Chapter 13: Current Liabilities and Contingencies

Characteristics of Liabilities

Probable, future sacrifices of economic benefit

Arise from present obligations

Result from past transactions or events

Funds can be provided by owners or must be borrowed.

When businesses issue notes and bonds, their creditors are:

Banks

Individuals

Organizations that exchange cash for securities

Most common type of liability - one to be paid in cash and for which the amount and timing are specifies by a legally enforceable contract

Liability: to be reported as a liability, an obligation needs to not be payable in cash

May require the company to transfer other assets or provide services

Doesn’t have to be represented by a written agreement or be legally enforceable

Time and payment does not need to be known

Characteristics of Current Liabilities

Obligation payable within one year or firm’s operating cycle

Satisfied from current assets

Satisfied by creation of other current liabilities

Liabilities should be recorded at their present values

Except liabilities payable within one year which are ordinarily recorded at maturity amounts

Most common obligations reported as current liabilities:

Accounts payable

Notes payable

Commercial paper

Income tax liability

Dividends payable

Accrued liabilities

Other

Current portion of long-term debt

Accounts Payable - are obligations to suppliers of merchandise or of services purchased on open account

Credit instrument: invoice

Short duration (30,45,60 days)

Non interest-bearing and reported at face amounts

Key accounting considerations

Determining existence

Recording in the appropriate accounting period

Trade Notes Payable - differ from accounts payable in that they are formally recognized by a written promissory note

Longer duration

Bear interest

Short-Term Notes Payable Characteristics (Bank Loan)

Temporary financing from bank

Promissory note is signed (like an IOU)

Lower interest rates than long-term debt

Companies have flexibility while selecting financial alternatives

Line of credit - is an agreement to provide short-term financing, with amounts withdrawn by the borrower only when needed

Can last several years

Non committed line of credit

Informal agreement

Permits a company to borrow up to a prearranged limit without formal loan procedures and paperwork

Borrower may be required to maintain a compensating balance in the bank (5% of the credit line)

Committed line of credit

Formal agreement

Requires the company to pay a commitment fee to the bank to keep a credit line amount available to the company

Typical commitment fee is ¼ % of the total committed funds and may also require compensating fee

Interest (“rent” paid for using money)

Paid by borrowing company during the loan term

Return for using lender’s money

Stated in terms of a percentage rate to be applied to the face amount of the loan

Interest = Face amount x Annual rate x Time to maturity

Non interest bearing note - interest is deducted from the face amount to determine the cash proceeds made available to the borrower

When interest is discounted from the face amount of a note, the effective interest rate is higher than the stated discount rate.

“being discounted at issuance at a 12% discount rate”

700,000 × 12% x 6/12 = 42,000

Amount borrowed is 658,000, so effective interest rate is higher than the 12% stated

42,000 for 6 months/658,000 = 6.38%

To annualize: 6.38% x 12/6 = 12.76% EIR

Secured loans - loan made by pledging a specified asset of the borrower as collateral or security

Pledging accounts receivable: When accounts receivable serves as a collateral

Factoring receivables: When the receivables actually are sold outright to a finance company

Commercial paper - unsecured notes sold in minimum denominations of 25,000 with maturities ranging from 1 - 270 days

Beyond 270 days the firm would be required to file a registration statement with the SEC

Interest often is discounted at issuance

Usually commercial paper is issued directly to the buyer (lender) and is backed by a line of credit with a bank

This allows the interest rate to be lower than in a bank loan

In a statement of cash flows, the cash a company receives from using short-term notes to borrow funds as well as the cash it uses to repay the notes are reported among cash flows from financing activities.

Total Short-Term Borrowings: secured by financing receivables (retail notes) on the balance sheet.

Accrued liabilities (accrued expenses): represent expenses already incurred but not yet paid

Recorded by adjusting entries

Usually combined and reported under a single caption in the balance sheet

Common examples:

Salaries and wages payable

Income taxes payable

Interest payable

Issuance of note Dr. Cr.

Cash xx

Notes payable xx

Accrual of interest Dr. Cr.

