Lecture 9

HAC Standard Errors

Autocorrelation refers to the correlation of a variable with itself over time intervals

Objective: Implement statistical inference for regression coefficients under heteroskedasticity and autocorrelation.

White's Robust Standard Error: Useful for heteroskedasticity but fails under autocorrelation. Thus, HAC SE expands by including autocorrelation when both issues present in the error terms.

Heteroskedasticity- and Autocorrelation-Consistent (HAC) Standard Error:

Also known as Newey-West standard error.

Suitable for estimating SE(( \hat{\beta}_j )) in the presence of both heteroskedasticity and autocorrelation.

HAC SE is another type of robust SE.

Implementation in R

Function:

vcovHACin the sandwich package allows for different versions of HAC standard errors.Example for simple regression model:

[ yt = \alpha + \beta xt + u_t ]OLS estimation in R:

fm = lm(y ~ x)HAC estimation:

vcovHAC(fm)

Statistical Inference Using HAC Standard Errors

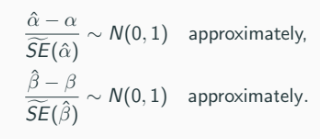

For computed HAC standard errors: [ \hat{\alpha} - \alpha \sim N(0, 1), \quad \hat{\beta} - \beta \sim N(0, 1) ]

Allows for standard statistical inference.

Asymptotic Properties of OLS Estimator

Without normality of ( u_t ), still maintain: [ \hat{\alpha}-\alpha \sim N(0, 1) \quad \text{and} \quad \hat{\beta} - \beta \sim N(0, 1) ]

Valid under large sample sizes.

Being normally distributed for the error term (as sample size grows) and independent of X (TS6)

Conditions Under Non-Normality

Asymptotic properties can be maintained under mild conditions.

OLS estimators become consistent as sample size ( T ) approaches infinity.

Stochastic Regressors

Many applications inaccurately treat regressors as non-stochastic.

Stochastic nature means that ( E[ut|xt] = 0 ) must be satisfied for OLS estimators to remain consistent.

The correlation between ( xt ) and ( ut ) becomes crucial.

Endogeneity

Often arises from omitted variables or measurement error.

Violates the exogeneity condition ( Cov(x{jt}, ut) = 0 ).

Sources of Endogeneity

Omitted Variable: Fails to include a relevant variable, resulting in correlated residuals.

Measurement Error: Improper measurement of regressors leads to correlations that disrupt consistency.

Endogeneity Bias

Impacts the estimates: [ \hat{\beta}2 = \frac{Cov(x{2,t}, yt)}{Var(x{2,t})} ]

If ( Cov(x{2,t}, ut) \neq 0 ), then bias occurs. The OLS estimators become inconsistent.

Example of Endogeneity

In empirical CAPM, substituting market portfolio returns with a specific index fund can introduce bias due to measurement error.

If the proxy is poor, it leads to an underestimation of the actual parameters.

Instrumental Variable (IV) Estimator

Used to address endogeneity in regression models.

Requires a third variable (instrument) that is correlated with the regressor but not with the error term.

Confirming IV Validity and Relevance

Validity: Requires testing that the instrument does not correlate with the error term.

Relevance: Test whether the instrument is correlated with the regressor (i.e., usefulness of the instrument).

[ Cov(xt, zt) \neq 0 \text{ (relevance)} \quad \text{and} \quad Cov(zt, ut) = 0 \text{ (validity)} ]

Final Notes on Inference Using IV

If the IV method is applicable, the estimators lead to valid inferences similar to OLS under correct circumstances.

Statistical inference can still proceed as long as the conditions of relevance and validity hold true.