Readings for Final

Chapter 6 - The Visible Hand

How Do Markets Form Equilibriums?

Government Intervention - moves market out of equilibrium

visible hand

There is a population of people who are willing to pay varying prices for a product (their willingness to pay) and a population of firms willing to accept varying prices for that product (their willingness to accept).

Firms are price-takers.

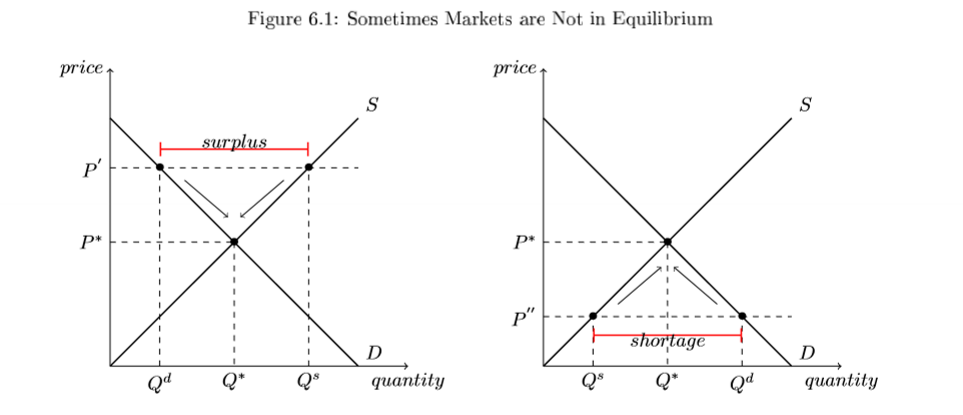

If quantity demanded is less than quantity supply, that means firms are brining too many products to the market

Unit Surplus

This unsold product becomes inventory, which must be stored at a cost

If a firm is a profit maximizer, which they should all be, then they will try to eliminate their inventory cost.

Firms will then bargain with consumers to take more goods for the same prices, so the price per unit decreases until it reaches the equilibrium where no inventory exists

this happens because firms face increased cost from unsold product, so they want to only bring to market the number of goods they expect to sell

If quantity demanded is more than quantity supplied, that means firms are not producing enough to meet all consumers.

Unit Shortage

This means not all consumers are able to purchase the good, despite having the WTP at least the equilibrium price

Consumers will then bargain with producers to pay the same price for lower quantities.

This causes the price per unit to rise until it reaches an equilibrium with no shortage.

Until the price reaches it’s equilibrium position, the market tries to get rid of any surpluses or shortages

Prices adjust until equilibrium is reached

Firms compete away surpluses by causing the price to drop, while consumers compete away shortages by causing the price to rise.

Dead Weight Loss

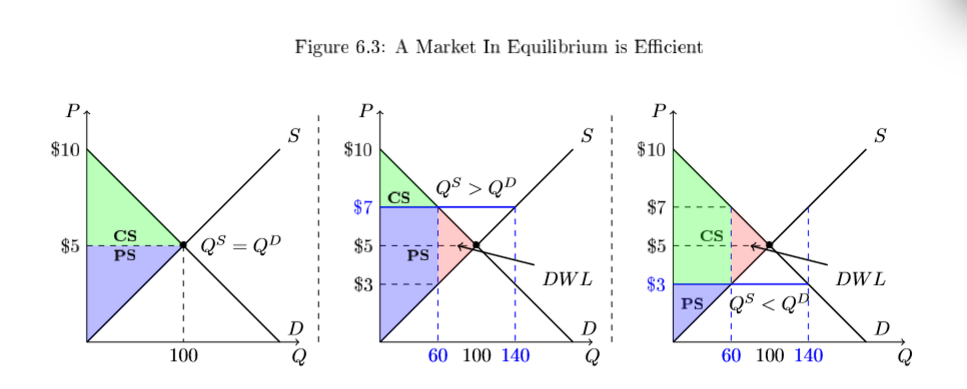

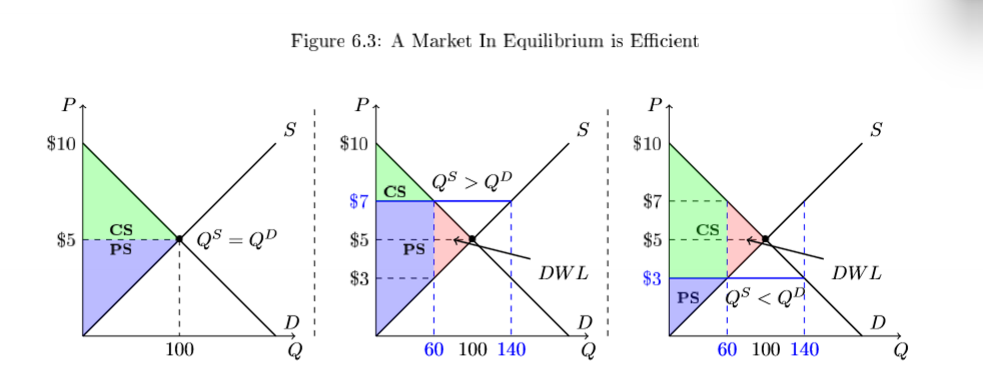

A market not in equilibrium is economically inefficient

Economic Inefficiency: the difference in a market’s potential and it’s actual outcome

One price equilibrates a market, price will only product one quantity

A market produces an economically efficient price and quantity pair, and any other price and quantity outcome is indefficient

Total Economic Surplus is lower if it is not the equilibrium

Dead Weight Loss (DWL) is our measure of economic inefficiency

Dead Weight Loss is the absence of consumer and/or producer surplus that should occur when a market is in equilibrium

Dead Weight Loss is produced in unit surpluses and unit shortages

When the market is not in equilibrium, either producers or consumers may benefit with the other side paying the cost

Whenever a competitive market is not in equilibrium, there is dead weight loss

Since markets try to move to equilibrium naturally, the only thing that could truly produce disequilibrium would be a Market Intervention (Government Intervention/Visible Hand)

Market interventions can take forms such as price ceilings, price floors, or subsidies, which inevitably lead to misallocation of resources and welfare losses.

Price Controls

When the government believes the price of a good in a market is too high or too low, they are making a normative decision

a judgment about the conditions set by a market

1st Fundamental Welfare Theorem holds, so the only reason for the government to intervene is if it would be more efficient for the government to set a price than the market

this is rarely true

What are the two types of price controls?

Price Floors: legal minimum prices that producers are not allowed to go below

Price Ceilings: legal maximum prices that producers are not allowed to go above

a binding price floor is one set above the market equilibrium price

a binding price ceiling is one set below the market equilibrium price

Binding Price Controls are Economically Inefficient

in this example, the price floor of $7 creates a unit surplus and the price ceiling of $3 creates a unit shortage

Both controls created dead weight loss

the prices are moving above or below what is the natural market equilibrium then economic efficiency is lost and fewer units of the good are ultimately consumed

Price controls can create winners or losers

in the example, the floor producers are better off and consumers are worse off

in the example, the ceiling consumers are better off and the producers are worse off

Price controls can make both consumers or producers worse off

ex: a price floor of $10 - no units are sold, so no consumer or producer surplus (too extreme)

Generally,

Binding price floors will always hurt consumers

Binding price ceilings will always hurt producers

Market is worse off with binding price controls

Example: Letting the Cherries Rot

In Michigan, cherries are a major cash crop

cash crop: economically important for their states

Since cherries are culturally and economically important, policy makers want to protect them from international competition (which is cheaper)

So, there is a binding price floor placed on cherries, so that farmers to not have to offer prices so low they cannot profit

Since binding price floors create surpluses, so farmers have to get rid of the cherries.

