Ch4 Regression Models

Chapter 4: Regression Models

Course: ISOM 201 Data & Decision Analysis

Instructor: Dr. Yuanxiang John Li

Affiliation: Sawyer Business School, Suffolk University, Boston

4.1 Chapter Outline

4.1 Scatter Diagrams: Visual tool to show relationships between variables

4.2 Simple Linear Regression: Involves one dependent and one independent variable

4.3 Measuring the Fit of the Regression Model: Techniques to evaluate model performance

4.4 Assumptions of the Regression Model: Necessary conditions for valid statistical tests

4.5 Testing the Model for Significance: Assessing the relationship between variables

4.6 Using Computer Software for Regression: Use of software tools for analyses

4.7 Multiple Regression Analysis: Models incorporating multiple independent variables

4.8 Binary or Dummy Variables: Treatment of qualitative data in regression

4.9 Model Building: Strategies for constructing effective models

4.10 Nonlinear Regression: Models addressing non-linear relationships

4.11 Cautions and Pitfalls in Regression Analysis: Important considerations and common mistakes

4.2 Introduction to Regression Analysis (1 of 2)

Purpose of Regression Analysis:

An invaluable tool for managers.

Used to understand relationships between variables.

Utilize in predicting variable values based on others.

Types of Regression Models:

Simple Linear Regression: Contains only two variables (one dependent and one independent).

Multiple Regression Models: Involves more than one independent variable.

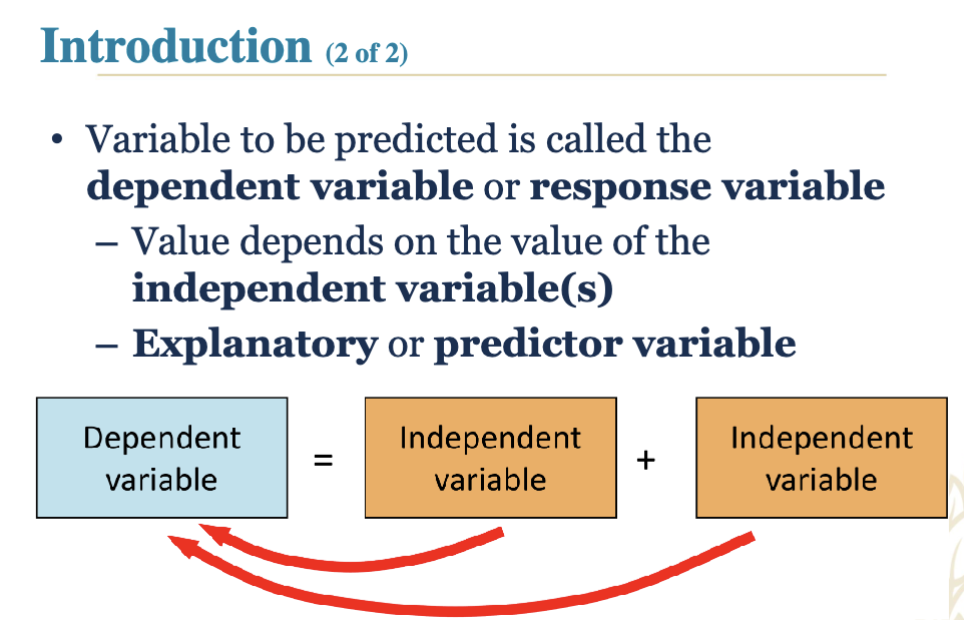

4.3 Introduction to Regression Analysis (2 of 2)

Dependent Variable:

Also known as the response variable.

Its value is influenced by the independent variable(s).

Independent Variable(s):

Known as predictor or explanatory variables, they are used to predict the dependent variable.

Explanatory or Predictor variable

4.4 Scatter Diagram

Definition: A graphical representation to investigate relationships between variables.

Axes:

Independent variable plotted on the X-axis.

Dependent variable plotted on the Y-axis.

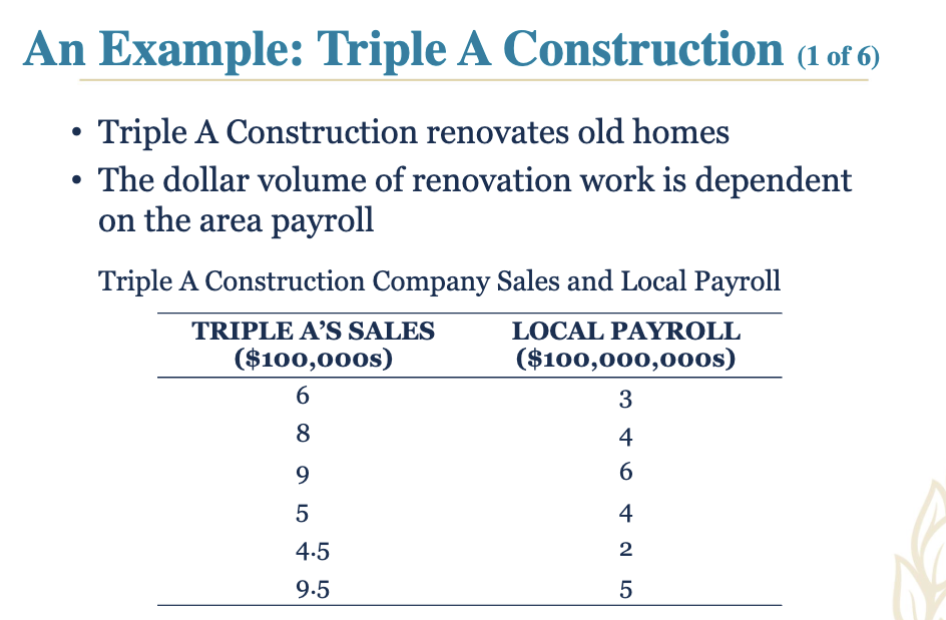

4.5 Example: Triple A Construction (1 of 6)

Case Context:

Triple A Construction specializes in home renovation.

