Lecture 5 Equity Capital Market and Equity Valuation

What is a Equity Capital Markets?

Definition: Markets that trade equity (stocks) instruments

Primary Market: Corporations raise funds through new share issues

IPO (Initial Public Offering): First-time public trading of shares

SEO (Seasoned Equity Offering): New equity issued by already public companies

Secondary Market: Trades financial instruments post-issuance

What is a Secondary Market Eco System?

Investors use stock exchanges (broker/trader) for buying/selling shares

Common Stock Exchanges: NYSE, NASDAQ, ASX

What are some Trading Practices?

Price-driven Trading System: Market makers quote bid and ask prices

Guarantees order execution (e.g., Forex market)

Order-driven Trading System: Displays all buy/sell orders

More transparency (e.g., ASX, Tokyo, Shanghai)

Hybrid System: Combination of price-driven and order-driven systems (e.g., NYSE, Nasdaq)

What is the Process of Trading Shares?

Investor contacts a stockbroker to open an account

Investor places an order via phone or internet

Types of orders: limit orders and market orders

Stockbroker executes the order via a counterparty

Settlement occurs, transferring ownership of shares for cash

Who are the Major Market Participants?

Buying and selling parties: individuals, institutions, fund managers

Fund Manager: Invests funds on behalf of clients

Stockbroker: Provides trading services, acts as a conduit or agent

Securities Exchange: Facilitates trading and self-regulation

What is Stock?

Stocks represent ownership in a company

Stock owners are entitled to a share of the corporation’s assets and profits

Investors provide cash to purchase shares, receiving a contract of ownership

Value growth realized upon selling stock; investors may also receive dividends

Why It Is Good to Own a Stock?

Potential for significant returns (e.g., Apple stock example)

Associated risks in stock ownership

What is Price?

Market Share Price: Price at which stocks are traded

Fluctuates based on supply and demand

Intrinsic Value: True value of a stock based on fundamentals

Focus on Dividend Discount Models and Value Multiples for identifying mispriced stocks

How can we use Intrinsic Value and Market Value?

Intrinsic Value (IV): True value according to a model

Market Value (MV): Consensus value represented by share price

Trading Recommendations:

IV > MV: Buy

IV < MV: Sell or Short Sell

IV = MV: Fairly Priced

What is the relationship between “No-Arbitrage” and “Security Prices”?

Security price must equal present value of cash flows to avoid arbitrage

A security price in finance refers to the current market value of a financial instrument, such as stocks, bonds, or derivatives.

Investors earn returns from dividends and capital gains

Share price reflects present value of future cash flows

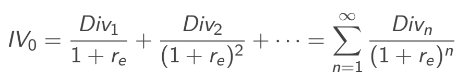

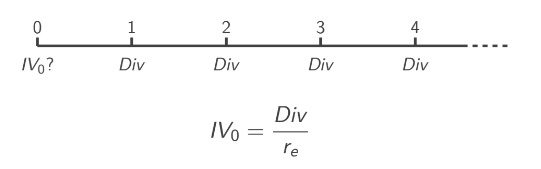

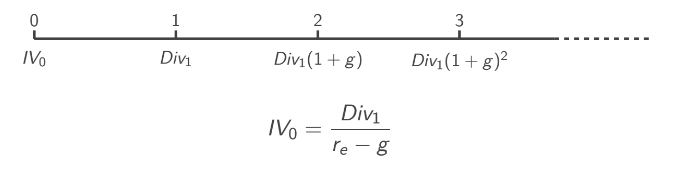

What is the “Dividend-Discount Model”?

Stock value = Present value of future expected cash flows (dividends)

Formula:

Discount rate (re): Expected return on similar risk securities

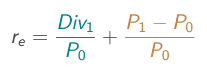

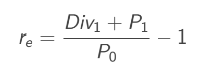

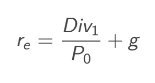

How to find ‘re’?

Total return = dividend yield + capital gain rate = equity cost of capital (re)

There’s 3 ways of representing this:

Other way is using Capital Asset Pricing Model (CAPM):

risk-free rate rf

market portfolio expected return E(Rmkt)

systematic risk B1

What are the other names for re?

cost of equity

required rate of return

cost of capital

How to estimate all future dividend payments?

Constant Dividend: Fixed dividends forever (perpetuity)

Constant Dividend Growth: Dividends grow at a constant rate

Changing Growth Rates: Initial high growth rates that stabilize over time, we have to use multistage DDM.

