Economics HL 2.4, 2.7, 2.8

2.4 - Behavioural Economics

Assumptions of Rational Consumer Choice

free markets are built on the assumptions of rational decision making

in classical economic theory, rational means economics agents are able to consider the outcome of their choices and recognise the net benefits of each one

rational agents - will select the choice that reaps highest benefit/utility

Rational choice theory - individuals use logic and sensible reasons to determine the correct choice (connected to an individual’s self-interest)

Consumer Rationality

assumption that individuals use rational calculations to make choices which are within their own best interest (using all information available to them)

Utility Maximization

economic agents select choices that maximize their utility to the highest level

Perfect Information

information is easily accessible about all goods/services on the market

individuals have access to all information available at all times in order to make the best possible decision

Limitations of Assumptions of Rational Consumer Choice

behavioural economics recognizes that human decision-making is influenced by cognitive biases, emotions, social, and other psychological factors that can lead to deviations from rational behaviour

individuals are unlikely to always make rational decisions

5 limitations are shown below:

Biases

biases influence how we process information when making decisions = influence the process of rational decision making

example: common sense, intuition, emotions, personal/social norms

Types of Bias

Rule of Thumb - individuals make choices based on their default choice gained from experience (ex: same product from same company, but not the best possible choice)

Anchoring and Framing - individuals rely too heavily on an initial piece of information (anchor) when making subsequent judgements or decisions (ex: car dealer says car is worth $10,000 and you know it’s worth less, but this anchor of information causes you to purchase the car for a higher price)

Availability - individuals rely on immediate examples of information that come to mind easily when making judgements/decisions (causes individuals to overestimate the likelihood/importance of events/situations based on how readily available they are in their memory)

Bounded Rationality

people make decisions without gathering all necessary information to make a rational decision within a given time period

rational decision making is limited because of

thinking capacity

availability of information

lack of time available to gather information

too many choices also cause people to make irrational decisions

example: in a supermarket, there are too many choices of products of the same good, making it difficult to reach a decision

Bounded Self-Control

individuals have a limited capcity to regulate their behaviour and make decisions in the face of conflicting desires or impulses

self-control is not an unlimited resource

because humans are influenced by family, friends, or social settings, it causes social norms to interfere in decision making (does not result in the maximization of consumer utility)

decision making based on emotions → does not yield the best outcome

businesses capitalize on the lack of bounded self-control of individuals when appealing to their target audience to maximize sales

Bounded Selfishness

economics agents do not always act within their own self interest

individuals do things for others without a direct reward

ex: altruism - selflessness without expecting anything in return

Imperfect Information

information is not perfectly accessible due to:

intelluctual property rights

cost of accessing information

amount of information and options available

people make decisions based on limited information

asymmetric information may also lead to decisions based on limited information

when one party has more information than another

Choice Architecture

intentional design of how choices are presented so as to influence decision making

simplifies the decision making process

3 types, as shown below:

Default Choice

individual is automatically signed up to a particular choice

decision is already made even when no action has been taken

individuals rarely change from the default change

Restricted Choice

choices available to individuals are limited which helps individuals make more rational decisions

Mandated Choices

requires individuals to make a specific decision or take a particular action by imposing a requirement or obligation

mandated choices can be used to ensure compliance with regulations or societal norms, making it necessary for individuals to make certain decisions

Nudge Theory

practice of influencing choices that economic agents make, using small prompts to influence their behaviour

firms should use nudges in a responsible way to guide and influence decision making

designed to guide people toward certain decisions or actions while still allowing them to have freedom of choice

consumer nudges should be designed with transparancy, respect for individual autonomy, and clear societal benefits in mind