The renovation dollar volume depends on the area payroll.

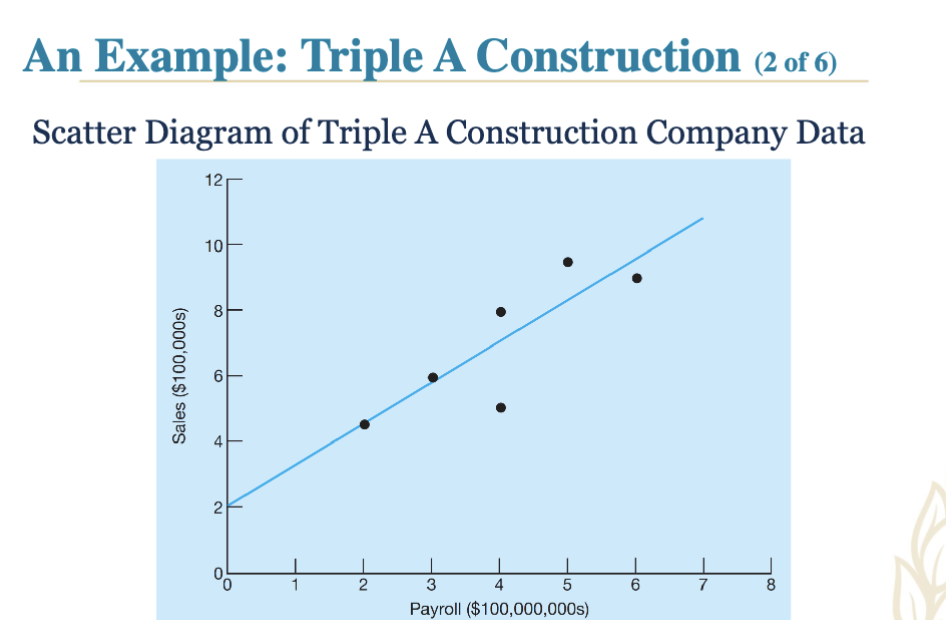

4.6 Example: Triple A Construction (2 of 6)

Data Representation: Scatter diagram is created from company sales versus local payroll data.

4.7 Simple Linear Regression (1 of 2)

Model Structure:

Simple linear regression has one dependent and one independent variable:

Y = β0 + β1X + e

Y: dependent variable (response)

X: independent variable (predictor)

β0: intercept (Y value when X = 0)

β1: slope of the regression line

e: random error.

4.8 Simple Linear Regression (2 of 2)

Estimation:

True values of slope (β1) and intercept (β0) are unknown but estimable from sample data:

Ŷ = b0 + b1X

Ŷ: predicted value of Y

b0: estimate of β0 from sample

b1: estimate of β1 from sample.

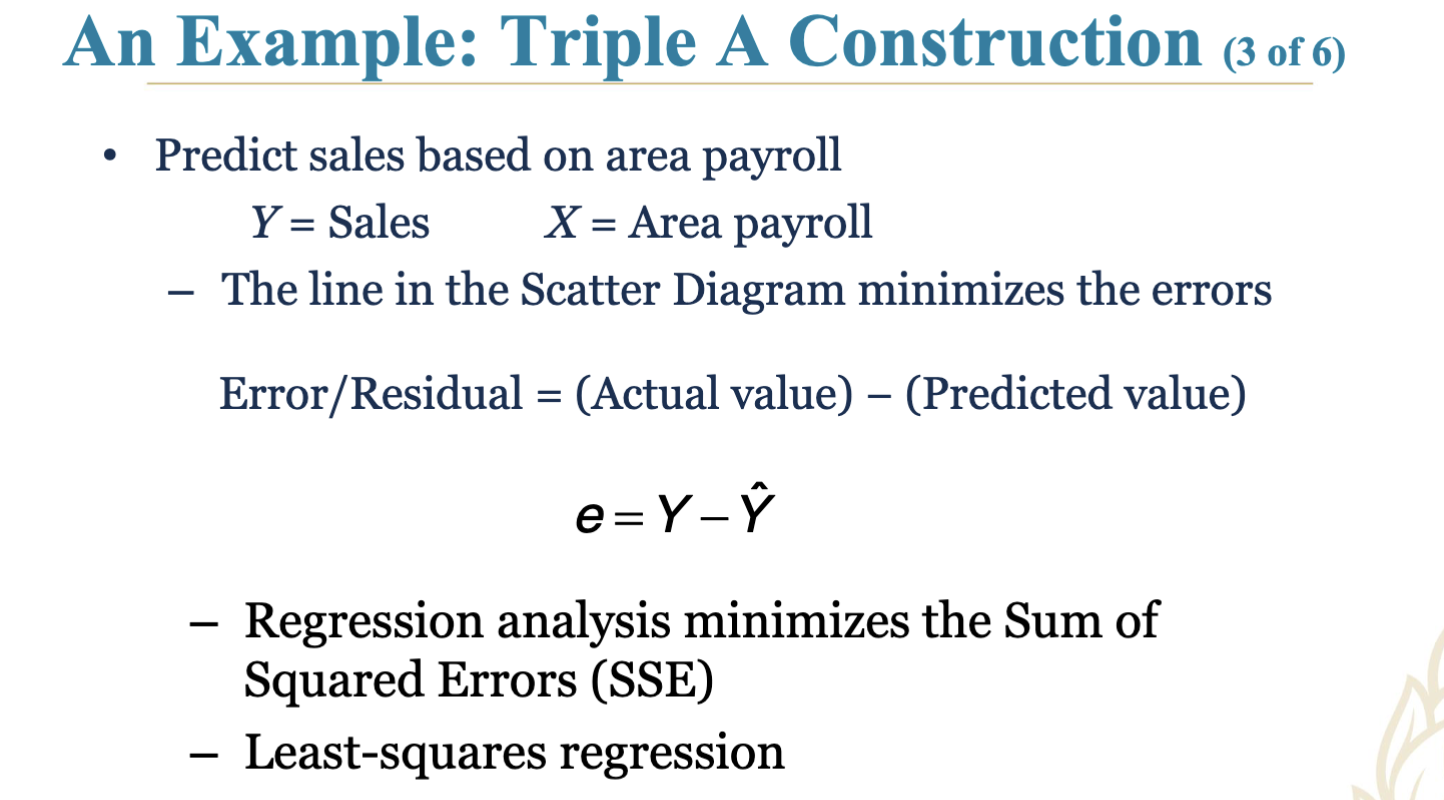

4.9 Example: Triple A Construction (3 of 6)

Prediction Setup:

Predict sales from area payroll.

