature, grouped into those reclassified to profit or loss and those not

• Share of OCI of equity-accounted associates and joint ventures

• Income tax relating to each OCI item disclosed either in the statement or notes

Treatment of Totals:

• Net profit after income tax and OCI figures transferred to the statement of changes in equity

Part C: Statement of Changes in Equity

2.9 IAS 1 Presentation of Financial Statements: Disclosures of Changes in Equity (p.91)

• The statement of changes in equity explains and reconciles movements in an entity’s equity (net assets) over a reporting period.

• Two primary sources of change in owners’ equity are:

1. Transactions with owners in their capacity as owners.

2. The total income and expenses generated by the entity’s activities (IAS 1, para. 109).

• IAS 1 requires the following disclosures in the statement of changes in equity:

• Total comprehensive income, allocated between non-controlling interests and owners of the parent (para. 106(a)).

• The effect on each equity component of any retrospective adjustments required by IAS 8 (para. 106(b)).

• A reconciliation between the opening and closing balance of each equity component, with separate disclosure of changes resulting from profit or loss, other comprehensive income (OCI), and transactions with owners (para. 106(d)).

• Revaluation of assets/liabilities must be included in changes to equity.

Part D: Statement of Financial Position

2.10 Format of the Statement of Financial Position (Balance Sheet) (p. 94)

• IAS 1 prescribes that the Balance Sheet should include presentation and disclosure requirements for assets and liabilities.

• There is no strict format for the statement of financial position, but it must include minimum disclosures for line items (IAS 1, para. 54).

• Entities must judge whether to present additional line items based on:

• Nature and liquidity of assets.

• Function of assets within the entity.

• Amounts, nature, and timing of liabilities (IAS 1, para. 58).

• The number of shares authorized, issued, and fully paid does not need to be included, while investments accounted for using the equity method do.

2.11 Presentation of Assets and Liabilities (p.95)

• Entities must present current and non-current assets and liabilities separately, except when a liquidity-based presentation is more reliable and relevant.

• Under the liquidity basis, assets and liabilities are presented in order of liquidity (IAS 1, para. 60).

• For entities with a clear operating cycle, current and non-current classifications provide reliable and relevant information (IAS 1, para. 62).

• Financial institutions often use the liquidity basis due to the critical nature of their solvency (IAS 1, para. 63).

• Entities must disclose amounts expected to be recovered or settled after 12 months if an asset or liability line item combines amounts due within and after 12 months (IAS 1, para. 61).

Current Assets and Current Liabilities (p.95)

• An asset is classified as current if it:

• Is expected to be realized or intended to be sold or consumed in the normal operating cycle.

• Is held primarily for trading purposes.

• Is expected to be realized within 12 months after the reporting period.

• Is cash or a cash equivalent, unless restricted for at least 12 months after the reporting period (IAS 1, para. 66).

• Examples of current assets: cash and cash equivalents, inventories, trade receivables, current tax receivable, and prepayments.

• Examples of non-current assets: property, plant, and equipment, intangibles, investments, and deferred tax.

• A liability is classified as current if it:

• Is expected to be settled in the normal operating cycle.

• Is held primarily for trading purposes.

• Is due to be settled within 12 months after the reporting period.

• Does not have an unconditional right to defer settlement beyond 12 months after the reporting period (IAS 1, para. 69).

• Current liabilities: bank overdraft, trade payables, accruals for operating costs, and employee wages.

• Non-current liabilities include financial liabilities that provide long-term financing not due within 12 months unless there are unresolved covenant breaches (IAS 1, para. 71).

2.12 IAS 1 Presentation of Financial Statements: Disclosures in the Notes to the Statement of Financial Position (p.96)

• Further subclassifications depend on the size, nature, and function of amounts involved and are usually presented in the notes.

• IAS 1 examples:

• Items of property, plant, and equipment disaggregated into classes (IAS 16).

• Receivables disaggregated into trade customers, related parties, prepayments, and other amounts.

• Inventories disaggregated into finished goods, work-in-process, and raw materials (IAS 2).

• Provisions disaggregated into employee benefits and other provisions.

• Equity capital and reserves disaggregated into paid-up capital, retained earnings, and other reserves.

