4b. Monetary policy

Monetary policy

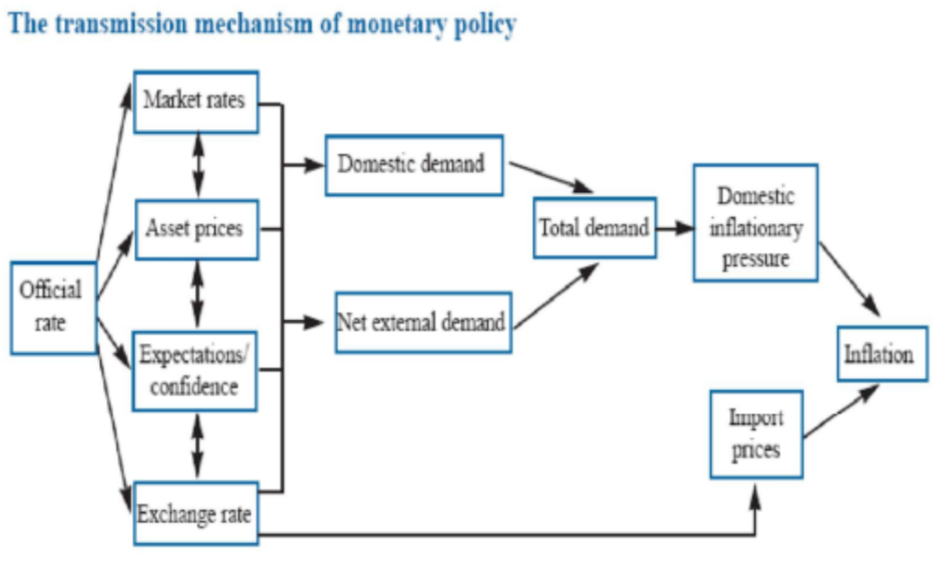

Monetary Policy is a demand-side policy that uses interest rates (the price of money) and the money supply in order to influence the level of aggregate demand (demand management).

Interest rates are the opportunity cost of holding money. They are the reward for saving and the cost of borrowing.

The objective of monetary policy is to keep CPI inflation at 2% (+/-1)

The Bank of England sets the base interest rate (on which other commercial rates are set) and potentially uses its other policies in order to meet this target.

Changes to interest rates

‘If interest rates go up, inflation will go down’, although true is very simplistic. It is important to use as many steps to link interest rate changes to inflation.

Market rates

The Base Rate is the rate at which the Bank of England charges commercial banks to borrow from it.

If the Official (Bank of England) Rate rises then high street banks should follow suit and raise market interest rates (as it is more expensive for them to borrow)

If interest rates rise, then people are more likely to save and firms are less likely to borrow to pay for factories etc., therefore C + I decrease

Asset prices

If the interest rates increase, then this makes saving more attractive. Investors are likely to increase saving rather than buy assets such as shares, property or gold.

If demand for assets decreases then asset prices fall, this creates a negative wealth effect, therefore C + I decrease

Hot money

Interest rates rising encourages investors from foreign countries to put their money in UK banks

Demand for £ increases and therefore the currency appreciates.

This means that exports fall and imports rise

Domestic demand (C+I+G)

Market Rates increase = C + I decreases = Domestic demand falls

Asset Prices decrease = C + I decreases = Domestic demand falls

Confidence decreases = C + I decreases = Domestic demand falls

Overall Effect = Domestic demand decreases

Net external demand (X-M)

Hot Money: Interest rates increase = currency appreciates = exports decrease, imports increase