However, farmers are forbidden to exchange or give the cherries away, so they have to destroy them.

Thus, the forces farmers to allow many cherries to rot left unsold

In this price control, increased profits are not occurring and thus many farmers left the market

Example: Is the Minimum Wage a Binding Price Floor

Minimum Wage is by definition a binding price floor

Economic theory would say that since it is a binding price floor, that a surplus of labor and reduction in available jobs should occur.

more people would be willing to work at that wage than employers that would be willing to hire workers at that wage

Labor economies go against the assumptions we make with competitive markets:

Lack of Bargaining Power

unions have fallen to less than 7% of all labor forces

hardly any minimum wage workers are in unions

labor market is more monopolistic

these firms reduce bargaining power to their employees, but also compete away small businesses that previoulsy existed

this decreases the labor market potential for laborers

Impact of Installing and Raising Minimum Wages

for low-skill, entry level jobs (fast food) early studies did show that raising the minimum wage did decrease jobs available

on net, there was an increase in average incomes after a minimum wage

Papers that concluded negative labor effects from a minimum wage were far more likely to be published by top economic journals.

On average, minimum wage does barely anything

important for groups that face wage discrimination

Labor markets do not adhere to economic theory

labor markets are not necessarily very competitive

Most economists believe wages should be set regionally, not nationally

The minimum wage is a good example of the limitations of supply and demand.

modern economics is very empirically driven; always revising economic theory with new data

Economic theory is not always perfect or 100% true or false

like gravity doesn’t always affect and object in the same ways

Taxation

Individual Taxes Come in 2 Forms:

Tax Based on spending ability (wealth and income tax)

often progressive tax systems: as income rises so does the percentage of income paid

ex: in the US, income taxes represent a graduated scale with each section called tax brackets

Tax based on actual spending (sales and excise taxes)

often regressive tax systems: as income falls the percentage of income going to the tax rises

ex: societies try to avoid regressive taxation as much as possible, usually using a tax-credit system to reduce the overall tax paid to eliminate the effects of the regressivity

Businesses can also pay income (profits), sales, and excise taxes.

Sales and Excise can be paid when purchasing intermediate goods and when selling their final product.

Business Income Tax is based on size of companies

small businesses paying their individual income tax

medium sized businesses (L.L.C.s) and large businesses (corporations) paying higher tax rates compared to small businesses

Economists consider society to have a efficiency vs equity trade-off

if you add equity to the system, you likely give up efficiency

Two Types of Equity:

Vertical Equity

as someone’s ability to pay rises, they should pay a larger portion of the revenue collected from taxes

Horizontal Equity

ensuring taxpayers with similar incomes pay similar taxes

Public Provision: the process that in which modern economics collect taxes to provide goods and services

Public Goods: specific features that cause markets to be ill-equipped to efficiently distribute them to society

ex: NYC mass transit system, where the private businesses could not keep the the system available for everyone and still turn a profit

the social benefits of mass transit system are so large, it becomes more efficient for a system to be publically funded and managed.

Negative Externality: a negative spillover from the market

ex: cigarette smoking as it puts a burden on the purchaser, those around them (second-hand smoke), and places a burden on the health care system

all negative externalities mentioned:

emissions (CO2, SO2, particulate matter)

noise

congestion

to negate negative externalities, we often turn to taxes

pigouvian taxes: taxes which seek to reduce the negative social consequences of negative externalities

Why Do We Tax Ourselves?

We set a social contract: markets are powerful, but we (society) are there to smooth the edges when they are too sharp for society

Government can be economically inefficient, sometimes for good reasons or bad reasons

Only informed citizens can create an efficient tax system that not only improves social mobility without harming the growth of the overall economy

Commodity Taxes

These taxes can be analuzed using supply and demand framework

Consumption Tax Comes in 2 Forms:

Sales Tax - based on a percentage

Excise Tax - a per-unit tax

Commodity taxes are the same thing as excise taxes

Three Truths of Commodity Taxation

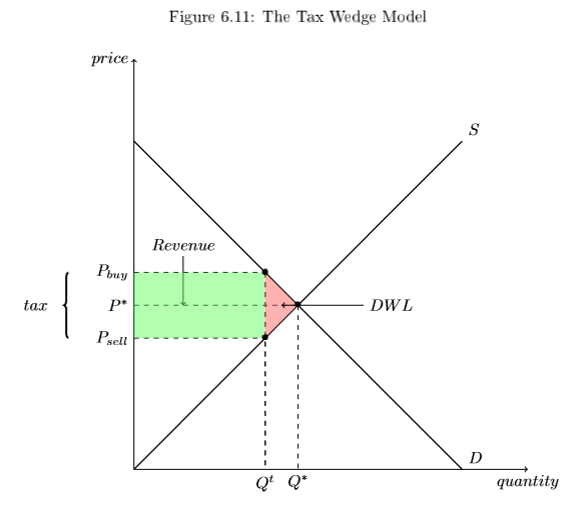

1. It does not matter whether you tax consumers or producers, the result of the tax is the same

2. A commodity tax drives a wedge between the price paid by consumers and the price recieved by producers. This created DWL and generates tax revenue

3. The budren of a commodity tax represents the loss in consumer and producer surplus from the wedge created by the tax. The comparative budrens are determined by the relative elasticities of supply and demand. Whichever side of the market is less elastic will be more burdened by the tax.

Tax Wedge Model

a tax does NOT cause the supply or demand curve to actually shift

the tax makes it APPEAR as if that side of the market has shifted

ex:

A tax on consumers does not change the consumers WTP, but it reduces their ability to pay for it.

after a tax is implemented, we expect some consumers to exit the market due to affordability and others to consume less

Tax Burdens

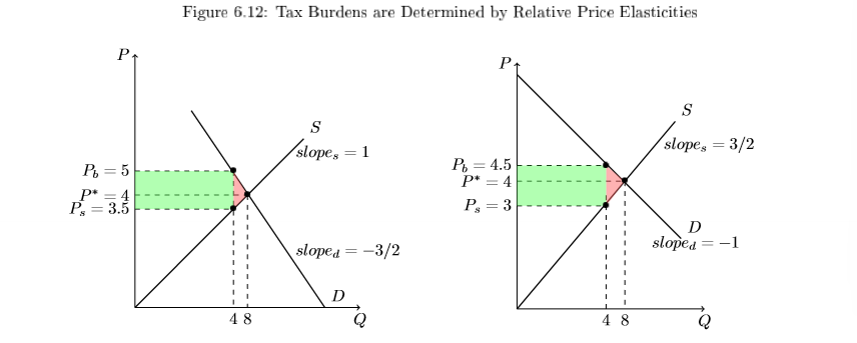

If the price elasticities between supply and demand are equal, then the tax burden (loss in consumer or producer surplus to tax revenue and dead weight loss) will be equal as well