Profit Maximization

most firms have the rational business objectiveof profit maximization

profits benefit shareholders as they receive dividends and also increase the underlying share price

an increase in the underlying share price increases the wealth of the shareholder

profit maximization rule

when MC=MR, then no additional profit can be extracted from producing another unit of output

when MC<MR, additional profit can still be extracted by producing another unit of output

when MC>MR, the firm has gone beyond the profit maximization level of output and starts making a marginal loss on each unit produced (beyond MR=MC)

in reality, firms find it difficult to produce at the profit maximization level of output

the level may be unknown

in the short term, they may not adjust their prices if the marginal cost changes

MC changes regularly and regular price changes would be disruptive

in the long-term, firms will seek to adjust prices to the profit maximization level of output

firms may be forced to change prices by the competition regulators in their country

profit maximization level of output often results in high prices for consumers

changing prices changes the marginal revenue

Growth

increasing sales revenue/market share

maximize revenue to increase output and benefit from economies of scale

a growing firms is less likely to fail

Revenue Maximization as a Sign of Growth

in the short-term, firms may use this strategy to eliminate the competition as the price is lower than when focusing on profit maximization

firms produce up to the level of output where MR=0

when MR>0, producing another unit of output will increase total revenue

Market Share as a Sign of Growth

sales maximzation which further lowers prices and has the potential to increase market share

occurs at the level of output where AC=AR (normal profit/breakeven)

firms may use this strategy to clear stock during a sale to increase market share

firms sell remaining stock without making a loss per unit

Satisficing

pursuit of satisfactory/acceptable outcomes rather than profit maximization

decision-making approaach where businesses aim to meet a minimum threshold or standard of performance rather than striving for the absolute best outcome

small firms may satisfice around the desires of the business owner

many large firms often end up satisficing as a result of the principal agent problem

when one group (the agent) makes decisions on behalf of another group (the Principal), often placing their priorities above the Principal’s

Corporate Social Responsibility (CSR)

conducting business activity in an ethical way and balancing the interests of shareholders with those of the wider community

extra costs are involved in operating in a socially responsible way and these costs must be passed on to consumers

2.7 - Government Intervention

Why do governments intervene in markets?