Interest expense xx

Interest payable xx

Note payment Dr. Cr.

Interest expense xx (NP x % promissory note x months)

Interest payable xx

Notes payable xx

Cash xx

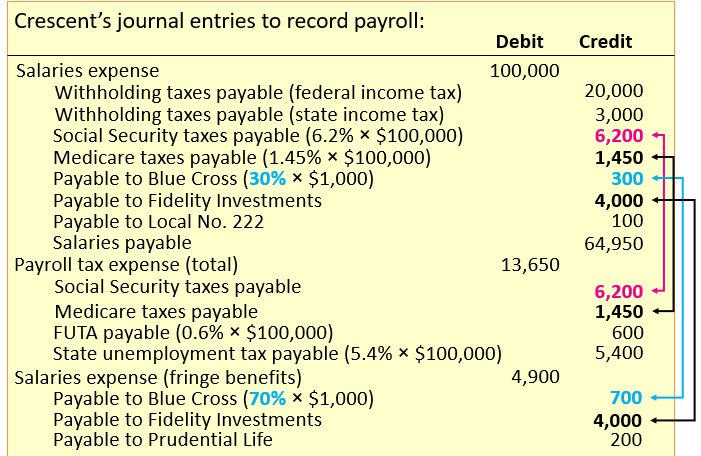

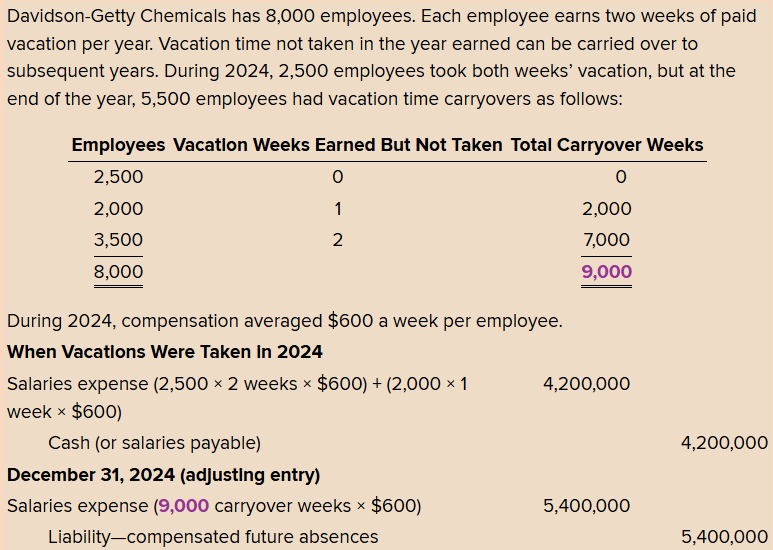

Four conditions for accrual of paid future absences:

1. The obligation is attributable to employees’ services already performed

2. The paid absence can be taken in a later year—the benefit vests or the benefit can be accumulated over time

3. Payment is probable

4. The amount can be reasonably estimated

Annual Bonuses

Tied to performance objectives to provide incentive to executives

Are compensation expense of the period in which they are earned

Financial measures

Earnings per share

Net income

Operating income

Non financial measures

Customer satisfaction

Product or service quality

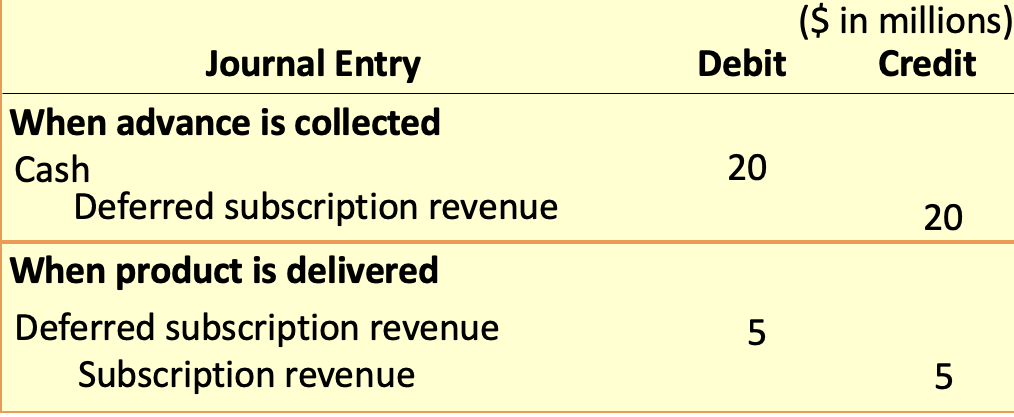

Liabilities are created when deposits and advances are received from customers.

Advance collections

Deposits and advances from customers

Refundable deposits

Advances from customers

Gift cards

Collections for third parties

Refundable deposits:

When deposits are collected Dr. Cr.

Cash xx

Liability - refundable deposits xx

When containers are returned

Liability - refundable deposits xx

Cash xx

When deposits are forfeited

Liability - refundable deposits. xx (90% x 300,000)

Revenue - sale of containers xx

COGS xx (300,000 - 270,000)

Inventory of containers xx (300,000/2)

