Lecture_12

Definition of Pollution: Significant global issue, notably in urban areas of the U.S., with health costs exceeding $100 billion annually.

Common Sources of Pollution:

Coal-fired power plants.

Others include:

Noise from parties.

Secondhand smoke.

Litter from neighbors.

Market Failure: Indications of inefficiencies in market transactions due to external costs.

Efficient markets consider both private and social costs/benefits.

Example: A smoker's enjoyment in a park versus the impact on others' health.

Externalities are costs or benefits affecting uninvolved third parties.

Types of Externalities:

Negative Externality: Cost imposed on an uninvolved party.

Examples:

Air pollution affecting health.

Under-vaccination leading to disease spread.

A concert-goer's obstructive hat.

Positive Externality: Benefit conferred on an uninvolved party.

Examples:

Beekeeping supports local agriculture through pollination.

A neighbor's well-maintained lawn enhances community aesthetics.

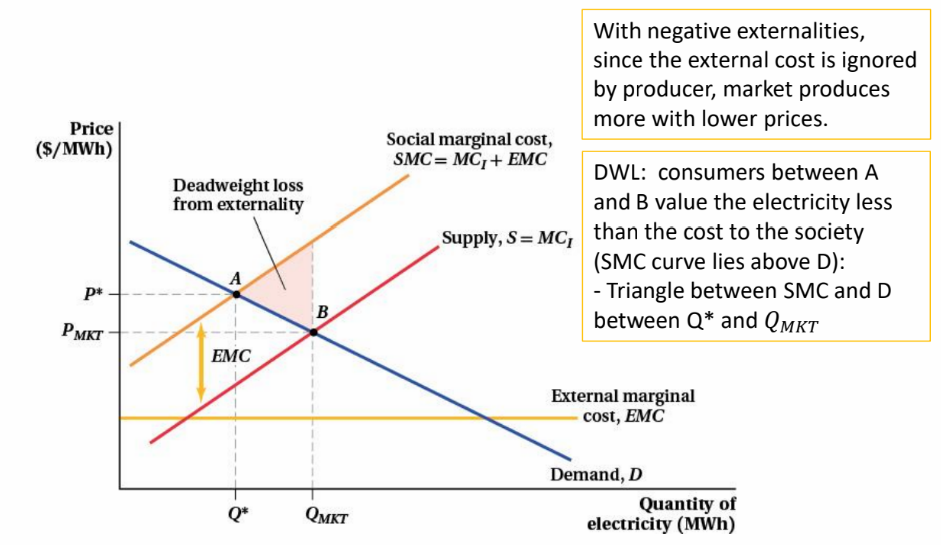

Social Costs vs. Private Costs:

Social Cost (SMC) = Private Cost + External Cost.

Social Benefit (SMB/SD) = Private Benefit + External Benefit.

External Marginal Cost (EMC), cost imposed on a third party when an additional unit of good is produced or consumed

External Marginal Benefit (EMB), the benefit conferred on third party when an additional unit of good is produced or consumed

Both affect the outcome of market transactions.

