ACCT accrual and depreciation

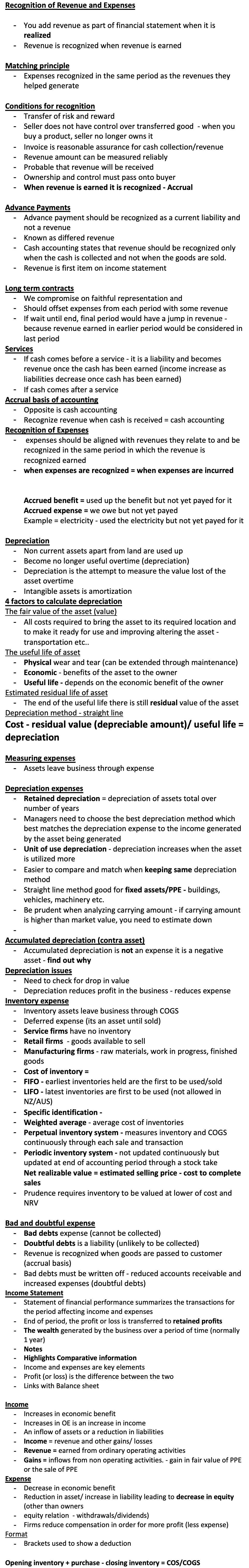

Recognition of Revenue and Expenses

You add revenue as part of financial statement when it is realized

Revenue is recognized when revenue is earned

Matching principle

Expenses recognized in the same period as the revenues they helped generate

Conditions for recognition

Transfer of risk and reward

Seller does not have control over transferred good - when you buy a product, seller no longer owns it

Invoice is reasonable assurance for cash collection/revenue

Revenue amount can be measured reliably

Probable that revenue will be received

Ownership and control must pass onto buyer

When revenue is earned it is recognized - Accrual

Advance Payments

Advance payment should be recognized as a current liability and not a revenue

Known as differed revenue

Cash accounting states that revenue should be recognized only when the cash is collected and not when the goods are sold.

Revenue is first item on income statement

Long term contracts

We compromise on faithful representation and

Should offset expenses from each period with some revenue

If wait until end, final period would have a jump in revenue - because revenue earned in earlier period would be considered in last period

Services

If cash comes before a service - it is a liability and becomes revenue once the cash has been earned (income increase as liabilities decrease once cash has been earned)

If cash comes after a service

Accrual basis of accounting

Opposite is cash accounting

Recognize revenue when cash is received = cash accounting

Recognition of Expenses

expenses should be aligned with revenues they relate to and be recognized in the same period in which the revenue is recognized earned

when expenses are recognized = when expenses are incurred

Accrued benefit = used up the benefit but not yet payed for it

Accrued expense = we owe but not yet payed

Example = electricity - used the electricity but not yet payed for it

Depreciation

Non current assets apart from land are used up

Become no longer useful overtime (depreciation)

Depreciation is the attempt to measure the value lost of the asset overtime

Intangible assets is amortization

4 factors to calculate depreciation

The fair value of the asset (value)

All costs required to bring the asset to its required location and to make it ready for use and improving altering the asset - transportation etc..

The useful life of asset

Physical wear and tear (can be extended through maintenance)

Economic - benefits of the asset to the owner

Useful life - depends on the economic benefit of the owner

Estimated residual life of asset

The end of the useful life there is still residual value of the asset

Depreciation method - straight line

Cost - residual value (depreciable amount)/ useful life = depreciation

Measuring expenses

Assets leave business through expense

Depreciation expenses

Retained depreciation = depreciation of assets total over number of years

Managers need to choose the best depreciation method which best matches the depreciation expense to the income generated by the asset being generated

Unit of use depreciation - depreciation increases when the asset is utilized more

Easier to compare and match when keeping same depreciation method

Straight line method good for fixed assets/PPE - buildings, vehicles, machinery etc.

Be prudent when analyzing carrying amount - if carrying amount is higher than market value, you need to estimate down

Accumulated depreciation (contra asset)

Accumulated depreciation is not an expense it is a negative asset - find out why

Depreciation issues

Need to check for drop in value

Depreciation reduces profit in the business - reduces expense

Inventory expense

Inventory assets leave business through COGS

Deferred expense (its an asset until sold)

Service firms have no inventory

Retail firms - goods available to sell

Manufacturing firms - raw materials, work in progress, finished goods

Cost of inventory =

FIFO - earliest inventories held are the first to be used/sold

LIFO - latest inventories are first to be used (not allowed in NZ/AUS)

Specific identification -

Weighted average - average cost of inventories

Perpetual inventory system - measures inventory and COGS continuously through each sale and transaction

Periodic inventory system - not updated continuously but updated at end of accounting period through a stock take

Net realizable value = estimated selling price - cost to complete sales

Prudence requires inventory to be valued at lower of cost and NRV

Bad and doubtful expense

Bad debts expense (cannot be collected)

Doubtful debts is a liability (unlikely to be collected)

Revenue is recognized when goods are passed to customer (accrual basis)

Bad debts must be written off - reduced accounts receivable and increased expenses (doubtful debts)

Income Statement

Statement of financial performance summarizes the transactions for the period affecting income and expenses

End of period, the profit or loss is transferred to retained profits

The wealth generated by the business over a period of time (normally 1 year)

Notes

Highlights Comparative information

Income and expenses are key elements

Profit (or loss) is the difference between the two

Links with Balance sheet

Income

Increases in economic benefit

Increases in OE is an increase in income

An inflow of assets or a reduction in liabilities

Income = revenue and other gains/ losses

Revenue = earned from ordinary operating activities

Gains = inflows from non operating activities. - gain in fair value of PPE or the sale of PPE

Expense

Decrease in economic benefit

Reduction in asset/ increase in liability leading to decrease in equity (other than owners

equity relation - withdrawals/dividends)

Firms reduce compensation in order for more profit (less expense)

Format

Brackets used to show a deduction

Opening inventory + purchase - closing inventory = COS/COGS

Knowt

Knowt