Influence (increase/decrease) household consumption

provide support to firms

earn revenue

influence the level of production of firms

provide support to low-income households

correct market failure

promote equity

Microeconomic forms of government intervention

price controls

indirect taxes

subsidies

direct provision of services

command and control regulation and legislation

consumer nudges

Price controls

price ceiling + price floor

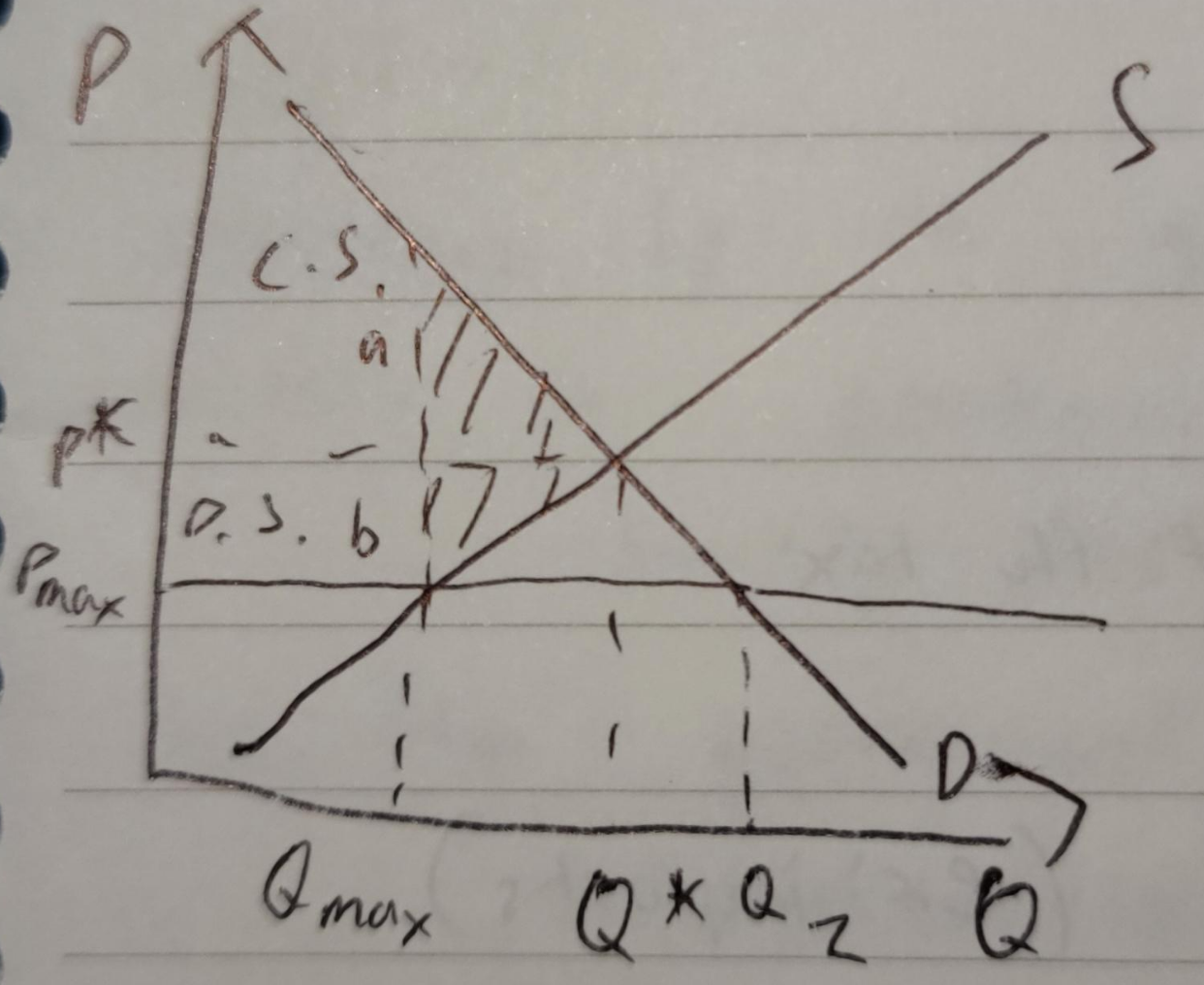

Price Ceiling

maximum price

below equilibrium point

the point where the price ceiling is set is Pmax

at Pmax, firms are willing to supply Qmax but the consumers demand a quantity above Q*

shaded area - 2 triangles, a and b

a = amount by which consumer surplus is reduced

b = amount by which produer surplus is reduced

excess demand shown by the values Qmax - Q1

managed through subsidies and tax breaks → costs

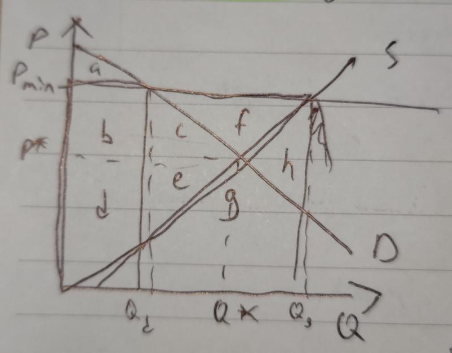

Price Floor

minimum price

above equilibrium point (Pmin)

common in agriculture

areas c, e, f, g, h are government expenditure → excess supply

producer surplus is increased (d+e → b, c, d, e, f)

f = directly from the government to the producers

a price floor creates welfare loss, indicating allocative inefficiency due to an overallocation of resources to the production of goods

