Cost Leadership vs Differentiation Strategies

OAM 331 Session 14 - Feb 27th

WHERE ARE WE: AFI Framework - Implementation

Business Strategy: Differentiation, Cost Leadership and Blue Oceans

Gaining and Sustaining Competitive Advantage: understanding external/internal analysis, strategic leadership, and business strategies

Business-Level Strategy: How Tco Compete, How to win

Strategy: set of activities that create a sustainable competitive advantage

Competitive advantage is a function of BOTH industry and firm effects

→ Industry Effects = 5 forces model, complements & strategic groups

→ Firm Effects: value position & Cost position (relative to compeitiors) → buisneess strategy: Cost, difefrenation, & blue ocean

Strategic Positioning: Different activities from rivals

Strategy creates a unique & valuableposition

COST & VALUE (relative to competitors)

If there were a single ideal position, we wouldn't need strategy, but things are constantly evolving

With strategic positioning → you choose actobotoes different from rivals

→ Uniqueness: Customers know what you stand for

→ Strength: Competitors won’t try to copy → trouble doing so

Strategic Trade-Offs

Consideration: Choose between cost OR value position

There is tension b/w value creation & pressure to keep costs in check

Goal: Maximize economic value creation and profit margin

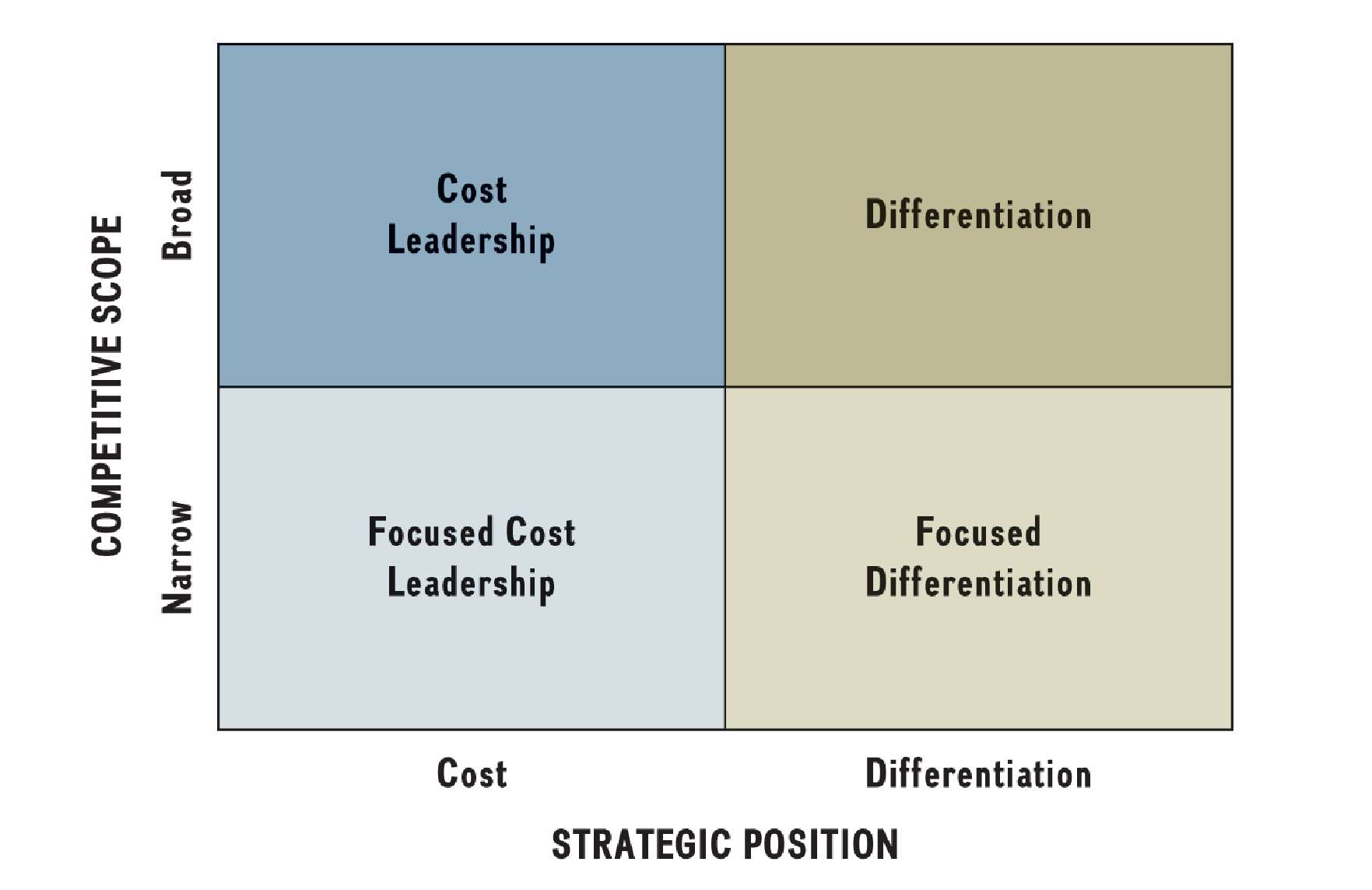

Generic Business Strategies

Differentiation:

Create higher value for consumers

→ In turn, increase willingness to pay (WTP) & Price

Example: Offer $12 value at $8 price

Cost Leadership:

Provide similar value at lower prices

→ Aim for lower costs to the firm

Example: Offer $10 value at $5 price with $3 cost

Strategic Position and Competitive Scope

Understanding market scope: Broad vs. Narrow.

Competive = Y Strategic Positions = X

Auto Industry Positioning

Broad Cost Positioning: Chevrolet

Narrow Differentiation: Cadillac

Airline Industry Positioning

Broad Cost Positioning: Southwest Airlines is competing against Frontier, Spirit, and Allegiant in the LOW-COST category

JetBlue → stuck between low-cost & differentiation

Straddling like this is difficult

Company Portfolios (cost vs differenattion)

Bottled water (least to most expensive)

Dasani, Glaceau, Smartwater (coke)

Aquafina, Soma, Lifewtrr (Pepsi)

Marriott Hotels Portfolio: Ranges from budget to luxury

Fairfield (family)

Residence in (extended stays → has a kitchen)

Marriot Courtyrad (business)

Marriot (full-service, conference)

Ritz Carlton (luxury)

Q: How to keep sister brands from competing with each other?

How to Differentiate?

Strategies for Differentiation:

Emphasize unique product features, superior customer service, and complementary products

Economies of Scale vs. Scope

Economies of Scale: Spread fixed costs over a larger number of units, decreasing the cost per unit

Economies of scale mean that as a business produces more, the cost per unit goes down.

→ This happens because fixed costs (like rent or machines) are spread over more product

Internal – Savings within a company, like buying in bulk or using better machines.

External – Savings from industry growth, like better suppliers or government support

ex: manufacturing plants with high fixed costs

Economies of Scope: Produce multiple outputs utilizing the same resources to achieve cost savings

ex: distilleries producing both spirits and hand sanitizer → alc

4 Primary Cost Drivers

1 - Cost of Inputs:

Airlines: Etihad, Qatar, Emirate

Cheaper inputs (labor, fuel, capital) increase economic value creation

2 - Economies of Scale:

Fixed costs remain constant regardless of volume

ex: rent, insurance, property tax

Marginal costs incurred with each additional unit

ex: raw materials, contract labor, commissions

Q: Why are movie thaters open during the weekdays despite being nearly empty?

3 - Learning Curve:

WW2 production of aircraft: production doubles, costs fall predictability → WHY?

Cumulative output with same technology over time (learning with experience)

90% learning curve → 10% per-unit decrease w/ each double in production

4- Experience Curve

Process innovation: improving how a product is made or delivered to make it faster, cheaper, or better. This can involve new technology, better workflows, or automation

enables firms to jump to a steeper learning curve

reduces per-unit costs

Key Takeaways

Strategic positioning requires pursuing different activities in comparison to rivals, focusing on difficult-to-imitate actions.

Differentiation: Raises WTP and often allows higher pricing

Cost Leadership: Involves lowering the cost structure for similar quality

Economies of Scale: lower per unit cost w/ volume (fixed costs distributes over time) and Scope: doing more things reducing costs

→ BOTH are crucial for decision-making

Cost structure matters: higher fixed costs (compared to MC) → more willing to reduce price

Learning Curve: learning by doing→ productivity increases every time production doubles

NO ideal strategy → just pros and cons of each

Narayana Health:

Narayana Health (NH), founded by Dr. Devi Shetty in India, is known for its low-cost, high-volume healthcare modH

Process innovation – Streamlined workflows, optimized resource utilization, and task specialization among medical staff.

How Narayana Health Benefits from Economies of Scale, Learning Curves & Economies of Scope

Economies of Scale – Lowering costs by increasing patient volume

Performs thousands of surgeries, reducing per-patient costs.

Buys medical supplies in bulk for cheaper rates.

Standardized processes improve efficiency and reduce waste.

Learning Curves – Improving efficiency through experience

Surgeons specialize, performing procedures faster and with better outcomes.

Data-driven decisions refine best practices and reduce errors.

Faster surgeries and recoveries free up resources for more patients.

Economies of Scope – Expanding services using existing resources

Adds new specialties (oncology, transplants) using the same infrastructure.

Uses telemedicine to reach rural patients without building new hospitals.

Runs training programs, reducing hiring costs and generating revenue