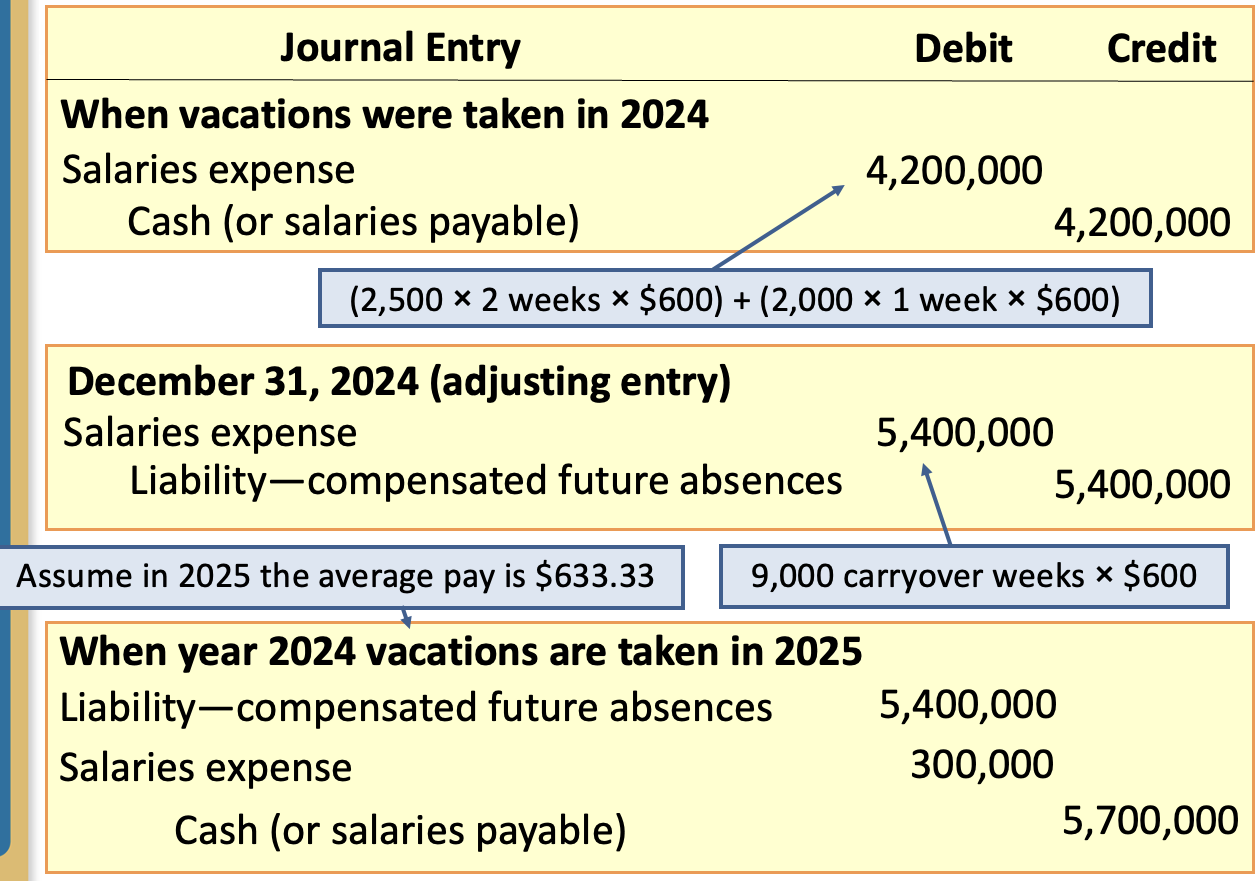

Advances from customers represent liabilities until the product or service is provided or the advance is collected.

Examples:

Gift certificates

Magazine subscriptions

Layaway deposits

Special order deposits

Airline tickets

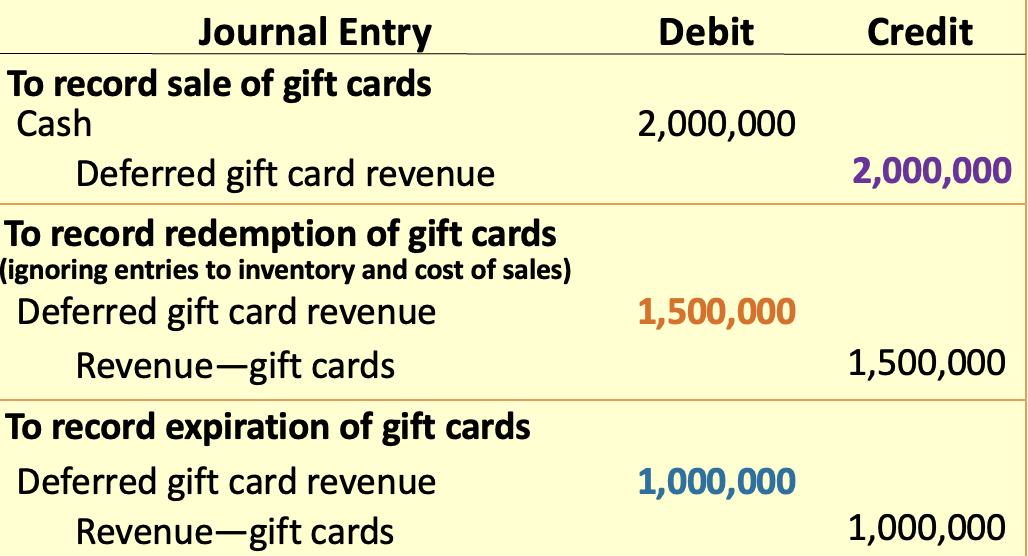

Gift cards (gift certificates): Cash received for sale of gift card recorded as deferred revenue

Later recognition of revenue

on redemption

on breakage (“remote probability of redemption”)

