Economics

economics - how individuals make choices to satisfy unlimited wants

established by Adam Smith

cost-benefit analysis - people rationally compare the pros and cons of actions and choose based on benefit

economic analysis

observe

describe

measure

theory

Types of Economics

Types of Studies:

Positive Economics

use cause-and-effect to predict events

Normative Economics

judgements based off what should be

cannot be proved false or true

Pareto Efficiency

efficiency of resource allocation

resource allocation - assigning tasks/resources to a certain business

exists so that people may benefit

Two Economic Fields:

Microeconomics

Macroeconomics

Microeconomics

-Examines the economy on an individual level

agents - individual consumers, groups of consumers, producers

supply and demand

how agents behave and interact

determines prices and distribution of products

Supply and Demand:

Demand:

the amount buyers are willing to purchase

main determinant - price

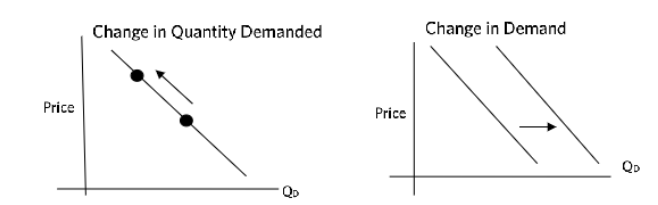

law of demand: inverse relationship between price and demand

demand schedule: lists the price and corresponding quality of products

dependent variable = demand

independent = price

market demand curve = sum of individual demand curves

quantity that every customer demands at each price

shifts in demand curve:

External Factors - Consumer Income, Prices of Related Goods, Consumer Preference, Consumer Expectations, Consumer Numbers

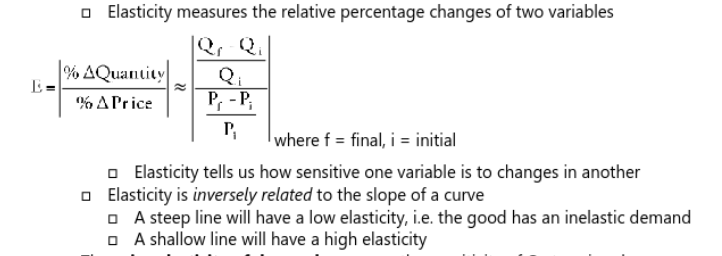

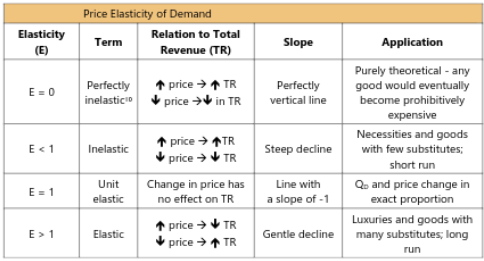

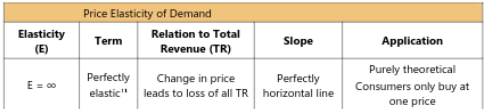

Elasticity of demand curve = demand curve shape

factors: substitutes (good), necessity (lower than luxury), time horizon (direct relationship), market size (inverse relationship)

decreases along demand curve

Supply:

amount sellers are willing to produce

most determinant = price

law of supply: direct relationship between supply and products

supply schedule: lists price and corresponding products

market supply curve = sum of all quantities at supplier prices

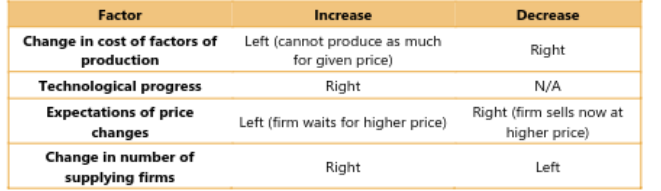

movement - change in quantity supplied

shift - change in supply [inward(left) = decrease, outward(right) = increase]

factors: Production Costs, Technological Process, Price Expectations, Number of Suppliers