Errors/Residual: Actual value minus Predicted value.

Regression analysis utilizes the least-squares approach to minimize Sum of Squared Errors (SSE).

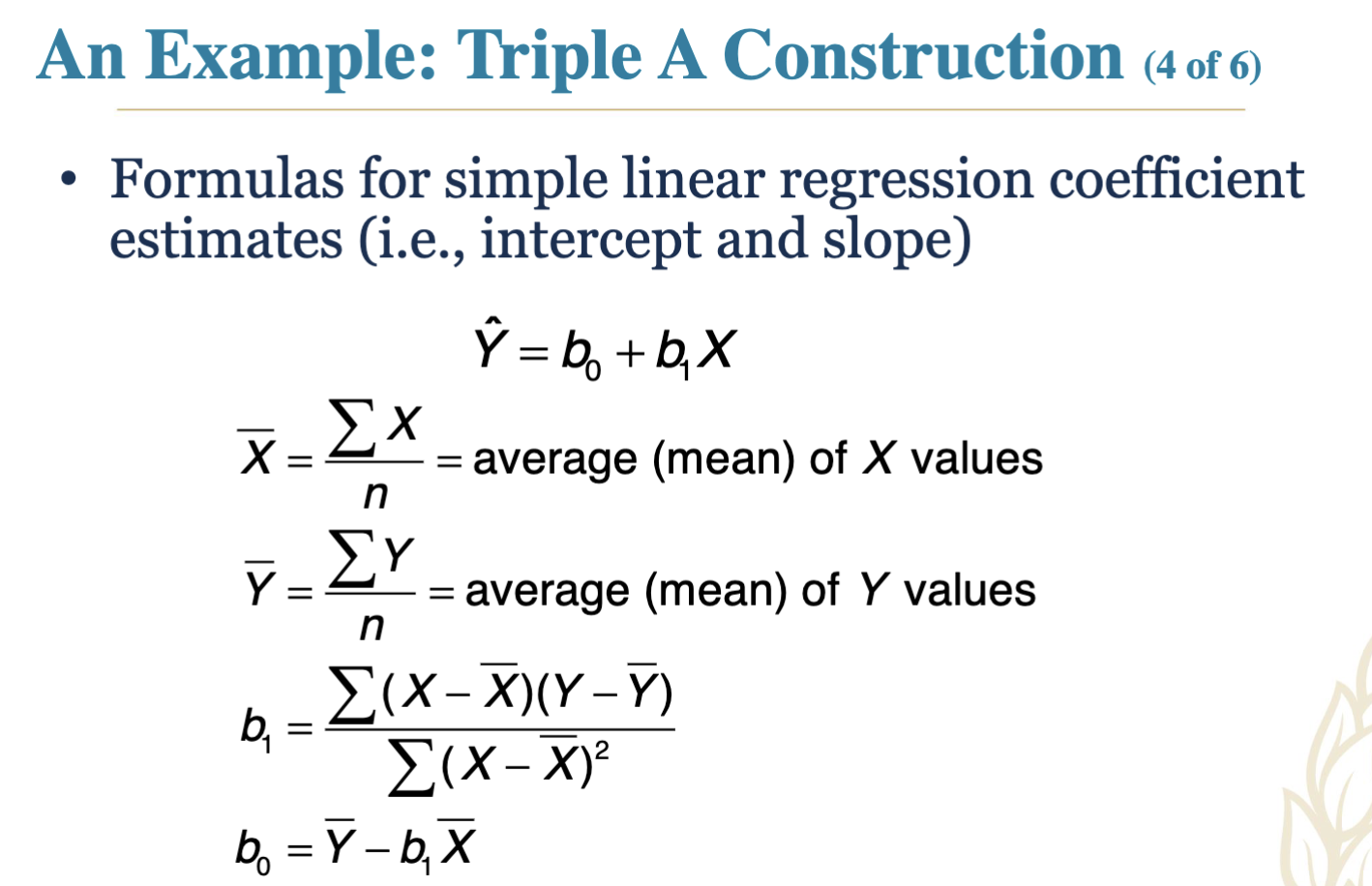

4.10 Example: Triple A Construction (4 of 6)

Formula Assumptions: Coefficient estimates for simple linear regression are calculated using the averages of values:

Sample means for Y (Sales) and X (Payroll) are used to calculate estimates.