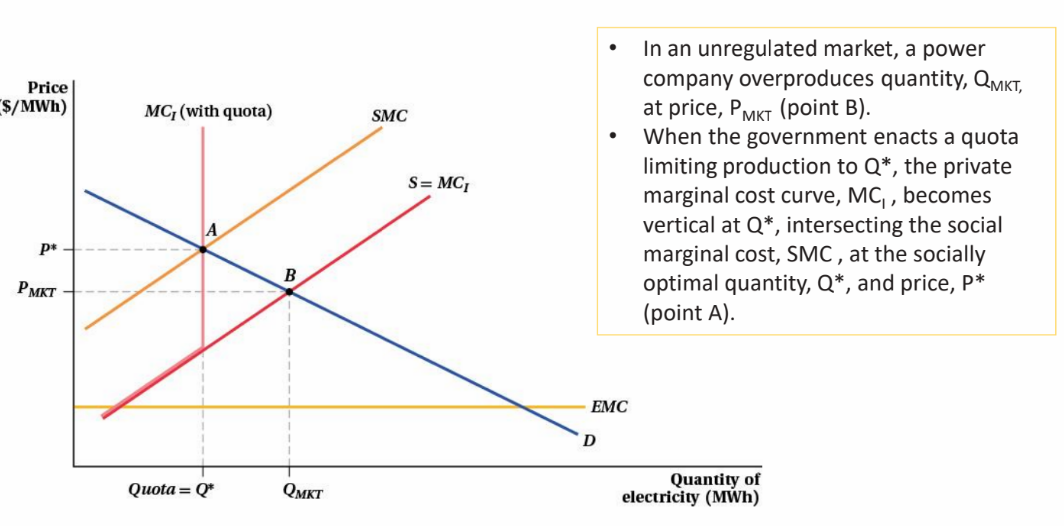

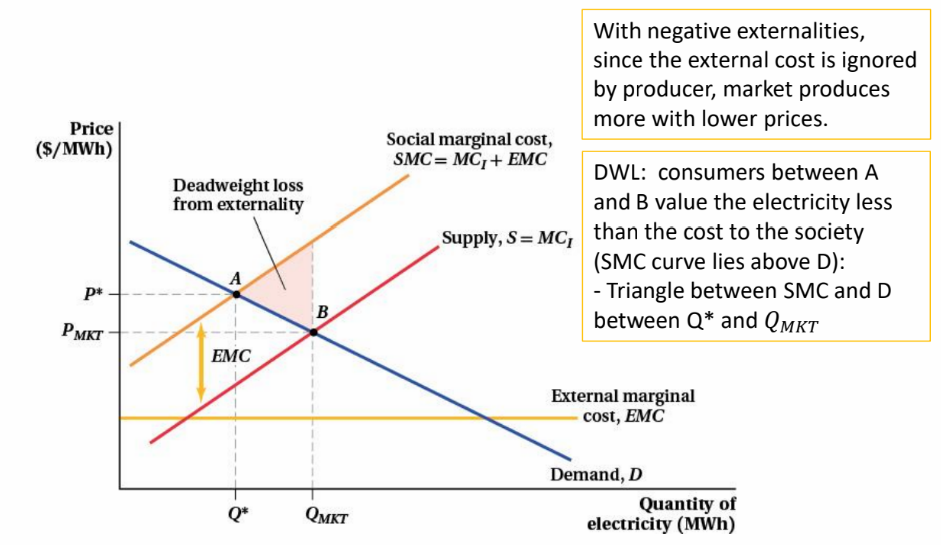

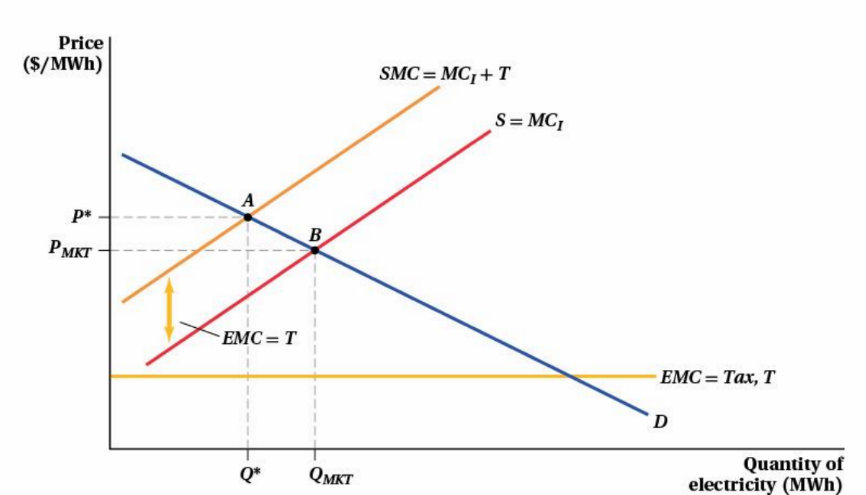

Example: Coal-Fired Power Plants

Produce electricity but emit pollutants harming health and environment.

Economic inefficiencies arise as the true societal costs are overlooked.

Market dynamics lead to overproduction due to ignorance of external costs from firms.

Graphical Analysis

DWL represents the social cost associated with the compeittive outcome in the presence of an externatlity.

The magnitude of DWL depends on:

size of externality EMC

Product that wouldn’t be bought if the price reflected the true social cost (Qmkt - Q*)