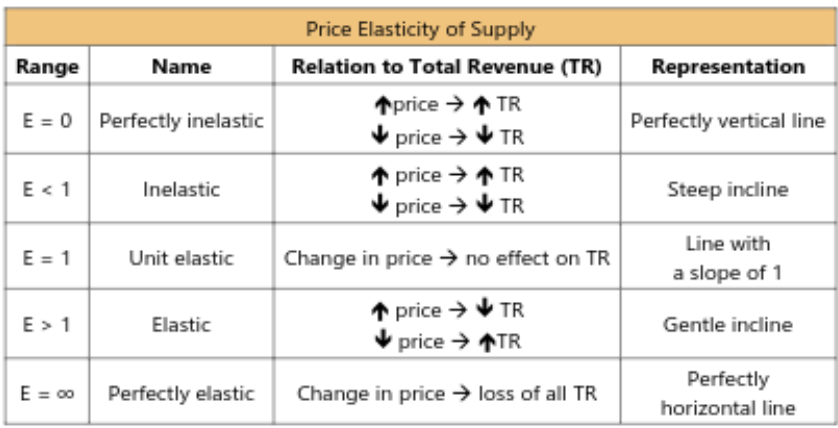

Elasticity

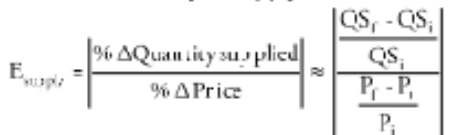

supply and price relationship sensitivity

factors: difficulty of transportation, time, production decisions of firms

f = final

i = initial

good elasticity = increase in price = small decrease in product quantity

Revenue = price x quantity

Unit Elasticity: price increase = equivalent quantity decrease

Markets:

Market - all buyers and sellers of a certain product

formal (stock exchange) & informal (gas station) markets

interdependent: relying/trading with strangers for supplies

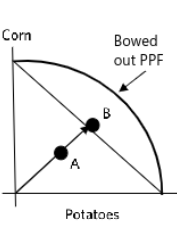

Production Possibilities Frontier - summarizes an economy’s possible products

moving along curve = substituting 1 good for another

linear curve- constant opportunity cost

most resources are best for 1 good; or else efficiency decreases

//////

Absolute Advantage

produces good more efficiently/ ability to produce more of a good or service

Comparative Advantage

ability to produce at lower opportunity costs

parties with different comparative advantages will benefit

Equilibrium:

point where all the forces in a system are balanced and stable

Market equilibrium = when supply and demand are equal

price taker - any buyer/seller

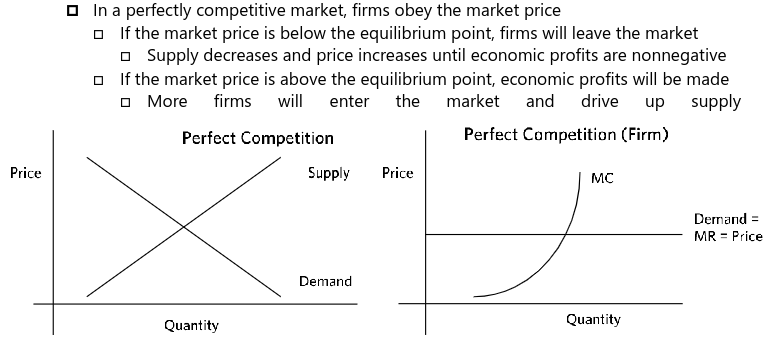

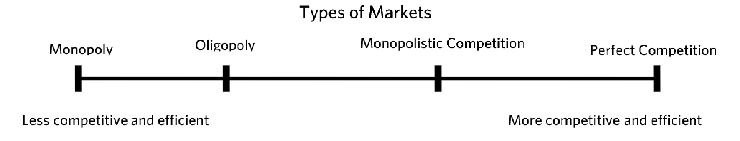

Perfectly Competitive Market -

Homogeneous/Standardized product

Large Number of buyers and sellers

Transparent market price info

No entry barriers

near equilibrium, allocates sources well, benefits consumers

consumer surplus: extra consumer benefit

producer surplus: market price exceeds opportunity cost

total market surplus: total participant benefits

marginal revenue = revenue from selling a unit

primary commodity markets

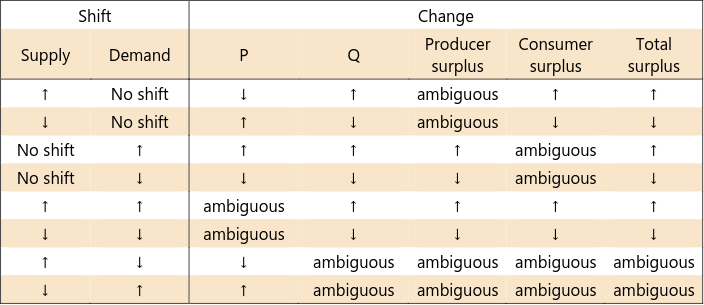

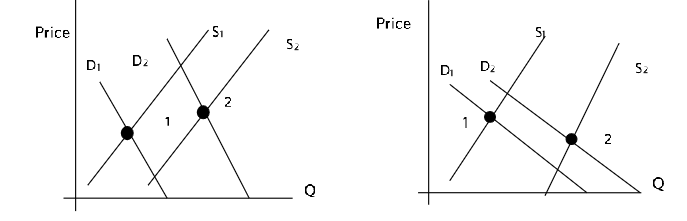

Changes in Market Equilibrium

Firms:

Economic actors that combine labor, capitol equipment, and raw materials to produce goods with max profits

Total Revenue = output quantity x price

Total costs - expenses

Accounting costs/profit: monetary costs/profit

Accounting Revenue = accounting profit - explicit cost

Economic costs/profit: monetary and opportunity costs/profit

economic profit = monetary profit - opportunity costs

Economic Revenue = economic profit - explicit costs - implicit costs

Fixed Costs - must be paid regardless

Variable Costs - paid based on amounts produced

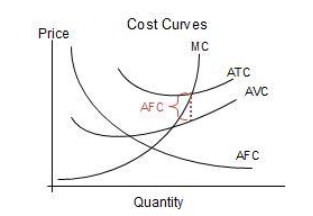

marginal cost - cost from producing an extra unit

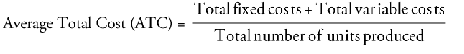

Average cost - total production cost of each output

Average Fixed Cost (AFC)

Marginal Cost (MC)

Average Variable Cost (AVC)

Average Total Cost (ATC)

Failures:

When Competitive Markets fail to produce socially desired outcomes

Externalities - costs or benefits of uninvolved 3rd parties

Negative: harm on others

Positive

Internalizing externalities - paying directly to market (taxes, fines)

helpful to the individual

Coase Theorem by Ronald Coase

private parties should be able to solve inefficiencies of externalities

not really effective

Quoata - numerical limit on quantity

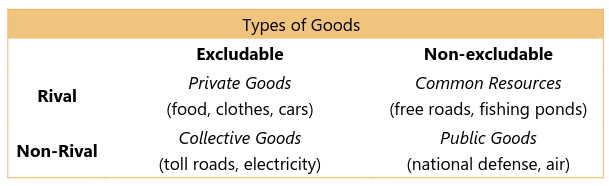

Rivalry in property rights and public goods

Imperfect competition

few suppliers

monopolies → scarcity → contrived scarcity

Legilsation

something something idk

Oligopoly

a market with some interdependent firms

produce both different and homogeneous products

common

ex. Organization of Petroleum Exporting Countries (OPEC) - oil

collusion - non-competitive/secret (sometimes illegal) agreement between rivals to disrupt market equilibrium

cartel - groups involved

Monopolistically Competitive

most common

ex. restaurants, clothing, service

competition through advertising, branding (but not prices)

Influences on Microeconomic Markets

lowkey common sense (taxes, gov, business)

Macroecomics

-Studies economics on a national level

Aggregation: combines multiple factors into 1 variable

2 Main Concerins:

Long-term

Short-term

Money and Inflation:

Money is:

A medium of exchange

A unit of account

A storage of value

Wealth = all value in economy

highly liquid: currency, stocks

not liquid: real estate, land

Commodity Money - made of material with intrinsic worth (ex. gold)

Fiat Money - value from gov order

Demand Deposits - money stored in accounts (withdrawn at anytime)

Time Deposits - money stored in accounts (cannot be withdrawn whenever)

Money Market Accounts - money stored with restrictions

Monetary Base, M0 - narrowest possible definition of money supply

M0 - all currency held by general public

M1 - very liquid forms of money

M2 - M1 + saving accounts, money market funds, and deposits

Price level and Inflation

Inflation - currency value decreased

sustained rise in general price level

reduces money’s value and purchasing power

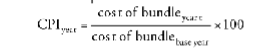

CPI - Consumer Price Index

measures inflation

Price Level - price relative to a base; average of current prices of goods and services for the entire economy

Aggregate Price Level = price level for the entire economy

price level rises —> more expensive

Money Market in the Long Run

Long Run - time it takes for the Demand money = Supply money

value of money depends on supply and demand

Quantity Money Theory/ Equation of Exchange = MV = PY

amount of money spent = amount of money used

M = money stock/supply

V = money velocity (frequency of money transactions in some time)

P = current average price level

Y = output of goods and services

Financial Institutions

coordinates the economy’s saving and investment decisions

financial markets - a place people can save money by giving to investors

investments - buying new capital equipment

Debt Finance - bond insurance

Bond - obligation to bond holder

Date of Maturity - date when payment + interest is due

longer maturity period = greater risk of price change

Principle - original bond value

large corporations will sell bonds to the public for funds

Default - risk of bond buyer if borrower goes bankrupt

Borrower: Seller

Equity Finance - stock sales

Stocks - share of onwership of a firm

National Association of Securities Dealers Automated Quotation System (NASDAQ)

New York Stock Exchange (NYSE)

prices depends on supply and demand

Dividends - shareholders receive this if the company does well

Financial Intermediaries

Intermediary - 3rd party used for connection (ex. banks)