4.11 Example: Triple A Construction (5 of 6)

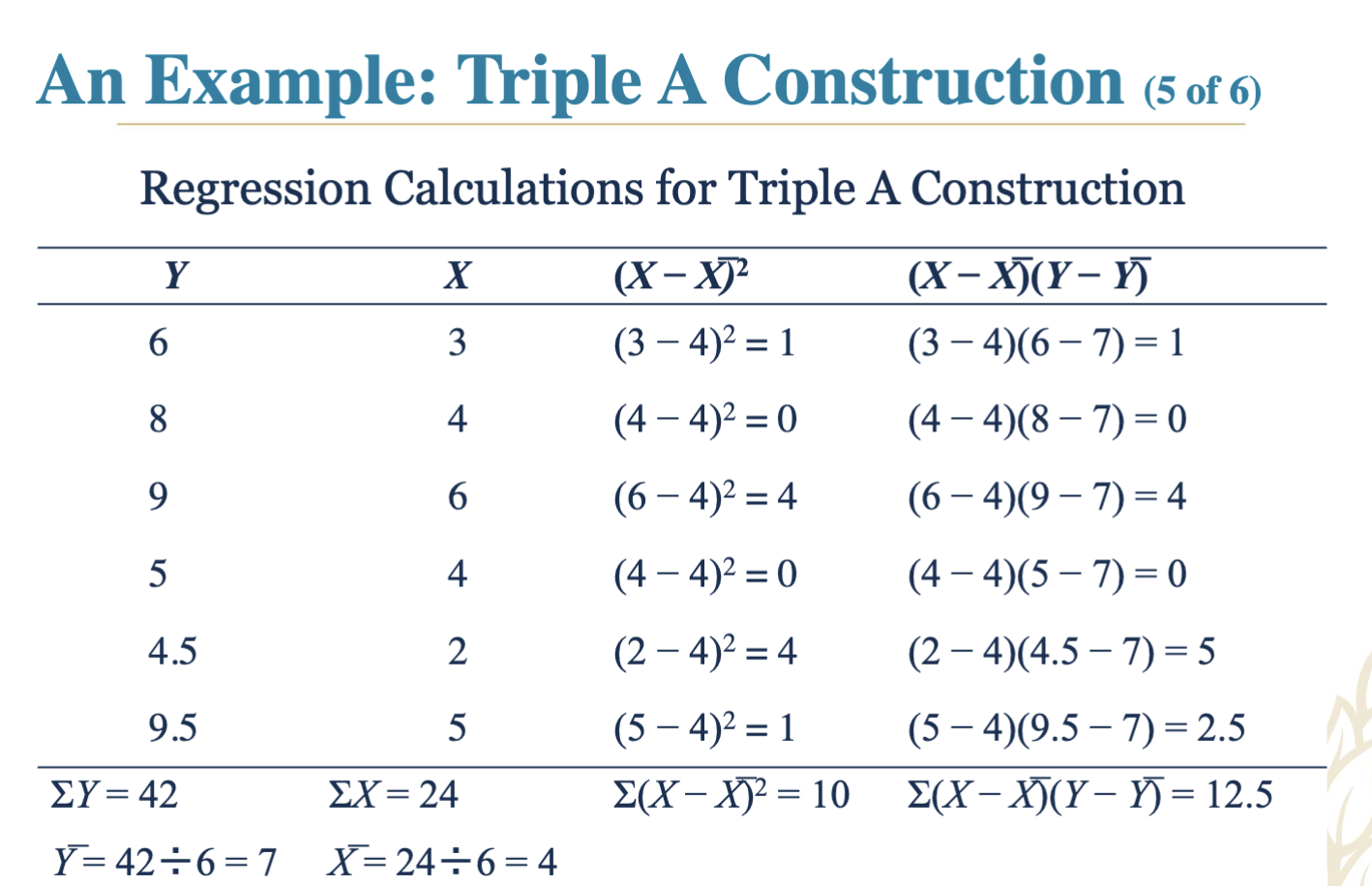

Regression Calculation Insights:

Computation for regression coefficients and analysis of the variance in Y scores.