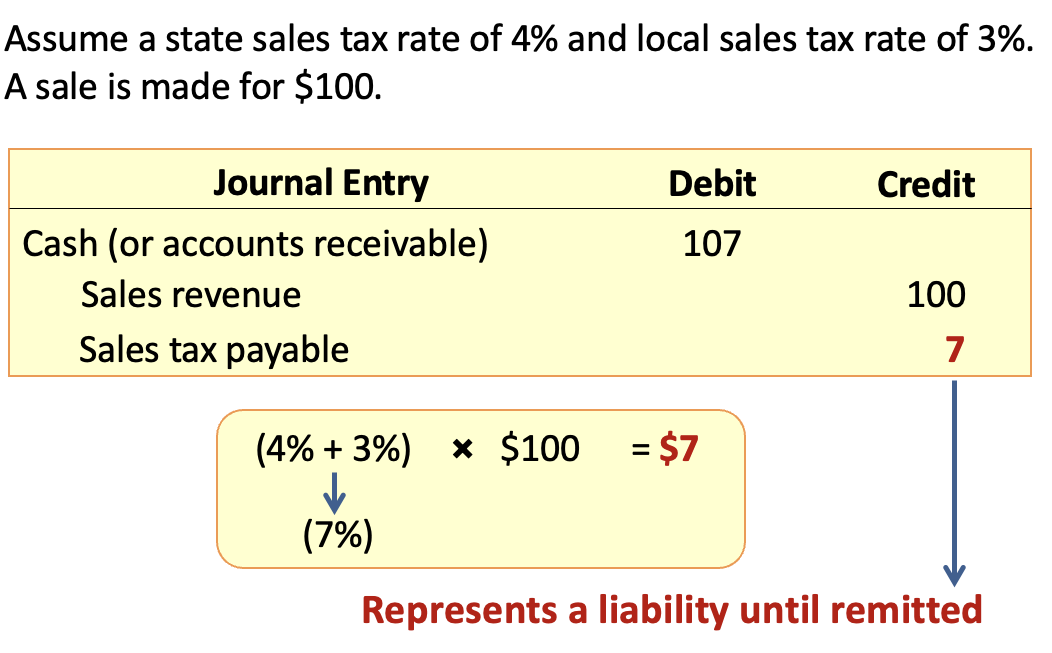

Collections for third parties: Collections made from customers or employees and remitted periodically to the appropriate third parties

Most Common Examples

Payroll-related deductions such as:

Withholding taxes

Social Security taxes

Employee insurance

Employee contributions to retirement plans

Union dues

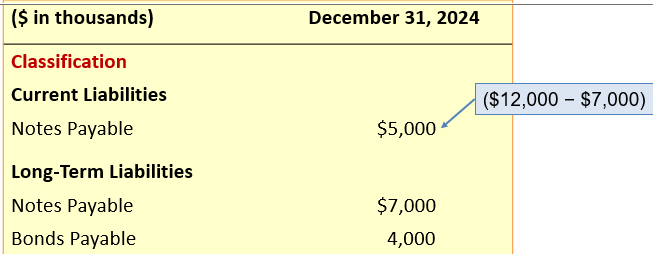

Companies typically prefer to report an obligation as noncurrent rather than current.

Noncurrent classification results in higher working capital and a higher current ratio

Long-term obligations are usually reclassified and reported as current liabilities when they become payable within the upcoming year (or operating cycle, if longer than a year).

bonds

notes

lease liabilities

deferred tax liabilities

Example: 20-year bond issue is reported as a long-term liability for 19 years but normally is reported as a current liability on the balance sheet prepared during the 20th year of its term to maturity.

The requirement to classify currently maturing debt as a current liability includes:

Debt that is callable (due on demand) by the creditor in the upcoming year/operating cycle, even if the debt is not expected to be called

When the creditor has the right to demand payment because an existing violation of a provision of the debt agreement makes it callable

Debt is not yet callable but will be callable within the year if an existing violation is not corrected within a specified grace period

Short-term obligations that are expected to be refinanced on a long-term basis can be reported as noncurrent liabilities if two conditions are met:

The company must intend to refinance on a long-term basis, and

The company must actually have demonstrated the ability to refinance on a long-term basis

This is demonstrated by an existing refinancing agreement or actual financing prior to the issuance of financial statements.

U.S. GAAP: liabilities payable within the coming year are classified as long-term liabilities if refinancing is completed before the date of issuance of the financial statements

