Evaluation of monetary policy

Using RWE’s, evaluate the effectiveness of monetary policy in achieveing economic growth during a recession (1) / combating high inflation (2) (15 marks)

Monetary policy is …

RWE: Bank of England decreased ir from 0.75% to 0.1% during recession in 2020.

RWE: Bank of England increased ir in small increments to reduce inflation in 2022-23.

1 AD-SRAS diagram, AD right (+ annotation)

2 AD-SRAS diagram, AD left (+ annotation)

Arguments:

Macro objectives

Conflict between macro objectives - expansionary: increase in growth but will also cause increase in inflation. Contractionary: decrease in inflation, but will also decrease growth.

Therefore the effectiveness of monetary policy depends on what problem the economy faces. Effective at solving one problem at a time but not at solving both at once.

RWE: Russia - Ukraine conflict caused a supply - side problem. (Increase in cost of energy → decrease in growth and increase in inflation).

Monetary policy could not be used to increase growth, as inflation too high.

Ability to use

Politically independent - therefore can always increase or decrease ir even if politically unpopular.

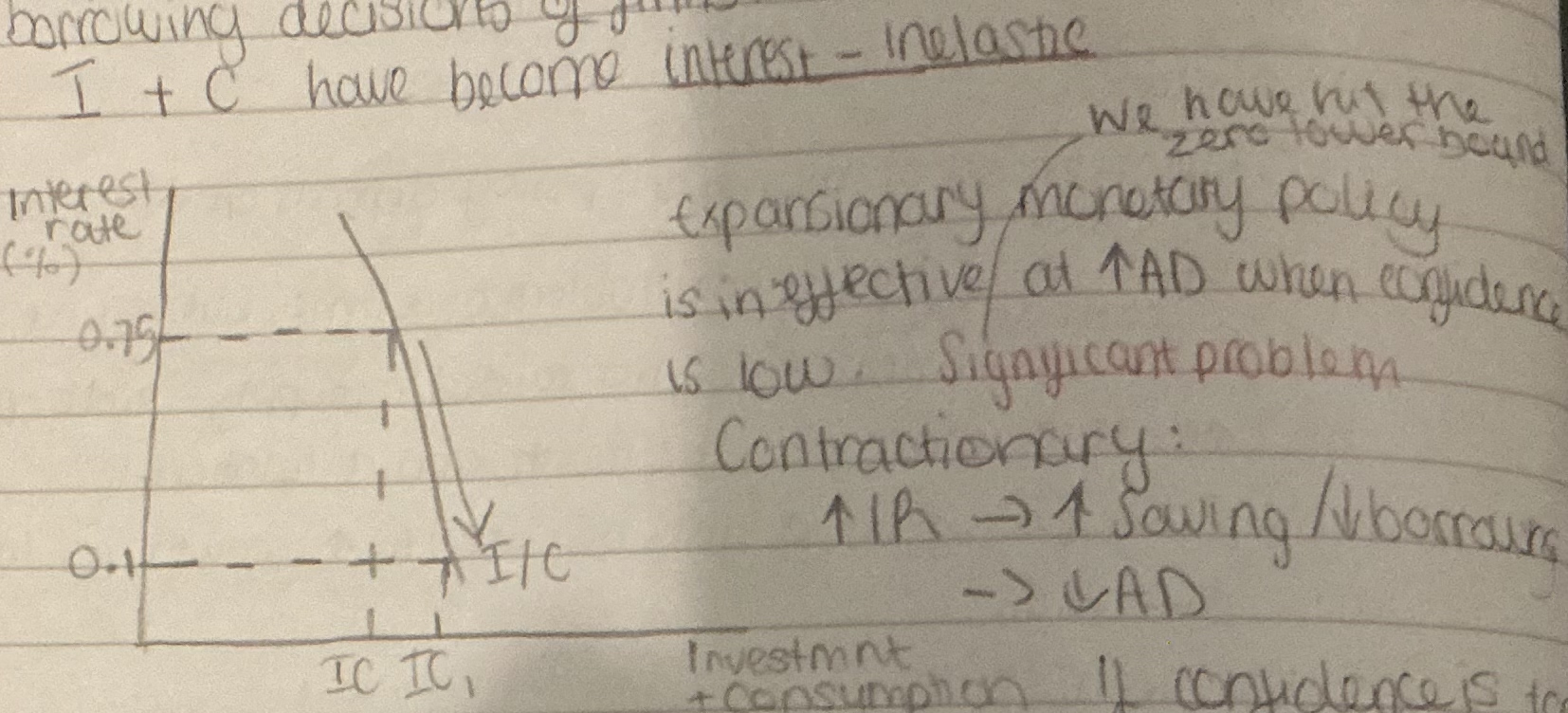

Expansionary: cannot be used if ir already close to 0%

RWE: decrease in ir during 2020 was impossible (UK) as it was already 0.75%.