society is getting too much of the good

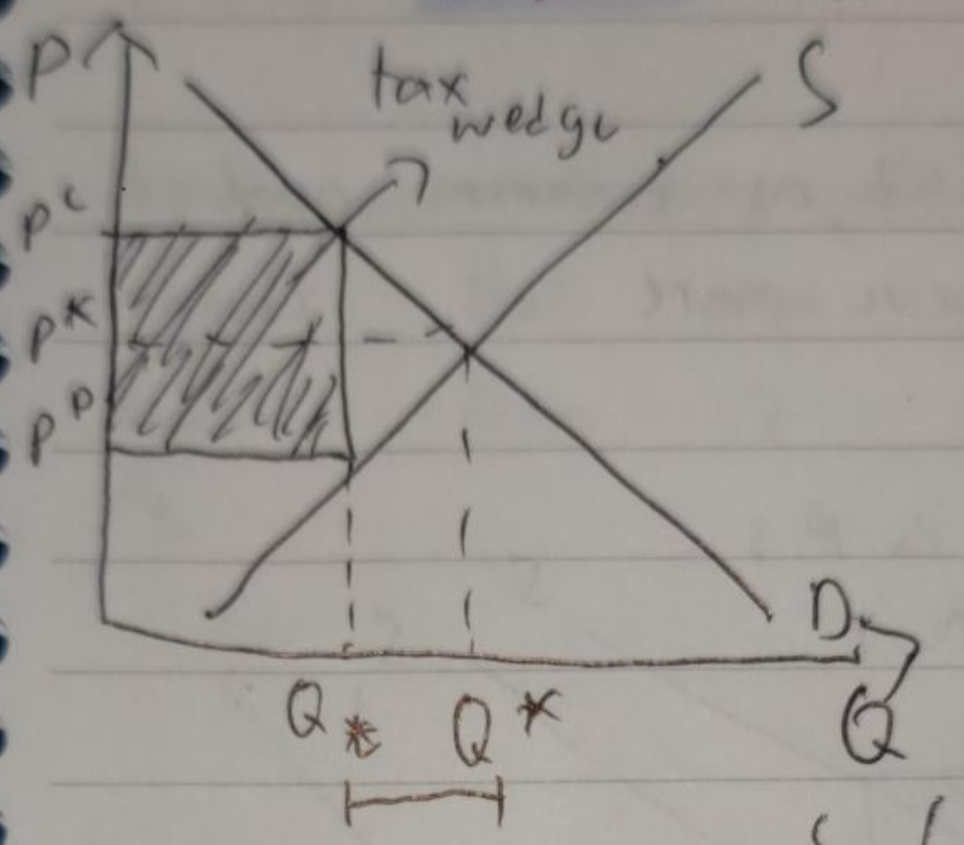

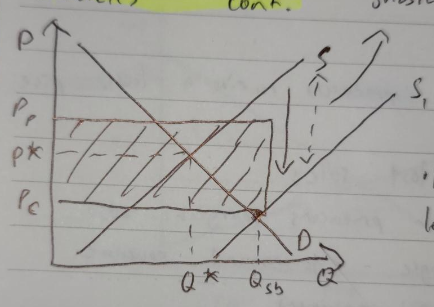

Indirect taxes

imposed on spending to buy goods and services

both consumers and producers pay a share of the tax

firms practically pay the tax

excise taxes - imposed on particular goods/services (ex: imports)

taxes on spending - value added tax (VAT) or goods/services tax (GST)

direct taxes are those directly paid to the government by taxpayers

an indirect tax creates a tax wedge

consumers face a higher price, while producers receive a lower price

Qt - Q* → lost sales (potential sales but they are lost/didn’t happen because of the tax)

Pp - price for producers, marginal cost

area of rectangle = government revenue

Pc - price for consumers

Pc>Pp, so demand decreases

shifts from S → S1

new equilibrium point formed at (Qt, Pc)

2 triangles, a and b

a + b - welfare loss, Dead Weight Loss (DWL)