Overall Effect = Net External Demand decreases

Total demand

Domestic Demand (C+I) decreases

External Demand (X-M) decreases

Overall Effect = Aggregate demand falls

So Domestic Inflationary Pressure reduces

Inflation

AD falls leading to a reduction in price levels Import prices fall

Overall Effect: Inflation falls

Expansionary and contractionary monetary policy

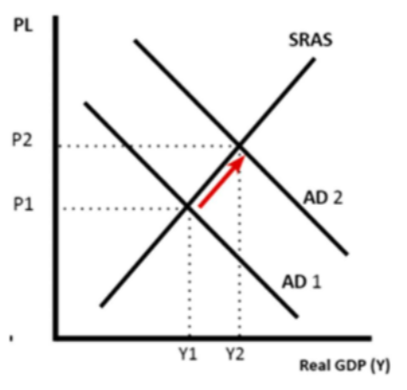

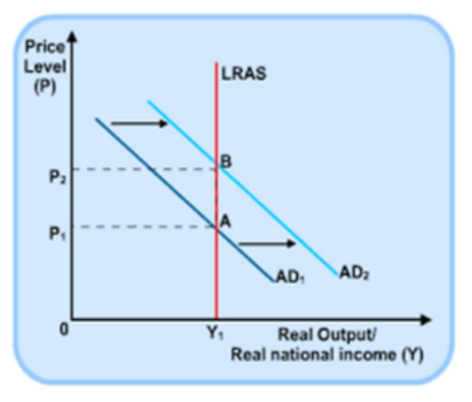

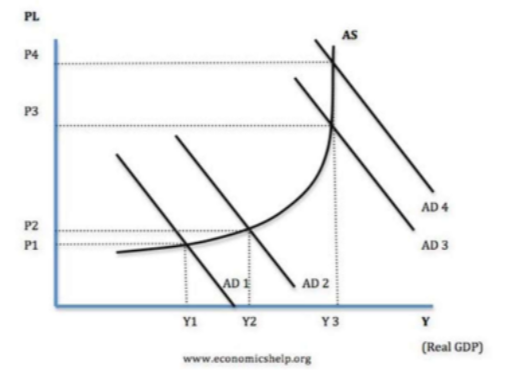

An expansionary policy would mean the Bank of England would cut interest rates and increase the money supply. The purpose of an expansionary policy is to raise the level of inflation.

A contractionary policy would mean the Bank of England would raise interest rates and reduce the money supply. The purpose of a contractionary policy is to reduce the level of inflation.

Expansionary monetary policy in the short run

Expansionary monetary using classical LRAS

Expansionary monetary policy using Keynesian LRAS

Expansionary monetary policy analysis

Impacts of interest rates

Consumer durables – large purchases made on credit

Housing market – bought using a mortgage which often tracks the BoE base rate

Wealth effect – falling interest rates can increase demand for assets such as houses

Saving – higher interest rates encourage consumers to save money

Investment – low-interest rates encourage firms to invest in capital in the hope of higher returns

Exchange rates – high-interest rates lead to the purchasing of the £, appreciating its value and making imports cheaper

Cutting interest rates close to zero should…

Mortgage payers have less interest to pay – increasing their effective disposable income

Cheaper loans should provide a possible floor for house prices in the property market

Businesses will be under less pressure to meet interest payments on their loans

The cost of consumer credit should fall encouraging the purchase of big-ticket items such as a new car or kitchen

Lower interest rates might cause a depreciation of the sterling thereby boosting the competitiveness of the export sector

Lower rates are designed to boost consumer and business confidence

However, low-interest rates might have no effect because…

The unwillingness of banks to lend – most banks have become risk-averse and they have cut the size of their loan books and making credit harder to obtain

Low consumer confidence – people are not prepared to commit to major purchases because the recession has made people risk averse. Weak expectations lower the effect of rate changes on consumer demand

Huge levels of debt still need to be paid off including over £200bn on credit cards

Falling or slowing rise asset prices makes it unlikely that cheap mortgages will provide an immediate boost to the housing market.

Although official monetary policy interest rates are now close to zero, the rate of interest charged on loans and overdrafts has actually increased – the cost of borrowing using credit cards and bank loans is a high multiple of the policy rate. Little wonder that many smaller businesses have complained that the Bank of England’s policy of ‘cheap money’ has done little to improve their situation during the recession and in the early stages of the recovery

Forward guidance

In order to help the UK recovery from recession a policy of ‘forward guidance’ regarding monetary policy was introduced in 2013.

This meant that the Bank of England would use interest rates to help boost the economy as well as to keep inflation at 2%.