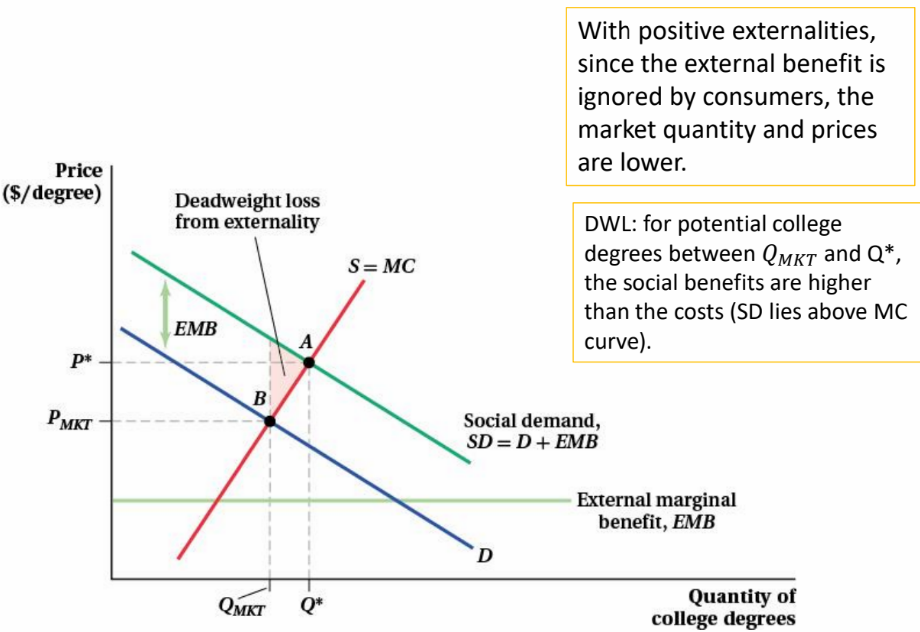

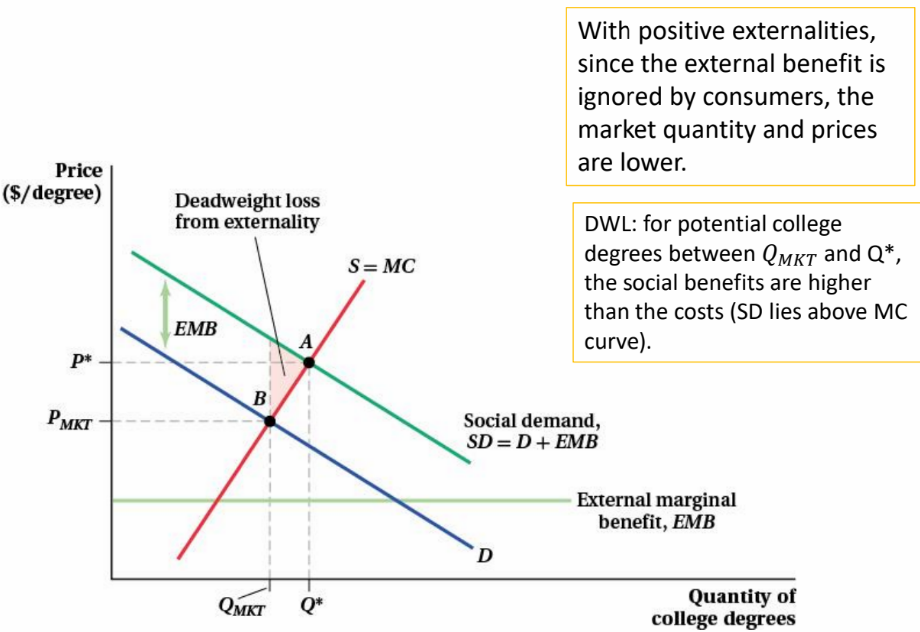

Marginal social benefit of an economy activity higher than the private marginal benefit. (the demand curve).

Example: Education

Education benefits not only individuals through higher earnings but also society through increased innovation and economic activity.

Graphical Representation: Marginal social benefits of education exceed private marginal benefits due to unaccounted external benefits.

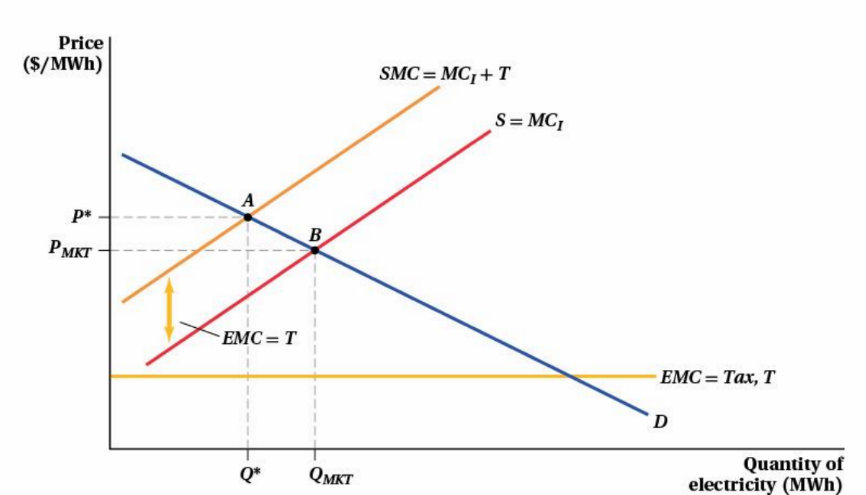

Strategies to address externalities, align with socially efficient include:

Taxes (for negative externalities to internalize costs).

