Chapter 2

Chapter Overview

Describe an Account and Its Use in Recording Transactions

An account systematically records increases and decreases in assets, liabilities, equity, revenue, or expenses.

Each account reflects individual transactions impacting financial positions.

Define Debits and Credits and Explain Double-entry Accounting

Debits and Credits: Terms used to record financial transactions, ensuring that for every entry made, there is a corresponding and opposite entry (double-entry accounting).

Compute the Debt Ratio and Describe Its Use

The debt ratio provides insight into a company's financial condition. It reflects the proportion of a company's assets that are financed by debt.

Prepare Financial Statements from a Trial Balance

Financial statements summarize the financial position, performance, and cash flows of a business.

Key Concepts

Basis of Financial Statements

Financial Statements: Begin with identifying business transactions from source documents.

Steps to financial statements:

Identify transactions from source documents.

Analyze transactions using the accounting equation.

Record transactions in a journal.

Post journal entries to ledger accounts.

Prepare and analyze trial balance and financial statements.

Source Documents

Definition: Documents that identify detailed transactions entering the accounting system.

Examples:

receipts

checks

purchase orders

bills from suppliers

payroll records

bank statements

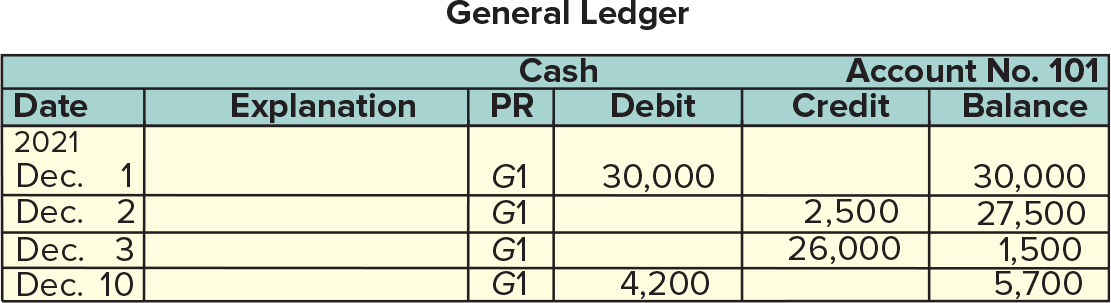

The General Ledger

General Ledger: Record of all accounts and their balances, aiding in the organization of a company’s financial data.

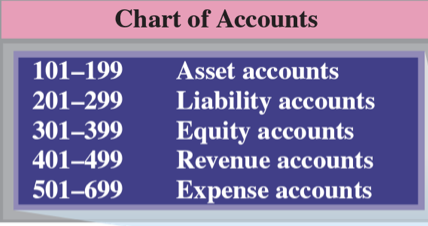

A chart of accounts lists all accounts with identification numbers for organizational purposes.

Accounts Overview

Asset Accounts

Include:

Cash

Accounts Receivable: held by the seller, and are promises of payment from customers to sellers. Increased by credit sales and decreased by customer payments

Notes Receievable: a promissory note that promises another entity to pay a specific sum of money on a specified future date to the holder of the note

Land

Equipment

Supplies

Prepaid Accounts (unexpired prepaid accounts)

Buildings: allocated over time to expense called depreciation

Liability Accounts

Include:

Accounts Payable: promises to pay later

come from purchases on credit like supplies, equipment, and services

Notes Payable: promissory note to pay a future amount (formal contract); also requires interest

Unearned Revenue: customers pay in advance for products or services

Accrued Liabilities: amounts owed that are not yet paid

Equity Accounts

Include:

Owner's Capital

Owner's Withdrawals

Revenues

Expenses (expired prepaid account)

Common Stock

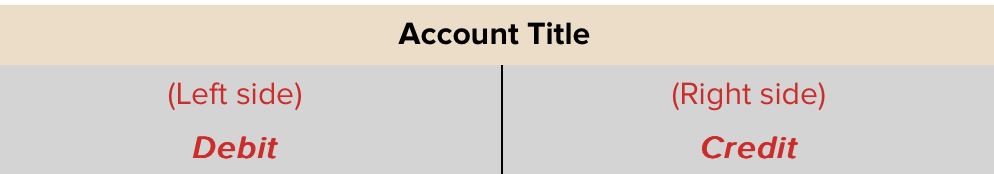

T-accounts (ledger account)

A visual representation to show the effects of transactions on individual accounts, where debits are on the left and credits are on the right.