The Bank of England would not consider raising interest rates from 0.5% until the unemployment rate has fallen to 7% or below (predicted 2016)

Unemployment reached the 7% target 2 years early undermining credibility in the Bank’s economic forecasting

They have now modified forward guidance so it focuses on a less specific objective of supporting economic growth and employment

Quantitative easing – important background

How banks work

Banks make money by taking deposits from savers and paying them an interest rate e.g. 2%…

…and then invest this money or lend it out to homeowners or businesses for a higher amount e.g. 5%

This would give them a profit margin of 3% as they pay 2% to savers but receive 5% from borrowers.

Some investments are riskier than others- the bank doesn’t want to lend out money that won’t get paid back…

…However, the higher risk the greater the return.

Government bonds

Government Bonds are how governments raise money to pay off their debts.

They are essentially ‘IOU’s where the government will pay back any money borrowed with interest

E.g. £100 government bond will pay back £100 after 10 years + 2% interest (yield) every year.

They are sold to private individuals such as banks, pension funds etc.

They can be bought and sold by anyone up to its expiry

Government bonds in a recession

Bonds are regarded as a ‘safe’ investment as the UK government has never defaulted on their debt

In a recession banks will therefore invest in government bonds rather than ‘riskier’ investment such as lending for mortgages or to start up new businesses

This makes it difficult for businesses or consumers to borrow and invest (Credit Crunch) so AD goes down causing inflation to drop

Quantitative easing

QE aims to encourage high street banks to lend to consumers and businesses rather than buy lots of government bonds

It does this by attempting to make government bonds less valuable

Quantitative easing – stage 1

Bank of England credits itself with money

They use this money to buy government bonds

Demand for bonds increase, price of bonds increase

As bond prices increase, yields of bonds fall (see opposite) so investing in other assets (e.g. loans to firms) becomes more attractive

High Street Banks therefore sell bonds to Bank of England and increase their available cash

What is relationship between bond prices and yields (interest rate)?

The yield of a bond is inversely related to its current price - meaning that if the price of a bond falls, its yield goes up.

If you bought a £100m bond with a £5m coupon (interest), your yield would be 5%. (Coupon/value of bond x 100) • If our bond with a face value of £100m fell to a market price of £90m, the yield would rise to 5.55% (5/90 x 100).

If the price of our bond rose to £110m then the yield would fall to 4.54%. (5/110 x 100).

NB Whoever holds the bond at redemption is still entitled to £100m from the government no matter what price they paid for it.

Quantitative easing – stage 2

High Street Banks have increased cash available from selling government bonds to the Bank of England so should lend more

Bond prices rise so there is an increase in the wealth effect for bond holders

As bond prices increase yields of bonds fall so banks are incentivised to invest their money using other methods i.e. mortgages or loans to firms

Quantitative easing – stage 3

Increase in borrowing and lending

Increase in C + I

Increase in AD

Increase in Inflation

Quantitative easing analysis

Advantages

A policy that can be used when interest rates don’t work due to a liquidity trap

Can help avoid the dangers of deflation

Can boost exports as it leads to a depreciation of the exchange rate

Disadvantages

It didn’t really solve the problem of the credit crunch as high street banks were very risk averse following the defaults on subprime loans. Even though yields on safe assets like government bonds went down they were still happy to go for the low risk option.

It is regressive as it boosts the price of assets. These assets are disproportionately held by the wealthy.

It lowers living standards for pensioners who are reliant on yields from investments to live.

The money could have been better spent on providing credit directly to small businesses rather than indirectly through bond buying

The effects are uncertain so it could lead to unexpected inflation

It could be difficult to reverse as the central bank would need to find lots of buyers for these bonds

Keeping interest rates so low can leads to excess lending and also keep ‘zombie’ companies alive who would go bankrupt in normal circumstances

Quantitative easing alternatives

Credit easing - Another policy proposed is called credit easing where the Bank of England buys the bonds issued by companies to help them finance a rise in capital investment.

Helicopter payments - Giving money directly to consumers

Funding for lending - Bank of England lends cheaply to banks to encourage further lending.

Term funding scheme - The Term Funding Scheme (TFS) was set up to support bank lending immediately after the 2016 referendum. It offered cheap money - on the condition that the bank lent the money to customers. It ended in 2018