Subsidies (for positive externalities to encourage usage).

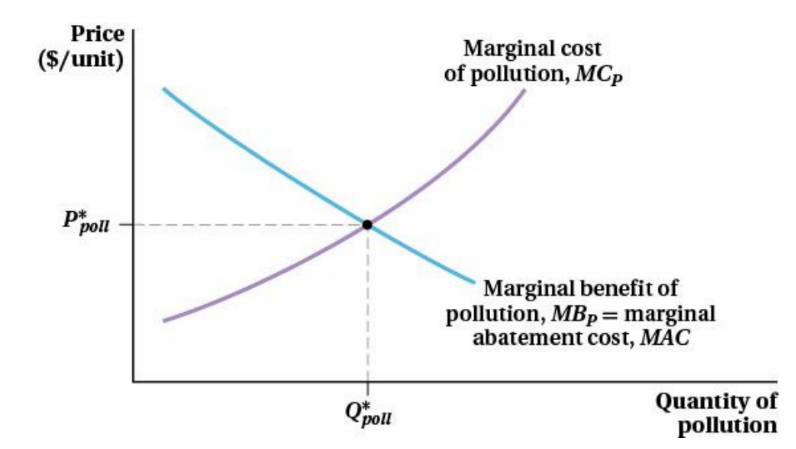

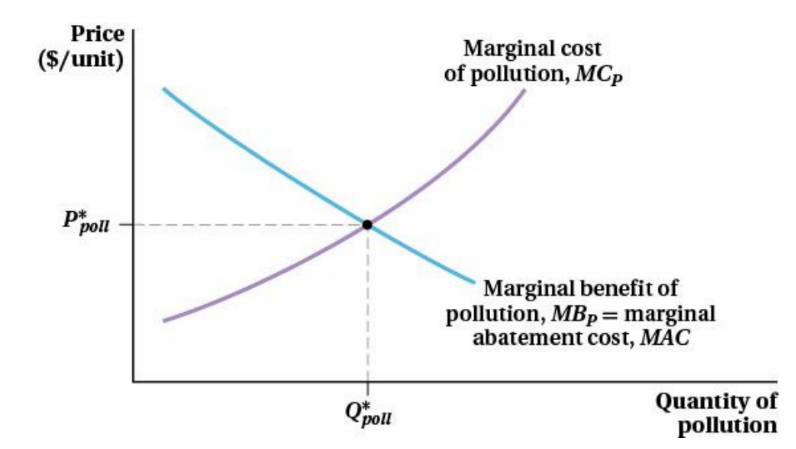

The efficient level of pollution balances benefits from production against health/environmental costs.

Pollution, a level of emissions necessary to produce the efficient quantity where demand = marginal social cost.

Benefits of pollution: require pollution to produce

costs of pollution: cost to human health and environment.