4.12 Example: Triple A Construction (6 of 6)

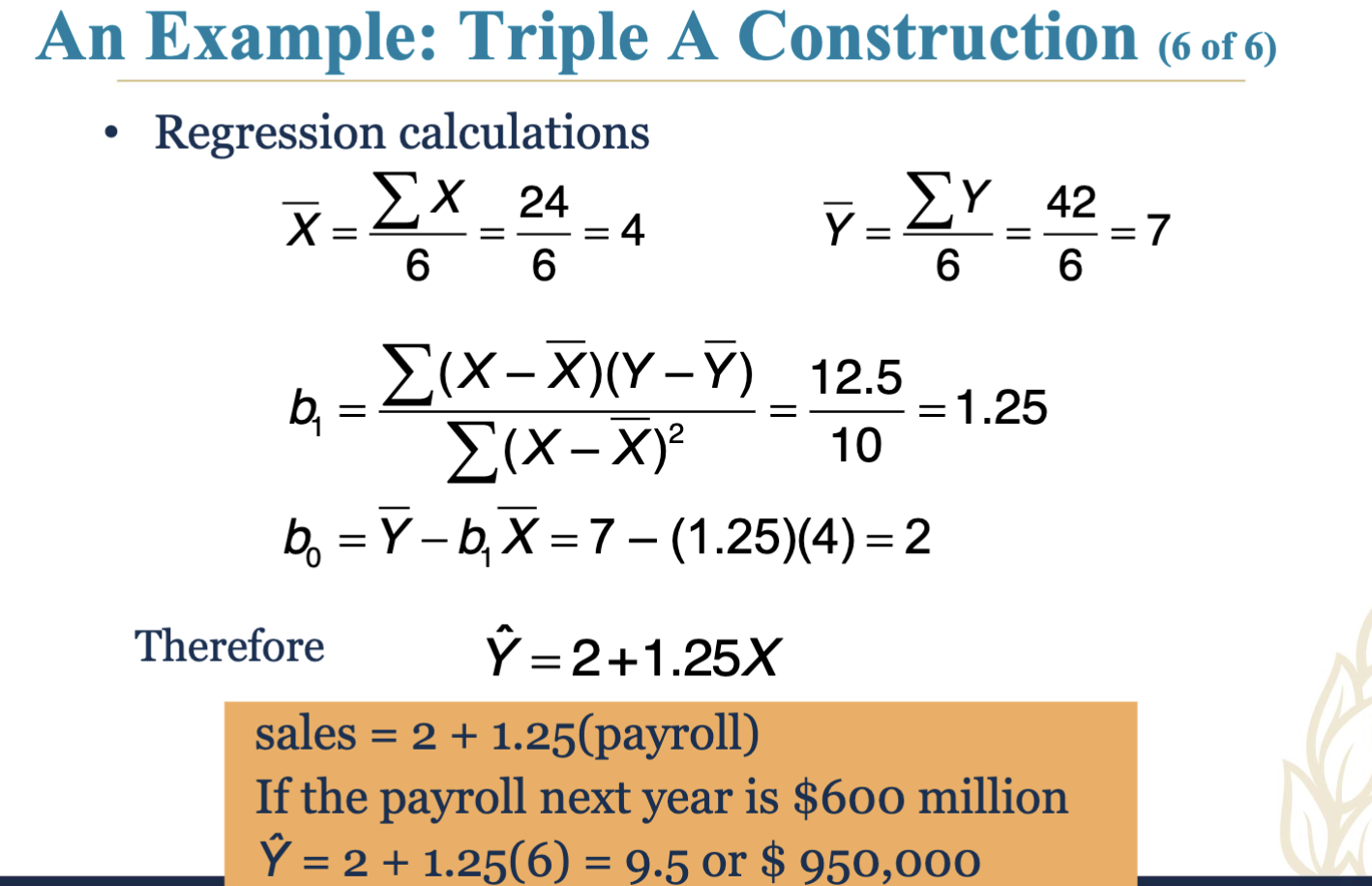

Final Model Output:

Resulting regression model: Sales = 2 + 1.25(Payroll).

4.13 Three Measures of Variability

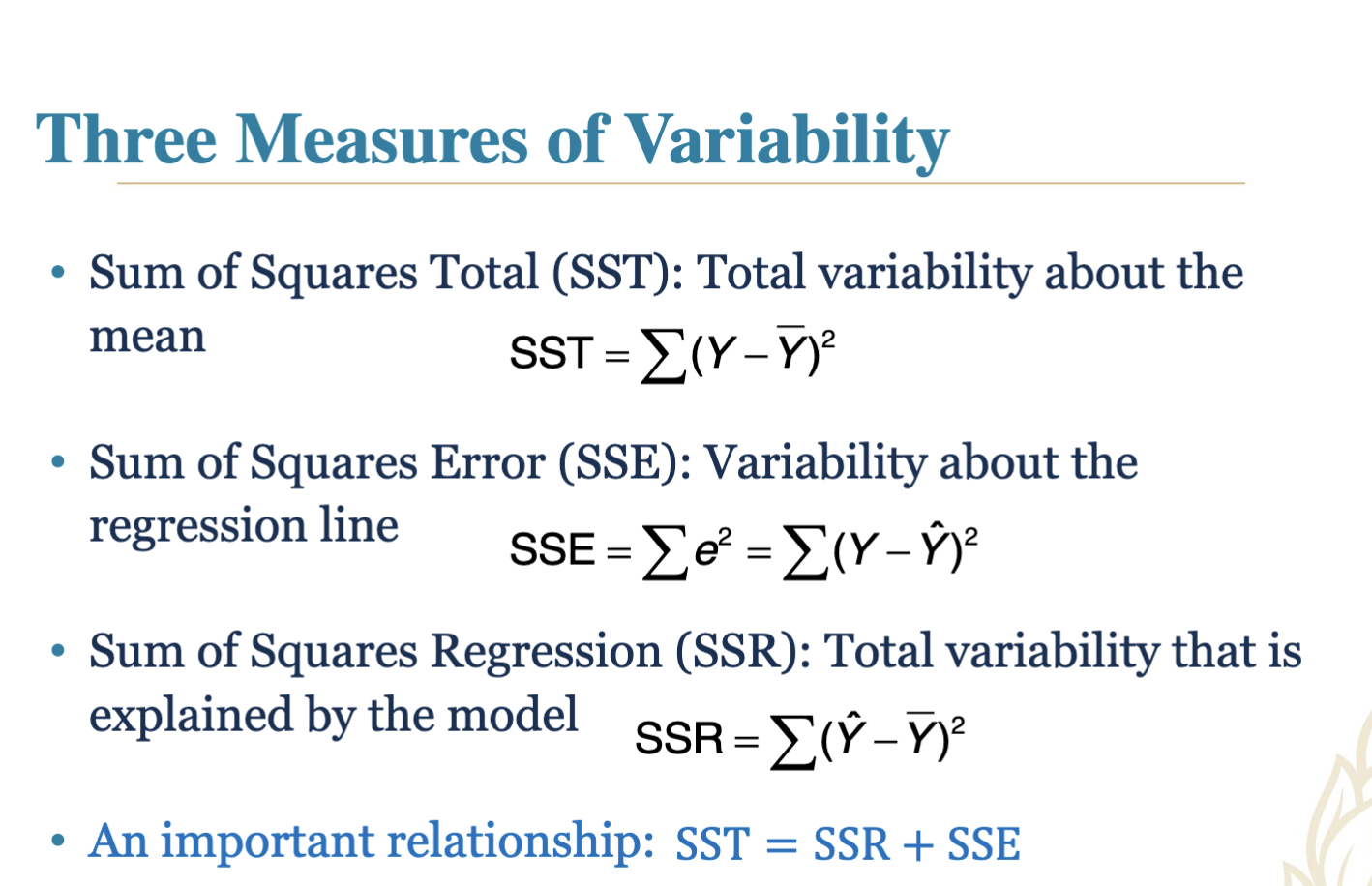

Sum of Squares:

Total Sum of Squares (SST): Total variability around the mean.

Sum of Squares Error (SSE): Variability around the regression line.

Sum of Squares Regression (SSR): Variability explained by the model.

