33 Financial statement

Statement of profit or loss (income statement)

Financial position

Eva: Inventory valuation

Eva: Depreciation

Why financial record is important

Assess business performance through profit or loss

Whether the business has paid supplier or bank

Whether customer paid or not

Statement of profit or loss

Revenue, costs and profit over some time

Statement of financial position

Business assets, liabilities at one time. Also called shareholder equity

Statement of profit or loss

Detailed report should be updated frequently for manager (monthly)

Less detailed report for the public, or else competitor can view business strength & weakness

Uses:

Compare performance with past self + competitor

Show banks whether business should get the loan or not (credit score)

Show investors whether they should buy shares or not

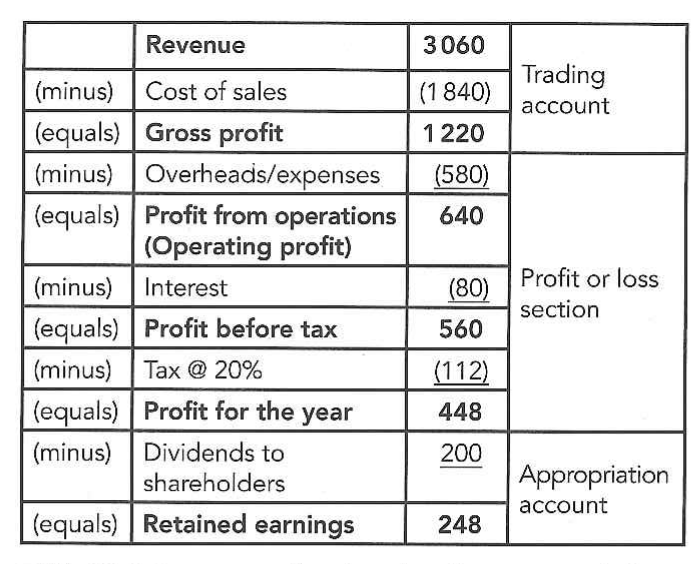

Content of statement

Revenue - Cost of sales

= Gross profit

- Overhead expenses

= Profit from operation

- Loans

= Profit before tax

- Tax

= Profit for the year

- Dividends

= Retained earnings

1. Trading account

Revenue - cost of sales (cost to make product) —> Gross profit

Cost of sales = (opening inventory + extra purchases) - closing inventory

Opening inventory: material at the start of the year

Closing inventory: products unsold at the end of the year

2. Profit or loss

Profit from operation: Minus expenses (overheads, rents)

Profit before tax: Minus interest cost of loans

Profit for the year: Minus tax

Appropriation account

Pay for shareholder dividends, this is the final cost

Profit for the year - dividend = final retained earnings

Low-quality profit: One-time profit that can not be repeated (sell of building)

High-quality profit: Profit that can be repeated (sell normal product)