If elasticities between supply and demand are different, then the relative tax burdens will also be different

in this example, we can see the slope of the demand curve is steeper in the left graph. This means the price elasticity of demand is inelastic compared with the supply curve

consumers are more sensitive to price changes than producers

the tax burden is therefore heavier on consumers

they have to pay $5, when it used to be $4

producers only recieve $0.50 less than it was before the tax

$4 compared with $3.50

in this example, we can see the slope of the supply curve is steeper in the right curve. This means the price elasticity of supply is inelastic compared with the demand curve.

thus, producers are more sensitive to price changes than consumers

tax burden is therefore heavier on producers

they are recieving a dollar less after tax

consumers are only spending $0.50 cents more after tax

whichever side is more elastic in response to the price change will be the side that experiences less of the burden

the more elastic supply or demand happen to be, the easier it is to avoid paying the tax

whatever side is more able to avoid the tax will be more able to avoid the burden

An Example: Cigarette Taxes in Practice

Pigovian Taxation: a tax placed on the product which produces the negative externality

naturally reduces the incentive to both produce and consume the product

referred to as sin taxes

create revenue

revenue then used to reduce the damage caused by the externality

Smoking is a negative externality as:

1. second hand smoke

2. cigarette smoking causes health insurance premiums rises

One issue with cigarette taxes is that they are regressive

smoking is predominantly a habit among low-income households

cigarette markets have low price elasticity of demand (smokers will not want to stop consumption)

thus, taxing cigarettes is sure to be regressive and not change the demand much

But, the regressivity of cigarette taxes is made up with the tax revenue that offsets increased health care costs

Subsidization

There are three types:

1. Positive Externalities - when a market creates social benefit

Infant Industries

such as electric automobiles and solar panel manufacturing (small markets trying to replace large existing markets)

have positive externalities

2. Social Welfare - where assistance for groceries, rent, and utilities assists low-income families

Temporary Assitance for Needy Families in the US are used to ensure people can purchase the basic necessities of life

economic benefit from the spillovers into the macroeconomy

3. Research and Development - the government does for especially valuable types of technology

ex: wireless internet

Public-Private Partnerships exist because companies find it in their interest to maintain relationships with universities

Subsidization happens for questionable reasons

ex: graft in the construction industry

government gives grants to construction projects that may involve corruption, as funds can sometimes be misallocated or siphoned off by unscrupulous contractors.

Commodity Subsidies

The Three Truths of Commodity Subsidization

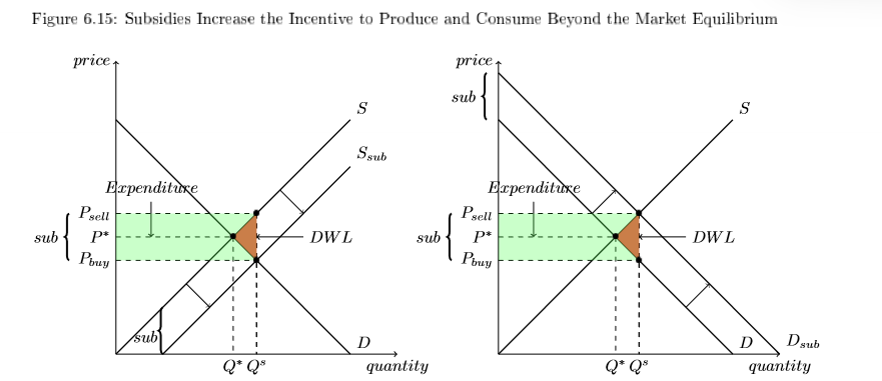

It does not matter who gets the subsidt, the effect on the market is the same

A subsidy drives a wedge between the price paid by consumers and the price recieved by producers compared with the natural market equilibrium. Both consumer and producer surplus will rise.

The cost of the subsidy is borne by society, while the benefits of the subsidy go to the market being subsidized

this is why economists will typically only support subsidies that have explicit positive spillovers - Positive Externalities

ex: flu shot

the use of the flu vaccine can potentially save thousands of lives per year and millions of lives over decades

the decision to get the flu vaccine is a private one, but for which there are social benefits that spill over from this decision. as if you get the flu shot, those around you have less chances of getting the flu

subsidization actually improves the flu shot market by increasing the number of people who can get the shot

(private market cannot support the social quantity that wants the flu shot)

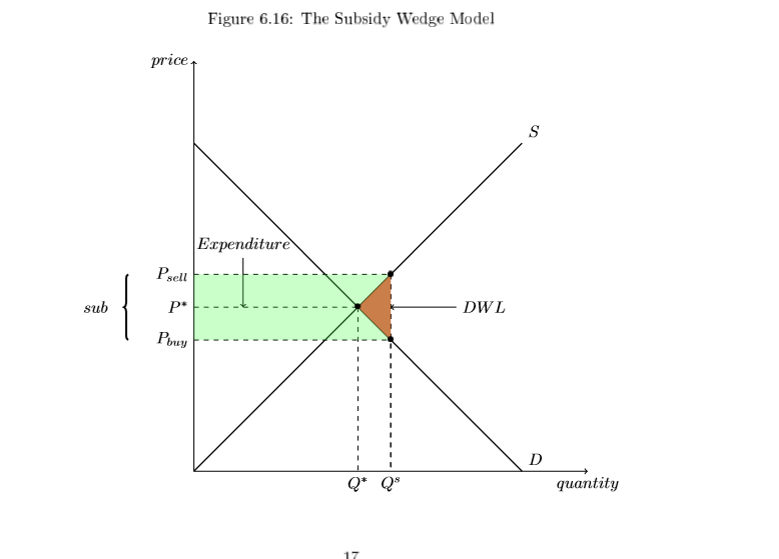

Subsidy Wedge Model

A commodity subsidy makes the market where there is an incentive to both produce and consume

DWL exists with subsidy as the price recieved by the producers rises and the price paid by the consumers falls

Normally, we only subsidize goods that arme

being under-produced

Cost of Subsidization - paid for by taxpayers (government)

Therefore, in order for the government to create the market below, it has to pay the green rectangle (subsidy expenditure)

Government not only creates the DWL, but has to pay for it too.

Chapter 10 - Don’t Be Afraid of Failure

Ever Adapting Economics

Economics is a discpline that relies on models (empirical and theoretical)

Economics is like physics

1. it seeks to explain how seemingly random events are actually a process that can be understood

2. there will always be a need to update and abandon existing theories when time or empirical investigation does away with their usage

3. retains many theories and ideas from its initial development

the ideas of comparative advantange, supply and demand, and marginality run throughout

Classical Assumptions

NeoClassical Assumptions

_

First Fundamental Welfare Theorem: competitive markets will produce pareto optimal outcomes as long as the previous assumptions hold and firms are price-takers

Pareto Optimality implies both economic and social effiency have been achieved

Free Markets are often held as the platonic ideal for economic systems

which is why capitalism is a dominant economic system for many democratic states

Reliance on free markets has led to some negative attention, so only now are issues like income inequality, resource exhaustion, and environmental destruction have recently entered the canon of modern economic analysis.

these are sub-fields concerned with analyzing and understanding the relationship between that natural world and our economic systems.

therefore, economics as a discpline is tackling more normative considerations of market failures

health care economics and financial economics are largely focused on the problems of information asymmetries

Social Welfare Revisited

Good Systems Align Self-Interest with Public Interest

Economics has treated social and economic efficiency as interchangeable

What are the welfare theorems?