Relationship: SST = SSR + SSE

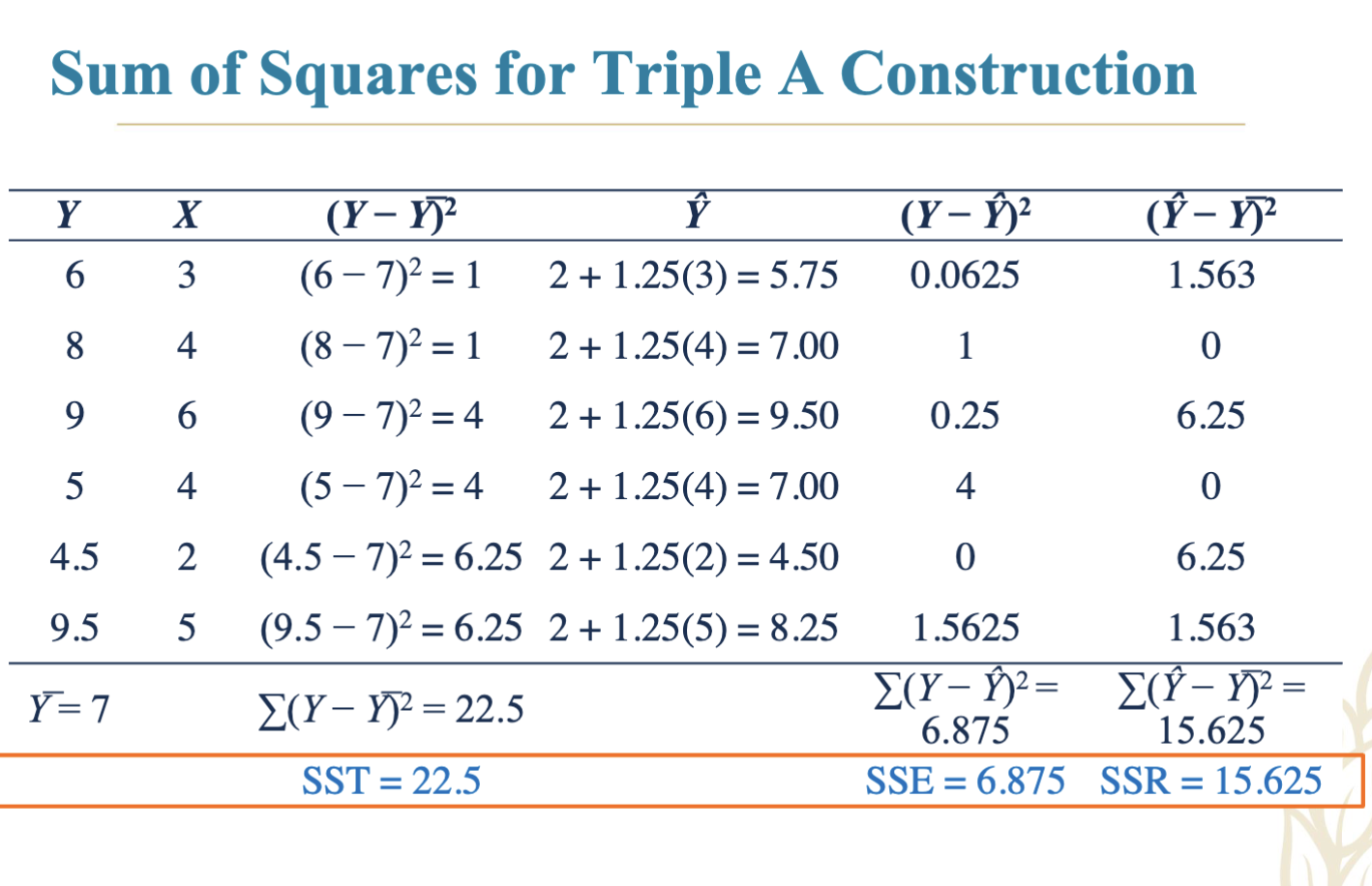

4.14 Example: Sum of Squares for Triple A Construction

Detailed statistical breakdown of Y, X, and their variances related to regression.