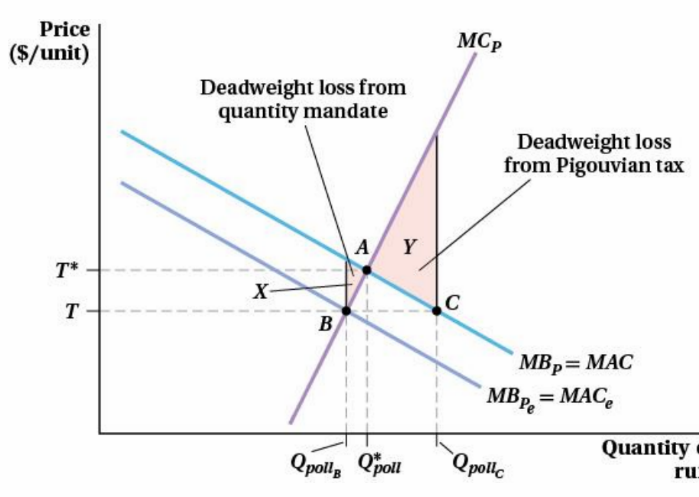

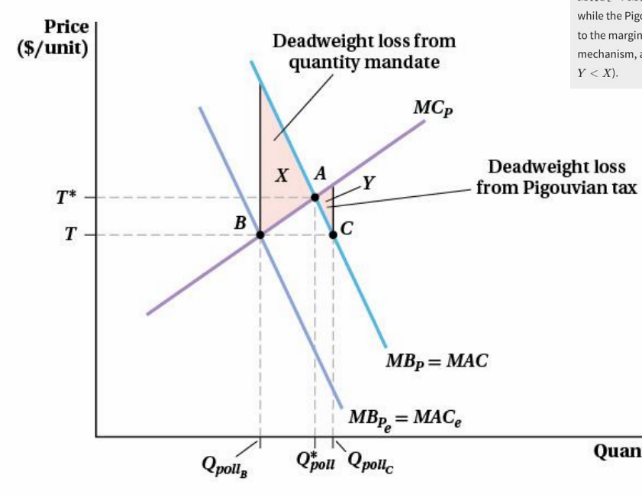

MCp: higher levels of pollution emission are more costly to society

MBp: higher pollution are associated with high levels of production thus lower market prices.

Marginal abetment cost (MAC) cost of reducing pollution by one unit which includes tech costs and forgone costs.

The intersection is the efficient level of pollution, where MCp=MBp=MAC.

Pigouvian Tax: Aims to correct negative externalities by raising production prices to account for external costs, to correct negative externalities.

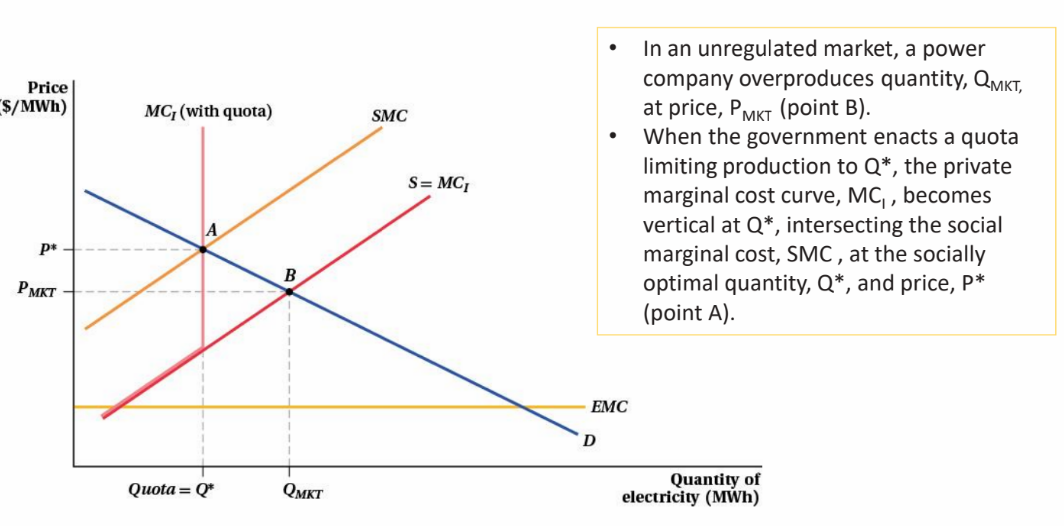

Pigouvian Subsidy: Quantitative mechanisms (quotas) can be implemented to regulate the amount of goods produced to optimal levels, to correct positive externalities.