Under the neoclassical assumptions, competitive markets are pareto optimal

If society is at a pareto optimal position, it can move to any other pareto optimal position through redistribution

If free markets produces DWL, they are not maximizing social welfare

There are market failures that happen because the goods prevent free markets from achieving social efficiency

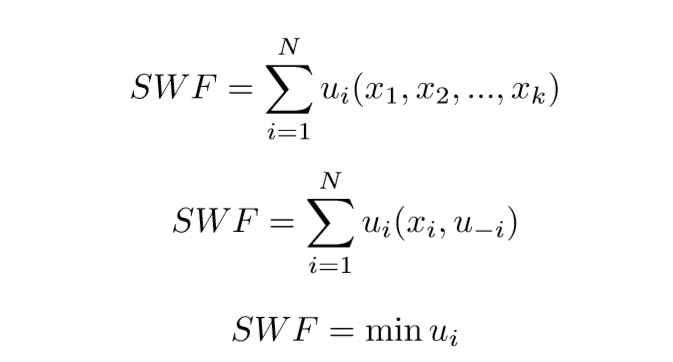

Social Welfare Function (SWF)

firms maximize profits, consumers utility, while collectively we will assume that society wishes to maximize its SWF.

in democratic nations, SWF is defined by the social contract.

ex: anti-trust policies, labor laws, and anti-discrimination rules

Three Different Types of SWF:

1. Utilitarian: u is utility of individuals indexed by i = 1,2,3…. N where N is the population of society, and the x terms are all the ways citizens attain utility

2. Social Utilitarian: the same as the Utilitarian view, but in addition to consuming goods (x terms), individual utility (ui for person i also includes the utility of everyone else u_i)

3. Rawlsian: here social welfare is measured by the happiness of the least well-off person. The goal is to maximize SWF, but only by making the least happiest person happier.

Pareto Improvement: a way to view societal progress

PI refers to the ability of society to increase the utility of one person or group of persons while not harming or making any group or individual worse off.

Second Fundamental Welfare Theorem: if society is at any Pareto Optimal point, it can move to another Pareto Optimal point by redistribution

Society chooses where to be on the Pareto Frontier, therefore it is up to society to address any social inefficiencies

Any uncompensated damages are inefficient

Damage: negative utility or negative profits

ex: exposure to air pollution increases asthma incidence rates, the damage is increased medical bills, lost wages from missed work, and reduction in quality of life

Negative Externalities

First Law of Thermodynamics - energy cannot be created nor destroyed, but can only change forms or be transfered

Coal has been one of the most important natural resources for human and economic development

Coal burning creates pollutants of Carbon Oxides, Sulphur Oxides, Methane, and Particulate Matter

This leads to significant environmental consequences, including climate change, acid rain, and adverse health effects on populations.

these can cause both environmental and human damage

have both economic benefits and social damages

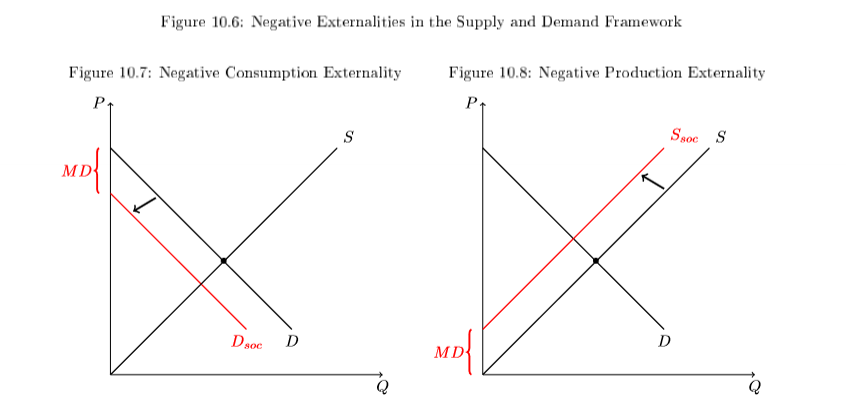

Negative Externality: when a product or activity creates benefits for one group and damages for another

The circular flow is a positive feedback loop— consumption and production feed into one another

Negative Externalitty: markets are unable to factor their damage into the value of the good

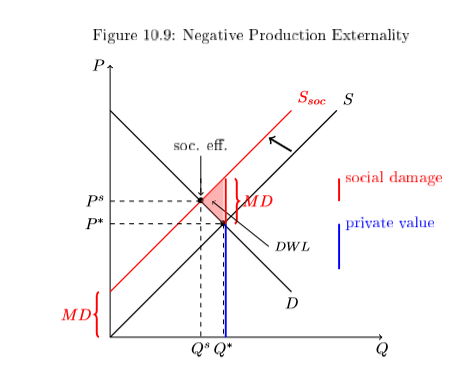

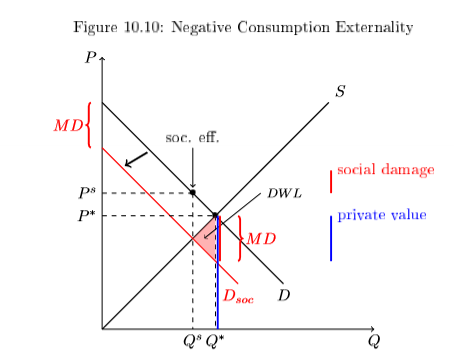

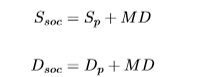

MD stands for Marginal External Damage: the external damage created by the negative externality

therefore, the difference between D and Dsoc and S and Ssoc is MD

The competitve market equilibrium is Pareto Optimal, but it is not socially efficient.

this is because the price of the good represents the Private Value of the good, to both consumers and producers in the market

consumers buy products — signaling the value the product at least at its market price

producers produce products —— signaling the market price is at most what the cost is to produce said product

Market Prices are Signals of WTP and WTA

signal the private value of the good

The private market price of a good is not affected by the MD/MED itself.

the private market continues to equilibrate where we expect it to —- the social supply curve does not exist as consumers and producers do not experience it

therefore, the price signal is not accurate of the true social cost of the good

The socially efficient equilibrium is where the social supply (or social demand) intersects the private demand (or private supply) curve

DWL only occurs at the private market equilibrium (in prescence of negative externalities)

The socially efficient equilibrium has no DWL

a market can be economically efficient, but not socially inefficient which implies the market is no longer maximizing the Social Welfare Function or that a potential Pareto Improvement could be made

By graphing and showing a socially efificent outcome, we are taking the externality and injecting it into the market

Simulates a world where the source of the externality has internalized the externality

this means the source behaves as it the damage created actually reduces the private value

by forcing the price up and/or incentivizing less consumption and production, we are able to find a theoretically and socially efficient outcome

Policy Responses

A private market will fail to maximize social effiency in the prescence of a negative externality

Many markets have negative externalities

1) most markets rely in some way on fossil fuels somewhere in their supply chain

2) there are many more acute forms of negative externalities, like mercury, lead, and hazardous chemicals from agricultural and industrial production

3) environmental degradation becomes almost impossible to avoid

The key to policy is to understand the severity of the problem

Types of Environmental Policies:

1) Command and Control

policy focuses on standards, limits, and/or bans

are best used when degradation is especially costly or damaging to human health

ex: leaded gasoline was a legal product up until the 1970s - when the US Environmental Protection Agency was formed and used the Clean Air Act to mandate the removal of leaded gasoline from the market completely