The difference between total debits and credits for an account, including the beginning balance is the account balance

Debit (money added): when total debits is more than total credits, the account has a debit balance, meaning it has more money in it

Credit (money taken out): when total credits is more than total debits, the account has a credit balance, meaning it owes money or it has less in the account

If debit and credit are equal it has a zero balance

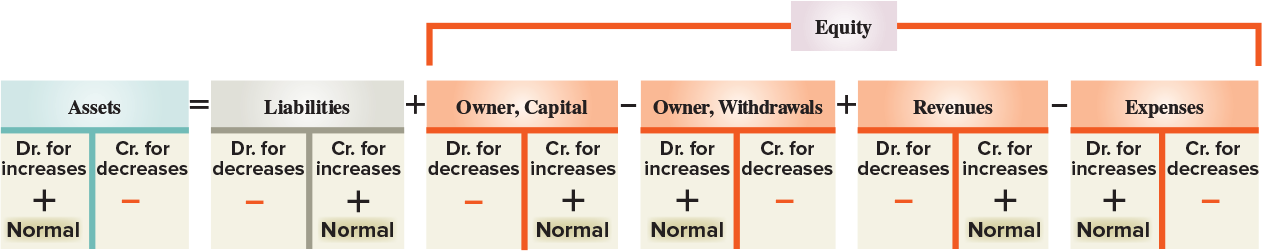

Double-Entry System

Explanation

Double entry accounting: the accounting equation must remain in balance for each transaction

Always atleast two accounts involved, one with debit and one with credit

Total amount debited must equal total amount credited

Assets on the left side of the equation increase on the left

Liabilities/equity on the right side of the equation increase on the right

Increases (credits) to owners capital/revenue increase equity

Increases (debits) to withdrawals and expenses decrease equity

normal balance for each account is side where increases are recorded

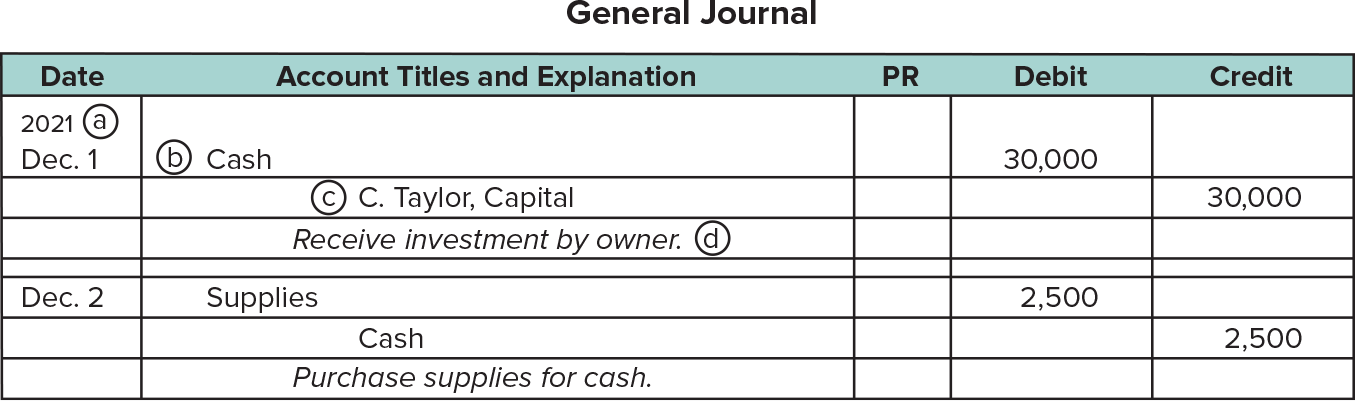

Journalizing and Posting Transactions

Journal: is a complete record of each transaction in one place (shows debits and credits for each transaction)

Transactions are entered in chronological order

Recording transactions/ posting a transaction is journalizing

The transfer of journal entry information to the ledger is called posting

Record transactions with a structured format that includes:

Transaction date

Titles of accounts debited and credited

Amounts in respective columns

Explanatory notes

General Journal

used to record any transaction

Steps in Processing transactions

Identify transactions from source documents.

Analyze the impact on the accounting equation.

Record the journal entry.

Post the entry to ledger accounts using T-accounts for illustration.

Preparing Financial Statements

Trial Balance Preparation

Trial balance: list of all ledger accounts and their balances at a point in time (not a financial account)

Process includes:

Listing account titles and their amounts from the ledger.

Computing total debits and credits to ensure they match.

Verifying that the total debits equal total credits.

Error Checking in Trial Balance

If the trial balance does not balance, follow a checklist to find and correct errors, ensuring all entries are accurate, added correctly, and that each journal entry maintains matching debits and credits.

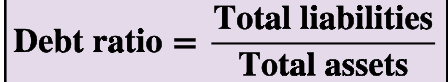

Debt Ratio

Definition: The debt ratio is a financial metric that measures the proportion of a company's total debt to its total assets, indicating the degree of leverage used by the company.

Debt Ratio Formula:

Indicates the level of debt risk and influences financial analysis.

A higher ratio suggests a greater risk of default on debts.