If dividend has a different timeframe than the cost or equity, make it equal to the cost of equity. e.g. a semi-annual dividend of $1.3 per share, and has an equity cost of capital equal to 12.4% p.a.

to calculate the IV of this stock, we have to times 1.3 by 2 to make it annual dividend then divided it for 12.4%.

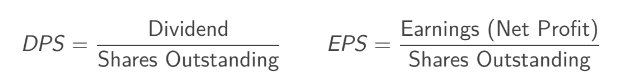

What can we find more about dividend?

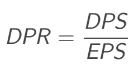

DPS: dividend per share

EPS: earning per share

Dividend payout ratio is the fraction of earnings paid as dividends each year.

How can firm increase its dividend?

assume the number of shares is constant:

increase its earnings (income)

increase its dividend payout rate

What can firm do if they had cash remaining?

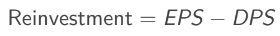

retain to reinvest the cash

pay dividends to shareholders

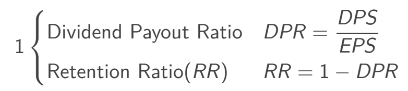

These ratios must add up to 100% (or $1):

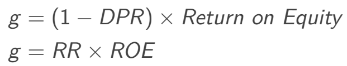

How to find ‘g’, the growth rate?

Growth rate (g) derived from earnings retention and payout

Formula:

DPR: Dividend Payout Ratio

RR: Retention Ratio

ROE: return on equity (in %)

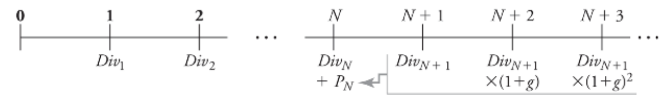

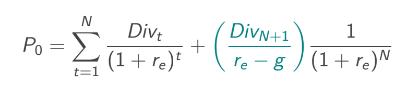

How to use the “Multistage DDM”?

Allows for multiple growth stages

Example: Two-stage growth model with initial high growth followed by stable growth

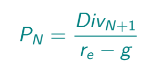

A terminal value represents the estimated value of an investment or project at the end of a forecast period, extending into perpetuity.

Terminal value

Value of the stock in multistage: the first part of this equation is the sum of all present value of growing dividend at the initial growth rate + the second part is the present value of terminal value (aka perpetuity under new changes) under the new growth rate.

Steps to find IV of multistage DDM:

Find the initial growth rate, EPS, DPS if not given.

Find the new growth rate

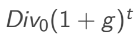

Find the dividend of each year incorporate the growth rate until the year with the change in growth rate (n). e.g. Div1 = 3.5 × 1.07 = 3.745; Div2 = 3.745 × 1.07 = 4.00715 and so on.

Using the same method in step 3, find the dividend in the new growth rate (divn+1). e.g. Div3 = 4.00715 × 1.023 = 4.099

Now to find the terminal value, apply the perpetuity formula using the “dividend under new growth rate” and the “new growth rate”. e.g. 4.099/(11.5%-2.3%)

Discount value of each dividends (of old growth rate) and the terminal value (n should = to the last dividend before change in growth rate, e.g. n = 2). Note: do not include the dividend under new growth rate because it is already used for perpetuity. e.g. 4.099 is not included.

Sum all the discounted value to find the IV.

What are the limitations of the Dividend-Discount Model?

Uncertainty in forecasting future earnings and dividends

Small changes in growth rate assumptions can significantly impact stock price estimates

Valuation Based on Comparable Firms

Method of Comparable: Value estimation based on similar firms

Valuation Multiple: Ratio of firm’s value to a measure of scale or cash flow

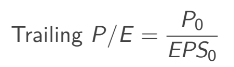

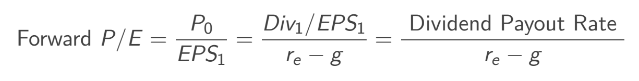

What are the Price-Earnings Ratio?

P/E Ratio: Share price divided by earnings per share

when asking to calculate the ratio, it meant both trailing and forward

Trailing P/E: earnings over the last 12 months

Forward P/E: expected earnings over the next 12 months

High growth firms typically have high P/E multiples

What are the Limitations of Multiples?

No clear guidance on adjusting for growth rates, risk, or accounting differences

Comparable provide relative value information only