2) Market-Based Mechanisms

policy takes advantage of natural market forces to achieve social efficiency in a cost effective manner

We have different policies to deal with pollution, as there are two broad categories of pollution

Fund Pollutants - emissions for which the earth has some absorptive capacity

ex: oxides

Stock Pollutants - emissions for which there is no absorption

ex: plastic

Pollutants have differences in terms of mobility and their sources (impt. part of the discussion regarding environmental policy)

air pollution tends to be very mobile and easily crossess city, state, etc. lines

water pollution may be mobile if spilled into rivers which spread the pollution, but can also be stationary when spilled into lakes and water tables

For fund and some stock pollutants, there is often a threshold to keep the pollutant at or below

meaning, there is an acceptable amount of emissions.

for these pollutants, it is possible to use the natural incentives of the market to get the market to behave in a socially advantageous way

for example, CO2 is a fund pollutant. Since CO2 is so prevalent in our economy/industrial markets, we have a decided social benefit to keep the level of CO2 below its damaging threshold without erasing its existence complete

Market-based mechanisms focus on understanding the underlying incentives of the market to target policy

three types of MBMs:

1) Pigovian Taxation

named for Arthur Pigou

correction taxation (sin taxes) - seek to reduce the production and consumption of an externality producing good by taxing the good

pigovian taxes internalize the externality by setting the tax equal to the marginal external damage of the externality

by taxing producers, we cause them to internalize the externality

negative compensation: charging producers for the negative externality they produce

has the added benefit of creating tax revenue

used for socially enhancing endeavors

ex: subsidizing environmental production

ex: reducing the regressivity of the commodity taxation (see cigarette taxes)

Double Divendend: argument of the pigovian taxation - the tax creates revenue and decreases production of negative externality

a corrective taxation is more cost-effective than a command and control mandate

less government administration as the market will naturally produce the preferred outcome under the taxation

2) Cap and Trade

cap: refers to the establishement of a threshold of acceptable pollution

trade: refers to the use of tradable pollution permits to achieve the cap

ex: 2 firms that each emit 15 units of a pollutant, so 30 units total. The government wishes to allow only 20 units of pollution.

each firm has their own pollution abatement cost (the per unit cost of reducing their own pollution voluntarily)

TAC for firm 1 = 0.5a²

TAC for firm 2 = a²

a represents the units of pollution reducing voluntarily

the government then distributes 10 pollution permits each to both firms, each permit allows a single unit of pollution (emissions standard: a command and control policy where firms are not able to trade permits)

TAC for firm 1 = 0.5a² = 0.5(5)² = $12.5 to abate/lessen 5 units.

TAC for firm 2 = (5)² = $25 to abate/lessen 5 units

TAC net = $12.5 + $25 = $27.5 to lessen/abate 10 units and meet standard

both firms not have an incentive to engage in trade with the pollution permits

firm 1 has pollution reduction cost that is half of firm 2’s

so, the firms may be able to engage in exchange

firm 1 could sell to firm 2 a number of pollution permits that would allow firm 2 to increase their allowed pollution level

ex: if firm 1 sells 5 permits to firm 2 for $4.75 each, firm 2 would accept this offer because 5 x $4.75 = $23.75 which is less than the $25 abate to lessen 5 units. this is also beneficial to firm 1, as they pay $50 to reduce 10 units, and recieve $23.75 in permit revenue

any time firms have different abatement costs, there is an opportunity to set up a permit market to take advantage of that fact.

because firms are profit maximizers, they will want to engage in permit trading.

Tradeable permits take advantage of profit maximization to induce a reduction in emissions in a cost-effective way

3) Coasian Bargaining

One of the most important factors of negative externalities is the efficiency of property rights.

Efficient Property Rights have 3 Features

1) Complete, meaning the property right matters

2) Enforceable, meaning the property rights can be maintained

3) Transferable, meaning, the property right can be sold

Negative externalities exist in part because property rights exist

ex: farmer who lives downstream of a stell smelting plant which converts one to steel, and produces mercury which makes its way into the stream. This steam then becomes polluted, so the farmer can not longer use the water to irrigate their land. Thus, the farmer has to pay for more expsnive water sold by the the city, which reduces the farmer’s profits

without the farmer owning the property and being able to earn profits in the first place, there would be no way to assign/assess damages

Bargaining may increase social welfare without the need for government intervention

excepting the establishement and maintence of property rights

To do so, we will rely on the Coase Theorem

Under this theorem, we will assume that bargining is costless, property rights are efficient, and there are only two entities

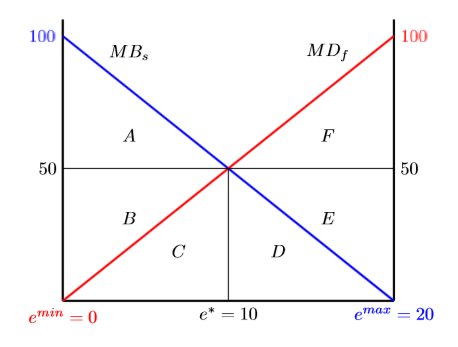

EX: (e is emissions)

MBs = 100 - 5e (steel plant)

MDf = 5e (farmer)

as we can see below, at emissions level below e*, MB > MD, implying that society wants at least e* level of the pollutant. Beyond e*, MD > MB, so social welfare is reduced.

e* is the socially efficient level of emissions

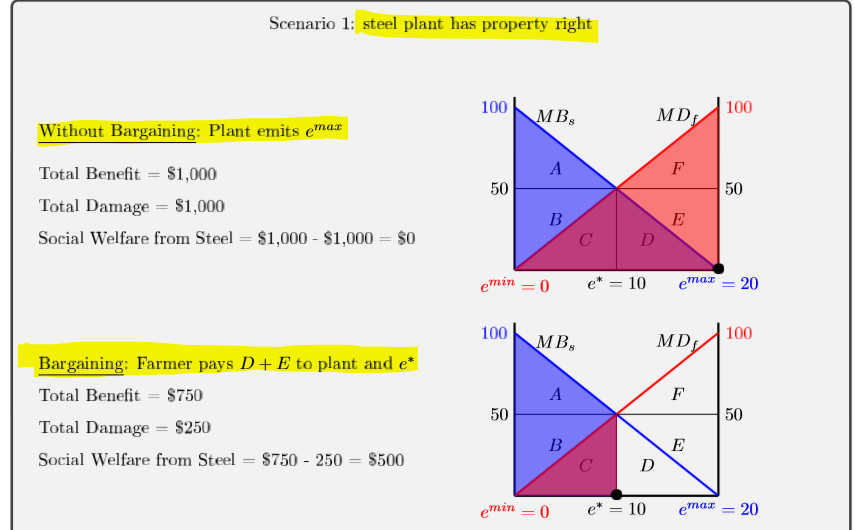

If Steel Plant Has Property Right over Stream:

here, farmers play D+E=$500 to reduce emissions because if not, they would experience $1,000 worth of damages. If they pay the plant $500 the plant will only emit e*, so the farmer will only experience $250 of damages. $750 is less than $1,000 so bargaining is preferable.