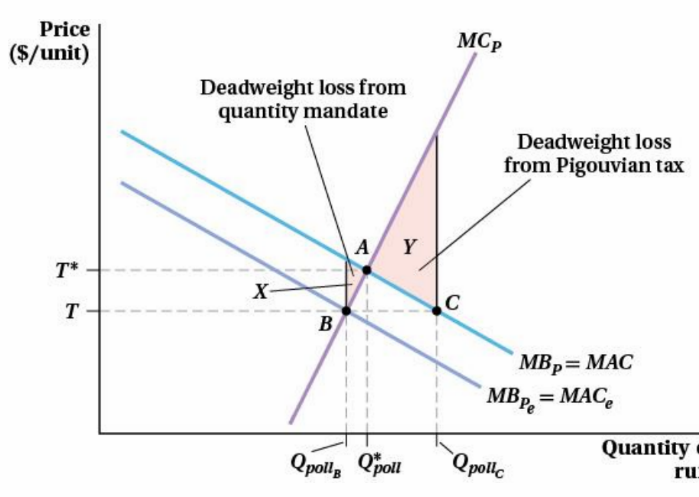

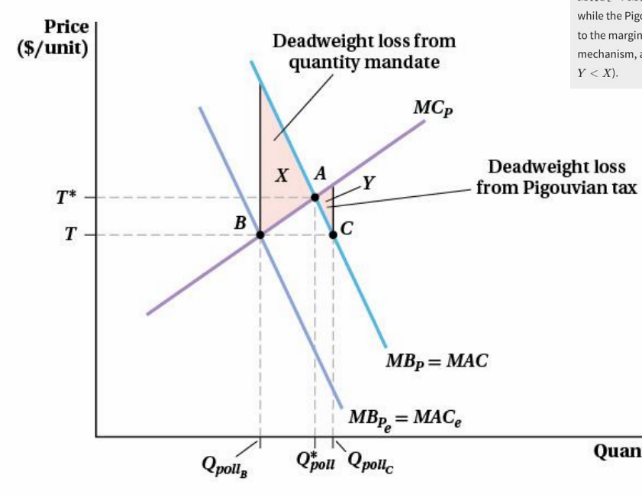

With perfect information, both methods are equally effective in controlling externalities. Without it:

costs of controlling externalities (marginal abatement costs) are difficult to implement

benefit of controlling externalities are difficult to estimate.

—> when there is uncertainty in marginal abatement costs, price and quantity mechanisms are not equivalent.

Under a pollution permit system: firms are forced to abate a fixed amount of pollution.

under a pollution tax system, firms will abate less pollution, limit pollution until the additional cost of reducing one more unit of pollution is equal to the tax.

If MB is flatter relative to MC: use quantity-based intervention.

Flatter MB means agents are very sensitive to prices so setting wrong prices create larger DWL.

If MB is steeper relative to MC: use price bases innervations.

Steeper MB means agents are very sensitive to quantities, setting wrong quantity create larger DWL.

Instead of setting price or quantity which takes a lot of effort, regulatory agencies can issue tradeable permits to control population.

government issued permit that allows a firm to emit a certain amount of pollution that can be traded to other firms.

High-cost firms purchase permits form low-cost firms until no mutually beneficial trades remain.

Market clearing price of permits will be equal to MAC for each firm.

States that with low negotiation costs, private parties can achieve efficient outcomes regardless of property rights holder.

doesn’t matter who own the property rights.

outcomes can be monitored, and individuals can coordinate and negotiate at low enough cost.

coordination is often very difficult, particularly with many participants and information’s problems

Important for designing pollution control regulations and tradable permits.

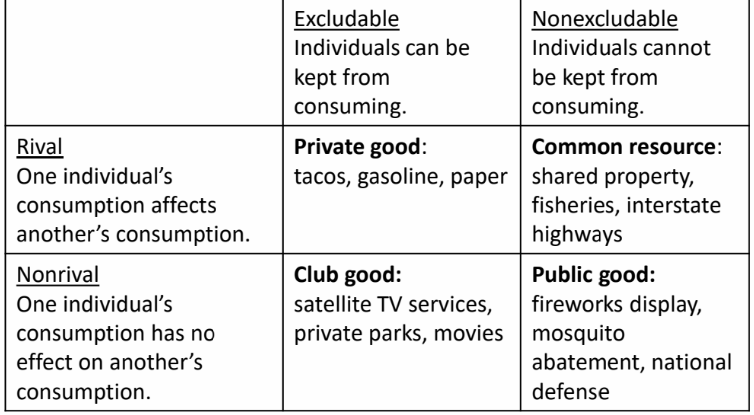

Nonexcludable: No user can be excluded from consumption.

Nonrival: One individual's consumption does not affect that of another.

Examples include national defense and public parks.