2.13 Tips on How to Analyse a Statement of Financial Position (p.97)

1. Review the value of total assets: Has it increased or decreased? Determine the drivers behind the change and whether it is due to current or non-current assets.

2. Review the value of total liabilities: Has it increased or decreased? Determine the drivers and whether the change is due to current or non-current liabilities.

3. Review the value of total equity (net assets): Is it positive? Has it increased from the previous period? Consider the stage of the business lifecycle, as mature businesses tend to have greater retained earnings.

4. Analyze the relationship between current assets and current liabilities: This indicates liquidity. A current ratio of 2:1 is a general rule, meaning current assets should be approximately twice the size of current liabilities.

Part E: IAS 7 Statement of Cash Flows (p.99)

2.14 How Does a Statement of Cash Flows Assist Users of Financial Statements (p.99)

• IAS 7 helps users understand how an entity:

• Generates future cash flows.

• Meets financial commitments as they fall due, including servicing borrowings and paying dividends.

• Funds changes in the scope or nature of its activities.

• Obtains external finance (IAS 7, paras 4 and 5).

• Useful for predicting future cash flows, evaluating management decisions, determining the ability to pay dividends and repay debt, showing the relationship of net profit to changes in cash balances, and assessing revenue and earnings quality.

2.15 Information to be Disclosed (p.100)

Cash and Cash Equivalents (p.100)

• Cash: cash on hand and demand deposits.

• Cash equivalents: short-term, liquid investments readily convertible to cash with insignificant risk of changes in value (IAS 7, para. 6).

• Short maturity (3 months or less from acquisition date); investments in equity securities do not qualify (IAS 7, para. 7).

• Bank overdrafts repayable on demand and fluctuating from positive to overdrawn are included (IAS 7, para. 8).

Classification of Cash Flows (p.100)

• Report cash flows classified by operating, investing, and financing activities (IAS 7, para. 10).

Operating Activities (p.100)

• Relate to the principal revenue-producing activities and not from investing or financing activities (IAS 7, para. 6).

• Report using either:

• Direct method: major classes of gross cash receipts and payments disclosed.

• Indirect method: profit or loss adjusted for non-cash income and expenses, accruals, and items for investing and financing activities (IAS 7, para. 18).

• Interest paid (borrowing costs) as operating cash outflow, interest received as investing cash inflow, dividends paid as financing cash outflow.

Investing Cash Flows (p.101)

• Relate to acquisition and disposal of long-term assets and other investments not in cash and cash equivalents (IAS 7, para. 6).

• Identified by analyzing movements in non-current asset accounts in the statement of financial position.

Financing Cash Flows (p.102)

• Result in changes in the size and composition of contributed equity and borrowings (IAS 7, para. 6).

• Relate to debtholders and equity participants (IAS 7, para. 17).

2.16 Common Methods Adopted on How to Prepare a Statement of Cash Flows (p.102)

• Three common methods:

1. Worksheet method (e.g., Excel™).

2. Formula method.

3. ‘T’ account reconstruction method.

Formula Method (p.103)

Reporting Cash Flows on a Net Basis (p.104)

• Normally reported on a gross basis; net basis is allowed in limited circumstances.

• IAS 7 allows net basis for:

• Cash receipts and payments on behalf of customers.

• Cash receipts and payments for items with quick turnover, large amounts, and short maturities (IAS 7, para. 22).

• Example: rents collected by an agent on behalf of property owners (IAS 7, para. 23).

• Example: principal amounts related to credit card customers (IAS 7, para. 23A).

Other Information to be Disclosed in the Statement of Cash Flow or Notes (p.104)

• Cash flow items include interest and dividends, income taxes, and loss of control of subsidiaries (IAS 7, paras 31, 35, 39, and 40).

• Disclose significant cash and cash-equivalent balances not available for group use (IAS 7, para. 48).

• Example: exchange controls or legal restrictions (IAS 7, para. 49).

• Disclosure of undrawn borrowing facilities for future cash needs is encouraged (IAS 7, para. 50).

Consolidated Financial Statements (p.105)

• Parent entity must prepare consolidated financial statements disclosing group