IFRS: refinancing must be completed before the balance sheet date

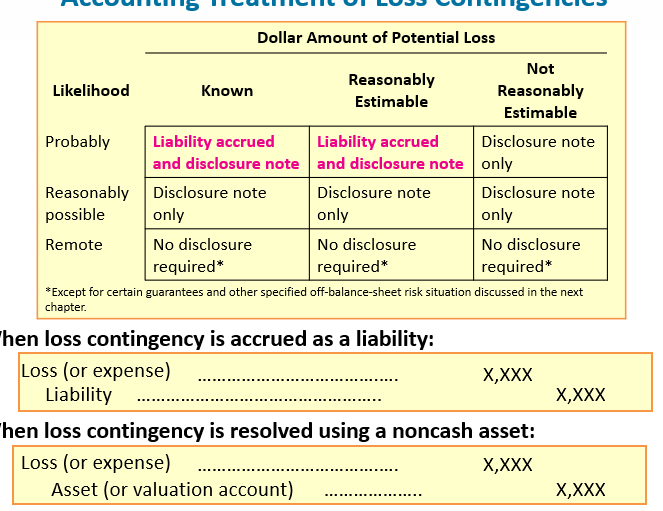

Loss contingency: an existing, uncertain situation involving potential loss depending on a future event

Whether a contingency is accrued and reported as a liability depends on:

The likelihood that the confirming event will occur

What can be determined about the amount of loss

U.S. GAAP requires that the likelihood that the future event be categorized as probable, reasonably possible, or remote.

Probable: confirming the event is likely to occur

Reasonably possible: the chance the confirming event will occur is more than remote but less likely

Remote: the chance the confirming event will occur is slight

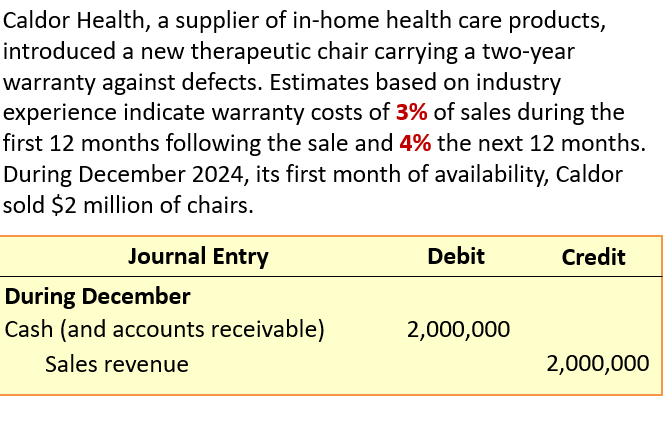

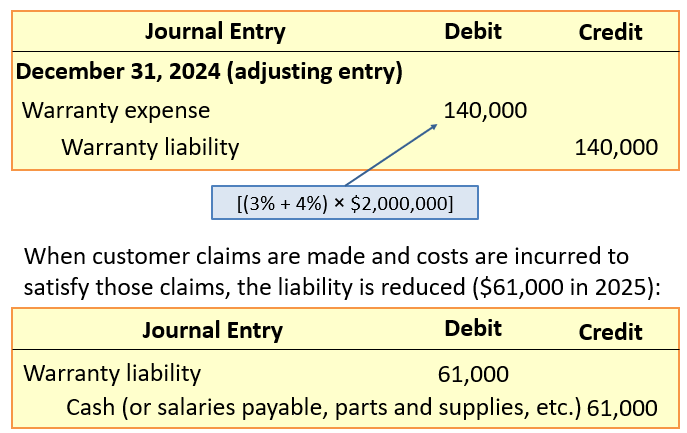

Most consumer products are accompanied by a guarantee, such as a quality-assurance warranty.

Loss contingency: costs of satisfying guarantees should be estimated and recorded as expenses in the same accounting period the products are sold

The criteria for accruing a contingent loss almost always are met for product warranties or guarantees

While we usually can’t predict the liability associated with an individual sale, prior experience makes it possible to predict reasonably accurate estimates of the total liability for a period

