Chapter 23 - Monetary policy & the Federal Reserve

The Federal Reserve

Board of Governors: leadership of the Fed, consisting of seven governors appointed by the president to staggered 14-year terms.

Federal Open Market Committee (FOMC): committee that makes decisions concerning monetary policy.

Banking panic: situation in which news or rumors of the imminent bankruptcy of one or more banks leads bank depositors to rush to withdraw their funds.

Deposit insurance: system under which the government guarantees that depositors will not lose any money even if their bank goes bankrupt.

Monetary policy and economic fluctuations

Federal funds rate: interest rate that commercial banks charge each other for very short-term (usually over night) loans; because the Fed frequently sets its policy in terms of the federal funds rate, this rate is closely watched in financial markets.

An increase in the real interest rate reduces both consumption spending and planned investment spending. Through its control of the real interest rate, the Fed is able to influence planned spending and short-run equilibrium output.

To fight a recession (a recessionary output gap), the Fed lowers the real interest rate, stimulating planned spending and output. Conversely, to fight the threat of inflation (an expansionary output gap), the Fed raises the real interest rate, reducing planned spending and output.

The Federal reserve and interest rates

Portfolio allocation decision: decision about the forms in which to hold one's wealth.

Demand for money: amount of wealth an individual or firm chooses to hold in the form of money.

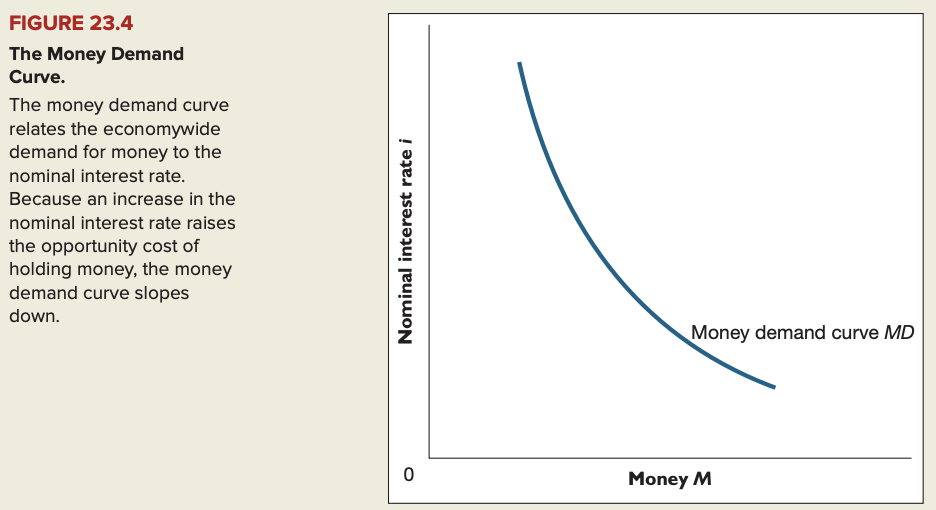

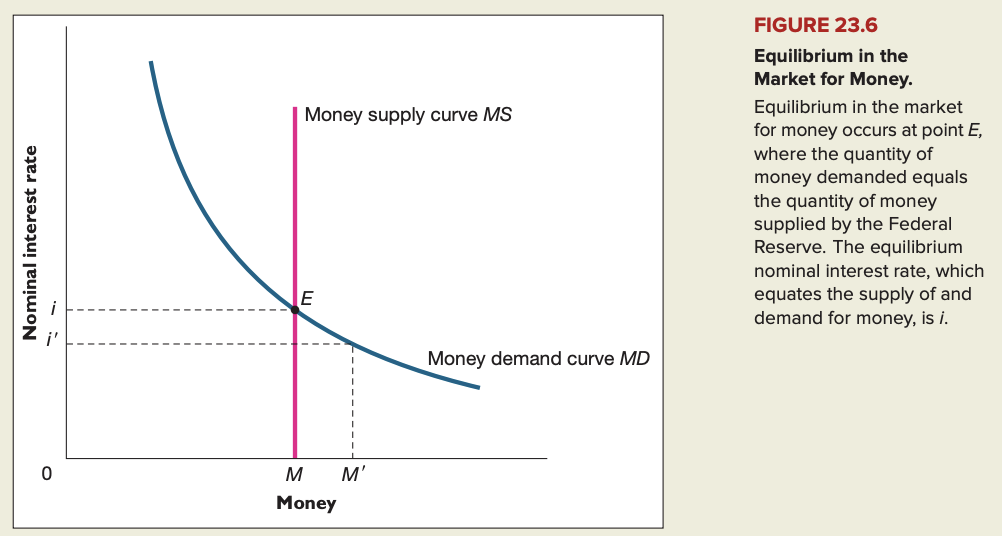

Money demand curve: curve that shows the relation ship between the aggregate quantity of money demanded M and the nominal interest i; rate i; because an increase in the nominal interest rate in creases the opportunity cost of holding money, which re duces the quantity of money demanded, the money demand curve slopes down.

How the Fed controls the nominal interest rate

The Federal Reserve controls the nominal interest rate by changing the supply of money. An open-market purchase of government bonds increases the money supply and lowers the equilibrium nominal interest rate. An increase in discount window lending, a reduction in reserve requirements, a decrease in the interest rate paid on required reserves, or quantitative easing will all have the same effect. Conversely, an open-market sale of government bonds reduces the money supply and increases the nominal interest rate, as will decrease in discount window lending, an increase in the interest rate paid on required reserves, or an increase in reserve requirements. The Fed can prevent changes in the demand for money from affecting the nominal interest rate by adjusting the quantity of money supplied appropriately.

Discount window lending: lending of reserves by the Federal Reserve to commercial banks.

Discount rate = primary credit rate: interest rate that the Fed charges commercial banks to borrow reserves.

Reserve requirements: set by the Fed, the minimum values of the ratio of bank reserves to bank deposits that commercial banks are allowed to maintain.

Quantitative easing (QE): expansionary monetary policy in which a central bank buys financial assets from private financial institutions, thereby lowering the yield or return of those assets while increasing the money supply.

Knowt

Knowt