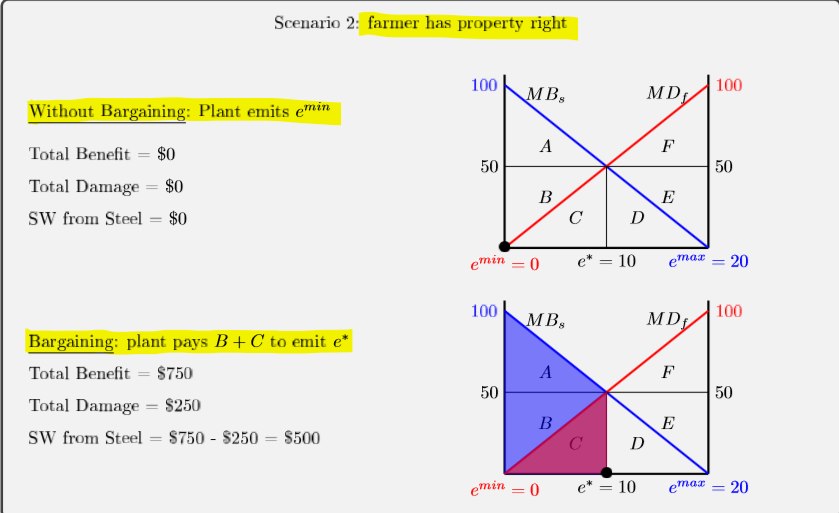

If Farmer has rights of land and can restrict steel plant:

in this one, the plant pays the farmer $500 to allow e*, so they will benefit $750. So net $250, which is better than the farmer not allowing them to operate and emit.

The Coase Theorem has a strong disclaimer

the assumptions are rigid, and more often than not do not hold true in real-world environmental damage scenarios.

if only because the parties invovled are usually numerous and not simply two entities. Nevertheless sometimes individuals join Class-Action Lawsuits - which are suits brought by a large group of indiivudals who are claiming damages from a defendant (usually a large entity)

Class Action Lawsuits give us a Coasian framework to work with, which perhaps explains why environmental law is especially booming as a form of law

litigation however disruptions the coasian framework as lawsuits are expensive

this means that to reduce the ability of those who cannot afford to challenge companies or individuals to environmental damages

In short, while the Coase Theorem provides a hopeful theoretical solution to a negative externality, it cannot be true for policy solutions

but, it does present a potential way to model environmental damges as a compensatory mechanism, where the ability to enforce property rights to claim environmental damage is paramount

MBMS have a decided advantage over C&C policies because they do not have costly monitoring or administration since it is market-driven

but MBMs are not preferred for all or even most pollutants, just those where a damaging threshold exists

Public Goods and Common Goods

Positive Externalities arise when the consumption and/or production of a good produces Marginal External beneift

opposite of a negative externalitiy

This positive externality means that others benefit from the market even when they do not involve themselves with it

Since this is an externality, the market does not see this benefit

Example: Flu Shot

The consumption of flu shots not only create private benefit (reduces your chance of flu) but also social benefit (reduces people around you chance of flu)

Example: Mass Transit

privately benefits the people who use it, benefits those that don’t by reducing road congestion and air pollution

Example: Education Investing in education provides individuals with knowledge and skills that enhance their career prospects, while also contributing to a more informed and productive society.

The MOST IMPORTANT TAKEAWAY from the positive externality graph is that a private market will under-provide the good if it has a positive externality

the market will be unable to value the spill-over benefits (it’s an externality, they don’t see them)

more examples:

driving lessons

psychological therapy

A competitve market will not create enough consumption and production relative to the True Social Value

TSV = U + N

u is use-value, n is non-use value

Use-Value refers to the economic benefit of something as it’s being consumed (direct utility value)

Non-use-value refers to the value of something either from its option value or its existence value

option value - the value you place on the ability to enjoy something in the future

existence value - the value you place on something that you will never consume but still have experienced utility from its existence

ex: never been to disney world, experience of others who have through social media or something

Hedonic Pricing Model: uses data on housing in an attempt to measure the WTP for clean air/air quality

so, it would be possible to estimate the true social value of clean air

could be helpful for environmental policy makers to know for cost-effective environmental policy.

Public Goods

Clean Air is a Public Good

Non-rival and Non-excludable

consumption cannot be prevented for clean air, and consuming does not reduce the overall social stock of clean air

With public goods, the private market behaves similar to how they do with positive externalities

the private market will under-provide the good

Public goods often suffer from the Free-rider Problem

Free-rider Problem: someone is able to enjoy the benefits (non-excludable) without also contributing to the good’s maintenance (turning it rival)

ex: forest land, where people camp and if they do not clean it up

then, they are in the free rider problem because the turn the land rival by reducing it’s clean ground

Private Goods are rival and excludable

competitive markets can distribute private goods in a socially benefit way

rivalness means that product will need to be produced often, or it will become scarce

excludability means that the good has barriers to consumption that can be monetized

ex: private beach

Common Goods

Public goods are non-excludable, so they may be prone to congestion

this turns a non-rival good into a rival one

this good then becomes a common good

common goods are prone to experience the Tragedy of the Commons

The Tragedy of the Commons arises when a good is both non-excludable and rival

due to the inability to prevent consumption, if costs are low enough then an unsustainable process called resource collapse may occur

ex: fisheries being overfished

Example: Out to Sea

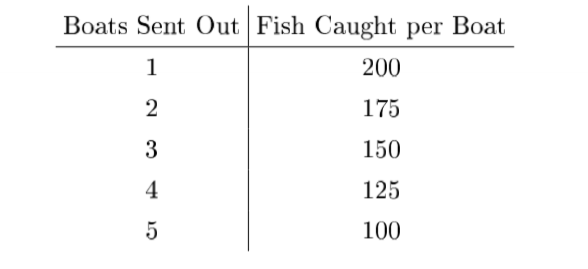

There are 5 people who each own a fishing boat

these boats are the only source of fish for the community

people who own the fishing boats must fish for their livelihoods

Boats are sent out once a month, with total cost of $500

there is no cost to keep a boat inland

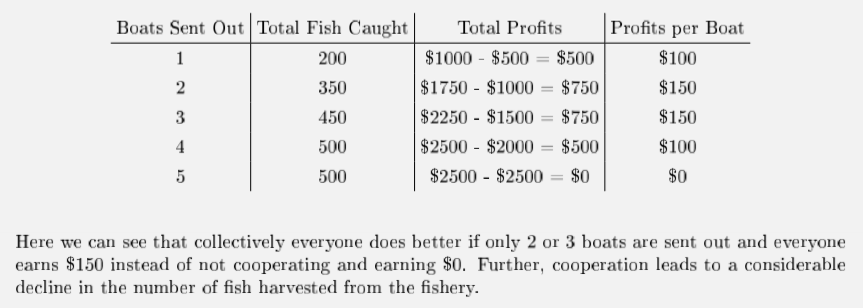

The current market price of a fish is $5, fishes are caught according to this:

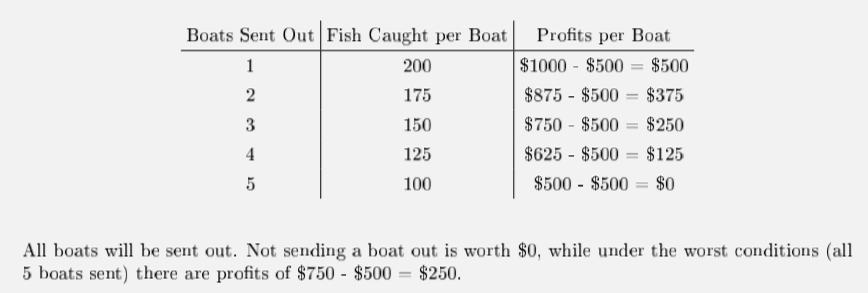

The boats decide to NOT cooperate:

The boats decide to cooperate:

Policy Responses

For goods with positive externalities, best policy response would be a Pigovian Subsidy

sigma set to MB of the good

When positive spill-overs are large enough that a good and its benefits become public, the free-rider problem arises

Social efficiency justifies the use of public provision to maintaine this public good

ex: public education

For common goods, the solution is usually regulation

Command and Control Fashion

ex: Total Allowable Catch for fisheries

once a fisherman fishes their share of the TAC, they must stop fishing

allows fisherman to trade their portion of TAC shares

Who was the first woman to be awarded the Nobel Prize in Economics?