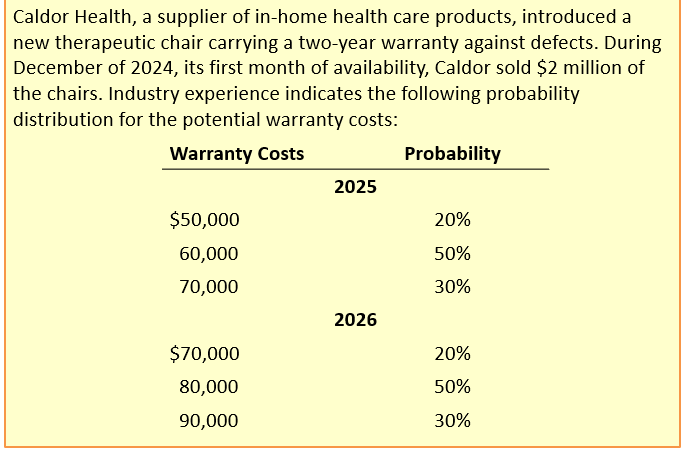

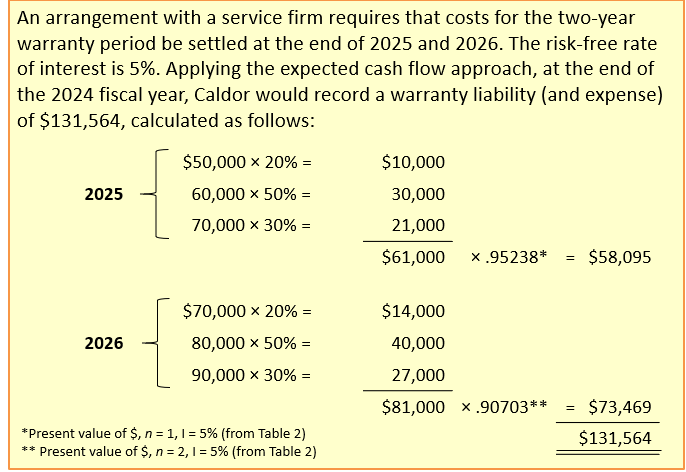

The traditional way of measuring a warranty obligation is to report the “best estimate” of future cash flows

The method ignores the time value of money

An alternative expected cash flow approach is described by SFAC No. 7

Incorporates specific probabilities of cash flows into the analysis

Required conditions:

When the warranty obligation spans more than one year and

We can associate probabilities with possible cash flow outcomes

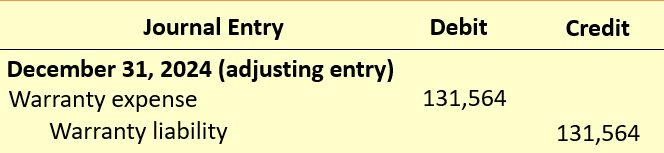

Extended warranty: provides warranty protection beyond manufacturer’s original warranty

Because an extended warranty is priced and sold separately from the warranted product, it constitutes a separate performance obligation.

Revenue Recognition:

Recorded as a deferred revenue liability at the time of sale

Recognized as revenue over the contract period

Straight-line basis

Pending litigation is not unusual.

Accrual of a loss from pending or ongoing litigation is rare

Outcome of litigation is highly uncertain

Loss is usually not recorded until after ultimate settlement

While companies should provide extensive disclosure of these contingent liabilities, they do not always do so.

Even after a firm loses in court, it may not make an accrual.

