Week 2 Corporate Governance

Chapter 2: Corporate Governance

2.1 Overview of Corporate Governance

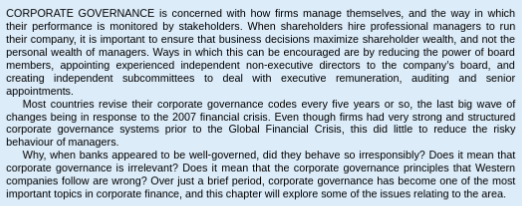

Definition: System of rules, practices, and processes by which a company is directed and controlled.

Key Functions:

Distributing power among stakeholders:

Shareholders: Owners of the company

Board of Directors: Oversee management

Management: Operate daily activities

Goal: Ensure efficient company operations.

2.3 Stakeholder Dynamics

Corporate governance concerns the way an organization is formed, structured, and controlled as well as how firms manage themselves, and how their performance is monitored.

Stakeholders Include:

Shareholders

Management

Customers

Suppliers

Financiers

Government

Community

Importance: Balancing interests among various stakeholders is crucial.

2.4 Governance Theories

Stewardship Theory:

Managers as stewards of the firm, focused on preserving assets for successors.

Agency Theory:

Managers as agents of shareholders, necessitating contracts to align interests.

2.5 Shareholder Rights and Principles

Protection of Shareholders:

Framework should protect rights and ensure fair returns.

The corporate governance framework should protect shareholders, and facilitate their rights in the company.

Companies should generate investment returns for the risk capital put up by the shareholders.

Equitable Treatment:

All shareholders deserve fair treatment, especially minorities and foreign shareholders.

Mechanisms should exist for redress in case of oppression.

2.6 Core Principles of Corporate Governance

Recognition of Stakeholders:

Legal rights of stakeholders should be acknowledged. The framework should recognize the legal rights of stakeholders and cooperate with them in order to create wealth, employment and sustainable enterprises.

Disclosure and Transparency:

Timely disclosures regarding financial performance and management are essential. Companies should make relevant, timely disclosures on matters affecting financial performance, management and ownership of the business.

Board Responsibilities:

Set company direction and monitor management effectively.

The board of directors should set the direction of the company and monitor management in order that the company will achieve its objectives.

2.7 Approaches to Corporate Governance

Principles-Based Approach (UK):

Companies comply or explain deviations from governance standards.

This involves establishing a comprehensive set of best practices to which listed companies should adhere.

The company should disclose to its shareholders if it choses not to abide by one or more of the standards along with the reasons for not doing so.

It may be a condition of membership of the stock exchange that companies strictly follow this ‘comply or explain’ requirement.

Principles-Based Approach (Adopted in the UK)

Approaches to Corporate Governance

The principle of ‘comply or explain’ means that companies have to take seriously the general principles of relevant corporate governance codes

Rules-Based Approach (US):

Standards are codified in law; mandatory compliance (example: Sarbanes-Oxley Act).

Under this approach, the desired corporate governance standards are enshrined in law and are therefore mandatory.

The best example of this is the US, where the Sarbanes-Oxley Act lays down detailed legal requirements.

Rules-based control is when behaviour is underpinned and prescribed by statute of the country’s legislature. US-listed companies are required to comply in detail with Sarbox provisions.

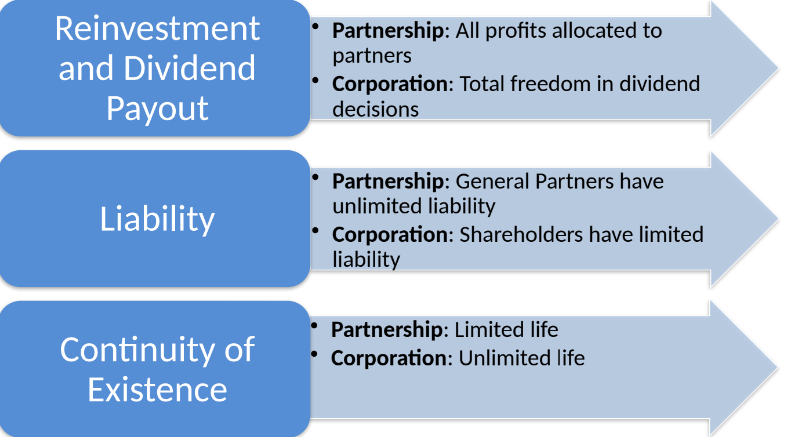

2.8 Forms of Business Organization

2.8.1 Types

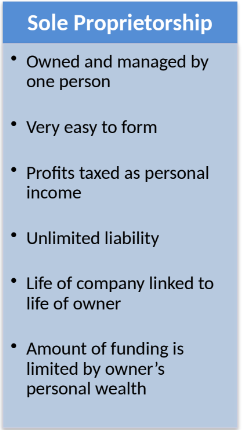

Sole Proprietorship:

Owned and managed by one person, easy to form, unlimited liability.