both disappear, allocative inefficiency

a - consumer surplus loss

b - producer surplus loss

2 prices, C.S. and P.S. at different equilibriums

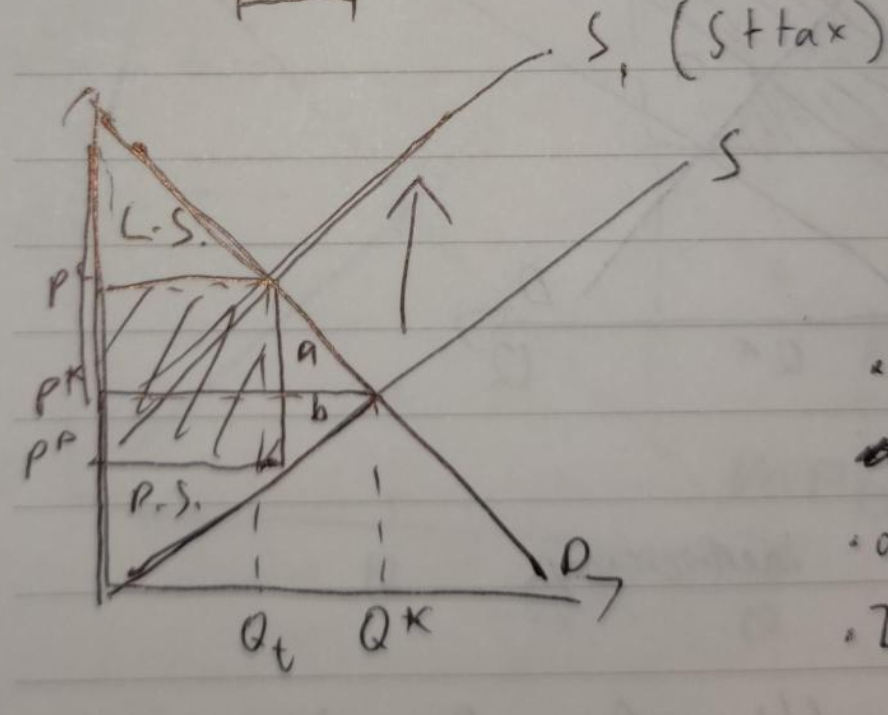

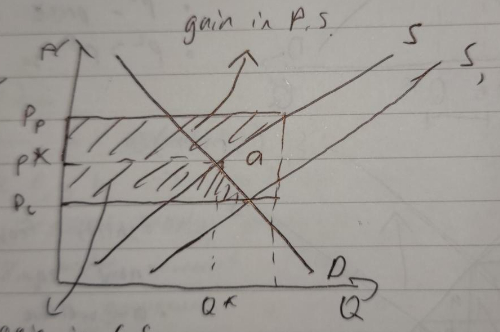

Subsidies

assistance by the government to individuals (firms, consumers, industries)

results in greater consumer and producer surplus

society loss as government spending on subsidy

loss from government spending is greater than the gain in surplus

welfare loss (allocative inefficiency) due to overallocation of resources to the production of goods (overproduction)

Pp and Pc switched (from indirect taxes), as consumers pay less and producers receive more

a = dead weight loss (DWL) due to overproduction

supply curve shifts (S → S1) because of one of the non-price determinants of supply (subsidies)

S1 = S + subsidy

2.8 - Market Failures

externalities are market failures, both positive and negative

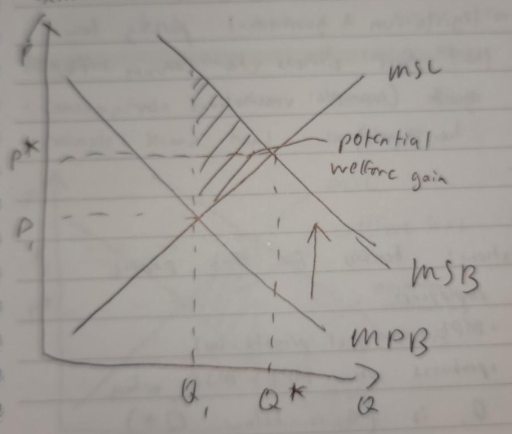

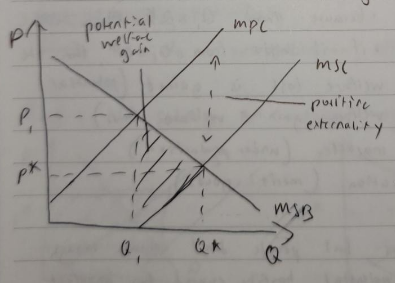

Positive externality of consumption

goods that when consumed, both the consumer and third parties benefit from it (ex: healthcare)

MSC - marginal social cost

MPB - marginal private benefit

MSB - marginal social benefit

in a free market, people would consume where MPB=MSC (Q1, P1)