Speed of impact

Very quick to implement (Bank of England sets interest rate every 6 weeks) → changes are quick to reverse if they cause adverse impacts (RWE: UK 2022-23). Effective at balancing conflicting objectives. Changes can be incremental (impact can be monitored closely). Effective at fine-tuning economy to a specific inflation target. (UK: 2%)

Short time lag while people respond to the change.

Size of shift

It depends on confidence. If confidence is low (RWE: 2020 pandemic) people save lots and borrow little regardless of the interest rate. Therefore monetary policy has little impact on AD. Ineffective.

If confidence is too low (or high), consumption and investment become interest inelastic.

Confidence low → a change in ir will not change the saving/borrowing decisions of firms/households.

If confidence is too high, people/firms may continue to borrow despite the higher ir. Policy effective at decreasing AD. Not a significant problem. If it does not work, the central bank can quickly increase ir again until it does.

If confidence is too high, people/firms may continue to borrow despite the higher ir. Policy effective at decreasing AD. Not a significant problem. If it does not work, the central bank can quickly increase ir again until it does.

Other advantage of monetary policy:

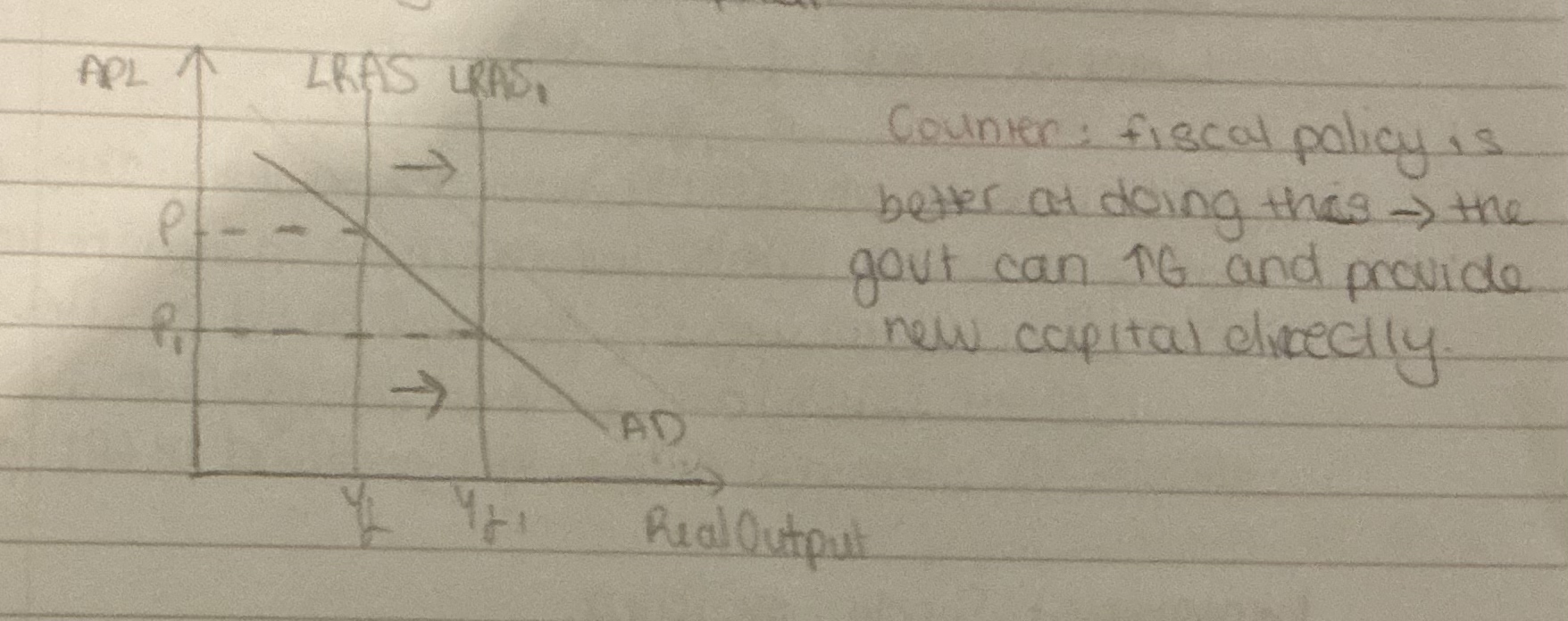

It can increase quality of the FoP’s. Increase in growth in the long term. Decrease in interest rate → encourages borrowing.

Increase I by firms

Increase spending on new capital

Conclusion:

Ineffective at increasing growth in a recession - fiscal policy better as more direct

Very effective at decreasing inflation - quick, politically independent, precise increments

Very effective at balancing objectives