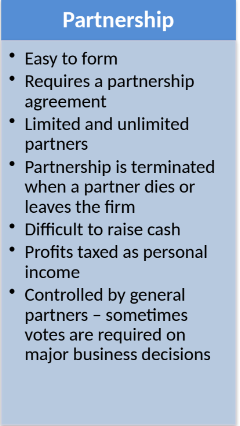

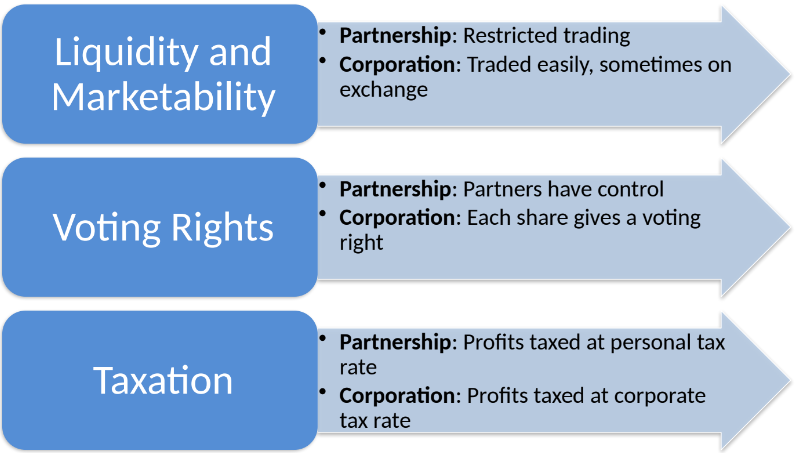

Partnership:

Requires agreement, can have limited/unlimited partners, taxed as personal income.

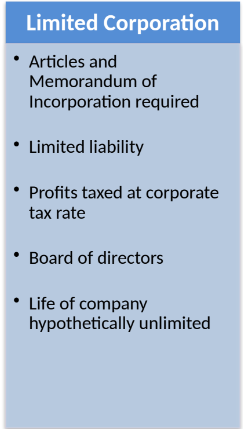

Limited Corporation:

Limited liability, board of directors, taxed at corporate rates.

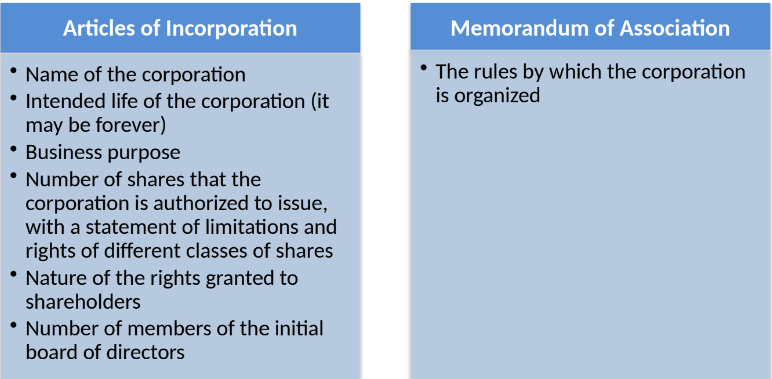

2.8.2 Articles and Memorandum of Incorporation

Articles of Incorporation:

Specifies corporation name, lifespan, purpose, share structure, and initial board members.

Memorandum of Association:

Rules governing organization.