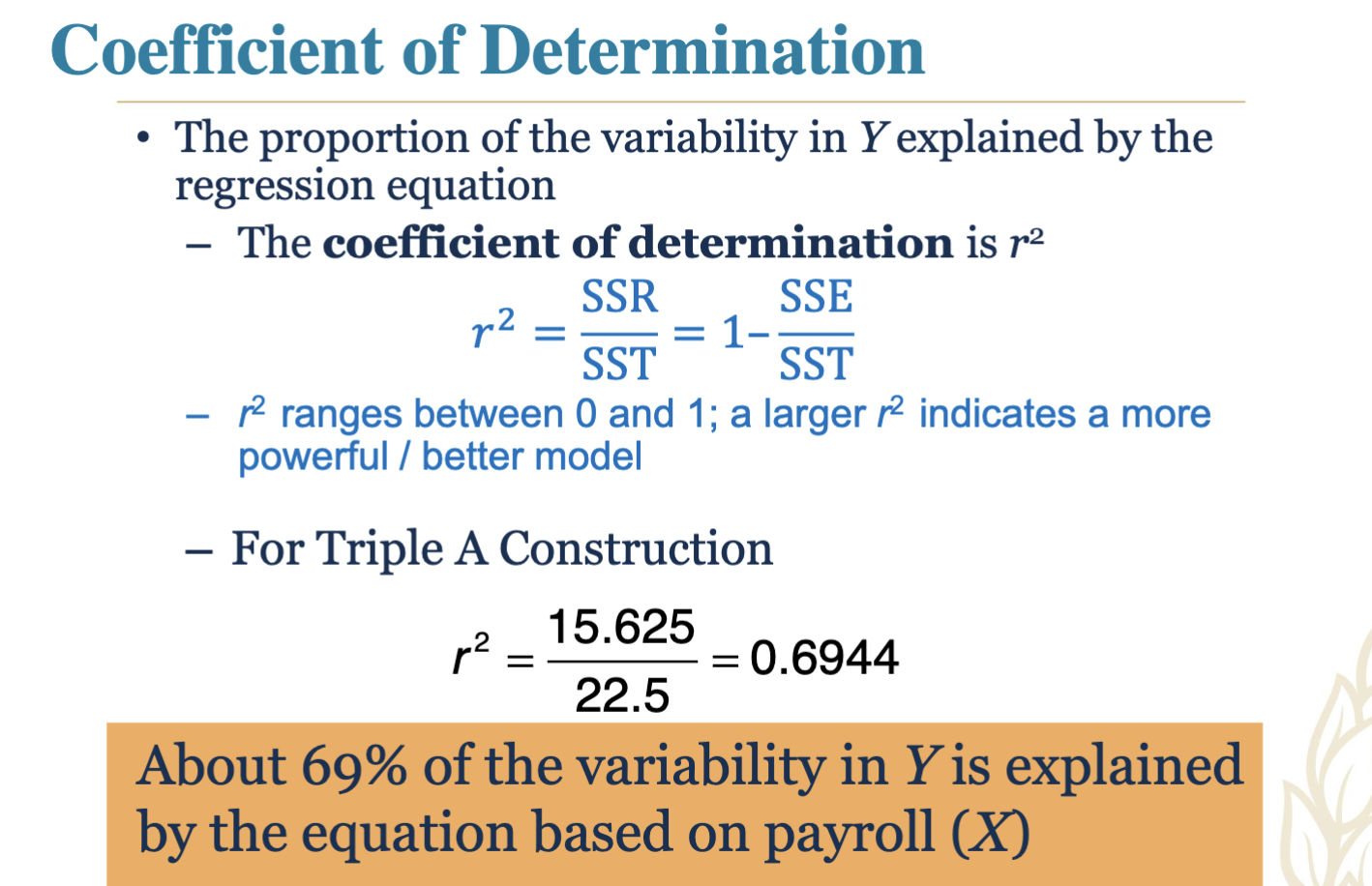

4.15 Coefficient of Determination

Definition: Proportion of variability in Y explained by the regression model.

Range: 0 to 1; higher values indicate a better-fitting model.

Example for Triple A Construction: r² is approximately 0.6944, indicating that about 69% of the variability in sales is explained by payroll.

4.16 Correlation Coefficient

Definition: Measures strength of linear relationships, ranging between +1 and -1.

Example calculation for Triple A Construction yields r = 0.8333.

4.17 Assumptions of the Regression Model

Key Assumptions:

Errors are independent.

Errors are normally distributed.

Errors have a mean of zero.

Errors have constant variance.

Residual plots can highlight violations of these assumptions.

4.18 Additional Topics Covered

Error Residual analysis through various plots.

Variance estimation methods using Mean Squared Error (MSE).

4.19 Hypothesis Testing Framework

General procedure for hypothesis testing around regression models, considering null and alternative hypotheses as well as F-statistics.

4.20 Multiple Regression Analysis (1 of 2)

Expansion of simple linear regression to include multiple independent variables with a defined relationship.

4.21 Multiple Regression Analysis (2 of 2)

Estimation process of parameters using data samples in a multiple regression framework.

4.22 An Example: Jenny Wilson Realty (1 of 6)

Establish a model to suggest pricing based on house size and age metrics.

4.23 Data Presentation: Jenny Wilson Real Estate

Information on properties sold, including selling price, square footage, condition, etc.

4.24 Evaluating the Multiple Regression Model (1 of 2)

Similarities and differences in evaluating significance in multiple regression compared to simple models using p-values and hypothesis testing.

4.25 Final Thoughts on Multiple Regression Analysis (2 of 2)

Consideration of significance for each independent variable in predicting outcomes for real estate pricing.

4.26 Understanding Binary or Dummy Variables

Definition: Created for qualitative data, allowing for inclusion of categorical variables (e.g., condition types) within the regression framework.

4.27 Example: Utilizing Dummy Variables in Jenny Wilson Realty

Implementation of dummy variables to enhance model predictions regarding house condition.

