Untitled Flashcards Set

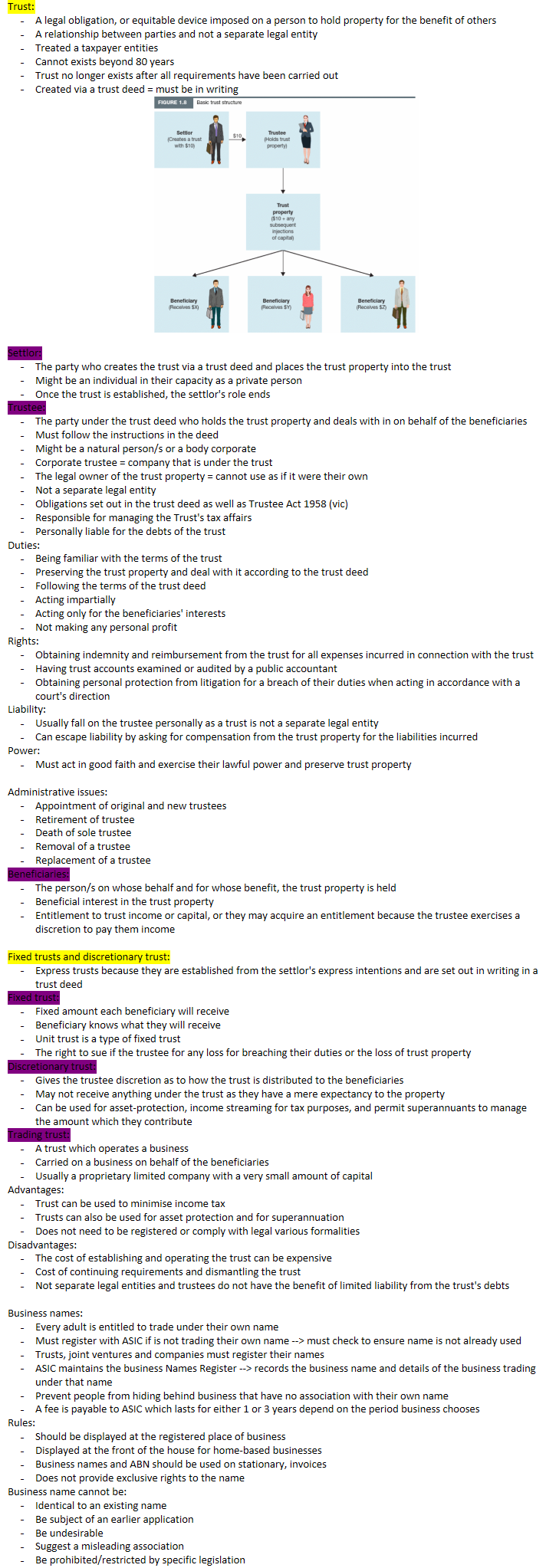

Trust:

A legal obligation, or equitable device imposed on a person to hold property for the benefit of others

A relationship between parties and not a separate legal entity

Treated a taxpayer entities

Cannot exists beyond 80 years

Trust no longer exists after all requirements have been carried out

Created via a trust deed = must be in writing

Settlor:

The party who creates the trust via a trust deed and places the trust property into the trust

Might be an individual in their capacity as a private person

Once the trust is established, the settlor's role ends

Trustee:

The party under the trust deed who holds the trust property and deals with in on behalf of the beneficiaries

Must follow the instructions in the deed

Might be a natural person/s or a body corporate

Corporate trustee = company that is under the trust

The legal owner of the trust property = cannot use as if it were their own

Not a separate legal entity

Obligations set out in the trust deed as well as Trustee Act 1958 (vic)

Responsible for managing the Trust's tax affairs

Personally liable for the debts of the trust

Duties:

Being familiar with the terms of the trust

Preserving the trust property and deal with it according to the trust deed

Following the terms of the trust deed

Acting impartially

Acting only for the beneficiaries' interests

Not making any personal profit

Rights:

Obtaining indemnity and reimbursement from the trust for all expenses incurred in connection with the trust

Having trust accounts examined or audited by a public accountant

Obtaining personal protection from litigation for a breach of their duties when acting in accordance with a court's direction

Liability:

Usually fall on the trustee personally as a trust is not a separate legal entity

Can escape liability by asking for compensation from the trust property for the liabilities incurred

Power:

Must act in good faith and exercise their lawful power and preserve trust property

Administrative issues:

Appointment of original and new trustees

Retirement of trustee

Death of sole trustee

Removal of a trustee

Replacement of a trustee

Beneficiaries:

The person/s on whose behalf and for whose benefit, the trust property is held

Beneficial interest in the trust property

Entitlement to trust income or capital, or they may acquire an entitlement because the trustee exercises a discretion to pay them income

Fixed trusts and discretionary trust:

Express trusts because they are established from the settlor's express intentions and are set out in writing in a trust deed

Fixed trust:

Fixed amount each beneficiary will receive

Beneficiary knows what they will receive

Unit trust is a type of fixed trust

The right to sue if the trustee for any loss for breaching their duties or the loss of trust property

Discretionary trust:

Gives the trustee discretion as to how the trust is distributed to the beneficiaries

May not receive anything under the trust as they have a mere expectancy to the property

Can be used for asset-protection, income streaming for tax purposes, and permit superannuants to manage the amount which they contribute

Trading trust:

A trust which operates a business

Carried on a business on behalf of the beneficiaries

Usually a proprietary limited company with a very small amount of capital

Advantages:

Trust can be used to minimise income tax

Trusts can also be used for asset protection and for superannuation

Does not need to be registered or comply with legal various formalities

Disadvantages:

The cost of establishing and operating the trust can be expensive

Cost of continuing requirements and dismantling the trust

Not separate legal entities and trustees do not have the benefit of limited liability from the trust's debts

Business names:

Every adult is entitled to trade under their own name

Must register with ASIC if is not trading their own name --> must check to ensure name is not already used

Trusts, joint ventures and companies must register their names

ASIC maintains the business Names Register --> records the business name and details of the business trading under that name

Prevent people from hiding behind business that have no association with their own name

A fee is payable to ASIC which lasts for either 1 or 3 years depend on the period business chooses

Rules:

Should be displayed at the registered place of business

Displayed at the front of the house for home-based businesses

Business names and ABN should be used on stationary, invoices

Does not provide exclusive rights to the name

Business name cannot be:

Identical to an existing name

Be subject of an earlier application

Be undesirable

Suggest a misleading association

Be prohibited/restricted by specific legislation