(Q*, P*) where MSB=MSC is the socially optimal level (potential welfare gain) because from Q1-Q*, MSB>MSC

if MPB shifts from Q1-Q* (toward MSB), then the welfare loss is gained (potential welfare gain = welfare loss)

underallocation of resources to this market (underproduction)

Merit Goods

goods that are beneficial to consumers but people do not consume enough

people underestimate/ignore potential benefits, caused by imperfect access to information

causes the demand to be lower than it should be

examples: healthcare, education

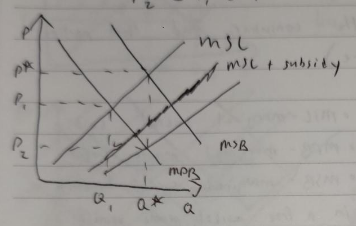

Government “fix”to positive externality of consumption

subsidies/direct provision

shifts the MSC curve downwards

new socially efficient level at Q* but at a lower price (P2)

P2 < P1 < P*

improving information (merit goods)

legislation: government passing laws that force citizens to consume the good

Positive externality of production

production of a good creates external benefits for third parties

ex: human capital: training employees

MPC - marginal private cost

produces where MPC=MSB, where Q1 is located (Q1 < Q*)

if production increases to Q*, there is a welfare gain (welfare loss turned into welfare gain)

underallocation of resources → market failure, allocative inefficiency

Government “fix” to positive externality of production

subsidies

causes MPC to be shifted downwards

full subsidy causes MPC=MSC when shifted

direct provision

high cost

offering training through the state for firms causes MPC=MSC

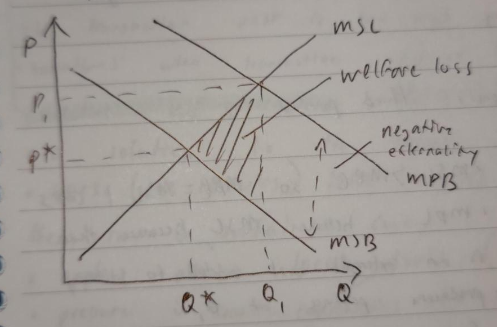

Negative externality of consumption

consumption causes adverse effects to third parties

ex: second hand smoking

in a free market, people maximize their private utility so they consume at MPB=MSC

in a free market, people maximize their private utility so they consume at MPB=MSCthere is a welfare loss as MSC>MSB from Q*-Q1

overconsumption of goods

too many resources allocated

Demerit Goods

goods that are harmful to the consumer but people still consume either because they are unaware of or ignore the potential harm

caused by imperfect information

demand is higher than it should be

creates negative externalities when consumed

example: cigarettes

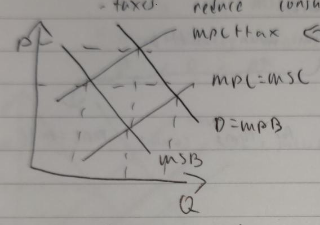

Government “fix” to negative externality of consumption

indirect taxes

taxes reduce consumption

legislation/regulation

making laws against the overconsumption of demerit goods

education/raising awareness

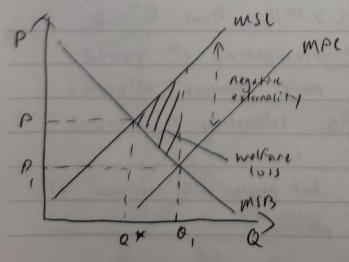

Negative externality of production

production of a good negatively impacts third parties

example: fumes from a factory

MSC<MPC so MPC=MSC+costs

MPC is below MSC, because there is an external cost added to society

producers produce at Q1

from Q1-Q*, MSC>MSB

welfare loss → market failure

Common Pool Resources

rivalrous and non-excludable (linked to negative externalities)

rivalrous: if one person uses, others cannot at the same level of utility

non-excluable: very difficult to exclude people/groups of people from using

typically natural resources

examples: fishing grounds, forests, atmosphere, etc.

Government “fix” to negative externality of production

international agreements

tradable permits

carbon taxes

legislations/regulations

subsidies