Mutual Funds - allow shareholders with little money to buy stocks/bonds

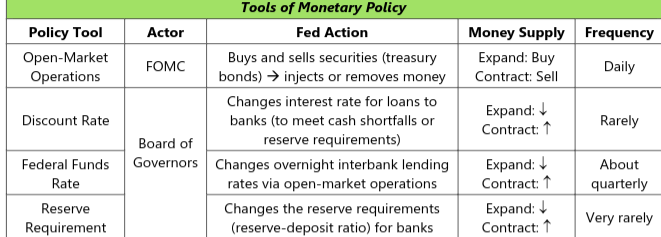

The Federal Reserve

Amount of Money in the US = public interactions, commercial banks, and the Federal Reserve System (Fed)

Fed Central Banks

12 regional banks per central bank

ran by 7 board of governors

Federal Open Market Committee (FOMC)

Fractional Reserve Banking

fractions keep a deposit of loans/deposits

bank run - when depositors rush to deposit in a bank

monetary policies increase/decrease the effective money supply

Contractionary policy - decreases money supply

Expansionary policy - increases money supply

Supply and Investment in aggregate

identity - an equation that is always true

something gdp agghghghgh

GDP (Gross Domestic Product)

interest in economic output

market value of all final goods and services

Simon Kuznets - developed modern concept of GDP (1934)

GDP = expenditures = C + I + G + NX

C = Household Consumption

I = Firm Investment

G = Government purchases

NX = Foregin Net Exports

real GDP - calculated by converting prices to the baseline year; to remove inflation;

average labor per capita

nominal GDP - calculated in prices of current year

depends on quantity of goods and services

larger economies should have greater GDPs (typically)

Human capita: skills acquired

Economic Growth

19th century - great US and European economic growth

circular flow model - relationship between sectors of the economy

factor market - where firms buy factors of production

factors of production - labor, capital, etc.

business secotr = firms

Unemployment

Bureau of Labor Statistics (BLS):

measures monthly unemployment rate

3 Types of Unemployment

Structural Unemployment

from change in consumer tastes, or technology

Cyclical Unemployment

business cycle

Frictional Unemployment

from time between changing jobs

effect on output

output group = potential - actual output gap

Aruthur Okun - noted output and cyclical unemployment relationship

Okun’s Law - if the unemployment rate changes by 1%, the output gap changes by 2%

Short-Run Fluctuations:

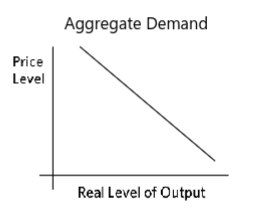

the Aggregate Demand Curve

Aggregate Demand (AD)

the 4 components of GDP (C + I + G + NX)

price level decrease = decrease in product prices

wealth effect

similar to income effect

price decrease →income increase →customers buy more

interest effect

price increase →more expensive →more borrowing money →increase rates go up

foreign exchange effect

cheaper domestic goods →consumers want more

Shifts of the Aggregate Demand Curve

changing local and foreign consumption = curve shifts

firm investment altered = curve shifts

direct relationship

consumer opinion

gov taxes

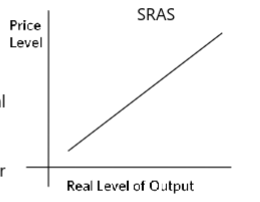

short-run aggregate supply curve (SRAS)

potential goods in the short-run

depends on long-run potential output and price level expectations

Shift in the Aggregate Supply Curve

change in price levels

Business Cycle

The Keynesian Model

developed by John Maynard Keynes

so like idc

Fiscal policy

allows gov to impact the overall economy

Expansionary Fiscal Policy - expand gov spending and lower taxes

Contractionary Fiscal Policy - decrease gov spending and raise taxes

Climate Change

Climate Commons: shared atmosphere for a stable climate

Economic Concepts and Climate: Theory and Practice

Externalities - irregularities in otherwise regularly-functioning markets (ex. public places)

Uni-directional/1 Way - externalities that only affect one party

Reciprocal - both parties affected

Collective Action = Expectations + Norms + Institutions

common property - belong to whole group

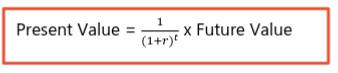

discount rate: interest rate used to determine the value of future cash flows

time value of money

people are myopic

myopic: short-sighted

Topics similar to Social Science Section

disagreements between countries, leaders, and organizations

more money-based contributions

Policy Responses

Do Nothing

Unilateralism

geoengineering

a single country taking action without consulting others

Negotiations

int treaties and cooperation

Multileralism

global organizations

alliance between countires

Knowt

Knowt