Elinor Ostrom

popularized the idea of Collective Action

society compelled by self-interest would see the benefit of cooperation

Collective Action serves as a framework of how society may overcome the collective action problems of free riding, congestion, and resource exhaustion

ex: city began charging congestion fees for those using behicles instead of public transport

Information Asymmetries

One of the core assumptions of economic efficiency is that information is either known or can be costlessly attainted (free without barriers to entry)

markets fail when goods have characteristics that give them a social value different from their private value

a similar issues arises when there is an information asymmetry

An information asymmetry refers to a situation where one party in a multi-party transaction has more information about the true value of some good than the other parties in the transaction.

this situation has potential market failure, therefore creating risk

Economic effiency relies on the idea that consumers make rational purchases, which implies they understand the value of the good

this breaks down with information asymmetries

Information Asymmetries create risk

risk refers to the chance that a transaction will be worth less than what is paid for it

examples:

a lottery ticket has risk because the most likely outcome (not winning) is a lower value than the cost of the ticket

a used car has risk because it may be a lemon

a company’s stock has risk because it may be run by a bad ceo

For most people, risk creates disutility

the chance of buying a lemon used car may create anxiety or even a refusal to purchase if the potential buyer does not like risk

risk aversion refers to the extent to which risk reduces someone’s utility

Types of Risk Aversion

1) Risk Averse

2) Risk Neutral

3) Risk Loving

People and entities that are risk averse will require a Risk Premium before engaging in a transaction unless the information asymetry can be eliminated

Risk Aversion - could refer to a psychological effect or could refer to the acceptable level of risk that maximizes a firm’s profits

ex: banks screen mortgage applicants for their credit scores, charging higher interests on those with lower credit scores

Two Types of Information Asymmetries:

1) Adverse Selection

ex ante risk - before the transaction

2) Moral Hazard

ex post risk - after the transaction

An Example: Akerlof’s Lemons

Assume that cars come in two types

1) Lemons

2) Peaches

Lemons have low true value = VL = $500

Peaches have high true value = VP = $1,000

Probability of a Lemon is 0.25

Probability of a Peach is 0.75

If you are a buyer, you would be worried about the chance of a lemon

To calulcate the expected value of a used car,

EV = pl x Vl + pp x Vl

EV = 0.25 x $500 + 0.75 x $1000 = $875

If a seller of a lemon offered $875, the buyer would take the offer

If a seller of a peach offers $875, the buyer will likely not accept

why would a seller offer a car worth $1,000 and give the $125 to the buyer

If buyers offer sellers $875, then we can expect that very few peaches will be sold at that price

the market for used cars at a WTA = $875 has more frequent lemon probabilites and less peaches probabilites

The EV of cars will now fall below $875 until there are only lemons on the market

the EV is below $500

With an EV below $500, the market unravels

Information Asymmetries cause markets to behave inefficiently

Adverse Selection and Health Insurance

There are many forms of adverse selection, but what they all have is common is that a pre-transaction information asymmetry creates risk, which lowers the value of the transaction.

because someone lacks full information about the potential value of the transaction, it is difficult for an effieicnt transaction to occur.

In the used car case, the buyer is not willing to pay full price for the value of the peach because there is the risk of the lemon

Consumers want to reduce risk

Unless the asymmetry is reduced, the market will stay inefficient

Example of Adverse Selection

Health Insurance Industry

involves the fact that among the population there are those prone to needing a substantially large amount of medical service, while others do not

disparity between the health outcomes of the wealthy and low income populations

low income families are more likely to suffer chronic health problems

these populations will want to purchase health insurance

health insurance wants to contract with them the least since they have little money

Insurance companies therefore screen potential clients and deny those with pre-existing coniditons or charge them higher premiums

Companies may also form risk pools

risk pools: collected premiums paid into by coverage holders that are used to fund coverage in the event of a needed health care service for a client

By charing high risk clients more and low risk clients less, insurance companies are able to reap economic profits.

social welfare problem arises as this outcome is not efficient or equitable

needing to pay for expensive health services has nothing to do with ability to pay

we do not have preferences for health care services the way we do with private goods

Price elasticity of demand for health services is extremely low

little practical choice with health services

There is a lot of randomness with diseases

health care markets do not function the way typical private markets do and we cannot rely on the effieicines of competitive markets to sort these disparities out

“Hockey-Stick” - On average, we pay 80% of our total lifetime health care in the last 20% of our lives. This implies that older populations are in a completely different risk category

U.S. Solution - Medicare System

taxpayers pay into that funds the health insurance coverage of those older than 65

this system is beneficial not only to the elderly but also those with private health insurance because the high-risk nature of the elderly would drive up the cost of coverage for everyon

U.S. Medicaid System - provides subsidized or fully covered health services through pay-roll taxes to low-income and out of work individuals

Anoter solution involves government intervention

seeks to create the largest possible risk pool

does not exclude anyone, regardless of any pre-existing conditions

With an all encompassing risk pool, the healthy in essence subsidize those with poor health

Healthy people pay into the system more than they use, while sicker people recieve more coverage than what they pay in

Two Forms:

1) Universal System - government subsidizes private health insurance comapnies to offer insurance plans to everyone

2) Single-Payer System - government operates a regulated monopoly of health care services funded with taxes and provides health care publicly

Adverse selections leads prive health insurance providers to charge higher premiums or deny coverage to those with conditions/poor health

economically efficient, not socially efficient

led the government to create the Affordable Care Act - sought to create a universal health care funding mechanism by requiring everyone have health insurance or pay a penalty

Moral Hazard, Adverse Selection, and the Great Recession

When the risk is felt before a transaction, it often requires a risk premium in order for the transaction to occur

this drives the cost of the good or service up

The ex post (after) risk of Moral Hazard

an individual’s behavior may be influenced by a transaction in a way the reduces the effieicny of screening

ex: firms that rent out personal cars usually require a client have a driver’s license, be older than a certain age, and pay for any damages.

nevertheless, people who rent behicles may be incentivized to drive in a manner different from their own personal vehicle

specifically, they may drive the vehicle with less caution and care, because they do not own it

In the aftermath of the Great Recession, many people were left wondering how such a large-scale financial collapse could have occurred

Financial Services is an industry rife with both adverse selection and moral hazard

Adverse selection plays an incredibly important factor in the financial services industry (credit screening, contractual agreements, and collatreral)

The U.S. financial services industry is extremely big and worth an astounding amount of economic value

throughout it’s history, it has faced many instance of systemic risk

systemic risk: risk spreads from one part of the industry to all others

It is rational that banks would want to reduce the number of loan defaults

The U.S. Government has rules and regulations to mitigate risk of the financial services industry