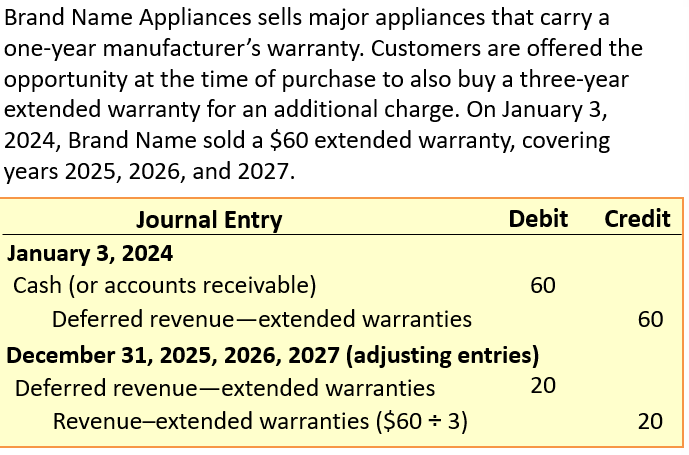

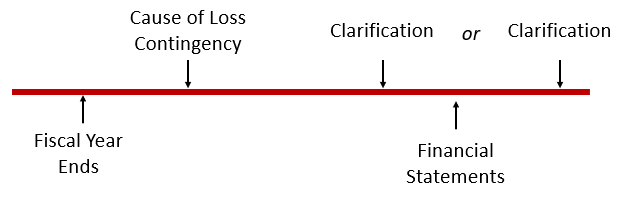

Subsequent events can clarify a pre-existing claim’s

Probability that a loss will occur

Estimated amount of loss

If contingency comes into existence after fiscal year-end

No liability accrues, but description provided in notes

Even if a claim has yet to be made when the financial statements are issued, a contingency may warrant accrual or disclosure.

A two-step process is involved:

Is it probable that a claim will be asserted? If the answer is “no,” stop. If “yes,” go on to step

Treat the claim as if the claim has been asserted.

U.S. GAAP:

All accrued and possible obligations are referred to as “contingent liabilities”

Higher threshold for “probable”

Uses the low end of the range to estimate the expenditure required to settle present obligation

Loss contingencies are not typically discounted for time value of money

No disclosures or loss recognition on “onerous contracts”

Gain contingencies are never accrued

Disclose when gain realization is “probable” but uses a higher threshold for “probable”

IFRS:

All accrued liabilities are referred to as “provisions” and possible obligations are referred to as “contingent liabilities”

Lower threshold for “probable”

Uses the midpoint of the range to estimate the expenditure required to settle present obligation

If material, liabilities to be stated at present value

Recognizes provisions and contingencies for “onerous contracts”

Gain contingencies are accrued if future realization is “virtually certain” to occur

Disclose when gain realization is “probable” but uses a lower threshold for “probable”

Gain contingency: uncertain situation that might result in a gain

Gain contingencies are not accrued

This is an example of conservatism—we record uncertain losses but not uncertain gains

Material gain contingencies are disclosed in the notes to the financial statements

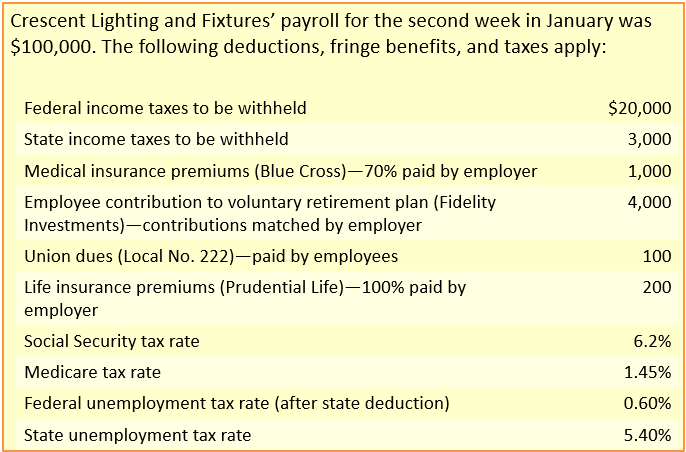

Payroll related liabilities:

Legal requirements to withhold taxes from employees’ paychecks

Legal requirements of the payroll taxes on firms

Voluntary payroll deductions of amounts payable to third parties

Employers are legally required to withhold:

Federal and state income taxes

Social Security taxes

Withholdings from employees’ paychecks

Remitted to taxing authorities

Amount withheld varies with:

Amount of earnings

Amount of exemptions claimed by employee

Federal Insurance Contributions Act (FICA): requires employers to withhold a percentage of each employee’s earnings up to a specified maximum

Employer pays matching amount on behalf of employee

Self-employed persons pay both the employer and employee portions

Voluntary deductions

Include union dues, contributions to savings or retirement plans, and insurance premiums

Represent liabilities until paid to appropriate organizations

Employers’ payroll taxes

Employer’s matching amount of FICA taxes

Employer pays federal and state unemployment taxes on behalf of employees

Fringe benefits

Payment of employees’ insurance premiums and/or contributions to retirement income plans by employer