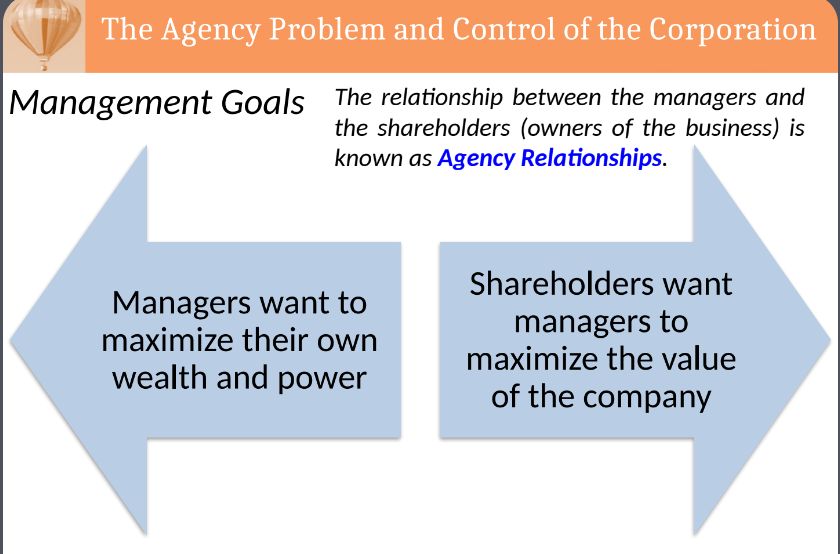

2.9 The Agency Problem

Definition: Occurs when the interests of managers diverge from those of shareholders.

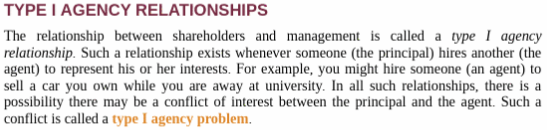

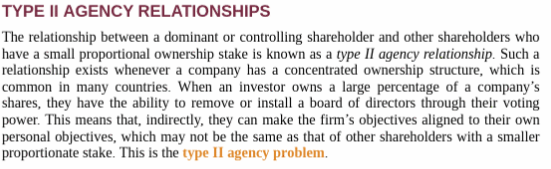

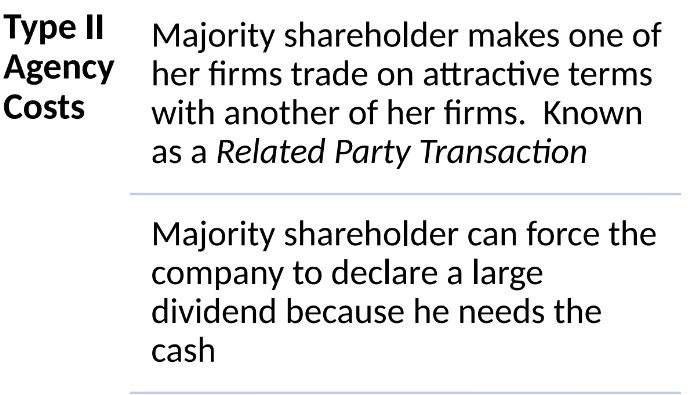

Types of Agency Relationships:

Type I: Relationships between Managers and shareholders

Type II: Relationships between Majority and minority shareholders

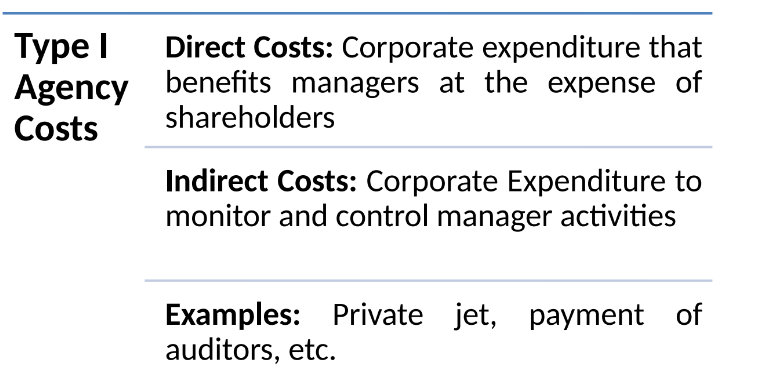

2.10 Agency Costs

Definition: Costs incurred in resolving agency problems. Agency cost in finance refers to the costs incurred in resolving conflicts of interest between managers (agents) and shareholders (principals) of a company. These costs arise when the interests of managers diverge from those of shareholders, leading to inefficiencies and potentially suboptimal decisions. Agency costs can include direct costs, such as excessive compensation for managers, and indirect costs, such as expenses related to monitoring managerial behavior.