Federal Reserve Bank of 1913: greatly reduced the amount of financial calamities that have occurred since it’s creation in 1913

Glass Steagall Act of 1933 - separated investment banking from retail banking

problem arises - banks are not in a technical sense playing with their own money

money that has been depositied

there is a potential moral hazard problem because once a depositor puts their money into the bank, the bank may behave in such a way that involves taking on and creating more risk

In an effort to reduce the concern depositors may have about a bank engaging in risky behavior and losing their deposit, the US created the Federal Deposit Insurance Corporation (FDIC)

main purpose: insure the depositors at commercial banks wont lose their money should the bank become insolvent

FDIC shields depositors from some of the moral hazard risk of banks

many would argue that the FDIC in fact creates it’s own moral hazard problem

consider that making prudent and well-conceived investments is incentivized, in part, by the risk of lost business should a client lose money due to banking actions

by taking that risk away, the FDIC insurance actually incentivizes riskier behavior by the banks

the FDIC may lead to moral hazard even if such insurance is a good idea

Main Catalyst for the Great Recession was the use of mortgage-backed securities as investment vehicles

MBS were bonds that paid out as long as the mortgages that made them up kept getting paid

Instead of a stock, a mortgage bond paid returns based on the health of the mortgages

the bonds would then recieve bond ratings, based on the amounnt of risk among the mortgages

As with most investments, the safer well-rated bonds had smaller potential returns than the riskier lower rated bonds

Investors rely on bond rating agencies to appropritaely assess the riskiness of bonds in order to make informed decisions

the purpose of these agenices is to reduce adverse selction — to make the bond market safer and more efficient

Financial services has a long history of Regulatory Capture

agencies meant to regulate businesses instead cater to those businesses with favorable treatment or outright ignoring of existing rules

form of moral hazard

Collateralized Debt Obligations (CDOs) and Credit-Default Swaps (CDS)

CDOs are like MBMs, but CDOs slice up the bonds into separate trenches each with their own bond rating

CDSs are contracts made up to a third party who agrees to compensate the bond purchaser in the event the bond defaults

In the case of MBSs, this would mean that enough of the underlying mortgages went bad that the bond itself failed

CDOs combined with bad bond rating behavior from rating agencies meant that you not only had the market for mortgages, but you had markets for MBS and CDOs

CDSs reduced the concern over the actual health of the mortgage market, because in effect bond purchasers were able to swap risk through CDSs.

risk become a tradable commodity

Financial meltdown was a case study in systemic risk and what happens when the levers of risk assessment are bent for the favor of additional profit

cautionary tale for future policy makers as to what happens when too much faith in markets and an unwillingness to address market failures causes seemingly irrational behavior

An Example: To Shirk or to Work

Annie hires Fred, but cannot monitor Fred’s effort

Fred experiences 1 unit of utility for every dollar he is paid, and could earn 10 units of utility at his next best option

Fred can either give High Effort or Low Effort

High effort reduces his utility by 2

Low effort reduces his utility by 0

The resturant may either be profitable or unprofitable

Fred is paid wp if profitable and wu if not profitable

The probability of a profitable or unprofitable outcome depends on fred’s effort

high effort leading to a profitable outcome with 80% probability and low effort with a 40% probability

Annie wants to design a contract that incentivizes Fred to give high effort

since fred can earn 10 units of utility otherwise, annie will have to pay a wage that produces at least 10 units of utility in expectation

Princple-Agent Problem

a form of Moral Hazard

Condition 1: EUh >= 10

Condition 2: EUh <= EUl

h = high effort, l = low effort

High Effort EUh = 0.8(wp) + 0.2(wu) -2

Low Effort: EUl = 0.4(wp) + 0.6(wu)

Condition 1: 0.8(wp) + 0.2(wu) -2 >= 10

wu >= 60 - 4(wp)

Condition 2: 0.8(wp) + 0.2(wu) - 2 >= 0.4(wp) + 0.6(wu)

wu <= wp - 5

Set Conditions Equal and find wp: 60-4(wp) = wp - 5

-5 (wp) = -65

wp = $13

since wu <= wp - 5

wu = $8

Thus, annie should pay fred at least $13 if the resturant is profitable and no more than $8 if not profitable

Prospect Theory

Expected utility theory does not accurately show the decision-making process in situations involving risk and uncertainty, as it fails to account for the psychological factors and biases that influence choices.

Creators of Prospect Theory: Kahneman and Tversky

descriptive alternative that fits experimental observations

Key Idea: People evaluate gains/losses relative to a reference point, not final wealth

people have biases which can lead to irrational decisions

Elements:

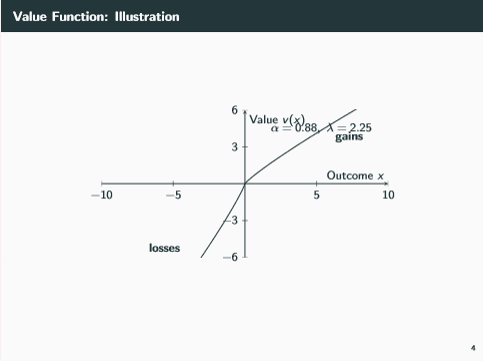

Reference dependence: outcomes are judged as gains or losses relative to a refrence point

refrence point is usually the status quo, expectation, or an aspiration level

small changes around the refrence point matter most (diminishing sensitivity)

big changes around the reference point does not affect us as much

framing effects: identical final wealth distributions can be percieved differently depending on how outcomes are framed (gains vs lossess

Value function v(): defined over gains/losses, concave for gains, convex for losses, steeper for losses (shows loss aversion)

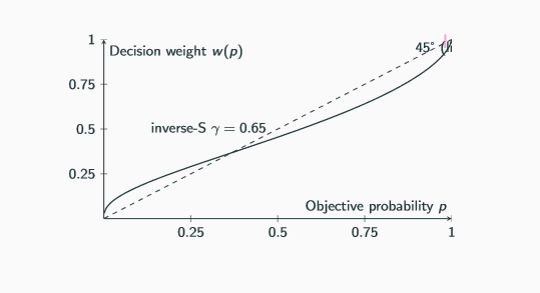

Probability weighting: decision weights distort objective probabilites (overweight small probs, underweight moderate to large probs)

People transform probabilities into decision weights, leading them to make choices that are irrational

ex: people will overweight low probabilites, such as buying lottery tickets but will underweight high probabilites like investing in stocks with steady returns, resulting in decisions that may not align with rational predictions of their expected outcomes.

Loss Aversion: individuals tend to prefer avoiding losses rather than acquiring equivalent gains, leading to risk-averse behavior in situations where potential losses are involved.

Sunk Cost Fallacy: the tendency to continue an endeavor once an investment in money, effort, or time has been made, resulting in irrational decision-making as individuals prioritize past investments over future outcomes.

Endowment Effect: people often demand much more to give up an item than they would pay to acquire it

ex: people choose between an ipod and $100, but do not trade iPod for $100

Certainty Effect: people overweight outcomes that are certain relative to improbable outcomes

Reflection Effect: risk aversion in gains and risk seeking in losses

Break Even Effect: losers become more willing to take on risk in an attempt to break even

In short, Prospect Theory gives a powerful descriptive account of choices under risk via reference dependence, a kinked asymmetric value function, and probability weighing