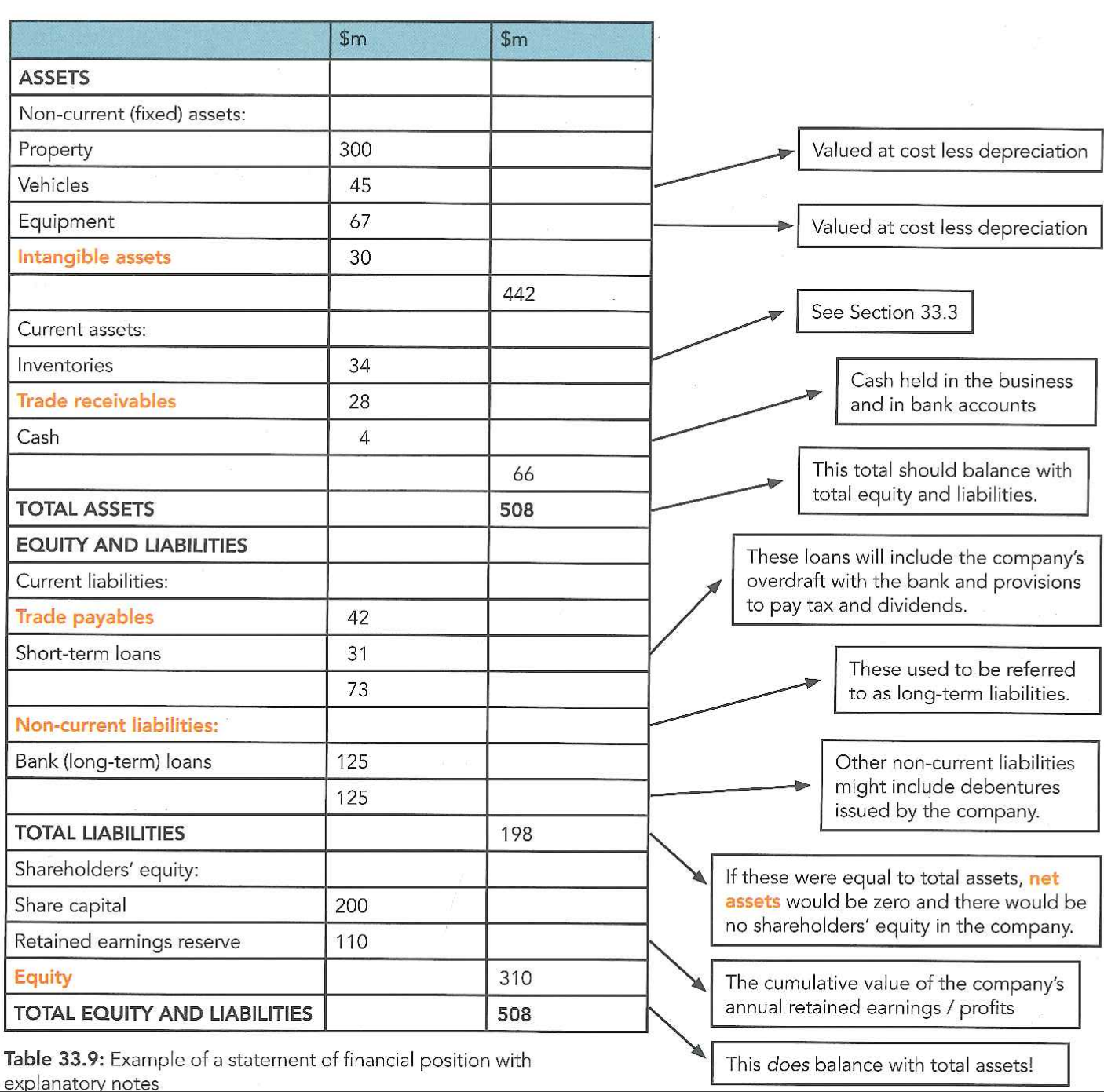

Statement of financial position - Balance sheet

Record the wealth of shareholder equity at a single time period

→ How much money is left if the business sell everything and pay all debt

Total assets MUST BE EQUAL to total liabilities + equity

Uses:

Determine the company’s ability to pay debts

Whether the company can pay dividends

Financial position

Content

1. Assets

Non-current assets: Assets that can not be converted into cash in a year (take time to sell)

e.g: building, trademark, copyright

Does NOT include intangible assets (trademark) unless of a takeover cause hard to value

Goodwill cost will only be included if business A takeover business B with a price higher than value of its assets

Current assets: Assets are can be quickly convert to money within a year

e.g: products, trade-receiveables

2. Liabilities

Current liabilities: Short term debts

Non-Current liabilities: Long term debts

For assessing the risks taken by boss, compare non-current liabilities with equity (all assets - all liabilities). E.g: if the cost of selling debenture is higher than the company’s ability to pay, then it’s risky.

Net current assets: (Working capital), money needed for day to day activities, current assets - current liabilities

3. Equity

Shareholders’ equity: Sum of money raised by selling shares + retained earnings in the past

(If company make a loss, shareholder equity will be reduced cause it contains profit, vice versa)

This is included in the liabilities section, cause all the assets now need to add up to liabilities and equity

Reserve: Total retained earnings + value of fixed assets from re-evaluation

Reserve is not a source of finance, retained earnings are often already invested back into business

Inventory valuation

Inventory is the unsold goods, might be raw material or work in progress

Conservatism accounting approach: accountant should pay attention to all risks, often this will generate lower profit but do not overstate value of assets → give a more accurate view

Inventory should be recorded at their purchase price OR net realizable value, whichever is lower

Net realizable value (NRV): Expected undone product selling price minus the cost of making it

(Should be lower than purchasing cost, often it makes a loss)

For internal use: we should value inventory low to be more accurate. This is accounting conservatism

For public: should window dress and increase value of inventory

The NRV does not include historical cost, only repair of storage cost. This is because you determine the selling price based on the historical cost already. So only need to minus cost of selling.

Moreover, you don’t need to find out the loss or profit of this because NRV is only used in the FINANCIAL STATEMENT. You only care about its value after depreciation.

If you want to calculate profit or loss with NRV, take NRV minus the historical cost (cost of buying in).

e.g: buy (60), repair (20), sell (70)

70-20 = 50 (NRV)

50 - 60 (buying in) = -10 loss

Depreciation

In statement of profit / loss: It is an overhead expense

In balance sheet: We subtract the value of assets directly

Net book value: current value of non-current assets. Original cost - accumulated depreciation

How to calculate depreciation? Straight line method

Straight line method: constant depreciation value is subtracted from the historical cost each year

(Original cost - expected value when it is broken) ÷ number of useful years

So we find the amount of value the asset lost from new till broken, and then divide it by the years that it can be used for to find average depreciation value. We then just minus that value each year

Easy to calculate

Useful years + final value are PREDICTED, might be wrong

Some assets depreciate at different rate (Cars lost value faster in first year than second year)

Repair cost is not included