Types of Costs:

Direct Costs: Inefficient expenditures benefiting managers.

Indirect Costs: Expenditures for monitoring manager behavior.

Indirect Costs: Expenditures for monitoring manager behavior.

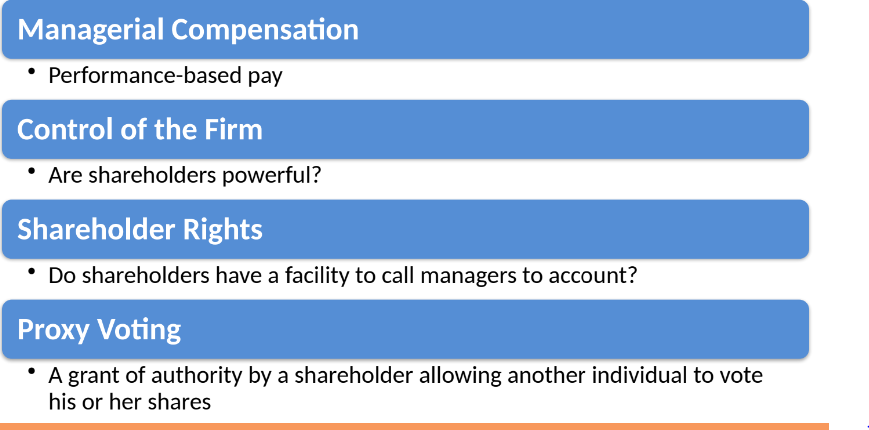

2.11 Control Mechanisms

Managerial Compensation: Performance-based pay to align interests.

Proxy Voting: Shareholders grant authority for voting on their behalf.

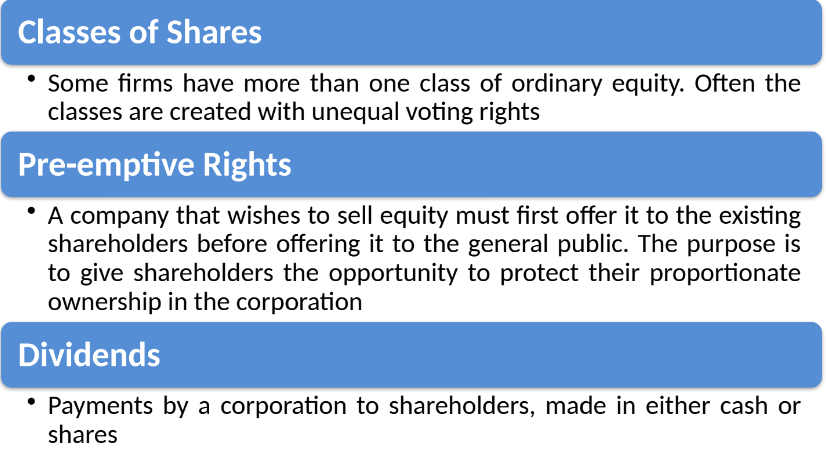

2.12 Classes of Shares and Shareholder Rights

Classes of Shares: Different classes may exist with varying voting rights.

Pre-emptive Rights: Existing shareholders get first option on new equity.

2.13 International Corporate Governance

2.13.1 Legal Systems

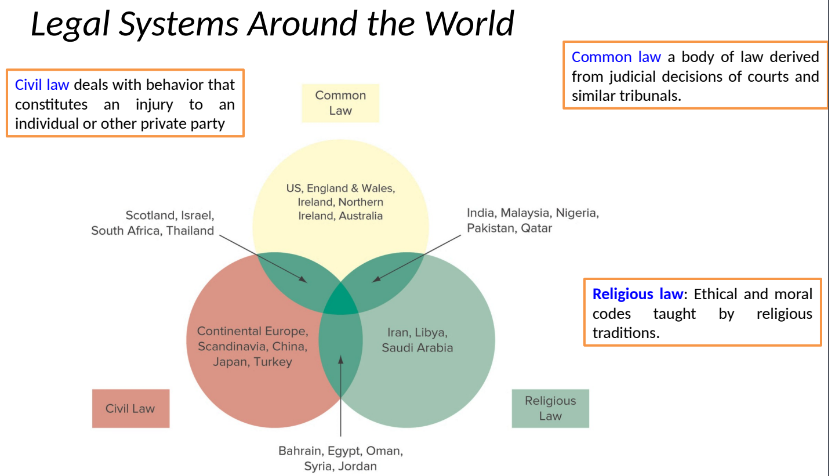

Common law: Derived from judicial decisions.