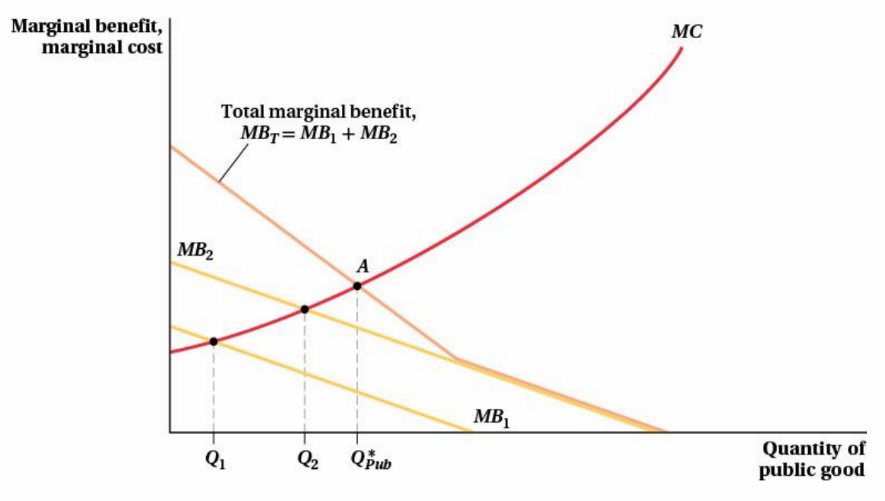

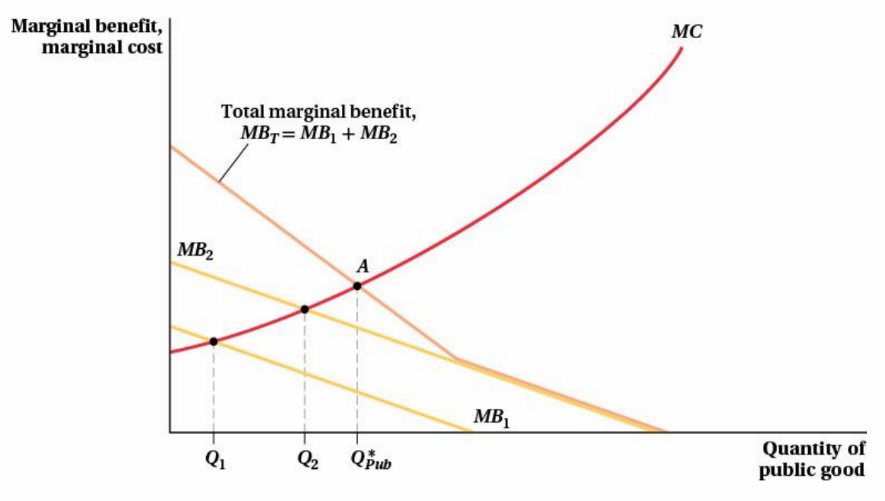

the marginal benefit of a public good is the vertical sum of all individuals’ marginal benefit curves.

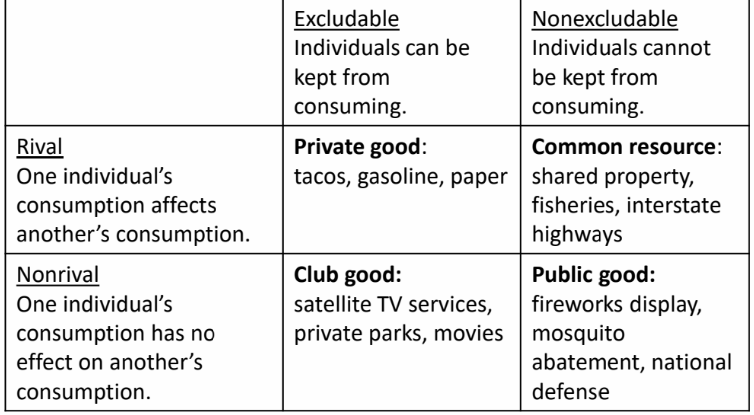

Private Goods: Rival and excludable.

Common Resources: Rival but nonexcludable.

Club Goods: Nonrival but excludable.

Pure Public Goods: Nonrival and nonexcludable.

Individual purchase the good for themselves and only so until private marginal benefit equals marginal cost.

The efficient level occurs when the total marginal benefits = marginal cost

Arises when individuals consume a public good without contributing to its cost, leading to under-provision.

Government intervention: Taxes help finance public goods.

Private solutions: Community groups can provide public goods collectively.

A dilemma showcasing how shared resources are overused due to non-excludability. e.g. public restrooms.

This is a form of negative externality.

Solutions include implementing Pigouvian taxes, quotas, and defining property rights to mitigate overuse.

Definition of Pollution: Significant global issue, notably in urban areas of the U.S., with health costs exceeding $100 billion annually.

Common Sources of Pollution:

Coal-fired power plants.

Others include:

Noise from parties.

Secondhand smoke.

Litter from neighbors.

Market Failure: Indications of inefficiencies in market transactions due to external costs.

Efficient markets consider both private and social costs/benefits.

Example: A smoker's enjoyment in a park versus the impact on others' health.

Externalities are costs or benefits affecting uninvolved third parties.

Types of Externalities:

Negative Externality: Cost imposed on an uninvolved party.

Examples:

Air pollution affecting health.

Under-vaccination leading to disease spread.

A concert-goer's obstructive hat.

Positive Externality: Benefit conferred on an uninvolved party.

Examples:

Beekeeping supports local agriculture through pollination.