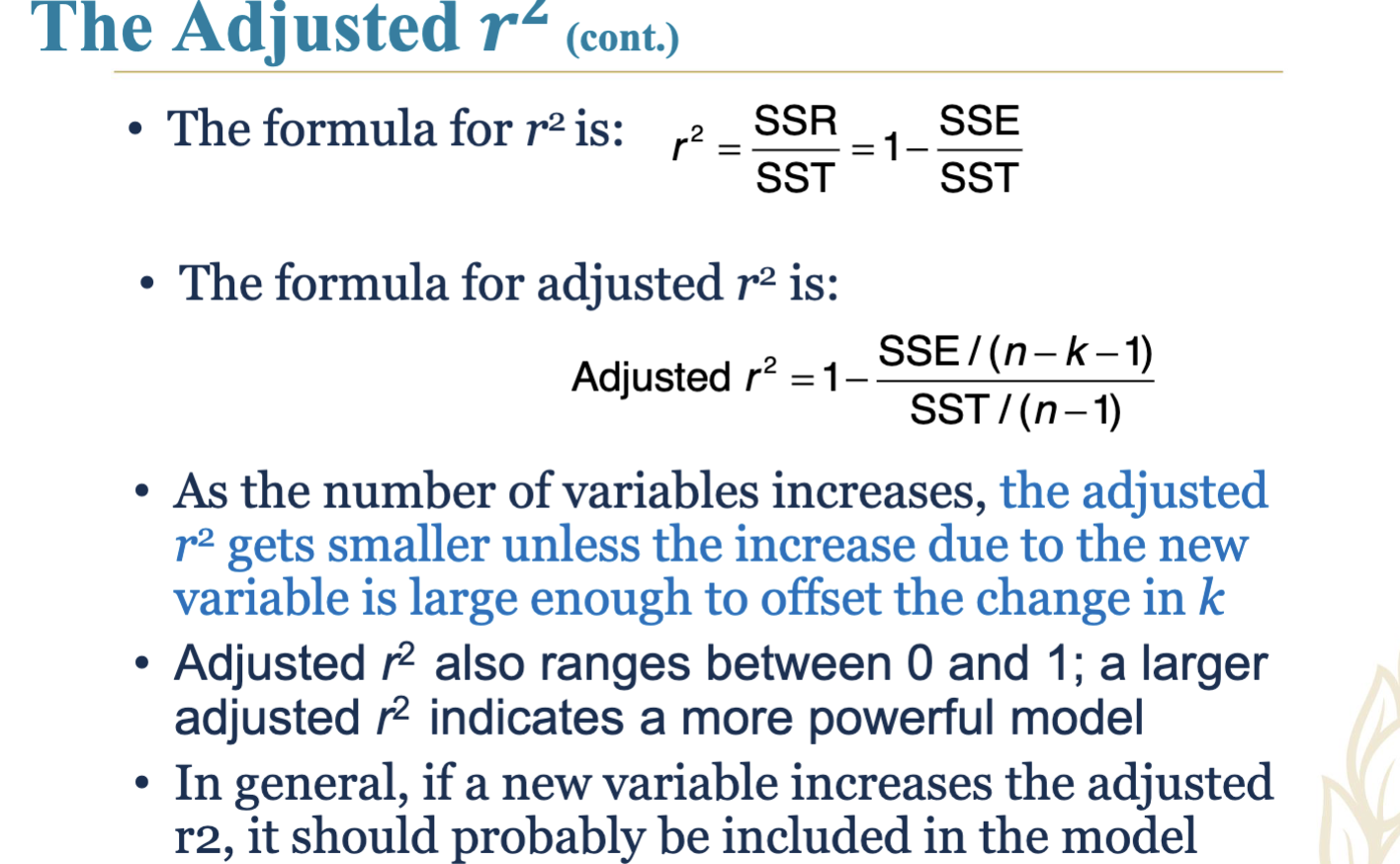

4.28 Adjusted r² as a Model Evaluation Metric

Importance of adjusted r² over regular r² for assessing model accuracy, particularly with added variables.

4.29 Model Building Techniques

Stepwise regression methodologies including forward and backward steps to enhance predictive modeling.

4.30 Nonlinear Regression Models

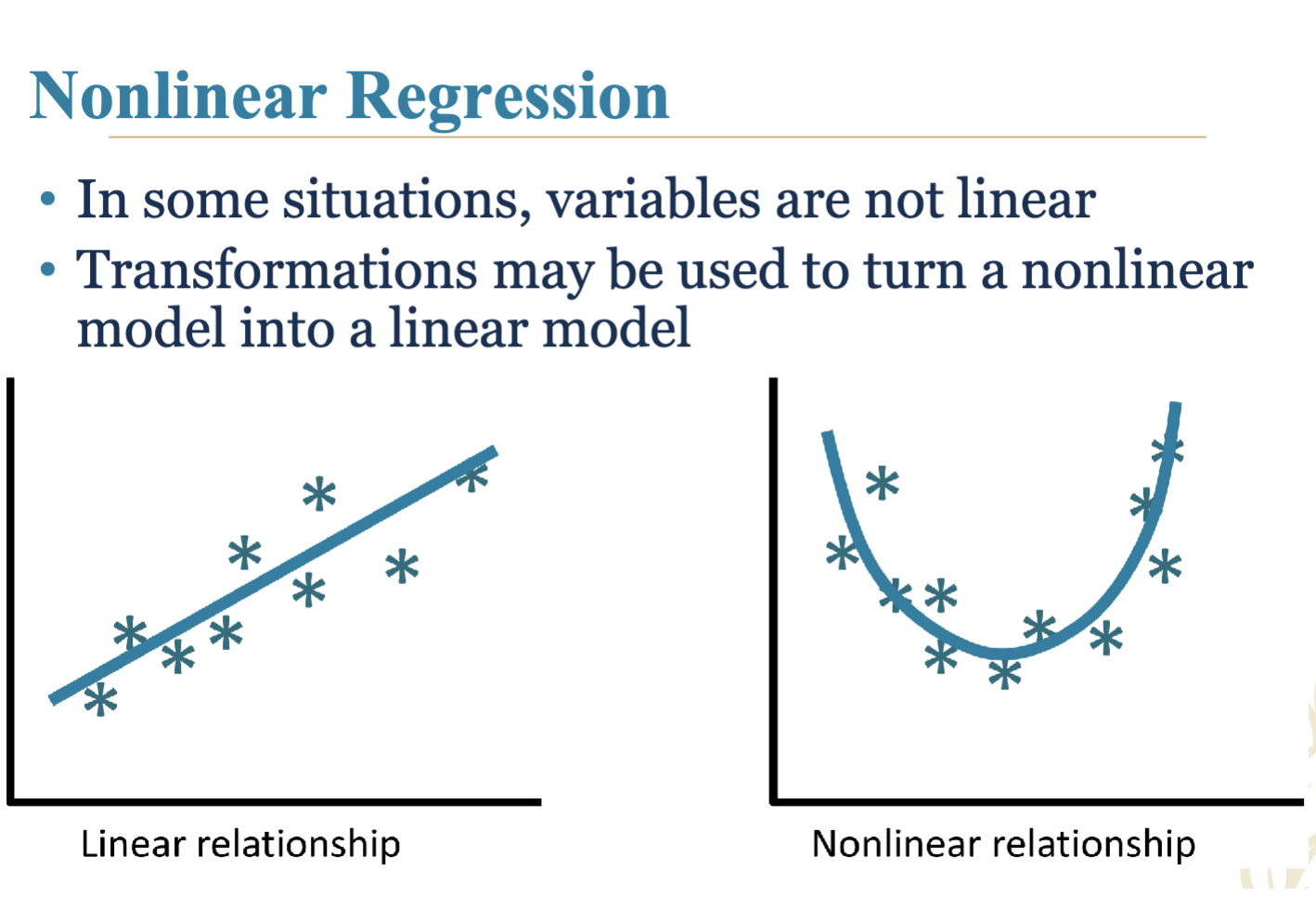

Introduction and methods for transforming non-linear relationships into linear models for ease of analysis.

4.31 Case Study: Colonel Motors

Analyzing the impact of weight on fuel efficiency (MPG) using regression techniques.

4.32 Considerations and Limitations

Cautions regarding invalid statistical tests, correlation vs. causation, various regression pitfalls, and modeling beyond known data ranges.