Civil law: Addresses individual rights and private party injuries.

2.13.2 Investor Protection Measures

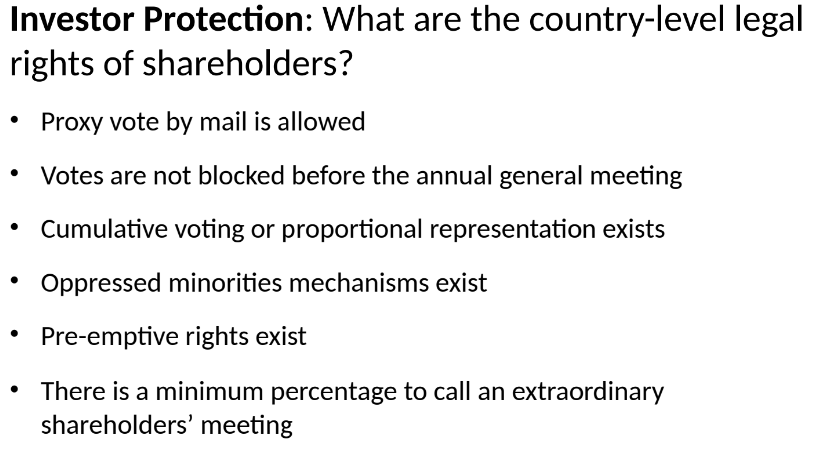

Rights vary by jurisdiction; include proxy voting, minority protections, and pre-emptive rights.

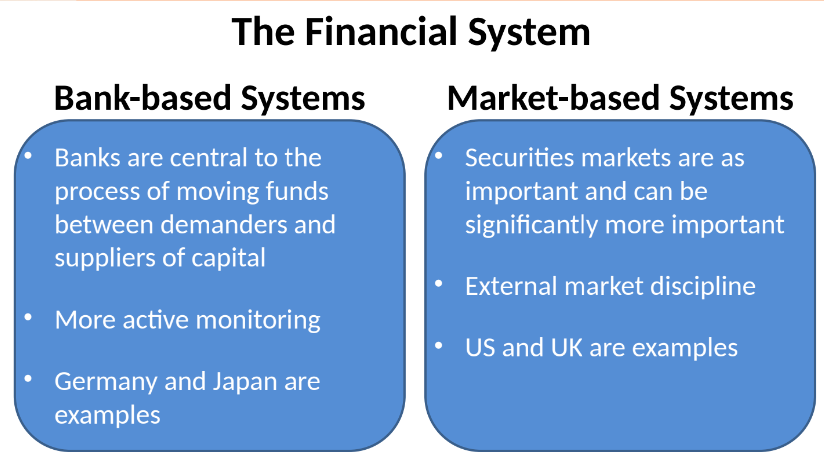

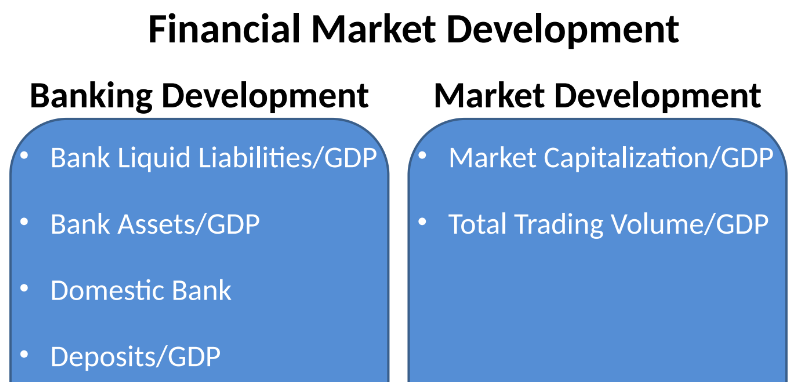

2.14 Financial Systems

Bank-Based Systems: Centralized capital movement (e.g., Germany, Japan).

Market-Based Systems: Securities market-driven (e.g., US, UK).