A neighbor's well-maintained lawn enhances community aesthetics.

Social Costs vs. Private Costs:

Social Cost (SMC) = Private Cost + External Cost.

Social Benefit (SMB/SD) = Private Benefit + External Benefit.

External Marginal Cost (EMC), cost imposed on a third party when an additional unit of good is produced or consumed

External Marginal Benefit (EMB), the benefit conferred on third party when an additional unit of good is produced or consumed

Both affect the outcome of market transactions.

Example: Coal-Fired Power Plants

Produce electricity but emit pollutants harming health and environment.

Economic inefficiencies arise as the true societal costs are overlooked.

Market dynamics lead to overproduction due to ignorance of external costs from firms.

Graphical Analysis

DWL represents the social cost associated with the compeittive outcome in the presence of an externatlity.

The magnitude of DWL depends on:

size of externality EMC

Product that wouldn’t be bought if the price reflected the true social cost (Qmkt - Q*)

Marginal social benefit of an economy activity higher than the private marginal benefit. (the demand curve).

Example: Education

Education benefits not only individuals through higher earnings but also society through increased innovation and economic activity.

Graphical Representation: Marginal social benefits of education exceed private marginal benefits due to unaccounted external benefits.

Strategies to address externalities, align with socially efficient include:

Taxes (for negative externalities to internalize costs).

Subsidies (for positive externalities to encourage usage).

The efficient level of pollution balances benefits from production against health/environmental costs.

Pollution, a level of emissions necessary to produce the efficient quantity where demand = marginal social cost.

Benefits of pollution: require pollution to produce

costs of pollution: cost to human health and environment.

MCp: higher levels of pollution emission are more costly to society

MBp: higher pollution are associated with high levels of production thus lower market prices.

Marginal abetment cost (MAC) cost of reducing pollution by one unit which includes tech costs and forgone costs.

The intersection is the efficient level of pollution, where MCp=MBp=MAC.

Pigouvian Tax: Aims to correct negative externalities by raising production prices to account for external costs, to correct negative externalities.

Pigouvian Subsidy: Quantitative mechanisms (quotas) can be implemented to regulate the amount of goods produced to optimal levels, to correct positive externalities.

With perfect information, both methods are equally effective in controlling externalities. Without it:

costs of controlling externalities (marginal abatement costs) are difficult to implement

benefit of controlling externalities are difficult to estimate.

—> when there is uncertainty in marginal abatement costs, price and quantity mechanisms are not equivalent.

Under a pollution permit system: firms are forced to abate a fixed amount of pollution.

under a pollution tax system, firms will abate less pollution, limit pollution until the additional cost of reducing one more unit of pollution is equal to the tax.

If MB is flatter relative to MC: use quantity-based intervention.

Flatter MB means agents are very sensitive to prices so setting wrong prices create larger DWL.

If MB is steeper relative to MC: use price bases innervations.

Steeper MB means agents are very sensitive to quantities, setting wrong quantity create larger DWL.

Instead of setting price or quantity which takes a lot of effort, regulatory agencies can issue tradeable permits to control population.

government issued permit that allows a firm to emit a certain amount of pollution that can be traded to other firms.

High-cost firms purchase permits form low-cost firms until no mutually beneficial trades remain.

Market clearing price of permits will be equal to MAC for each firm.

States that with low negotiation costs, private parties can achieve efficient outcomes regardless of property rights holder.

doesn’t matter who own the property rights.

outcomes can be monitored, and individuals can coordinate and negotiate at low enough cost.

coordination is often very difficult, particularly with many participants and information’s problems

Important for designing pollution control regulations and tradable permits.

Nonexcludable: No user can be excluded from consumption.

Nonrival: One individual's consumption does not affect that of another.

Examples include national defense and public parks.

the marginal benefit of a public good is the vertical sum of all individuals’ marginal benefit curves.

Private Goods: Rival and excludable.

Common Resources: Rival but nonexcludable.

Club Goods: Nonrival but excludable.

Pure Public Goods: Nonrival and nonexcludable.

Individual purchase the good for themselves and only so until private marginal benefit equals marginal cost.

The efficient level occurs when the total marginal benefits = marginal cost

Arises when individuals consume a public good without contributing to its cost, leading to under-provision.

Government intervention: Taxes help finance public goods.

Private solutions: Community groups can provide public goods collectively.

A dilemma showcasing how shared resources are overused due to non-excludability. e.g. public restrooms.

This is a form of negative externality.

Solutions include implementing Pigouvian taxes, quotas, and defining property rights to mitigate overuse.